Blockchain technology adoption has increased rapidly in recent years. The proliferation of tools for big data analysis and artificial intelligence based processing pushes organizations to collect and make available large amounts of data.

Blockchain provides a secure, distributed, and efficient way for organizations to track, trade, organize, and store data. As such, implementations of blockchain can be found in almost every major industry.

The adoption of blockchain technology for a variety of data organization and tracking applications suggests a paradigm shift in the way that organizations will track, and share data moving forward.

There has been a large increase in patent filings on blockchain innovations in the past few years. (1) In 2014, patent filings on blockchain innovations took off and have doubled, tripled, and in some sectors even quadrupled since then.

A second sharp spike was experienced in 2017 as implementations of smart contracts and corresponding patent applications began to appear.

During the time period between 2010 and 2019, the percentage of overall filings represented by the United States dropped a few percentage points but remains around or just below 80%. The biggest gains in the percentage of overall blockchain patent filings over the last decade are represented by Japan and South Korea.

These gains may correspond to the export of American cryptocurrency and fintech applications into Asian markets as well as the continued expansion of Asian markets into fintech ventures.

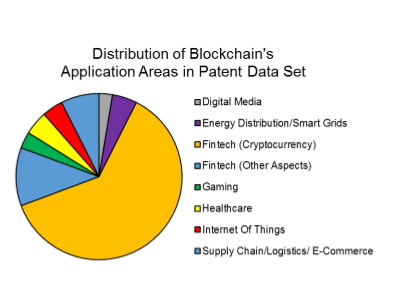

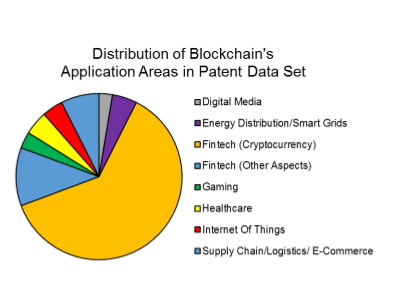

At present, the fintech industry remains the largest driver of blockchain related patent filings. More particularly, applications related to cryptocurrency represent over 60% of all blockchain patent filings in the United States.

The second largest portion of blockchain related patent filings comes from non-cryptocurrency fintech applications such as account storage, authentication, authorization, and accounting.

Despite the dominance of fintech related applications for the blockchain technology, applications to other economic sectors have expanded in recent years. The number of blockchain patent filings has grown in supply chain logistics, healthcare, energy distribution, and the Internet of Things.

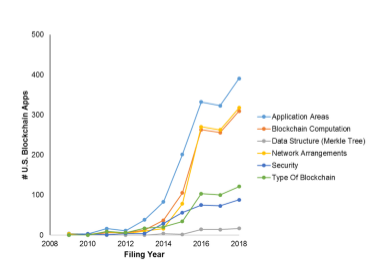

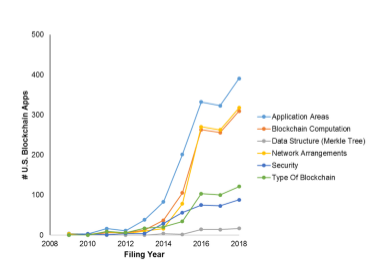

The expansion of patent filings also varies across categories of blockchain innovations. Patent filings for most blockchain innovations began to climb in 2013 and took off in 2014 for some categories.

For example patent filings on blockchain innovations including security, data structures (e.g., merkle trees), and types of blockchain (public vs private, sub-blockchains) have increased at a steady and near-linear rate since 2014.

However, patent filings on network structure (e.g., networks supporting blockchain implementations), block computation (e.g., block addition), and implementations of blockchain to specific applications (light blue) have significantly increased since 2014.

These filings levelled off slightly in 2016 but continued to climb around 2017 after smart contracts technology began to spread and gain adoption. The three largest generators of blockchain patent filings are IBM, Bank of America, and

Mastercard.

Blockchain innovations are generally implemented in software and therefore tend to be assigned to art units within the business methods groups of technology center 3600.

Many of the blockchain patent filings related to application areas, network structure, and blockchain computation are assigned to art units 3685 and 3697, which both have very low average grant rates of about 20% and 6% respectively.

Higher allowance rates may be found within Tech Center 2100 relating to computer hardware and software.

Applicants are strongly encouraged to claim a clear practical application of blockchain technology as implemented on specific hardware or network structure if possible, in order to increase the likelihood that the patent filing will be examined in a 2100 art unit rather than 3600, as well as to mitigate issues arising under 24 U.S.C. 101.

What does this data teach in-house and firm practitioners?

• The expanding implementation of blockchain technology across many industries means that even practitioners outside of computer and electrical engineering fields may be presented with blockchain related disclosures.

Even practitioners who do not handle fintech sector patent filings should familiarize themselves with the nature of block basics of blockchain technology in order to help clients identify and capture related innovations.

• Practitioners representing clients in internet of things, energy distribution, supply chain logistics, and healthcare fields should be probing to determine whether any innovations are supported by blockchain technology.

• Anticipate that the number of filings from Asian markets will continue to increase. Practitioners supporting Japanese, South Korean, and Chinese high-tech clients should be aware of blockchain basics.

• Practitioners representing domestic clients within the fintech, supply chain logistics, and internet of things sectors should strongly consider a foreign filing strategy that includes Japan, South Korea, and China.

• The continued growth in patent filings on blockchain technology indicates strong economic interest in the adoption of the technology. Blockchain technology may be a strong space for investment.

However, there is risk associated with the potential difficulty of successfully obtaining patent coverage on blockchain innovations depending what art unit at the patent office examines the case.

The acquisition of blockchain patents may impact he success of ventures that rely on blockchain backed services.

Blockchain provides a secure, distributed, and efficient way for organizations to track, trade, organize, and store data. As such, implementations of blockchain can be found in almost every major industry.

The adoption of blockchain technology for a variety of data organization and tracking applications suggests a paradigm shift in the way that organizations will track, and share data moving forward.

There has been a large increase in patent filings on blockchain innovations in the past few years. (1) In 2014, patent filings on blockchain innovations took off and have doubled, tripled, and in some sectors even quadrupled since then.

A second sharp spike was experienced in 2017 as implementations of smart contracts and corresponding patent applications began to appear.

During the time period between 2010 and 2019, the percentage of overall filings represented by the United States dropped a few percentage points but remains around or just below 80%. The biggest gains in the percentage of overall blockchain patent filings over the last decade are represented by Japan and South Korea.

These gains may correspond to the export of American cryptocurrency and fintech applications into Asian markets as well as the continued expansion of Asian markets into fintech ventures.

At present, the fintech industry remains the largest driver of blockchain related patent filings. More particularly, applications related to cryptocurrency represent over 60% of all blockchain patent filings in the United States.

The second largest portion of blockchain related patent filings comes from non-cryptocurrency fintech applications such as account storage, authentication, authorization, and accounting.

Despite the dominance of fintech related applications for the blockchain technology, applications to other economic sectors have expanded in recent years. The number of blockchain patent filings has grown in supply chain logistics, healthcare, energy distribution, and the Internet of Things.

The expansion of patent filings also varies across categories of blockchain innovations. Patent filings for most blockchain innovations began to climb in 2013 and took off in 2014 for some categories.

For example patent filings on blockchain innovations including security, data structures (e.g., merkle trees), and types of blockchain (public vs private, sub-blockchains) have increased at a steady and near-linear rate since 2014.

However, patent filings on network structure (e.g., networks supporting blockchain implementations), block computation (e.g., block addition), and implementations of blockchain to specific applications (light blue) have significantly increased since 2014.

These filings levelled off slightly in 2016 but continued to climb around 2017 after smart contracts technology began to spread and gain adoption. The three largest generators of blockchain patent filings are IBM, Bank of America, and

Mastercard.

Blockchain innovations are generally implemented in software and therefore tend to be assigned to art units within the business methods groups of technology center 3600.

Many of the blockchain patent filings related to application areas, network structure, and blockchain computation are assigned to art units 3685 and 3697, which both have very low average grant rates of about 20% and 6% respectively.

Higher allowance rates may be found within Tech Center 2100 relating to computer hardware and software.

Applicants are strongly encouraged to claim a clear practical application of blockchain technology as implemented on specific hardware or network structure if possible, in order to increase the likelihood that the patent filing will be examined in a 2100 art unit rather than 3600, as well as to mitigate issues arising under 24 U.S.C. 101.

What does this data teach in-house and firm practitioners?

• The expanding implementation of blockchain technology across many industries means that even practitioners outside of computer and electrical engineering fields may be presented with blockchain related disclosures.

Even practitioners who do not handle fintech sector patent filings should familiarize themselves with the nature of block basics of blockchain technology in order to help clients identify and capture related innovations.

• Practitioners representing clients in internet of things, energy distribution, supply chain logistics, and healthcare fields should be probing to determine whether any innovations are supported by blockchain technology.

• Anticipate that the number of filings from Asian markets will continue to increase. Practitioners supporting Japanese, South Korean, and Chinese high-tech clients should be aware of blockchain basics.

• Practitioners representing domestic clients within the fintech, supply chain logistics, and internet of things sectors should strongly consider a foreign filing strategy that includes Japan, South Korea, and China.

• The continued growth in patent filings on blockchain technology indicates strong economic interest in the adoption of the technology. Blockchain technology may be a strong space for investment.

However, there is risk associated with the potential difficulty of successfully obtaining patent coverage on blockchain innovations depending what art unit at the patent office examines the case.

The acquisition of blockchain patents may impact he success of ventures that rely on blockchain backed services.