blockchain technology

- by William G. Miller

- 7 posts

-

Banking Everywhere

From our ancestors exchanging livestock tens of thousands of years ago to the brokers trading stocks on Wall Street today, bartering is a foundational aspect of human society.

Throughout history, we have traded what we have for what we need, and through these transactions, we have survived.As we made the transition from trading in cattle and grains to dollars and cents, we started relying more and more heavily on financial institutions such as banks, investment firms, and lenders to help us manage our assets.

As of 2015, 93 percentof U.S. households had at least one checking or savings account, and that’s not including the millions of people who also have mortgages, credit cards, or other ties to the finance industry.For decades, nearly every aspect of our lives has involved a third-party financial institution in some way, but despite their ubiquity, these institutions are fundamentally flawed.

Unexpected fees and slow transaction times can regularly leave users frustrated, but even those problems are relatively benign compared to other, more foundational issues.

Because they store data on centralized servers, banks and other traditional financial institutions are susceptible to security breaches. In some cases, those breaches can lead to the loss of huge sums of money, such as when hackers stole $80 million from Bangladesh’s central bank in 2016.

In other instances, identities are the target, like when a Brazilian bank’s website was hijacked for five hours in April, during which account holders willingly supplied the hackers with sensitive personal information.

These institutions also have barriers to entry that prevent some from participating in them. For example, a single past mistake like a bounced check can leave a person blacklisted from opening a bank account for several years, and in some nations, such as Saudi Arabia, women aren’t even allowed to open accounts without permission from their husbands.

For these reasons and others, a whopping 38 percent of the adult population worldwide doesn’t have a bank account. That’s roughly 2 billion people who are largely unable to participate in the world economy as it currently operates.Thankfully, an alternative to traditional finance has emerged in the form of the blockchain.Enter: The Blockchain

A blockchain is a distributed digital ledger, which means it doesn’t have one centralized authority verifying and recording transactions (like a bank or a brokerage does). Instead, when two parties want to trade blockchain assets (better known as cryptocurrencies), the request is sent out to a network of computers.

These “nodes” individually verify and record the transaction on their identical copy of the ledger, and a group of these transactions will become one timestamped block on the blockchain.This process can be completed within seconds, and because it is distributed (and not confined to one central server), a blockchain is protected against the security issues that plague traditional finance institutions.

Anyone can participate in the blockchain economy, and transactions can be completed anonymously, further protecting individuals’ identities.Over the last year, these various benefits have caused interest in cryptocurrencies to skyrocket. From a relatively paltry $17 billion in January, the global cryptocurrency market cap has grown to $126 billion.

Wall Street traders are turning their attention to cryptocurrency exchanges, and instead of debit cards, customers are now using their crypto wallets to buy everything from coffee to video games.

Despite this growth, however, the blockchain economy is still in its nascent stages, and all of the kinks haven’t been worked out yet.One of the biggest issues involves how cryptocurrencies are traded. While the blockchain itself is decentralized, the major exchanges used for the buying and selling of assets are not.

That means that, just like banks, these exchanges are susceptible to security breaches, so when traders entrust them with their funds, they are leaving themselves vulnerable. In fact, just a few months ago, one of the largest bitcoin exchanges was hacked, compromising the data of 30,000 customers and leading to the loss of an estimated $870,000.

Because trading is spread out over dozens of exchanges, individual exchanges can also have problems meeting volume demands as interest in crypto grows. This lack of liquidity can force traders to pay higher fees, as well as lead to “flash crashes” that can send the value of a cryptocurrency plummeting from hundreds of dollars (or more) down to mere cents in just a single second.

Of course, there have been attempts to make decentralized exchanges, but these, too, are problematic. For example, they have inherently higher latency, higher fees, less fluidity, and an increased potential for unfairness than centralized exchanges.

But new, alternative ways to exchange cryptocurrencies are emerging, and they could help solve many of the ongoing issues. One of these newest contenders is AirSwap, which is a platform that is built off of a truly peer-to-peer model.Peer-To-Peer Trading

AirSwap is a new way to trade Ethereum tokens. Unlike bitcoin, which is essentially a form of digital money, a token offers its holder some utility within a system, such as voting power, access to special features, or an amount of a virtual currency.

Because Ethereum’s decentralized platform was designed specifically to support token networks, it has become the go-to blockchain for anyone looking to launch a new token.

When ready to trade these tokens, members of the AirSwap community can announce that they are interested in trading and connect directly with other members — no third party required. To ensure they’re getting a fair deal, AirSwap provides real-time price suggestions before committing to a transaction, both for sellers and buyers.

AirSwap members can even build their own storefronts, creating new ERC20 tokens from the ground up and seamlessly bringing them to market.Because tokens are in the possession of either the buyer (the “maker” of the order) or the seller (the “taker” of the order) right up until a smart contract is executed on the Ethereum blockchain, the AirSwap protocol eliminates the opportunity for theft provided by centralized exchanges.

Liquidity is no longer a problem either, as sellers aren’t beholden to the asset price set by the exchange. Because each deal is negotiated directly between the two parties and not set up through the blockchain, the problems of decentralized exchanges are also eliminated.

AirSwap takes everything that makes the blockchain itself revolutionary — its high level of security, lack of a centralized authority, and low barrier to entry — and applies it to the trading of blockchain assets.

All that token traders need to do to take advantage of this new decentralized exchange is purchase the AirSwap Token (AST), which will launch on October 10. After that, they’ll be free to use AirSwap to frictionlessly manage their tokenized assets in this new era of finance.

Follow more reports about the blockchain on Futurism here: https://futurism.com/blockchain-is-radically-transforming-societys-oldest-institutions/

-

By

Admin

Admin - 0 comments

- 7 likes

- Like

- Share

-

By

-

As many as four blockchain-related amendments, funding various initiatives, could find their way into the European Union's 2018 budget.

Public documents published yesterday reveal a proposal to use blockchain as a payments rail for an EU-wide free Wi-Fi access project, as well as funding proposals for two working groups dedicated to the tech.

There are actually two amendments related to the idea of using blockchain as part of the "WiFi4EU", including one from the Group of the Progressive Alliance of Socialists and Democrats political party as well as the Parliamentary Committee on Industry, Research and Energy. The party has proposed allotting €10 million euros to the initiative, whereas the committee has proposed just €1 million euros.

The aim, according to the amendments, is to test "the feasibility and demonstrate the usefulness of using blockchain technology in the interaction between the EU Institutions and the citizens."The budget document goes on to explain:"As a starting point, the project will aim at underpinning the voucher scheme of the Wifi4EU project with blockchain technology, allowing for transparent and traceable payment of EU funds to the private companies, which install the Wifi4EU infrastructure. It will also provide the citizens with the tools to examine the transactions registered in the ledger. It will rely on Open Source software and seek collaboration with Member States for providing blockchain services (also known as Govchains)."

WiFi4EU was first unveiled in May with a budget of €120 million euros, with a goal to offer free connectivity across the bloc over the next three years.The 2018 budget also includes a proposal to use DLTs as part of humanitarian efforts by the EU to help companies and groups which aid "migrants [and] displaced groups," among others.

CoinDesk previously reported on efforts within the European Parliament to advance this use case.

The €1 million euro investment will also go in part towards companies developing DLT platforms which can aid the union in this effort.An additonal €1 million euros will go toward the Horizontal Task Force on Distributed Ledger Technology, which aims to analyze how the parliament can effectively utilize DLTs applications.

The task force was first announced in 2015, and was originally formed to watch the development of blockchain and DLT platforms.

Continue reading to discover even more stories like this on Coindesk here:

https://www.coindesk.com/eu-budget-amendments-call-millions-blockchain-funding/ -

Earlier this week, JPMorgan Chase CEO Jamie Dimon made a controversial statement at a banking industry conference organized by Barclays, condemning bitcoin and threatening to fire portfolio managers within JPMorgan who have been trading bitcoin.

Despite the warning, according to sources, JPMorgan Securities Ltd. purchased massive amounts of bitcoin through Swedish Bitcoin exchanges when the price dipped to the US$3,000 level.

Dimon’s baseless comments toward bitcoin and his threats to traders led to criticism from bitcoin experts, bankers and former JPMorgan executives including former JPMorgan head of global macro Alex Gurevich.More to the point, Dimon demonstrated a complete lack of knowledge of the structure of bitcoin and blockchain technology in general when he stated that bitcoin should be closed down by the government in the near future.

CNBC analyst Brian Kelly criticized Dimon’s statement, explaining that bitcoin was specifically designed to circumvent governments and authorities by creating a decentralized financial system.

Despite Dimon’s strong condemnation of bitcoin and his threats toward JPMorgan traders, many trusted sources including bitcoin developer Andrew DeSantis and bitcoin trader I am Nomad revealed that JPMorgan Securities Ltd. had purchased massive amounts of Bitcoin XBT, an instrument tracking the price of bitcoin, through a Swedish exchange.

Similar to Digital Currency Group’s Bitcoin Investment Trust (GBTC), Bitcoin XBT is an investment vehicle allowing institutional and retail traders to invest in bitcoin through strictly regulated channels in the public stock market.

Both DeSantis and Iam Nomad revealed that many accounts under JPMorgan Securities Ltd. purchased bitcoin as its price dipped below $3,000.

On the World Crypto Network, a YouTube news channel and cryptocurrency podcast hosted by Vortex, bitcoin consultant and derivatives trader Tone Vays noted that it is not possible any trader at JPMorgan directly invested in a bitcoin investment vehicle.

He suggested that a more likely scenario was that JPMorgan processed bank transfers to Nasdaq Nordic’s stock exchange, in which Bitcoin XBT is supported, on behalf of their customers.For his part, IamNomad noted that a department at JPMorgan could have invested in Bitcoin XBT since its traders are not allowed to invest in bitcoin directly.

However, a more reasonable explanation of JPMorgan’s bank transfers to Nasdaq Nordic was that JPMorgan clients were purchasing bitcoin exchange traded notes in Bitcoin XBT.

Whether JPMorgan itself purchased shares in Bitcoin XBT is of minimal importance. It is crucial for investors and traders to take away the fact that an increasing number of JPMorgan traders are willing to purchase bitcoin and demonstrate enthusiasm even after the harsh criticism toward bitcoin issued by the company’s CEO.

As mainstream adoption of bitcoin as a digital currency, a long-term investment and a safe haven asset continues to increase at an exponential rate, demand for the crypto from public markets as well as professional and institutional traders will increase rapidly.

Regardless of the recent closure of Chinese bitcoin exchanges, international markets and leading regional bitcoin exchange markets are strengthening with efficient regulations and the emergence of major conglomerates within the global bitcoin industry....

Discover more articles like this from the Merkle here: https://themerkle.com/jpmorgan-clients-purchase-bitcoin-in-stock-market-despite-ceos-warnings/

-

By

Admin

Admin - 0 comments

- 6 likes

- Like

- Share

-

By

-

On the most recent episode of This Week in Startups, host Jason Calacanis sat down with Blockchain CEO Peter Smith to discuss everything from darknet markets to Ethereum-based initial coin offerings (ICOs).

During the chat, Smith also shared his views on the possibility of a government issuing their own digital currency in the near future.For those who don’t know, Blockchain is the most widely-used consumer bitcoin wallet in the world.

They also recently added support for ether.24 Months from a Government-Backed Digital CurrencyAt one point during the conversation, Smith noted that he went back and forth with Bank of England governor Mark Carney on how a government will issue a sovereign digital currency at the World Economic Forum.

When Calacanis asked Smith how far away a government is from issuing their own digital currency, Smith responded, “Not far. 24 months from a major government — not from a little one but a major one.”Smith then clarified that he’s talking about a “top 30” government in the world.In terms of the United Kingdom, which is where Blockchain is based, Smith guessed that they would be the first of the G7 countries to issue a digital currency.

He added that the UK may have moved even faster on this if Brexit hadn't happened.

When it came to the United States, Smith was less bullish on the issuance of a digital currency in the near term. He pointed to gridlock in Washington DC and the dominance of the US dollar in the world today as reasons that the United States will move....continue reading:

https://www.forbes.com/sites/ktorpey/2017/08/30/blockchain-ceo-peter-smith-were-24-months-from-a-top...

-

Francisco Gimeno - BC Analyst I think everybody is expecting this to happen soon or later. Singapore or a small Baltic country is good news, but if a big 30 Government does this, then nothing will stop other governments to do the same when they realize the convenience and the advantages for the economic growth and the need of shifting to a new economy

-

-

How to Invest in Cryptocurrency

Blockchain technology has been heating up in the past several months, thanks in large part to the surge in Bitcoin's price since early May. The cryptocurrency skyrocketed from less than $1,000 in March to an all-time high of $4,440 on August 14.

Given this meteoric rise, it's no surprise that investors are clamoring to figure out how to break into the Bitcoin marketplace. But there are many other cryptocurrencies (such as Ethereum) and blockchain companies on the stock exchange where investors can funnel their money.

However, investing in a cryptocurrency is different than investing in a regular stock. When you invest in a company, you're buying shares of that company and essentially own an extremely small percentage of it. When you invest in Bitcoin or Ethereum, you receive digital tokens that serve different purposes.

With Bitcoin, you get decentralized currency that also happens to be partially anonymous. With Ethereum, you get a piece of the power that runs decentralized apps and smart contracts. Trading cryptocurrencies occurs on dedicated exchanges. Larger exchanges like GDAX, Kraken, Bitfinex, and Gemini typically offer solid volume to trade cryptocurrencies through bank transfers or credit cards.

Coinbase is also an option that is growing in popularity thanks to its ease of use and a built-in wallet. But the trade off here is comparatively higher fees.Poloniex is another exchange that offers more than 80 cryptocurrencies for trading, but the catch is you can only use Bitcoins or other cryptocurrencies to fund these trades.Top Cryptocurrencies to Invest In

There are several paths one can take when deciding in which cryptocurrencies to invest, but a handful of these have risen to the top as the most popular options for investment:- Bitcoin: There's a reason you've heard the name Bitcoin all over the financial news space. The price of the cryptocurrency has increased nearly 8x in the last year as of the time of this writing. Moreover, the original design of Bitcoin ensured that there would never be more than 21 million in existence (and math indicates we'll never actually reach that number). This means Bitcoin is not subject to inflation.

- Ethereum: Arguably the second-most well-known cryptocurrency, the price of Ethereum has exploded more than 3000% in the last year. Even with that growth, the price remains at less than 1/10th of Bitcoin, so it could be a better value play for investors who don't have the resources to

- Litecoin: Litecoin has risen more than 2000% in the last year. The peer-to-peer digital currency acts in a complementary way to Bitcoin, and its comparatively low price makes it a solid entry point for new crypto investors.

- Monero: Think of Monero as a second level of privacy and anonymity beyond what something like Bitcoin offers. The price exploded in 2016, and the market cap swelled from $5 million to $185 million thanks in large part to the cryptocurrency's adoption by the major darknet market AlphaBay. Law enforcement shut down AlphaBay in July 2017.

- Bitcoin Cash: In August 2017, the Bitcoin blockchain spun off a more nimble iteration called Bitcoin Cash. It's essentially identical to Bitcoin, but with the important distinction that it has more block size capacity. The price of the cryptocurrency has already doubled from $300 to more than $600 as of this writing. And if you owned Bitcoin before the split, then you received an equal amount of Bitcoin Cash. There are approximately 16.5 million units of each in existence, which makes Bitcoin Cash the third-most valuable cryptocurrency in the world with a market cap of more than $10 billion.

- Ripple: Ripple is a protocol that permits near instantaneous transaction settlements and reduces transaction fees to mere cents. Some VCs and even several major banks (such as Bank of America, UBS, and BBVA) have implemented Ripple into their systems. The key difference from Bitcoin, though, is that it is centralized and pre-mined.

- ZCash: ZCash operates in a manner similar to Monero. The price of the cryptocurrency surged in June 2017 to nearly $400, but has since leveled off to the sub-$300 range.

Genesis MiningHow to Invest in Blockchain Technology

Blockchain technology powers Bitcoin and other cryptocurrencies, but there are many ways to invest in blockchain tech without pouring your money into these digital currencies. The first is to look into blockchain startups (we'll detail more in the next section).

The second option is crowdfunding platforms, as blockchain startups in their infancy will often look into crowdfunding to get off the ground. A platform called BnkToTheFuture allows investors to place their money into several Bitcoin and blockchain startups.

Another possibility is to invest in the initial coin offerings, or ICOs, of new blockchain projects. Blockchain companies issue cryptocurrencies or other tokens through ICOs in order to raise capital. There is a bit more risk in this route, as this new form of crowdfunding is still rather unregulated, but the returns reported thus far have been stellar.Top Blockchain Stocks & Companies to Invest In

The following six blockchain stocks and companies have become popular investment choices:

BTCS: With a market cap of more than $7 million and shares trading around 14 cents as of this writing, BTCS is a solid entry point for blockchain investors. It's the first blockchain-centric public company in the U.S. and was one of the first entrants into the digital currency space.Global Arena Holding: Global Arena Holding acquires patents related to blockchain tech, but it's also working on applying that tech to ATMs. If successful, this could have major implications for the everyday consumer.DigitalX: DigitalX developed a mobile product called AirPocket that assists with secure cross-border payments from more than 30,000 locations in 14 countries, primarily in North and South America.BTL Group: The Vancouver-based company offers blockchain solutions across several spaces, including banking and fantasy sports.Coinsilium Group: This London-based company invests in other blockchain startups and helps develop them. It was also the first recognized IPO for a blockchain tech company.First Bitcoin Capital: This company focuses on acquiring Bitcoin startups and funding them to develop both hardware and software for the cryptocurrency.More to Learn

The financial potential of blockchain could be tremendous, and...continue reading:

http://uk.businessinsider.com/invest-cryptocurrency-blockchain-technology-2017-8-

Francisco Gimeno - BC Analyst Wow. The ecosystem is full of exciting creatures....hoping that BC will soon be one of them and our tokens very valuable. Please read this article and comment too.

-

Ethereum has made it possible for practically anyone to create their own token. By removing this barrier of entry, there has recently been a huge flood of new tokens to the market.At the time of this article, there are over 5300 ERC-20 tokens out there.

This number is growing considerably every month. However, not all tokens act as a store of value.The Cointelegraph provides a quick overview of the most popular token utilities.It is important to understand that Ethereum tokens have many applications and are not always a share in a startup.

In the coming months, we will likely witness many more types of tokens come to life as the Ethereum ecosystem acquires more strength and support.Governance

Decentralized Autonomous Organizations (DAOs) are companies that function with a certain set of hard-coded rules. These are frequently updated by a decentralized form of leadership.However, when the leadership of a business is comprised of hundreds of individuals, it can be very challenging to take decisions through formal routes of communication.

This is, therefore, a significant scenario where Ethereum tokens can be applied.Startups like District0x implemented a token-based governance system. DNT token holders can vote on what projects should be built next on the platform, and participate in key decisions.Tokenized security

Recently, the SEC ruled that tokens can be securities and therefore need to undergo adequate regulations. Despite these warnings, tokenized securities are still an extremely attractive model for startups.This token utility makes it possible for investors to benefit financially from the success of the startup.

This can either be in the form of dividends, or through a token buy-back program. An example is the gambling site Etheroll, which recently paid out the first dividend round to its investors.In-Dapp currency

Many Dapps have chosen to use their own token for in-dapp interactions between users. In many cases, this increases efficiency and loyalty to the platform.In the Golem network, GNT is necessary for the interaction with the platform. The token is used for transferring value between computing power requesters and providers.Staking mechanism

In some business models, a rigorous quality assurance mechanism is fundamental. This is especially the case for Numerai. Numerai works together with data scientists to create a machine learning-based hedge fund.Users can submit algorithms that can make autonomous trades on the stock market and Numerai rewards them in NMR tokens.

However, in order to avoid submissions of inferior quality, users have to stake a certain amount of NMR tokens on their algorithm before submitting it.If the algorithm delivers the desired results, the creator of the algorithm receives his stake back. If not, then the tokens are burned. This incentivizes data scientists to only submit their very best work.Tokenized assets

Tokenizing assets that are either very...continue reading: https://cointelegraph.com/news/there-are-currently-over-5300-erc-20-tokens-what-are-they-all-for-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

For those of you that do not know, Goldman Sachs is one of the world’s leading financial institutions. Goldman Sachs provides a wide range of financial services, such as investment banking and asset management; the group reported a net revenue of $30.61 billion in 2016.

In short, Goldman Sachs is a very influential player amongst financial institutions, and this is what the group had to say about the cryptocurrency market.

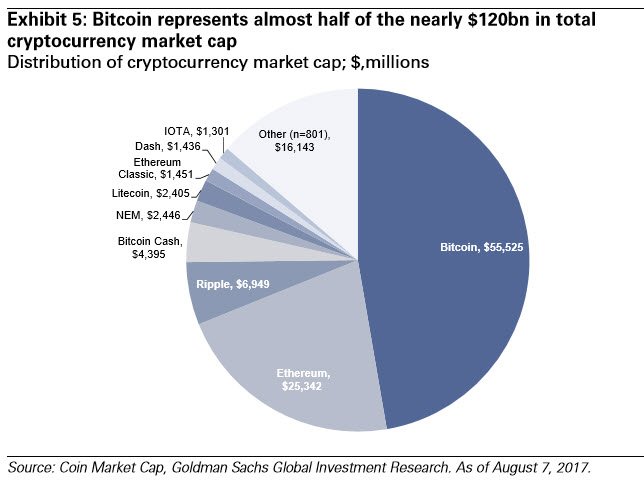

In a note circulated by Robert D. Boroujerdi, an analyst at Goldman Sachs, he indicated that: 'with the total value of cryptocurrencies nearing $120 billion, it was becoming harder for institutional investors to ignore the market'.

Considering that the value of the cryptocurrency market was $40 billion at the start of the year, there are significant growth opportunities that financial institutions could potentially capitalise on. Should Goldman Sachs whole-heartedly embrace the cryptocurrency market, this may signal to other financial institutions to do same.

As of now, many financial institutions have predominantly held back from fully committing to the crypto-space. A big reason for this, is the risk of uncertainty in the market with regard to how it will be regulated. For example, The Securities and Exchange Commission (SEC) recently ruled that initial coin offerings (ICOs) can be regarded as securities, and as a result, they should be subject to securities regulation.

Thus, it is entirely possible that, as a clearer picture is formed with regard to how the crypto-space is regulated, the more capital that financial institutions may commit to cryptocurrencies, in hopes to capture the growth that the space has experienced so far.Goldman Sachs On Initial Coin Offerings

In a Goldman Sachs FAQ, held for institutional investors, the group highlighted the increasing popoularity of ICOs in the market. Over $1 billion has been raised so far this year through ICOs.

ICOs, as a method of raising capital, has proved far more popular amongst start-ups than Angel & Seed VC funding.

Similarly to the manner in which financial institutions profit from a company’s Initial Public Offering (IPO), there may be an opportunity for financial institutions such as Goldman Sachs, to position themselves in such a way that allows them to benefit monetarily from ICOs. Given the substantial amount of money that ICOs normally raise, ICOs could be a very lucrative source of revenue for financial institutions in the future.

Long Tail In The Crypto-Market

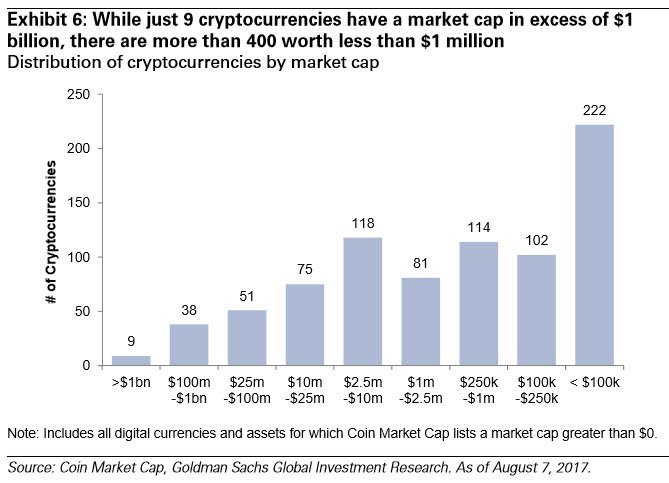

Goldman Sachs also highlighted the long tail in the cryptocurrency market, alluding to the disproportionate market capitalisation across digital coins. As Goldman Sachs noted in the FAQ: ‘There are currently over 800 cryptocurrencies out there, though just 9 have a market capitalisation in excess of $1 billion'.

The obvious implications of having such a concentration of capital in a handful of cryptocurrencies is that the cryptocurrency market is really only being driven by the performance of a few coins. This is especially true for Bitcoin, where crypto-market movements are heavily linked to Bitcoin’s performance.

However, this is to be expected when Bitcoin, in terms of market capitalisation, represents nearly half of all cryptocurrency market capitalisation. It is important to note that tailwinds do also provide investment opportunities, as one is likely to find undervalued coins that have significant room to grow and realise potential.

Conclusion

Goldman Sachs’s recognition of the potential of cryptocurrencies is an important one. It will serve as... continue reading:

https://busy.org/cryptocurrency/@adsactly/goldman-sachs-on-the-cryptocurrency-market-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By