For those of you that do not know, Goldman Sachs is one of the world’s leading financial institutions. Goldman Sachs provides a wide range of financial services, such as investment banking and asset management; the group reported a net revenue of $30.61 billion in 2016.

In short, Goldman Sachs is a very influential player amongst financial institutions, and this is what the group had to say about the cryptocurrency market.

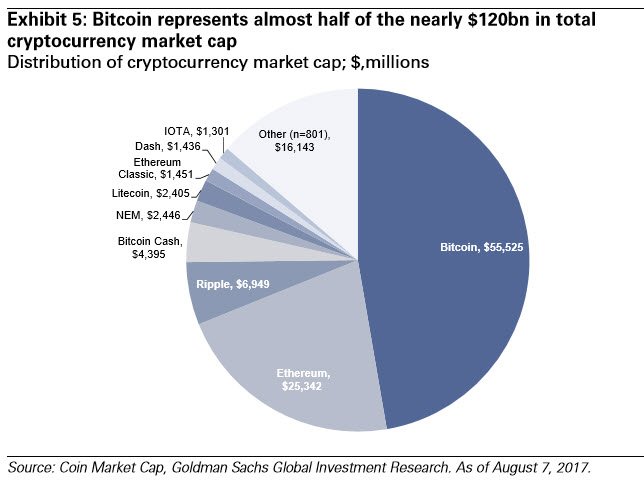

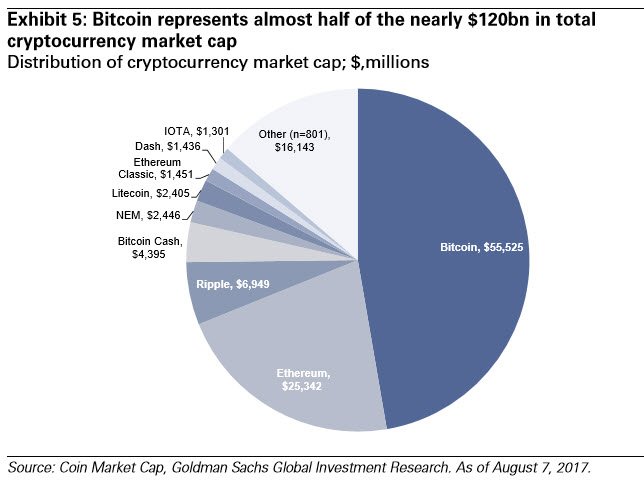

In a note circulated by Robert D. Boroujerdi, an analyst at Goldman Sachs, he indicated that: 'with the total value of cryptocurrencies nearing $120 billion, it was becoming harder for institutional investors to ignore the market'.

Considering that the value of the cryptocurrency market was $40 billion at the start of the year, there are significant growth opportunities that financial institutions could potentially capitalise on. Should Goldman Sachs whole-heartedly embrace the cryptocurrency market, this may signal to other financial institutions to do same.

As of now, many financial institutions have predominantly held back from fully committing to the crypto-space. A big reason for this, is the risk of uncertainty in the market with regard to how it will be regulated. For example, The Securities and Exchange Commission (SEC) recently ruled that initial coin offerings (ICOs) can be regarded as securities, and as a result, they should be subject to securities regulation.

Thus, it is entirely possible that, as a clearer picture is formed with regard to how the crypto-space is regulated, the more capital that financial institutions may commit to cryptocurrencies, in hopes to capture the growth that the space has experienced so far.Goldman Sachs On Initial Coin Offerings

In a Goldman Sachs FAQ, held for institutional investors, the group highlighted the increasing popoularity of ICOs in the market. Over $1 billion has been raised so far this year through ICOs.

ICOs, as a method of raising capital, has proved far more popular amongst start-ups than Angel & Seed VC funding.

Similarly to the manner in which financial institutions profit from a company’s Initial Public Offering (IPO), there may be an opportunity for financial institutions such as Goldman Sachs, to position themselves in such a way that allows them to benefit monetarily from ICOs. Given the substantial amount of money that ICOs normally raise, ICOs could be a very lucrative source of revenue for financial institutions in the future.

Long Tail In The Crypto-Market

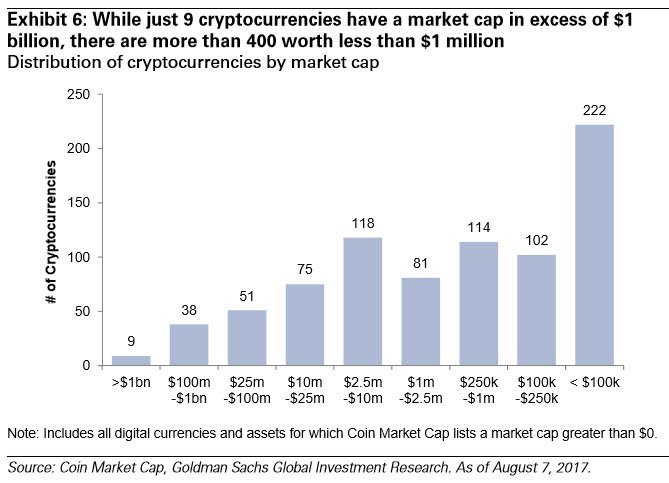

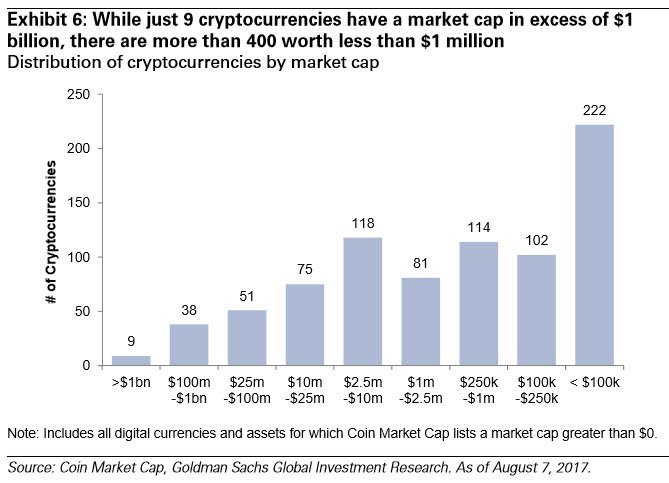

Goldman Sachs also highlighted the long tail in the cryptocurrency market, alluding to the disproportionate market capitalisation across digital coins. As Goldman Sachs noted in the FAQ: ‘There are currently over 800 cryptocurrencies out there, though just 9 have a market capitalisation in excess of $1 billion'.

The obvious implications of having such a concentration of capital in a handful of cryptocurrencies is that the cryptocurrency market is really only being driven by the performance of a few coins. This is especially true for Bitcoin, where crypto-market movements are heavily linked to Bitcoin’s performance.

However, this is to be expected when Bitcoin, in terms of market capitalisation, represents nearly half of all cryptocurrency market capitalisation. It is important to note that tailwinds do also provide investment opportunities, as one is likely to find undervalued coins that have significant room to grow and realise potential.

Conclusion

Goldman Sachs’s recognition of the potential of cryptocurrencies is an important one. It will serve as... continue reading:

https://busy.org/cryptocurrency/@adsactly/goldman-sachs-on-the-cryptocurrency-market

In short, Goldman Sachs is a very influential player amongst financial institutions, and this is what the group had to say about the cryptocurrency market.

In a note circulated by Robert D. Boroujerdi, an analyst at Goldman Sachs, he indicated that: 'with the total value of cryptocurrencies nearing $120 billion, it was becoming harder for institutional investors to ignore the market'.

Considering that the value of the cryptocurrency market was $40 billion at the start of the year, there are significant growth opportunities that financial institutions could potentially capitalise on. Should Goldman Sachs whole-heartedly embrace the cryptocurrency market, this may signal to other financial institutions to do same.

As of now, many financial institutions have predominantly held back from fully committing to the crypto-space. A big reason for this, is the risk of uncertainty in the market with regard to how it will be regulated. For example, The Securities and Exchange Commission (SEC) recently ruled that initial coin offerings (ICOs) can be regarded as securities, and as a result, they should be subject to securities regulation.

Thus, it is entirely possible that, as a clearer picture is formed with regard to how the crypto-space is regulated, the more capital that financial institutions may commit to cryptocurrencies, in hopes to capture the growth that the space has experienced so far.Goldman Sachs On Initial Coin Offerings

In a Goldman Sachs FAQ, held for institutional investors, the group highlighted the increasing popoularity of ICOs in the market. Over $1 billion has been raised so far this year through ICOs.

ICOs, as a method of raising capital, has proved far more popular amongst start-ups than Angel & Seed VC funding.

Similarly to the manner in which financial institutions profit from a company’s Initial Public Offering (IPO), there may be an opportunity for financial institutions such as Goldman Sachs, to position themselves in such a way that allows them to benefit monetarily from ICOs. Given the substantial amount of money that ICOs normally raise, ICOs could be a very lucrative source of revenue for financial institutions in the future.

Long Tail In The Crypto-Market

Goldman Sachs also highlighted the long tail in the cryptocurrency market, alluding to the disproportionate market capitalisation across digital coins. As Goldman Sachs noted in the FAQ: ‘There are currently over 800 cryptocurrencies out there, though just 9 have a market capitalisation in excess of $1 billion'.

The obvious implications of having such a concentration of capital in a handful of cryptocurrencies is that the cryptocurrency market is really only being driven by the performance of a few coins. This is especially true for Bitcoin, where crypto-market movements are heavily linked to Bitcoin’s performance.

However, this is to be expected when Bitcoin, in terms of market capitalisation, represents nearly half of all cryptocurrency market capitalisation. It is important to note that tailwinds do also provide investment opportunities, as one is likely to find undervalued coins that have significant room to grow and realise potential.

Conclusion

Goldman Sachs’s recognition of the potential of cryptocurrencies is an important one. It will serve as... continue reading:

https://busy.org/cryptocurrency/@adsactly/goldman-sachs-on-the-cryptocurrency-market