ICO Resources

- by Francisco Gimeno - BC Analyst

- 36 posts

-

The world may be on the verge of large-scale adoption of “private money” such as Facebook’s Libra, a major investment bank predicts, although there are still hurdles to overcome before the vision can become reality.

According to the JPMorgan Perspectives report, released this past weekend by the major investment bank JPMorgan Chase, people are ready to embrace so-called “private money,” meaning any type of currency issued by a private institution.

The argument for this is that the vast majority of fiat currency as we know it today is already privately issued, by the way of fractional reserve banking.In this system, which all nations today have adopted, private banks indeed create electronic money every time a loan is given out.

However, governments in most countries still have a monopoly on issuing cash, although this only accounts for a very small portion of all the monetary transactions that are made in society.

In the report, titled Blockchain, digital currency and cryptocurrency: Moving into the mainstream?, the bank placed a heavy emphasis on the role of stablecoins.

Meanwhile, the report largely dismissed traditional cryptocurrencies for their high volatility, saying “volatility remains a severe impediment to broader adoption” and that crypto currently has “a limited role” as an asset for portfolio diversification and hedging.

According to the report, stablecoins that are backed by financial assets is the type of and asset that will first gain large-scale acceptance and that may challenge traditional fiat currencies.

However, issuers of stablecoins should be prepared that their business may be about to face regulatory scrutiny at a whole new level compared to what has been the case so far, with regulators treating them much in the same way as traditional banks are treated.

As JPMorgan notes, “the privilege of doing so [issuing private money] comes with significant regulatory oversight and costly compliance obligations.

”On the same note, the report said that “rapid adoption and scale are hindered by the underlying technology and the need for substantial regulatory oversight,” while estimating that blockchain-based solutions in traditional banking are still “three to five years away.

”In conclusion, the report authors reiterated that the regulatory hurdles for a stablecoin to be accepted for tax payments to the government – which could be seen as a stamp of approval – remains “significant.” In addition, it also listed the sourcing of stablecoin collateral and energy requirements of proof-of-work cryptocurrecies as potential limitations.

“Absent substantial and ongoing improvements in efficiency, it will be very difficult for truly distributed stablecoins to achieve global scale, in our view.

Reliance on a central authority for validating transactions and maintaining the integrity of the ledger is a possible solution, but does not offer the same benefits as a true [distributed ledger technology],” the report concluded.-

- 1

Francisco Gimeno - BC Analyst Global changes are apace in all fields. Digital money (private, crypto...) is coming. It is an ongoing process. We don't know if the existent cryptos are the ones which will be used as money (as we understand the word money). Most probably more iterations on the crypto world are needed until we start seeing normal to use cryptos or other digital means as money.- 10 1 vote

- Reply

-

-

The Consumer Token Offering (CTO) framework seeks to be a set of best practices for launching new tokens or Token Generation Events on Ethereum.

By Ki Chong Tran

The crypto industry reached new heights in 2017 and early 2018 in large part because of the FOMO and hype generated from ICOs, but that was also one of the main reasons for the dizzying crash that followed.

Scams, false promises, and legal repercussions have made ICOs a thing to be feared, but new technology adapts and evolves. Out of the Initial Coin Offering (ICO), came the Security Token Offering (STO), the Initial Exchange Offering (IEO), and now the Consumer Token Offering (CTO).

Crowdfunding has always been a very strong use case for blockchain technology because anyone on the planet was able to participate in funding and owning a piece of a promising new network by buying a token or coin.

Since distributing tokens via blockchain is simply too effective and desirable to ignore, new practices are being worked out on how to do this best and that is where the Consumer Token Offering (CTO) comes in.We explore this new phenomenon below.What is a Consumer Token Offering?

The Consumer Token Offering (CTO) framework seeks to be a set of best practices for launching new tokens or Token Generation Events on Ethereum.

The framework centers on 10 key concepts of token usage, governance, distribution methods, distribution purpose, supply, conflict resolution, security, marketing, consumer protection, and compliance.

The CTO framework is designed to be an open and evolving collaborative effort that will hopefully create a high standard of trust and reliability between token projects, token holders, and regulators.Consumer Token Offering Framework Concepts

The Consumer Token Offering framework outlines 10 concepts:- Tokens should be useable for goods, services, or content and not for money-making schemes like equity and investments.

- The management and governance of the token should be transparent and clearly identifiable as decentralized or not.

- Tokens should be distributed fairly and transparently.

- The reason for the token distribution should be clear and transparent.

- The rules for the supply, creation, and destruction of tokens should be clear and transparent.

- There should be a procedure to deal with conflicts.

- Related smart contracts, dapps, and tokens should be audited for security.

- Marketing should not be misleading.

- Projects should protect and empower users.

- Project should consult with legal counselors to make sure they are compliant with all relevant laws.

Who Invented the Consumer Token Offering?

The CTO is a framework created by the Brooklyn Project, which is a collaboration led by the ConsenSys Legal Team and consisting of different blockchain industry partners.Did you know?

Two well-known projects that have used the Consumer Token Offering framework are Civil and FOAM. They were both launched on the Consensys Token Foundry platform in 2018 and applied a rigorous standard that required token offering participates to prove that they were knowledgeable about the project and the crypto industry in general.

In order to participate, Token Foundry users had to pass a quiz as part of the onboarding process and buyers were not able to sell their tokens until they proved that those tokens were actually used.A brief history

- November 2017 – The Brooklyn Project is launched at the height of the ICO and crypto boom.

- September 2018 – Version 1.0 of the Consumer Token Framework is released after public feedback.

- April 2019 – The US Securities and Exchange Commission (SEC) releases their crypto offering framework called ‘Investment Contract Analysis of Digital Assets’ as general guidance for new token offerings.

What’s so special about it?

The problem with ICOs is their completely unstructured nature, which makes the process vulnerable to fraud, rampant speculation, and legal repercussions. Security Token Offerings STO are more legally compliant but are restricted to qualified or accredited investors, which defeats one of the main purposes of a token offering, which is to have a wide and diverse network of early adopters.

Initial Exchange Offerings (IEOs) are centrally managed by exchanges, which negates the permission-less and decentralized feature of blockchain technology. The CTO hopes to be the best of all worlds by creating a voluntary set of standardsSEC Framework Concepts

The release of the SEC framework for token offerings offers the clearest guidance so far for token sales from U.S regulators. The main points that the framework discusses are whether there is an expectation of profit and whether the project is truly decentralized.

Basically, if there is a usage for the token right away and it is not explicitly an investment device and the platform is decentralized, then the token might not be a security.

When comparing the SEC and CTO frameworks, the CTO framework may be compliant in that it emphasizes tokens having a use case and not having an expectation of profits as it did with FOAM and Civil. However, it should be noted that the SEC framework does not offer any legal guarantees so projects still need to proceed with caution.The Future

Though Consumer Token Offerings have not been widely adopted in the crypto industry, it is a big part of the future for ConsenSys, which is behind fundamental and vital projects in the Ethereum ecosystem. Joseph Lubin, ConsenSys’s founder, said during his keynote address at the 2019 South by Southwest (SXSW) Conference that they will be conducting four or five CTOs in the year. It will be interesting to see if other projects follow their lead.-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

Crypto Exchange Bitfinex Shareholder Claims Imminent IEO Will Offer $1 Billion i... (cointelegraph.com)Crypto exchange Bitfinex shareholder Zhao Dong has revealed details of the company’s reported plans to issue a native exchange token, which he claims will launch via a $1 billion initial exchange offering (IEO) in the coming days.

According to a report from crypto news outlet CoinDesk on May 1, the Chinese bitcoin (BTC) billionaire posted to a public chat on local messenger WeChat on Wednesday, outlining that the sale will offer a total supply of 1 billion tokens, priced at $1 apiece, with a minimum buy-in of $1 million.Zhao — who runs a major Chinese BTC over-the-counter trading desk and is the founder of Singapore-based DFund — reportedly further claimed that $500 million tokens had already been vouched for.

He is cited as having said that “only qualified foreign investors will be allowed to invest,” and that all those interested must make a soft commitment to the IEO by May 5.

Once investors will have had a chance to review the token’s white paper, they will then be able to either cancel their soft commitment, or cement it as a hard commitment by providing a 10% deposit, Zhao reportedly added. The shareholder further outlined that:“The system works on a first-in, first-served basis. If all tokens are fully allocated, we will not have to run the IEO to the retail channel, it will be like a private placement.”

The new token has reportedly been characterized by Zhao as a hybrid of the model used for crypto exchange Binance’s native token binance coin (BNB) — which is used by Binance users to pay for exchange trading fees — and Bitfinex’s erstwhile BFX token.

As previously reported, BFX tokens were issued by the exchange in 2016 to compensate Bitfinex users affected by a major hack, which had resulted in the theft of around 120,000 BTC.

Upon Zhao’s first revelation of the Bitfinex’s alleged IEO and proprietary exchange token plans on April 29, the news sparked a wave of community concern in light of the lengthy history of controversies that have beset both Bitfinex and affiliated USD stablecoin company Tether.

As recently reported, the New York Attorney General’s office has this month alleged that Bitfinex lost $850 million in user deposits, and had subsequently secretly covered up the shortfall using funds from Tether — the latter of which has itself come under renewed criticism for allegedly being only backed 74% by USD reserves.

In an official statement, Tether rebuffed the allegations, stating that the “New York Attorney General’s court filings were written in bad faith and were riddled with false assertions, including in regard to the purported $850 million loss.-

Francisco Gimeno - BC Analyst Bitfinex huge IEO is coming, among controversies and weird news, fired by allegations by NY General Attorney on misuse of Tether funds and a 2016 hack. It will be very interesting to see how private investors react to this last movement and what comes from all of this.

-

-

Executive Summary

ICO / STO Report March 2019 – Global Status-Quo

ICO / STO - A strategic perspective:

• In 2018, over 1’132 ICOs / STOs have happened successfully, which is twice as much as in 2017 (total of 552)

• Total amount raised has nearly tripled to almost USD 20bn compared to 2017 (total of USD 7bn)

• However, two unicorn ICOs (EOS USD 4.1bn & Telegram USD 1.7bn) accounted for over 5.8bn of the 2018 volume

• In H2 2018, numbers and volume of ICOs / STOs declined sharply, reflecting both the shift from ICO to STO and the

“crypto winter”

Regulatory

Environment

• Jurisdictions continue to pass specific crypto assets and tokenization laws across all continents

• As a global trend, jurisdictions leverage existing security regulations as “STO framework”, allowing management of

cross-boarder complexity

STOs &

Tokenization

of Assets

• Security Token Offerings (STOs) are not fundamentally different from ICOs, but a more mature and regulated form, as the

underlying tokens provide different financial rights, including dividends or shares

• STOs combine many features of ICOs (e.g. low entry barriers for investors) as well as traditional Venture Capital / Private

Equity fundraising characteristics (e.g. regulations based on local security laws, incl. KYC / AML)

• Tokenization of Assets (i.e., process of converting an asset into a digital token on the blockchain system) is another trend

and expands from commodity tokenization (e.g. gold, oil) to tokenization of intangible goods (e.g. music rights)

Infrastructure

“Level Up”

• As STOs are becoming fully regulated, the corresponding infrastructure must “level up” – e.g., for trading and exchange,

incumbent exchanges are entering the crypto space

• Moreover, additional services will be demanded by market participants, such as flexible custody solutions, market data

services (MDS), reliable rating services & quality research as well as technical standards & APIsDownload the full PDF report here:

https://cryptovalley.swiss/wp-content/uploads/ch-20190308-strategyand-ico-sto-report-q1-2019.pdf-

Francisco Gimeno - BC Analyst When reading this report we feel the strength of the blockchain and crypto space, even at this early stage. ICOs, STOs, new expectations for the next future, and how the sphere is slowly expanding into the global economy. Short and to the point!

-

-

Fervent blockchain supporters claim the technology has the potential to transform the world we live in – and venture capital investors (VCs) are paying attention.

With hefty funds to deploy, and returns to make for their limited partners, it’s common knowledge that VCs are always looking for the next big thing.

A huge part of their job entails evaluating nascent technologies to separate innovative companies doing revolutionary work from more derivative projects – and blockchain is no exception.

In fact, research released last year showed that the number of VC blockchain deals doubled in the 12 months up to October 2018, by which time investors had already poured $3.9 billion into companies across the globe.

According to Pitchbook data shared with Hard Fork, venture capital investment in the US cryptocurrency and blockchain space has been steadily increasing year on year – going from a mere €14.43 million in 2013 to €723.13 million last year. The number of funds closed has increased, too (17 in 2013 and 106 in 2018).

Courtesy of Pitchbook

Back in 2017, a TNW contributor argued that Initial Coin Offerings (ICOs) would render traditional VCs a thing of the past, but a different story has played out all-together.

At Hard Fork, we want to know what piques investors‘ interest, what drives them to back certain companies, what they’re uninspired by, and why.With this in mind, we reached out to notable figures to find out what’s driving investment in the space.Viable solutions

Octopus Ventures Zihao Xu’s first encounter with Bitcoin took place when a friend emailed him the cryptocurrency‘s whitepaper in 2012. At that time, a coin’s price oscillated between $5 and $13 throughout the year.

“I found it really intriguing as I’d been interested in the idea of denationalized money since my university days,” Xu told Hard Fork.

Xu believes those interested in Bitcoin‘s underlying blockchain technology before the asset price took off fall into three categories. First, the tech enthusiasts who were interested in the code element.

Then, those in finance who figured out they could trade Bitcoin and potentially make money. Finally, the libertarians who saw the potential of censorship-resistance, decentralization, and a free market for money.Initially, Xu fell into the latter camp, but fast forward seven years and his vision for blockchain technology has altered significantly.I no longer think blockchains are the most elegant or suited type of database. In fact, the idea of using a blockchain to distribute a database is probably the most crude one conceptually – giving every node a full copy of the entire database is old-fashioned.

Xu wants to find viable blockchain solutions which could help the technology achieve mainstream adoption. He’s trying to avoid companies that use blockchain for the sake of it, or because it’s a buzzword that’s likely to entice investors.

“We look for companies or projects building something with the core value that comes from a set of functions native to [decentralized ledger technology] (DLT), and cannot be attained in the absence of DLT.”“Right now, only a small handful of projects fits this criterion, but cryptocurrency functionality is improving and expanding all the time,” he added.Tech convergence

Jamie Burke came across Bitcoin entirely by chance.He became so enamored with the technology that he set up Outlier Ventures – credited with being Europe’s first dedicated blockchain VC and venture platform – in 2014.

At the time, Bitcoin hovered around the $300-$400 mark and there seemed to be little, or no, interest outside of the academic and developer community.But things changed quickly. A year later, in the Summer of 2015, Ethereum – the brainchild of Vitalik Buterin, Gavin Wood, and Joseph Lubin – burst on the scene.

“When Ethereum came along and introduced their vision for a virtual machine as well as the way they financed the project through what was only the second ICO at the time, it became clear this promised to be as transformational as The Web was in the 1990s and [it] was something we had to be part of,” Burke told Hard Fork over email.

It was then that academics’ and developers’ interest in the technology started to transcend into the commercial arena, with Microsoft sponsoring Ethereum’s DevCon One conference that same year.

Burke says he’s been bullish about the underlying potential of decentralized ledgers from the very beginning.What’s been surprising to me is how quickly startups in this space have rushed to codify assumptions into their design decisions before testing and validating them. Equally, I have started to realize just how much cultural baggage ‘crypto’ owes to the field of cybernetics, the new communalism of the 60s, and its merging with the libertarian right of the 90s.

Burke thinks the current cryptocurrency winter, which has resulted in some companies making significant layoffs, will be hugely positive for the space in the long-run.

The perceived scarcity of funds in the blockchain and cryptocurrency space, Burke believes, will force founders to concentrate on what really matters: building usable products to solve real-world problems, and in turn, achieve adoption. It’s basically the survival of the fittest.

“We speak to over 100 inbound projects a month and have met over 1500 blockchain startups since our founding. Many don’t go beyond the first round of due diligence because they have no experience or understanding of the industries they want to touch or are too dogmatic,” Burke noted.

He believes the real value will be found where, and when, blockchain helps enable other technologies such as artificial intelligence, internet-of-things, as well as augmented and virtual realities.

It will be then that blockchain will serve as a viable solution to store the increasing abundance of data required to power advancements in these fields.“We definitely don’t look at blockchain and cryptocurrency in isolation,” he explained.Staying close to the problem

Burke is not the only investor to think that blockchain technology’s success – and therefore its potential viability as an investment – will rely on its convergence with other technologies.Sherman Lee, a partner at early stage accelerator program Zeroth AI, agrees.Lee discovered Bitcoin in 2014.

Three years later he began to look at blockchain technology as a solution to a problem he’d encountered with AI training.“During the great bull run of 2017, the euphoria was incredible. Hundreds of teams kept popping up with whitepapers with amazing visions. As an engineer, I was quite skeptical on the ability of all these teams to deliver on their promises of 1 million transactions per second. As an investor, well, it didn’t matter because we started seeing parabolic gains on our investments.”

A year later, everything changed. The bear market of 2018 brought everyone back to reality. Token prices crashed, leading to projects and companies running out of cash, with many ceasing operations completely.“Many thought cryptocurrency was dead, but not me. As an engineer, I saw real technology being built by incredibly talented people.

All the scammers and speculators have mostly disappeared. All the noise is gone. We now have left only the strongest teams. These are the ones that will survive,” he said.Lee wants founders who are “super close” to the problem they’re solving and understand that to be a sustainable blockchain company, you have to have a path to revenue.

“The ability to self reflect is also valuable. Many companies got caught up in the ICO hype and now they have to clean up the mess,” Lee added.Data, data, data

Will Orde, a technology investor at Oxford Capital, discovered cryptocurrencies in 2015, when Bitcoin‘s value moved between $200 and $500. Two years later, in 2017, Oxford Capital began to seriously explore applied uses of blockchain technology.

“When I started looking at cryptocurrencies in 2015, the core premise was focused on digital currencies – Bitcoin being the most famous. But over time I think the more interesting applications (in the immediate future) are using distributed ledger technology in more practical situations, particularly around data.

”As a fund, Oxford Capital wants to back companies at the point where products first hit the market – and blockchain is no different.“Recently I’ve been focusing on use-cases revolving around the creation, sharing and management of data in multi-party situations.

You can find situations like this in many sectors, from insurance to personal identity.”Importantly, though, Orde is quick to point out that, like many others in the market, he’s not interested in blockchain companies looking for a problem to solve.He wants “someone with a clear vision for what they’re building, a balanced skill set, and an ability to get stuff done”.Real innovation

Alicia Garabedian also discovered Bitcoin in 2015 when she was working at Morgan Stanley.Real exposure to the blockchain ecosystem, though, came in 2017 when she joined Samsung Next, where she’s an investor.

When she first came into the space, Garabedian thought cryptocurrencies were about speculation, and admits she didn’t really understand the underlying blockchain technology.

“As I learned more, I became captivated by the speed of industry, the growth of the ecosystem and intrigued by the influx of ambitious entrepreneurs,” she shared with Hard Fork.Today, Garabedian is looking for real applications, actual enterprise implementation, and consumer adoption.“We are interested in the deep, enabling technology that capitalizes on the potential of blockchain. We look at companies that are doing something new and innovative with blockchain, as opposed to leveraging it as, say, a data store. In this sense, we are less interested in companies that are trying to put something on the blockchain, or creating a token, without clear justification or end game.”

In her experience, blockchain technology proves to be useful when there’s an issue that lacks distribution, not only geographically, but organizationally.

But, will investment in cryptocurrency and blockchain startups continue to rise or stagnate?

Well, it’s highly likely the number companies that raise considerable amounts via ICOs will stagnate, and those building a solution without a problem will struggle (or even cease to) exist.It seems that, somewhat predictably, the future looks bright for blockchain businesses which fundraise reasonably with a clear path to monetization.

A clear value proposition and a solid market strategy are also a must. This is what’s really attracting investors and that’s unlikely to change.

-

Francisco Gimeno - BC Analyst This is one of the most clear articles we have read related to the status of the ICOs in 2019. Different opinions but all understand that the blockchain Wild West is not needed anymore, and only serious projects with serious value proposition, strategy and team will get funds from investors. This is the beginning of a new stage for all things blockchain.

-

-

Table of content

- Blockchain Technology 101

Blockchain roundup: Invaluable advice from top blockchain experts

Blockchain: A technical primer

by Greg Brady

- Blockchain Technology 101

- Blockchain Advanced Development

From Java to blockchain: How to become a blockchain developer

Interview with Eugene Kyselev

dApps 101: Tips and tricks to get you started

by Michael Kordvani

Making smart contracts safe with Hyperledger Sawtooth

Interview with Dan Middleton

“The currently unrivaled programming language for smart contracts is Solidity for the Ethereum blockchain”

Interview with Alfred Shaffir

Programming a crypto mining rig: How does it work?

by Amir Gvili

How Can Blockchain Technology Help Boost Cyber Security?

by Victor Stolyarenko

- Blockchain Advanced Development

- Blockchain Impact & Strategy

Overledger aims to open blockchain’s “borders” and facilitate development of multi-chain applications

Interview with Paolo Tasca

School is in session: Blockchain education is needed ahead of mainstream adoption

by Nicola Stojano

- Blockchain Impact & Strategy

-

- The Fourth Industrial Revolution will take center stage at the World Economic Forum's (WEF) annual meeting next week in Davos, Switzerland.

- It's a term used by CEOs, policymakers and industry to describe technologies like artificial intelligence, quantum computing, 3D printing and the internet of things.

- Some companies and governments are struggling to keep up with the Fourth Industrial Revolution.

Elizabeth Schulze | @eschulze9

What is the Fourth Industrial Revolution? 1 Hour Ago | 04:10

The Fourth Industrial Revolution will take center stage at the World Economic Forum's (WEF) annual meeting next week in Davos, Switzerland.The concept, a theme of Davos this year, refers to how a combination of technologies are changing the way we live, work and interact.

Klaus Schwab, founder and executive chairman of the Geneva-based WEF, published a book in 2016 titled "The Fourth Industrial Revolution" and coined the term at the Davos meeting that year.

Schwab argued a technological revolution is underway "that is blurring the lines between the physical, digital and biological spheres."Simply put, the Fourth Industrial Revolution refers to how technologies like artificial intelligence, autonomous vehicles and the internet of things are merging with humans' physical lives.

Think of voice-activated assistants, facial ID recognition or digital health-care sensors.

Schwab argued these technological changes are drastically altering how individuals, companies and governments operate, ultimately leading to a societal transformation similar to previous industrial revolutions.The first three industrial revolutions

Zvika Krieger, the head of technology policy and partnerships at WEF, told CNBC on Tuesday there is a common theme among each of the industrial revolutions: the invention of a specific technology that changed society fundamentally.

The First Industrial Revolution started in Britain around 1760. It was powered by a major invention: the steam engine. The steam engine enabled new manufacturing processes, leading to the creation of factories.

The Second Industrial Revolution came roughly one century later and was characterized by mass production in new industries like steel, oil and electricity.

The light bulb, telephone and internal combustion engine were some of the key inventions of this era.The inventions of the semiconductor, personal computer and the internet marked the Third Industrial Revolution starting in the 1960s. This is also referred to as the "Digital Revolution.

"Krieger said the Fourth Industrial Revolution is different from the third for two reasons: the gap between the digital, physical and biological worlds is shrinking, and technology is changing faster than ever.Telephone vs. 'Pokemon Go'

For evidence of how quickly technological change is spreading, Krieger pointed to the adoption of the telephone. It took 75 years for 100 million people to get access to the telephone; the gaming app "Pokemon Go" hooked that many users in less than one month in 2016.

Toru Hanai | Reuters

Pokemon Go app on an iPhone, Tokyo, Japan, July 22, 2016.Companies in industries from retail to transportation to banking are vying to incorporate new technologies like augmented reality, 3D printing and artificial intelligence into their operations.

A 2017 study by the European Patent Office found the number of patents filed related to the Fourth Industrial Revolution increased a growth rate of 54 percent in the past three years.

"Technology, and specifically digital technology, is so intertwined with many businesses, as well as our social and economic lives, that trying to separate 'tech' from 'non-tech' is becoming increasingly redundant," said David Stubbs, head of client investment strategy for EMEA at J.P. Morgan Private Bank, in an email to CNBC.Left behind

Companies, governments and individuals are struggling to keep up with the fast pace of technological change.

Krieger, who served as the U.S. State Department's first-ever representative to Silicon Valley from 2016 to 2017, said technology is often missing from policymakers' "toolkits.

" As a result, he said, companies are left filling a void trying to understand how to implement — and regulate — advancements like A.I."There's an absolute hunger for concrete things companies can do," Krieger said.

Will robots take our jobs? 10:40 AM ET Tue, 30 Oct 2018 | 03:10

Jordan Morrow is the head of data literacy at analytics firm Qlik. He said individuals and companies lack skills, like interpreting and analyzing data, to successfully compete in the Fourth Industrial Revolution.

"Not everyone needs to be a data scientist but everyone needs to be data literate," he said in a phone interview with CNBC. Studies show technologies like artificial intelligence will eliminate some jobs, while creating demand for new jobs and skills.

Some experts warn of a "winner-take-all economy," where high-skilled workers are rewarded with high pay, and the rest of workers are left behind.A 2018 report by investment firm UBS found billionaires have driven almost 80 percent of the 40 main breakthrough innovations over the past four decades.

In 2016, Schwab predicted inequality would be the greatest societal concern associated with the Fourth Industrial Revolution.

"There has never been a time of greater promise, or one of greater potential peril," he said.

Follow CNBC International on Twitter and Facebook.-

Francisco Gimeno - BC Analyst Great article here. 4th IR is coming at a very fast pace, and if not prepared, a kind of darwinian evolution will take place, where the winners will be those involved in the digital world, and losers those who don't understand yet the whole world is going to change. All revolutions have their birth and growing pains, and the debris of disruption will be left behind. We have to choose where to stand.

-

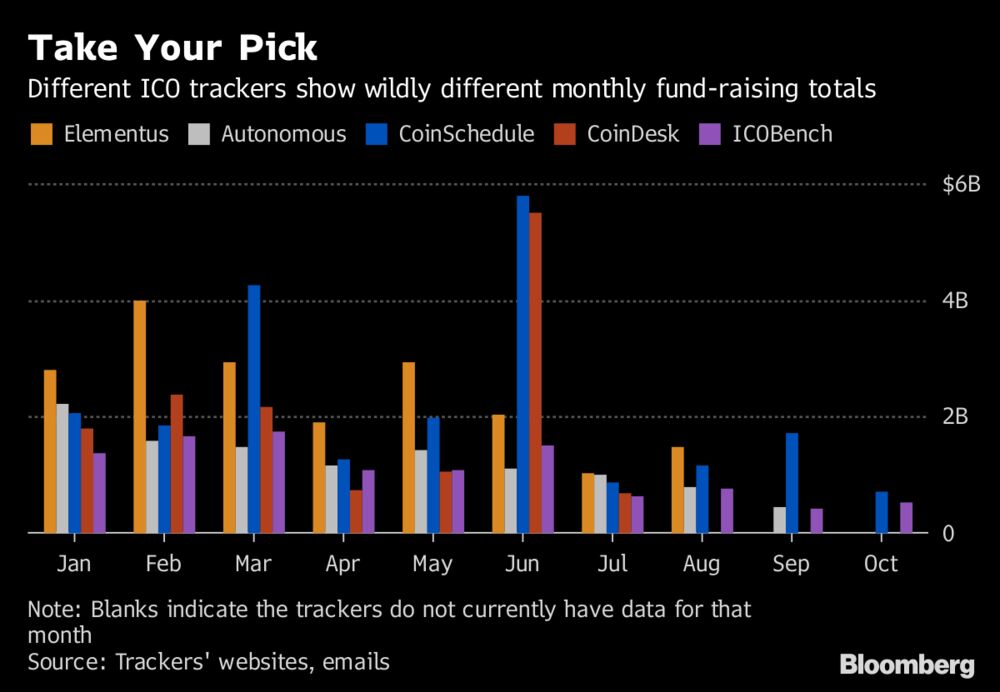

- Lack of rules, transparency leaves issuance amounts murky

- More digital tokens are being issued through direct sales

So far this year, initial coin offerings have raised $22 billion, or half of that -- depending on where you look.

With the cryptocurrency market nearly 80 percent off its peak, a critical question is exactly how much the ICO boom has deflated. That becomes harder to answer when even the most commonly used websites that track the phenomenon disagree on the figures.

Blockchain may be billed as an immutable public ledger, but in the controversial world of crypto it spawned, establishing truth can be tricky when disclosure standards are still being improvised daily.

In the case of ICOs, it remains hard to ascertain the amount of funds a issuer claims it’s raised when no one has to submit any regulated filings or even reveal their identities.

“At the end of the day, there’s no way to really agree on the information based on provable facts,” said Alex Buelau, co-founder of Oxford, U.K.-based listing site CoinSchedule.

“It’s early days. The question is how can the industry create an incentive for these guys to report accurate numbers? At this point there’s no incentive.”

Most data trackers, which make money from charging token sellers for listings or other services, rely on issuers for information on the ICOs.Take Ruby-X, a crypto exchange project.

CoinSchedule says it raised $1.2 billion; ICORating, $200 million; Autonomous Research says it’s chosen to exclude it, since its online footprint was unreliable. Ruby-X, which hasn’t disclosed where it’s based, didn’t reply to e-mails seeking comment.

Or consider an even more extreme example: Venezuela’s sovereign Petro. In March, President Nicolas Maduro said it has garnered $5 billion in offers; in April, he said the sale raised $3.3 billion; the token’s website says $735 million, the figure cited by CoinSchedule and ICORating.

Even with the best intentions, collecting basic facts about token sales can be a challenge. ICORatings combines information from issuers, investors and the blockchain itself. Elementus, a new startup, tracks data from the blockchain, supplemented with reported figures that it considers credible.

With the ability to trace actual transactions, on-chain data are more reliable and comprehensive, which is why their fund-raising totals are higher, says Elementus co-founder Nuria Gutierrez Prunera. The downside is that on-chain data don’t capture investments in fiat currency.

Autonomous Research goes through about 50 different underlying trackers to compile its ICO data and manually removes entries it considers untrustworthy, said Lex Sokolin, global director of fintech strategy.

The trackers it depends on have varied over time as their quality can fluctuate, possibly because the economics of maintaining a database have weakened, he added.To complicate things further, the nature of ICOs is also evolving.

A growing portion of tokens are offered privately to selected investors, rather than crowdfunded via the internet as the innovation was initially known for.Read More: Hedge Funds Flip ICOs, Leaving Other Investors Holding the Bag “It’s a lot more difficult to find out information about private sales,” said Sasha Kamshilov, co-founder of ICORating in St. Petersburg, Russia.

“It’s really important for regular investors to know the actual price and conditions of a private sale.”

The Dragon token, which professes to offer a payment system for the entertainment industry, told Bloomberg News in August that it raised $12 million in a public round and $408 million in its private sale.

For that sale, Elementus and CoinSchedule gave the $420 million total, ICORating had $3.9 million, whereas CoinDesk and Autonomous had $320 million.Telling the right story about crypto matters when debates over its future are raging amid the fading speculative frenzy.

After Autonomous published a report that showed token offerings were down 90 percent from their monthly peak in September, it received criticisms that that month actually saw more than $1 billion of funds raised, rather than the $300 million it cited earlier.

“There’s always a little bit of a difference, but when things were going up it didn’t matter at the edges,” said Sokolin at Autonomous. “Now that things are getting tight people want to tell different stories.”-

Francisco Gimeno - BC Analyst ICO' ecosystem is yet at its early period. It can wildly grow and then suddenly fall, while evolving in quality too. We are seeing ICOs looking for private sales before being public, and investors more critical on the White papers information. The info on the Web is not very reliable yet. Narratives and images show one thing, real facts usually lead to the opposite.

-

The cryptocurrency market has been in decline since January, but it appears blockchain startups are still profiting big. Indeed, new data suggests Ethereum-based initial coin offerings (ICOs) are sitting on $830 million in reserves – that is despite having already sold almost as much ETH as they initially raised.

According to data from BitMEX Research, blockchain startups raised a total of $5,463 million worth of Ethereum $ETH▼1.02% (approximately 15 million ETH) in ICOs by September 2018. Interestingly, the sum almost matches the total amount of ETH these companies sold during the same period – $5,452 million (or 11.3 million ETH).

The data essentially shows that most blockchain startups sold their ETH at a value higher than initially raised. This is also what made it possible to secure the funds initially raised (in terms of dollars), but also keep a huge treasure trove of Ether in reserve.

(Source: Ethereum Blockchain, BitMEX Research, TokenAnalyst, Token Data, Price data from Etherscan)Indeed, it would appear that ICOs sold much of their Ethereum before the price dropped 85 percent, from $1,400 last December to $230 in September 2018.

As a result, ICOs have realized profits of $727 million, while still retaining $830 million worth of Ethereum (3.9 million ETH) in reserves. It would seem the ETH being held is pure profit for the ICOs.

(Source: Ethereum Blockchain, BitMEX Research, TokenAnalyst, Token Data, Price data from Etherscan)BitMEX points out the findings are significant in two ways. On the one hand, it shows that most ICOs don’t engage in “panic selling” as a strategy to off-load funds.

On the other, it highlights how easy it is for blockchain startups to run ICOs for quick cash rewards.As the value of Ethereum remains low and panic selling isn’t a strategy ICOs seem to endorse, it is unlikely that we will see any ICOs sell more of their ETH funds for the time being.

However, even if these ICOs did decide to off-load all 3.9 million Ether that they currently hold, it’s unlikely that this amount would be large enough to negatively impact the price of Ethereum – given that there is 102 million ETH currently in circulation.If you’re interested in everything blockchain, chances are you’ll love Hard Fork Decentralized.

Our blockchain and cryptocurrency event is coming up soon – join us to hear from experts about the industry’s future. Ticket sales are now open, check it out!-

Francisco Gimeno - BC Analyst Companies which have raised ICOs, naturally have to raise some profits to continue working in their products, while reserving most of their tokens based on Ethereum for future. This article is common sense, and also shows how most of the ICOs don't move in crypto speculation but into development of their own projects. Good data here.

-

-

Kieran Smith

The buy and hold strategy of ICO investing is losing its appeal for retail investors who have become more discerning about where the put their money and the active management style of hedge funds is starting to attract billions of inflows from wealthy investors willing to punt on a new style of fund manager.

Capital consultancy Greyspark have released a report charting the changing landscape of cryptocurrency investment.

As the marketplace matures, two tidal shifts are taking place: ICOs are losing popularity with retail investors, and avenues for institutional investors to enter the space are increasing.Disappointing progress, poor marketing and the proliferation of scam projects are cited in the report as the key reasons for the falling success rate of ICOs, and their returns have been significantly reduced in 2018. Crypto hedge funds on the other hand have seen continued growth despite a slight downturn in parallel with the bear market.

Half of all ICOs fail to hit funding target

According to Greyspark, half of the ICOs from 2017 and 2018 failed to hit their funding target, and as many as 890 token sales raised no funds at all. But in the same period, more than 40% of ICOs (743 firms) raised more than $1 million.

This data suggests that since the mania of 2017 has subsided, investors have become increasingly astute, and the quality of projects has risen in tandem.

Greyspark's report found that in Q2 2018, 15% of ICO projects already had a working product, compared to only six percent of projects in Q1.Despite the lagging performance of ICOs, the report finds general cryptocurrency development continues unabated—at least when measured by growth in Google search queries (still up from last Autumn despite the bubble) and by number of exchange sign ups, which show a similar upward trajectory.

But as the market matures, this growth is taking a new form. Retail investors swayed by the marketing of ICOs are being replaced by institutions, whose trading is largely conducted through OTC crypto trading desks and a small number of crypto hedge funds.

These avenues are relied on by institutional players to help them overcome the challenges they face when entering the market—including access to sufficient liquidity, privacy, security, and reduced counterparty risk. "Financial institutions have started to engage, although carefully, with their first cryptocurrency-related projects and the whole industry is evolving rapidly with the clear objective to attract the big money" said hedge fund manager and report co-author Eitan Galam, in a statement.

As of September, the number of crypto hedge funds has increased significantly, and after bouncing back from a drop in January, the total number of funds is now approaching 150, up from only nine in 2012.

What is a crypto hedge fund?

In the traditional financial world, hedge funds use their expertise to invest the money of institutions and wealthy individuals—luring them in with the possibility of earning returns much greater than those offered by standard market index trackers by managing market ups and downs by taking long and short positions.

In a similar way, crypto hedge funds provide active portfolio management for cryptocurrency assets, using a range of different investment strategies to try and generate larger returns than would be granted by following the market movements of any one cryptocurrency.

This approach has proved appealing to institutional investors, who usually don't have the inclination to keep up with such a fast-moving market, or the means to store large amounts of cryptocurrency safely.

Crypto hedge funds hold up to $5 billion

According to the report, while institutional trading in crypto is still relatively low compared to other asset classes, the number of crypto hedge funds has increased significantly over the past two years, and is expected to reach between 160 and 180 by the end of 2018.

These funds—which are usually run by fewer than five people—are made up from a mix of both defectors from the traditional world of finance seeking escape from the excruciatingly low yields of bonds and equities, and famous figures from within the crypto community.

Collectively, these funds manage up to $5 billion in crypto assets, mostly on behalf of institutional investors, wealthy individuals, and Venture Capital firms like Sequoia Capital and Andreessen Horowitz, who have both backed Naval Ravikant's crypto hedge fund MetaStable.

Active versus passive debate enters crypto

In recent years managed money has underperformed passive strategies with the proliferation of ETFs which have eaten into hedge fund profits and market share. Traditionally hedge funds have charged notoriously high fees dubbed the "Two and Twenty" ratio which is a flat 2% management fee on top of a 20% slice of the profits if they reach a certain threshold.

So if a fund has $1 billion in assets under management (AUM) it is guaranteed an annual $20 million regardless if it generates a profit or loss, and with their underperformance in this extended stockmarket bull run even wealthy individuals have switched to passive funds.In contrast, the SPY ETF, one of the world's most liquid exchange-traded funds that tracks the S&P 500, has a management fee of 0.09%.

Hedge fund managers have responded by cutting their fees to as low as 1:10 split.What this investment means for crypto is not easy to predict, but by acting as supersized individual investors—or 'whales' in crypto parlance—these funds add liquidity to the market, potentially creating greater price stability, and in the long run more confidence for increasingly mainstream institutional investors to enter the space.-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

It’s no longer the case that blockchain startups can run a successful ICO with just an idea and a token. In this article, you will learn how to assemble the fundamental components of a successful ICO pitch deck

A persuasive ICO deck or pitch that addresses investor considerations is key to successfully selling your token. However, most startups spend too much time with an expert technical team building the perfect blockchain-based technology, only to find that they’re unable to develop and present a compelling ICO pitch to raise funds.

Here are some of the key components we’ve found from working with successful blockchain clients that make up the general structure of a successful ICO pitch:

1. Prove you’re solving a real problem by leveraging the blockchain

The increasing popularity of ICOs has resulted in numerous projects where the application of blockchain technology appears to be an afterthought and potentially unnecessary. Getting clear as to why you’re building the blockchain application and illustrating the magnitude of the problem you’re solving will help you get initial buy-in from investors.

“ICOs have gotten a bad rep because many perceive them as a cash grab,” says Jack Yeu, CCO at Switcheo Network. “If your identified ‘problem’ can be solved by using a database instead of your solution, is it really a problem worth investing in?

”In your pitch, it should also be made clear that your solution is relevant to a problem that people are facing at this current moment versus something that people theorise might happen.

2. Sound token economicsMost crypto-investors are usually interested in one thing —the value appreciation of the tokens that they purchase. To allay doubts of a dud token investment, blockchain founders need to be able to clearly articulate how their tokens are created, how they will be used and why they’ll grow in value over time.

More popular as of recent, blockchain companies running ICOs mostly create utility tokens that can be spent or exchanged for services, rebates or goods. That way, tokens get burnt after use and become more scarce. The result? The token’s worth increases naturally.

Source: BOLT Token website

Making a case for the longevity of your token value means illustrating what the circulation of the currency will look like as well as highlighting scenarios for increasing demand, adoption and scarcity. Communicating how the tokens work in the grand scheme of things will increase your chances of swaying investors.

3. Highlight the competence of your team

As with any company or solution, it’s the people and teams behind it that make or break the project. Ask yourself these questions:

What are the technical strengths of my team?Do the members have any notable achievements or associations?Are their experiences relevant to the blockchain solution in development?

Token holders want to invest in not only the longevity of the technology but also the people behind it. Identify the greatest strengths within the team and keep the format of the team profiles consistent. Another tip is to avoid making general boastful statements like: ‘creator of multiple successful startups’. Instead, always use quantitative numbers or facts to substantiate any statements. (e.g. former CEO at X, 20 years in IT).

Source: LAToken Pitch Conference Pitchdeck

Here’s one example from LAToken (raised $20M). The format of introducing the team is consistent. It states their position and their experience and describes their roles.

4. Detail your ‘post-ICO’ plan

Some investors buy tokens to HODL for the long-haul and not just sell immediately after the ICO is over in anticipation of value growth. As such, they’ll want to know exactly what founders plan to do in the months or years ahead. This is called your 'roadmap' and it should include:

i) Marketing and Growth Plans

Community members want to know how you’ll continue to acquire and retain new token holders to bring added liquidity and value to tokens on sale. This helps to instill confidence in holders that the tokens they own will continue to stay relevant and valuable.

ii) Project Timeline

Having clear set dates (e.g. 2018 Q4) helps keep founders accountable for their promises made before the ICO and lets investors closely track the progress of solution development. A simple linear illustration in these cases usually works best.

Source: Inmediate.io - Blockchain Insurance Ecosystem

5. Financial plans and ICO proceeds

This is perhaps the most important piece of information for any token investor — the mechanics of the raise and how ICO proceeds will be distributed. Prospective investors need to know the factors to consider in their purchase.

This means including the token price, whether there are hard caps and limits to the number of tokens and also how these will be distributed to their wallets.

Unfortunately, there have been a number of blockchain companies that have taken token holders for a ride, by misspending proceeds or never get any closer to realising their solution idea. “Investors have become more wary of ICOs with token caps that are too high.

Hence, we decided earlier on that we’d only raise what we needed” says Switcheo’s Yeu, “The question you need to truly answer as a founder is whether you really need that much money?”

A transparent breakdown like the one above from Inmediate.io is a good example of accounting for proceeds to be raised during an ICO and what a successful token sale would entail.

Navigating this new world of cryptocurrency and blockchain can be confusing when you’re trying to get traction in the initial stages. However, as with any difficult endeavor, strategies that work will leave patterns and we can learn from these successes and apply the lessons to our own projects.About the author:

Eugene Cheng is a Partner and Creative Lead at HighSpark - a strategic presentation and training company that works with Fortune 500 companies and blockchain startups to communicate more powerfully. Eugene writes about blockchain trends, business and marketing for leading publications like Lifehack, Techinasia, e27 and more.-

Francisco Gimeno - BC Analyst ICOs' writers would benefit from reading an article like this. How many ICOs are yet appearing which have a good technology and a nice idea but a lousy pitch and poor explanation on how are they going to do what they pretend to do? ICOs investors in 2018 are more strict and want something more than vape and hype. What do you think?

-

-

Highly Recommended: A guide to blockchain-as-a-service (BaaS) for CTOs and IT le... (information-age.com)As servitisation business models continue to grow in popularity, it's only natural that we are now seeing as-a-service offerings emerge for blockchain applications. Blockchain-as-a-service (BaaS) has established a strong market presence and is promising enterprises a way to utilise the much-hyped technology

As business put evermore information online, understanding BaaS suppliers and agreements has never been more important. BaaS vendors have a duty of care and must be able to explain the benefits and the risks of their servicesA recent survey from Gartner revealed that the current number of blockchain deployments in enterprises is scarce.

According to their research, only 1% of CIOs indicated any sort of blockchain adoption within their organisation, while only 8% were in short-term planning or active experimentation with it. Furthermore, 77% said they had no plans to investigate it further.Given the amount of excitement we’ve all heard about blockchain, this is a rather anti-climatic response to such a hyped technology.

There is, of course, more than one reason for the reluctance.

Figure 1 – Blockchain Adoption, Worldwide. Source: Gartner (May 2018)

It’s been argued that all the marketing hype around blockchain has resulted in CTO’s and IT leaders unsure about what is real and what is not.Phil Fersht, founder and CEO of HfS Research, wrote in his article: “Sadly, blockchain runs the risk of being yet another representative of the ludicrous hype our industry has fallen for hook, line, and sinker.

We live in a hype bubble that we so desperately need to burst and find our way back to reality.”

>See also: How CTOs can introduce blockchain to the enterprise

On the other hand, beyond the overblown confidence in blockchain, IT leaders, who would actually like to implement it, are being held back by the lack of qualified blockchain developers.

David Furlonger, vice president and Gartner Fellow, said: “Blockchain technology requires an understanding of, at a fundamental level, aspects of security, law, value exchange, decentralised governance, process and commercial architectures.”

“It, therefore, implies that traditional lines of business and organisation silos can no longer operate under their historical structures.”Blockchain-as-a-service

Faced with a sense of disillusionment and concrete roadblocks, for the enterprise blockchain appears as an elusive piece of kit, however, new offerings from a whole host of tech giants may be providing a gateway for accessibility.

Organisations like Oracle, Microsoft and IBM have launched blockchain-as-a-service (BaaS) offerings.

Although their solutions differ from each other in various ways, they all seem to be establishing themselves as a way for enterprises to take on the nascent technology without the cost or risk of developing it in-house.

>See also: Deciphering the buzz around blockchain

Poised to play an important role in the IT sector, BaaS, similar to the way other software-as-a-service (SaaS) offerings work, allows customers to leverage cloud-based solutions, to develop and use their own blockchain apps, smart contracts and other blockchain functions while a cloud-based service provider takes care of all the necessary tasks and activities relating to the infrastructure.

BaaS offerings have the potential to offer a real solution to the talent shortage, as CTOs and business leaders will be able to utilise their external vendor’s pool of talent, from a financial point of view, it also provides them with an opportunity to play around without having to invest in a new infrastructure.

Bill Fearnley Jr, the IDC research director of Worldwide Blockchain strategies, stated, “One advantage of partnering with a BaaS provider is how users can leverage the lessons learned by the provider to help make their systems more secure.

”For clarity, it is worth breaking down in more detail what a relationship between an organisation and a BaaS vendor entails.

Typically a BaaS vendor provides all the necessary blockchain technology and infrastructure to a customer for a fee. The vendor is then responsible for setting up and maintaining the back-end of the blockchain’s infrastructure.

>See also: The rise of subscription billing in software and digital servicesMany BaaS vendors are trying to distinguish themselves by providing competitive side-offerings, such as training, or additional security options.Security and blockchain

While BaaS may mean that the costs of implementing blockchain will be a lot less than doing in-house development, security must be taken into account.

Blockchain is commonly considered a step in the right direction for securing processes, but similar to most things in computing, security is not inherent. Blockchain uses public key encryption, hashing, and digital signatures, and other mechanisms, most of these are well known, however, they are not always administered correctly.

Mistakes in securing a blockchain, or simple bugs in the platforms can and have happened, and they cause serious disruption.

>See also: More than just cryptocurrency: The advent of blockchain for business

Understanding the technicalities and security issues associated with BaaS is very important. Looking online, it is hard to find a comprehensive security assessment of the various blockchain-as-a-service offerings out there. With this in mind, it will mean that the CTO’s looking into these services will need to take a more hands-on approach.

This is ultimately similar to what CTOs and IT leaders have to do when considering cloud vendors.

As business put evermore information online, understanding BaaS suppliers and agreements has never been more important. BaaS vendors have a duty of care and must be able to explain the benefits and the risks of their services.At the same time, for a CTO, a good starting point would be to set out principles of what they expect from the BaaS provider, such as deciding what type of assurances they require.The BaaS market

Here is a list of some popular blockchain-as-service (BaaS) providers to have a look at:- Amazon’s Blockchain Templates – AWS Blockchain Templates aims to help organisations and individuals quickly create and deploy blockchain networks on AWS using different blockchain frameworks.

- Oracle Blockchain Cloud Service

-

Francisco Gimeno - BC Analyst There is haste and disappointment in some people about Blockchain as they would like blockchain to be already implemented in real use cases all around the world. This technology, however, needs time and a lot of care, and many trials, to be of general use. BaaS is arising because of this, to supply firms and individuals with solutions as services. We are yet at the beginning of the road. Faith, patience and work will lead to the 4th IR. What do you think?

-

Recommended Reading: Calling out the corrupt ICO experts, advisors, and rating s... (cointelligence.com)

By On Yavin

Corruption creeps into everything. While the blockchain revolution was started with grand ideas of decentralization and privacy, its growing popularity has led to unsavory elements looking for ways to corrupt it for their own means. The ICO industry is an especially popular target for bad behavior.

Some people are just out for the money and the blockchain is a convenient tool for them; from fraudulent ICOs to advisors and rating agencies accepting payment to promote projects without doing basic due diligence. We’re here today to shine a light on some of the worst offenders and call for more vigilance and better behavior going forward.

Let’s dive into the rabbit hole…The case of Cremit

My research team was analyzing Cremit’s ICO and found disturbing problems, as can be seen here. These issues are not even the worst part. When my head of research approached the advisors of Cremit, he received the following response to his questions:

Mr. Vladimir Nikitin is considered to be one of ICOBench’s top experts! How can a crypto expert allow himself to join the advisory team of an ICO without doing proper due diligence on the team?When my head of research approached another advisor, this was the response he received:

His team allowed him? He has been added as an advisor to ICO without even researching the ICO and the team himself? Tell me this is some kind of joke!ICO advisors – you have a responsibility to the blockchain and the crypto community.

You can’t keep joining ICO teams just because they pay you to do so! You should be joining teams because you believe that they have potential and you want to see them grow and succeed.

Still, the answers from these alleged top experts were better than what my head of research received when he tried to reach out to the rest of the team, including Cremit’s alleged CTO, marketer, developer, as well as a third ICOBench advisor.

None of these individuals could be bothered to respond. As of publishing, we’ve received no response from any of them. You can see here how multiple attempts to contact their brand manager and one of their developers went unanswered.

What are the ICO rating sites saying?

Now let’s continue to the ICO rating websites out there. While my research team was analyzing the ICO mentioned at the beginning of this blog post, they discovered the following:

ICO rating websites – stop assigning higher ratings to the projects that pay you. Doing so greatly impacts our industry in a negative way. If you can’t put in the effort to properly and professionally review ICOs before rating them, it’s better that you go offline rather than hand out fraudulent ratings.ICOBench continues to disappoint

I wish I could say that falsely inflated ratings were the only problems my team found on ICOBench in the course of their research. They found failures to provide accurate information about ICOs and failures to catch obvious scams. Let’s look at a couple examples.

For Ink Labs Foundation, ICOBench listed the wrong exchanges. As seen in the images above, CVProof’s coin is available on these two exchanges. Our research and discussions with members of the community suggest that this is an issue with ICOBench’s methods of collecting exchange data.

In order to save time, ICOBench uses a bot to crawl the various exchanges to see which ones are offering a coin with the ICO’s symbol. The problem arises when the ICO has chosen a symbol that matches one that is already in existence.

An easy example of this is the ICO BitChord. They chose BCD as the symbol for their token; however, BCD is already in use for Bitcoin Diamond, which would lead a bot to believe that any token offering Bitcoin Diamond is actually offering BitChord.

While this is a good reminder for ICOs to make sure that they’re choosing a unique identifier for their token, it also highlights the importance of not over-relying on automation. It’s one thing to have a bot crawl the exchanges to save you the time of manually checking them yourself, but there should still be some human oversight.

Before this information is added to an ICO listing, it should be checked and confirmed to avoid such mistakes. I would suggest taking an extra step in cases like BitChord/Bitcoin Diamond, such as making notes of tokens with identical or similar symbols; in this way, we will be able to avoid investor confusion.

More concerning than this issue, however, is the instance of Veio, where ICOBench failed to spot an obvious scam.Some scams are difficult to see coming. Some broadside experts who should know better. Some, like Veio, think they can fleece investors by creating a team populated entirely by stock photos.

It’s ridiculously easy to investigate this; just do a Google image search and you can trace an ICO team member’s photo back to its source. This isn’t the only example of scams making use of stock photos or other people’s social media profile pictures to create a team out of thin air.

We’re not sure how much longer ICOs will try to use this easy-to-spot method, but in the meantime, there’s no excuse for rating sites not to do this quick and easy research into the identities of the projects they’re rating.While ICOBench did eventually catch on to the fact that Veio was a scam, for a time this ICO was listed on their site with a 3.5 rating.

ICO ratings should never be done for payment. ICO rating websites need take extreme measurements to avoid corruption. Don’t get me wrong – I am not against profiting financially, but there are red lines that should never be crossed. Paying for advertisement, including premium listings, is fine and is a common practice.

To build brand awareness and exposure you need to pay for your marketing efforts. However, paying for ratings is completely different and doing so is misleading ICO investors, especially the inexperienced ones. The crypto industry has enough problems with world governments and banks, we don’t need to add to these issues by perpetuating the reputation that the industry is filled with scams and fraud.

We need to do everything we can to protect ICO investors so that the industry will continue to grow and continue to change our lives for the better.The community has had enough!

I’m not the only whistleblower! A quick tour of the crypto experts on LinkedIn will turn up many others directly calling out ICOBench, fraudulent raters, and the pay-to-play mentality rearing its ugly head in the crypto community.

Hosam Mazawi called this issue out back in April, pointing out a couple of blatant examples of ICOBench advisors giving a scam a good rating, only to hastily revise their ratings when other, more vigilant sites spotted the truth.I enjoyed Hosam’s article so much that I reached out to him for his opinion about Cremit. He provided this insightful quote:It doesn’t make sense to see ICO’s rated 4.9/5 or 9/10, when you compare them to ethereum ICO.Let’s assume that ethereum is 10/10, now compare every other single ICO to ethereum as benchmark, what rating would you give Cremit ICO with their “top star” ICO bench advisors?

Steven J. Bodnar spells it out clearly. “Web crawling does not equal due diligence.” It takes actual research to provide ratings of any value, and this combination of slap-dash effort and bribery is pulling the entire industry down into the mud.

Bruno Skvorc seems to believe that the writing is on the wall for ICOBench. He doesn’t think that they are going to be able to recover from this damage to their reputation, especially not since so many experts refuse to be associated with them, as seen here:

You’ve got to respect Jen Buakaew. She doesn’t pull any punches about the steamier side of the blockchain industry. She could have just stopped at ICOBench, but her other points have some real merit even if they’re outside of the scope of this blog post.

Other people seem optimistic. Sophia Ha Ho is refusing to take sides, and rightly pointing out that this is an embarrassing situation for all of us to be in. She’s holding out hope for ICOBench to turn things around, which may make her a minority in the crypto community.

In the meantime, those who still believe in the value of ICOBench’s ratings may find themselves ridiculed on social media, as happened to Zhazira Lepess, founder and CEO of ZAZA.

Getting a 4.9 out of 5 rating on a legitimate site would be something worth crowing about, but if you’re proud of your rating on ICOBench, people will be happy to drag you back down to reality. I especially like this pointed comment from Robert Herman:

A “pointless rating meaning nothing”. How much longer until it goes beyond meaning nothing? At this rate, anyone sharing their ICOBench rating may risk facing suspicion that they paid to get it.The fact that you can pay for a better ICOBench rating is an open secret, to the point where it’s no longer shocking when you hear about it.

Well, Markus Hartmann, co-founder of Alethena, might have some insight to share about that. You see, like me, Markus is concerned about the current state of ICO lists and ICO rating, so he decided to see what would happen if he tried to improve the ranking of his own ICO.There’s a lot of great stuff in Markus’s article, but this really brings it full-circle.

This needs to stop.

This behavior we have seen with ICOBench, Cremit, and others cannot continue. My team, and those who share our convictions, will continue to fight scammers. We will fight the ICO teams who believe they can fool investors and get away with it.

We will call out the corrupt ICO advisors who join projects without conducting their due diligence.We advise all crypto experts and ICO advisors to stop thinking about making a quick buck, and instead consider their own integrity and the future of the crypto community.

The blockchain can accomplish great things, but not if it’s being held back by greed and dishonesty.

Discover more from Cointelligence here: https://www.cointelligence.com/content/ico-rating-expert-corruption/-

Francisco Gimeno - BC Analyst Love this article. The anti scam groups which already exist in the Web for other business sectors have seen also the need to be in the ICO sphere, and this is good news. So, if you are preparing an ICO, make sure you are ready to answer all questions from people. And if you want to invest, make sure you do your own due diligence and see what the antiscam groups say.

-

-

Andrew Gillick, 11 Jul 2018 -Bitcoin, Blockchain, Cryptocurrency, Opinion

An idyllic lakeside town nestled in Switzerland is becoming the unlikely global control centre for blockchain and cryptocurrency. Zug has been dubbed “Crypto Valley” for attracting startups, ICOs and brain power but the country as a whole is carving itself out as the dominant thought and policy leader in the industry.

With its culture of financial secrecy and favour for the ultra-wealthy, should we be asking whether this is such a good thing?

Historically, Switzerland is synonymous with growing the wealth of the rich and hiding it away from the rest of the world to preserve it. Private banking, vaults of gold hidden deep within mountains and personal financial alchemy have become the country’s domain of expertize since the Japanese outdid them at watchmaking with their quartz technology.

Why are the Swiss so interested in crypto?

Since bitcoin was conceived as a way to send pseudo-anonymous transactions it is only natural that the Swiss would be interested in a technology that makes their job of hiding people’s money easier.

Switzerland is the world leader in private banking and home to the world’s largest private wealth manager, UBS, with $2.3 trillion of assets under management for high net-worth individuals — Credit Suisse is the third largest wealth manager behind JPMorgan.

Comparatively, this is over three times the annual GDP of the entire country. Both Swiss bank CEOs and policymakers are alert to the potential disruption crypto assets pose to this business if people really were to use them as a store of value as opposed to gold. These fears are shaping the corporate form of the industry as the Swiss create novel ways of integrating the new technology with its legacy financial sector.

The price of bitcoin against the US dollar BTC/USD in red over gold and US dollar XAU/USD.One of the major benefits of crypto assets over the traditional physical storage of value, like gold, is precisely that it is digital and doesn’t need to be physically stored.

However, an almost parodic industry has been created in Swiss wealth management - computer servers housing cryptocurrency private keys stored in Swiss gold vaults, hidden within alpine mountains.

This month, the company that operates the Swiss stock exchange, SIX, announced its plans to launch a crypto trading platform that will be “the first market infrastructure in the world” to be fully regulated where digital assets can be issued and existing securities can be tokenized. The Swiss seem determined to put an “official stamp” on crypto first.

Home of the World Economic Forum

With a population of just 8 million, Switzerland has a disproportionate representation in the financial world, with the world’s largest banks and the most influential financial think tank, the World Economic Forum (WEF), situated there.

The not-for-profit WEF was created in 1971 by German economist Klaus Schwab who was also a business professor at the University of Geneva at the time.

Its annual conference in the alpine town of Davos has become the Coachella of the financial world where politicians, bankers, CEOs, rock stars and celebrities of all kinds network apparently for the benefit of mankind.

The invite-only event costs in the region of $72,000 for membership and a ticket — and as much as Davos has become the mecca for globalization and neo-liberal economics, it has also become a focus point for protestors who make an annual pilgrimage there to object to its corporate doctrine.

The Swiss school of cryptonomics

In 2016, Schwab the 80-year-old progenitor of the WEF published a book titled The Fourth Industrial Revolution, outlining his thesis of the future economy and the chronology of the previous three — contrary to years of acceptance that there has been just two preceding revolutions.

To propagate Schwab’s Fourth Industrial Revolution thesis, the WEF has established the Centre for the Fourth Industrial Revolution in the US. This month it also opened a centre in Japan and later this year will open centres in India and China.

The centre says it engages with “governments, leading companies, civil society, and experts from around the world to co-design and pilot innovative new approaches to policy and governance in the Fourth Industrial Revolution.

”The centre is “co-designing and piloting policy frameworks and governance protocols across nine areas of focus” - among them AI, machine learning, IoT, drones and blockchain technology.The forum’s board of trustees is a diverse bunch of politicians, business people and royalty, among them former US vice president Al Gore and Alibaba founder Jack Ma.

That global centres of research and policy-making for the future of these emerging technologies are taking place under the banner of one man’s book is almost unheard of — apart from Scientology’s L Ron Hubbard. Would we be receptive of Al Gore’s Centre for Inconvenient Truths that influenced global climate policy?

Conclusion

Many countries are positioning themselves for the impending technology revolution — regardless which iteration — and many of them are smaller nations like Malta, Cayman Islands, Gibraltar and Lichtenstein that want to protect the financial centers that make up a significant part of their economies.

Switzerland is no different in this regard but its expertise in growing and hiding the money of the world’s ultra wealthy and helping them circumventing jurisdiction tax laws is a culture antithetical to the “unbanking the banks” ethic that cryptocurrencies have sprung from.

The WEF, while by no means an official representative of Switzerland, is the pinnacle of neoliberal economic thinking of a class of millionaires and billionaires that pushes for globalization uber alles (even though Trump’s protectionist policy has proven its powerful efficacy).

The massive push of its Fourth Industrial Revolution doctrine espoused by one man is worrying and has the potential to take the financial power of cryptocurrencies away from the people they were created to empower.

See more analysis from Brave New Coin here: https://bravenewcoin.com/news/should-we-trust-the-swiss-with-shaping-global-crypto-policy/-

Francisco Gimeno - BC Analyst Places like Zug, Gibraltar, Malta or other so called blockchain hubs are needed. Some (and those are not few) think that this is also dangerous are TPTB (The Powers That Be) which are controlling the finances now will want to continue doing that through the control of the new 4IR. My take: there will be a fight between those who think they can control a revolution based in decentralisation and democratisation through new technologies, and those who believe the opposite. The fight will determine the time when the new societal paradigm is finally arriving. In all revolutions TPTB have just changed names and ways. But this one is different. This is, I think, the first historical revolution which will not be based on politics or "same collars different dogs", but on people's empowerment, beyond capitalism or socialism, communism or any -ism. And we must be always on guard to defend it.What do you think?

-

-

Zug is a municipality and small town located just outside of Zurich in Switzerland. The tiny region has earned itself a reputation for being known as “Crypto Valley,” due to its establishment of a global hub for virtual currencies. Equally as important, a number of blockchain and DLT (distributed ledger technologies) innovations have also occurred in Switzerland, ranking it as one of the top 10 European countries for starting a blockchain company.