-

Minting Your First NFT: A Beginner’s Guide to Creating an NFT

It took 12 hours and three different Apple devices, but this 30-something poet successfully minted her first NFT – and so can you. Here's a step-by-step guide to creating an NFT.

By Megan DeMatteo

I’m no Emily Dickinson, but the latest developments in internet culture – excuse me, Web 3 culture – has me thinking I can shill my grad school poems for 1 ETH ($3,000) a pop.

And on January 20, 2022, I did. After all, imposter syndrome doesn’t have a place in a burgeoning industry where even founders admit to being in the midst of a learning curve.

If I were a creator during Gutenberg’s era, I like to think I wouldn’t have passed up the chance to play around with the printing press. Why should NFTs be different?

When I first heard about non-fungible tokens (NFTs) in April 2021, I was immediately thrilled by the high-level concept of them: Artists, seemingly overnight, now had a way to own their own work and determine their own royalties. I needed to hear more.

Being a journalist, I was fortunate that my first conversation about NFTs was with Whale Shark, a prominent collector and founder of the WHALE token who once spent 22 ETH on a one-of-a-kind pair of sneakers.

Ahead, I share what I’ve learned since that first NFT conversation and my chats with dozens of creators and founders in the blockchain world. As they say in crypto, time moves so fast.

One month is basically a year, and it took me about seven months – essentially one whole dog year – to finally work up the nerve to put one of my poems on a blockchain. I’d like to make it easier for you.

Here’s a step-by-step guide on how to mint your first NFT using OpenSea, a popular NFT platform among first-time creators. (Great alternative platforms also exist, which we’ll touch on below.)Step 1: Decide on the concept

Outside of my financial journalistic work, I have a growing affinity for all things astrology-based. Looking at my recent astrology chart with astrologer Noah Frere, I noticed that Juno was very active. In light of this, I decided to base my first NFT collection on the tumultuous relationship between Juno and Jupiter – two gods from Roman mythology.

And after a great conversation with my business coach, Lisa Fabrega, I knew I wanted to explore the tension between love and duty through the lens of devotion.

I therefore decided to name my poetry alter ego – every creator needs one, right? – “Juno Muse.”

With my concept nailed down, I had my marching orders: Resurrect my old poems and write several new ones. Then, learn how to mint them on a blockchain.Step two: Decide on the platform

The tech skills required to mint NFTs on OpenSea are comparable to the ones I used to sign up for Myspace in 2006.

“There's a big misconception that you have to be technical in order to participate in crypto,” said Denise Schaefer, co-founder of the blockchain education platform Surge. “But I look at NFTs as a fun entryway into the space that doesn't require coding skills when minting in marketplaces like OpenSea or Rarible.”

Here are some beginner-friendly NFT platforms where first-time creators can mint:OpenSea

- Blockchains used: Ethereum and Polygon

The creator can upload their artwork, “mint” it to their profile and list it for sale without paying gas fees. When the collector buys it, they will pay the gas fees.What you’ll need to get started:

An ETH wallet (e.g. MetaMask, Coinbase or dozens of others)Creator fees:

2.5% of your saleLearn more:

Visit the OpenSea resource page.Rarible

- Blockchains used: Ethereum, Flow and Tezos

Rarible considers itself a community-owned NFT marketplace. Using Rarible’s unique token (ERC-20 RARI) makes you an owner of the Rarible project. This is a cool feature, but it was a little over my head for my first mint. I hope to learn more about this.What you’ll need to get started:

A wallet compatible with your choice of blockchain.Creator fees:

Vary depending on the blockchain you use, but the option for free minting exists.Learn more:

Read the Rarible FAQsHolaplex

- Blockchain used: Solana

Solana’s speed and efficiency also cuts down on energy usage, therefore giving it a reputation as a new, less environmentally damaging, alternative to Ethereum.What you’ll need to get started:

Phantom wallet and Arconnect WalletCreator fees:

Reportedly 0.000005 SOL ($0.00025) per transaction. Fees can fluctuate, but they are almost zero.Learn more:

Check out this Artist’s Guide to Solana and Holaplex and visit the Holaplex.Objkt

- Blockchain used: Tezos

What you’ll need to get started:

Choose from these compatible wallets:- Spire

- Temple Wallet

- Galleon

- Kukai Wallet

- Umami

- AirGap Wallet

Creator fees:

2.5% for all successful salesLearn more:

Visit the objkt website and/or discord server.Step three: Connect and build community

Get ready to tweet and DM. If you want to start making NFTs, you’ll need to dust off your Twitter account. You’ll also need to join Discord, a Slack-like chat platform for gamers and crypto lovers. Expect to get most of your information and build authentic relationships through these types of communication

channels.

Read more: Crypto Discord: Where to Go, What to Know

When you’re ready to sell your NFTs, expect your community to be your number-one marketing resource. It sounds a little cliche, but you don’t need to spend a lot of money on sophisticated marketing tactics to create a successful project.

“Regardless of how low or high the market is, the community is so enthusiastic and constantly tagging our project in different things constantly talking about it,” said Maliha Abidi, whose Women Rise NFT collection launched in November 2021 and sold out in 50 days, generating 2,000 ETH of trading volume in the process.

“We have not put in even $1 in marketing so far, but we were literally just featured in Vanity Fair yesterday and today in Rolling Stone,” Abidi told CoinDesk on Jan. 19.

Even 1-of-1 creators – artists who mint unique, single pieces of art, compared to algorithmically generated avatars that people use as Twitter profile pictures – seemingly trust that making friendships can go a long way.

“We interact with each other every day. You're going to see your collectors in a Twitter space or if there’s good alpha information, we share it with each other,” said Thao Nguyen, an artist who pivoted from making Etsy creations to NFT artwork on OpenSea in 2021.

“It's a very giving relationship, and I absolutely love it.”Step four: Create your art

To start turning my poems into art, I asked my mom to mail me an old iPad she wasn’t using and signed up for an online illustration class at the Baltimore Academy of Illustration.

I bought an Apple Pencil, downloaded Photoshop for iPads, and plugged in my Yeti microphone (which I already had) to practice recording audio clips in iMovie and GarageBand. I dug out my old poems from grad school, walked around Manhattan thinking of ideas and bought a notebook to start scribbling.

Every creator has their own process, but no matter what, you need to think about how your art will translate digitally. Follow these guidelines to make your first NFT:- Use materials and tools you already have.

- Invest in new technology or knowledge as needed.

- Find other creators and learn from each other.

- Consider the audience you think will like your work and keep them in mind as you create.

- Choose whether you want your NFTs to have visual, audio or written components – or all three.

- Pick a file type. OpenSea accepts JPG, PNG, GIF, SVG, MP4, WEBM, MP3, WAV, OGG, GLB and GLTF.

- Think about the file size. OpenSea’s limit is 100 MB.

- Factor in accessibility – I chose to have subtitles along with my spoken-word poems so that they could be enjoyed by as many people as possible, including people with visual and/or hearing impairments.

After some experimenting, I ended up scrapping the graphics I created in Photoshop and instead used Canva to make a simple title image and subtitles for my poem. I then recorded myself reading the poem along with the slides.I’m not the most talented visual artist.

But I gave myself permission to play around – and I don’t intend to stop experimenting. The advice I’ve gotten is this: Don’t pigeonhole yourself too soon or limit your notions of what’s possible.

Unless you have a clear aesthetic like Abidi, an experienced painter, consider NFTs your opportunity to try new things. NFTs are a new art form, so let your message translate to the new medium.Step five: Mint and share

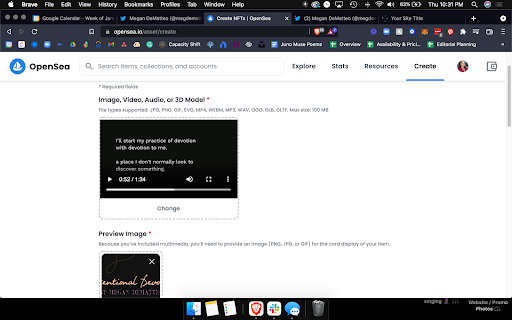

In OpenSea, the minting process is so easy I kept waiting for a clown to jump out and tell me I’d been tricked.

It’s as simple as uploading your files, inputting your collection’s description and making your profile, determining your royalties (for later, when your art is sold in a secondary marketplace) and completing your listing.

Note the accepted file types: OpenSea Screenshot

OpenSea Screenshot

I chose to mint my first NFT on Polygon, which had no fees.Once you mint your NFT, you will see it on your profile. Blockchain data is public and accessible by anyone.

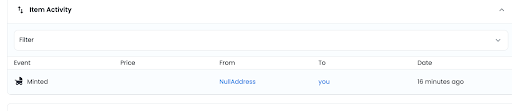

Your NFT's buying and selling history will be available forever, helping you and prospective investors track its price.

“Etherscan is where you can see all the transactions that have happened in the Ethereum blockchain,” Schaefer told CoinDesk. “It is specific to all transactions that are occurring in the Ethereum network, and in and out of the network.

Everybody having access to these public records is what allows for blockchains to operate without a central authority and without a bank.” OpenSea item activity

OpenSea item activity

But you might not want the whole world to know how much money you have and how much money you're transacting, said Schaefer.

This is where pseudonyms and having multiple wallets – totally legal in the blockchain world – come in.The final step: Selling your NFT

After minting, it’s time to list your NFT for sale. I opted to keep things simple and list mine for 1 ETH, or $2,922.42 at the time of minting.

My 1 ETH price will remain on my Juno Muse OpenSea profile until Feb. 20, or whenever someone takes my NFT off the market.

In the meantime, I plan to keep experimenting with how I price my NFTs. I plan on releasing my old grad school poems, and, to make Juno proud, I plan to keep writing poems on Thursdays, which is ruled by Juno’s love, Jupiter.

Maybe, just maybe, this new routine will help me fall in love with NFTs and – most important – my own art again.

Keep Learning: How to Create, Buy and Sell NFTs

This article was originally published on Jan 24, 2022.

DISCLOSURE

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies.

CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

Megan DeMatteo

Megan DeMatteo is a service journalist currently based in New York City. In 2020, she helped launch CNBC Select, and she now writes for publications like CoinDesk, NextAdvisor, MoneyMade, and others.

Follow @megdematteo on TwitterSubscribe to Shows, show newsletter promo.

Sign Up

By signing up, you will receive emails about CoinDesk product updates, events and marketing and you agree to our terms of services and privacy policy.-

- 1

Francisco Gimeno - BC Analyst If you are a creator, new to NFTs, or just someone interested on them, this is simple, valid explanation on how to create and sell your own NFT without much hassle. Every journey starts with the first step, they say. NFTs are a new space to explore, enjoy and even to make some profit, in the digital world.- 10 1 vote

- Reply

- Blockchains used: Ethereum and Polygon

-

Universities have historically been central to getting new industries off the ground. Stanford was instrumental in the rise of Silicon Valley, and the MIT has helped birth thousands of tech startups, from artificial intelligence to aerospace.

What role will universities play in the development of blockchain technology? Will they be as pivotal as before, or will the cryptocurrency industry, by nature distrustful of institutions and central authorities, develop its own academic methods and learning approaches?

CoinDesk is keen to track how universities are doing when it comes to blockchain education across courses, employment outcomes, student services and research.

In October 2020, we published our first ranking of the top 20 U.S. schools for getting an education in blockchain (MIT, Cornell University and the University of California, Berkeley were the top three).

Read more: The Top Universities for Blockchain (2020 Ranking)This year, we're going further, analyzing 200 schools in the U.S. and internationally and adding ranking categories.

To identify the best schools, we need your help. We're asking students, practicing academics and industry stakeholders to give their opinions in the survey below.

Don't worry, it doesn't take long. You can choose between a quick one-minute questionnaire and a deeper five-minute one. And you’ll be doing a valuable service: Our goal in tracking and comparing what universities are doing on blockchain education and research is to improve overall standards – and, in turn, the entire industry.

We’ve seen plenty of blockchain startups emerge from universities already, including Ava Labs from Cornell and Algorand from MIT. Most leading schools now offer classes in blockchain subjects. Some have built research centers, hired specialist faculty and sanctioned student clubs.

The big question is whether universities can remain relevant to such a fast-moving industry. Many in crypto are suspicious of institutions and credentialism, favoring self-education, online innovation and community-based approaches.

Universities themselves have to come to grips with this decentralization of information. Let’s see how well they’re up to the test.

If you are a faculty or staff member at an accredited university and you are concerned that your school will not be represented in our rankings, please reach out to joe.lautzenhiser [at] coindesk.com.

If we are not currently collecting data on your school, you will have the opportunity to provide data and place your school under consideration. Student emails will not be answered.-

Francisco Gimeno - BC Analyst CoinDesk calling for us to help them to build a list of Universities good at teaching and learning about the blockchain and 4th IR techs. We could even improve this by asking ourselves if enough universities are already changing their views on new technologies and the new paradigm. Tell us your opinion.

-

-

Bitcoin poses a serious challenge to traditional currencies as the world’s first cryptocurrency. However, considering its price history, there should be a lot of volatility along its path.Below are four steps that will help you trade Bitcoin:

Mechanisms to deal Bitcoin

Bitcoin can be dealt with in two ways: buying the Bitcoin itself and hoping to sell it at a profit or theorize on its value without ever owning it. CFDs work in the latter sense. What a CFD does is enable you to deal with a contract that is constructed on the prices in an underlying market.

This is a purchased product, which means that you need to initially put down a small deposit and again disclose a much more prominent position. This can appreciate your profits. It should be noted, however, that it has the same effect on your losses.

When trading Bitcoin, do I need to use an exchange?

To take a position on the price of Bitcoin, what you need is an IG trading account. However, when you deal with bitcoins CFDs, you do not interact directly with an exchange.

As an alternative, you trade the sell and buy prices sourced from a couple of exchanges on your behalf.Same as traditional exchanges, Bitcoin exchanges work the same way.

This enables investors to purchase the cryptocurrency from or dispose of it to another person. There are some advantages when you cut them out of the picture entirely.

Their service and matching engines are unreliable. This can result in reduced execution precision or shelving of markets.They inflict restrictions and fees on the withdrawing and funding from your exchange account, while accounts can take long periods to acquire.

When you trade Bitcoin CFDs, you acquire considerably improved liquidity at the touch price you’ve chosen. When you sell and buy from the exchange directly, you will have to accept multiple prices to finalize your order.

Factors that change the price of Bitcoin

The volatility of Bitcoin makes it an attractive opportunity and dealing with cryptocurrency. Due to the Bitcoin market operating continuously, this can happen at any time of the day. Bitcoin is free from the various political and economic concerns that influence the traditional currency.

However, due to its young age, there remains a lot of uncertainty uniquely based on the fact that it’s a cryptocurrency.

Any of these factors can impact its price suddenly and significantly, and for this reason, you need to research and know-how to navigate these risks that may come up.

Bitcoin supply

Even though there are a limited number of bitcoins, the last Bitcoin will be mined in 2140. However, the availability of Bitcoin changes as to how they enter the market. For example, their holders’ activity, dealing with them in Bitcoin slots, also affects this availability.

BTC market capThe Bitcoin market value is recognized to be both an impactful and opportune because traders will want to jump on a surging opportunity, or not.

Industry adoption

What remains to be seen is the impact Bitcoin will have on the corporate stage as it is yet to be accepted generally by most businesses around the world.

Trading strategies of Bitcoin

Day trading

When you day trade, there is a need to take a position that considers an accidental movement in the short term. It would help if you also closed it out by the end of that specific trading day.

This is an effective strategy if you desire to acknowledge opportunities in the short term in the Bitcoin market. This is in light of emerging patterns or developing news.

Scalping

This is when you place intraday traits frequently one small movement in price.This is a worthy strategy if you desire to place yourself in a position to form continuous but small profits.

This is when you do not want to wait for a significant breakdown or break out.

Swing trading

This is when you capture trends the moment they are made and clutch on to that position up to the point the trend shows the signs of a reversal or runs its course.This is the preferred strategy for you if you decide to take advantage of this chance from market momentum.

Automated trading

It is advisable to automate your processes in trading and react to changing market conditions on your behalf.This strategy is best used if you consider yourself a passive trader.

The steps to trading Bitcoin

Open an account

You will need an IG trading account if you want to trade CFDs. It is an easy task to do, and you can go ahead and take your first position when you have added funds to your account.

Establish a trading plan

It is always a smart move to establish a trading plan. This works hand in hand with your chosen trading strategy. If you’re new to the market, you need to consider having these two.

A trading plan will assist you in making objective decisions regardless of the stakes being high. This mixture that you do not leave trades open for long or close them early.

Do your study

To understand what’s next for the cryptocurrency price, you need to do your research and speed with the latest Bitcoin news. It is essential to do this before you start on your trading journey.

When you are looking up to interpret how Bitcoin behaves, charts are an important tool. Past data is an excellent indicator of how the market is progressing. The comparison of time frames can also provide better insight as to the emerging patterns and trends.

Place a trade

Using a web trading platform, you will be required to place a trade once you have decided on your position.

You need to enter the deal tickets the amount you have decided to stake on your trade.

While you do this, you have an option of defining your clothes conditions: you can set a stop to terminate your position when the market is not in your favor up to a certain amount or a restraint for when it’s move is in your favor.

Always check yourself; limits and stops are important to sound risk management.

Note that, if you anticipate Bitcoin to appreciate, you then ‘purchase’ the market. If you believe that it will depreciate, you will ‘sell.’To finalize your position, you need to place the reverse of your initial trade.

This means that if you purchased at first, you’d have to sell the same amount;If you had sold, you would not need to buy it. You will be required to click sell or buy to finalize your trade as your deal ticket is automatically filled.References

How to trade Bitcoin: Get to grips with the basics of how to trade bitcoin with our step-by-step guide.

Cryptocurrency trading: Find out how to get started trading cryptocurrency in this step-by-step guide. By Andrew Munro.

Disclaimer: This is a paid post and should not be considered as news/advice.-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

ETFs, or exchange-traded funds, are one of the most important product innovations in the history of the investment industry. ETFs give investors a cheap and efficient way to gain diversified exposure to the stock market.

ETFs are now established as tools that can form the cornerstone of any portfolio whether self-managed or managed by investment advisors or robo advisors.Definition of ETFs

ETFs are listed trusts that own a portfolio of securities. Typically, the fund is structured to mirror and track an index. It will, therefore, hold securities in exactly the same proportion as the index it tracks. ETFs are publicly listed on stock exchanges and can be traded like other listed shares.History of ETFs

Before ETFs were introduced, mutual funds and investment trusts were the only way for retail investors to invest in a portfolio of securities, without actually building a portfolio themselves.

Mutual funds gained momentum in the 1970s and 1980s due to strong performance from a handful of funds.

However, during the 1990s it became clear that the majority of mutual funds failed to outperform their benchmark. During this period, index funds – mutual funds that track market indexes – also began to gain traction amongst investors.

These funds were designed to match the performance of an index, rather than outperform the index, but charged a lower fee for doing so.

The first exchange-traded fund was launched in 1993 by State Street Global Investors.

The fund tracks the S&P 500 index with the ticker SPY, and units are often referred to as SPDRs or Spiders. It remains the largest ETF by value, with $298 billion in assets as of August 2020.Since the introduction of the first ETF, over 6,000 funds have been launched.

Funds have been launched to track popular indexes, as well as specific asset classes, sectors and investment themes. In fact, whenever there is demand for a specific type of investment, an ETF will probably be created to cater to that demand.Examples Of ETFs

As mentioned, the first and largest ETF is the SPDR S&P 500 index fund, which holds all 500 stocks in the index, in exactly the same proportion as the index. At least five other ETFs listed on US exchanges also track the S&P500, while numerous ETFs listed on exchanges around the world track the same index.

Similar funds track the Dow Jones Industrial index with 30 stocks and the Nasdaq Composite index with 100 stocks. The largest global ETF is the Vanguard FTSE Developed Markets fund which tracks the MSCI EAFE Index. This fund holds 1,889 stocks listed in developed markets outside of North America.

The SPDR Gold Trust (GLD) which holds physical gold bullion is the most widely traded commodity ETF. The largest bond ETF is the Vanguard Total Bond Market ETF which tracks the Barclays Capital U.S. Aggregate Bond Index. This fund holds US treasuries and government-backed mortgage securities.Types of ETFs

Most large ETFs track headline stock market indexes like the S&P500, the FTSE 100 or the Nikkei 225.

These indexes include the most valuable companies in each market and are typically weighted by market capitalization. If you invest in these ETFs you will always be invested in the largest companies in a given market.

However, there are lots of other types of ETFs, structured according to other criteria.The following are the more common types of ETFs:- Sector ETFs invest in specific equity market sectors like the financial or technology sectors.

- Bond ETFs invest in government bonds, corporate bonds and high yield bonds.

- Commodity ETFs invest in physical commodities and precious metals. Some funds like the SPDR Gold Trust holds just one asset (physical gold) while others track commodity indexes and hold a portfolio of commodities.

- Multi-asset ETFs invest in range of asset classes. These funds are often designed to comply with pension fund regulations that limit exposure to certain asset classes.

- Real Estate ETFs invest in REITs (real estate investment trusts) and other property related securities.

- International ETFs invest in stocks from around the world. These funds can be further differentiated between developed and emerging markets, and whether or not US equities are included.

The types of ETFs listed above account for the largest funds. More specialized types of funds include the following:- Market cap ETFs focus on companies of a specific size, from large-cap down to medium, small and micro-cap stocks.

- Industry ETFs have a narrower focus than sector funds. Examples include biotech, cybersecurity, and cannabis companies.

- Investment style ETFs track indexes that select companies according to investment factors. These include growth, value, volatility and income.

- Currency ETFs invest in portfolios of currencies or in individual currencies.

- Leveraged ETFs increase the exposure of a fund by using derivatives. These funds typically provide exposure worth 2 or 3 times the fund’s assets. This means both positive and negative returns are amplified.

- Inverse ETFs are structured to generate positive returns when an index falls, but also generate negative returns when the index rises. These can be used to hedge a portfolio, or to speculate on a market decline.

Advantages and Disadvantages of ETFs

ETFs offer investors several notable advantages, but there are a few drawbacks to be aware of.Pros of ETF investing:

- The most obvious advantage of ETFs is that fees are substantially lower than mutual funds. Equity indexes have risen over the long term, while few investors have managed to consistently outperform those indexes. ETFs allow you to earn the market return for as little as 0.1% a year.

- Most ETFs offer instant diversification with just one investment. For a portfolio to be well diversified it must include at least 20 stocks from different sectors. If you buy an ETF that tracks a market index with at least 20 constituents, you are effectively buying a diversified portfolio.

- ETF investing is very efficient in terms of time and trade costs. You do not need to spend time picking and trading individual shares and you do not need to pay commission on each underlying share.

- ETFs offer tax advantages too. If you own individual stocks you may be liable for capital gains tax when you sell each share. In the case of ETFs, you are only liable for capital gains tax when you sell the ETF.

- Finally, ETFs allow you to start investing sooner. Investing in mutual funds requires some knowledge and investing in individual stocks requires even more knowledge. Very little knowledge is required to begin investing in ETFs that track market indices.

Cons of ETF investing:

- Most ETFs will only generate the market return and will not generate additional returns.

- Commissions are payable when you buy an ETF, unlike no-load mutual funds that do not charge commissions.

- Specialized ETFS like leveraged, inverse, sector and industry funds all come with unique risks.

ETFs vs Stocks

ETFs are listed on stock exchanges just like other stocks, and they trade just like other stocks. So, what is the difference between the two?Traditional stocks represent shared ownership in a company.

The value of the stock represents the value of the company’s assets, and/or its future profits. ETFs give their holders shared ownership of a basket of securities.

The value of the fund reflects the price at which these securities are trading. The price at which an ETF trades is determined by supply and demand, but is usually close to the net asset value of the underlying holdings.ETFs vs Mutual Funds

ETFs and mutual funds are both products that allow investors to invest in a portfolio of securities with just one transaction. There are however several differences. The most notable differences are the following:- In most cases ETFs passively track an index, while a fund manager actively manages a mutual fund. However, some ETFs are actively managed, while some mutual funds are index funds that are passively managed.

- Mutual funds charge higher management fees as they are more expensive to manage. Mutual funds require larger teams of fund managers and analysts than ETFs.

- When you invest in a mutual fund, you invest at a price equal to the NAV (net asset value) of the fund. When you buy an ETF, the price is determined by the market, though in practice the price will usually be close to the NAV.

How ETFs Work

ETFs are created and managed by two types of companies, the ETF Issuer and Authorized Participants.Well known ETF issuers include iShares, Vanguard, State Street and Invesco. These are the companies responsible for launching, underwriting, and marketing ETFs. Before a fund is launched, the issuer chooses an existing index, or creates a new index for the fund to track.

A legal entity to hold the securities is then created and funded.Authorized Participants (APs) are banks or brokers responsible for the day to day management of the fund.

This means they are authorized to create or redeem shares and act as market makers for the ETF shares.

APs quote a bid and offer price, above and below the fund’s NAV to ensure there is always liquidity for investors.When demand rises, the AP will create new ETF shares and buy the corresponding securities to be held by the trust.

Likewise, when there is too much supply, the AP cancels shares and sells the corresponding securities. If there is any change in the index, the issuer will instruct an AP to buy or sell securities to ensure that the fund mirrors the index.Management fees are deducted from an ETF’s NAV on a daily basis.

Because the annual management fee is spread across an entire year, the daily adjustments are very small and barely noticed. Dividends and other income are distributed at monthly or quarterly intervals.ETF Investment Strategies

There are several ways to go about investing in ETFs. One of the simplest for long term investors is dollar cost averaging (DCA). In this case, you can simply invest a fixed amount at regular intervals.If you plan to build a portfolio of ETFs, you may decide to use a strategic asset allocation strategy. In this case you would decide on the percentage of your portfolio you want to hold in each ETF or in each asset class.

You then make subsequent investments in the funds that are below their target weight, thus bringing the portfolio in line with the target allocation over time. You can also rebalance the portfolio at regular intervals to keep the allocation in line with the target allocation.

A slightly more active approach is tactical asset allocation. In this case, the weighting of each fund or asset class can be adjusted as market conditions change.

The core/satellite strategy combines ETFs with individual stocks. In this case, a core holding of ETFs is combined with a smaller portfolio of individual shares. This approach seeks to generate some outperformance through stock selection while earning the market return from ETFs.Conclusion

Exchange-traded funds are the cheapest and most efficient investment products that allow you to earn the same return as broad market indexes.

They can also be used to build a portfolio with diversified exposure to specific asset classes, sectors, industries, and investment themes. Perhaps most importantly, they are a means to begin investing with very little capital or knowledge.-

Francisco Gimeno - BC Analyst The "esoteric" financial and trade knowledge that before was known only to traders is now public for anyone in the digital era, where anyone who want to invest just educate himself using digital for ex exchanges and other platforms. Thus, knowledge of ETFs are useful too in an economy where to work 9 to 5 is not enough anymore.

-

It can be a challenge to find accessible information about cryptocurrency and blockchain tech―which sites offer the best guides and tutorials?Learning about blockchain can be a chore: the crypto world is full of information, and navigating that material is no small task.

Until recently, there were very few comprehensive resources―instead, information was scattered across project documentation, wikis, and forums. This uncoordinated approach was not very convenient for newcomers.

However, there are now a number of projects and companies that have taken it upon themselves to create educational blockchain websites. These websites generally cover a broad range of topics, keep up to date with the latest changes, and collect everything together in one place. Let's take a look at five of the most significant education sites.Coinbase Earn

Coinbase is one of the most popular crypto exchanges, and it's making an effort to ensure that its investors are informed about trading. Since May, Coinbase has been paying users to study major cryptocurrencies through a subsite called Coinbase Earn.

The site covers several notable coins, including EOS, 0x, Zcash, Dai, Stellar Lumens, and Brave's Basic Attention Token.

RELATED ARTICLES- IBM and Smart Dubai Launch First State-Backed BaaS Platform in the Middle East

- Singapore Launches Blockchain Marketplace for Renewable Energy Certificates

Coinbase Earn merely scratches the surface of these topics: after viewing each brief tutorial, you'll be able to complete a quiz. In return, you'll typically earn $10 of crypto, total―though you can earn $40 more if you invite other users.

Overall, Coinbase Earn is a good site for beginners, as it covers recognizable cryptocurrencies, not in-depth technical concepts.Binance Academy

Binance is another major exchange with its own educational initiative. Unlike Coinbase, Binance Academy doesn't cover any particular coins, and it won't pay you to participate.

Instead, it offers encyclopedia-like coverage of various technical topics. In fact, Binance Academy offered 450 different articles as soon as it went live in December 2018―and it's adding more each day.

The site covers topics of all complexities, from basic blockchain overviews to more thorough explanations of security, cryptography, and economics. Binance Academy also has several side features, such as a glossary, quizzes, and tutorials.

Plus, the site is available in fifteen different languages, which means that Binance's efforts are incredibly inclusive and accessible.Lisk Academy

Lisk Academy has been active since March 2018, and despite its name, it covers far more than Lisk itself. Rather, it covers blockchain topics in general through two main modules: one half of the site is dedicated to general users, and the other half is devoted to business users.

Together, these categories cover several topics, including P2P networking, cryptocurrencies, and ICOs.

Lisk's website boasts over 69,000 words of text, making it a fairly in-depth resource. It is, however, quite simple as well: Lisk's original announcement claims that just ten minutes of reading will give anyone the ability to understand and explain blockchain technology.

There is even a small section targeted at children, using an "explain like I'm five" conversational style.District0x

District0x is a network for decentralized marketplaces, but it also has a secondary purpose. Since August 2018, District0x has been running its own educational portal. This collection of resources is partially devoted to District0x itself, but the main attraction is the site's extensive coverage of the Ethereum blockchain.

Right now, the site is fairly small, with about two dozen topics―roughly on par with Lisk Academy, but not nearly as large as Binance Academy. However, District0x plans to grow the site, and it is publishing new entries each month. District0x also makes learning fun with eye-catching pictures, engaging videos, and other media.Tari Labs University

Tari Labs is an initiative co-founded by Riccardo Spagni, one of Monero's lead developers. The project is primarily tasked with creating the Tari protocol, which Monero will use to handle special digital assets in the same vein as CryptoKitties.

Additionally, Tari Labs also offers an educational site called Tari Labs University, which went live in October 2018.This site doesn't focus on any particular cryptocurrencies, but it does cover some basic topics, such as blockchain consensus and scalability.

It also covers some cutting-edge privacy coin topics, such as bulletproofs and Mimblewimble. Although TLU covers topics at every level, some of its articles are fairly advanced, and prior knowledge is often necessary.Before You Go

Before you check out the sites listed above, consider our own educational resources as well. Bitrates offers a wide selection of guides and tutorials, as well as in-depth series on special topics such as zero-knowledge proofs, IOTA, and Ethereum's Plasma ecosystem. We don't offer as much as you will find on a full-fledged academy site, but our resources are a good crash course.

On top of that, every website discussed in this article is a valuable resource. Each site is freely accessible, much like Khan Academy and various online coding boot camps.

One of the central values of the blockchain community is accessibility and financial inclusion, and free information can facilitate that―nobody should need to spend money to learn about their options.Additionally, these sites help promote development.

Since there are no formal blockchain education standards, it's up to the community to spread knowledge―and nobody is in a better position to do this than industry leaders. It's not just a chance for leaders to promote themselves: it's also a way for them to give back to the crypto community at large.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.-

By

Admin

Admin - 2 comments

- 1 like

- Like

- Share

-

Francisco Gimeno - BC Analyst No excuses now. Crypto and blockchain resource are more and more available on the Web, not just on Github or other developer's forums. Educate yourself before you get behind the times! This is a good start. Anyway, a reminder: DYOH... Do Your Own Homework. We don't advertise any of these sites as being the best. Judge yourself.

-

From Fintech To Blockchain: How My MBA Is Helping Me Master Digital Disruption |... (businessbecause.com)

As technologies like blockchain and artificial intelligence advance, no industry will be left untouched

It’s sometime around 2015 and Tomislav Prša is sitting at his desk in Wilmington, Delaware. There’s something on his mind; he’s missing school and learning new things.

Tomislav (pictured below, right) grew up in Croatia, where he completed most of his education, later moving to the US to work as a financial analyst.

He's in his early 30s now, and he knows there's no better time to start studying again.Tomislav works just under an hour’s drive from the heart of Philadelphia. He chose to enroll on the Part-Time MBA at Temple University’s Fox School of Business as he wanted more exposure to the US business world.

He wants to develop his knowledge of how the economy works, to network, and learn something new. Two years into the degree, he's using his MBA to explore disruptive tech topics like fintech and blockchain.

Digital disruption was on the agenda on the Fox Global Immersion in LondonLearning about digital disruptionWhen BusinessBecause spoke to Tomislav, he’d recently returned from a weeklong fintech immersion in London, an optional, one-off Global Immersion available to Part-Time MBA, Online MBA, and Specialized Master's students at Fox.

Tomislav and 15 MBA colleagues visited startups and established financial institutions. They toured two companies per day, he explains; an intense schedule leaving little time for sleep.

“The best part is you got to go into the real world and interact with people doing this as part of their actual jobs—seeing how these things are applied in practice.”

Tomislav and his peers on a company visit in London Tomislav says interacting with representatives from companies like Salesforce and R3, a blockchain software firm, opened his eyes to the possibilities that using technologies like artificial intelligence, machine learning, and blockchain could bring.

One of the tasks that students on the fintech immersion in London had to complete was to create a new business idea around blockchain, and then pitch it to R3. Tomislav developed an idea around a universal credit scoring model that could be applied worldwide.

The idea stems from difficulties he had proving his credit score when moving from Croatia to the US.

“The great thing was being able to discuss these things with leaders of companies,” he adds. “Since it was a more academic environment, you were able to ask very direct questions and receive very honest feedback.”

Bora Ozkan Technology is changing the skills MBAs need“Every industry is being impacted by digital disruption,” says Bora Ozkan, the academic director of the Online MBA and BBA programs at the Fox School, “and that's going to create new jobs for MBAs.

”As an MBA candidate, you need to understand the skills required as technology and data move us into a new age, and then how best to apply those skills. According to McKinsey, future leaders will need creativity, analytical thinking, the ability to connect with others, and the power of persuasion.

With the impact of the rapid change of technology on industry, businesses will have an increased need for leaders within the regulation and data protection spheres, Bora says. You will also need to think about ethics alongside diversity and inclusion.

While MBAs don’t need to be coders or computer scientists, an understanding of the underlying systems of these two areas is a necessity, as workers become more accustomed to working alongside machines.

For students like Tomislav, Bora says one thing is clear: “MBA students need to be able to deal with more digital and more data-oriented jobs.”-

Francisco Gimeno - BC Analyst These are the kind of news which make us smile. Three years ago no good MBA holder or student would even speak about the blockchain... now the possibility of disruption, and the emergence of education and training outside colleges, change the landscape practically every week. And more is coming.

-

-

Technology has a way of making even smart people seem stupid. Often the names of advanced technologies appear to be in some foreign and unfathomable language. In reality, many of these technologies aren’t that complicated once someone explains to you what they are.

A good example of this is a blockchain.You may have heard the term “blockchain” banded with cryptocurrencies such as Bitcoin. Often, the word seems almost synonymous with digital currencies.

Blockchains were created for cryptocurrencies. However, their applications go far beyond them. Even if you have no intention of buying or using cryptocurrencies, the multiple applications of blockchain technology may positively impact your life one day.In this blockchain 101 primer, we will give you an introduction and guide to understanding “how blockchain works”.

We will also describe how technology is affecting a myriad of important industries. At the same time, we will tell you how it may change your life for the better.What Is Blockchain?

To truly understand what blockchain is, you must first understand why it was created.Bitcoin was the first cryptocurrency. By far, it is the most popular digital currency. However, it was not the first attempt to create a digital currency.

What held others back from mainstream acceptance was a flaw called double-spending in which a digital token representing money could be spent more than once.

The creator of Bitcoin developed blockchain. It was created specifically to solve double-spending. Moreover, it did so without the need of any central authority.

A blockchain gets its name from the fact that, in form, it is a chain of transaction blocks. This sounds complicated, but it is quite simple. You can look at a blockchain as being nothing more than a financial ledger.

However, instead of keeping this ledger in a book, it is stored digitally and distributed over many independent computer servers that are also known as decentralized nodes.

Each of these nodes keeps the same digital ledger. Moreover, each of these nodes confirms every single transaction made to the ledger. Additionally, these nodes prevent any changes to transactions that are already in the ledger. It also provides equal access to data stored in the ledger for all participants.

The distributed nature of blockchains makes it impossible for anyone, individual or entity, to control or manipulate ledger data. All other nodes will contradict and disavow any changes made to the ledger if a hacker had compromised a node or a node owner had malicious intent to it. Photo on Wikimedia Commons

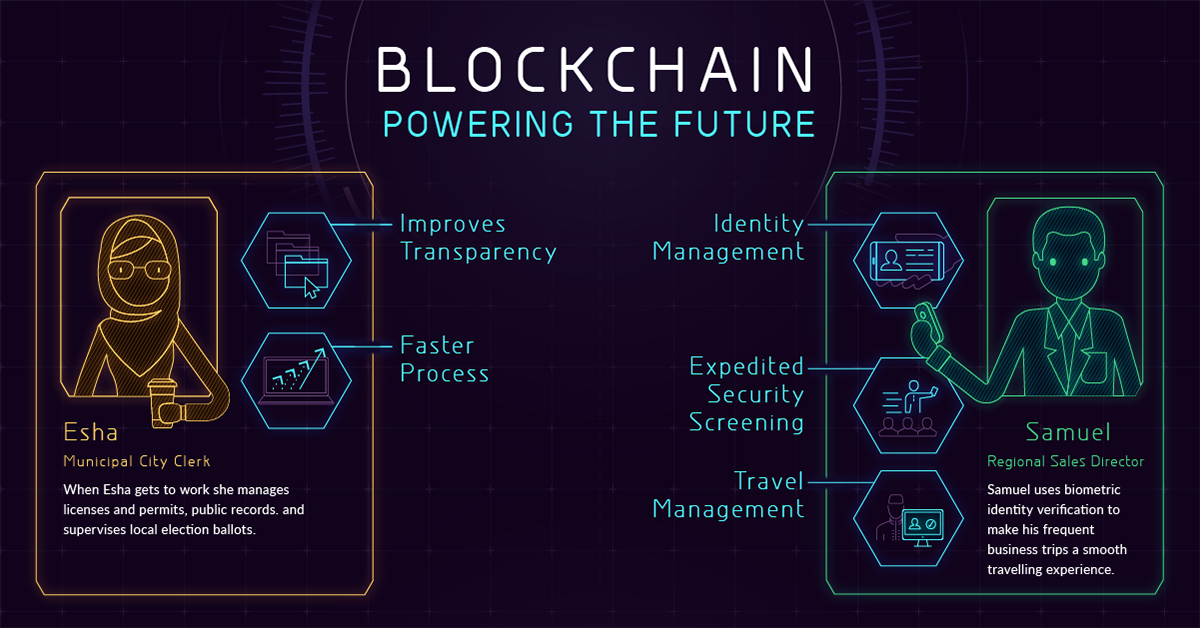

Photo on Wikimedia Commons Blockchain: Powering The Future

Everyone can trust the data kept within a blockchain. Moreover, they needn’t rely on any third party to provide this trust. This technology has helped cryptocurrencies to explode in popularity. Owners of these currencies know that no government, corporation, or individual has control over their money.

This same technology has also led to an explosion of other authority-less applications.

Another key benefit of blockchain technology is transparency. Most blockchains, such as the one that underlies Bitcoin, uses a public blockchain.

This means that anyone with access to the Internet can view every single transaction made to the ledger. In the case of Bitcoin, you can trace every Bitcoin from the time it was first created until the time it passed to its current owner. Even in a private blockchain, all participants have equal access to the ledger and can track all transactions made to it. Photo by Jenny Scribani on Visual Capitalist

Photo by Jenny Scribani on Visual Capitalist Why Non-Cryptocurrency Organizations Are Using Blockchain Technology?

Blockchain technology was designed specifically for cryptocurrencies such as Bitcoin. While these currencies rely on blockchains, organizations in both the private and public sectors quickly saw that they could apply the technology to solve a wide range of problems that had nothing to do with cryptocurrencies.

For many private-sector organizations, the decentralized nature of blockchains and its immutable and verifiable data means that they can use them to reduce the need for third parties to act as a counterparty to contractual obligations between two parties.

Some organizations also see blockchains as a means to automate complex processes and reduce the need for creating and maintaining vast amounts of paperwork. Many large organizations are further using blockchains to track the distribution of goods and services, from the time of their creation until they reach their end-user.

For public-sector organizations, the prime benefit of blockchain technology is transparency. By placing important public information on a publicly accessible blockchain, all citizens can not only access this information but also trust it. A blockchain allows people to hold their government and the people who work for it more accountable. Photo by Iulia on Digitaltokens

Photo by Iulia on Digitaltokens The Applications Of Blockchain Technology

Blockchain technology is relatively new. Despite many organizations being naturally skeptical of new technologies, it has already been applied (or is in the process of being applied) in a wide variety of real-world applications outside of cryptocurrencies. These include the following:Smart Contracts

Smart contracts are legal obligations between two entities. They are created and executed completely in computer code. Moreover, they allow these entities to track and enforce these obligations without the use of any third parties, including the judicial system.

Many smart contracts also implement automated escrow payments in digital currency to complete the contract. This can dramatically reduce contract-related transaction costs.

Moreover, it can increase the speed of contract execution.

Ethereum is currently the second-largest cryptocurrency by market capitalization. It was created specifically to facilitate these contracts. Many other cryptocurrencies, including Bitcoin, can support them as well.Supply Chain Management

Major international corporations, such as Nestle and Walmart, have been developing applications that use blockchain technology for supply chain management. This allows them to track the entire chain of the products they sell.

This starts from raw materials to work-in-progress inventory, all the way to their sale. Their systems do all this while providing data access to all interested parties, such as their business partners. Blockchains can also improve the auditing of these supply chains.

This allows companies to find inefficiencies that they would have never found otherwise.

IBM has even developed various products to let companies quickly and easily build blockchain-based supply chain management systems. The Blockchain in Transport Alliance has been developing standards for these systems.Financial Services

Blockchains are used to create and execute smart contracts. Moreover, in the development of systems that will settle stock trades, they also use Blockchain. A traditional settlement of trade can take many days. However, the use of a blockchain can reduce this wait to nothing.

This is because the executing, clearing, and settling of trade takes place at the time of the trade. Additionally, it does all this without sacrificing any security. Blockchain-based settlement systems can also significantly reduce the cost of settling trades.

Settlement systems are being developed for the settlement of stock trades. Furthermore, it is also developed for the settlement of other types of securities, such as bonds.Other forms of blockchain-based financial services systems include:- Cross-Border Payment Systems

- Auditing Systems

- Regulatory Compliance Systems

Digital Voting

As stated previously, blockchains are not just for private companies or financial gain. Governments all around the world are using blockchain technology. They are using it to create applications that register various forms of public data. One of the most promising of these applications is digital voting.

In many parts of both the developed and the developing world, voter fraud is a major issue. However, many localities are building systems that use blockchain technology. These help them eliminate problems while providing the public with unprecedented transparency and trust.How Will Blockchain Technology Benefit You

Not everyone gets rich from the Internet. However, technology is benefitting everyone. You can see this benefit every time you perform a search for information that would have been difficult (if not impossible) to collect.

It also helps when you want to book rideshare or a bed & breakfast using your phone. Blockchain technology will benefit you in many ways even if you do not make millions from investing in it.

One of the biggest ways blockchain technology will benefit you is in the transaction fees you pay for bank accounts, money transfers, and escrow services.

This is because the elimination of intermediary third parties will reduce the cost of these fees significantly. But this is just the beginning.

Joe Duran, the founder and CEO of United Capital, believes that in a decade from now, every transaction you make will involve a blockchain. This will make transactions cheaper, faster, and more secure than ever before.

A recent survey by accounting and consulting powerhouse, PricewaterhouseCoopers, backs Duran’s assertion. It indicates that nearly 85% of companies are actively developing blockchain solutions. Furthermore, this will increase in the coming years. Photo by Sergey Lypchenko on DZone

Photo by Sergey Lypchenko on DZone -

By

Admin

Admin - 2 comments

- 2 likes

- Like

- Share

-

Francisco Gimeno - BC Analyst Optimistic blockchain guide for beginners. The blockchain is rapidly evolving and changing, and more and more people is asking why is this about and how it will impact their lives, jobs and investments. Understanding the basic concepts is a necessary step.

-

Follow along with the course eBook: http://bit.ly/2W8PHvi

Take the full course: https://systemsacademy.io/courses/tok...

Utility tokens, also called app coins or user tokens, represent current or future access to a blockchain network's services. The defining characteristic of utility tokens is that they are not designed as investments.

https://twitter.com/systemsacademy-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Follow along with the course eBook: http://bit.ly/2W8PHvi

Take the full course: https://systemsacademy.io/courses/tok...

With blockchain base token economies we are not just expanding what value types get incorporated into the economy but also by reducing transaction cost we are extending markets further out. By converting centralized organizations with boundaries and borders into open networks we are making the networks of the global economy accessible to many more people.

https://twitter.com/systemsacademy-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Follow along with the course eBook: http://bit.ly/2W8PHvi

Take the full course: https://systemsacademy.io/courses/tok...

With these token economies a new form of economic development is emerging, one that is more organic and evolutionary. Key components of that are; initial coin offerings as means to bootstrap the token network; prediction markets as distributed mechanisms for bringing in the best available information and predicting what will happen in the future; and advanced analytics as means of optimizing the allocation of resources on the network through big data analytics.

https://twitter.com/systemsacademy-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Follow along with the course eBook: http://bit.ly/2W8PHvi

Take the full course: https://systemsacademy.io/courses/tok...

In this video, we talk about the effect that token economics will have on the structure of the enterprise. The enterprise of tomorrow will unlikely be based on the static structures of today but instead will be event-driven networks as we go from a push model of industrial production to the pull model of the services economy. Service-oriented blockchain based networks will use advanced analytics to pull together resources when and where needed on demand.

https://twitter.com/systemsacademy-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Follow along with the course eBook: http://bit.ly/2W8PHvi

Take the full course: https://systemsacademy.io/courses/tok...

Game theory is the study of the strategic interaction between adaptive agents and the dynamics of cooperation and competition that emerge out of this. A much more recent extension of this is mechanism design. Mechanism design is a field in economics and game theory that takes an engineering approach to designing economic incentives toward desired objectives, in strategic settings. Because it starts at the end of the game, then goes backward, it is also called reverse game theory. It has broad applications in the management of markets, auctions, voting procedures and is of particular relevance to token economics.

https://twitter.com/systemsacademy-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Follow along with the course eBook: http://bit.ly/2W8PHvi

Take the full course: https://systemsacademy.io/courses/tok...

In this video we talk about how token economics enables us to better capture and define the concept of intrinsic value. Our traditional financial system and the basis of neoliberal free market economics is the construct of value as utility. Utility is the value that something gives to some person. In contrast to utility is intrinsic value. Intrinsic value is the value that something contributes to the maintenance and functionality of a whole system. With intrinsic value, we have a unit that values the functionality of the whole network.

https://twitter.com/systemsacademy-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Follow along with the course eBook: http://bit.ly/2W8PHvi

Take the full course: https://systemsacademy.io/courses/tok...

Discount tokens are one of the new innovations made possible at a large scale within a blockchain based token economy. In short, discount tokens are digital assets that give their holders a specific claim to receive discounts on purchases of products or services from an organization — such as an enterprise, a cooperative, or a blockchain network. Unlike gift cards, discount tokens are not invalidated when used but remain active and in possession of the holders. The specific size of the discount that the token delivers for its owner is designed to grow in proportion with the overall utilization of the network. The discount token itself allows the holder to access the discount.

https://twitter.com/systemsacademy-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Follow along with the course eBook: http://bit.ly/2W8PHvi

Take the full course: https://systemsacademy.io/courses/tok...

The blockchain originates out of the purely digital realm of Bitcoin. Thus blockchain networks themselves can only ever manage what is on the network. This is fine if the asset is simply a digital token, but going forwards we find ourselves increasingly wanting to use these networks to manage real-world assets, thus these value networks will have to interface with the real economy and this interface between the physical and information realms creates major issues. Economies are at the end of the day still very much physical systems of technology, land, natural resources, buildings etc. if we are serious about migrating our economic systems to the blockchain major consideration has to be given to that interface to ensure that the tokens are securely and accurately connected to their underlying physical assets.

https://twitter.com/systemsacademy-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Follow along with the course eBook: http://bit.ly/2W8PHvi

Take the full course: https://systemsacademy.io/courses/tok...

When you remove the centralized component in these networks you also remove the wall around them that they create which can work to greatly increase transparency across whole networks. By switching to a peer-to-peer model you switch to a model based upon direct feedback loops between peers, to get that dynamic real-time information feedback loop you need transparency; the information has to actually flow directly instead of being mediated. By aligning the interests of the network, you can make transparency possible as people have less of their misaligned incentives to hide from each other. When things are on the blockchain then everyone can go and audit what has happened, this is like finding bugs in open source software where "many eyes make all bugs shallow."

https://twitter.com/systemsacademy-

By

Admin

Admin - 0 comments

- 0 likes

- Like

- Share

-

By

-

Follow along with the course eBook: http://bit.ly/2W8PHvi

Take the full course: https://systemsacademy.io/courses/tok...

The first application of blockchain technology may have been in currencies but people are becoming increasingly aware that a secure distributed ledger system of this kind could in fact potentially support all economic activity one day. Today startups around the world are feverishly building new frameworks for migrating ever more spheres of financial and economic activity to distributed ledger technology.

https://twitter.com/systemsacademy

-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Follow along with the course eBook: http://bit.ly/2W8PHvi

Take the full course: https://systemsacademy.io/courses/tok...

Token economics offers the potential to break down divides between users and producers, between workers and owners; working to align their incentives within a whole ecosystem. By connecting people peer-to-peer and automating the operations of the network, blockchain technology enables us to take out the centralized component and reintegrate producers and consumers into a much more functional ecosystem of exchange.

https://twitter.com/systemsacademy-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Follow along with the course eBook: http://bit.ly/2W8PHvi

Take the full course: https://systemsacademy.io/courses/tok...

Blockchain protocols build upon the capacities of telecommunication networks to interconnect, and of the capacities of the microprocessor to run complex software systems for coordination. But whereas the previous set of information technologies gave us digital platforms for organizing economic production the blockchain promises to extend this model to fully automated distributed networks.

https://twitter.com/systemsacademy-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Follow along with the course eBook: http://bit.ly/2W8PHvi

Take the full course: https://systemsacademy.io/courses/tok...

How to create incentive systems that align the interests of the individual with the overall beneficial outcomes for the organization or economy is a central issue of interest in business management and economics in general. In this video, we explore how token networks give us new ways to design and build incentive systems.

https://twitter.com/systemsacademy-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Follow along with the course eBook: http://bit.ly/2W8PHvi

Take the full course: https://systemsacademy.io/courses/tok...

The blockchain is a new coordination technology that relies on a decentralized network of computers in order to coordinate individual actions in a decentralized manner. We can think of token economies as a way for people to mimic the social dynamics found in certain highly social creatures like bees, ants, and termites as a way to promote and ideally achieve effective collective organization. By recording individual actions on a distributed database the blockchain makes it possible for people to coordinate themselves indirectly and collaborate on a global scale, without any centralized authority or hierarchical structure. This is something quite new in human civilization until very recently the basic premise has been that order and organization are achieved by centralized authority.

https://twitter.com/systemsacademy-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Follow along with the course eBook: http://bit.ly/2W8PHvi

Take the full course: https://systemsacademy.io/courses/tok...

ICO, Initial Coin Offerings or first token sale, has become a new way to bootstrap a community, through pre-selling tokens that give users access to the futures services that the network will deliver. In an ICO, a quantity of the crowdfunded cryptocurrency is redistributed to investors in the form of "tokens", in exchange for fiat currencies or other cryptocurrencies. These tokens become functional units of currency when the ICO's funding goal is met and the project launches.

https://twitter.com/systemsacademy-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Follow along with the course eBook: http://bit.ly/2W8PHvi

Take the full course: https://systemsacademy.io/courses/tok...

A huge structural change that is coming about as we move into the information services economy - base on information networks - is the shift from static structures to dynamic flows of value, which take the form of service networks. The organization is not based on fixed structures, roles or boundaries, but instead is based more upon value produced and exchange, this value can be defined in terms of services. From this perspective, the organization is a network of value exchange and the members of the organization are those that provide value, the service providers.

https://twitter.com/systemsacademy-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Follow along with the course eBook: http://bit.ly/2W8PHvi

Take the full course: https://systemsacademy.io/courses/tok...

Prediction markets are speculative markets, very similar to futures markets which have been designed so that the prices can be interpreted as probabilities for events occurring and used to make predictions. Put very simply prediction markets enable users to trade shares in the outcomes of an event and in so doing to reveal the information that people have about the likelihood of an event occurring. In a very elegant way, blockchain prediction markets use tokens to reduce uncertainty and find truths about future events, as they align truthful statements with token investments. They create a way for people and groups to come to consensus about a shared conception of reality by using markets to create valid sources of information.-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Watch the full webinar at: https://pages.consensys.net/blockchai...

Most people know that current blockchain use cases in healthcare and life sciences include tracking the pharmaceutical supply chain, provider directories, physician credentialing and more. But the real potential will come with advancements in patient-mediated data, a cultural shift on sovereignty and regulation, and maturing market functions for data monetization. Come to this webinar to learn about how blockchain will revolutionize healthcare and life sciences for patients, physicians, insurers, R&D, pharmaceutical companies, and health care providers.

· How do we conceptualize blockchain adoption in the industry at scale

· Learn about the internet of medical things (IOMT)

· What are barriers to adoption of blockchain in healthcare and life sciences

· What’s a strategic view of transformation and how it’s implemented

Learn more at https://consensys.net/solutions/

Presented by:

· Heather Leigh Flannery - Global Lead, Consensys Health; Chair, IEEE SA P2418.6; Co-Founder & Chair, BiHG, IEEE ISTO; Co-Chair, HIMSS Blockchain Task Force

· Dr. Alex Cahana - Head Of Healthcare and Blockchain Consulting At Genesis Block; Blockchain Expert UN/CEFACT, Economic Commission Europe

· Robert Miller - Senior Consultant at Consensys Health; Fellow, Blockchain In Healthcare Global-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Today it was revealed that tech giant LG’s tech subsidiary, LG CNS, is planning a food traceability blockchain. In partnership with SayIT, a Korean IT service provider, the platform will provide traceability information on food served at school canteens.

According to ZDNet, the information on the food’s production, processing, distribution, acquisition, and consumption will be stored on a public blockchain. It will enable parents and carers to check on what their children are eating at school, for their health and food sustainability.

LG CNS and SayIt plan to monetize the blockchain by allowing food producers to promote their products. There’s a suggestion that firms could send online ‘mobile flyers’ to users of the platform.It will run on the tech firm’s dedicated blockchain, Monachain, launched last May.

The platform is based on HyperLedger Fabric, with which LG CNS announced a collaboration.

Back in 2017, it partnered with R3. But according to Korean site BChain, Kim Ki Young, the LG CNS blockchain project lead explained “In the past, we had joined the finance sector-dedicated R3 consortium to exploit the technology, but licensing the technology proves costly and it was extremely difficult to catch up with it.

This helps explain why we have developed our own homegrown Monachain.

”The Monachain platform was developed for use in authentication, digital identities, and supply chain management. LG CNS plans to release a blockchain project each month.Last year LG developed the first public blockchain platform in its native Korea for KOMSCO, a currency minting and security printing firm.

The aim was to issue digital vouchers or community currencies for use on campus or for local government services.In a separate partnership with KB Kookmin Bank, it is working on the Magok Community Currency Platform.

This is a blockchain-based payment system which is currently being used in-house and will be extended to the local science park.

LG CNS has also developed a traceability blockchain for electric car batteries. Knowing how much battery life is left and its history allows for more efficient recycling.

Sister companies within the LG group are also on the governance council of blockchain initiative Klaytn, by Korean messaging firm Kakao.-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Two more universities get into blockchain education with specialized online cour... (thenextweb.com)This week sees two more universities get into the blockchain game by offering courses in cryptocurrency, fintech, and distributed ledger technology.

Earlier this week, Ireland‘s Minister for Business, Enterprise, and Innovation Heather Humphreys launched the country’s first Master’s in blockchain technology.

While on the other side of the Atlantic, the Wharton School of the University of Pennsylvania introduced a new course on all things fintech.

Ireland‘s new blockchain Master’s was developed in collaboration with Technology Ireland ICT Skillnet, a government funded ICT training organization, and Dublin City University.

The course is targeted primarily at IT professionals looking to build their blockchain dev skills.

The “MSc in Blockchain” aims to close the skills gap that ICT Skillnet claims is currently preventing adoption of the technology, and to help Ireland become one of the world’s leading developers of blockchain related technology, according to the prospectus.

Although it’s an online course, only residents of the Republic of Ireland can apply, though.

The University of Pennsylvania‘s business school, The Wharton School is – as you might expect – taking a more business-oriented approach.

Its new “Fintech: Foundations and Applications of Financial Technologies” course has been launched in response to the world’s “rapidly changing business landscape,” an announcement reads.

The course will cover cryptocurrency and blockchain, and other topics including: payments, crowdfunding, and modern investing. Wharton’s course, which will be available through online learning platform Coursera, is aimed at complete beginners and will be open to everyone.

This means that although it’ll be taught by Wharton educators, you won’t receive any university credits. The course takes 16 weeks to complete, and will set you back about $80 (70 euro) a month for a Coursera subscription.

Over the last 12 months, nearly half the world’s top universities have launched new courses designed to educate the next generation of blockchain professionals.

IBM also partnered with the University of Louisville to offer the IBM Skills Academy, which offered courses in a range of developing technologies, including blockchain.

Blockchain courses are nothing new, but it certainly seems to be a growing industry in its own right.-

Francisco Gimeno - BC Analyst We have stated several times that the job market for those skilled in the blockchain is increasing, but most of those working now in it have not learnt it in universities or colleges, but on the work, on the hard way. Universities are realising that the blockchain and soon other new techs will have to be taught to get prepared skilled people in the job market.

-

-

Get up to speed with the tech that's powering cryptocurrencies, logistics, and more.

Blockchain may have been the bandwagon technology of 2018, but its popularity is still going strong this year as more groups leverage it in increasingly inventive ways. From potentially tracking prescription drugs to creating a blockchain smartphone, the digital ledger tech is going far beyond the realm of Bitcoin.

If you're looking to add this skill to your repertoire and cash in on a six-figure salary, the Blockchain Certification Advanced Training Bundle is a solid starting point, and it's on sale for only $29. This two-course collection features 35 hours of instruction designed to take you from zero to hero with this groundbreaking tech.

You'll develop a detailed understanding of blockchain basics, including its origins, objectives and challenges; and you'll expand your know-how to mining methodologies and, of course, cryptocurrency.

In fact, this collection offers a multi-faceted look at several cryptocurrencies like Bitcoin, Hyperledger and Ethereum, as well as various blockchain platforms.

Make your way through the collection, and you'll develop a solid foundation in blockchain tech and even earn two certificates of completion to validate your skills. While the Blockchain Certification Advanced Training Bundle usually retails for $899, you can get it on sale today for over 90 percent off.

Engadget is teaming up with StackSocial to bring you deals on the latest headphones, gadgets, tech toys, and tutorials. This post does not constitute editorial endorsement, and we earn a portion of all sales.

If you have any questions about the products you see here or previous purchases, please contact StackSocial support here.-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Duke University is teaming up with blockchain startup Citizens Reserve on an educational initiative aimed to develop students’ interest in blockchain technology.

Citizens Reserve, a firm led by a team of former Deloitte blockchain employees, told CoinDesk Friday that it will jointly create a new incubation lab on Duke campus for students to work on real blockchain projects and host blockchain-focused events.

The company will also support the university in putting together a curriculum on blockchain technology, as well as in connecting students with blockchain experts and helping them find jobs in the sector when they graduate.

“As a Duke MBA alumnus, I am excited to spearhead this program, and help the next generation of blockchain advocates and leaders succeed,” said Yonathan Lapchik, chief innovation officer at Citizens Reserve.He added:“Many industries, including finance, supply chain, and healthcare, are already exploring the potential of blockchain technology, so it is more important than ever to provide students with the tools needed to develop the skills, connections, and knowledge employers will seek from tomorrow’s workforce.”