Reports

- by Paula Nita

- 8 posts

-

ABOUT THE AI NOW INSTITUTE

The AI Now Institute at New York University is an interdisciplinary research institute dedicated to understanding the social implications of AI technologies. It is the first university research center focused specifically on AI’s social significance. Founded and led by Kate Crawford and Meredith Whittaker, AI Now is one of the few women-led AI institutes in the world.

AI Now works with a broad coalition of stakeholders, including academic researchers, industry, civil society, policy makers, and affected communities, to identify and address issues raised by the rapid introduction of AI across core social domains.

AI Now produces interdisciplinary research to help ensure that AI systems are accountable to the communities and contexts they are meant to serve, and that they are applied in ways that promote justice and equity. The Institute’s current research agenda focuses on four core areas: bias and inclusion, rights and liberties, labor and automation, and safety and critical infrastructure.

Our most recent publications include:

● Litigating Algorithms, a major report assessing recent court cases focused on government use of algorithms

● Anatomy of an AI System, a large-scale map and longform essay produced in partnership with SHARE Lab, which investigates the human labor, data, and planetary resources required to operate an Amazon Echo

● Algorithmic Impact Assessment (AIA) Report, which helps affected communities and stakeholders assess the use of AI and algorithmic decision-making in public agencies

● Algorithmic Accountability Policy Toolkit, which is geared toward advocates interested in understanding government use of algorithmic systems We also host expert workshops and public events on a wide range of topics.

Our workshop on Immigration, Data, and Automation in the Trump Era, co-hosted with the Brennan Center for Justice and the Center for Privacy and Technology at Georgetown Law, focused on the Trump Administration’s use of data harvesting, predictive analytics, and machine learning to target immigrant communities.

The Data Genesis Working Group convenes experts from across industry and academia to examine the mechanics of dataset provenance and maintenance. Our roundtable on Machine Learning, Inequality and Bias, co-hosted in Berlin with the Robert Bosch Academy, gathered researchers and policymakers from across Europe to address issues of bias, discrimination, and fairness in machine learning and related technologies.

Our annual public symposium convenes leaders from academia, industry, government, and civil society to examine the biggest challenges we face as AI moves into our everyday lives. The AI Now 2018 Symposium addressed the intersection of AI ethics, organizing, and accountability, examining the landmark events of the past year.

Over 1,000 people registered for the event, which was free and open to the public. Recordings of the program are available on our website. More information is available at www.ainowinstitute.org.

Download the full December 2018 Report here: https://ainowinstitute.org/AI_Now_2018_Report.pdf

EXECUTIVE SUMMARY

At the core of the cascading scandals around AI in 2018 are questions of accountability: who is responsible when AI systems harm us? How do we understand these harms, and how do we remedy them? Where are the points of intervention, and what additional research and regulation is needed to ensure those interventions are effective?

Currently there are few answers to these questions, and the frameworks presently governing AI are not capable of ensuring accountability. As the pervasiveness, complexity, and scale of these systems grow, the lack of meaningful accountability and oversight – including basic safeguards of responsibility, liability, and due process – is an increasingly urgent concern.

Building on our 2016 and 2017 reports, the AI Now 2018 Report contends with this central problem and addresses the following key issues:

1. The growing accountability gap in AI, which favors those who create and deploy these technologies at the expense of those most affected

2. The use of AI to maximize and amplify surveillance, especially in conjunction with facial and affect recognition, increasing the potential for centralized control and oppression

3. Increasing government use of automated decision systems that directly impact individuals and communities without established accountability structures

4. Unregulated and unmonitored forms of AI experimentation on human populations

5. The limits of technological solutions to problems of fairness, bias, and discrimination Within each topic, we identify emerging challenges and new research, and provide recommendations regarding AI development, deployment, and regulation.

We offer practical pathways informed by research so that policymakers, the public, and technologists can better understand and mitigate risks. Given that the AI Now Institute’s location and regional expertise is concentrated in the U.S., this report will focus primarily on the U.S. context, which is also where several of the world’s largest AI companies are based.

The AI accountability gap is growing: The technology scandals of 2018 have shown that the gap between those who develop and profit from AI—and those most likely to suffer the consequences of its negative effects—is growing larger, not smaller.

There are several reasons for this, including a lack of government regulation, a highly concentrated AI sector, insufficient governance structures within technology companies, power asymmetries between companies and the people they serve, and a stark cultural divide between the engineering cohort responsible for technical research, and the vastly diverse populations where AI systems are deployed.

These gaps are producing growing concern about bias, discrimination, due process, liability, and overall responsibility for harm. This report emphasizes the urgent need for stronger, sector-specific research and regulation.

AI is amplifying widespread surveillance: The role of AI in widespread surveillance has expanded immensely in the U.S., China, and many other countries worldwide. This is seen in the growing use of sensor networks, social media tracking, facial recognition, and affect recognition. These expansions not only threaten individual privacy, but accelerate the automation of surveillance, and thus its reach and pervasiveness.

This presents new dangers, and magnifies many longstanding concerns. The use of affect recognition, based on debunked pseudoscience, is also on the rise. Affect recognition attempts to read inner emotions by a close analysis of the face and is connected to spurious claims about people’s mood, mental health, level of engagement, and guilt or innocence.

This technology is already being used for discriminatory and unethical purposes, often without people’s knowledge. Facial recognition technology poses its own dangers, reinforcing skewed and potentially discriminatory practices, from criminal justice to education to employment, and presents risks to human rights and civil liberties in multiple countries.

Download the full free report here: https://ainowinstitute.org/AI_Now_2018_Report.pdf-

- 1

Francisco Gimeno - BC Analyst AI technology is growing and expanding, and although we are yet some time from the singularity, it's time for those working with this technology to work with very practical and urgent issues, such as control, fairness in the AI algorithms, accountability, etc. This is not any technology, but a totally disrupting one which can change everything into dystopian societies or into a better world.- 10 1 vote

- Reply

-

-

Blockchain for agriculture and food

A new Wageningen University & Research report documents experiences and findings from the public private partnership (PPP) project ‘Blockchain for Agrifood’ that was started in March 2017. The project aims to contribute to a better understanding of the blockchain technology (BCT) and its implications for agrifood, especially how it can impact specific aspects of supply chains and what is needed to apply BCT in agrifood chains.

A second aim of this project is to conceptualise and develop a proof of concept in an application based on a case concerning table grapes from South Africa where BCT could be applied. This has been done by building a demonstrator that keeps track of different certificates involved in the table grapes supply chain. The code of this demonstrator is published at Github.

Furthermore, the project explored issues regarding the relevance, applicability and implications of BCT for the agrifood sector through literature study and stakeholder consultation.

The project took an agile multi-actor approach i.e. with lean and active stakeholder participation. The main focus was on obtaining hands-on experience with the development of blockchain applications in agrifood and insights into the perspectives of key stakeholders.

Download the full study here.-

By

Admin

Admin - 0 comments

- 3 likes

- Like

- Share

-

By

-

Abstract

The first global blockchain benchmarking study

presents a systematic and comprehensive picture of a rapidly evolving

industry, examining how blockchain and distributed ledger technology

(DLT) are being used in the public sector and enterprise.

The

study analysed non-publicly available data gathered from over 200

central banks, other public sector institutions, DLT start-ups, and

established companies.

Findings from the study include which

protocols central banks and are testing (57% of surveyed central banks

are experimenting with the Ethereum codebase), targeted use cases,

emerging revenue models, timing of deployment, and key challenges.BY:

Garrick Hileman

Judge Business School, University of Cambridge; Centre for Macroeconomics, London School of EconomicsMichel Rauchs

Cambridge Centre for Alternative FinanceDate Written: September 22, 2017Download This Research Paper Here:

https://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID3043513_code2521690.pdf?abstractid=3040224&mirid=1

Source Site:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3040224

-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Josh Nussbaum

CONTRIBUTOR

Joshua Nussbaum is a partner at the New York-based venture

firm, Compound.

Blockchain technology, cryptocurrencies, and token sales are all the rage right now. In the 5+ years I’ve been working in the VC industry, this is by and large the fastest I’ve seen any area of technology take off in terms of new company (or project) formation.

It wasn’t too long ago that founders and VCs were mainly focused on centralized exchanges, enterprise or private blockchain solutions, wallets, amongst several other popular blockchain startup ideas that dominated the market from 2012 to somewhere around 2016.

However, as I wrote about a few months ago, the rise of Ethereum with its Turing-complete scripting language and the ability for developers to include state in each block, has paved the way for smart contract development.

This has led to an influx of teams building decentralized projects seeking to take advantage of the most valuable property of blockchains — the ability to reach a shared truth that everyone agrees on without intermediaries or a centralized authority.

There are many exciting developments coming to market both in terms of improving existing blockchain functionality as well as the consumer’s experience. However, given the rapid pace at which projects are coming to market, I’ve found it to be difficult to keep track of each and every project and where each one fits into the ecosystem.

Furthermore, it’s easy to miss the forest for the trees without a comprehensive view of what the proverbial forest looks like.

As a result, here’s a compiled a list of all of the decentralized blockchain-based projects that I have been following, and was able to dig up through research, along with recommendations from friends in the ecosystem.

A quick disclaimer: While it’s difficult to pigeonhole a number of projects into one category, I did my best to pinpoint the main purpose or value proposition of each project and categorize them as such. There are certainly many projects that fall into the gray area and could fit into multiple categories.

The hardest ones are the “fat protocols” which offer functionality in more than a couple of areas.Below is an overview of each broader category I’ve identified, touching on some of the subcategories that comprise them:Currencies

For the most part, these projects were created with the intention of building a better currency for various use cases and represent either a store of value, medium of exchange, or a unit of account.

While Bitcoin was the first and is the most prominent project in the category, many of the other projects set out to improve upon a certain aspect of Bitcoin’s protocol or tailor it towards a specific use case.

The Privacy subcategory could probably fall into either the Payments or Base Layer Protocols categories, but I decided to break them out separately given how important anonymous, untraceable cryptocurrencies (especially Monero and ZCash) are for users who would like to conceal a transaction because they prefer not to broadcast a certain purchase for one reason or another, or for enterprises who don’t want to reveal trade secrets.

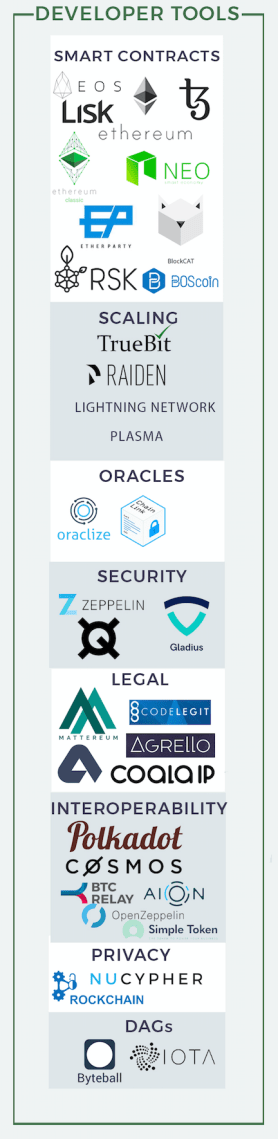

Developer Tools

Projects within this category are primarily used by developers as the building blocks for decentralized applications. In order to allow users to directly interact with protocols through application interfaces (for use cases other than financial ones), many of the current designs that lie here need to be proven out at scale.

Protocol designs around scaling and interoperability are active areas of research that will be important parts of the Web3 development stack.In my opinion, this is one of the more interesting categories at the moment from both an intellectual curiosity and an investment standpoint.

In order for many of the blockchain use cases we’ve been promised to come to fruition such as fully decentralized autonomous organizations or a Facebook alternative where users have control of their own data, foundational, scalable infrastructure needs to grow and mature.

Many of these projects aim at doing just that.Furthermore, these projects aren’t in a “winner take all” area in the same way that say a cryptocurrency might be as a store of value.

For example, building a decentralized data marketplace could require a a number of Developer Tools subcategories such as Ethereum for smart contracts, Truebit for faster computation, NuCypherfor proxy re-encryption, ZeppelinOS for security, and Mattereum for legal contract execution to ensure protection in the case of a dispute.

Because these are protocols and not centralized data silos, they can talk to one another, and this interoperability enables new use cases to emerge through the sharing of data and functionality from multiple protocols in a single application.

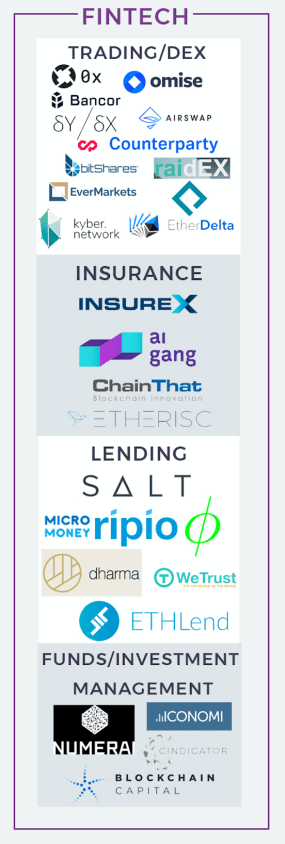

Preethi Kasireddy does a great job of explaining this dynamic here.Fintech

This category is fairly straightforward. When you’re interacting with a number of different protocols and applications (such as in the Developer Tools example above), many may have their own native cryptocurrency, and thus a number of new economies emerge.

In any economy with multiple currencies, there’s a need for tools for exchanging one unit of currency for another, facilitating lending, accepting investment, etc.The Decentralized Exchanges (DEX) subcategory could arguably have been categorized as Developer Tools.

Many projects are already starting to integrate the 0x protocol and I anticipate this trend to continue in the near future. In a world with the potential for an exorbitant number of tokens, widespread adoption of applications using several tokens will only be possible if the complexity of using them is abstracted away — a benefit provided by decentralized exchanges.

Both the Lending and Insurance subcategories benefit from economies of scale through risk aggregation.

By opening up these markets and allowing people to now be priced in larger pools or on a differentiated, individual basis (depending on their risk profile), costs can decrease and therefore consumers should in theory win.

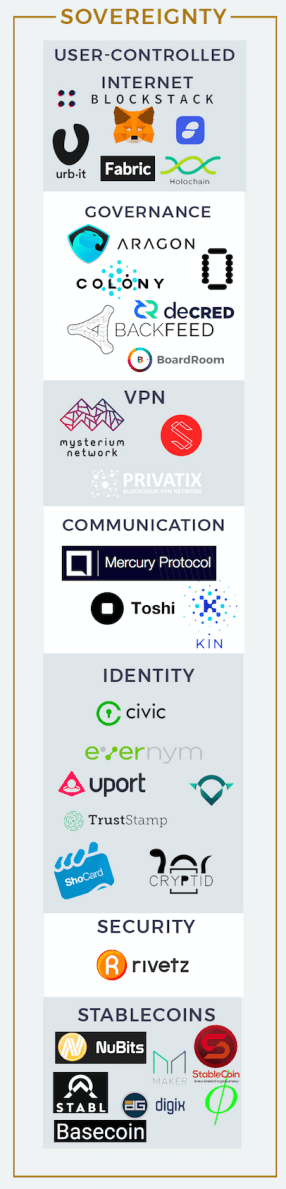

Blockchains are both stateful and immutable so because previous interactions are stored on chain, users can be confident that the data that comprises their individual history hasn’t been tampered with.Sovereignty

As the team at Blockstack describes in their white paper:“Over the last decade, we’ve seen a shift from desktop apps (that run locally) to cloud-based apps that store user data on remote servers. These centralized services are a prime target for hackers and frequently get hacked.

”Sovereignty is another area that I find most interesting at the moment.While blockchains still suffer from scalability and performance issues, the value provided by their trustless architecture can supersede performance issues when dealing with sensitive data; the safekeeping of which we’re forced to rely on third parties for today.

Through cryptoeconomics, users don’t need to trust in any individual or organization but rather in the theory that humans will behave rationally when correctly incentivized.

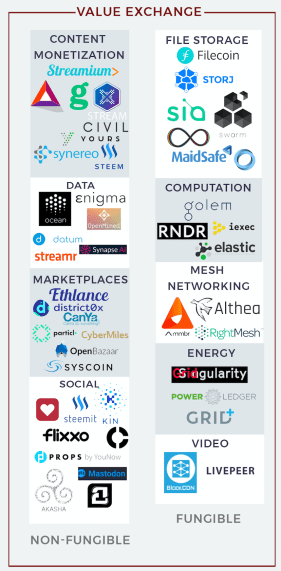

The projects in this category provide the functionality necessary for a world where users aren’t forced to trust in any individual or organization but rather in the incentives implemented through cryptography and economics.Value Exchange

A key design of the Bitcoin protocol is the ability to have trust amongst several different parties, despite there being no relationship or trust between those parties outside of the blockchain.

Transactions can be created and data shared by various parties in an immutable fashion.It’s widely considered fact that people begin to organize into firms when the cost of coordinating production through a market is greater than within a firm individually.

But what if people could organize into this proverbial “firm” without having to trust one another?

Through blockchains and cryptoeconomics, the time and complexity of developing trust is abstracted away, which allows a large number people to collaborate and share in the profits of such collaboration without a hierarchical structure of a traditional firm.

Today, middlemen and rent seekers are a necessary evil in order to keep order, maintain safety, and enforce the rules of P2P marketplaces. But in many areas, these cryptoeconomic systems can replace that trust, and cutting out middlemen and their fees will allow users to exchange goods and services at a significantly lower cost.

The projects in the subcategories can be broken down into two main groups: fungible and non-fungible. Markets that allow users to exchange goods and services that are fungible will commoditize things like storage, computation, internet connectivity, bandwidth, energy, etc.

Companies that sell these products today compete on economies of scale which can only be displaced by better economies of scale.

By opening up latent supply and allowing anyone to join the network (which will become easier through projects like 1Protocol) this no longer becomes a daunting task, once again collapsing margins towards zero.

Non-fungible markets don’t have the same benefits although they still allow providers to earn what their good or service is actually worth rather than what the middlemen thinks it’s worth after they take their cut.Shared Data

One way to think about the shared data layer model is to look at the airline industry’s Global Distribution Systems (GDS’s). GDS’s are a centralized data warehouse where all of the airlines push their inventory data in order to best coordinate all supply information, including routes and pricing.

This allows aggregators like Kayak and other companies in the space to displace traditional travel agents by building a front end on top of these systems that users can transact on.

Typically, markets that have been most attractive for intermediary aggregators are those in which there is a significant barrier to entry in competing directly, but whereby technological advances have created a catalyst for an intermediary to aggregate incumbents, related metadata, and consumer preferences (as was the case with GDS’s).

Through financial incentives provided by blockchain based projects, we’re witnessing the single most impactful technological catalyst which will open up numerous markets, except the value no longer will accrue to the aggregator but rather to the individuals and companies that are providing the data.

In 2015, Hunter Walk wrote that one of the biggest missed opportunities of the last decade was eBay’s failure to open up their reputation system to third parties which would’ve put them at the center of P2P commerce.

I’d even take this a step further and argue that eBay’s single most valuable asset is reputation data which is built up over long periods of time, forcing user lock-in and granting eBay the power to levy high taxes on its users for the peace of mind that they are transacting with good actors.

In shared data blockchain protocols, users can take these types of datasets with them as other applications hook into shared data protocols, reducing barriers to entry; increasing competition and as a result ultimately increasing the pace of innovation.

The other way to think about shared data protocols can be best described using a centralized company, such as Premise Data, as an example. Premise Data deploys network contributors who collect data from 30+ countries on everything from specific food/beverage consumption to materials used in a specific geography.

The company uses machine learning to extract insights and then sells these datasets to a range of customers.

Rather than finding and hiring people to collect these datasets, a project could be started that allows anyone to collect and share this data, annotate the data, and build different models to extract insights from the data.

Contributors could earn tokens which would increase in value as companies use the tokens to purchase the network’s datasets and insights. In theory, the result would be more contributors and higher quality datasets as the market sets the going rate for information and compensates participants accordingly relative to their contribution.

There are many similar possibilities as the “open data platform” has been a popular startup idea for a few years now with several companies finding great success with the model. The challenge I foresee will be in sales and business development.

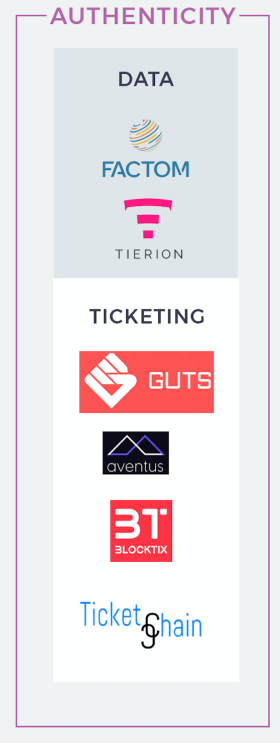

Most of these companies sell their dataset to larger organizations and it will be interesting to see how decentralized projects distribute theirs in the future. There are also opportunities that weren’t previously possible or profitable as a standalone, private organization to pursue, given that the economics don’t work for a private company.Authenticity

Ultimately, cryptocurrencies are just digital assets native to a specific blockchain and projects in this category are using these digital assets to represent either real world goods (like fair tickets) or data.

The immutability of public blockchains allows network participants to be confident in the fact that the data written to them hasn’t been tampered with or changed in any way and that it will be available and accessible far into the future.

Hence why, for sensitive data or markets for goods which have traditionally been rife with fraud, it would make sense to use a blockchain to assure the user of their integrity.Takeaways

While there’s a lot of innovation happening across all of these categories, the projects just getting started that I’m most excited about are enabling the web3 development stack by providing functionality that’s necessary across different use cases, sovereignty through user access control of their data, as well as fungible value exchange.

Given that beyond financial speculation we’ve yet to see mainstream cryptocurrency use cases, infrastructure development and use cases that are vastly superior for users in either cost, privacy, and/or security in extremely delicate areas (such as identity, credit scoring, VPN’s amongst others) seem to be the most likely candidates to capture significant value.

Longer-term, I‘m excited about projects enabling entire ecosystems to benefit from shared data and the bootstrapping of networks (non-fungible value exchange). I’m quite sure there are several other areas that I’m not looking at correctly or haven’t been dreamt up yet!

As always if you’re building something that fits these criterion or have any comments, questions or points of contention, I’d love to hear from you.

Thank you to Jesse Walden, Larry Sukernik, Brendan Bernstein, Kevin Kwok, Mike Dempsey, Julian Moncada, Jake Perlman-Garr, Angela Tran Kingyensand Mike Karnjanaprakorn for all your help on the market map and blog post.

Disclaimer: Compound is an investor in Blockstack and two other projects mentioned in this post which have not yet been announced.

*This article first appeared on Medium and has been republished courtesy of Josh Nussbaum.

To discover more in depth reporting and articles about the blockchain and other technologies from Techcruch, click here: https://techcrunch.com/2017/10/16/mapping-the-blockchain-project-ecosystem/

-

By

Admin

Admin - 0 comments

- 5 likes

- Like

- Share

-

By

-

How can you prepare for tomorrow’s blockchain world? TCS blockchain expert Andreas Freund shares perspective

By

September 14, 2017

Minda Zetlin

Blockchain technology will be as revolutionary as the internet, or maybe even the steam engine, predicts Andreas Freund, Ph.D., a senior manager for Tata Consulting Services' blockchain advisory. It’s a bold claim.

But in the first part of our two-part interview, Freund makes a strong case that blockchain technology will, at the very least, change our marketplaces and our enterprises in ways that are hard to imagine right now. Blockchain protocols (best known for enabling cryptocurrencies such as bitcoin or ether) create a distributed ledger in which many nodes on a network each have a record of every transaction that has taken place.

(See our recent story, Blockchain: 3 big implications for your company.)

“To really understand and appreciate the value blockchain can bring, you need to understand why it’s a paradigm shift,” Freund says. “You need to look at human beings. What defines us is our physical strength, our intelligence, and our trust relationships.

The most fundamental shifts occur when these functions become automated and exponentiated.”[ How can you get started with blockchain? See our related story, Blockchain: 4 ways to experiment. ]Consider intelligence, he says. Computer technology has already done a lot to automate and exponentially increase human intelligence.

Artificial intelligence is set to surpass human intelligence within the next 30 years, according to experts. As for our physical strength, that was automated and exponentially increased back in 1765 with the invention of the steam engine, which Freund says is “the most important event in human history if you look at it.”Rethinking trust and intermediaries

"I can trust the transaction will be executed properly every single time."Why should the invention of blockchain protocols rank with these events? Because it does the same thing to trust relationships, Freund says.

“What automates trust is decentralized consensus that’s economically incentivized,” he notes. “It’s the combination of game theory and cryptography. When we’re interacting through the blockchain, not only as human beings but as things as well, I can trust the transaction will be executed properly every single time.

There’s no chance of tampering or censorship. From a human perspective, I can now trust you without trusting you.”Right now, people who want to transact with strangers must use a trusted intermediary, as people do when they buy and sell items on the Amazon Marketplace, or buy and sell shares on an exchange, or, say, summon an Uber ride.

In the 1990s, anthropologist Robin Dunbar suggested that each of us can maintain stable relationships with only about 150 other people. “We need to delegate trust to others every single time we gather in groups larger than the Dunbar limit,” Freund says. “That’s why pyramidal hierarchies emerge. That’s why governments emerge.”Does Freund think blockchain technology will replace governments?

He doesn’t go that far, but he does believe it could render some long-standing institutions less necessary than they are today. “When you no longer need these arbiters of trust, we can get together and form a decentralized organization,” he says. “We don’t even need to incorporate as a company.

We can simply offer a service and people will pay us.”You can see how this approach might permeate every transaction we make, he adds. “I don’t need a bank account then. The responsibility of the individual will increase, and people want that.”Accordingly, the finance and insurance industries have become early experimenters with blockchain.

How are they using it? See this related blog post: The future of blockchain — how can financial institutions embrace it and win?How enterprises can prepare

How can today’s enterprises prepare for tomorrow’s blockchain world? “There are new revenue opportunities that go beyond blockchain’s ability to reduce risk,” Freund says. On the other hand, “There is a significant danger of disruption, particularly for companies that function primarily as trust intermediaries.

”As blockchain becomes mainstream, he adds, “You need to have a mindset shift. That control that you need because you can’t trust anyone else – that needs to be let go. You’re trusting the protocol instead. That’s one of the key things we teach when we introduce corporations to blockchain.”

It’s more important to understand how blockchain will change many common practices than it is to understand the precise technology behind it, Freund notes. “In the end, how the technology works doesn’t matter,” he says.

“TCP/IP enables the internet, although nobody really knows how it works. Without it, we’d still have the walled gardens of the AOL era.” When it comes to blockchain, he says, “We are still in the AOL era.

We have these walled gardens, with many companies experimenting and many public blockchains, but eventually there will be something equivalent to that moment when TCP/IP broke down those walls.”Back then, most established businesses were caught unprepared...continue reading:

https://enterprisersproject.com/article/2017/9/blockchain-predictions-what-it-means-you-

Francisco Gimeno - BC Analyst Reading this article after all the doom and gloom from the orchestrated anti-bitcoin news this week has refreshed my mind. Loved it!

-

-

The World's First Research Center on the Social Science of Blockchain Opens... (cryptocoinsnews.com)The Royal Melbourne Institute of Technology (RMIT) has established the RMIT Blockchain Innovation Hub to explore the social science of blockchain technology.

In an announcement today, RMIT unveiled details of the research center focused on blockchain technology, an innovation that the university believes will become “a core infrastructure for the global economy.”

The hub is being proclaimed as the world’s first research center aimed at exploring the social science of blockchain technology.The research center will be led by Professor Jason Potts from RMIT’s School of Economics, Finance, and Marketing. Professor Ian Palmer, pro-vice chancellor business and vice-president at the university stated:The RMIT Blockchain Innovation Hub is the only full-service, research, learning and industry-linked blockchain body in the world.

Blockchain, the underlying tech that powers cryptocurrencies like bitcoin, will ‘revolutionize businesses as we know it in the coming years” with smart contracts and instant payments globally, the university added.

The new hub will establish a global interdisciplinary research team looking into the economic, cultural and societal implications of blockchain technology. Notably, it will also partner with companies in multiple industries to share research to ensure that students are work-ready upon graduation.

The hub will also develop and implement policies to facilitate the future blockchain economy and will also engage with policymakers and government to discuss and debate the social and policy impact of the decentralized technology.

The new blockchain-specific research hub opens within months of the University of Sydney (USYD) developing its ‘Red Belly Blockchain’ with the striking claim of processing 400,000 transactions per second, over 7x that of the world’s biggest payments network – Visa.Blockchain Hub

Australia is quickly becoming a hotbed for financial technologies (FinTech) with markedly rampant development in blockchain tech in both private and public sectors as well as a number of industries.

The Australian Securities Exchange (ASX), the country’s biggest stock exchange, is among the world’s first securities markets operators to embrace blockchain technology in a move that could completely replace its existing post-trade process. The ASX is currently completing a trial of a blockchain developed by New York-based Digital Asset.

Earlier this year, the Commonwealth Bank of Australia (CBA), one of the country’s biggest banks, announced the issuance of a blockchain-powered ‘cryptobond’ for the Queensland Treasury Corporation, touted as the world’s first blockchain bond issuance by a government entity.

In August, two pro-bitcoin Australian senators who called on the central bank to legalize cryptocurrencies established...continue reading: https://www.cryptocoinsnews.com/aussie-university-establishes-worlds-first-research-center-social-sc...-

By

Admin

Admin - 0 comments

- 3 likes

- Like

- Share

-

By

-

The first marketplaces date back to the mid-1500s. Brokers, moneylenders, and citizens would go to a specific physical location — often a city square or centrally known area — to buy or sell goods and deal with business, government, and individual debt issues.

Over time, exchanges evolved into a concept similar to what we know today. One of the first futures and options exchanges began in Chicago in 1884. The traders stood on the octogon-shaped floor and made trades in the pits by negotiating buys and sells.

The bids were placed in local currency (U.S. Dollars), and while the trading was peer-to-peer, the clearing of the trade was handled by the exchange.Eventually, advances in computing made it possible for orders to be stored in a single source of “truth,” famously named an “order book.

” An order book is a list of the bids and offers in a given asset, organized and matched according to a specific algorithm. Currently, order books are both physically and logically centralized. They are physically centralized because they run on a single server, and they are logically centralized because all messages are processed synchronously.

Today, assets trade through centralized exchanges with trusted centralized parties conducting the transactions. The exchange must be in a physical location and jurisdiction, and both parties in the transaction must be in the local jurisdiction — foreign parties are not allowed to buy or sell.

Orders are handled first-in-first-out, and every participant in the market is subject to the same algorithm treatment with respect to order execution.Lawyers, bankers, brokers, clearinghouses, and governments are all part of the trading equation. But do they need to be?Removing Middlemen

A new paradigm of transaction execution called blockchain could eliminate the need for all of these middlemen.In a blockchain, transactions are verified by distributed nodes, and anyone can join or leave the network as they please without disrupting the network’s ability to form consensus on transactions.

Instead of using a single computer to manage transactions, like we do now, we could leverage a global computer.

Bitcoin was the first example of a blockchain being used to communicate value globally, with trust and without middlemen, and Ethereum extends the power of the blockchain.

The Ethereum platform runs smart contracts, applications that run exactly as programmed without any possibility of downtime, censorship, fraud, or third-party interference. It allows for decentralization to take hold in a much more meaningful way, as Ethereum users can exchange anything atomically and, most importantly, with trust.

Ethereum tokens are an implementation of a smart contract. They are accessible globally, and a token’s market can flourish without a middleman. Already, they have dramatically changed how software projects are funded by replacing the traditional venture capital/angel investor model.

Instead of individuals having to go through these investors to get their projects funded, they can sell tokens directly to the public. With a simple text string and the click of two buttons, users can participate in these new business models from anywhere in the world.

People have the opportunity to invest in the protocol and not the company directly, and this new way to create and finance business models has been a runaway success.Decentralized Exchanges

In addition to removing the need for middlemen, blockchain technology enables us to build decentralized exchanges.Decentralized exchanges are global, borderless, frictionless, private, and secure.

They allow users to exchange assets without the interference of a central party or jurisdiction. This is significant because central parties and localization impose a major financial burden on the current system.

With blockchain technology, an exchange mechanism can be codified into the blockchain directly. This new kind of “order book” does not need to be physically centralized because the servers forming consensus are distributed, and no single server has definitive power over the other servers.

Exchanges do not need to be logically centralized since the code is open-source and free for anyone to audit.

Decentralized exchanges can communicate across borders. They’re not located in one specific location like Hong Kong or New York because they live on the global network, the blockchain. For example, users in Kuala Lumpur can trade directly with users in Berlin or Chicago, while their assets remain local and free of unnecessary intermediaries.The Future of Trading

By allowing value to be communicated globally and without middlemen, decentralized exchanges will have the same disruptive power that tokens have had over VCs. Instead of a trader going through a centralized exchange to reach another trader, they can trade directly with one another through a decentralized exchange.

The traders can be located anywhere and can trade with anyone in the world, without any intermediaries involved. A globally accessible exchange, without intermediaries, provides new access and liquidity to assets.

The global, frictionless nature of these new blockchain-based exchange models will propel them to succeed at the same scale that tokens have succeeded.

The current exchange system is antiquated and...

continue reading: https://futurism.com/blockchain-will-eliminate-middlemen-and-usher-in-a-new-paradigm/-

Francisco Gimeno - BC Analyst This is a very enthusiastic opinion about how future would be on the new paradigm. No third parties wherever two parties agree to exchange though block chain protocols. Although up to that moment when the shifting happens and the new paradigm is there I suppose all these mediators, banks and strong lobbies will try their best to block with archaic regulations and delays their demise.

-

-

Download this Free 114 Page Research Report by Cambridge University further below.

The world of money and finance is transforming before our eyes. Digitised assets and innovative financial channels, instruments and systems are creating new paradigms for financial transaction and forging alternative conduits of capital.

The Cambridge Centre for Alternative Finance, since its founding in 2015, has been at the forefront of documenting, analysing and indeed critically challenging that digital financial transformation. This Global Cryptocurrency Benchmarking Study is our inaugural research focused onalternative payment systems and digital assets.

Led by Dr Garrick Hilleman, it is the first study of its kind to holistically examine the burgeoning global cryptocurrency industry and its keyconstituents, which include exchanges, wallets, payments and mining.The findings are both striking and thought-provoking. First, the user adoption of various cryptocurrencies has really taken of, with billions in market cap and millions of wallets estimated to have been ‘active’ in 2016.

Second, the cryptocurrency industry is both globalised and localised, with borderless exchange operations, as well as geographicallyclustered mining activities.

Third, the industry is becoming more fluid, as the lines between exchanges and wallets are increasingly ‘blurred’ and a multitude of cryptocurrencies, not just bitcoin, are now supported by a growing ecosystem, fulfilling an array of functions.

Fourth, issues of security and regulatory compliance are likely to remain prevalent for years to come. I hope this study will provide value to academics, practitioners, policymakers and regulatorsalike.

We thank Visa very much for its generous support of independent academic research in this important area.

Bryan Zhang

Co-founder and Executive Director (Interim)Blockchain has received a significant amount of analyst and press attention over the last few years as this emerging technology holds significant potential.

Use cases are many and varied:

ranging from programmable cryptocurrencies to property deeds management to provenance tracking to voting records.

Cryptocurrencies were the first application of this technology, and in doing so introduced an entirely new set of businesses, jobs and vocabulary to the world of payments. Visa has been exploring the impact of these technologies to determine how this new ecosystem will continue to grow and evolve.

Amongst all the excitement and enthusiasm in the press there has also been some hyperbole, and any efforts to provide a realistic snapshot of the industry should be welcomed.

Visa welcomes opportunity to sponsor research from a respected organisation, the Judge Business School at Cambridge University, which we trust, the reader will find objective, informative and insightful.

Jonathan Vaux

VP, Innovation & Strategic Partnerships

Download the Free 114 Page Research Report Here:

https://www.jbs.cam.ac.uk/fileadmin/user_upload/research/centres/alternative-finance/downloads/2017-...

-

By

Admin

Admin - 0 comments

- 0 likes

- Like

- Share

-

By