Guides&Training

- by Paula Nita

- 6 posts

-

Bitcoin SEO is still a developing field, however, if you start by working with a firm with strong roots in SEO, there is a very good chance they will figure out how to adapt their strategies to meet the needs of this innovative technology

Even while the mainstream continues to play catchup, the blockchain revolution is well underway, and it is changing the game for business, data science, computer science, global finance, and more.

That’s a big claim, and many people who are just hearing about blockchain for the first time have a hard time verifying it. Even as Bitcoin and the altcoins top themselves price-wise week after week, and new ICOs introduce exciting new technologies, it’s possible to keep oneself abreast of all of these changes.

Using Bitcoin savvy finance blogs to understand what’s going on in the “cryptosphere” will give you a leg up on the competition, so that you can anticipate the way our world is changing with regard to technology, communication, and money. Here are some of the best ways to keep up to date with the blockchain revolution.

Follow the Blogs. Many of the best finance blogs cover blockchain issues. Blockchain is a way to validate transaction data by making records of these transactions public, and available in thousands of sources around the world.Using complex mathematical formulae, each transaction is validated and placed on these immutable ledgers.

Because they are public, any discrepancies can be checked against each other and the fraudulent record exposed.Blockchain bloggers note that in this way, the blockchain ledger system is taking a job away from banks, who up till this point had to validate our financial transactions in their secret ledgers.

Invest. One of the best ways to understand blockchain is to learn about the best projects and invest in their coins. Blockchain isn’t just for logging transactions. There are many other ways to store information on the blockchain.

New coins are introduced into the blockchain ecosystem every day, each one offering a new way to use blockchain storage to solve real world problems. For example, Metaverse ETP is a Chinese cryptocurrency that is storing real world assets on the blockchain. Valuable items like houses or priceless antiques are being “digitized”.

An immutable digital token is paired with the real world asset, and must be transferred anytime the asset it bought or sold. Therefore, even if a real world painting was stolen, the thief would have a hard time selling it if they did not also have the digital token. The same technology is being used to store unhackable records of Metaverse users, including name, SSN, passport, passwords, etc.

Metaverse is an example of a coin that has had 300%+ growth in the past couple of months. Crypto investing isn’t set it and forget it Betterment investing, but it is potentially more profitable.

Use the Technology. Possibly the best way to learn about the blockchain revolution in real time is to use the technologies that are being introduced. Ethereum, the world’s second biggest cryptocurrency after Bitcoin, just entered its third stage of development.

Now “smart contracts” are going to start to become common. Smart contracts are algorithms that are stored on the blockchain. They’re kind of like websites or platforms like Facebook or Reddit. They can be anything.

The only difference is that once stored, the algorithms operate by themselves, without human intervention.

This way, it will be possible to create decentralized applications without CEOs, staffs, or immense server farms.These smart contracts are already available in certain financial applications. Try them out for yourself.

As you can see, there’s a lot going on in the blockchain space, but that doesn’t mean that you should wait by the sidelines for it to develop more.Get in now and learn about these burgeoning technologies. Not only will this get you ahead of the curve mentally, you could profit from it in your investment life.

Learn even more from Information Age here: http://www.information-age.com/mobile-banking-innovation-spurs-rapid-growth-123470079/

-

By

Admin

Admin - 0 comments

- 2 likes

- Like

- Share

-

By

-

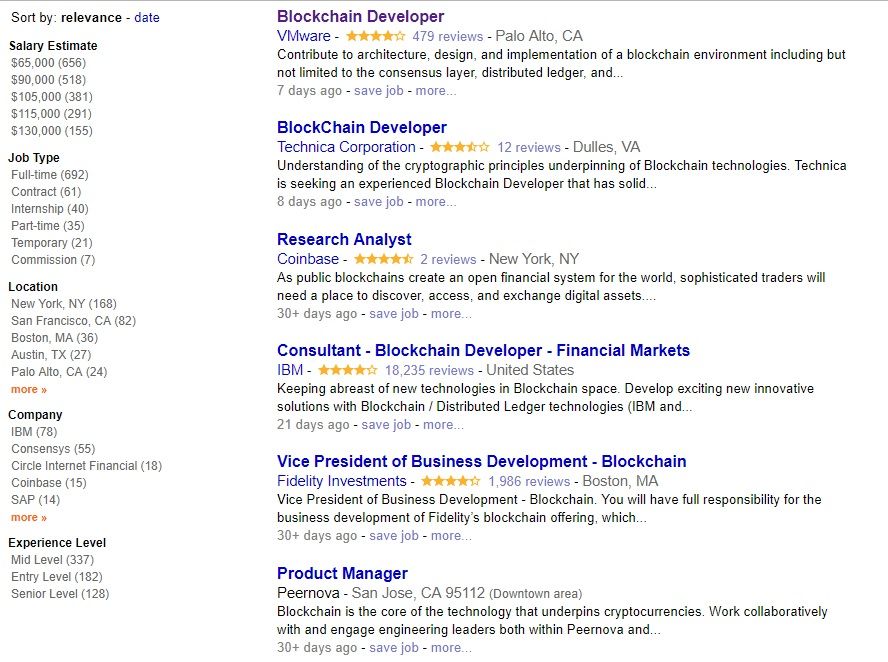

Bitcoin and Blockchain-related jobs are becoming increasingly popular today. That’s why the issue of a relevant education is becoming a topic of interest as well.

No one would argue that bitcoin and blockchain are becoming more and more widespread today.

There are new solutions, new fields and new inventions applying the technology, and thereby, creating the need for professional developers, market specialists and many others. As the industry is quite young, there has been a lack of experienced and educated specialists in the field, as it was simply impossible to obtain the relevant education anywhere.

The leading cryptocurrency and blockchain professionals known to us at present are self-educated, driven by passion and enthusiasm for their work.Education is not a Problem, but What is it Needed For?

Over the course of time, leading education establishments of the world have realised the need for blockchain and cryptocurrency related courses, so now it is not so difficult to obtain an education and become a real professional in the sphere.

For example, you may study at Princeton University, Duke University,Stanford University,Berkley, The University of Cumbria, IT University of Copenhagen, B9lab Academy etc. This list is far from exhaustive.

There is even the Blockchain Academy - a specialized education establishment based in Cape Town providing both full-time and online education on blockchain technology. As we may see, there is no problem in obtaining an education at a credible university, which would make you a credible specialist at once, but what is the use of such education.

For it is not enough to get a certificate, you would need to get a job to earn your living.

Fortunately, job offers are plenty to provide enough choice. A fresh blockchain specialist may get a job at Blockchain startups and consortiums, large tech firms, banks and other private sector firms, professional services firms or even the government. They seek blockchain developers, research analysts, consultants, product managers and many other specialists.

The salaries vary considerably. In the UK, a blockchain specialist may earn £40-60k. Large companies are willing to pay £100,000 - £150,000 to the experienced professional. In Russia, an expertise in cryptocurrency or blockchain may raise your wages by 25% from the average rate.

A Recipe from Ian Balina

The education opportunities are plenty. However, one may become a blockchain or cryptocurrency specialist without a university. All you need is the desire to learn. Ian Balina, a cryptocurrency investor, serial entrepreneur, author, and filmmaker, has his own recipe of how to become an expert, which he shared at Quora:- Read up on Bitcoin and Blockchain Wikipedia articles

- Read a book on Bitcoin and Blockchain; I highly recommend “Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money” by Nathaniel Popper

- Invest in Bitcoin and altcoins and actively follow them

- Every month, attend at least one local meetup or event on Bitcoin and Blockchain in your area and network with the community

- Join a Bitcoin/Blockchain related project

a. If you’re looking to become a technical expert, then definitely look at the open source code and become a contributor

b. If you’re looking to be a non-technical expert, become a writer or blogger on Bitcoin and Blockchain related topics - Attend large annual Bitcoin and Blockchain conferences

- Repeat steps 3 through 6 for at least two years, and then you will be credible enough to be a Bitcoin and Blockchain expert.

- Once an expert, you could do the following:

a. Start your own Bitcoin or Blockchain related startup

b. Start a consulting or software company on Bitcoin or Blockchain

c. Write a book on Bitcoin or Blockchain

It is up to you to choose your way of becoming a blockchain or cryptocurrency expert, for no one will argue the industry brings many opportunities and prospects.

However, no education will help you gain true expertise if you have no passion and enthusiasm for what you do.

How did you become a bitcoin and blockchain expert? Feel free to share your personal story of success in the comments below!

Have you benefitted from reading this article? Then discover even more on Coinidol here to keep up: https://coinidol.com/become-blockchain-specialist-and-where-profession-required/

-

Francisco Gimeno - BC Analyst The recipe stated in the article forgot Blockchaincompany.info! This platform is awesome for those who want to be experts on Blockchain and Crypto. The author is right somehow that by now any person who is interested and move along some parameters is automatically a Blockchain expert as becomes a "believer" who can explain at least the non technical side of Blockchain and can lead a discussion on the importance and impact of Blockchain. On a personal side, I am already using this recipe, at least most of the points. On my way.... What about you?

-

Mining cryptocurrency can be a lucrative endeavor with enough computing power

Mining cryptocurrency is in the news a lot lately. People are finding their computers have been compromised by malware and are mining, or in some cases entire botnets are mining. But what does that mean?

This isn’t mining in the traditional sense. There are no pick axes or canaries involved. Instead. it’s more about trying to win a blockchain lottery to earn the reward at the end.

What does that all mean? Let’s hash it out.

What is cryptocurrency?

To begin a discussion of mining cryptocurrency we need to start with what cryptocurrency is. Cryptocurrency is a digital form of currency with a cryptographic underpinning that is used as a secure medium of exchange. There are literally hundreds of different cryptocurrencies with varying real-world values. Many believe it’s the future of currency.

The most popular cryptocurrency is bitcoin, you may have heard of others like Etherium, too. While cryptocurrencies may differ in terms of the algorithms and encryption they use, they all share one similiarity: blockchain. And that’s what we need to talk about next.

What is blockchain?

Blockchain is a digital ledger of transactions that is impossible to alter. It uses hashing and a concept similar to salting to continuously complete blocks of information that chain to form an immutable ledger.

Hashing is the act of mapping data of any length to a fixed-length output. When cryptography is involved it’s a one-way function. The most popular hashing algorithm is SHA-256, which outputs at a length of 256 bits. Every hash value is unique. Even the tiniest alteration to the data being hashed caused the entire value to change.

Hashing is considered one-way because of the amount of computing power it would take to reverse-hash it. For a 256-bit output, calculate 2 to the power of 256 (2 X 2 X 2… 256 times). Your odds of finding the correct value are 1 in… the product of that equation. Those are astronomical odds. It would take a supercomputer thousands of years to compute that.

Blockchain + Cryptocurrency

Now let’s fit it all together. With a cryptocurrency blockchain, as transactions occur they are broadcast and added to various private ledgers. Each one of these transactions is digitally signed for the sake of authenticity. On the other end, there are people or groups collecting these transactions and building ledgers.

They are also computing to find a value that when hashed along with the ledger, produces a set number of 0s at the beginning of the hash value. That’s the portion that’s similar to salting.

So let’s say that for our example cryptocurrency, we’ve set the total to 10 0s. That means the first 10 spots of the 256-character hash value should all be 0s.

When the correct value is found, the block is closed, it’s broadcast officially and added to everyone’s blockchain, then the hash of the old block is put atop the new ledger and the process begins again. This is how blocks are created in the chain.

So, what is mining cryptocurrency?

The act of computing the correct value to satisfy the hash function in blockchain is called mining. When it comes to cryptocurrency, a reward is provided to whoever solves for the correct value. That makes it lucrative to compute the correct value, though it takes quite a bit of power to accomplish that.

Oftentimes people pool their computing power together and split the reward if they solve for the correct value. In other cases, hackers have been known to co-opt others’ computers and use some of their computing power – behind the scenes – to mine cryptocurrency. There are entire botnets doing nothing but mining.

Really, solving for the correct value is like winning the lotto. There are countless people and botnets attempting to find the value and whoever finds it first gets the reward.

Of course, if you can accumulate enough computing power you could solve for the value enough of the time that you could accrue a substantial amount of cryptocurrency.

Wrapping Up

When someone says “mining cryptocurrency” what they’re referring to is the act of trying to compute a specific hash value by producing a set value that, when hashed along with the block ledger, produces a specific result. This requires considerable computing power, but considering the rewards – it’s well worth it.

What we Hashed Out (for Skimmers)

Here’s what we covered in today’s discussion:

Blockchain is an immutable ledger of digital transactions

Cryptocurrency is a digital currency that is a secure medium of exchange

Mining cryptocurrency is computing a specific value that produces a specific hash result and completes a block on the blockchain

This article is provided by The SSLstore. Discover more here: https://www.thesslstore.com/blog/what-is-mining-cryptocurrency/

-

Francisco Gimeno - BC Analyst Good explanation about what is mining. This is the explanation a would be miner need before starting looking for crypto mining hardware and software.

-

-

Recommended Academic Tutorial: Bitcoin, blockchain and ICOs: Confused? We explai... (journalistsresource.org)By David Trilling

Bitcoin is no longer just for geeks in obscure corners of the internet. Today you can use the digital currency to fly to Britain, buy an apartment and enroll in the London Sushi Workshop. Fans like its libertarian footing, how it dodges government control and how – especially in this privacy-challenged era – it boosts anonymity.

But some detractors blast bitcoin and other cryptocurrencies as a “fraud,” while others argue that they fuel cybercrime.Unlike the American dollar or British pound – which are guaranteed by central banks that set interest ratesand print currency, stabilizing their value – bitcoin is decentralized.

No one controls it. In part for that reason, its value has yo-yoed wildly.

After more than quadrupling against the dollar between January and August 2017, bitcoin fell by a third in the first two weeks of September. Some blamed a crackdown on digital currencies in China and the “fraud” comments from J.P. Morgan Chase CEO Jamie Dimon, who comparedbitcoin to the Dutch tulip bubble of the 17th century.

Yet as Fortune magazine noted, bitcoin meltdowns have been a regular feature of its brief lifetime.This volatility makes it unlikely bitcoin (or another cryptocurrency, such as ethereum) will become an effective store of value (like gold) or a unit of account (like the dollar) anytime soon. You wouldn’t want to be paid in bitcoin, since your real (i.e., dollar-denominated) salary would fluctuate all over the place.

And you wouldn’t want to spend bitcoin today if you think it’d be worth a lot more tomorrow.In this explainer, we discuss what makes bitcoin different from the old-fashioned greenback and why some governments are trying to ban it. We describe how the blockchain technology behind the system could revolutionize many other industries.

And we look at how a bitcoin outgrowth known as initial coin offerings (ICOs) is testing regulators.How bitcoin worksAny bitcoin transaction – let’s say between a buyer (me) and a seller (the London Sushi Workshop) – creates a unique digital code that is stored in an online, open ledger known as a blockchain.

Everyone has access to the blockchain, but no one can see who those buyers and sellers are unless they wish to be identified. Each has a unique, pseudonymous address for the transaction.

The London Sushi Workshop’s balance, which has grown because I paid my tuition, is a series of codes, also known as personal keys. The sushi school can keep them in “cold storage” – offline on something like a USB stick – or print them out. Or the school can keep them in something called a “wallet,” which is run by an online third party and, just like your physical wallet, can be stolen (or in this case hacked).

When the London Sushi Workshop wants to convert bitcoins to dollars or pounds, it can make the transaction through an online exchange (also third parties, which have likewise been hacked, resulting in losses for individuals) and transfer the cash to a bank account.This decentralization puts bitcoin beyond the reach of regulators, but also creates risks.

Third parties in the “wallet” or “exchange” businesses do not offer the kind of insurance you get at a bank. And, like with cash, if you print your bitcoin codes and stash them under your bed, you run the risk of losing all in a fire or robbery.

Blockchain and miningAn anonymous programmer calling himself Satoshi Nakamoto introduced bitcoin in a 2008 paper. The widely cited paper may be best remembered for something else, though: Nakamoto also introduced the first working blockchain, the technology underpinning bitcoin.

Blockchain is an online ledger of all transactions that’s available for anyone to view and copy, but that no one individual controls. Instead, it lives on many computers, where it is constantly updating itself. This decentralization and openness ensure a transaction can’t be faked – because that transaction wouldn’t appear on all the other copies of the ledger.

If one copy of the ledger does not match the rest, that copy will stand out. Thus blockchain is sometimes called a “distributed ledger” or “distributed ledger technology” (including by J.P. Morgan Chase, which is researching how to use it).For the bitcoin blockchain, powerful computer networks called “miners” validate the most recent transfers, ensuring someone doesn’t send money they don’t have.

These miners’ computers compete with one another to verify and then lock the transfers onto the ledger, where they never can be changed, adding a new block of confirmed transactions about every 10 minutes.

As an incentive for constantly checking and verifying bitcoin transactions, the miner that succeeds in creating a new block is rewarded in new bitcoins that he has created. These days, the reward is 12.5 bitcoins and there are about 16.5 million bitcoins in circulation (worth, as of this writing, about $65 billion in U.S. dollars). By design, the reward drops by half about every four years until, sometime a few decades from now, the miners have created 21 million bitcoins.

The creator artificially capped bitcoin at that number, ensuring the currency cannot be debased by oversupply; the coins can, of course, be divided into smaller and smaller units.Because the database is distributed across such a broad network, hacking it would require enormous computing power. Any would-be fraudsters with that much computing muscle would find it more profitable to mine the blockchain and create new bitcoins.

The blockchain solves the “double-spending problem” that plagued earlier cryptocurrencies, whereby someone could spend the same money in two places (or counterfeit it). Today, sending the same bitcoins to two different sellers would create a “fork” in the blockchain, immediately rendering one of the transactions invalid.

Likewise, it’s not possible to alter a transaction record. To go back and change a link in the chain, you’d have to change all the links that follow. That would require more computer power than all the computers that are managing the blockchain put together. The altered chain wouldn’t match; it would be a clear counterfeit.

These days, miners often work with specialized computer farms that use loads of electricity; sometimes they share resources to form “mining pools.” You could run a mining application in the background of your work computer, but it likely wouldn’t net you anything besides a slower computer.

(Check out this Quartz feature on a farm using subsidized, coal-powered electricity in China, which is home to 58 percent of the world’s major mining pools, according to a University of Cambridge study; the U.S., the second-largest host, has 16 percent.)

The promise of blockchain

Some researchers see blockchain as having revolutionary applications beyond bitcoin, such as trading stocks, safely storing data and managing supply chains, all without a middleman. It is a “foundational” technology, argues a 2017 paper by two Harvard Business School professors, with the potential – perhaps in decades – to render accountants, traders and even contract lawyers superfluous.

Blockchain “has the potential to become the system of record for all transactions. If that happens, the economy will once again undergo a radical shift, as new, blockchain-based sources of influence and control emerge.”Initial coin offeringsA new trend in cryptocurrencies is the “initial coin offering,” or ICO.

ICOs raised $2.2 billion in the first nine months of 2017, according to one industry estimate. These are not bitcoins, but essentially a new digital currency used to fund a specific product.ICOs work like this: A company raises capital by selling virtual coins or tokens. Perhaps these coins could be used later to participate in the project, or they offer some other future reward.

But they do not offer the same rights demanded by a venture capitalist or shareholder. Indeed, though they sound suspiciously similar, an ICO is not an IPO – initial public offering (which is when a company begins selling shares to the public and becomes listed somewhere like the New York Stock Exchange).

Rather, an ICO happens well outside the regulated banking industry.The Securities and Exchange Commission (SEC) – the regulator of U.S. financial assets – has warned investors that some ICOs may constitute fraud, and that some coins may in fact function like securities and need to be regulated as such.

Canada’s securities regulator has issued a similar statement.Government responseGovernments don’t like bitcoin much. Its anonymity allows users to operate in the shadows, sell narcotics, capitalize on ransomware (software that hijacks a computer until the owner pays a ransom in a cryptocurrency) and maybe, some fear, finance terrorists.

Plus, there are tax implications. In most countries, citizens are required to pay taxes on earnings. But the taxman can’t peer into your bitcoin holdings the way he can look at your Bank of America statement (though, by law, Americans are required to pay taxes on bitcoin profits).

And finally, cryptocurrencies undermine government authority. North Korea may be using bitcoin to evade sanctions.

In September 2017, China took steps to ban cryptocurrency transactions shortly after banning new ICOs. After both announcements, bitcoin’s value tumbled.

Bitcoin supporters argue that the community can regulate itself. But Tim Swanson, a scholar of cryptocurrencies at the Singapore University of Social Sciences, wrote on his blog in September 2017 that the idea the cryptocurrency community can police itself ignores its users’ self-interested motivations.

Some users, trying to drum up demand, discount the threat posed by hackers (who exploit weaknesses in third-party systems used to store bitcoin). Others lobby against regulations because “much of the original bitcoin infrastructure was set up and co-opted by bitcoiners themselves, some of whom were bad actors from day one.

”A cat-and-mouse game between regulators and bitcoiners seems likely to occupy both communities, as well as scholars and governments, for the foreseeable future. Proposals for an outright ban are unlikely to end the conversation, since, to work, any ban would require harsh punishments, says a 2017 paper in the Journal of Economic Behavior and Organization.One potential solution is for governments to issue their own cryptocurrencies.

A September 2017 reportfrom the Bank for International Settlements – the Basel-based arbiter for central banks – describes some projects in the works. Sweden, for example, is thinking about using blockchain technology in some of its central bank’s currency-trading infrastructure.

In America, some have proposed “Fedcoin” as a government-backed crypto-dollar. Though Fedcoin may attract users, it is unlikely, suggests one American central banker, to satisfy diehard bitcoiners.

Other resourcesBecause there is no official organization or bank behind bitcoin, this explainer referenced a number of community forums for data, such as bitcoin.org and the Bitcoin Foundation, which the Washington Post once described as the “closest thing the anarchic bitcoin community has to an official public face.

”The Initiative for Cryptocurrencies and Contracts at Cornell University publishes some of the most cutting-edge research.This blogpost by freeCodeCamp is a fun and easy-to-follow bitcoin explanation.Oh and, by the way, the bitcoin blockchain occasionally splits. Fortune explains. Fortune’s blockchain reporter, Jeff John Roberts, also has an intriguing look at what happens to your bitcoins when you die.

A good overview of bitcoin, who uses it, who mines it and where, is this 2017 paper from the University of Cambridge Center for Alternative Finance.Selected studies:- On bitcoin volatility:

- Bitcoin is up to 30 times more volatile than the dollar;

- How mining and economics affect bitcoin’s price;

- “Bitcoin is a poor hedge and is suitable for diversification purposes only.”

- On security:

- Bitcoin exchanges would be safer if they demonstrated solvency;

- Cryptocurrencies like bitcoin risk routing attacks;

- What would be needed to trace a bitcoin transaction.

- On blockchain:

- Using blockchain to manage inventories;

- Some blockchain security concerns;

- Which industries and companies could benefit and be hurt by the technology.

A project of the Harvard Kennedy School's Shorenstein Center and the Carnegie-Knight Initiative, Journalist’s Resource is an open-access site that curates scholarly studies and reports.-

By

Admin

Admin - 2 comments

- 8 likes

- Like

- Share

- On bitcoin volatility:

-

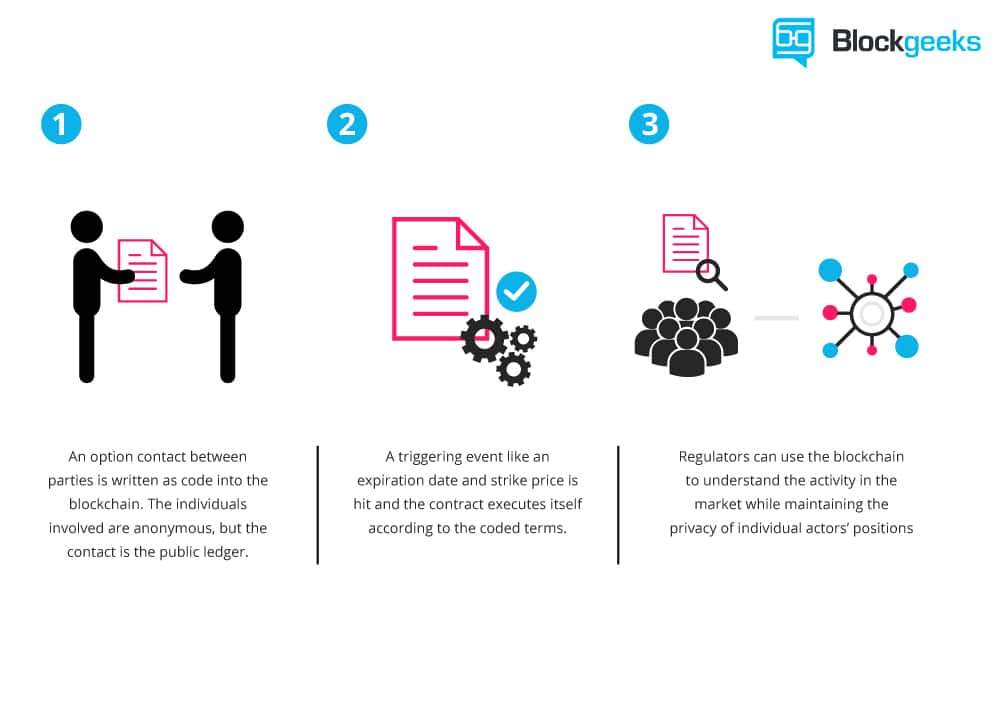

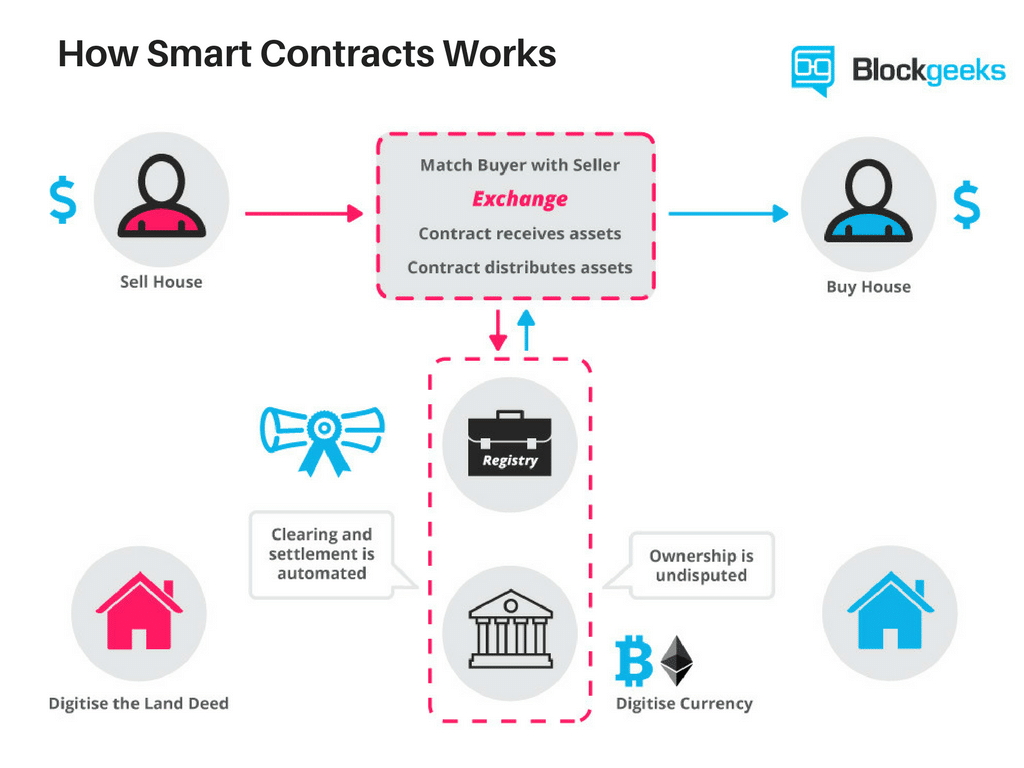

A Beginner’s Guide to Smart Contracts One of the best things about the blockchain is that, because it is a decentralized system that exists between all permitted parties, there’s no need to pay intermediaries (Middle men) and it saves you time and conflict.

Blockchains have their problems, but they are rated, undeniably, faster, cheaper, and more secure than traditional systems, which is why banks and governments are turning to them. In 1994, Nick Szabo, a legal scholar, and cryptographer, realized that the decentralized ledger could be used for smart contracts, otherwise called self-executing contracts, blockchain contracts, or digital contracts.

In this format, contracts could be converted to computer code, stored and replicated on the system and supervised by the network of computers that run the blockchain. This would also result in ledger feedback such as transferring money and receiving the product or service.

What are Smart Contracts?

Smart contracts help you exchange money, property, shares, or anything of value in a transparent, conflict-free way while avoiding the services of a middleman.

The best way to describe smart contracts is to compare the technology to a vending machine. Ordinarily, you would go to a lawyer or a notary, pay them, and wait while you get the document. With smart contracts, you simply drop a bitcoin into the vending machine (i.e. ledger), and your escrow, driver’s license, or whatever drops into your account.

More so, smart contracts not only define the rules and penalties around an agreement in the same way that a traditional contract does, but also automatically enforce those obligations.

As Vitalik Buterin, the 22-year-old programmer of Ethereum, explained it at a recent DC Blockchain Summit, in a smart contract approach, an asset or currency is transferred into a program “and the program runs this code and at some point it automatically validates a condition and it automatically determines whether the asset should go to one person or back to the other person, or whether it should be immediately refunded to the person who sent it or some combination thereof.

”In the meantime, the decentralized ledger also stores and replicates the document which gives it a certain security and immutability.

Example

Suppose you rent an apartment from me. You can do this through the blockchain by paying in cryptocurrency. You get a receipt which is held in our virtual contract; I give you the digital entry key which comes to you by a specified date. If the key doesn’t come on time, the blockchain releases a refund. If I send the key before the rental date, the function holds it releasing both the fee and key to you and me respectively when the date arrives.

The system works on the If-Then premise and is witnessed by hundreds of people, so you can expect a faultless delivery. If I give you the key, I’m sure to be paid. If you send a certain amount in bitcoins, you receive the key. The document is automatically canceled after the time, and the code cannot be interfered by either of us without the other knowing, since all participants are simultaneously alerted.

You can use smart contracts for all sort of situations that range from financial derivatives to insurance premiums, breach contracts, property law, credit enforcement, financial services, legal processes and crowd funding agreements.

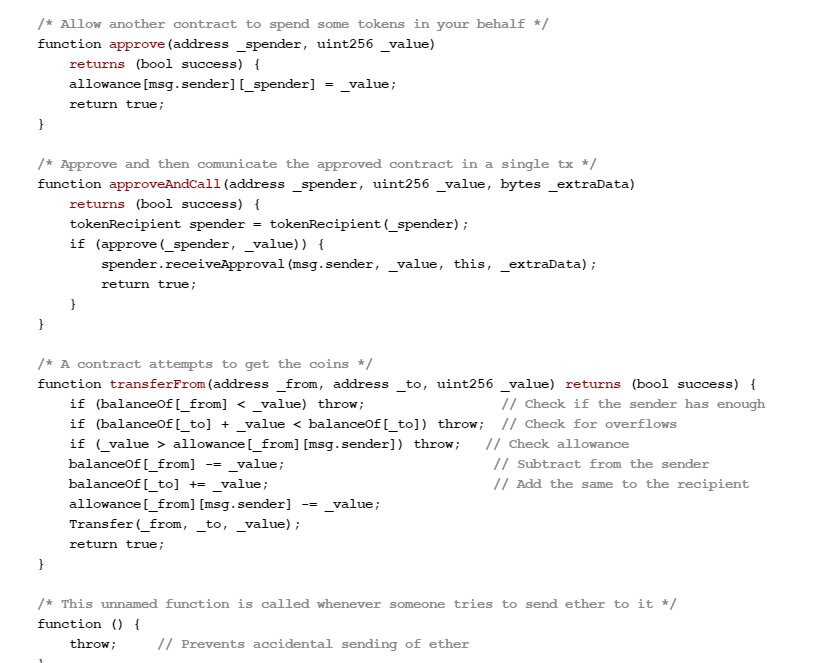

A Smart Contract ExampleHere is the code for a basic smart contract that was written on the Ethereum blockchain. Contracts can be encoded on any blockchain, but Ethereum is mostly used since it gives unlimited processing capability.

An example smart contract on Ethereum. Source: www.ethereum.org/token

The contract stipulates that the creator of the contract be given 10,000 BTCS (i.e. bitcoins); it allows anyone with enough balance to distribute these BTCs to others.Here’s How You Can Use Smart Contracts

J

J

erry Cuomo, vice president for blockchain technologies at IBM, believes smart contracts can be used all across the chain from financial services to healthcare to insurance.

Here are some examples: Government Insiders vouch that it is extremely hard for our voting system to be rigged, but nonetheless, smart contracts would allay all concerns by providing an infinitely more secure system. Ledger-protected votes would need to be decoded and require excessive computing power to access.

No one has that much computing power, so it would need God to hack the system! Secondly, smart contracts could hike low voter turnout. Much of the inertia comes from a fumbling system that includes lining up, showing your identity, and completing forms. With smart contracts, volunteers can transfer voting online and millennials will turn out en masse to vote for their Potus.

ManagementThe blockchain not only provides a single ledger as a source of trust, but also shaves possible snarls in communication and workflow because of its accuracy, transparency, and automated system. Ordinarily, business operations have to endure a back-and forth, while waiting for approvals and for internal or external issues to sort themselves out.

A blockchain ledger streamlines this. It also cuts out discrepancies that typically occur with independent processing and that may lead to costly lawsuits and settlement delays. Case history In 2015, the Depository Trust & Clearing Corp. (DTCC) used a blockchain ledger to process more than $1.5 quadrillion worth of securities, representing 345 million transactions.

Supply ChainSmart contracts work on the If-Then premise so, to put

in Jeff Garzik’s words,

“UPS can execute contracts that say, ‘If I receive cash on delivery at this location in a developing, emerging market, then this other [product], many, many links up the supply chain, will trigger a supplier creating a new item since the existing item was just delivered in that developing market.’

” All too often, supply chains are hampered by a paper-based systems, where forms have to pass through numerous channels for approval, which increases exposure to loss and fraud. The blockchain nullifies this by providing a secure, accessible digital version to all parties on the chain and automates tasks and payment.

Case history

Barclays Corporate Bank uses smart contracts to log change of ownership and automatically transfer payments to other financial institutions upon arrival

Automobile

There’s no doubt that we’re progressing from slothful pre-human vertebrates to super-smart robots. Think of a future where everything is automated.

Google’s getting there with smart phones, smart glasses, and even smart cars. That’s where smart contracts helps. One example is the self-autonomous or self-parking vehicles, where smart contracts could put into play a sort of ‘oracle’ that could detect who was at fault in a crash; the sensor or the driver, as well as countless other variables.

Using smart contracts, an automobile insurance company could charge rates differently based on where, and under which, conditions customers are operating their vehicles.

Real Estate

You can get more money through smart contracts. Ordinarily, if you wanted to rent your apartment to someone, you’d need to pay a middleman such as Craigslist or a newspaper to advertise and then again you’d need to pay someone to confirm that the person paid rent and followed through. The ledger cuts your costs.

All you do is pay via bitcoin and encode your contract on the ledger. Everyone sees, and you accomplish automatic fulfillment. Brokers, real estate agents, hard money lenders, and anyone associated with the property game can profit.

Healthcare

Personal health records could be encoded and stored on the blockchain with a private key which would grant access only to specific individuals. The same strategy could be used to ensure that research is conducted via HIPAA laws (in a secure and confidential way).

Receipts of surgeries could be stored on a blockchain and automatically sent to insurance providers as proof-of-delivery. The ledger, too, could be used for general health care management, such as supervising drugs, regulation compliance, testing results, and managing healthcare supplies.

Smart Contracts are Awesome!

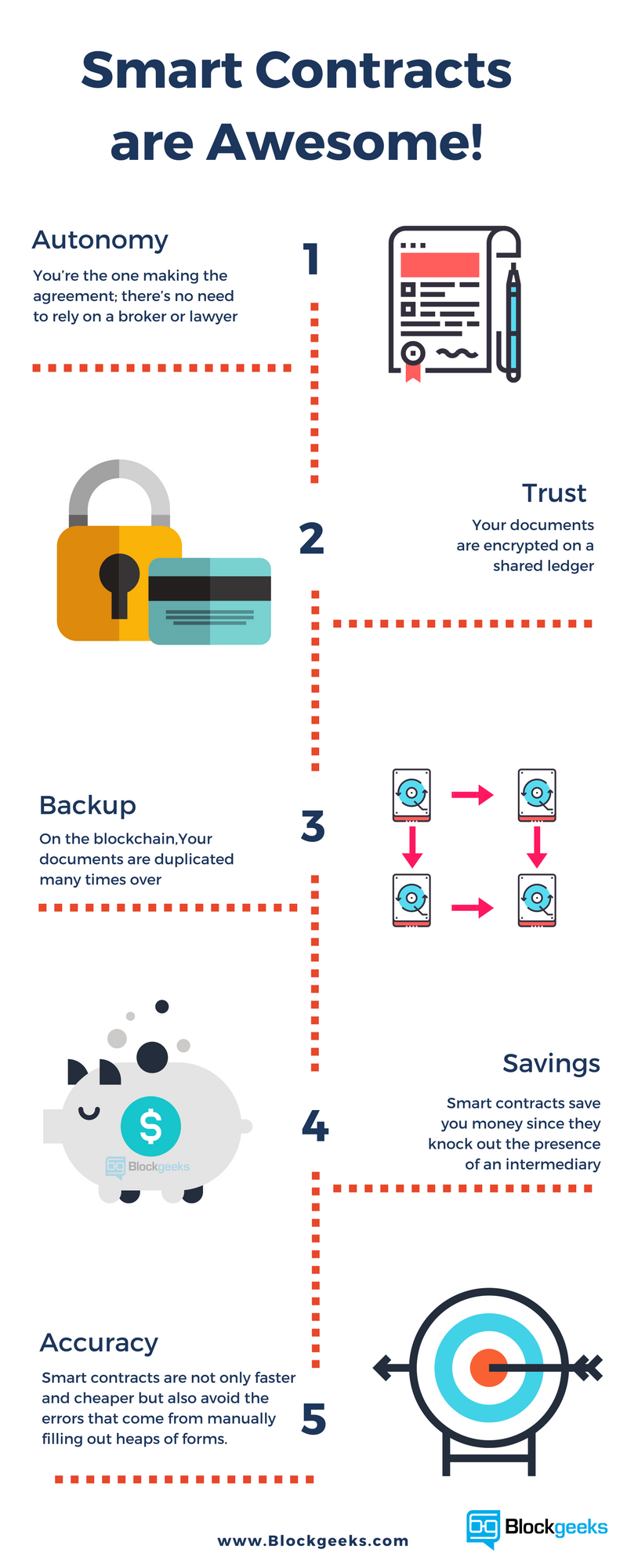

Here’s what smart contracts give you: Autonomy – You’re the one making the agreement; there’s no need to rely on a broker, lawyer or other intermediaries to confirm. Incidentally, this also knocks out the danger of manipulation by a third party, since execution is managed automatically by the network, rather than by one or more, possibly biased, individuals who may err.

Trust – Your documents are encrypted on a shared ledger. There’s no way that someone can say they lost it. Backup – Imagine if your bank lost your savings account. On the blockchain, each and every one of your friends has your back.

Your documents are duplicated many times over.Safety – Cryptography, the encryption of websites, keeps your documents safe. There is no hacking. In fact, it would take an abnormally smart hacker to crack the code and infiltrate.

Speed – You’d ordinarily have to spend chunks of time and paperwork to manually process documents.

Smart contracts use software code to automate tasks, thereby shaving hours off a range of business processes.Savings – Smart contracts save you money since they knock out the presence of an intermediary. You would, for instance, have to pay a notary to witness your transaction.

Accuracy – Automated contracts are not only faster and cheaper but also avoid the errors that come from manually filling out heaps of forms.

Here’s how Jeff Garzik, owner of blockchain services Bloq, described smart contracts:“Smart contracts … guarantee a very, very specific set of outcomes. There’s never any confusion and there’s never any need for litigation.”

“Smart Contracts are where the rubber meets the road for businesses and blockchain technology. While a few highly specialized distributed financial services use cases for blockchain have appeared—for example, payment ledger services for the Yangon Stock Exchange in Myanmar. Its services on top of blockchain that are really interesting.

In the Yangon Exchange, it solves the problem of distributed settlement in a trading system that only synchronizes trades twice a day.

But the autonomous execution capacities of smart contracts extends the transactional security assurance of blockchain into situations where complex, evolving context transitions are required. And it’s this possibility that has Amazon, Microsoft Azure and IBM Bluemix rolling out Blockchain-as-a-Service (Baas) from the cloud.” – Patrick Hubbard, Head Geek, SolarWinds

Now for Problems

Smart contracts are far from perfect. What if bugs get in the code? Or how should governments regulate such contracts? Or, how would governments tax these smart contract transactions? As a case in point, remember my rental situation?

What happens if I send the wrong code, or, as lawyer Bill Marino points out, I send the right code, but my apartment is condemned (i.e., taken for public use without my consent) before the rental date arrives? If this were the traditional contract, I could rescind it in court, but the blockchain is a different situation.

The contract performs, no matter what.The list of challenges goes on and on. Experts are trying to unravel them, but these critical issues do dissuade potential adopters from signing on. And here’s To the Future of Smart Contracts… Part of the future of smart contracts lies in entangling these issues.

In Cornell Tech, for instance, lawyers, who insist that smart contracts will enter our everyday life, have dedicated themselves to researching these concerns.

Actually, when it comes to smart contracts, we’re stepping into a sci-fi screen. The IT resource center, Search Compliance suggests that smart contracts may impact changes in certain industries, such as law.

In that case, lawyers will transfer from writing traditional contracts to producing standardized smart contract templates, similar to the standardized traditional contracts that you’ll find on LegalZoom.

Other industries such as...continue reading:

https://blockgeeks.com/guides/smart-contracts/-

Francisco Gimeno - BC Analyst I was talking yesterday to some friends who work as lawyers. They were telling me they have so much work they can't stop and read about smart contracts, block chain, etc.... well, beyond my personal opinion that if you are overwhelmed by work it means your planning is not so good, I told them that horses' owners at the end of the 19th century were also overwhelmed as there was a big transport business for them but because of that they didn't see the sign of the times and they lost everything to the motor vehicles. In an era of smartphones and smart everything, smart contracts are the solution to many issues nowadays and when on the mainstream this is going to affect every sector and every person. I know more than yesterday about this by reading this article, and that is enough for me.

-

-

Since 2013, Google search for Blockchain has risen 1900 percent. It’s considered one of the hottest technologies on the market, as Blockchain is on the edge of transforming how we all interact in the digital world.

Cointelegraph has compiled a list of the top 8 sources where you can get crucial information about Blockchain technology.“Blockchain Revolution: How the Technology Behind Bitcoin is Changing Money, Business, and the World”

Don and Alex Tapscott, the authors of “Blockchain Revolution” explain with clarity the workings of Blockchain technology, how it will expand in the future and transform how things are done online.

This book also explains the different ways in which blockchain technology is changing the future of transactions, money and business.Don Tapscott, author of bestselling book “Wikinomics”, and his son ‘Alex Tapscott’, a Blockchain expert, present a well-researched, highly readable foundational book about the future of the economy.

The book is regarded as the business leader’s playbook for the next decade and beyond. According to Tapscotts, this technology is going to enhance delivery of expanding financial services, protecting personal identity information, personal contracts and business.“Down the Rabbit Hole: Discover the Power of the Blockchain”

Down The Rabbit Hole is a book written in plain English by Tim Lea. According to the author, the book is written from the ground up as your easy-to-read, deep primer for the Blockchain.

A perfect choice for business people like you, Down the Rabbit Hole will not only help you to understand the power of the Blockchain, but it will also help you to understand how to capitalize on that power.

No matter what your role is, Down the Rabbit Hole will give you a practical hands-on guide to the technology and its potential. If you wish to make your organization more effective or want to make yourself more valuable in your marketplace, this book is for you.

In addition to this, the book also helps you to make your business more competitive and will teach your clients more about Blockchain technology and its implications.“Blockchain: Blueprint for a New Economy”

Blockchain: Blueprint for a New Economy is a well-written book by Melanie Swan on Blockchain technology. This book primarily focuses on recognizing and examining the practical implications of decentralized ledger technology.

Blockchain: Blueprint for a New Economy is recommended for those people who want to know how blockchain technology works and its potential applications.

The author of this book writes that the inspiration for this book was the realization that the application of Blockchain technology extends well beyond digital currencies.“The Science of the Blockchain”

The Science of the Blockchain explores the basic concepts and techniques for building fault-tolerant distributed systems.Written by Roger Wattenhofer, the book presents different protocols and algorithms that enable fault-tolerant operations.

Moreover, this book also discusses practical systems which implement protocols and algorithms.The author’s research interests include fault-tolerant distributed systems, network algorithms and cryptocurrencies like Bitcoin. So far, he has published 250+ scientific articles.Blockchain University

Blockchain University is a great place to learn about Blockchain technology as it provides a free course that will teach Blockchain development.It’s a good resource for people who are interested in learning about Blockchain and its development.“The Complete Guide to Understanding Blockchain”

The Complete Guide to Understanding Blockchain is written by Miles Price. The book explores the different ways in which Blockchain technology will change the way information is shared across the world.

Additionally, this book discusses how Blockchain technology is going to revamp financial services and how governments will adopt Blockchain to issue digital versions of their national currencies. This technology has completely moved out of the realm of...continue reading:

https://cointelegraph.com/news/8-best-sources-to-study-blockchain-technology