-

Italy will issue nearly 500,000 new work visas for non-EU nationals from 2026 to 2028, a cabinet statement said on Monday, as part of a strategy to expand legal immigration channels in response to labour shortages.

#Italy #visas #immigration

🔔 Subscribe to France 24 now: https://f24.my/YTen

🔴 LIVE - Watch FRANCE 24 English 24/7 here: https://f24.my/YTliveEN

🌍 Read the latest International News and Top Stories: https://www.france24.com/en/

Like us on Facebook: https://f24.my/FBen

Follow us on X: https://f24.my/Xen

Bluesky: https://f24.my/BSen and Threads: https://f24.my/THen

Browse the news in pictures on Instagram: https://f24.my/IGen

Discover our TikTok videos: https://f24.my/TKen

Get the latest top stories on Telegram: https://f24.my/TGen-

By

Admin

Admin - 0 comments

- 0 likes

- Like

- Share

-

By

-

Dr. Jordan B. Peterson sits down with South African filmmaker, author, and activist Dr. Ernst Roets. They discuss the genetic and cultural hyper-diversity of Africa, the early settlement patterns of South Africa, the origin story of the Boers, how forgotten history breeds rhyming conflicts in the present, and the complex needle that must be threaded for shared prosperity.

Dr. Ernst Roets is an Afrikaner activist, author and filmmaker from South Africa. He serves as Executive Director of the newly established Pioneer Initiative, which seeks to promote a more sustainable political dispensation for South Africa, based on the principles of decentralization and self-governance. Dr Roets is the leading expert on the topic of farm murders in South Africa. His book, Kill the Boer: Government Complicity in South Africa's Brutal Farm Murders is an international bestseller on Amazon. He is also the producer of several documentary films. He regularly appears in the media - both in South Africa and the international media - about issues relating to South Africa and he regularly speaks at international conferences, including CPAC and NatCon. He is a leading advocate for the protection of free speech and property rights in South Africa, and for farm murders to be regarded as a priority crime.

This episode was filmed on March, 14th, 2025.

Unlock the ad-free experience of The Jordan B. Peterson Podcast and dive into exclusive bonus content on DailyWire+. Start watching now: http://dwpluspeterson.com/yt

ALL LINKS: https://feedlink.io/jordanbpeterson

| Sponsors |

Shopify: Sign up for your one-dollar-per month trial period at http://shopify.com/jbp

PreBorn!: Help save babies from abortion. Visit https://preborn.com/JORDAN

Hallow: Get 3 months free at https://hallow.com/Jordan

Oracle Netsuite: Make better business decisions with NetSuite https://www.NetSuite.com/JBP

| Links |

For Dr. Ernst Roets:

On X https://x.com/ernstroets?lang=en

On YouTube / @ernstroets

/ @ernstroets

Read “Kill the Boer: Government Complicity in South Africa's Brutal Farm Murders” https://a.co/d/cMWyuMH

| Chapters |

(0:00) Coming up

(1:01) Intro

(3:48) Early settlement patterns in South Africa

(6:35) Who are the Bushmen?

(12:38) 1652: Enter the British

(15:52) “We skipped the enlightenment”

(22:39) Conflict and Cooperation: The Afrikaner story is remarkably similar to the American pioneer story

(25:20) The Zulu King’s betrayal, the vow, and the Battle of Blood River

(31:33) Rapid population growth across three hundred years

(35:08) Rebutting the typical western colonial narrative, clashing cultural views on property rights

(39:32) Warfare technology: stirrups effectively made horses into tanks

(43:22) The western obsession with self-loathing

(48:08) Returning to how the enlightenment “skipped” Africa, what led to the destruction of Rome

(53:12) You cannot force a frame of reference—bridging multiplicity for shared flourishing

(56:36) The dismantling of the apartheid system: like riding on the back of a tiger

(1:01:43) Safe but not sustainable: the rise of socialist solutions and why they’re failing

(1:07:09) The cost of innovation is inequality—things have to start somewhere

(1:09:12) The ship is headed in the wrong direction… and sinking

(1:11:23) How South Africa destabilized in just ten years, “blame the pipes”

(1:18:43) “Kill the Boers,” what it means and why it’s a deadly statement

(1:27:12) Shameful: the hierarchy of recognition

(1:31:11) President Trump’s impact on global acknowledgment

(1:33:26) What the west can offer South Africa

// LINKS //

Peterson Academy https://petersonacademy.com

ARC https://www.arcforum.com

Books - https://www.jordanbpeterson.com/books/

#JordanPeterson #JordanBPeterson #DrJordanPeterson #DrJordanBPeterson #DailyWirePlus-

By

Admin

Admin - 0 comments

- 0 likes

- Like

- Share

-

By

-

In Japan, the number of abandoned homes - known as Akiyas - is at an all-time high, with 9,000,000 million properties sitting empty on city streets and turning rural communities into ghost towns.

Click here to subscribe to our channel 👉🏽 https://bbc.in/3VyyriM

Lucy Hockings is joined by BBC Tokyo correspondent Shaimaa Khalil to ask why these abandoned homes are such a problem? What they say about Japan's existential population crisis? And whether there are any solutions?

00:00 Introduction

01:00 Spotting the abandoned homes

02:20 Dolls replace people in 'dying' village

02:55 Abandoned homes in cities

03:23 Why are there 9,000,000 empty homes in Japan?

04:06 Cultural and economic factors

05:22 'Homes die when the people die'

06:29 Impact on rural communities

07:00 Why not just knock the homes down?

07:47 Empty houses creating earthquake hazards

09:00 Foreigners buying and renovating these homes

10:53 Can tourism solve the empty home crisis?

12:42 Why foreigners are buying Akiyas

14:15 Japanese opinion on foreigners buying up empty houses

15:00 Does the Government have a plan for Akiyas

16:44 Japan's aging population problem

17:35 'Akiyas tell the story of Japan'

Watch more episodes of The Global Story here 👉🏽 • The Global Story

• The Global Story

You can listen to more episodes of The Global Story here. Making sense of the news with our experts around the world. Insights you can trust, Monday to Friday, from the BBC 👉🏽 https://www.bbc.co.uk/programmes/w13x...

----------------

This is the official BBC World Service YouTube channel.

If you like what we do, you can also find us here:

Instagram 👉🏽 / bbcworldservice

/ bbcworldservice

Twitter 👉🏽 / bbcworldservice

/ bbcworldservice

Facebook 👉🏽 / bbcworldservice

/ bbcworldservice

BBC World Service website 👉🏽 https://www.bbc.co.uk/worldserviceradio

Thanks for watching and subscribing!

#BBCWorldService #WorldService #Japan #Akiyas #Housing-

Francisco Gimeno - BC Analyst The problem of “akiyas” (abandoned homes) mainly in rural areas ofJapan has grown in a such way that s already presenting significant challenges. There are approximately 9 million empty homes, a result of several interconnected factors, like demographic shifts, as elders die, and young people go to towns and cities, leaving rural areas empty. Also some tradicional practices when Japanese believe that homes die when the people die, then add high inheritance tax and high renovation costs. SO rural areas are becoming ghost areas, which are considered even hazards, and the typical Japanese ambiance becomes kind of disturbing. What can be done? Government is trying to open to young foreign buyers trying to revitalise areas, and other initiatives, but this means a change, always slow, in the Japanese culture, not used to live with foreigners, and change or accommodate their culture with foreign ones. In short this trend is going to continue for a time yet, in a country who already suffers from one of the less birthrate in the world. A sign of the times.

-

-

#CathieWood #crypto #ElonMusk #yahoofinance

Ark Invest CEO and CIO Cathie Woods spoke to Yahoo Finance in 2022 about inflation, the state of crypto following the FTX crash, Elon Musk, why she is pulling out of social stocks, supply chains and more.

Don't Miss: Valley of Hype: The culture that built Elizabeth Holmes

WATCH HERE:

https://youtu.be/Sb179GLPNYE

Subscribe to Yahoo Finance: https://yhoo.it/2fGu5Bb

About Yahoo Finance:

At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates that help you manage your financial life.

Yahoo Finance Plus: With a subscription to Yahoo Finance Plus get the tools you need to invest with confidence. Discover new opportunities with expert research and investment ideas backed by technical and fundamental analysis. Optimize your trades with advanced portfolio insights, fundamental analysis, enhanced charting, and more.

To learn more about Yahoo Finance Plus please visit: https://yhoo.it/33jXYBp

Connect with Yahoo Finance:

Get the latest news: https://yhoo.it/2fGu5Bb

Find Yahoo Finance on Facebook: http://bit.ly/2A9u5Zq

Follow Yahoo Finance on Twitter: http://bit.ly/2LMgloP

Follow Yahoo Finance on Instagram: http://bit.ly/2LOpNYz

Follow Yahoo Finance Premium on Twitter: https://bit.ly/3hhcnmV-

By

Admin

Admin - 0 comments

- 0 likes

- Like

- Share

-

By

-

Get The Hottest Crypto Deals 👉 https://www.coinbureau.com/deals/

📲 Insider Info in Guy's Socials 👉 https://guy.coinbureau.com/socials/

👕 Guy's Merch Store 👉https://store.coinbureau.com

🔥 TOP Crypto TIPS In Guy's Newsletter 👉 https://guy.coinbureau.com/signup/

~~

Episode 30 of the Coin Bureau Podcast!

Note that you can listen to the full episode using the links below:

https://open.spotify.com/show/41TtLE0...

https://www.iheart.com/podcast/1119-t...

~~

📜 Disclaimer 📜

The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial legal or tax advice. The content of this video is solely the opinions of the speaker who is not a licensed financial advisor or registered investment advisor. Trading cryptocurrencies poses considerable risk of loss. The speaker does not guarantee any particular outcome.

#crypto #podcast #coinbureau #metaverse #cryptocurrency-

Francisco Gimeno - BC Analyst Excelente talk between two big names of 4th IR communicators. Robin's podcasts are always a hopeful glimpse of the possible future of the digital era, where hopes and expansion of human awareness is possible, and Guy is always explaining with tremendous detail the meaning of all. It's refreshing after this week of crypto and digital finance becoming a drama and even a soap opera, lots of FUD and "I told you so!" from social media wannabe pundits. Yes it's a long one hour podcast, but perfect to rekindle our hopes and expectations. Enjoy.

-

-

On the morning of August 2, 2016 all around the globe, thousands of unsuspecting crypto investors woke up to find their digital wallets mysteriously wiped out. News broke of a shocking digital heist: nearly 120,000 bitcoins stolen from Bitfinex and the start of a manhunt for the hackers. It has all the ingredients of a wide screen thriller…only this one is true, and is unfolding to be “super, super weird,” according to one of the investors targeted in the hack.

CNBC takes you inside one of the largest crypto currency heists in history and delivers a revealing look at the investigation to recover $3.6 billion dollars in bitcoin. According to court records, the five-year long investigation ultimately led the feds to the Wall Street apartment of a young married couple where the IRS says they uncovered burner phones, multiple passports, hollowed out books and the private keys investigators used to access billions in stolen crypto connected to the hack. Heather Morgan and Ilya Lichtenstein were later arrested in the alleged multi-billion dollar crypto laundering scheme.

When news of the arrests broke and the world discovered hundreds of videos the couple shared on social media, the story went viral. Music videos of Morgan rapping on YouTube as the so-called “Crocodile of Wall Street” and videos of her husband saying he’s tried their exotic Bengal cat’s pet food had everyone asking how this couple could be accused of such an elaborate scheme.

CNBC’s in-depth report delivers a revealing look at the duo from the rise of Razzlekahn, Morgan’s rapping alter ego to the day she bizarrely stripped down to her bra in front of dozens of startup founders, to Lichtenstein’s startup companies and the couple’s stranger-than-fiction wedding day. Eamon Javers’ reporting exposes fascinating details about their unusual lives from people who knew and worked with them and reveals exactly how the feds accuse the couple of conspiring to launder billions in bitcoin.

CNBC uncovers how a five-year investigation led to the largest financial seizure in DOJ history and what happens next as hack victims, the government and Bitfinex battle over who really owns the billions in recovered bitcoin.

Chapters:

00:00 - Introduction to the bitcoin heist

04:43 - Tracking the stolen crypto

11:16 - Getting to know the accused couple

22:29 - The day my crypto vanished

26:54 - Tracking the stolen bitcoin

35:30 - A master class in manipulation

37:49 - Investigators begin closing in

40:28 - Battling over billions in bitcoin

» Subscribe to CNBC: https://cnb.cx/SubscribeCNBC

» Subscribe to CNBC TV: https://cnb.cx/SubscribeCNBCtelevision

About CNBC: From 'Wall Street' to 'Main Street' to award winning original documentaries and Reality TV series, CNBC has you covered. Experience special sneak peeks of your favorite shows, exclusive video and more.

Connect with CNBC News Online

Get the latest news: https://www.cnbc.com/

Follow CNBC on LinkedIn: https://cnb.cx/LinkedInCNBC

Follow CNBC News on Facebook: https://cnb.cx/LikeCNBC

Follow CNBC News on Twitter: https://cnb.cx/FollowCNBC

Follow CNBC News on Instagram: https://cnb.cx/InstagramCNBC

#cnbc

Crocodile Of Wall Street And The Battle Over Billions In Stolen Bitcoin-

By

Admin

Admin - 0 comments

- 0 likes

- Like

- Share

-

By

-

Legendary investor Cathie Wood (ARK Invest founder) and Mike Novogratz (Galaxy Digital founder & CEO) sit down with CNBC’s Kate Rooney to discuss investing in crypto. They explain their approach to allocating within the digital asset space, Bitcoin’s price target and what an Elon Musk-led Twitter could look like. Finally, offer their thoughts on Web3, decentralized platforms and the next big industries to be disrupted.

Crypto Bahamas is a 4-day gathering of the leading investors and builders in the blockchain, digital assets and web3 space. The event features discussion and unique experiences in The Bahamas. Event programming covers Bitcoin, DeFi, NFTs, regulation, web3, gaming and more.

𝗣𝗿𝗲𝘀𝗲𝗻𝘁𝗲𝗱 𝗯𝘆 𝗙𝗧𝗫 𝘅 𝗦𝗔𝗟𝗧

𝗙𝗧𝗫 is a cryptocurrency exchange built by traders, for traders. FTX offers innovative products including industry-first derivatives, options, volatility products and leveraged tokens.

𝗦𝗔𝗟𝗧 is a global thought leadership and networking forum at the intersection of finance, technology, and public policy. SALT’s global events and technology solutions connect leading asset managers and entrepreneurs with top asset owners, investment advisors and policy experts.

To learn more, visit https://www.cryptobahamas.com

Chapters:

0:00 – Crypto access, institutional adoption & legislation

10:34 – Allocations within crypto & Bitcoin

15:47 – Bitcoin price target

22:45 – Elon Musk, Twitter & decentralized platforms

28:52 – Web3

33:37 – DeFi, disruption & predictions

𝗙𝗼𝗹𝗹𝗼𝘄 𝗖𝗿𝘆𝗽𝘁𝗼 𝗕𝗮𝗵𝗮𝗺𝗮𝘀 𝗼𝗻 𝘀𝗼𝗰𝗶𝗮𝗹 𝗺𝗲𝗱𝗶𝗮:

Twitter: https://twitter.com/CryptoBahamas

Instagram: https://www.instagram.com/cryptobahamas/

𝗙𝗼𝗹𝗹𝗼𝘄 𝗙𝗧𝗫 𝗼𝗻 𝘀𝗼𝗰𝗶𝗮𝗹 𝗺𝗲𝗱𝗶𝗮:

Twitter: https://twitter.com/FTX_Official

Instagram: https://www.instagram.com/ftx_official/

LinkedIn:-

By

Admin

Admin - 0 comments

- 0 likes

- Like

- Share

-

By

-

Everyone is blabbing about the metaverse. But what does this future digital world look like? WSJ’s Joanna Stern checked into a hotel and strapped on a virtual-reality headset for the day. She went to work meetings, hung out with new avatar friends and attended virtual shows. Photo illustration: Tammy Lian / The Wall Street Journal

More from the Wall Street Journal:Visit WSJ.com: http://www.wsj.comVisit the WSJ Video Center: https://wsj.com/videoOn Facebook: https://www.facebook.com/pg/wsj/video... Twitter: https://twitter.com/WSJOn Snapchat: https://on.wsj.com/2ratjSM

#Metaverse #JoannaStern #WSJ #JoannaStern-

Francisco Gimeno - BC Analyst The Metaverse itself is a future technology. Gamers, engineers and others are already using VR to design, play, live and many other things; this can make us feel how the metaverse will one day work, if possible. Many things need to be developed before we can really see a metaverse platform like the ones at science fiction books. It is a interesting podcast.

-

-

#bitcoin #bitcoinshares #bitcoinprice

Meltem Demirors, CoinShares Chief Strategy Officer spoke with Yahoo Finance's Zack Guzman about bitcoin hitting a nearly 3-month high, PayPal launching crypto service in UK, and Visa's first NFT purchase.

Watch the 2021 Berkshire Hathaway Annual Shareholders Meeting on YouTube:

https://youtu.be/gx-OzwHpM9k

Subscribe to Yahoo Finance: https://yhoo.it/2fGu5Bb

About Yahoo Finance:

At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates that help you manage your financial life.

Yahoo Finance Plus: With a subscription to Yahoo Finance Plus get the tools you need to invest with confidence. Discover new opportunities with expert research and investment ideas backed by technical and fundamental analysis. Optimize your trades with advanced portfolio insights, fundamental analysis, enhanced charting, and more.

To learn more about Yahoo Finance Plus please visit: https://yhoo.it/33jXYBp

Connect with Yahoo Finance:

Get the latest news: https://yhoo.it/2fGu5Bb

Find Yahoo Finance on Facebook: http://bit.ly/2A9u5Zq

Follow Yahoo Finance on Twitter: http://bit.ly/2LMgloP

Follow Yahoo Finance on Instagram: http://bit.ly/2LOpNYz

Follow Cashay.com

Follow Yahoo Finance Premium on Twitter: https://bit.ly/3hhcnmV-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Audius, a music streaming platform based on the Ethereum and Solana blockchains, is partnering with TikTok on the video-sharing app’s new “Sounds” library. "The Hash" squad discusses how the partnership, the first of its kind for TikTok, could help artists on Audius increase their exposure to users and discover crypto more broadly. Will the worlds of decentralized services and Big Tech continue to collide?

-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

30 years after Europe’s first offshore wind farm, the US is building its first industrial-scale offshore wind farm, 15 miles south of Martha’s Vineyard, Massachusetts. It will be home to the world’s most powerful wind turbines, and is expected to help the US transition to a new clean energy economy and reach the Biden administration’s goal of 30GW of wind power by 2030.

Visit the Energy Source hub for more videos: https://channels.ft.com/en/ft-energy-...

► Check out our Community tab for more stories on the economy.

► Listen to our podcasts: https://www.ft.com/podcasts

► Follow us on Instagram: https://www.instagram.com/financialti...-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Ex-Google TechLead exposes Ethereum and it's scalability problem. Here's Vitalik Buterin's blog post "Limits to Blockchain Scalability" https://vitalik.ca/general/2021/05/23...

Join ex-Google/ex-Facebook engineers for my coding interview training: https://techinterviewpro.com/

💻 100+ Videos of programming interview problems explained: https://coderpro.com/

💻 Sign up for my FREE daily coding interview practice: http://dailyinterviewpro.com/

📷 Learn how I built a $1,000,000+ business on YouTube: http://youtubebackstage.com/

💵 Get 2 FREE Stocks on WeBull valued up to $1850 (when you deposit $100): https://act.webull.com/k/S4oOH2yGOtHk...

🛒 All my computer/camera gear: https://www.amazon.com/shop/techlead

🎁 Get the TechLead wallet (ultra thin) on Amazon: https://amzn.to/3eGPWbB

⌨️ My favorite mechanical keyboard (80 series): http://iqunix.store/techlead

🎉 Party up:

https://instagram.com/techleadhd/

https://twitter.com/techleadhd/

https://www.linkedin.com/in/techleadhd/

Disclosure: Some links are affiliate links to products. I may receive a small commission for purchases made through these links.-

Francisco Gimeno - BC Analyst Techno Lead makes fun of serious things. And that is good when we talk about complicated things like scalability of Ethereum. There is a big problem there as many projects and products are in the Ethereum blockchain or its clones. It's PoS the solution? How it's energy consumption based? And if not what are we going to do?

-

-

Get my full interview w/ Johann: http://patreon.com/mattdavella

🙊 Here are the goods I mention in this video:

(Some are affiliate links. All are my genuine recommendations):

Get Johann's book: https://amzn.to/2UT6Ewe

💯 You can also follow me here:

Newsletter: http://mattdavella.com

IG: http://instagram.com/mattdavella

Twitter: http://twitter.com/mattdavella

Podcast: http://groundupshow.com

❤️ Get more videos & support my work:

http://patreon.com/mattdavella

Thanks for watching!-

Francisco Gimeno - BC Analyst A loneliness epidemic is being portrayed as happening in an overcorrected society which lacks profound connections, in family, friends and social groups. Anxiety is on the rise. This is global, but mostly on Western and some Asian societies. We can't disconnect from tech, but we should find a way to really deeply connect in it too. Otherwise depression and anxiety will be the norm.

-

-

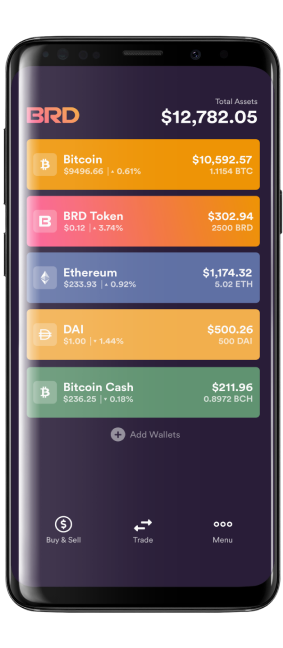

Cryptocurrency wallet BRD reaches 6 million users, driven by growth in Latin Ame... (techcrunch.com)Mobile cryptocurrency wallet BRD announced today that it now has more than six million users worldwide, thanks to strong growth in India and Latin America.

With this momentum, the company expects to reach 10 million users by early 2021.

Founded in 2015, Zurich-based BRD also said it now adds about one million new users every two months, after initially taking more than four years to hit the one million user mark.

It reached 550,000 monthly active users at the beginning of July. Co-founder and chief executive officer Adam Traidman attributes the increased interest in cryptocurrency, especially among first-time users, to the COVID-19 pandemic.

“It’s causing a lot of people who are staying at home and sheltering in place to reconsider a lot of fundamental questions about their life and family right now,” he told TechCrunch.

“It’s causing a lot of thinking about money and finances. People have had a lot more time over the last six months to look at their investments and as a result of that, we found that for cryptocurrency in general, but especially for BRD’s business, we’ve been growing dramatically.”

An image of mobile cryptocurrency wallet BRD’s user interface

He added that BRD, which has raised $55 million in funding from investors like SBI Crypto Investment and East Ventures, has two main groups of users. The first are millennials who have discretionary income that they invest using apps like Robinhood instead of traditional brokerages.

The second group are people who have been more financially impacted by the pandemic and are turning to Bitcoin and other cryptocurrencies to cope with currency fluctuations in their countries or as a more cost-effective alternative to international wire transfers to send money to family members.

Falling bank interest rates have also prompted many people to consider alternative places to put their money.

While Bitcoin and Ethereum are still the most popular purchases through BRD, in countries with volatile currency fluctuations, like Venezuela, Argentina and India, interest in stablecoins, which are pegged to the U.S. dollar, is growing.

The company is also seeing more adoption in Eastern European countries.BRD is a non-custodial wallet and cryptocurrencies are stored on users’ devices, which makes it more accessible to users in countries who need to undergo lengthy registration processes to use custodial wallets.

The app also allows people to use Apple Pay or their bank cards to buy cryptocurrency. This ease of use is one of the reasons for its growth, Traidman said.

The company’s most recent funding announcement was a $15 million Series B announced in January 2019 for expansion in Asian markets.

BRD also offers enterprise blockchain tools called Blockset and says it is currently used to store the equivalent of about $6 billion in cryptocurrencies.-

Francisco Gimeno - BC Analyst Cryptocurrencies are growing in emerging markets where traditional financial products are difficult to get. Thus is no surprise companies like BRD has got its clients from India or South America and expects growth in Eastern Europe. The future of digital economy is going to empower those who have been abandoned by the banking tradicional system. Go on BRD!

-

-

The Evolution of Cryptocurrency Since its Creation

Since cryptocurrency gained fame in the mainstream, it has been showing rapid growth in the economic realm. But, why so?

There are several reasons behind it. Being fraud-proof, cryptocurrency does not permit any authorities to control it, not even the Government.Blockchain technology guarantees safe transactions that make it completely out of the reach of hackers or any scammers.

Over “two Billion” people are accessible to the Internet who do not have proper access to the conventional system, so they are advised to go for crypto.However, you need to keep one thing in mind, and that is once your crypto holdings gush in value, it will get much attention from the scammers.

It might sound unpleasant, but the truth is unavoidable. To prevent such unsettling events, holders are decentralizing crypto storage by eliminating cryptocurrency from the exchange. This is where purchasing wallets for your crypto assets becomes the most necessary to keep them secured.7 Mandatory Wallets for Keeping your Crypto Safe

It would be best if you had wallets to protect your currencies, and this is what you will exactly get to know in this article. Know how to keep digital cryptocurrency protected with the 7 must-have wallets.Keepkey

Keepkey is not that old in the business. It has come up with a hardware wallet with a very clean design. This wallet is commonly recognized as a port of Trezor’s code and firmware. It is like a premium wallet. However, it might be a bit on the heavier half, and resultantly it becomes more vulnerable to drops. In short, it is created with standard and is quite straightforward to operate client UI.Atomic Wallet

This one has become a lot popular in its ground even being quite new in the market. It is a new non-custodial creation that has acquired a huge user base. It should be a primary pick as it already has the place to support more than 300 major coins and tokens. All the major operating systems such as Windows, Linus, Mac, Android, and iOS have the place for Atomic Wallet as it is easily available for all of them at present.

Another benefit of going for the Atomic Wallet is that it bestows a long-range of specifications, such as a default option for purchasing cryptocurrency just with a debit/credit card, “decentralized storage for private keys”, and instant exchange of assets.

That was all about its typical features.But, do you know what sets Atomic Wallet apart from the other wallets? It is none other than Atomic Swaps. It is a new decentralized transaction technology created based on hash timelock contracts.

This particular feature is only obtainable for Bitcoin (BTC), Litecoin (LTC), and QTUM. Recently, Atomic Wallet also added the name of Ethereum in the list of Atomic Swaps.Guarda Wallet

Guarda is a wallet made for software, and it is running successfully in the business for over 5 years.

This one originally joined the market as an open-source single currency wallet when the market was in need. Now, it has evolved more than expected, and it has grown as a prospering ecosystem of products along with crypto monitoring services.

Several creativities have been applied during productivity. Nonetheless, the preliminary plan was really transparent as ever. The whole team aims to make an easy, completely decentralized, and pretty flexible cryptocurrency wallet fitted for all the beginners and the advanced users.

Guarda Wallet has evolved much and has a room for 45 leading blockchains with their tokens. It is also inclusive of the ones that are also not normally seen in multi-asset wallets.

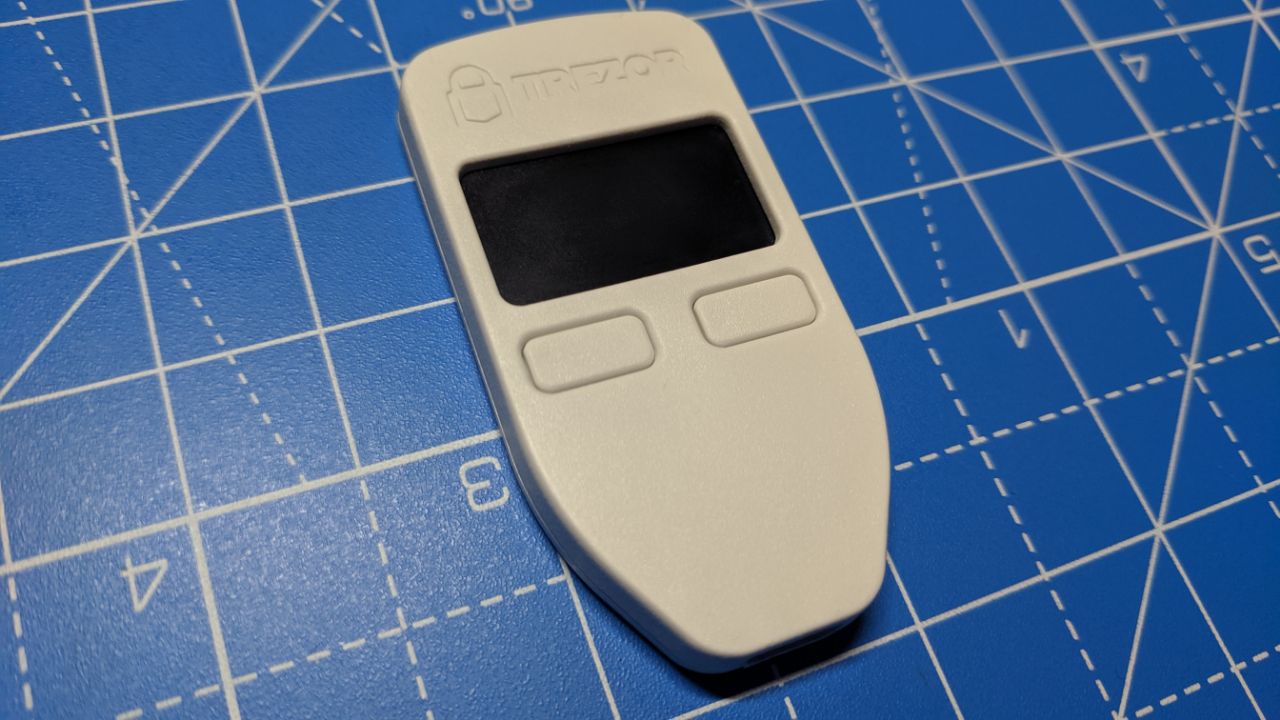

For instance, Monero XMR which has the support of the web version. Guarda is proving every time being the best as it stays user friendly besides applying high-quality solutions for making the wallet set itself apart.Trezor

It is another quality hardware wallet. Trezor is one of the very first ones in the realm of hardware wallet business. It is considered as the grade A space created to secure cryptocurrency.

What is it so popular for? Well, Trezor is the one to provide high-quality protection to your crypto assets, keeping it safe from both physical and virtual theft.It might not bear the look to turn many heads but can definitely show its capability through the work it does in securing the crypto assets.

The best part of using a Trezer wallet is that even if your computer bears the chances to get exposed to malware, your private keys will always be in the safe hands of Trezor. Trezor basically acts more as a treasury than a wallet in such scenarios. So, once you own one Trezor wallet, you can sleep peacefully.Nano Ledger S

This is another hardware wallet that has mainly got fame for its work at a comparatively lower price. It costs as low as 65 USD. It is cheaper than its competitors. It is portable and easier to carry from one place to another compared to Keepkey. The lower price of the wallet actually made it quite highlighted in the market.MyEtherWallet

This is a paper wallet. A paper wallet becomes quite necessary for the ones who desire to possess their very own personal wallets. They will be able to use their saved money for investing in the coins. You can create your wallet online on myetherwallet.com.

A good thing about this platform is that it does not store any of your personal data. It also comes with an offline version that you can download before use in case you are in doubt with the online one.

Download it from GitHub and use it offline as much you want. It is better to keep it in your head that paper wallets are free to use, but it can be operated successfully only when you gain enough knowledge about it.Coinbase

Have you used GDAX? Coinbase is exactly the novice version of “GDAX”. Coinbase is a “hot wallet” which can be easily transferred to the “GDAX exchange” without any hindrance, and the transaction is completely free. It is only limited to Bitcoin and Ethereum wallets.Electrum

Being a software wallet, it is a lightweight crypto wallet for mobile and desktop users. It has various features that have given it the position of the most flexible wallet of the present decade. It also comes up with a collaboration with hardware wallets like Trezor and Keepkey. In short, it is quite the one to make your crypto assets safer than ever.Last Note

No wallets have been released till now that can be all in one. You have to go for the right wallet based on your assets and the protection you need. Always understand what your primary requirements are. Then, go for choosing the perfect crypto wallet to keep your assets completely safe from the scammers’ sight.-

Francisco Gimeno - BC Analyst Do you know your wallets beyond their propaganda and shiny names? Before putting your crypto anywhere research which wallet could be the one for you, according to your location, specific needs, your assets, and even your own personal quirks! Get a read here!

-

-

One of the major points of contention when entering the cryptocurrency industry either as a trader or a HODLer is the security of digital assets. Many investors are on the fence when it comes to participating in this budding industry just because of the infamous incidents of hacks and cyber-attacks on crypto exchange platforms that have swindled investors to the tune of millions of dollars. As a measure to safeguard their investments, seasoned investors store their digital assets only on the most trusted and reputable crypto wallets.In this article, we look at four of the most trustworthy and secure crypto wallets in the market today – CryptX, Ledger, Bitamp, and Electrum.

Differentiation Between Hot Wallets and Cold Wallets

Before we delve deeper into the aforementioned cryptocurrency wallets, it’s important to know about the different kinds of cryptocurrency wallets.Primarily, cryptocurrency wallets can be divided between hot wallets and cold wallets.What Are Hot Wallets?

Hot wallets, as the name suggests, are digital wallets that are connected to the Internet. Due to their online nature, hot wallets enable rapid access to digital assets. There is no dearth of secure hot wallets in the industry, with some of the most popular of them being MyCelium, Bread, Edge, Bitamp, and Electrum, among others.

Hot Wallets are optimal for those who require ‘on-the-go’ access to their digital assets for quick trades.

As the price movement in the cryptocurrency industry is notoriously volatile, having or not having quick access to crypto investments can make or break the game for investors. Therefore, if you’re a trader or even just want to HODL cryptocurrencies for the long-term, you can bet your money on hot wallets. Investors can add an extra layer of security to their wallets by enabling PIN password and two-factor authorization.What Are Cold Wallets?

As the name might suggest, cold wallets are ‘cold’ in the sense that they’re disconnected from the Internet. Cold wallets from companies such as Ledger and Trezor are becoming increasingly popular among novice and veteran investors alike courtesy of their unparalleled security.

However, due to their offline nature, they might not be the ideal choice for investors who are actively trading cryptocurrencies to make profits. Despite that, the stellar security provided by cold wallets makes them an ideal choice for those who want to store large amounts of crypto assets for the long-term.Some of the Top Cryptocurrency Wallets

CryptX

Dubbed the “Swiss Bank for Digital Coins,” CryptX is a leading cryptocurrency wallet that offers its users enterprise custodial services with institutional-grade security. It is fast and easy to onboard.

(Source: CryptX)With an intuitive and sleek user-interface, CryptX provides the simplest and most convenient way of sending, receiving, and managing crypto assets at minimal fees.

The wallet secures users’ private keys in the impenetrable Swiss bank-grade Hardware Security Modules (HSM) that are developed, manufactured, and programmed in Switzerland. This, in essence, means that CryptX users can rest assured that no one is gaining unauthorized access to their private keys.

CryptX cryptocurrency wallet supports a wide array of digital assets and regularly introduces support for new ones, thereby eliminating the need for individuals to maintain multiple crypto wallets.

At present, CryptX can be used to manage more than 100 cryptocurrencies including top digital assets such as Bitcoin (BTC), Ether (ETH), Litecoin (LTC), Tether (USDT), and Chainlink (LINK), among several others.

CryptX also supports other crypto-specific events such as forks, and token airdrops so that users do not have to shuffle and move their digital assets to other wallets.

All secure information related to accessing the cryptocurrencies supported by CryptX are stored in Swiss HSM devices which can be managed through the wallet’s secure APIs via Two-Factor Authentication.

In addition, CryptX also leverages several other robust security mechanisms such as wallet freezing, and address whitelisting.CryptX provides its users with cutting-edge trading features.

For instance, consider the CryptX Auto Swap functionality that automatically swaps BTC, ETH, BCH, LTC, and USDT within the user’s wallet to eliminate exchange rate risk involved in cryptocurrency operations. In simpler terms, the Auto Swap feature ensures that users do not lose their investments on volatility.

Users can tap this feature to safeguard their digital assets from undesirable price swings.Last but not the least, CryptX is cognizant of how big a pain enormous transaction fees can be for users. In that regard, CryptX offers SegWit, transaction batching, and other fee management tools to ensure its users have minimal exposure to unnecessary expenses.

Interested individuals can book a CryptX wallet Demo on their official website here.Ledger

Ledger is a leading hardware or cold wallet firm based out of France. Ledger’s two flagship products – Ledger Nano S and Ledger Nano X, are often considered the industry-benchmark for hardware wallets because of their robust and cutting-edge security mechanism.

Ledger Nano S supports a swathe of cryptocurrencies, including some of the most popular digital assets, such as Bitcoin (BTC), Ether (ETH), XRP, Litecoin (LTC), and Bitcoin Cash (BCH), among others.

(Source: Amazon)Further, despite being a hardware wallet, it’s not necessary for users to keep their Ledger online if they want to receive any cryptocurrency.

The user can simply share their relevant wallet address and check later if the Ledger Live app whether they’ve received their assets.Bitamp

A leading Bitcoin (BTC) wallet, Bitamp is a trusted name in the cryptocurrency wallet space. Bitamp is an open-source, client-side, Bitcoin wallet that enables users to seamlessly send and receive the premier cryptocurrency from anywhere in the world.The wallet keeps user privacy at its core and requires no user information at all.

Users are not required to share their email addresses or any other personal information to enjoy the benefits of this free Bitcoin wallet. Bitmain strives to preserve user’s anonymity and, in that regard, never stores the seed phrase, private key, IP address, or user browser details.What’s more, Bitamp can also be accessed through a VPN or TOR browser.

(Source: Bitamp)Bitamp enables users to make lightning-fast Bitcoin transactions. Bitamp believes in providing users the liberty to make transactions from anywhere in the world at the fastest speeds. Staying true to the ethos of Bitcoin, making transactions through Bitamp wallet takes minimal time compared to transactions made through traditional banks.

In addition,Bitamp works without any borders in that it users to send Bitcoin to any recipient in the world without any restrictions at costs that are not even a fraction of the fees charged by banks.

Finally, Bitamp believes in the notion of giving complete control of financial assets to their owners.

With Bitamp, users can rest assured about the security of their Bitcoin holdings as they get complete control over their assets. This way, they need not worry about exchange hacks and cyberattacks pulled by criminals aimed toward stealing crypto assets.

With Bitamp, users need not worry about losing their data to third parties who have time and again failed to live up to expectations. Bitamp helps users self-custody their Bitcoin in a secure manner.

As an icing on the cake, Bitamp also allows its users to integrate famous hardware wallets such as Ledger, and Trezor.Electrum

One of the oldest digital wallets in the industry, Electrum has successfully maintained its reputation throughout the years.Electrum is a desktop Bitcoin wallet compatible with various operating platforms such as Windows, Mac, and Linux. Because it’s an open-source wallet, Electrum has continually undergone important additions from the best programmers and security enthusiasts in the crypto space.

The continual refinement has cemented Electrum as one of the most respected Bitcoin wallets in existence today. Just like Bitamp, Electrum can also be integrated with several leading hardware wallets including Ledger, Trezor, and others.

(Source: Bitcoinelectrum)However, unlike Ledger, Electrum is a Bitcoin-only wallet. On a plus side, however, Electrum offers the possibility of creating multi-sig wallets.Final Remarks

Choosing the right kind of cryptocurrency wallet largely depends on the use. If you’re an active trader and want to capitalize on the price movements of cryptocurrencies to make small and healthy profits without compromising on the security of your assets, hot wallets such as Bitamp could be the way to go.

Similarly, long-term HODLers typically tend to stick to hardware wallets such as Ledger due to their offline nature.

People who have been in the cryptocurrency space since its initial days would prefer Electrum due to its rich and long history in the industry.All in all, it goes without saying that every crypto investor must have at least one secure digital wallet. Always remember, not your keys, not your Bitcoin.-

Francisco Gimeno - BC Analyst Coming to the crypto world can be very confusing at the beginning. Want to buy and hold crypto? Better you learn first the terms, in order to understand and be successful. Read to his to do that. Or maybe you have some input for us. Get involved.

-

-

When it comes to storing cryptocurrencies safely, hardware wallets are widely considered to be the gold standard.

As opposed to web wallets and software-based wallets that store your private keys on an internet-connected device, hardware wallets keep your private keys stored in a secure offline environment. This makes them immune to online-based attacks, while the best hardware wallets are also resistant to physical tampering.

Hardware wallets are ideal for anybody looking to safely store a substantial cryptocurrency portfolio, or are looking to carry their portfolio with them on the move. They are an excellent choice for anybody looking to store their crypto assets long term, with little need to access them regularly.The top crypto news & features in your inbox.

Join the Decrypt Debrief for a daily curation of top news, features, guides and more.

There are currently dozens of options on the market, each with their own pros and cons, and target userbase. Decrypt's overview of the best hardware wallets serves as a resource base for anybody considering which hardware wallet to buy, and looking for an unbiased review to base their decision on.

This list will be updated regularly as new hardware wallets are released and reviewed, so be sure to check back regularly if the device you're interested in isn't yet listed.Ledger Nano X

Ledger Nano X (Image: Decrypt)

First released in 2019, the Ledger Nano X is one of the latest entries to the hardware wallet market. A step up from the older Ledger Nano S, the Nano X features improved internal memory, a revamped design and Bluetooth support.

Like its predecessor, the Nano X supports a huge variety of cryptocurrencies and is one of the most portable wallets available, making it ideal for those regularly on the move.Read our full review of the Ledger Nano X

Trezor Model T

Trezor Model T (Image: Decrypt)

The Trezor Model T is SatoshiLabs' latest foray into the hardware market. The Model T is similar in design to the older Trezor Model One—albeit with a larger touchscreen interface, and support for a much wider range of cryptocurrencies.

Although pricey, the Trezor Model T is regarded as one of the best hardware wallets on the market, particularly for those concerned with the security implications of the Bluetooth connectivity that many recent flagship wallets come equipped with.Read our full review of the Trezor Model T

Ledger Nano S

Ledger Nano S (Image: Decrypt)

One of the most popular cryptocurrency hardware wallets on the market, the Ledger Nano S is an attractive, easy to use wallet that is suitable for those looking for robust security on a budget.The Ledger Nano S features support for well over 1,000 cryptocurrencies, and packs a built-in bank-grade secure element.Read our full review of the Ledger Nano S

Trezor Model One

Trezor Model One (Image: Decrypt)

First released by SatoshiLabs in 2014, the Trezor Model One was one of the first hardware wallets to hit the market.

Despite its age, the Trezor One still impresses with its security features, support for a huge range of cryptocurrencies and compatibility with dozens of external wallets.As one of the older wallets, the Trezor One is attractively priced, but still hangs with some of the best in terms of features.Read our full review of the Trezor Model One

Bitfi Knox

Bitfi Knox (Image: Decrypt)

Unlike other hardware wallets, the Bitfi Knox never stores private keys on the device, meaning that attackers have nothing to hack. Instead, the Bitfi uses an innovative system to generate private keys on the fly, in a way that is never exposed to any connected devices.

The Bitfi Knox is larger than most other wallets, and has some issues with usability, but is arguably one of the most secure hardware wallets available.Read our full review of the Bitfi Knox

Ledger Blue

Ledger Blue (Image: Decrypt)

One of the largest hardware wallets available, the Ledger Blue was designed with accessibility in mind, allowing individuals and businesses with limited cryptocurrency experience to safely store their funds. Like all Ledger wallets, the Ledger Blue features top-notch security that has never been cracked.

Although the device's large touch screen makes it simple to use, its poor availability and limited asset support make this wallet only suitable for those that prioritize simplicity above all else.Read our full review of the Ledger Blue

CoolWallet S

Cool Wallet S (Image: Decrypt)

The CoolWallet S is a slimline hardware wallet that's designed to fit in your wallet alongside your debit and credit cards. The CoolWallet S features support for most major cryptocurrencies and is one of the few waterproof hardware wallets available.

The CoolWallet S also comes with Bluetooth connectivity, allowing you to manage your portfolio from almost any Bluetooth-capable device.Read our full review of the CoolWallet S

KeepKey

KeepKey (Image: Decrypt)

The KeepKey is a simple hardware wallet with a premium design and feel. Designed to be easily accessible, the KeepKey allows users to store most popular cryptocurrencies in cold storage and exchange assets directly on the device thanks to its built-in ShapeShift functionality.

As one of the cheapest hardware wallets on this list, the KeepKey provides excellent bang for the buck, particularly for those that don't need top-end features.Read our full review of the KeepKey

SafePal S1

SafePal S1 (Image: Decrypt)

The Binance backed SafePal S1 is a lesser-known hardware wallet that looks to make cryptocurrency storage more secure through a completely self-contained device that lacks USB, Bluetooth, Wi-Fi and any other connection methods.

This relatively cheap device features a built-in camera and six physical buttons, which are all you need to store and access thousands of different cryptocurrencies by scanning QR codes on the associated mobile app.Read our full review of the Safepal S1

https://decrypt.co/19326/best-cryptocurrency-hardware-wallets-

Francisco Gimeno - BC Analyst If you are scared by the news of digital exchanges being hacked and crypto disappearing, and find difficult to store your hard earned bitcoins or satoshi, better to explore harder wallets. Interesting article. However, we yearn for a world where store and transact crypto is as easy as using now our debit or credit cards (while being safe too).

-

-

Cryptocurrency is maturing. While it’s impossible to make any lofty predictions or guarantees about the fluctuations of the market, there are plenty of signs that we’ve entered a new age of investing.

Cryptocurrency is maturing. While it’s impossible to make any lofty predictions or guarantees about the fluctuations of the market, there are plenty of signs that we’ve entered a new age of investing. The top crypto exchange handles a volume of nearly $50 billion. Your next-door neighbor might have a little bit of bitcoin.

A growing number of major banks, hedge funds and even family offices are turning to digital assets to complement their traditional investment portfolios.In what is likely a first for university endowments, the Harvard Management Company (the largest academic endowment in the world) recently invested some $5 to $10 million into cryptocurrency.

This past February, JPMorgan Chase launched JPM Coin, making it the first US bank to create a digital coin representing a fiat currency. Their token is in a prototype phase and is being tested solely with JPMorgan institutional investment clients.

But cryptocurrencies aren’t physical goods that can be locked up in a safe or transported in a Brink’s truck. Digital assets like Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP) exist on the blockchain and are maintained in a decentralized environment.

To establish “ownership” of cryptocurrencies, the transaction activity is tracked on a public ledger - the much-heralded blockchain itself - by public and private keys. Public keys are the address used to send and receive crypto. It’s necessary that everyone knows this address.

Private keys must be kept secret because they are used to authorize the transmission of cryptocurrency held. Keys are stored in what’s typically called a wallet. There are various forms of digital wallets, which I will get into shortly.

While cryptocurrency investment is on the rise, in order for this digitally-based currency to prosper the right infrastructure must be in place.Let’s be honest: cryptocurrency is a ripe target for theft. According to a report by Ledger, nearly $1 billion was stolen in 2018.

The threat landscape faced by cryptocurrency investors is similar to that facing security professionals in all tech spaces. Traditional cyberattack methods like site clones, phishing and SMS hacks coupled with hardware tampering and social engineering are still problems in this new frontier.Hackers have absconded with millions of dollars by hijacking cell phone accounts.

Entire crypto exchanges - handling upwards of hundreds of millions - have been forced to shut down as a result of cyberattacks. And it’s not just hackers to worry about. The nature of crypto storage can lead to the loss of funds as well. Take the recent QuadrigaCX debacle for instance.

At its peak, the Canadian cryptocurrency exchange handled nearly $200 million in assets. Its lone operator, Gerald Cotton, personally held all his clients’ security keys.

Last year, on December 9th, Cotton died after being hospitalized due to complications from Crohn’s disease. Because he was the only one with access to those private keys proving crypto ownership, all the assets under Quadriga’s management followed Cotton to his grave.

Though highly anomalous, the Quadriga event has served as a final wakeup call to both institutional investors and their customers as to how important it is to securely safeguard your digital assets with a trusted platform.

In the cryptocurrency world, there are several ways to store your holdings but they all generally involve some form of wallet. Basically, a “crypto wallet” is a device on which your private keys are stored. Your private keys are a critical piece of information used to authorize spending and selling crypto on the blockchain.

The wallets in which you hold them can be physical devices, software- or solution- based or simply the online exchange from which you’ve purchased your currency.Of those wallets there are two types: hot and cold. Hot wallets are connected to the internet, while cold wallets are not. Cold wallets are considered much more secure than hot wallets.

Hot Wallets

There are two main types of hot wallets:Web/Online/Exchange: Leaving your crypto on an exchange is an example of hot wallet storage. Any type of storage that is online is considered “hot.” These types of online wallets are the most unsecure and susceptible to being hacked, having your email and login info being stolen, or to a counterparty risk.

Software Wallets: A software wallet is an application that you download to your computer or phone. It is considered safer than a web/exchange wallet because you, rather than a third party, have control of your private keys. However, since your computer and phone are vulnerable to hacks, software wallets still aren’t the best option.

Cold WalletsThere are two main types of cold wallets:

Hardware Wallets: Hardware wallets are widely considered the safest option for storing your crypto. Typically, in USB format, a hardware wallet can be connected to the internet to transfer an exchange for trading, but it can be disconnected, with your crypto stored totally offline and inaccessible to hackers. The main principle behind hardware wallets is to provide full isolation between the private keys and your easily-hacked computer or smartphone.

Paper Wallets: A paper wallet is an offline mechanism for storing. You literally print out your public and private keys on paper and keep them somewhere safe. This is extremely safe - and cheap - but obviously not the best method. If you lose the paper, you completely lose your private keys.So clearly you can’t be running crypto on a bunch of jump drives. Even the most novice crypto holder needs a wallet that has both a secure element and custom OS without compromising security and convenience. While blockchain aims at revolutionizing financial systems, many investors are still decades in the past when it comes to the way they are safekeeping their digital assets.

Hardware wallets have become the de facto best practice amongst individuals serious about their investments but think about enterprises handling millions of dollars’ worth of crypto. In the early stages of institutional investing, asset managers would find themselves securing massive amounts of wealth on hardware wallets with no convenient and efficient way to implement a meaningful segregation of duty.

Finding a Holistic Security Solution

This may have created new jobs for bodyguards and generated revenue for security equipment companies, but it hindered the growth of the segment by exposing crypto funds to an operational risk far above the appetite of the average investor. Institutional investors can’t simply rely on standard wallets, however secure they may be.

The financial industry needs custody solutions that are more holistic in their approach, combining both hot and cold approaches, and encompassing both hardware and software technology solutions.The absolute most secure way to manage crypto assets is through a multi-authorization governance infrastructure.

Secure storage of large digital asset funds is complex, and exchanges and institutions need safe, comprehensive and integrated solutions. This approach employs a multi-authorization self-custody system of management and gives financial institutions security, control and speed of execution along with a reliable governance framework.

Proper security is crucial to the diligent management of crypto assets, whether you’re just a hobby holder or an institutional investor overseeing millions. Mainstream adoption of crypto is gaining momentum and as more come on board, there will be more targets for cyberattacks.

Echoing a common refrain in the tech world: It’s crucial for everyone involved to be aware of the risks and how to mitigate them.

About the Author:

Demetrios Skalkotos leads global business unit operations for Ledger Vault, a multi-authorization cryptocurrency self-custody management solution built to secure large amounts of various digital assets. Skalkotos has decades of experience running global software and infrastructure businesses for the U.S. exchanges Nasdaq and ICE. -

This might seem like an obvious one to a seasoned cryptocurrency hodler, but if you’re new to the game – there are a few basic things you should know when it comes to storing your cryptocurrency.

Technically, you don’t actually store your cryptocurrency, but rather the private key that allows you to access, send, and spend your cryptocurrency. But without that private key, you can’t access your coins, so for the most part storing your private key is effectively storing your coins.

There are three main ways of storing your cryptocurrency: custodial wallets, software wallets, and hardware wallets. Cryptocurrency storage can be either hot or cold.

Hot storage is when your coins are stored online, and – yep, you guessed it – cold storage is when your coins are kept offline.This article will take you through what each of these is and why you might or might not want to use them to store your cryptocurrency.Custodial wallets

This might actually sound like the most complicated of the bunch, but it’s probably one of the first cryptocurrency wallets most people actually use. If you buy your cryptocurrency through exchanges like Coinbase or Abra, you might say you store your cryptocurrency on your Coinbase account. What you’re actually doing is storing it in a custodial wallet.

A custodial wallet is just a fancy way of saying that your private keys are being stored, and looked after for you by a third-party custodian. Custodial wallets are usually hot wallets.In some cases this is good because all you have to remember is your login details to the platform, the custodian takes care of ensuring your coins are safe. Good custodians are often more diligent with security than careless individuals.

That said, storing your coins in a custodial wallet doesn’t give you complete control over them. If you want to move them, you have to ask the custodian and hope that they comply with your request.If a custodian controls a large number of wallets on behalf of its clients, it may also be a big target for attackers. It might be a quick and easy way to store your coins, but it might not be the safest.Software wallets

Software wallets are one the most accessible forms of cryptocurrency storage available. As the name suggests, it’s simply a piece of software that runs on hardware you already own, like your laptop or smartphone.

The software encrypts and protects your private keys. Like custodial wallets, software wallets are usually hot too.Software wallets have few barriers to entry as they don’t cost anything to download, and all you have to do is set them up, generate an address, and start sending or receiving cryptocurrency.

Most smartphone wallet apps have on screen guides that take you through the initial set up too, which can be very useful. However, software wallets, particularly those on smartphones, aren’t always secure.

The level of security in a smartphone-based software wallet varies depending on how the app makes use of the phone’s hardware to secure coins. You should also be aware that there are a lot of fake wallet apps that make off with your coins as soon as you put them into the app.

What’s more, as smartphones are usually always online, they are vulnerable to many more attack vectors, like phishing, than offline hardware-based storage.Hardware wallets

Hardware wallets are one of the more secure ways of storing your cryptocurrency at the moment, as they store your cryptocurrency offline. A hardware wallet is an actual physical device responsible for protecting your cryptocurrency and private key.

Most of them look like a USB flash drive, usually with a small screen, and some buttons on them.You only ever need to connect a hardware wallet to the internet when you need to make a transaction, so if a hacker is going to try and target you over the web, they have a very small window of opportunity.

However, the fact you need to keep them offline makes them a little more cumbersome than a software wallet which has all your funds – ready to go – at all times. If you’re constantly moving coins around, hardware wallets might become a headache, from a practical point-of-view.

As hardware wallets are cold storage they are quite safe from hackers, but they’re not immune. They can be infected with malware, which tricks a user into sending coins to scammers. Also, because you are buying a physical device, you have to be sure you’re buying a legitimate version; not one that’s been tampered with and might siphon your coins to someone else’s address as soon as you load your coins.

If you’re really keen about long term cryptocurrency storage, you could put all your coins on a hardware wallet and lock it away in a safe-deposit bank, almost as if it were gold bullion! But even sometimes, that isn’t totally safe.Which should I choose?

There is no such thing as a perfect way to store cryptocurrency. If you want a fast way of moving coins around, you’ll likely have to sacrifice security, and vice-versa.

Generally speaking, it makes sense to choose a wallet type based on how you use cryptocurrency and how much of it you plan on storing in said wallet.If you have a lot of coins, you’d be stupid not to try and pick the most secure form of storage.

If you have small amounts, that you regularly trade and can realistically afford to lose – custodial or software wallets should work just fine, but make sure you get a trustworthy one.-

Francisco Gimeno - BC Analyst Cryptocurrency wallets are yet at an early stage of operations. A newcomer will find difficult to understand their types and their benefits or dangers. We hope when the crypto market evolves and become more ubiquitous there will be wallets easier to use. Meanwhile this article explains everything very well.

-

-

We review five of the top cryptocurrency wallet apps that will let you buy, sell, and trade a huge number of digital assets and cryptocurrencies such as bitcoins and altcoins.

By Oliver Rist

Love it or hate it, cryptocurrency is enjoying its time in the technology spotlight. Whether you're simply grabbing a few bitcoins to experiment with this new currency or you're a more seasoned digital currency investor, your process will remain similar.

To purchase or trade digital currency, you'll need access to an exchange, either an organized platform under a single corporate flag such as Coinbase Consumer, or one of the more automated and distributed exchanges that have lately started to emerge, such as ShapeShift.

Via the exchange, you'll be able to purchase and trade your chosen crypto-bucks. But if you're looking to store your new currency or even spend it on goods, services, or debts, then you'll need a cryptocurrency wallet. But just like the constantly shifting crypto exchange landscape, the concept of the perfect cryptocurrency wallet is a constantly moving target, too.What Is a Cryptocurrency Wallet?

Cryptocurrency wallets come in several different forms and can span software, hardware, or even paper. But they're all intended to store at least one kind of digital currency, and in the case of cryptocurrency, manage the cryptographic keys and other security considerations associated with key storage, digital currency transactions, and sometimes identity (ID) verification.

When you're talking about the cryptographic keys associated with your cryptocurrency wallet, you're referring to a very long string of numbers and letters that's machine-generated, and is used to lock and unlock access to your cryptocurrency collection as well as to generate the addresses of your wallet.

That's a lot of power to attach to a key, so where these keys are generated and who controls them is something you should consider carefully when choosing your cryptocurrency wallet platform.

Kinds of Cryptocurrency Wallets

Currently, there are five basic kinds of cryptocurrency wallets:

1. Cold Wallets: This kind of cryptocurrency wallet uses keys created by a source that's not connected to the internet. This adds an extra layer of "air-gap" security and lets these wallets come in a hardware format. Usually some kind of portable Universal Serial Bus (USB) hard disk or thumb drive.

2. Hot Wallets: As you might expect, this kind of cryptocurrency wallet uses keys generated by internet-connected devices, typically servers at the wallet manufacturer's location or the wallet's back-end exchange.

Even though the internet connectivity makes hot wallets notably less secure than cold wallets, they're still the most popular cryptocurrency wallets in use today since they're easily able to trade currencies, make internet purchases, and even access other kinds of digital assets besides cryptocurrency.

3. Decentralized Wallets: You'll see this term a lot, and it simply means that the cryptocurrency wallet has no centralized back end you need to work through when you want to sell, trade, or buy. You control your wallet's keys, and that lets you connect and generate a transaction with anyone, anywhere. Then again, you control your keys, which means you better protect the heck out of them or face a potentially very bad day.

4. Hosted Wallets: This is the opposite of decentralized, where the cryptocurrency wallet manufacturer or the exchange controls and stores your keys. On the one hand, they probably have better security than you do.

But on the other hand, they're also likely storing thousands of users' keys, which means the hackers will be targeting them much more strongly than they would a single user like you. It also usually means that you'll need to begin your transaction with the hosted environment rather than simply connecting with anyone you like. That's not just an extra step; it also potentially impacts your privacy.

5. Paper Wallets: As the name implies, this type of cryptocurrency wallet boils down to printed sheets of paper that record your public and private crypto keys. To use a paper wallet, you simply transfer your digital currency to a public address that's shown on your paper wallet.

To spend some of it, you simply initiate a transfer and reprint your wallet. Quick Response (QR) codes are often used to turn large chunks of typing into faster and less-easily-copied scanning operations. Some folks don't consider paper wallets a separate kind of wallet, instead referring to them simply as the "coldest of cold wallets."

In this cryptocurrency wallet review roundup, I'm reviewing hot wallets with an eye toward multicurrency support. All of the cryptocurrency wallets reviewed here support more than one kind of digital asset, though some support far more than others do.A Word on Exchanges

Whether viewed from a financial or technical perspective, cryptocurrency moves fast. Blockchain technology is in an almost constant state of innovation and even conflict, while the regulations regarding cryptocurrencies are also in flux in multiple jurisdictions all over the globe.

From an investor's standpoint, this isn't just a commodity, this is truly the Wild, Wild West. That can make choosing the right exchange on which to do your crypto-trading a crucial decision.Fortunately, exchanges don't have to be so wild and woolly.

It depends on what kind of investor you want to be. In the reviews that follow, we make mention of two basic "personalities" when it comes to exchange trading.

Those that want a more stable and regulated environment can choose an exchange that specifically caters to this kind of customer, such as Coinbase Consumer (mentioned above).

This kind of exchange is characterized by lots of effort being paid toward adhering to the financial regulations of its geographic jurisdiction. In the case of Coinbase, that's the U.S., which means the exchange is going to do whatever it needs to maintain compliance with U.S. banking laws.

That includes gathering lots of information on the people who trade with it, including personal contact information as well as financial data, like your Social Security number. Another characteristic of a more controlled exchange is fewer options when it comes to what kinds of cryptocurrencies you can trade.

That's because each type of cryptocurrency is being evaluated individually by each country's banking regulators, so an exchange that wants to remain in compliance with banking laws needs to move slowly and carefully when it comes to the currencies it supports.

That bothers a lot of crypto-investors, who are attracted to this commodity specifically because of the large number of currencies they can trade (hundreds on some exchanges!) and because of the anonymous nature of the transaction. These folks represent true cryptocurrency speculators, and if you're on of these, then regulated exchanges like Coinbase are not for you.

You're looking for exchanges with a wide swath of currency support and as little information as possible being gathered on both the transaction and its participants. In the reviews that follow, we pull out Shapeshift as one exchange that fits this kind of bill.

However, in true crypto-fashion, in the time it took to write these reviews, the market changed and Shapeshift altered its anonymous trading policy in favor of one that adheres to KYC banking guidelines intended to combat money laundering and other financial crimes. That measure will help Shapeshift with scrutiny from banking regulators, but it'll effectively kill its reputation for privacy.

If you're still in the market for a Shapeshift-style exchange, however, don't fret as there are still plenty of options. One that's moved very quickly to capitalize on Shapeshift's change of heart is Flyp.me, which offers about 26 cryptocurrencies, everything from Bitcoin Cash and Litecoin to some fairly fringe altcoins.

There's also Coinswitch, which boasts support for over 300 cryptocurrencies, though it also seems to be built on top of several other exchanges, including Shapeshift and Changelly, so it remains to be seen how Shapeshift's new KYC policy will affect Coinswitch. Changelly is another Shapeshift-style option, however, with support for a wide range of cryptocurrencies and fairly little personal information required to start trading.

All that said, however, be very careful when picking your exchanges. There's still plenty that can go wrong with a crypto-investment these days, up to and including the loss of your funds.

Therefore, picking a platform from which to store, invest, and trade cryptocurrency is an important part of maintaining a positive experience and not getting burned. Research your platform carefully, ask current traders about it before using, and when investing, start small.Desirable Cryptocurrency Wallet Features

The most important feature you should be looking at when choosing a cryptocurrency wallet is whether or not it supports the currencies you want to use. Bitcoin is a standard, but even this currency isn't supported by every cryptocurrency wallet, and not even by every cryptocurrency wallet reviewed in this review roundup yet.

There are literally dozens of cryptocurrencies available today, with more on the way.If you want to use a specific currency for some reason, then you need to make sure your cryptocurrency wallet supports it. If you want to dabble in multiple currencies or other kinds of digital assets, then you should make sure that your cryptocurrency wallet supports as many as possible, and can also easily connect with an exchange that allows multicurrency operations.

Both Exodus and Jaxx fit this particular bill.If you're looking to speculate, then you're likely comfortable with a certain amount of risk. You're probably also interested in protecting your transaction privacy.

This means you should be looking for a cryptocurrency wallet that doesn't require any specific exchange on the back end, or if it does, then it's an exchange that doesn't require much in the way of ID verification or identifying transaction data.

ShapeShift is currently a very popular exchange for these kinds of users (but not covered in this cryptocurrency wallet review roundup). Again, both Exodus and Jaxx are good fits for you.

But maybe speculating isn't your thing. Perhaps you'd like to experiment with cryptocurrency but you want to do it in a safer, more regulated environment, and you're willing to give up a certain amount of transaction privacy to do it. This kind of user is looking for a regulated exchange such as Coinbase Consumer, which also makes the Coinbase Wallet (included in this review roundup).

Coinbase is a company in the United States that goes to great pains to meet U.S. banking regulations and has the deep venture capital (VC) financial backing to do it. You're limited in the kinds of currencies and assets you can access via Coinbase Consumer or store in the Coinbase Wallet, but many people feel safer using this kind of platform for that very reason.

Next, there are more minimalist cryptocurrency wallets, such as BRD and Copay Bitcoin Wallet (also included in this review roundup). These are primarily mobile wallets intended to let you track and access your digital funds on the go. They're not meant to work as trading platforms nor as holders of large amounts of different kinds of digital assets.

The good thing about these solutions is that their security is decent and you can use many of them at the same time.

The Security Question

You may be wondering if cryptocurrency wallets are safe. Unfortunately, that's not an easy question to answer. On a day-to-day basis, all of the cryptocurrency wallets I reviewed in this roundup are safe and employ a basic layer of security to protect your assets. But, yes, some are a little safer than others.

At a basic level, these cryptocurrency wallets all have password-controlled access to them, which is potentially another passcode or pin code to control access to your account (though most often this is one step, not two). They encrypt all transaction data via Secure Sockets Layer (SSL) while in transit, and they securely store your public and private keys, either encrypted on your local device or on the cryptocurrency wallet maker's servers.

That's the minimum level of security any cryptocurrency wallet should support, and surprisingly, it's all that four out of our five reviewed cryptocurrency wallets can do. Only Coinbase and Copay Bitcoin Wallet added more security than what I just listed, even though many cryptocurrency wallet customers are asking primarily for two additional capabilities: two-factor authentication (2FA) and multi-signature support.

What are these features?2FA: This feature would generate a token or key from the cryptocurrency wallet maker that you'd need to know to access your wallet. Generally, this additional code is initially sent via an email or text. However, things aren't over once you enter the code.

Once this code is entered and you have full access to your cryptocurrency wallet, the two-factor system will keep generating new codes every few seconds. That means, to hack your account, malcontents would need to know not only your primarily account credentials but also your device itself. That's significantly more difficult and dangerous for the bad guys to do, so it's an excellent additional layer of security.

Multi-Signature Support: This feature works like a joint bank account but at the key level. Typically, such a system is referred to as a "two out of three" system.

That's because it generates three keys: one controlled by the account holder (you), one that's controlled by the service, and one that's shared. To access the account, you need at least two out of the three keys. There are variations on this feature, including the 3-of-5 scheme that Coinbase uses for its Vault service.

Final Thoughts

Overall, the cryptocurrency wallets I review here in this roundup represent some of the best hot wallet solutions available. All of them will do well for you whether you're a beginner or a seasoned veteran. However, even among this relatively small group, you'll need to decide which of two basic camps you fall into before you can choose the right cryptocurrency wallet for you.

The first camp is composed of the speculators who are comfortable with risk and therefore aren't looking for a cryptocurrency wallet that asks a lot of questions. The second camp is made up of conservative investors who are interested in fewer digital assets and desire a safe environment that's more akin to our regulated banking industry.

If you're in camp number 1, then you're best off with our Editors' Choice Exodus. This cryptocurrency wallet is easy to use and supports a huge number of digital asset types via the distributed exchange ShapeShift.

If you're in camp 2, then our Editors' Choice Coinbase Wallet is the cryptocurrency wallet you want. This one is backed by a reputable U.S. firm that's not only well funded, but also well secured and in compliance with all relevant U.S. banking laws.