courses

- by William G. Miller

- 5 posts

-

The Times Higher Education World University Rankings for 2018 uses 13 “carefully calibrated performance indicators to provide the most comprehensive and balanced comparisons, trusted by students, academics, university leaders, industry and governments.

” The findings for their 2018 international league table were independently audited for data accuracy by PwC, making this the “only global university rankings subjected to full, independent scrutiny of this nature.

” A quick glance at the list reveals many of the world’s top schools are also ones adding blockchaineducation to their courses and modules. This is an indication that jurisdictional competition between universities is going to now include blockchain technology offerings as institutions compete to attract the best academic talent.

Many industries have already turned to blockchain, and recognized it alongside machine learning and artificial intelligence as fundamental to the transforming global economy.

Organizations like Goldman Sachs, Microsoft, and IBM already have a presence in the space. It was only a matter of time before academia and government followed suit.

To better understand how universities are remaining relevant by incorporating blockchain technology into their curriculums, ETHNewsspoke with Dr. TAN Chuan Hoo of the National University of Singapore, one of Times Higher Education 2018 top performing universities. TAN told ETHNews:“Blockchain is an emerging disruptive technology that has critical applications in the financial sector. It is important that our Information Systems students are equipped with a robust understanding of latest technologies and have updated skillsets to deploy them smartly in key industry sectors, such as the financial industry.

Perhaps there is an equation that describes how technological adoption plays out at institutions of higher education. That might explain why forward thinking academics arrived at a consensus about blockchain’s importance after the power brokers of big business.

This year, we are launching the financial technology specialisation in our Bachelor of Computing (Information Systems) degree programme. In this specialisation, we have three core modules and three elective modules. The module on blockchain technology is one of the three core modules under the financial technology specialisation.”

Regardless, it seems both industry and academia will be exploiting the benefits of blockchain technology long before many governments of the world. If such an equation that describes these relationships does exist, it may be found by one of the following world class academic institutions.

While nearly every school on Times Higher Education’s 2018 list is likely to offer some form of blockchain related course, club, or society, ETHNews took time to identify a few of the pack leaders.

Times Higher Education’s 2018 #2 University of Cambridge, UK

The University of Cambridge has been maintaining academic excellence and has been a world class research institution for nearly 1000 years. Its Centre for Alternative Finance at the Judge Business School recently published a landmark study on cryptocurrencies.

Times Higher Education’s 2018 #8 Imperial College London, UK

Imperial College London often plays second fiddle to the Oxbridges of the United Kingdom; however, their Centre for Cryptocurrency Research and Engineering is already world class.

Times Higher Education’s 2018 #15 University of California, Los Angeles, USA

UCLA’s Blockchain Lab beats out stiff competition in California.

Times Higher Education’s 2018 #19 Cornell, USA

Cornell might be frozen over half of the year, but it’s one of the hottest blockchain universities on the planet. Cornell is where Citi sends their employees to learn from professors like Emin Gun Sirer.

Times Higher Education’s 2018 #22 National University of Singapore

The National University of Singapore has blockchain partnerships with IBM as well as unique course offerings.It will be exciting to see what developments will come out of universities, now that they are catching up to the blockchain technology revolution. TAN continued:“We see teaching blockchain technology as a very good fit in our Bachelor of Computing (Information Systems) degree programme. Our students are not only trained in programming, but also in enterprise platform design, development and deployment. Teaching blockchain technology as an advanced module is a natural, fitting choice.”

Discover more stories like this on Ethnews here:

https://www.ethnews.com/times-higher-education-reveals-academia-is-adopting-blockchain-technology-

- 2

Admin Blockchain Company Task: Follow Ethereum to be awarded 10 Bonus BC Tokens on record as a user. Click on " About Free Tokens " at the top of this page to learn more.- 20 2 votes

- Reply

-

-

What is a cryptocurrency exchange?

Cryptocurrency exchanges are websites where you can buy, sell or exchange cryptocurrencies for other digital currency or traditional currency like US dollars or Euro. For those that want to trade professionally and have access to fancy trading tools, you will likely need to use an exchange that requires you to verify your ID and open an account.

If you just want to make the occasional, straightforward trade, there are also platforms that you can use that do not require an account.

Types of exchanges- Trading Platforms – These are websites that connect buyers and sellers and take a fee from each transaction.

- Direct Trading – These platforms offer direct person to person trading where individuals from different countries can exchange currency. Direct trading exchanges don’t have a fixed market price, instead, each seller sets their own exchange rate.

- Brokers – These are websites that anyone can visit to buy cryptocurrencies at a price set by the broker. Cryptocurrency brokers are similar to foreign exchange dealers.

What to look out for before joining an exchange

It’s important to do a little homework before you start trading. Here are a few things you should check before making your first trade.- Reputation – The best way to find out about an exchange is to search through reviews from individual users and well-known industry websites. You can ask any questions you might have on forums like BitcoinTalk or Reddit.

- Fees – Most exchanges should have fee-related information on their websites. Before joining, make sure you understand deposit, transaction and withdrawal fees. Fees can differ substantially depending on the exchange you use.

- Payment Methods – What payment methods are available on the exchange? Credit & debit card? wire transfer? PayPal? If an exchange has limited payment options then it may not be convenient for you to use it. Remember that purchasing cryptocurrencies with a credit card will always require identity verification and come with a premium price as there is a higher risk of fraud and higher transaction and processing fees. Purchasing cryptocurrency via wire transfer will take significantly longer as it takes time for banks to process.

- Verification Requirements – The vast majority of the Bitcoin trading platforms both in the US and the UK require some sort of ID verification in order to make deposits & withdrawals. Some exchanges will allow you to remain anonymous. Although verification, which can take up to a few days, might seem like a pain, it protects the exchange against all kinds of scams and money laundering.

- Geographical Restrictions – Some specific user functions offered by exchanges are only accessible from certain countries. Make sure the exchange you want to join allows full access to all platform tools and functions in the country you currently live in.

- Exchange Rate – Different exchanges have different rates. You will be surprised how much you can save if you shop around. It’s not uncommon for rates to fluctuate up to 10% and even higher in some instances.

The Best Cryptocurrency Exchanges

Today there are a host of platforms to choose from, but not all exchanges are created equal. This list is based on user reviews as well as a host of other criteria such as user-friendliness, accessibility, fees, and security. Here are ten of the best crypto exchanges in no specific order.

Coinbase Backed by trusted investors and used by millions of customers globally, Coinbase is one of the most popular and well-known brokers and trading platforms in the world. The Coinbase platform makes it easy to securely buy, use, store and trade digital currency.

Users can purchase bitcoins, Ether and now Litecoin from Coinbase through a digital wallet available on Android & iPhone or through trading with other users on the company’s Global Digital Asset Exchange (GDAX) subsidiary. GDAX currently operates in the US, Europe, UK, Canada, Australia and Singapore.

GDAX does not currently charge any transfer fees for moving funds between your Coinbase account and GDAX account. For now, the selection of tradable currencies will, however, depend on the country you live in. Check out the Coinbase FAQ and GDAX FAQ- Pros: Good reputation, security, reasonable fees, beginner friendly, stored currency is covered by Coinbase insurance.

- Cons: Customer support, limited payment methods, limited countries supported, non-uniform rollout of services worldwide, GDAX suitable for technical traders only.

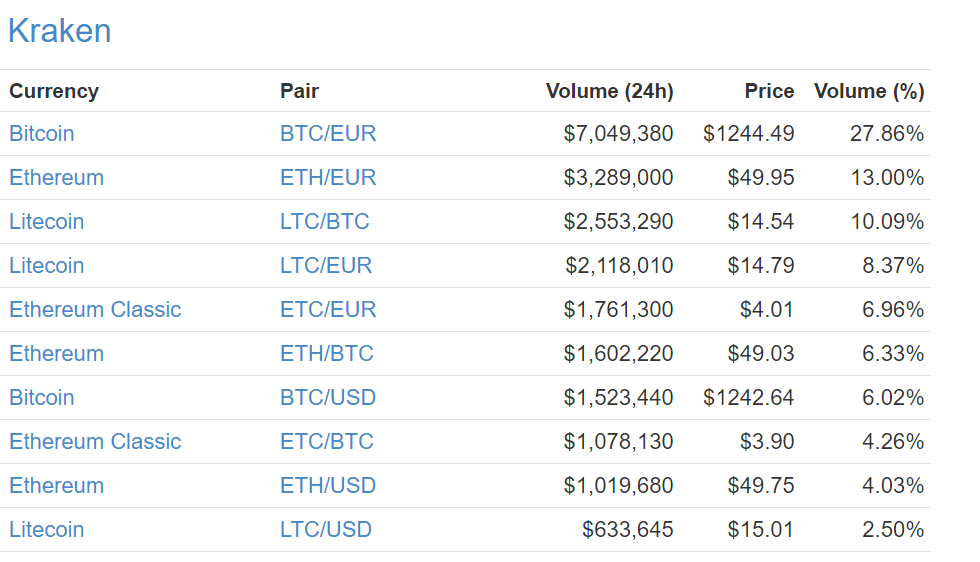

KrakenFounded in 2011, Kraken is the largest Bitcoin exchange in euro volume and liquidity and is a partner in the first cryptocurrency bank. Kraken lets you buy and sell bitcoins and trade between bitcoins and euros, US Dollars, Canadian Dollars, British Pounds and Japanese Yen.

It’s also possible to trade digital currencies other than Bitcoin like Ethereum, Monero, Ethereum Classic, Augur REP tokens, ICONOMI, Zcash, Litecoin, Dogecoin, Ripple and Stellar/Lumens. For more experienced users, Kraken offers margin trading and a host of other trading features. Kraken is a great choice for more experienced traders. Check out the Kraken FAQ- Pros: Good reputation, decent exchange rates, low transaction fees, minimal deposit fees, feature rich, great user support, secure, supported worldwide.

- Cons: Limited payment methods, not suitable for beginners, unintuitive user interface.

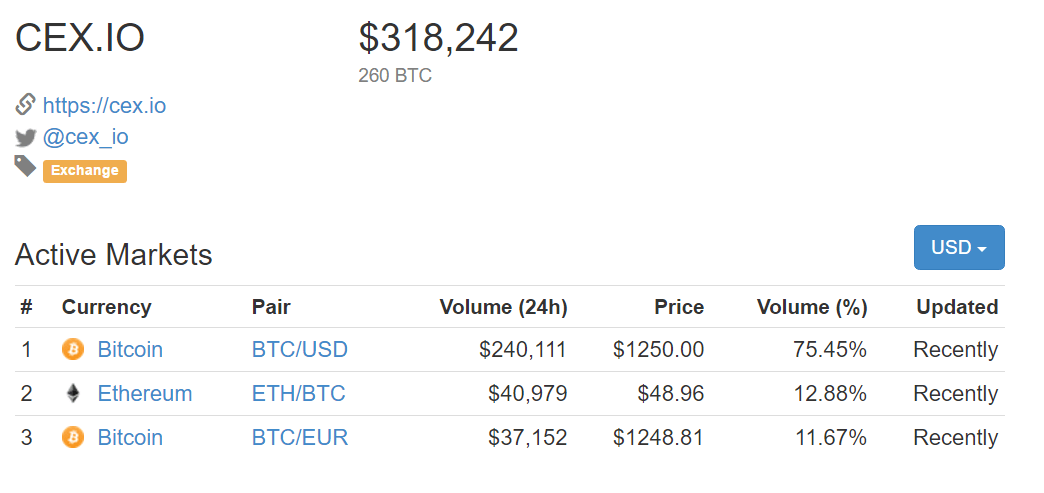

Cex.ioCex.io provides a wide range of services for using bitcoin and other cryptocurrencies. The platform lets users easily trade fiat money with cryptocurrencies and conversely cryptocurrencies for fiat money. For those looking to trade bitcoins professionally, the platform offers personalized and user-friendly trading dashboards and margin trading.

Alternatively, CEX also offers a brokerage service which provides novice traders an extremely simple way to buy bitcoin at prices that are more or less in line with the market rate. The Cex.io website is secure and intuitive and cryptocurrencies can be stored in safe cold storage. Check out the Cex.io FAQ- Pros: Good reputation, good mobile product, supports credit cards, beginner friendly, decent exchange rate, supported worldwide.

- Cons: Average customer support, drawn out verification process, depositing is expensive.

ShapeShiftShapeShift is the leading exchange that supports a variety of cryptocurrencies including Bitcoin, Ethereum, Monero, Zcash, Dash, Dogecoin and many others. Shapeshift is great for those who want to make instant straightforward trades without signing up to an account or relying on a platform to hold their funds.

ShapeShift does not allow users to purchase crypto’s with debit cards, credit cards or any other payment system. The platform has a no fiat policy and only allows for the exchange between bitcoin and the other supported cryptocurrencies. Visit the Shapeshift FAQ- Pros: Good reputation, beginner friendly, Dozens of Crypto’s available for exchange, fast, reasonable prices.

- Cons: Average mobile app, no fiat currencies, limited payment options and tools.

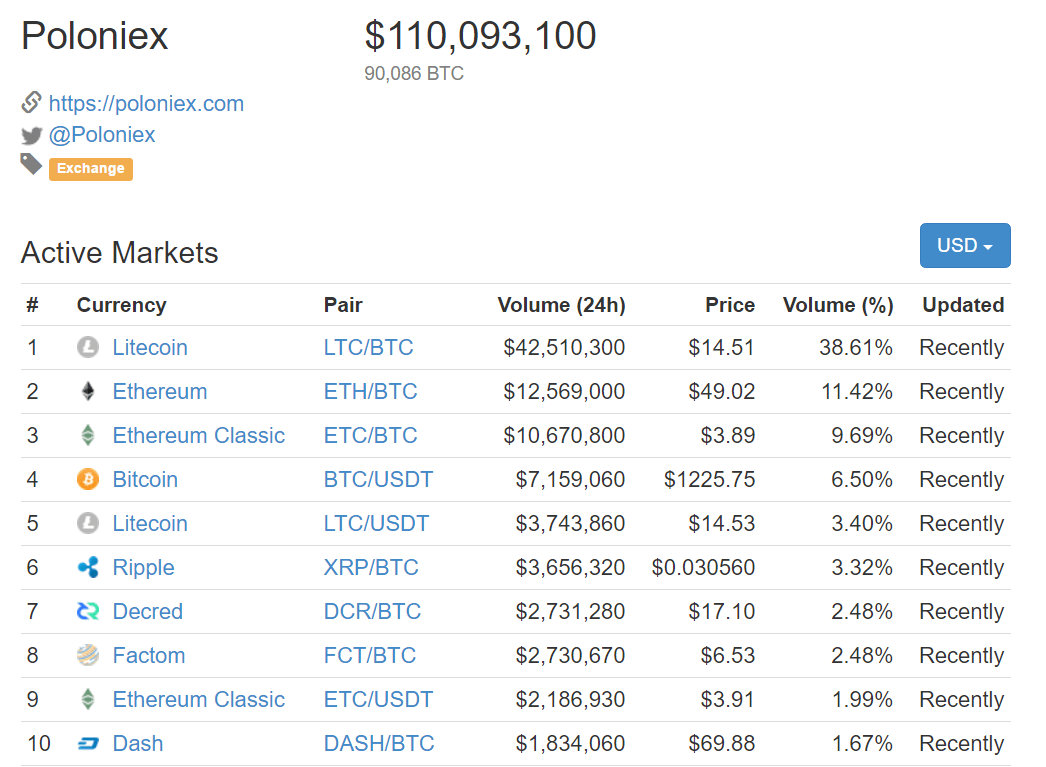

PoloniexFounded in 2014, Poloniex is one of the world’s leading cryptocurrency exchanges. The exchange offers a secure trading environment with more than 100 different Bitcoin cryptocurrency pairings and advanced tools and data analysis for advanced traders. As one of the most popular trading platforms with the highest trading volumes, users will always be able to close a trade position.

Poloniex employs a volume-tiered, maker-taker fee schedule for all trades so fees are different depending on if you are the maker or the taker. For makers, fees range from 0 to 0.15%, depending on the amount traded.For takers, fees range from 0.10 to 0.25%. There are no fees for withdrawals beyond the transaction fee required by the network.

One of the unique tools on the Poloniex platform is the chat box which is constantly filled with user help and just about everything. Any user can write almost anything but inappropriate comments are eventually deleted by moderators. It can sometimes be hard to distinguish the good advice from the bad, but the Chatbox is a great tool that will keep you engaged.- Pros: fast account creation, feature rich, BTC lending, high volume trading, user-friendly, low trading fees, open API.

- Cons: Slow customer service, no fiat support.

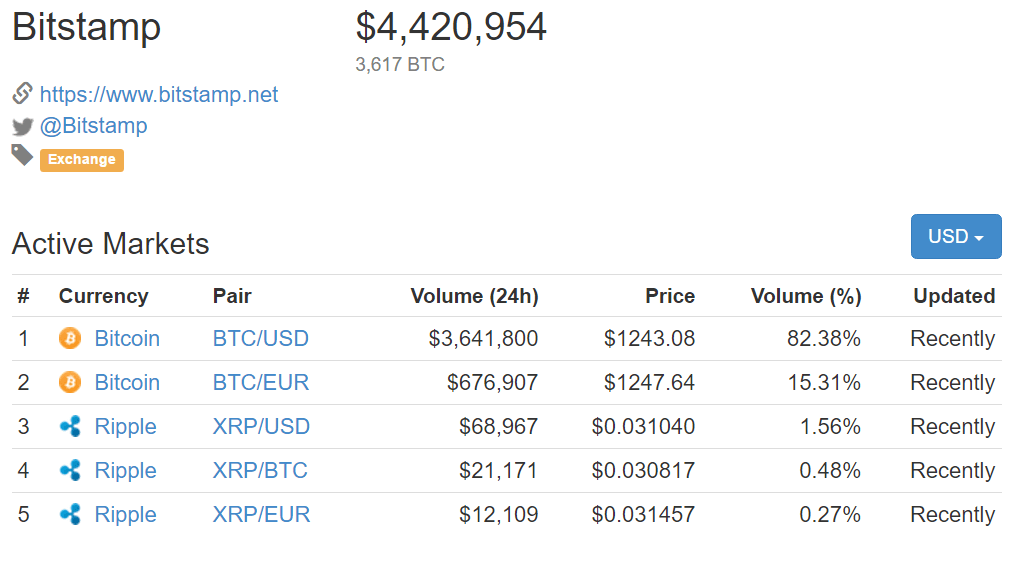

BitstampBitstamp is a European Union based bitcoin marketplace founded in 2011. The platform is one of the first generation bitcoin exchanges that has built up a loyal customer base. Bitstamp is well known and trusted throughout the bitcoin community as a safe platform.

It offers advanced security features such as two-step authentication, multisig technology for its wallet and fully insured cold storage. Bitstamp has 24/7 support and a multilingual user interface and getting started is relatively easy. After opening a free account and making a deposit, users can start trading immediately. Check out the Bitstamp FAQ and the Fee Schedule- Pros: Good reputation, high-level security, worldwide availability, low transaction fees, good for large transactions.

- Cons: Not beginner friendly, limited payment methods, high deposit fees, user interface.

CoinMama

CoinMama is a veteran broker platform that anyone can visit to buy bitcoin or Ether using your credit card or cash via MoneyGram and the Western Union. CoinMama is great for those who want to make instant straightforward purchases of digital currency using their local currency.

Although the CoinMama service is available worldwide, users should be aware that some countries may not be able to use all the functions of the site. CoinMama is available in English, German, French, Italian and Russian. Check out the CoinMama FAQ- Pros: Good reputation, beginner friendly, great user interface, good range of payment options, available worldwide, fast transaction time.

- Cons: High exchange rates, a premium fee for credit card, no bitcoin sell function, average user support.

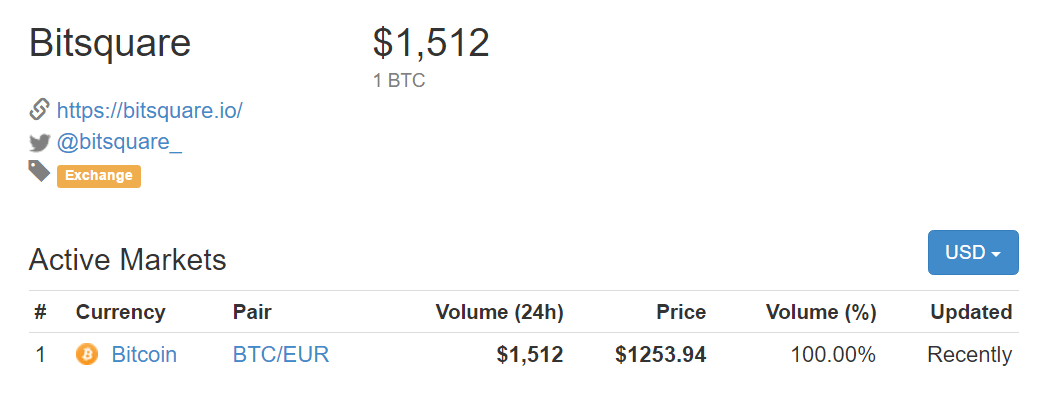

BitsquareBitsquare is a user-friendly peer to peer exchange that allows you to buy and sell bitcoins in exchange for fiat currencies or cryptocurrencies. Bitsquare markets itself as a truly decentralized and peer to peer exchange that is instantly accessible and requires no need for registration or reliance on a central authority.

Bitsquare never holds user funds and no one except trading partners exchange personal data. The platform offers great security with multisig addresses, security deposits and purpose built arbitrator system in case of trade disputes. If you want to remain anonymous and don’t trust anyone, Bitsquare is the perfect platform for you. Check out the Bitsquare FAQ- Pros: Good reputation, secure & private, a vast amount of cryptocurrencies available, no sign-up, decent fees, open source, available worldwide, good for advanced traders.

- Cons: Limited payment options, average customer support, not beginner friendly.

LocalBitcoinLocalBitcoin is a P2P Bitcoin exchange with buyers and sellers in thousands of cities around the world. With LocalBitcoins, you can meet up with people in your local area and buy or sell bitcoins in cash, send money through PayPal, Skrill or Dwolla or arrange to deposit cash at a bank branch.

LocalBitcoinLocalBitcoin is a P2P Bitcoin exchange with buyers and sellers in thousands of cities around the world. With LocalBitcoins, you can meet up with people in your local area and buy or sell bitcoins in cash, send money through PayPal, Skrill or Dwolla or arrange to deposit cash at a bank branch.

LocalBitcoins only take a commission of 1% from the sellers who set their own exchange rates.

To ensure trading is secure, LocalBitcoins takes a number of precautions. To start, the platform rates each trader with a reputation rank and publicly displays past activities. Also, once a trade is requested, the money is held on LocalBitcoins’ escrow service.

After the seller confirms the trade is completed the funds are released. If something does happen to go wrong, LocalBitcoins has a support and conflict resolution team to resolve conflicts between buyers and sellers. Check out LocalBitcoins FAQ- Pros: No ID required, beginner friendly, usually free, instant transfers, available worldwide.

- Cons: Hard to buy large amounts of bitcoin, high exchanges rates.

-

By

Admin

Admin - 0 comments

- 2 likes

- Like

- Share

-

Since 2013, Google search for Blockchain has risen 1900 percent. It’s considered one of the hottest technologies on the market, as Blockchain is on the edge of transforming how we all interact in the digital world.

Cointelegraph has compiled a list of the top 8 sources where you can get crucial information about Blockchain technology.“Blockchain Revolution: How the Technology Behind Bitcoin is Changing Money, Business, and the World”

Don and Alex Tapscott, the authors of “Blockchain Revolution” explain with clarity the workings of Blockchain technology, how it will expand in the future and transform how things are done online.

This book also explains the different ways in which blockchain technology is changing the future of transactions, money and business.Don Tapscott, author of bestselling book “Wikinomics”, and his son ‘Alex Tapscott’, a Blockchain expert, present a well-researched, highly readable foundational book about the future of the economy.

The book is regarded as the business leader’s playbook for the next decade and beyond. According to Tapscotts, this technology is going to enhance delivery of expanding financial services, protecting personal identity information, personal contracts and business.“Down the Rabbit Hole: Discover the Power of the Blockchain”

Down The Rabbit Hole is a book written in plain English by Tim Lea. According to the author, the book is written from the ground up as your easy-to-read, deep primer for the Blockchain.

A perfect choice for business people like you, Down the Rabbit Hole will not only help you to understand the power of the Blockchain, but it will also help you to understand how to capitalize on that power.

No matter what your role is, Down the Rabbit Hole will give you a practical hands-on guide to the technology and its potential. If you wish to make your organization more effective or want to make yourself more valuable in your marketplace, this book is for you.

In addition to this, the book also helps you to make your business more competitive and will teach your clients more about Blockchain technology and its implications.“Blockchain: Blueprint for a New Economy”

Blockchain: Blueprint for a New Economy is a well-written book by Melanie Swan on Blockchain technology. This book primarily focuses on recognizing and examining the practical implications of decentralized ledger technology.

Blockchain: Blueprint for a New Economy is recommended for those people who want to know how blockchain technology works and its potential applications.

The author of this book writes that the inspiration for this book was the realization that the application of Blockchain technology extends well beyond digital currencies.“The Science of the Blockchain”

The Science of the Blockchain explores the basic concepts and techniques for building fault-tolerant distributed systems.Written by Roger Wattenhofer, the book presents different protocols and algorithms that enable fault-tolerant operations.

Moreover, this book also discusses practical systems which implement protocols and algorithms.The author’s research interests include fault-tolerant distributed systems, network algorithms and cryptocurrencies like Bitcoin. So far, he has published 250+ scientific articles.Blockchain University

Blockchain University is a great place to learn about Blockchain technology as it provides a free course that will teach Blockchain development.It’s a good resource for people who are interested in learning about Blockchain and its development.“The Complete Guide to Understanding Blockchain”

The Complete Guide to Understanding Blockchain is written by Miles Price. The book explores the different ways in which Blockchain technology will change the way information is shared across the world.

Additionally, this book discusses how Blockchain technology is going to revamp financial services and how governments will adopt Blockchain to issue digital versions of their national currencies. This technology has completely moved out of the realm of...continue reading:

https://cointelegraph.com/news/8-best-sources-to-study-blockchain-technology -

Please note: Everything in this article is just advice, based on our best understanding of the current situation. Everything is still very uncertain and subject to change: Be extremely careful!

Bitcoin Cash (sometimes referred to as Bcash, and mostly using the tickers BCH or BCC) launched today. Anyone who held bitcoin at 12:20 p.m. UTC should have an equivalent amount of BCH attributed to their Bitcoin private keys.

In our beginner’s guide to surviving the BIP 148 split, which was subsequently updated to also cover the Bitcoin Cash launch, we explained how to secure your private keys so you could be sure to access your BCH. At the time of writing that article, much was still uncertain about how this event would play out.

Much is still uncertain, but to the extent that it is know, this article explains how you can claim — and potentially use — your BCH.Author’s note: If you want to play the BTC/BCH markets as soon as possible, and you are fine with taking risks and/or you really know what you are doing, this article is probably not for you — it’s a beginner’s guide.Take Your Time

The good news is that, if everything went according to plan, Bitcoin Cash enforces strong replay protection. This means you shouldn't be able to accidentally spend your BTC when you mean to spend BCH, or vice versa.As such, if you don’t care about BCH at all right now, you don’t need to do a thing. You can just keep using bitcoin as you always have.

If you ever change your mind (and don’t lose your Bitcoin private keys in the meantime), you can still claim your BCH at any point in the future.Likewise, if you want to hold on to your BCH long-term, you also don’t need to do anything right now.

You can keep using BTC as if nothing happened; just make sure to never lose your private keys.Now let’s assume you do care about BCH right now, at least enough to want to sell your share.If you followed the advice outlined in our beginner’s guide, the good news is that you should be in full control of your Bitcoin private keys.

This means you now hold BTC as well as BCH.The bad news is that it’s not necessarily easy or safe to claim your BCH straight away. If you are not careful, you may accidentally expose your private keys while claiming your BCH. And because these are the same private keys that secure your BTC, this could lead to your BTC being stolen.

Needless to say, you want to avoid this! You almost certainly stand to lose much more from losing your BTC than you stand to gain from, say, selling your BCH fast.Therefore, you are going to want to take your time and make sure you understand what you are doing well enough to do it without exposing your private keys. Your BCH isn’t going anywhere. And in part because the situation is still developing, even this article may contain accidental errors …Claim Your Coins

In our previous beginner’s guide, we explained how to secure your private keys and recommended different wallet options. Here, you can find, per option, how to access your BCH.Full Node Wallet

Our first recommendation was to use a full node wallet, like Bitcoin Core orBitcoin Knots. These wallets store your private keys in a dedicated folder on your computer. You can make a backup of this folder using the menu in your wallet. Once you’ve done this, you should be able to import this backup into a Bitcoin Cash full node, like Bitcoin ABC.

However, to be on the safe side at this point in time, we are not fully comfortable recommending any Bitcoin Cash software. It is all very new, developed within a short timeframe, and the peer review done on all this software has probably not been as extensive as it usually is within the Bitcoin space. It is therefore probably wise to not import your private keys in such software right away; instead, wait to see if there are any reports of problems.

Furthermore, some Bitcoin Cash full node wallet software, like Bitcoin ABC, conflict with Bitcoin software, such as Bitcoin Core. It is therefore not recommended to install a Bitcoin Cash full node wallet on the same computer. Instead, it’s best to install it on a completely different computer. It is on this computer that you can import your wallet backup and have access to your BCH.If you are not exactly a beginner, there is one alternative option.

NBitcoin developer Nicolas Dorier created a splitting tool, which allows you to split your BTC from your BCH. However, this tool requires you to work in the command line of your operating system; if you know how to do this, you probably don’t need this article.Paper Wallet

Our second recommendation was to use a paper wallet. This advice was given in the context of storing your coins long-term in particular. But if you want to access your BCH, of course you can do this right away.Unfortunately, however, not many wallets actually support directly importing your private key(s) — and less so for BCH. One wallet that does allow for this option in Bitcoin is Electrum.

Therefore, the BCH version of Electrum, dubbed “Electron Cash,” should allow you to do this, too.However, Electrum itself has issued an official warning concerning Electron Cash. Electron Cash is not properly vetted and therefore not guaranteed to work as advertised. This is a big risk, and we recommend against using it for now. (This may change in the future.) That said, if you do choose to opt for this solution (at your own risk!), make sure to at least take two additional precautions.

First, run the software on a different computer as the computer you run Electrum on, if you already run Electrum. (In fact, it’s probably best to use it on a different computer than the one where you hold any bitcoins or any other sensitive data, for that matter.)

Additionally, first move the BTC from your paper wallet to a new Bitcoin address (like a new paper wallet) before you do anything with BCH. That way, even if the Electron Cash wallet manages to steal your private keys, the damage should be limited: these private keys won’t hold any BTC anymore. (Make sure not to send BTC to this address later on either, though.)Hardware Wallet

Our third recommendation was to use a hardware wallet, as listed onbitcoin.org. Two of these hardware wallets in particular, Trezor andLedger, have gone through the effort of offering you access to your BCH. So if you have one of these wallets, you’re in luck: this is probably the safest and easiest way to access your BCH.Ledger has published a blog post explaining how to access your BCH, which you can find here.

Trezor has also published a blog post on how to claim your BCH, which you can find here. Update: Trezor has removed BCH for now, due to a bug in their Bitcoin Cash backend server. Don't worry, your funds are secure.The third hardware wallet, Digital Bitbox, has published an FAQ on how to access your BCH.

However, note that this wallet recommends using Electron Cash, which is not guaranteed to be secure. See the above section on paper wallets for more details.The last hardware wallet, KeepKey, has also published a blog post onBitcoin Cash. At the time of writing, it seems you won’t be able to access your BCH quite yet; keep an eye on their blog for updates.Other Bitcoin.org Wallets

If you didn’t take these three recommendations, perhaps you used one of the other wallets listed on bitcoin.org.Once again, whichever of these wallets you used, your BCH should be safe and there’s no rush to claim them. But actually being able to claim them may differ a bit from wallet to wallet. Most wallets use a recovery phrase. This phrase essentially holds your BTC private keys, and therefore also your BCH private keys.

As such, you should be able to access your BCH by inserting this phrase into a dedicated BCH wallet.However, at this point in time there are no BCH wallets available yet that allow this and which we can confidently recommend using. If BCH becomes somewhat of a success over time, this will probably change. It’s probably best to just wait until this is the case. (If it ever becomes the case.)Until then, you can just keep using BTC without worrying about your BCH.Other (Non-bitcoin.org) Wallets, Exchanges, etc.

If you did not follow our advice, and instead stored your BTC in any other wallet, or on an exchange, or anywhere else, you may or may not still be able to claim your BCH. In this case, you’ll have to figure out for yourself whether this is the case or not, and how to do so.Using (or Selling) Your BCH

Once you have claimed your BCH, you can use it however you please. Just like any other (alt)coin, you could for example sell it for BTC, or perhaps spend it somewhere, or move it to another wallet, etc.However, there are still three factors to keep in mind before doing so.

The first factor is privacy. Your addresses are identical for BTC and BCH. This means that whenever you spend your BCH (for example, to send them to an exchange), you do not only reveal your BCH addresses but also your BTC addresses.

This can in turn reveal a lot about your current holdings as well as your past and future transactions, and can by extension even reveal such data about people or entities you have transacted with. Make sure you are comfortable with giving up this data if you are going to send your BCH to an exchange or anywhere else.

(There may be more privacy-friendly options for selling your BCH for BTC in the near future, but these aren’t ready yet.)The second factor is mostly theoretical at this point, but...continue reading: https://bitcoinmagazine.com/articles/beginners-guide-claiming-your-bitcoin-cash-and-selling-it/-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

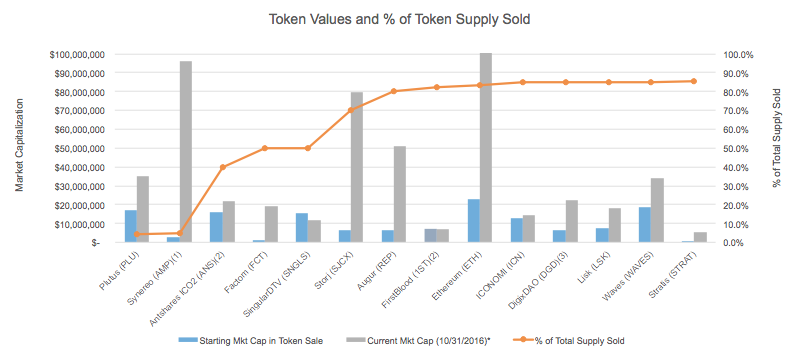

We’ve now seen several multi-million dollar crowdfundings done on a blockchain. Projects are raising money through the token model: selling the native token needed to use their corresponding networks (Ethereum’s ether, Augur’s Rep, IPFS’ Filecoin, and others).

What is the token model?

For the basics on how this token model works and why it’s powerful, you can read my introductory post. I’ll refer to these tokens as protocol tokens in this post — a more accurate name to what others and I have called “App Coins” in the past.When considering raising money through a token, a few common questions arise:- Should we consider the token model?

- How do we perform the token sale?

- Is this legal?

Should we consider the token model?

In short: if your project has a network effect, yes.While tokens serve many functions, the biggest benefit to the token model is that it provides the economic incentives for your network to get off the ground and overcome the classic chicken and egg problem. In other words, it gives all users of your app the ability to own a little piece of your network, incentivizing them to start using it at the start. This gives it a higher chance of success with a lot less capital needed.How do we identify the network effect in our project?

In some projects the network effect and token model is obvious. For example, the network effect of Uber is the growing network of riders and drivers. So the token model for a Decentralized Uber and dUberCoin is pretty straight forward: make dUberCoin the native token of the Decentralized Uber network and reward early riders and drivers with more of it at the start.Bitcoin was the first example of the token model: early miners could mine bitcoin of unclear value at the time — now worth ~$65,000 per block — using just a laptop. While that’s no longer possible, it attracted the initial miners needed to bootstrap the network.

It may take a little work to think about what this would look like for your project. My hunch is that a surprising percentage of current and future businesses fall into this category since most businesses rely on some kind of network effect.It’s important to recognize what the network (or networks!) within your project are.

At the moment many “apps” are really a bundle of a few things. For example, a food delivery app like GrubHub is really a bundle of: a network of restaurants and consumers, another network of restaurant advertisers (for sponsored placement in the app) and consumers, and a thin end-user client “app” that sits on top of these networks.

Each of these networks could have their own token. It’s also possible some tokens don’t fully encompass all elements or what feels like the full value of a project. For example, Augur’s Rep token allows you to participate as an oracle to the prediction markets of the network and get compensated for it, but doesn’t take a cut of all transactions in the network.

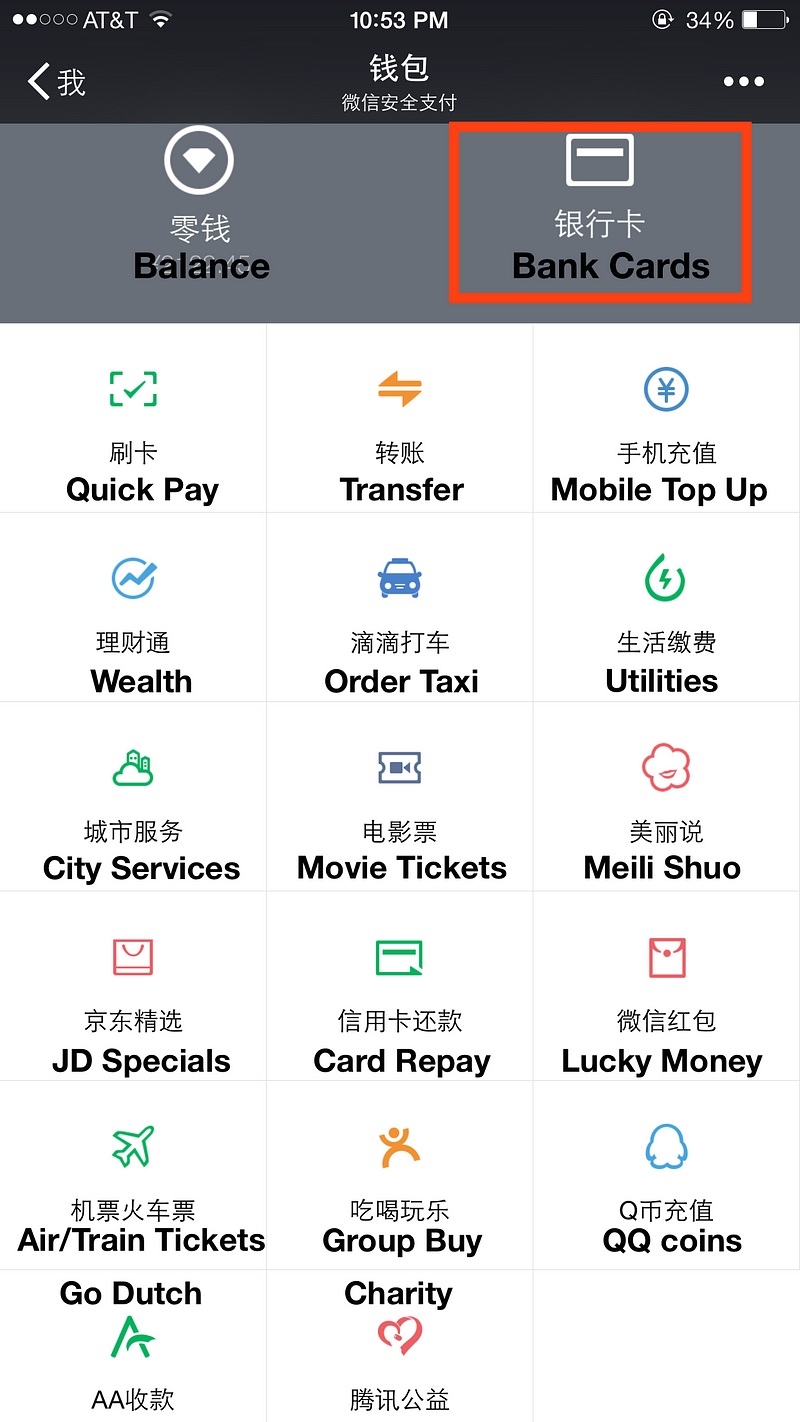

Different thin clients to the Twitter networkThese underlying networks and their user interfaces will get unbundled and re-bundled. We will see a bunch of different interfaces to the same blockchain-based networks in the same way there were a bunch of different Twitter clients early on and there are a bunch of different Bitcoin/Ethereum wallets today. Similarly, we will probably see a bunch of different networks and their tokens under the hood of what feels like a single end-user “app”. WeChat is a great example of this: it has many different networks in one UI.

WeChat’s many networks in one UIHow do we perform the token sale?

There have been two major types of fundraising through protocol tokens:1. Pre-release sales

Pre-release sales have historically been most common and can be conducted in fiat, digital currency, or some combination. Examples include Ethereum (pre-sold ether for bitcoin), ZCash (pre-sold ZCash for fiat in a traditional equity fundraise from angel and institutional investors). They occur when a project needs money to develop and test a protocol to get it off the ground. Importantly, this means the protocol’s native token also has not yet been created, so IOUs for those tokens are being sold, not the token itself.

Augur pre-release sale2. Post-release sales

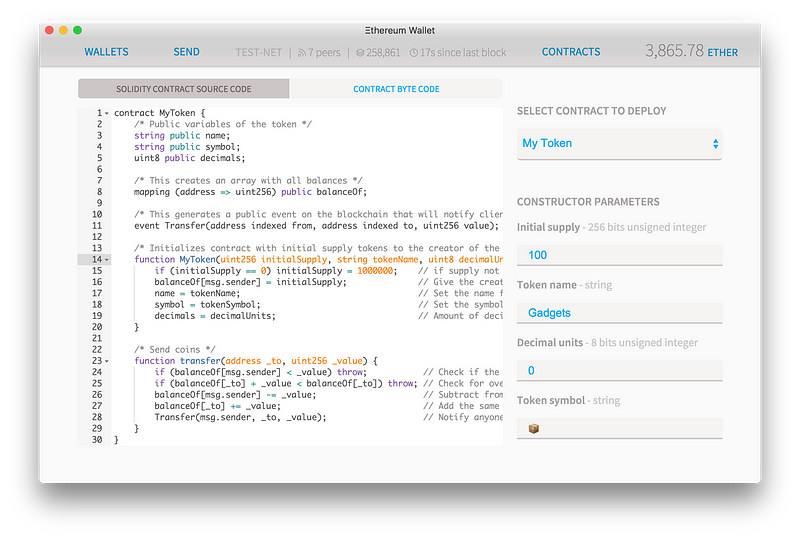

Post-release sales are increasingly common. While they can be conducted through a central escrow agent, they are increasingly being conducted through a smart contract on the Ethereum blockchain which accepts crypto and atomically pays out the new protocol token.

A recent example is the FirstBlood project. They occur when a project has launched an initial version of their protocol and corresponding token and wants money to continue its development. The project can then use digital currency raised to fund the continued development of the project.Sales conducted on-chain through smart contracts couldn’t really be done before Ethereum, which is why they are a newer concept. I think this style will become the most common over time.

Ethereum.org has a simple tutorial on how to code one up. You can also create your first basic token in 15 seconds using The Token Factory.Pre-release sales make sense: it’s hard work to get a well-thought-out and tested protocol off the ground. Just like a startup, funding is often needed to get to an initial release. However, there are problems with these pre-release sales: we’ve gone off the blockchain and there’s now an IOU for a token that doesn’t yet exist.

We also now need some kind of legal entity to accept these initial investments (more on that later).A potential approach to get the early funding benefits of a pre-release sale with the reduced trust required in a post-release sale is as follows:- Create your protocol token as a standard Ethereum (ERC20) token, but just release to the blockchain the standard functions needed to create the token and have it fit the ERC20 standard. At this point none of the “hard part” of writing the protocol has been done. Said another way, you modularize the development of the protocol such that you just release the standard token functionality (send, receive, basic accounting) on-chain as the first piece of the protocol developed, with the rest to be completed later.

- Use the digital currency raised to fund further development of the protocol.

Basic Ethereum token functionality, in codeThis approach avoids the trusted/centralized “IOU” portion of pre-sales by giving token purchasers the token itself, even though the protocol is not yet complete. It obviously has its risks: projects funded this way could never come to fruition, like any early project.

But the forces in the world from both sides are clear: developers want to be able to raise money to create new protocols and people want access to these new protocol tokens as early as possible. The two will converge and stabilize in a way where developers and future users can fund projects to a minimum viable product more easily.How much of the token should we sell and how should we distribute the funds raised?

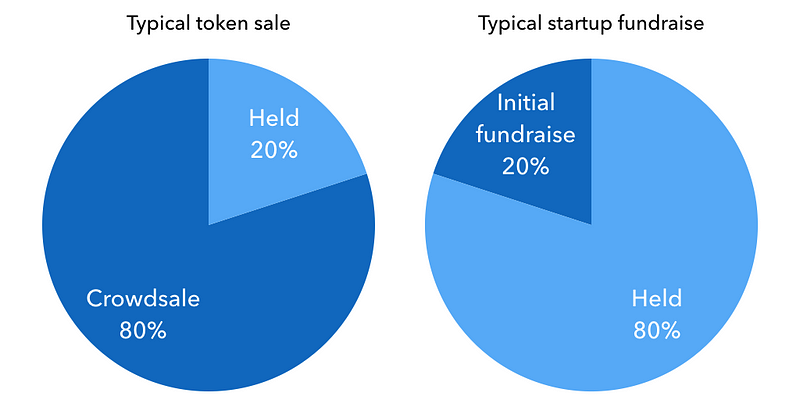

Different approaches will make sense for different protocols.The current norm is setting aside 10–20% of the protocol tokens and selling the remaining 80–90%. A small portion of tokens set aside immediately goes to the core developers of the protocol to recognize their work to date, with the majority set aside to fund future work. This gives the project two sources of funding: the funds raised in the initial sale, and the ability to sell or disburse the tokens held back in the future.

How these allocations work is evolving and taking ideas from traditional companies. An early example of this is ZCash, where there is a “Founder’s Reward” that looks like the 4 year vesting schedule you’d typically find in a startup.Whether or not these rough allocations make sense remains to be seen. A typical startup has the opposite structure: typically 20% (not 80–90%) of a project is sold in its first funding.

And therein lies a key point in the early stages of protocol tokens. We have yet to hit a situation where the combination of funds set aside in the initial sale and tokens held back have run out — yet. This is a close equivalent to running out of cash and the options pool in a typical company. Ethereum, for example, hasn’t hit this bump yet because 1) it’s young and 2) the price of ETH vs every fiat currency has, more or less, been on the rise, making the ETH the Ethereum Foundation set aside last longer.

As a result, we’ve never seen the idea of multiple fundraises as is common with startups. Running out of funds for future development seems likely, as work on these protocols is never really “done”, although they may mature and change less over time.Some combination of three things will happen in the future as a result:

Protocols will hold back more than 10–20% of the tokens in the initial sale. This allows for more cushion to fund development. In a scenario where these funds are not really needed, token holders could vote to distribute or burn those funds so all token holders get an even share of that value back.The companies who have built value-added services on top of these protocols will directly pay for or themselves work on the protocols in the future. We’ve seen some of the major internet companies like Google, Facebook, and Apple do this with current core internet protocols. The Bitcoin Foundation is an early example of this: industry members had paid memberships which funded core developers.The users of these protocols could agree on mutual dilution. This is a way of using the protocol to raise funds for further development, much in the way that everyone in a startup will dilute themselves to create more options for new employees. This requires reasonably-functioning decentralized governance. Something similar was proposed by Vitalikwhen the Ethereum foundation was running low on funds, but became unnecessary as the price of Ethereum climbed. I’m not aware of this being done yet in practice, but I think it will become more common in the future along with the first two points.Is this legal?

As with most legal questions, it seems the answer is: it depends. This model is new and largely untested. The most important question is whether or not it will be considered a security under US securities law. Some approaches to the various properties of a token which make it feel more like a security (thus riskier) and others which make it feel less like a security (less risky).

One example is is the amount of functionality of the token. If the token is only a vehicle to pay out a portion of profits it feels more like a security. If it allows you to uniquely use and access a network with a specific utility it feels less like a security. Another factor is the marketing around a token. If it’s marketed as generating or even guaranteeing profit, it feels more like a security. If it is marketed as serving a specific utilitarian purpose, it feels less like a security.

We are currently working on an simple legal framework to categorize the level of risk associated with different approaches along with top lawyers and industry groups like Coin Center. We hope to open source this framework in the next few weeks as part of our goal to advance the decentralized application ecosystem. This post will be updated at that time. Coin Center, a non-profit industry policy group, published a...continue reading: https://blog.gdax.com/how-to-raise-money-on-a-blockchain-with-a-token-510562c9cdfa-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share