Need further evidence that the digital-currency market is in a frenzy? How about the fact that only about one out of 10 tokens issued in initial coin offerings is in use following the sales.

Of the 226 ICOs analyzed, only 20 -- such as Storj, Augur and TenX -- are used in the running of their networks, according to Token Report, which keeps a database of token sales information.

The rest can only be traded, and are purely speculative instruments, Galen Moore, chief executive officer of Token Report, said in an interview.

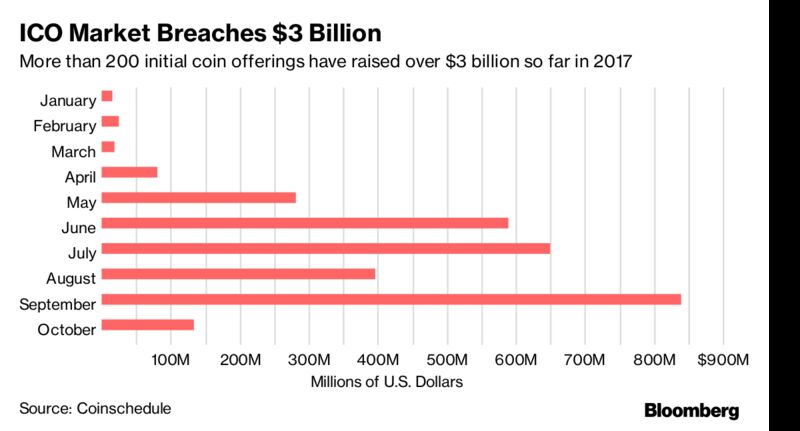

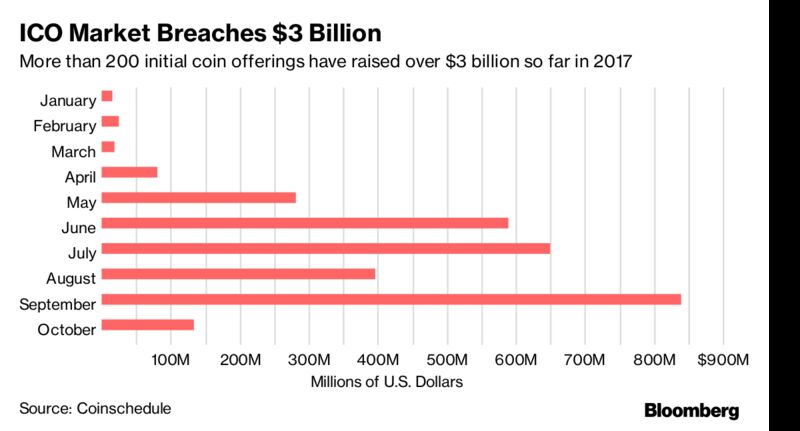

Investors have poured in excess of $3 billion into over 200 ICOs this year, according to data from Coinschedule.com. September was among the busiest months, bringing in almost $850 million alone in 37 offerings. There is now in excess of 1,000 digital tokens.

Read more: What’s an ICO? Like an IPO But With Digital Coins

The low rates of use could have big ramifications. Some startups may be facing scrutiny from regulators, Moore said. The Commodity Futures Trading Commission released a primer last week on virtual currencies, reiterating its view that virtual tokens can fall under its authority.

The U.S. Securities and Exchange Commission has already said tokens from some ICOs can be deemed securities under its oversight.

"If the coin is regulated as a security, rather than a utility, that limits how it can be traded and raises questions about whether developers are prepared to comply with securities regulators," Moore said.

Investors also face the risk that the product that their token is supposed to run on never materializes.— With assistance by Lily Katz

Of the 226 ICOs analyzed, only 20 -- such as Storj, Augur and TenX -- are used in the running of their networks, according to Token Report, which keeps a database of token sales information.

The rest can only be traded, and are purely speculative instruments, Galen Moore, chief executive officer of Token Report, said in an interview.

Investors have poured in excess of $3 billion into over 200 ICOs this year, according to data from Coinschedule.com. September was among the busiest months, bringing in almost $850 million alone in 37 offerings. There is now in excess of 1,000 digital tokens.

Read more: What’s an ICO? Like an IPO But With Digital Coins

The low rates of use could have big ramifications. Some startups may be facing scrutiny from regulators, Moore said. The Commodity Futures Trading Commission released a primer last week on virtual currencies, reiterating its view that virtual tokens can fall under its authority.

The U.S. Securities and Exchange Commission has already said tokens from some ICOs can be deemed securities under its oversight.

"If the coin is regulated as a security, rather than a utility, that limits how it can be traded and raises questions about whether developers are prepared to comply with securities regulators," Moore said.

Investors also face the risk that the product that their token is supposed to run on never materializes.— With assistance by Lily Katz

-

- 2

Francisco Gimeno - BC Analyst Meeting with blockchain enthusiasts and crypto fanatics I realize that there is yet a lot of confusion even among this groups about the use and value of tokens, and the impact of token and tokenization. This article is very interesting.