Training

- by Lwembu Henjewele

- 4 posts

-

Recommended Training: ICO Basics, To Invest or Not? Cutting Through The Bullshit... (blockgeeks.com)ICO Basics, To Invest or Not? Cutting Through The Bullshit. There are many terms associated with the cryptocurrency world that has become, more or less, very mainstream over the last 4-5 years.

Everyone has an idea about what a “blockchain” is and people definitely know what a “bitcoin” is. Lately, however, one term has been gaining more and more mainstream attention.

That term is “ICO” or Initial Coin Offerings and has raised OVER $1.3 Billion for blockchain based start ups. It has been called everything from “revolutionary” to “a Ponzi scheme. Before we get into the meat of this, we need to understand everything that surrounds this astounding phenomenon.The origins of ICO

In the real world, companies can always secure funds by approaching angel investors and venture capitalists but by doing that, they would have to give away a share of their equity to them. What companies wanted, was to get a lot of funds without giving away equity and ownership. The only way that they could do that was by going public.

The way companies do this is by holding an IPO aka Initial Public Offering. How does an IPO work?In an IPO a private company basically decides to put up its private shares up for sale to the general public. Anyone anywhere can buy the shares of the company. Initially, these shares are dirt cheap and if the company hits it big then there is a chance of your shares ballooning up to exorbitant prices.

We have all heard stories of the masseuse who became a multi-millionaire after her 500 “useless” stocks in Google matured over time. So, people started wondering what would happen if we used the same concept and put it on a blockchain based environment. This is what gave birth to the concept of ICOs. ICOs are pretty similar to IPOs but with 3 major differences.

Firstly, the ICO was decentralized with no central authority, secondly, the ICOs lacked the tedious red tape that most IPOs were bogged down by and finally, they were unregulated while IPOs have always under been heavy regulation.

Now there was a problem that blockchain based companies were facing when it came to ICOs. In an IPO, the investors got shares in return of their investment. What would a blockchain based company give away in exchange of capital? They had to invent the blockchain equivalent of a share and that was when they came up with the idea of “Tokens”.What is a Token?

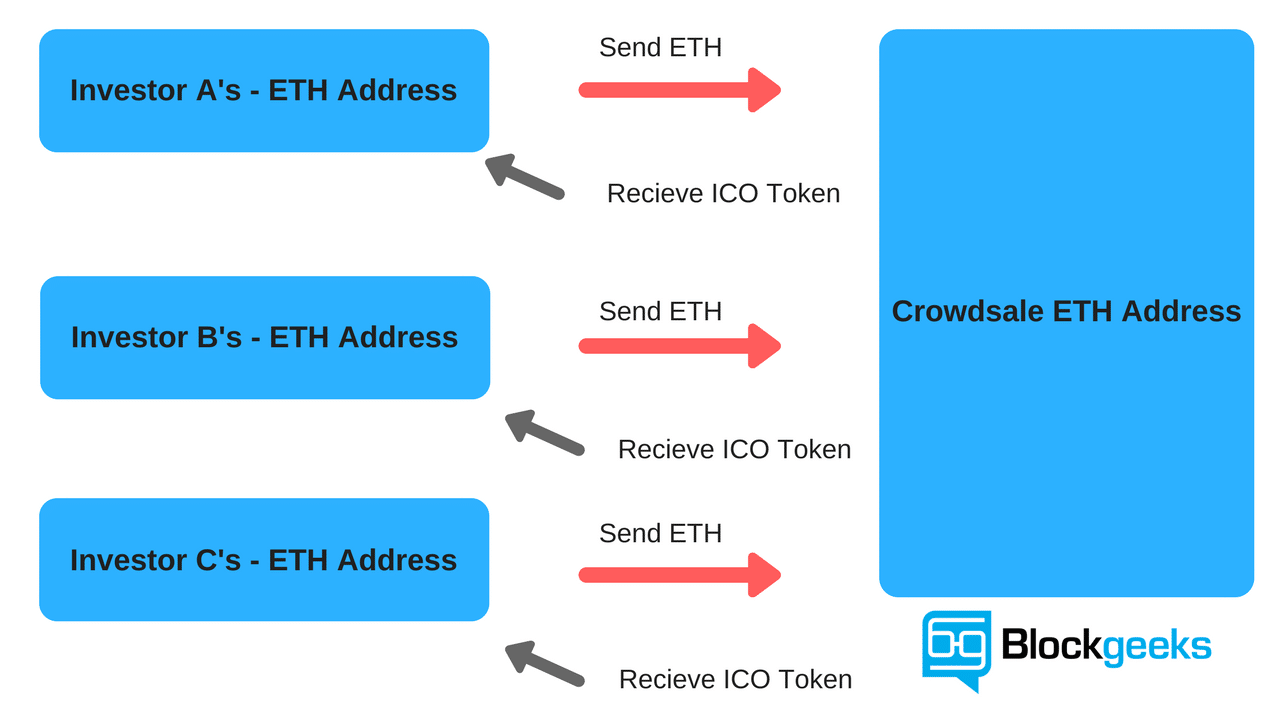

An ICO is a sort of mixture of an IPO and a crowd-sale. When you are interested in a particular project in the blockchain, the way you can gain access to it is by sending the developing team some amount of money, which is usually paid in Bitcoin or Ethereum and getting the equivalent amount of tokens in return.

Tokens have gained even more prominence since the advent of Ethereum. Ethereum provides a platform where you can use the blockchain technology not just for making currency, but to make decentralized applications (DAPPS) as well. If you want to use these DAPPS then you will need the tokens that are native to its respective environment. There are two categories that all tokens fall under:- Usage Tokens.

- Work Tokens.

Usage Tokens: These are tokens that act as native currency in their particular environment and can be exchanged for other tokens or FIAT money. Ether is a great example of a usage token. In short, usage token is a currency. Work Token: Not all tokens, however, act as currency.

Some tokens are there to give you various rights within their native environment. Eg. If you were a DAO token holder, then you had the right to vote on whether a particular DAPP could get funding from the DAO or not.How do you make a token?

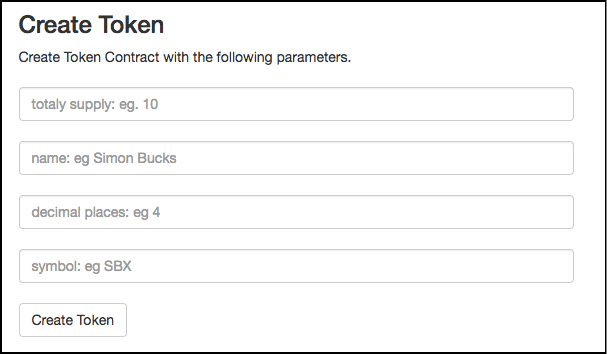

Making a token is deceptively simple. By far the easiest method is to go on Token Factory and fill up the following fields:

Firstly, you will have to determine the total supply. You don’t want a humongous amount of tokens available, that will kill their value.Then you have the name field. Give your tokens any name you want. Make it sounds professional though if you want a good and profitable ICO.

Determine how many decimals places the value of your tokens will go to.And finally, decide on a symbol for your token! It is that simple.Now., if you are one of those DIY types who would prefer coding their tokens then that is a possibility as well.

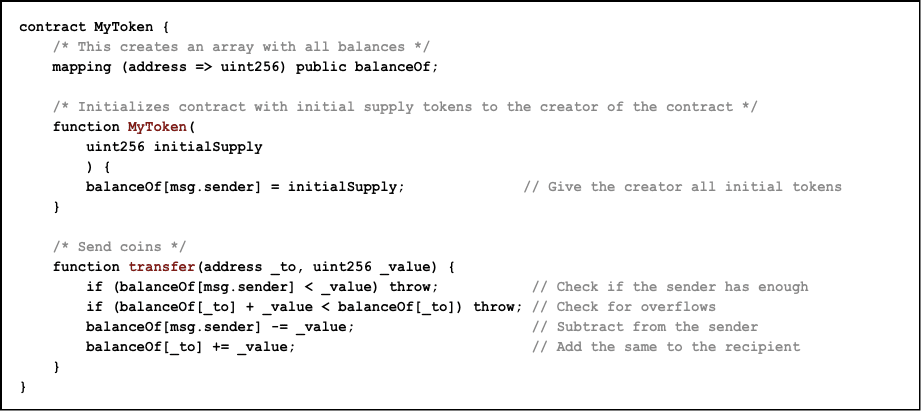

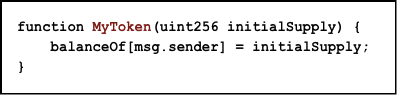

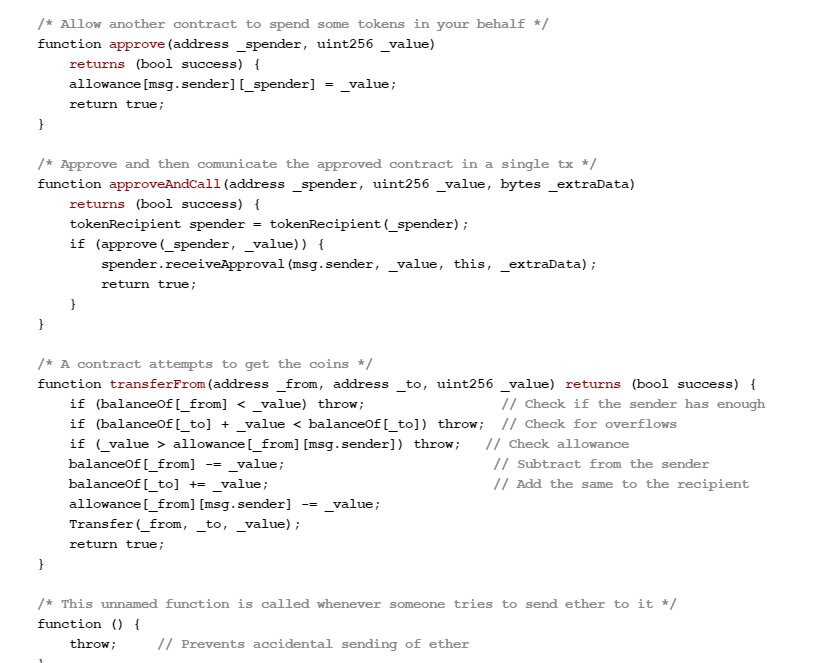

If you are making a DAPP in Ethereum you can simply use the solidity code to create your own token contract. This is what a simple token contract looks like:

The block of code is divided into 3 parts:

The Mapping.Giving the creator all the tokens.Transfer the sender the requisite amount of tokens for the ether.

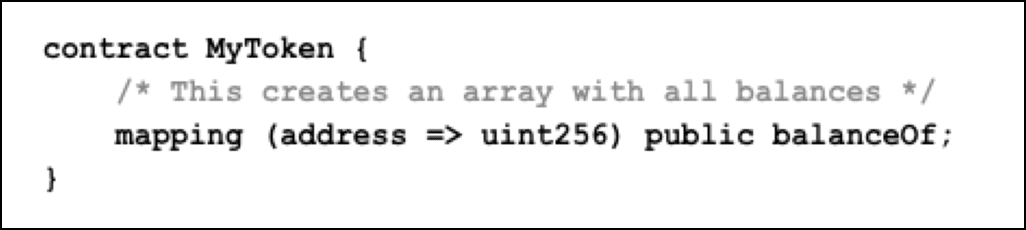

Now we will go into the code and understand what is exactly happening and how it is working. It may appear complicated on the surface but once you go deep into it, you will see how simple and easy to understand it is.The Mapping:

Ethereum, like all cryptocurrency, is an open ledger. So it makes sense that all token made on an Ethereum contract will be registered on an open database clear for everyone to see. The mapping function makes sure of that.The creator getting all the tokens:

When all the tokens are created, the entire supply goes to the contract creator who can then send the tokens to anyone who funds the project with ETH.The Transfer:The last part of the code is the transfer.

You will give your tokens an initial value and based on the amount of ETH that you are getting paid by the sender, they will get the requisite amount of tokens. The same number of tokens will cut from your balance and it will be added to the sender’s balance.

As you may have already guessed, there are thousands of tokens out there, and while that’s a good thing, there is also a major flaw that needed to be addressed. Think about this, if everyone designed their own tokens giving it their own unique twist, it will be an absolute horror show to save them in a wallet.

Many times you will have to follow elaborate and needlessly complicated steps just to store your tokens in a wallet. That would have been a nightmare. What was needed was a standard or a basic blueprint for all tokens to follow. Fabian Vogelstellar, one of the founders of the Mist Wallet came up with the solution with his ERC20 token standards.What is the ERC20 Token Standard?

The ERC20 standards have been put in place so that all Ethereum tokens follow a particular rule and standard. While this is not an enforced rule, most DAPP developers are encouraged to follow the standards to ensure that their tokens can undergo interactions with various wallets, exchanges and smart contracts without any issues.

These standards also helped others gain an idea of how future tokens are expected to behave. ERC20 tokens have gotten widespread approval and most of the DAPPS sold on ICO’s have tokens based on the ERC20 standard. So what are these standards?They are basically a set of 6 functions which, when executed, do the following 4 activities:- Get the total token supply.

- Get the account balance.

- Transfer the token from one account to another.

- Approve the use of the token as a monetary asset.

How does an ICO work?

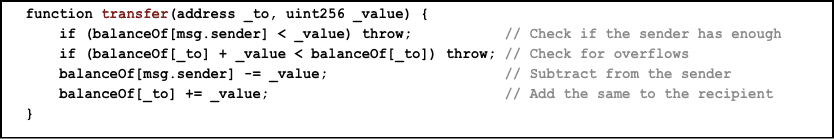

So now that you have gotten a crash course on what tokens are and how they work, let’s do a deep dive on ICOs and why, for better or for worse, people are calling it the new “Gold Rush”. A number of millionaires that ICOs have made in the last year or so is staggering. Check out this graph:Check out this graph:

Over the past 12 months, have raised over $600 million as opposed to $140.30 million by established Venture Capitals. That is mind-boggling! So what is it about ICOs that has attracted so many investors? ICO is the rockstar of the investment world, it is the untamed wild genius wearing a torn t-shirt and baggy jeans, living among a group of suit-wearing snooty businessmen.

There is something extremely seductive about the concept. Think about this, anyone, with an idea for a project, can gain massive financial backing from a community without being bogged down by politics or endless red tape.

The idea that anyone anywhere can get the financial backing they need in an unregulated manner was a welcome idea for all. No longer will investments be reserved just for the uber-rich, anyone can gain the funds to make their dreams a reality.The exact procedure behind an ICO can be broken down into the following steps.

Firstly, the developers will announce their intention of making the project to generate hype and interest in the project. This step is very important because first impressions are everything. Then, the developers will create a white paper. A white paper is a document issued by the developers which highlight their project and the specific features of that project that makes it enticing for the potential investors.

While it is true that white papers are supposed to be a sales and marketing tool, it is nowhere near as flashy and over-the-top as a brochure or a sales letter. Whitepapers are written in an academic manner and the specific purpose is to entice the investors by showing its potential and features. They are at least 2500 words long and are meant to be purely informational.

After that, they will run the white paper through prominent members in the blockchain community to get their backing. Getting this backing is critical because this is where they will gain the credibility required to carry forward with the project. Now, they will need to create the tokens which they are going to exchange for Bitcoin or ETH in the token sale. The process of token creation has already been covered above.

Developers will have to decide the limit to the number of tokens and the amount that they want to charge for each token. Usually, the price of these tokens is very low at the start of the ICO. Setting a cap on the number of tokens is necessary because having a limited supply of tokens automatically increases their demand (according to the law of supply and demand).

Along with the cap on the number of tokens issued, developers will have to decide a time at which they want to hold their ICO. Selecting the time, and the amount of time it runs for is CRITICAL and this will be covered in detail later on. Along with that they also need to decide on the cap for the amount of money they will be taking in.

Once all these are decided, the developers choose a platform where they can advertise their ICO. Earlier it used to be tough to do so because developers had to convince people to come to their websites to gain more information about the ICO. But now, there are a number of websites which provide the platform for developers to address this particular need. Some of the best ones are:- Waves.

- ICONOMI.

- State of DAPPS (for Ethereum Tokens only).

- TokenMarket.

Think of these websites as Kickstarter or Indiegogo of the crypto world. Once the ICO has been advertised the developers can then actually do the ICO. For a visual representation of how an ICO works:

Investors send the coins to the public address of the developers and in exchange, they get tokens in return. So to summarize:- Firstly, the developers declare their intention of making the project.

- Then, the project developers create a white paper which includes the details of their project explained in a descriptive way.

- They get the backing and confidence from certain prominent members in the cryptocurrency world who act as “advisors”.

- They then create the tokens and decide on various caps such as a token cap, money cap, and time cap.

- Advertise the ICO using one of the platforms mentioned above.

- Hold the ICO.

In the broad spectrum of things there are two different kinds of ICOs:- Currency ICO.

- Project ICO

Currency ICO

A currency ICO is when developers bring in a new currency system. The developers give out tokens which become new cryptocurrencies in exchange of the older more established coins such as Bitcoin and Ethereum. The reason why people are drawn to these ICOs are that of investment opportunities. One of the best examples of these kinds of ICOs is the Ethereum ICO.

In later 2013, a young programmer named Vitalik Buterin was working for Bitcoin as a developer and was getting increasingly frustrated. He realized that the blockchain technology had more potential than being a mere currency system. His vision was to make an alternate form of the internet.

This vision was Ethereum, a platform where people not only will have access to a new form of currency (Ether) but they will also be able to create and develop a newer form of DAPPS on the platform itself. The Ethereum ICO lasted for 42 days and went on from July-August 2014 and raised >$18 million.

Back then it was the biggest crowdfunding even in human history. The early birds got a humongous ROI. In the beginning, if you invested just 1 BTC you would get 2000 ether in return. The current valuation of those 2000 ether is ~$420,000. Not bad for a $2500 investment!

But more than the ROI the biggest thing that makes this particular ICO so important in crypto history is the concept of the project itself. If you want an advertisement for why ICOs are so important, just read up on the Ethereum ICO.

This was one man with a vision who got a dedicated and talented team around him, got the white paper out, convinced people to invest in his project and then ultimately made one of the most important platforms in crypto history. This is what ICOs should be like.Project ICO

Along with the currency ICO we have the project ICOs which issue “work tokens”. When you buy these tokens in the crowd sale you gain certain rights and votes inside the environment of the DAPP itself. One of the most famous, and consequently, infamous examples of this kind of ICO is the DAO.

The DAO aka the decentralized autonomous organization was a decentralized venture capital fund which was going to be used to fund future projects made in the Ethereum eco-system.

This how it was supposed to work. People invest money in the DAO by giving ether and they get “DAO Tokens” in return. These DAO tokens made the holders part of the DAO community. So, suppose Jill wanted a project to be funded by the DAO, she would introduce the project to the DAO community.

The token holders will then hold a vote and if Jill gets the majority vote then she would gain the required funding from the DAO itself. This was a revolutionary idea and was getting mainstream press exposure as well. The ICO went down in history as one of the biggest ever.

The ICO raised $150 million in ether, that was the 14% of the total ether issued at that time and everything was looking up. Unfortunately, that is when the infamous DAO Attack happened and a total of $50 million worth of ether was taken away. This attack had huge repercussions because this was what caused the Ethereum hardfork and resulted in two different Ethereums:

Ethereum and Ethereum Classic. Another great example of the “Project ICO” is Augur, a decentralized market prediction system. ICOs nowadays are raising a ridiculous amount of money, the Brave ICO, an Ethereum based browser raised in $35 million in 30 seconds.

That’s ~$1.2 million per second!! The Tezos ICO recently became one of the largest ICOs of all time by raising more than $200 million. SO the question that you are probably thinking of right now is,

“How do you make sure that the funds that you are investing is going to be used properly by the developers?”

What if they just run away with it? Let’s answer that question.

What steps should be taken to ensure the safety of the funds aka how to not get scammed?

Unfortunately, because of the unregulated nature of the ICOs and the sheer amount of money to be made in this space, it does attract a lot of scammers. If you are investing in an ICO then you would want some assurances on your end that all the funds that you are going to invest are going to be used in a right way. So what should you be looking into when you are about to invest to make sure that you are not going to get scammed?- The project developers should be able to clearly define the purpose of their project using simple and short sentences. If they are taking too much time and beating around the bush, then that either means: their agenda is not clear or they are hiding something. Both of which are not that encouraging scenarios.

- Make sure that the developers are not anonymous. There should be 100% transparency when it comes to their names, business plans, locations etc. You should be able to contact them regarding any and all information that you need to get from them.

- There should be a legal framework between the developers and the contributors including terms and conditions set for the ICO.

- Lastly, and most importantly, you need to make sure that the ICO funds are being stored in an escrow wallet. An escrow wallet is basically a multi-sig wallet which needs multiple keys to be opened. One of those keys must be held by a neutral third party.

If you keep these 4 points in mind, then you will be able to spot the scammers with relative ease and invest in projects which have real potential.

So are we in an ICO bubble right now and is it going to pop?

With the sheer amount of money going into ICOs nowadays and everyone and their mothers wanting a piece of that ICO pie, there are legit fears going around of ICO being a bubble much like the dot com bubble and the real estate bubble. To understand how a bubble works, let’s look at one of the most famous examples of the bubble, the dot-com bubble which went from 1997-2002.

Around 1997, the internet became big and tech companies began to emerge everywhere. Investors started putting in their money and flipping their investments into huge sums.

Eventually, everyone who saw this started getting major FOMO (fear of missing out) and they began giving away their money to companies without even having any idea as to whether the business had the potential to work or not.

Common sense went out of the window and every random internet business was making a killing in the IPOs. Warren Buffet noted that: “The fact is that a bubble market has allowed the creation of bubble companies, entities designed more with an eye to making money off investors rather than for them.

Too often, an IPO, not profits, was the primary goal of a company’s promoters.”. BOOM! He hit the nail right on the head, most of the companies that got millions from their investors failed and some turned out to be nothing more than scams. Eventually, the bubble burst in 2002.

Companies crashed and lost millions within a year. One of the most infamous examples of this is Pets.Com which lost $300 million in just 268 days! However, while 1 in 2 companies got shut down, the companies that did survive, hung on and changed the way we live today.

One of the best examples of that is Amazon. Before the bubble burst, Amazon stocks were at $100/share. After the burst, it went down to $7/share but eventually, it went up to $600/share.

The parallels between the ICO bubble and the dot-com bubble are a bit frightening and as they say “if you don’t learn from history, it is going to repeat itself.” Much like dot-coms, the ICOs have attracted a lot of investors who don’t want to miss out on the gold rush.

Much like the dot-coms ALL the investing is done purely from speculation. You have to realize that most of the companies that you are investing in, in ICOs barely have anything ready. Most of them don’t have the alpha version of their end result, it is all based on speculation and the potential of the project.

As with anything, most of these projects will fail to get the end results. The reason why the Ethereum ICO worked so wonderfully was that it had a dedicated and driven team of talented developers who were a day in and day out to make it a success, same with Golem.

Another problem plaguing the ICO is the greed of the developers. Some developers are making projects ONLY so that it can look enticing enough for a good ICO. They have no interest in carrying through nor do they have any inclination of turning a profit for their investors. The parallels are very apparent and it can get real scary thinking about it.

But we are not market experts. All we can do is speculate. We don’t know whether we are living in the “ICO bubble” or not, nor do we know whether it is a bubble that is going to pop. What we can tell you to do is to be smart with your money. Don’t get enticed by shiny objects, and have basic common sense.

Read the points we have given above to know whether an ICO is a scam or not.

So if I am a developer how should I approach ICOs?

If you are a developer, then first and foremost have a very clear idea and agenda as to what your project is and what do you want to do with it. You must state the purpose of your project and the future that you envision with it.

You must also choose the platform that you want to advertise your ICO in (waves, iconomi etc.) and then you must design your tokens. After you are done creating your white paper and running it through the advisors and getting legal backing, the most important thing that you need to do is to pick a good time and date.

Nothing kills an ICO faster than not getting the timing right. So when selecting the time of the ICO to keep the following points in mind:- Do not choose holiday weeks or weeks when important people take off: You need as much hype as possible and the best investors for your ICO. Do not hold your ICO during spring break when most people, including reporters, take off. Similarly, if there is an important event around the week then it’s best to not have your ICO during that time. As Margaux Avedisian says, if your main investors are going to be in The Burning Man, then it is best to not have your ICO during that week,

- Day of the week: You must notify the working patterns of your target investors and see which day best suits them. It is best to not choose a weekend for your ICO.

- Time Cap: While there are some ICOs that meet their target in 10 mins or even 35 seconds, those are the rarest of the rare scenarios. Even the Ethereum ICO took 42 days, even though that was before ICOs became so popular. So you have to decide on the time cap and the amount of time that you are willing to run your ICO for.

- Time Zone: If your target investors are Americans and then it makes little to no sense to have your ICO during midnight EST. Decide where you want your target investors to be from and decide on a time that will be convenient for them.

What are the Pros and Cons of ICOs?

Pros of ICO- Gives opportunities to promising projects: Think of what Ethereum has accomplished in the last year. From becoming the second most powerful cryptocurrency in the world to providing a platform for DAPP creators to create their projects. It is truly becoming the “platform where the future will be built”. All this got started because of an ICO.

- Doesn’t require unnecessary paperwork: Many projects don’t get executed because they get caught up in the red tape. For raising funds through IPOs or crowdfunding the project developers need to go through a lot of paperwork and more often than not, they just don’t get the documentation required to collect funds for their project. On the other hand, all that you need to do take part in an ICO is create a “white paper” (The white paper contains all the details of your project.) After that, anyone can read the white paper and choose to invest in the project if it interests them.

- Community building: It gives the project creators an opportunity to build a community around their projects. Having a healthy community gives a product immense credibility. Plus, the members of the community can have real say in the direction of the projects and keep the creators accountable.

- Exposure for projects: The hype that surrounds an ICO can do wonders for the exposure of the project. The more the exposure, the more the people will know about the project. This increases the number of potential investors.

- Early access to potentially valuable tokens: Some tokens have the potential of becoming truly valuable cryptocurrencies. ICOs give investors an opportunity to invest in tokens, with potential, for dirt cheap. Eg. During the Ethereum presale, 1 Ether cost 35-40 cents. Right now, as of writing, 1 Ether costs ~$277.

- The incentive for innovation: The roaring success of various ICOs over the last 12 months has given extra incentive to various developers to innovate and develop more exciting projects.

Cons of ICO- Attracts a lot of scammers: Because there is so little paperwork involved in ICOs it attracts many scammers who can simply create a bogus white paper and make off with a lot of money. Some developers also purposefully omit certain important details from their white paper to make their projects look more appealing than they actually are. The biggest consequence of all these scams is the decreased faith of the public in blockchain technology which can potentially spell absolute disaster.

- Based on pure speculation: When you are investing in a project in an ICO you are investing in the idea of the project. You read the white paper and if you think that the team is credible and the project has promise than you invest. So, basically, you have no idea whether the project will even be successful or not. Over 90% of the startups fail and blockchain projects are not immune to that as well. Plus, the developers may get lazy and not even bother to finish what they have started. And, let’s not forget, there is always the possibility of a project getting ruined because of hacks and attacks. The DAO is a perfect example of that.

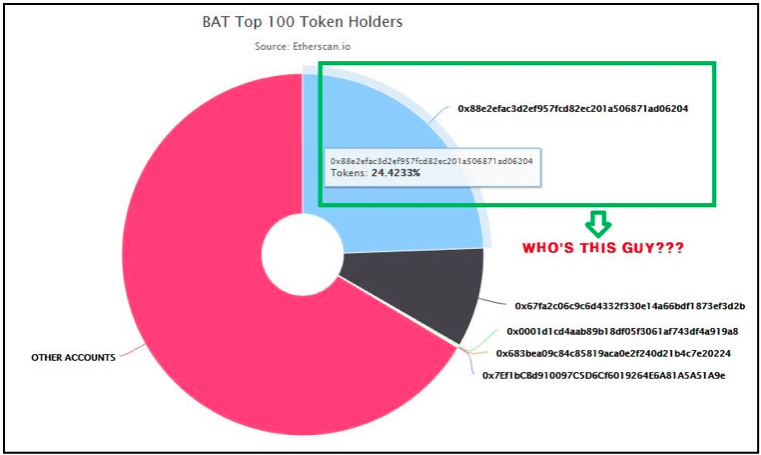

Whaling: Let’s take the example of what happened in the, now infamous, BAT ICO. The ICO got over in just 24 seconds and they were able to raise 35 million USD! The shocking part was, not a lot of people were able to take part in the ICO at all as major chunks of the tokens were bought by certain individuals. In fact, a quarter of the BAT tokens are owned by one person!

These people are called whales. Basically, people who have a lot of money and resources and they rig the ICO game in their favour. The way they do it is by paying extremely high mining fees which help them “cut in line” and get first preference during ICOs. In the case of the BAT ICO, whales paid as much as $2220 in transaction fees to make sure that they take the first bite of the pie. Afterward, they mostly sell these tokens at a premium to turn in a profit.- Network Congestion: The increased amount of activity during ICOs causes a huge strain in the blockchain and may result in a bottleneck. During the Status ICO, when they raised a $100 million, there was so much backlog in the network that many people, who wanted to invest in Status, saw their transactions fail.

- Storing the tokens: There is a chance that you will not be able to store some of the tokens in any of your crypto-wallets. You can store any tokens made in Ethereum in your ether wallet but tokens made outside of Ethereum can be very complicated to store.

- Government intervention: This is where it gets scary. Because of the increased number of scams and a huge amount of unregulated money, various governments may simply decide to start regulating the ICOs. If this happens then this truly could be the death of cryptocurrency. The whole point of cryptocurrency is the idea of decentralization and being outside of government control.

Conclusion

ICOs are going to continue being a part of cryptocurrency and blockchains. We simply cannot overlook the good that they have done. From giving birth to innovative technologies like Ethereum and Golem to giving DAPP developers, around the world, an incentive to innovate and come up with newer and more exciting technologies, their contribution simply cannot be understated.

Having said that though, there is no doubt that ICOs can be a “necessary evil”.

Human tendency is to exploit any loopholes for their selfish benefits and ICOs seem to be the tool of choice for many corrupt individuals. Looking forward, what we can all do is act more responsibly and do our own research.

Study the white papers, interview the team involved with the specific projects that are up for ICOs and then invest your money.We have several courses and training for you to discover about the Blockchain and Cryptocurrencies on Blockgeeks, click here!

-

By

Blockgeeks

Blockgeeks - 1 comment

- 5 likes

- Like

- Share

-

- 1

Admin Blockchain Company Task: Follow Blockgeeks to be awarded 10 Bonus BC Tokens on record as a user. Click on " About Free Tokens " at the top of this page to learn more.- 10 1 vote

- Reply

-

The Times Higher Education World University Rankings for 2018 uses 13 “carefully calibrated performance indicators to provide the most comprehensive and balanced comparisons, trusted by students, academics, university leaders, industry and governments.

” The findings for their 2018 international league table were independently audited for data accuracy by PwC, making this the “only global university rankings subjected to full, independent scrutiny of this nature.

” A quick glance at the list reveals many of the world’s top schools are also ones adding blockchaineducation to their courses and modules. This is an indication that jurisdictional competition between universities is going to now include blockchain technology offerings as institutions compete to attract the best academic talent.

Many industries have already turned to blockchain, and recognized it alongside machine learning and artificial intelligence as fundamental to the transforming global economy.

Organizations like Goldman Sachs, Microsoft, and IBM already have a presence in the space. It was only a matter of time before academia and government followed suit.

To better understand how universities are remaining relevant by incorporating blockchain technology into their curriculums, ETHNewsspoke with Dr. TAN Chuan Hoo of the National University of Singapore, one of Times Higher Education 2018 top performing universities. TAN told ETHNews:“Blockchain is an emerging disruptive technology that has critical applications in the financial sector. It is important that our Information Systems students are equipped with a robust understanding of latest technologies and have updated skillsets to deploy them smartly in key industry sectors, such as the financial industry.

Perhaps there is an equation that describes how technological adoption plays out at institutions of higher education. That might explain why forward thinking academics arrived at a consensus about blockchain’s importance after the power brokers of big business.

This year, we are launching the financial technology specialisation in our Bachelor of Computing (Information Systems) degree programme. In this specialisation, we have three core modules and three elective modules. The module on blockchain technology is one of the three core modules under the financial technology specialisation.”

Regardless, it seems both industry and academia will be exploiting the benefits of blockchain technology long before many governments of the world. If such an equation that describes these relationships does exist, it may be found by one of the following world class academic institutions.

While nearly every school on Times Higher Education’s 2018 list is likely to offer some form of blockchain related course, club, or society, ETHNews took time to identify a few of the pack leaders.

Times Higher Education’s 2018 #2 University of Cambridge, UK

The University of Cambridge has been maintaining academic excellence and has been a world class research institution for nearly 1000 years. Its Centre for Alternative Finance at the Judge Business School recently published a landmark study on cryptocurrencies.

Times Higher Education’s 2018 #8 Imperial College London, UK

Imperial College London often plays second fiddle to the Oxbridges of the United Kingdom; however, their Centre for Cryptocurrency Research and Engineering is already world class.

Times Higher Education’s 2018 #15 University of California, Los Angeles, USA

UCLA’s Blockchain Lab beats out stiff competition in California.

Times Higher Education’s 2018 #19 Cornell, USA

Cornell might be frozen over half of the year, but it’s one of the hottest blockchain universities on the planet. Cornell is where Citi sends their employees to learn from professors like Emin Gun Sirer.

Times Higher Education’s 2018 #22 National University of Singapore

The National University of Singapore has blockchain partnerships with IBM as well as unique course offerings.It will be exciting to see what developments will come out of universities, now that they are catching up to the blockchain technology revolution. TAN continued:“We see teaching blockchain technology as a very good fit in our Bachelor of Computing (Information Systems) degree programme. Our students are not only trained in programming, but also in enterprise platform design, development and deployment. Teaching blockchain technology as an advanced module is a natural, fitting choice.”

Discover more stories like this on Ethnews here:

https://www.ethnews.com/times-higher-education-reveals-academia-is-adopting-blockchain-technology -

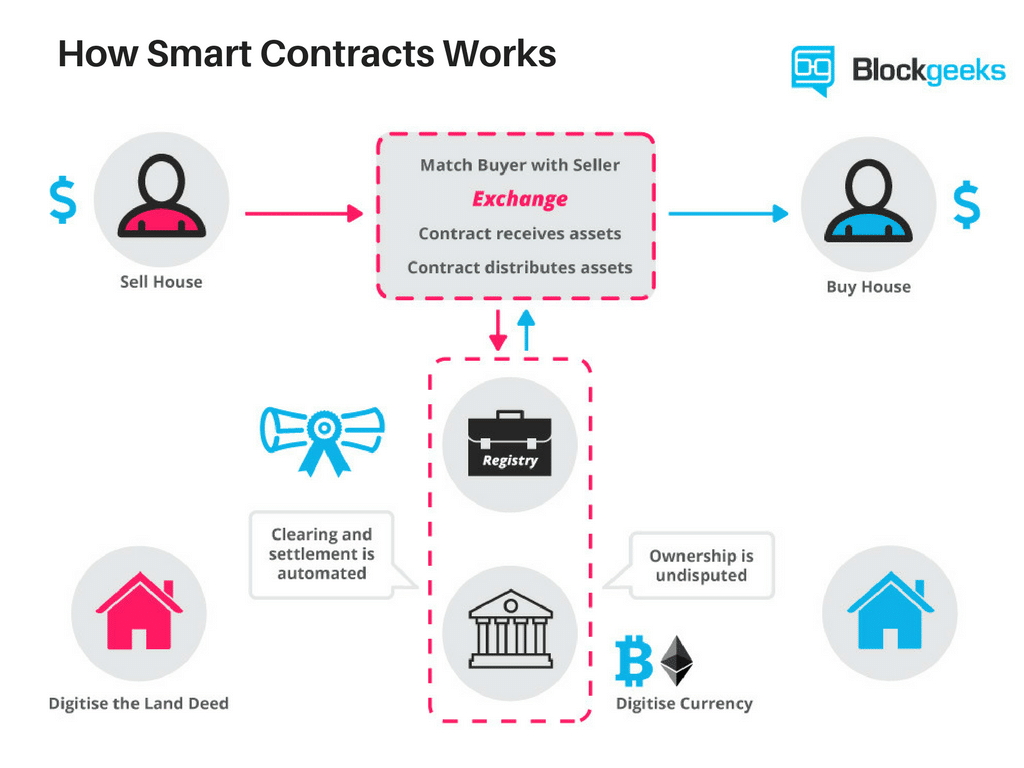

A Beginner’s Guide to Smart Contracts One of the best things about the blockchain is that, because it is a decentralized system that exists between all permitted parties, there’s no need to pay intermediaries (Middle men) and it saves you time and conflict.

Blockchains have their problems, but they are rated, undeniably, faster, cheaper, and more secure than traditional systems, which is why banks and governments are turning to them. In 1994, Nick Szabo, a legal scholar, and cryptographer, realized that the decentralized ledger could be used for smart contracts, otherwise called self-executing contracts, blockchain contracts, or digital contracts.

In this format, contracts could be converted to computer code, stored and replicated on the system and supervised by the network of computers that run the blockchain. This would also result in ledger feedback such as transferring money and receiving the product or service.

What are Smart Contracts?

Smart contracts help you exchange money, property, shares, or anything of value in a transparent, conflict-free way while avoiding the services of a middleman.

The best way to describe smart contracts is to compare the technology to a vending machine. Ordinarily, you would go to a lawyer or a notary, pay them, and wait while you get the document. With smart contracts, you simply drop a bitcoin into the vending machine (i.e. ledger), and your escrow, driver’s license, or whatever drops into your account.

More so, smart contracts not only define the rules and penalties around an agreement in the same way that a traditional contract does, but also automatically enforce those obligations.

As Vitalik Buterin, the 22-year-old programmer of Ethereum, explained it at a recent DC Blockchain Summit, in a smart contract approach, an asset or currency is transferred into a program “and the program runs this code and at some point it automatically validates a condition and it automatically determines whether the asset should go to one person or back to the other person, or whether it should be immediately refunded to the person who sent it or some combination thereof.

”In the meantime, the decentralized ledger also stores and replicates the document which gives it a certain security and immutability.

Example

Suppose you rent an apartment from me. You can do this through the blockchain by paying in cryptocurrency. You get a receipt which is held in our virtual contract; I give you the digital entry key which comes to you by a specified date. If the key doesn’t come on time, the blockchain releases a refund. If I send the key before the rental date, the function holds it releasing both the fee and key to you and me respectively when the date arrives.

The system works on the If-Then premise and is witnessed by hundreds of people, so you can expect a faultless delivery. If I give you the key, I’m sure to be paid. If you send a certain amount in bitcoins, you receive the key. The document is automatically canceled after the time, and the code cannot be interfered by either of us without the other knowing, since all participants are simultaneously alerted.

You can use smart contracts for all sort of situations that range from financial derivatives to insurance premiums, breach contracts, property law, credit enforcement, financial services, legal processes and crowd funding agreements.

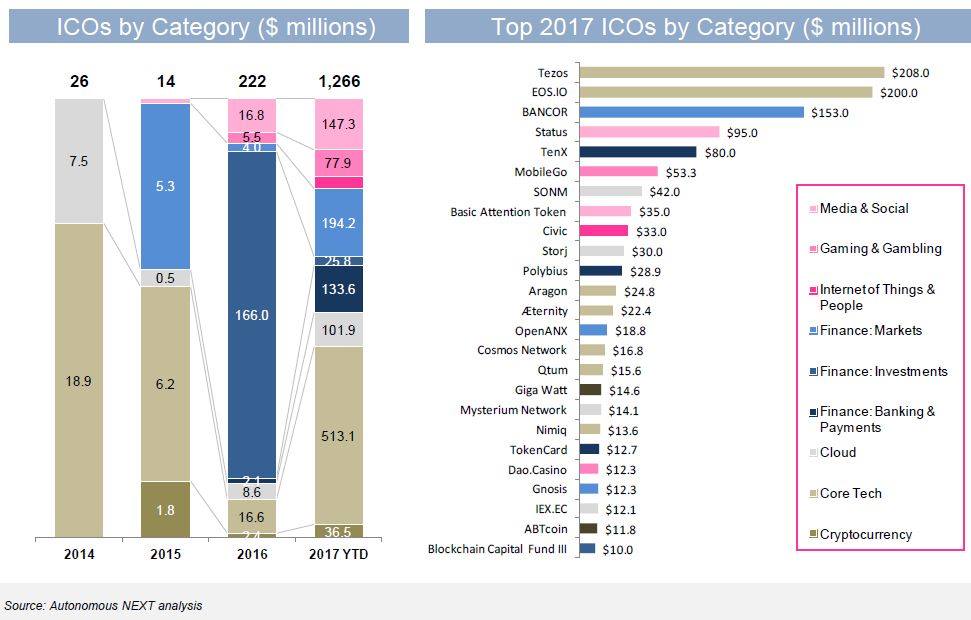

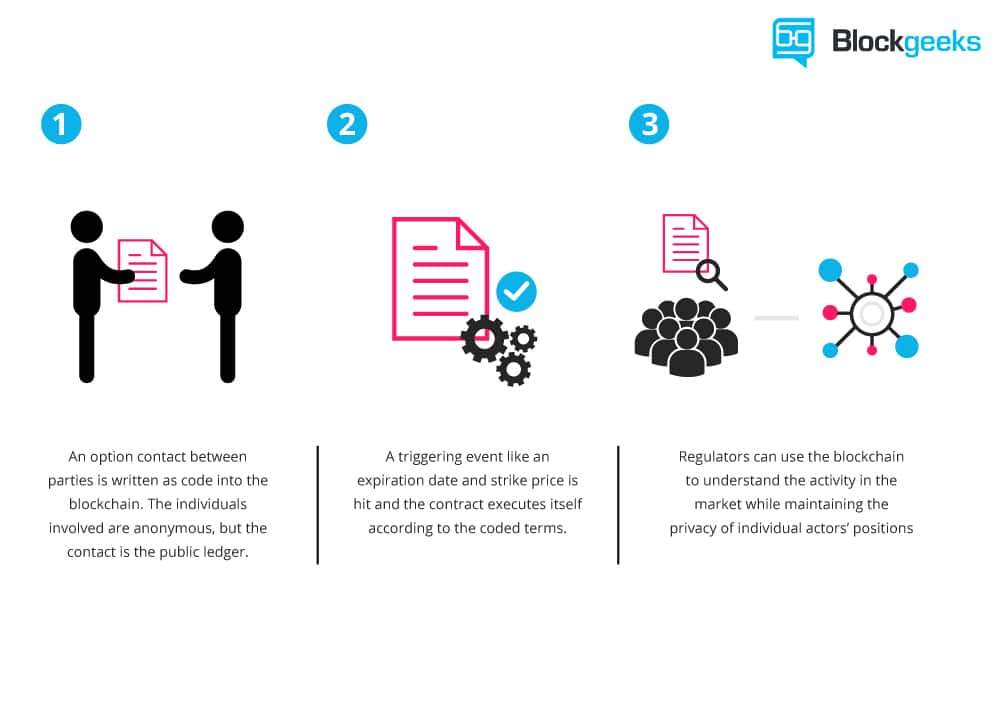

A Smart Contract ExampleHere is the code for a basic smart contract that was written on the Ethereum blockchain. Contracts can be encoded on any blockchain, but Ethereum is mostly used since it gives unlimited processing capability.

An example smart contract on Ethereum. Source: www.ethereum.org/token

The contract stipulates that the creator of the contract be given 10,000 BTCS (i.e. bitcoins); it allows anyone with enough balance to distribute these BTCs to others.Here’s How You Can Use Smart Contracts

J

J

erry Cuomo, vice president for blockchain technologies at IBM, believes smart contracts can be used all across the chain from financial services to healthcare to insurance.

Here are some examples: Government Insiders vouch that it is extremely hard for our voting system to be rigged, but nonetheless, smart contracts would allay all concerns by providing an infinitely more secure system. Ledger-protected votes would need to be decoded and require excessive computing power to access.

No one has that much computing power, so it would need God to hack the system! Secondly, smart contracts could hike low voter turnout. Much of the inertia comes from a fumbling system that includes lining up, showing your identity, and completing forms. With smart contracts, volunteers can transfer voting online and millennials will turn out en masse to vote for their Potus.

ManagementThe blockchain not only provides a single ledger as a source of trust, but also shaves possible snarls in communication and workflow because of its accuracy, transparency, and automated system. Ordinarily, business operations have to endure a back-and forth, while waiting for approvals and for internal or external issues to sort themselves out.

A blockchain ledger streamlines this. It also cuts out discrepancies that typically occur with independent processing and that may lead to costly lawsuits and settlement delays. Case history In 2015, the Depository Trust & Clearing Corp. (DTCC) used a blockchain ledger to process more than $1.5 quadrillion worth of securities, representing 345 million transactions.

Supply ChainSmart contracts work on the If-Then premise so, to put

in Jeff Garzik’s words,

“UPS can execute contracts that say, ‘If I receive cash on delivery at this location in a developing, emerging market, then this other [product], many, many links up the supply chain, will trigger a supplier creating a new item since the existing item was just delivered in that developing market.’

” All too often, supply chains are hampered by a paper-based systems, where forms have to pass through numerous channels for approval, which increases exposure to loss and fraud. The blockchain nullifies this by providing a secure, accessible digital version to all parties on the chain and automates tasks and payment.

Case history

Barclays Corporate Bank uses smart contracts to log change of ownership and automatically transfer payments to other financial institutions upon arrival

Automobile

There’s no doubt that we’re progressing from slothful pre-human vertebrates to super-smart robots. Think of a future where everything is automated.

Google’s getting there with smart phones, smart glasses, and even smart cars. That’s where smart contracts helps. One example is the self-autonomous or self-parking vehicles, where smart contracts could put into play a sort of ‘oracle’ that could detect who was at fault in a crash; the sensor or the driver, as well as countless other variables.

Using smart contracts, an automobile insurance company could charge rates differently based on where, and under which, conditions customers are operating their vehicles.

Real Estate

You can get more money through smart contracts. Ordinarily, if you wanted to rent your apartment to someone, you’d need to pay a middleman such as Craigslist or a newspaper to advertise and then again you’d need to pay someone to confirm that the person paid rent and followed through. The ledger cuts your costs.

All you do is pay via bitcoin and encode your contract on the ledger. Everyone sees, and you accomplish automatic fulfillment. Brokers, real estate agents, hard money lenders, and anyone associated with the property game can profit.

Healthcare

Personal health records could be encoded and stored on the blockchain with a private key which would grant access only to specific individuals. The same strategy could be used to ensure that research is conducted via HIPAA laws (in a secure and confidential way).

Receipts of surgeries could be stored on a blockchain and automatically sent to insurance providers as proof-of-delivery. The ledger, too, could be used for general health care management, such as supervising drugs, regulation compliance, testing results, and managing healthcare supplies.

Smart Contracts are Awesome!

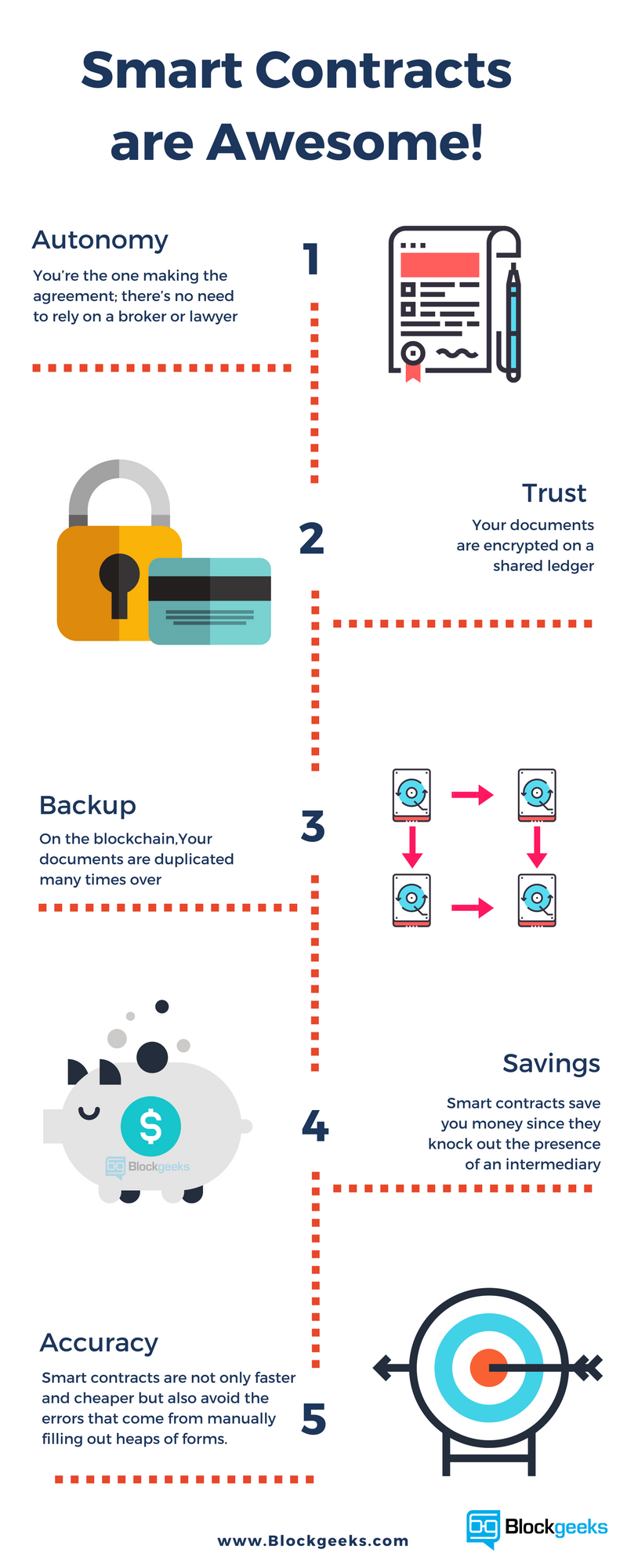

Here’s what smart contracts give you: Autonomy – You’re the one making the agreement; there’s no need to rely on a broker, lawyer or other intermediaries to confirm. Incidentally, this also knocks out the danger of manipulation by a third party, since execution is managed automatically by the network, rather than by one or more, possibly biased, individuals who may err.

Trust – Your documents are encrypted on a shared ledger. There’s no way that someone can say they lost it. Backup – Imagine if your bank lost your savings account. On the blockchain, each and every one of your friends has your back.

Your documents are duplicated many times over.Safety – Cryptography, the encryption of websites, keeps your documents safe. There is no hacking. In fact, it would take an abnormally smart hacker to crack the code and infiltrate.

Speed – You’d ordinarily have to spend chunks of time and paperwork to manually process documents.

Smart contracts use software code to automate tasks, thereby shaving hours off a range of business processes.Savings – Smart contracts save you money since they knock out the presence of an intermediary. You would, for instance, have to pay a notary to witness your transaction.

Accuracy – Automated contracts are not only faster and cheaper but also avoid the errors that come from manually filling out heaps of forms.

Here’s how Jeff Garzik, owner of blockchain services Bloq, described smart contracts:“Smart contracts … guarantee a very, very specific set of outcomes. There’s never any confusion and there’s never any need for litigation.”

“Smart Contracts are where the rubber meets the road for businesses and blockchain technology. While a few highly specialized distributed financial services use cases for blockchain have appeared—for example, payment ledger services for the Yangon Stock Exchange in Myanmar. Its services on top of blockchain that are really interesting.

In the Yangon Exchange, it solves the problem of distributed settlement in a trading system that only synchronizes trades twice a day.

But the autonomous execution capacities of smart contracts extends the transactional security assurance of blockchain into situations where complex, evolving context transitions are required. And it’s this possibility that has Amazon, Microsoft Azure and IBM Bluemix rolling out Blockchain-as-a-Service (Baas) from the cloud.” – Patrick Hubbard, Head Geek, SolarWinds

Now for Problems

Smart contracts are far from perfect. What if bugs get in the code? Or how should governments regulate such contracts? Or, how would governments tax these smart contract transactions? As a case in point, remember my rental situation?

What happens if I send the wrong code, or, as lawyer Bill Marino points out, I send the right code, but my apartment is condemned (i.e., taken for public use without my consent) before the rental date arrives? If this were the traditional contract, I could rescind it in court, but the blockchain is a different situation.

The contract performs, no matter what.The list of challenges goes on and on. Experts are trying to unravel them, but these critical issues do dissuade potential adopters from signing on. And here’s To the Future of Smart Contracts… Part of the future of smart contracts lies in entangling these issues.

In Cornell Tech, for instance, lawyers, who insist that smart contracts will enter our everyday life, have dedicated themselves to researching these concerns.

Actually, when it comes to smart contracts, we’re stepping into a sci-fi screen. The IT resource center, Search Compliance suggests that smart contracts may impact changes in certain industries, such as law.

In that case, lawyers will transfer from writing traditional contracts to producing standardized smart contract templates, similar to the standardized traditional contracts that you’ll find on LegalZoom.

Other industries such as...continue reading:

https://blockgeeks.com/guides/smart-contracts/-

Francisco Gimeno - BC Analyst I was talking yesterday to some friends who work as lawyers. They were telling me they have so much work they can't stop and read about smart contracts, block chain, etc.... well, beyond my personal opinion that if you are overwhelmed by work it means your planning is not so good, I told them that horses' owners at the end of the 19th century were also overwhelmed as there was a big transport business for them but because of that they didn't see the sign of the times and they lost everything to the motor vehicles. In an era of smartphones and smart everything, smart contracts are the solution to many issues nowadays and when on the mainstream this is going to affect every sector and every person. I know more than yesterday about this by reading this article, and that is enough for me.

-

-

What is a cryptocurrency exchange?

Cryptocurrency exchanges are websites where you can buy, sell or exchange cryptocurrencies for other digital currency or traditional currency like US dollars or Euro. For those that want to trade professionally and have access to fancy trading tools, you will likely need to use an exchange that requires you to verify your ID and open an account.

If you just want to make the occasional, straightforward trade, there are also platforms that you can use that do not require an account.

Types of exchanges- Trading Platforms – These are websites that connect buyers and sellers and take a fee from each transaction.

- Direct Trading – These platforms offer direct person to person trading where individuals from different countries can exchange currency. Direct trading exchanges don’t have a fixed market price, instead, each seller sets their own exchange rate.

- Brokers – These are websites that anyone can visit to buy cryptocurrencies at a price set by the broker. Cryptocurrency brokers are similar to foreign exchange dealers.

What to look out for before joining an exchange

It’s important to do a little homework before you start trading. Here are a few things you should check before making your first trade.- Reputation – The best way to find out about an exchange is to search through reviews from individual users and well-known industry websites. You can ask any questions you might have on forums like BitcoinTalk or Reddit.

- Fees – Most exchanges should have fee-related information on their websites. Before joining, make sure you understand deposit, transaction and withdrawal fees. Fees can differ substantially depending on the exchange you use.

- Payment Methods – What payment methods are available on the exchange? Credit & debit card? wire transfer? PayPal? If an exchange has limited payment options then it may not be convenient for you to use it. Remember that purchasing cryptocurrencies with a credit card will always require identity verification and come with a premium price as there is a higher risk of fraud and higher transaction and processing fees. Purchasing cryptocurrency via wire transfer will take significantly longer as it takes time for banks to process.

- Verification Requirements – The vast majority of the Bitcoin trading platforms both in the US and the UK require some sort of ID verification in order to make deposits & withdrawals. Some exchanges will allow you to remain anonymous. Although verification, which can take up to a few days, might seem like a pain, it protects the exchange against all kinds of scams and money laundering.

- Geographical Restrictions – Some specific user functions offered by exchanges are only accessible from certain countries. Make sure the exchange you want to join allows full access to all platform tools and functions in the country you currently live in.

- Exchange Rate – Different exchanges have different rates. You will be surprised how much you can save if you shop around. It’s not uncommon for rates to fluctuate up to 10% and even higher in some instances.

The Best Cryptocurrency Exchanges

Today there are a host of platforms to choose from, but not all exchanges are created equal. This list is based on user reviews as well as a host of other criteria such as user-friendliness, accessibility, fees, and security. Here are ten of the best crypto exchanges in no specific order.

Coinbase Backed by trusted investors and used by millions of customers globally, Coinbase is one of the most popular and well-known brokers and trading platforms in the world. The Coinbase platform makes it easy to securely buy, use, store and trade digital currency.

Users can purchase bitcoins, Ether and now Litecoin from Coinbase through a digital wallet available on Android & iPhone or through trading with other users on the company’s Global Digital Asset Exchange (GDAX) subsidiary. GDAX currently operates in the US, Europe, UK, Canada, Australia and Singapore.

GDAX does not currently charge any transfer fees for moving funds between your Coinbase account and GDAX account. For now, the selection of tradable currencies will, however, depend on the country you live in. Check out the Coinbase FAQ and GDAX FAQ- Pros: Good reputation, security, reasonable fees, beginner friendly, stored currency is covered by Coinbase insurance.

- Cons: Customer support, limited payment methods, limited countries supported, non-uniform rollout of services worldwide, GDAX suitable for technical traders only.

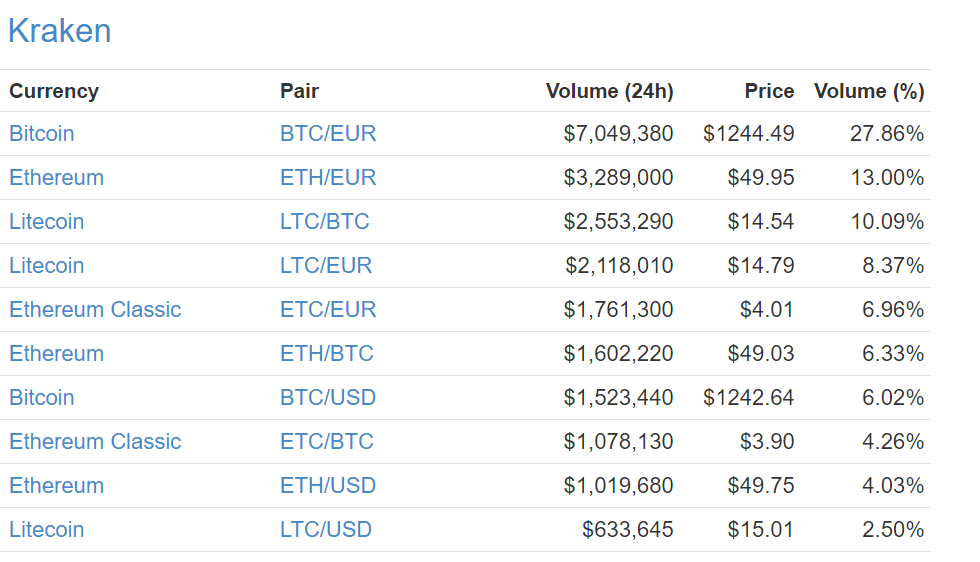

KrakenFounded in 2011, Kraken is the largest Bitcoin exchange in euro volume and liquidity and is a partner in the first cryptocurrency bank. Kraken lets you buy and sell bitcoins and trade between bitcoins and euros, US Dollars, Canadian Dollars, British Pounds and Japanese Yen.

It’s also possible to trade digital currencies other than Bitcoin like Ethereum, Monero, Ethereum Classic, Augur REP tokens, ICONOMI, Zcash, Litecoin, Dogecoin, Ripple and Stellar/Lumens. For more experienced users, Kraken offers margin trading and a host of other trading features. Kraken is a great choice for more experienced traders. Check out the Kraken FAQ- Pros: Good reputation, decent exchange rates, low transaction fees, minimal deposit fees, feature rich, great user support, secure, supported worldwide.

- Cons: Limited payment methods, not suitable for beginners, unintuitive user interface.

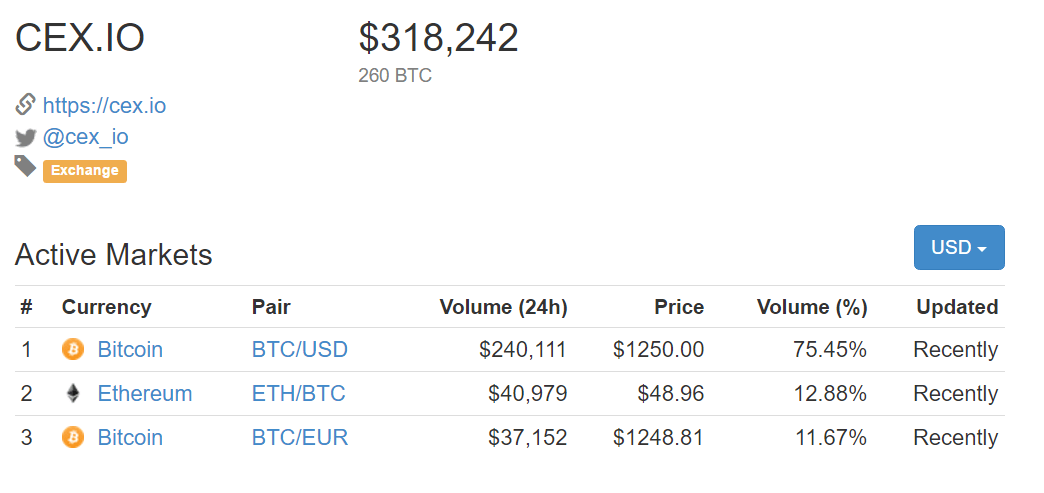

Cex.ioCex.io provides a wide range of services for using bitcoin and other cryptocurrencies. The platform lets users easily trade fiat money with cryptocurrencies and conversely cryptocurrencies for fiat money. For those looking to trade bitcoins professionally, the platform offers personalized and user-friendly trading dashboards and margin trading.

Alternatively, CEX also offers a brokerage service which provides novice traders an extremely simple way to buy bitcoin at prices that are more or less in line with the market rate. The Cex.io website is secure and intuitive and cryptocurrencies can be stored in safe cold storage. Check out the Cex.io FAQ- Pros: Good reputation, good mobile product, supports credit cards, beginner friendly, decent exchange rate, supported worldwide.

- Cons: Average customer support, drawn out verification process, depositing is expensive.

ShapeShiftShapeShift is the leading exchange that supports a variety of cryptocurrencies including Bitcoin, Ethereum, Monero, Zcash, Dash, Dogecoin and many others. Shapeshift is great for those who want to make instant straightforward trades without signing up to an account or relying on a platform to hold their funds.

ShapeShift does not allow users to purchase crypto’s with debit cards, credit cards or any other payment system. The platform has a no fiat policy and only allows for the exchange between bitcoin and the other supported cryptocurrencies. Visit the Shapeshift FAQ- Pros: Good reputation, beginner friendly, Dozens of Crypto’s available for exchange, fast, reasonable prices.

- Cons: Average mobile app, no fiat currencies, limited payment options and tools.

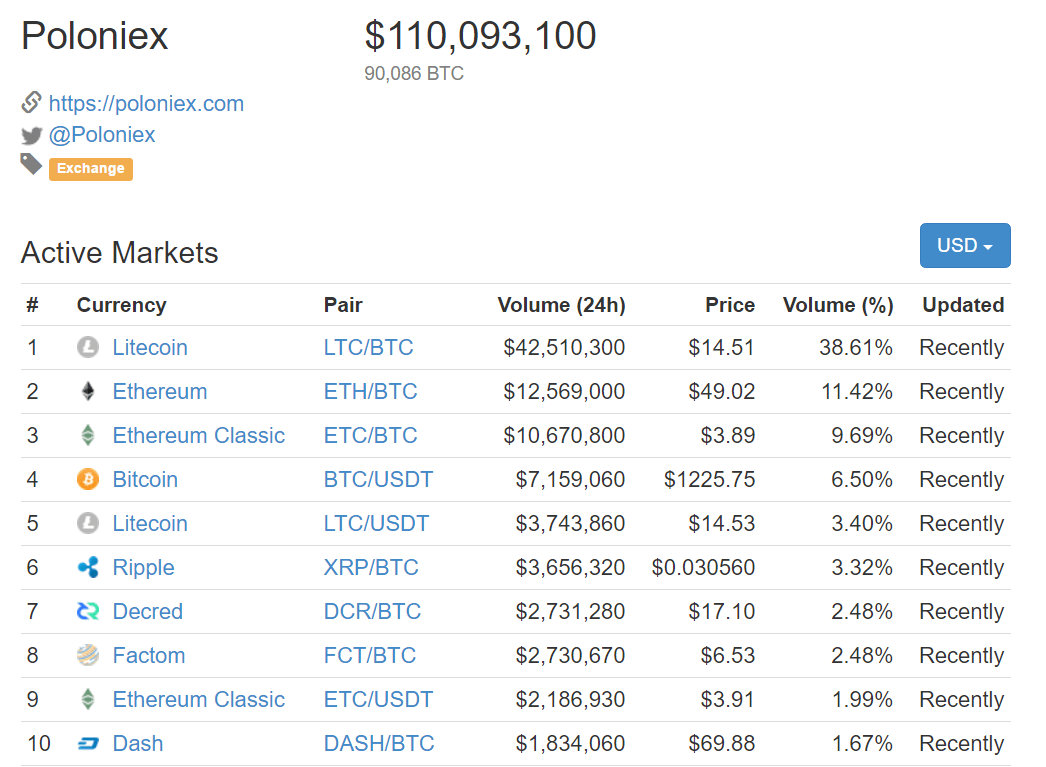

PoloniexFounded in 2014, Poloniex is one of the world’s leading cryptocurrency exchanges. The exchange offers a secure trading environment with more than 100 different Bitcoin cryptocurrency pairings and advanced tools and data analysis for advanced traders. As one of the most popular trading platforms with the highest trading volumes, users will always be able to close a trade position.

Poloniex employs a volume-tiered, maker-taker fee schedule for all trades so fees are different depending on if you are the maker or the taker. For makers, fees range from 0 to 0.15%, depending on the amount traded.For takers, fees range from 0.10 to 0.25%. There are no fees for withdrawals beyond the transaction fee required by the network.

One of the unique tools on the Poloniex platform is the chat box which is constantly filled with user help and just about everything. Any user can write almost anything but inappropriate comments are eventually deleted by moderators. It can sometimes be hard to distinguish the good advice from the bad, but the Chatbox is a great tool that will keep you engaged.- Pros: fast account creation, feature rich, BTC lending, high volume trading, user-friendly, low trading fees, open API.

- Cons: Slow customer service, no fiat support.

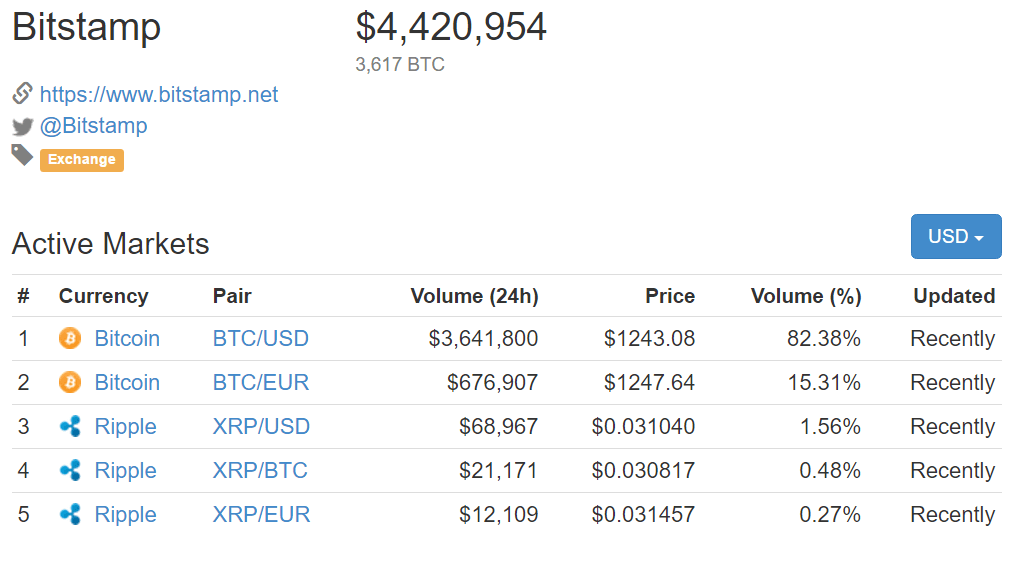

BitstampBitstamp is a European Union based bitcoin marketplace founded in 2011. The platform is one of the first generation bitcoin exchanges that has built up a loyal customer base. Bitstamp is well known and trusted throughout the bitcoin community as a safe platform.

It offers advanced security features such as two-step authentication, multisig technology for its wallet and fully insured cold storage. Bitstamp has 24/7 support and a multilingual user interface and getting started is relatively easy. After opening a free account and making a deposit, users can start trading immediately. Check out the Bitstamp FAQ and the Fee Schedule- Pros: Good reputation, high-level security, worldwide availability, low transaction fees, good for large transactions.

- Cons: Not beginner friendly, limited payment methods, high deposit fees, user interface.

CoinMama

CoinMama is a veteran broker platform that anyone can visit to buy bitcoin or Ether using your credit card or cash via MoneyGram and the Western Union. CoinMama is great for those who want to make instant straightforward purchases of digital currency using their local currency.

Although the CoinMama service is available worldwide, users should be aware that some countries may not be able to use all the functions of the site. CoinMama is available in English, German, French, Italian and Russian. Check out the CoinMama FAQ- Pros: Good reputation, beginner friendly, great user interface, good range of payment options, available worldwide, fast transaction time.

- Cons: High exchange rates, a premium fee for credit card, no bitcoin sell function, average user support.

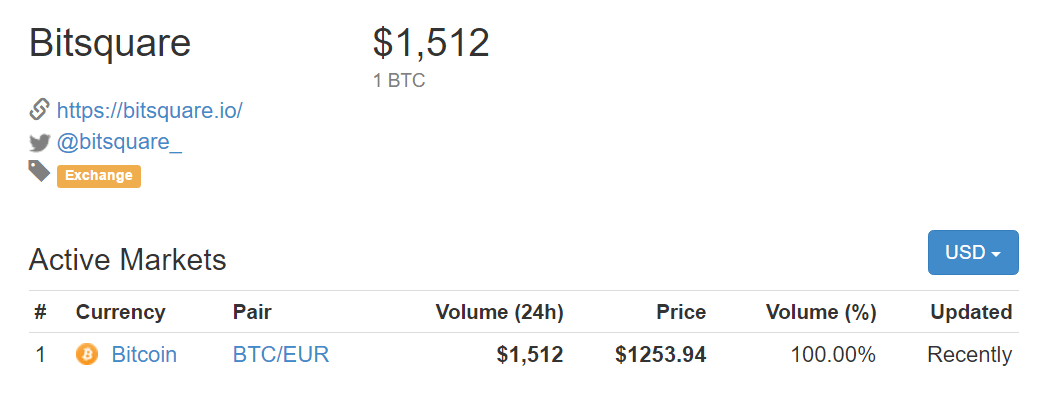

BitsquareBitsquare is a user-friendly peer to peer exchange that allows you to buy and sell bitcoins in exchange for fiat currencies or cryptocurrencies. Bitsquare markets itself as a truly decentralized and peer to peer exchange that is instantly accessible and requires no need for registration or reliance on a central authority.

Bitsquare never holds user funds and no one except trading partners exchange personal data. The platform offers great security with multisig addresses, security deposits and purpose built arbitrator system in case of trade disputes. If you want to remain anonymous and don’t trust anyone, Bitsquare is the perfect platform for you. Check out the Bitsquare FAQ- Pros: Good reputation, secure & private, a vast amount of cryptocurrencies available, no sign-up, decent fees, open source, available worldwide, good for advanced traders.

- Cons: Limited payment options, average customer support, not beginner friendly.

LocalBitcoinLocalBitcoin is a P2P Bitcoin exchange with buyers and sellers in thousands of cities around the world. With LocalBitcoins, you can meet up with people in your local area and buy or sell bitcoins in cash, send money through PayPal, Skrill or Dwolla or arrange to deposit cash at a bank branch.

LocalBitcoinLocalBitcoin is a P2P Bitcoin exchange with buyers and sellers in thousands of cities around the world. With LocalBitcoins, you can meet up with people in your local area and buy or sell bitcoins in cash, send money through PayPal, Skrill or Dwolla or arrange to deposit cash at a bank branch.

LocalBitcoins only take a commission of 1% from the sellers who set their own exchange rates.

To ensure trading is secure, LocalBitcoins takes a number of precautions. To start, the platform rates each trader with a reputation rank and publicly displays past activities. Also, once a trade is requested, the money is held on LocalBitcoins’ escrow service.

After the seller confirms the trade is completed the funds are released. If something does happen to go wrong, LocalBitcoins has a support and conflict resolution team to resolve conflicts between buyers and sellers. Check out LocalBitcoins FAQ- Pros: No ID required, beginner friendly, usually free, instant transfers, available worldwide.

- Cons: Hard to buy large amounts of bitcoin, high exchanges rates.

-

By

Admin

Admin - 0 comments

- 2 likes

- Like

- Share