- Despite predictions from bitcoin bulls that prices would recover as Tax Day passed, prices pulled back dramatically below $8,000 late Tuesday.

- The IRS views bitcoin and other cryptocurrencies as property, meaning profits from transactions are subject to capital gains tax.

- U.S. households could owe roughly $25 billion in taxes for digital currency holdings, according to Tom Lee, head of research at Fundstrat Global Advisors.

Artur Widak | NurPhoto | Getty Images

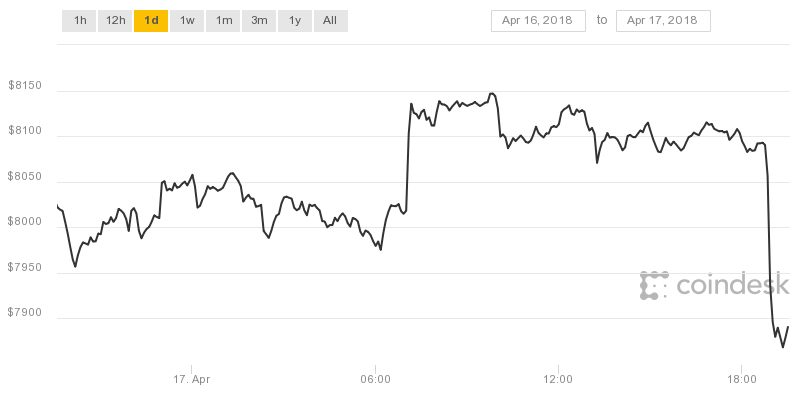

A man passes in front of a Bitcoin exchange shop in Krakow, Poland.Bitcoin pundits had bet on prices recovering after U.S. investors filed their taxes. But as markets headed into the close on Tax Day, prices pulled back dramatically below $8,000. Bitcoin fell more than $200 in 30 minutes, to a low of $7,861 as of 4:00 p.m.

ET, according to CoinDesk. The digital currency has dropped roughly 45 percent this year, after trading above $14,000 in January.The Internal Revenue Service views bitcoin and other cryptocurrencies as property, meaning profits from transactions are subject to capital gains tax. U.S. households could owe roughly $25 billion in taxes for digital currency holdings after bitcoin's meteoric rise last year, according to Tom Lee, head of research at Fundstrat Global Advisors.

Lee, the only major Wall Street strategist to issue bitcoin price targets, has predicted that the cryptocurrency will hit $20,000 by the middle of the year and $25,000 by the end of 2018.Bitcoin's Tax Day price moves

Source: CoinDeskJack Tatar, co-author of "Cryptoassets:

The Innovative Investor's Guide to Bitcoin and Beyond," said prices could still rebound after Tax Day, but it won't be immediate."I think we'll start to see bitcoin start to trade in a range with current levels as a support," Tatar said. "I do believe that later in the year we'll see a breakout as more institutional money comes in and investors become better educated."Last week, the digital currency rose to its highest level since March.

The move followed a spike from a low of $6,786 to above $8,000, which some traders attributed to investors covering their shorts, or buying back into the market after betting against bitcoin.

Prices rallied to a high of $8,151.10 earlier Tuesday after International Monetary Fund Managing Director Christine Lagarde published a blog post listing potential upsides of cryptocurrencies.

"Policymakers should keep an open mind and work toward an even-handed regulatory framework that minimizes risks while allowing the creative process to bear fruit," Lagarde said.

The IMF chief's writing had a noticeably more optimistic tone than her last post, which highlighted the potential use for financing of terrorism and money laundering.

Kate Rooney

Markets Reporter

See more from CNBC here: https://www.cnbc.com/2018/04/17/bitcoin-tax-day-rally-is-apparently-not-happening-as-price-drops.htm...

-

- 1

Christine Great insights.