Favorite list

- by RashidSniper

- 7 posts

-

You may have already heard about digital currencies like bitcoin. But it's the technology behind bitcoin that's exciting some very big dreams for the future.

It's called block-chain - and it's been described as the next generation of the internet. Although still in its infancy - blockchain's already being promoted as the next disruptive force in everything from banking to government.

-

By

Admin

Admin - 2 comments

- 6 likes

- Like

- Share

-

- 1

Francisco Gimeno - BC Analyst We hope so!!!! ethical anarchy and real democratisation and less corporation and government control is something to be cherished- 10 1 vote

- Reply

-

- 2

Jose Ojeda Portillo Adviser at Blockchain Company / Water Health Environment / Biosphere University A short and clear video explaining why we should be optimistic about the future :-)- 20 2 votes

- Reply

-

By

-

Smart contracts are a major technological breakthrough that will affect our society substantially. So far, interfacing with said smart contracts is still a bit challenging for the average user. Even developers sometimes struggle to do so. This is where ChainLink comes into the picture, as it provides a fully decentralized oracle network called LINK.

ChainLink is an Interesting Venture

It is certainly true that smart contracts can make a big impact on our society as a whole, although a lot of use cases have yet to be identified. Interfacing with a smart contract on any platform is a major challenge right now. This is especially true for financial institutions and other organizations looking to explore this technology.

Rather than using public blockchains, they will often develop a private and a permissioned version to use similar technologies. In the long run, these private and individual efforts still must communicate with one another, as well as with public blockchains in the future.

Connecting a smart contract to external sources is currently not possible in a convenient manner. Off-chain data and even APIs need to be introduced to smart contracts and vice versa. Currently, this is a major hindrance which can’t be resolved all that easily whatsoever.

ChainLink may be the solution for all these problems in the future. That is what its developers are hoping, at least. In fact, some new solutions are required to make this concept work in the first place. ChainLink is capable of connecting any smart contract to an external system and an API.

This secure blockchain “middleware”, as the team calls it, provides the bridge for the gap between smart contracts, APIs, and any other form of external data one might need. While it may not be the perfect solution, it should be useful for at least 90% of current and future use cases.

The project revolves around a fully decentralized network of oracles which are compatible with Bitcoin and Ethereum. It is possible other blockchains will be supported in the future, but those are the two main points of focus for the time being. In a perfect future world, this new platform would allow anyone in the world to use the LINK network.

All service providers would be able to securely provide smart contracts with access to key external data and potentially even off-chain payments. This latter point will be of particular interest to a lot of companies and service providers, for obvious reasons. Do keep in mind you will need LINK tokens to do so, though.

While it is commendable to see such a decentralized network, the use of proprietary tokens will not necessarily make it more appealing. This is the first solution of its kind, though, and we may see more competing services in the near future.

ChainLink will certainly find its place in the market, as users can become node operators to monetize their API experience. It’s a very intriguing concept, although it remains to be seen how many companies will actually use it.

Discover even more blockchain articles on Merkle here: https://themerkle.com/what-is-chainlink/

-

By

Admin

Admin - 0 comments

- 5 likes

- Like

- Share

-

By

-

By Tim Sandle 17 hours ago in Health

Several startup companies are finding new and important ways to bring blockchain technology to healthcare. The cryptographically-secured, distributed ledgers can be used for everything from supply chains to medical records.

According to new analysis from CB Insights, several startups are pioneering blockchain technology into the health and pharmaceuticals market. The types of applications stretch from medical record interoperability; data security; patient or supplier reimbursement; and pharmaceutical supply chain management.

Big players are also working on blockchain technologies for healthcare. For instance, IBM Watson has entered into an agreement with the U.S. Food and Drug Administration to see whether blockchain technologies can better secure share patient data.

This will start with oncology data in the form of electronic medical records, clinical trials, genomic data, and health data from mobile devices, wearables and the Internet of Things.

Transparency in healthcare

In terms of startups, the CB Insights report details five companies that have secured significant investment in order to develop healthcare related blockchains.

The first is PokitDok, which is developing a secure network for all sources of patient data. This will include pharmacies and data collected wirelessly from medical devices.

Partnering with Intel, PokitDok are calling their solution Dokchain. The primary aim is to provide an identity management system to validate that each party involved in the transaction is who they say they are, whether patient or health provider.

A second area is with transparency. This would mean when a medic writes prescription, this would become logged on the chain with the pricing clearly stated for the patient. T

he electronic capture of the prescription also assists with inventory and order management of medical supplies and drugs.

Portable patient records

The second startup is Patientory, which aims to add portability to patient data. This means a patient's health record becomes electronic and it can be moved across health institutions.

Blockchain technology allows for new records, be they visits of images, to be added. All of the data is then visible to the patient and to any other institution granted access.

Medical claims process

Third comes Gem, which develops blockchain applications for healthcare and supply chain management. The focus here is on the medical claims process, making the technology viable for countries with privatized healthcare.

The company's GemOS platform allows patients, providers, and insurers to view a patient’s health timeline in real-time in a secure manner.

Digital patient records

Fourth is Guardtime, which has a major contract with the Estonian e-Health Authority to secure over 1 million patient records. This is in order to integrate health data with the health cards that citizens carry and also to add stronger data integrity and security to the health records process.

Tracking organ donations

Fifth, and finally, is Chronicled, which has produced a platform to allow for the tracking of a range of products including pharmaceuticals, blood, and human organs. These products are critical to human health and they often have a tight time expiry and they need to be kept at low temperatures (cold chain management). This makes safely tracking each step something of great importance.

Read more on Digital Journal: http://www.digitaljournal.com/life/health/blockchain-technology-set-to-transform-healthcare/article/503744#ixzz4u7iBdyKy

-

By

Admin

Admin - 0 comments

- 4 likes

- Like

- Share

-

By

-

A new report published by The Alan Turing Institute and Lloyd’s Register Foundation identifies significant potential for engineers to use distributed ledger (blockchain) technology to improve safety. However, understanding of this new technology remains a major issue.

Distributed ledgers are a special type of database whose contents are distributed across a network in multiple sites, countries or institutions and use cryptographic techniques to provide a transparent and permanent record of activities between parties within that network.

Financial services are pouring investment into it in the wake of the famous bitcoin currency, and there are many more industries keen to capitalize on this new digital system. The report examined the potential application of blockchain technology to engineering and found obvious challenges within engineering where it could help.

For example, its potential to provide transparency and traceability could help to assure supply chain provenance, maintenance cycles and the monitoring of Internet of Things networks, enabling industry to quickly identify fraud and identify when something goes wrong.

IoT devices are becoming ever more pervasive with an estimated 8.4 billion connected things in use in 2017, and 20.4 billion anticipated by 2020. It is also estimated that business IoT spending will represent 57 percent of overall IoT spending in 2017.

Blockchain technologies potentially hold key benefits in the management of such systems. Their distributed architecture is particularly suited to a network of distributed devices. Peer-to-peer communication not only potentially reduces the cost associated with deploying centralized control systems, it provides a means of preventing single point failure.

Cryptographic mechanisms ensure that communication between devices is secure and that logs of data flows are maintained as permanent records. Transparency ensures that the details of data flows, such as who or what has accessed the data, are visible. This could incentivize greater rigor in design and quality control and also potentially speed up the process of learning from malfunctions and accidents.

The technology could provide an immutable record of maintenance activities and parts used. Having instant access to a global, immutable log of who carried out such activities and what they did would be highly beneficial for operators and maintainers, equipment providers, and regulatory bodies.

“In some industries, such as shipping, the technology has the potential to radically transform the whole practice of maintenance,” states the report.

However, there is significant confusion around the understanding of what blockchain technology is which could have serious implications for business. Part of this stems from the terminology, with many people using the ‘blockchain’ term as a catch all for a range of system technologies. Additionally, there is no “one size fits all” solution.

Many engineering systems are not 100 percent digital, and blockchain technologies need to be adapted to cater for industries with physical, as well as digital components. The scalability of distributed ledger also needs to be carefully considered in order for it to apply to the engineering sector, which often requires processing of vast quantities of data.

With the relatively low throughput of transactions, many blockchain based solutions would currently be unsuitable where real-time analytics of truly big data is required.The report calls for education and more support from standards bodies to define and professionalize the technology.

Additionally, further investigation needs to be conducted into developing understanding of the legal implications of using such technologies, particularly across international boundaries. The report states: “It is interesting to note that even after approximately eight years of being in existence, many people have not heard of Bitcoin, and even more have not heard of distributed ledger or blockchain technologies.

It should also be noted that many engineers and technical experts have not heard of these technologies, and it is this community that might be expected to be involved in its implementation. Often when the technologies are mentioned in news items, it is associated with descriptions of illicit trade which serves to raise doubts about its use.

”Gary Pogson, author of the report, commented: “We spoke to a wide range of industrial professionals and researchers to inform our report. It’s clear from this research that distributed ledger technology could provide real benefits within certain areas of engineering.

However, in order to cut through the hype, a greater understanding of the range of potential system configurations and their capabilities is needed, together with practical implementation of real case studies that demonstrate impact to potential investors.”

Discover more reports on Maritime Executive here: http://www.maritime-executive.com/article/engineers-not-ready-for-blockchain

-

Recommended Use Case: Blockchain-like ID may mean end of paper birth certificate... (newscientist.com)By Chris Baraniuk

THERE’S a new way to prove you are who you say you are – inspired by the tech underpinning bitcoin. Usually, when you need to verify your identity, the process is archaic, insecure and time-consuming. You get a copy of your birth certificate in the post, put it in an envelope and hope it gets to whoever is asking for it. In the digital era, this should take seconds.

But putting something as sensitive as a birth certificate online risks identity theft in the era of hacks and leaks. Now, the US state of Illinois is experimenting with a secure way of putting control of that data into its citizens’ hands, with the help of distributed ledgers, similar to the blockchain used by bitcoin.

Just last month, Illinois announced a pilot project to create “secure ‘self-sovereign’ identity” for Illinois citizens wishing to access their birth certificate.

The idea is to use a blockchain-like distributed ledger that allows online access only to the people owning the ID, and any third parties granted their permission.

Illinois is working with software firm Evernym of Herriman, Utah, to create a record of who should be able to access data from the state’s birth register. Once this is done, no central authority should be required, just your say-so.

They’re not the only ones. According to a report by Garrick Hileman and Michael Rauchs at the Cambridge Centre for Alternative Finance, UK, governments are increasingly experimenting with it, including the UK and Brazil.

Activists have long called for people to have greater control of their data. Hacks and leaks are making it too risky for authorities to be the central repository of citizens’ most vital information.

With distributed ledgers, all participants within a network can have their own identical copy of data like access permissions – so no one can view cryptographically sealed birth certificate data unless they’re meant to.

Blockchains are a type of distributed ledger that gets the whole network to observe and verify transactions – such as when someone sends a bitcoin to their friend.Distributed ledgers could be a great way to store critical data. But “the devil is always in the details”, says Dave Birch at electronic transactions consultancy Consult Hyperion.

Done wrong, distributed ledgers could carve mistakes in stone. “If your midwife fat-fingers the weight of the child or the name then you’re going to have a typo in your name from birth forever,” he says. “Bullshit in, bullshit forever.”Nonetheless, some think these projects are a step towards a world where all data is managed by the individuals who own it.

It could backfire on governments, though. Citizens in Catalonia are gearing up for a referendum on independence from Spain, planned for 1 October. It has been termed “illegal” by authorities in Madrid.

But a start-up is studying the possibility of using blockchain technology to let citizens hold their own vote, with no government authority needed.This article appeared in print under the headline “Time to digitally prove who you are”

Discover even more stories like this on New Scientist here: https://www.newscientist.com/article/mg23531454-500-blockchaininspired-project-means-you-are-who-you...

-

What accountants need to know about blockchain technology beyond bitcoin | Accou... (accountingtoday.com)The phrases blockchain and artificial intelligence are mentioned so frequently in academic articles, practitioner publications and the general media landscape that they may have overshadowed the previous hot topic of data analytics.

With all of the coverage, debate and questions surrounding these areas, it would be relatively easy to get lost in the weeds with what these technologies mean for the accounting profession. In addition to, and compounding, the potential confusion surrounding these topics is the somewhat justifiable fear that these technologies will automate large functions of the accounting profession.

Accounting professionals, trained and educated in quantifying data, analyzing different streams of information, and increasingly technology savvy, are facing the reality that technology may surpass, and ultimately, replace many practitioners.

Such a perspective, however, only represents a partial and incomplete view of the implications that blockchain and artificial intelligence will have on the profession. Bitcoin may be the most commonly associated term and aspect of blockchain technology, but that only represents the proverbial tip of the iceberg.

Although some organizations are indeed using bitcoin for processing transactions, are accepting payment from customers in bitcoin, or the other various cryptocurrencies, this is only one potential implication for the accounting profession. Regardless of whether an accountant works in public practice, private industry, academia or a consultative capacity, it is critically important to understand the potential changes that are coming.

Blockchain technology has the potential, and already is, changing how the accounting profession operates and will navigate the business landscape moving forward. While the specific implications of these changes will differ from organization to organization, and some of these changes will occur faster than others, there are some themes that appear to be consistent.

Clearly, this short list is not meant to be all-encompassing, but rather is meant to focus the conversation on the changes blockchain is having in a manner that is productive and applicable to practitioners.To do that, however, accountants need to understand what exactly blockchain technology is, and what is might mean for the profession. Let’s take a look at three things every accountant needs to know about blockchain

1. Blockchain secures information and reduces alterations.

Although the basis for the spread of blockchain technology is the internet, and some uses have involved criminal enterprises, the basis of the technology is the encryption that secures transactions and records.

To put it simply, every transaction that is conducted using blockchain technology is encrypted, the involved participants are identified by a string of characters, and after a certain period of time has passed (which may vary) all of these transactions become part of the block.

After this block has been finalized, it is broadcast to all parties associated with that network, or chain. If it is altered at a future date, reviewers of the block (record) will be able to identify when due to time stamp functionality. Clearly this technology will lead to changes in not only how audits are performed, but will also drastically reduce the amount of time needed to verify or confirm certain balances.

2. Blockchain will reduce errors.

Especially as it pertains to accounts payable or accounts receivable, the potential for blockchain to be accretive from the very beginning is a relatively straight forward concept. Building on point 1, if the participants in a certain transaction are identified, the time and date of the transaction is verified, and the associated data is secured, the possibility of errors decreases dramatically.

Specifically, the number of transposition corrections, verification of payments, and other lower-value activities can be automated by blockchain and ultimately replaced with higher-value activities. Reducing errors, both during the audit process itself as well as during ongoing operations, will add value to clients in a quantifiable manner.

This may certainly place some current accounting jobs in jeopardy, but also provides numerous opportunities for accounting practitioners willing to learn, and eventually master, blockchain technology.

3. Accounting will become real time.

Just like doctors are increasingly able to monitor the health of patients in real time thanks to advances in technology, blockchain technology will help enable accountants to monitor financial performance in real time.

Due to the fact that blockchain technology is based on, and leverages, an internet-based and decentralized platform, it will be simpler than before to track and monitor the inflows and outflows from a business.

Building on the increasing utilization of cloud computing technology by both accounting organizations and client firms, this facet of blockchain represents a logical step in this same direction.

Leveraging these advances in technology, and the ability for both business owners and accountants to keep abreast of changes in the business will only help accountants elevate their position to that of trusted business advisor.

Blockchain technology is already disrupting the accounting profession, and will continue to do so moving forward, but it will deliver both opportunities and challenges.

Understanding the implications and possibilities of this technology on the profession is essential for practitioners seeking to keep up to date and relevant in a rapidly changing marketplace. Technology tools can provide opportunities, and CPAs have both the mindset and opportunities to take advantage of them.

Learn more about the impact of the blockchain on accounting today here: https://www.accountingtoday.com/opinion/what-accountants-need-to-know-about-blockchain-technology-be...

-

By

Admin

Admin - 0 comments

- 4 likes

- Like

- Share

-

By

-

A quote often attributed to St. Augustine, the early Christian theologian, is: “The world is a book, and those who do not travel read only a page.” I feel blessed to be able to travel as much as I do—not because I’m a big fan of 10-hour flights or living out of a hotel room.

I feel blessed because travel allows me to meet and speak at length with some truly fascinating and successful people, from CEOs of firms both large and small, to deal lawyers, to audit partners.Hearing varying opinions on global issues and politics has helped expand the scope and depth of my “book,” or understanding of the world. In turn, I enjoy sharing some of these thoughts with you.

Opinions come a dime a dozen, of course, and in today’s hyper-partisan world, it’s impossible to expect everyone to agree on all things all of the time.

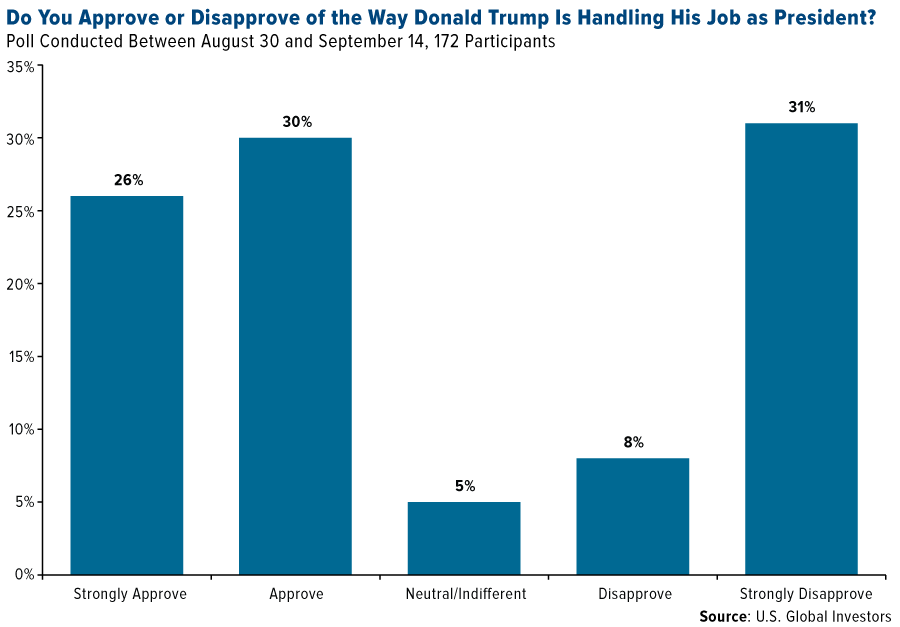

Case in point: I recently polled readers on their approval of the way Donald Trump has handled his job as president so far. This isn’t a scientific poll by any stretch of the imagination, but for whatever it’s worth, a combined 56 percent of participants said they approve of the president.

Amazingly, that’s roughly the percentage of Electoral College votes given to Trump in November. (The exact figure is 56.87 percent.)

Approve or disapprove of way Trump is handling his job as PresidentSome could easily take from this poll that my readers are huge Trump supporters—and many of them are—but that would be overlooking the fact that nearly 40 percent said they disapprove of the way he’s handled his job.

I share this because it serves as a relatively accurate cross section of the types of opinions and perspectives I come across during my travels. Some of those opinions end up informing my own thinking, some don’t—but all of them are added to my “book.”Now with North Korea launching even more rockets over Japan, the market continues to make new highs.

This is what I was asked most often last week on CNBC Asia, Bloomberg Radio and Fox Business. As I said then, I’m bullish because the purchasing manager’s index (PMI) is up and oil prices are down, thanks to the ingenuity of Texas fracking, which has created a global peace tax break. The weaker dollar is also favorable for exports and gold.Bitcoin on Sale After the China-Dimon One-Two Punch

Someone whose opinion I greatly admire, even if I don’t always agree with it, is Jamie Dimon’s. The highly-respected JPMorgan Chase (NYSE:JPM) CEO was asked last week at a global financial services conference in New York to share his thoughts on Bitcoin—which can be as polarizing as President Trump.

Some people love the cryptocurrency, some people hate it.Dimon, who’s decidedly in the latter camp, didn’t mince his words. Although he likes blockchain technology, which Bitcoin is built on top of, he began by saying he would fire any JPMorgan trader who was caught trading Bitcoin, which he went on to call “stupid,” “dangerous” and “a fraud.”

“You can’t have a business where people can invent a currency out of thin air,” he said.With all due respect to Dimon, some might point out that “inventing a currency out of thin air” is how we got Federal Reserve Notes and other forms of paper money in the first place. Even he admits this:“The first thing a nation does when it forms itself—literally the first—is forming currency.”

Bitcoin—and any of the 800 other cryptocurrencies—takes this idea to the next level, the main difference being that no third party or monetary authority controls its issuances or transactions. It’s all peer-to-peer.

Governments tend to resist anything that disrupts the status quo, which is why we saw China restrict new initial coin offerings(ICOs) the week before last. I suspect we’ll see a few more countries attempt to regulate ICOs in other ways, and as long as these regulations are fair and reasonable, I welcome them.

The Bitcoin price was knocked down following the one-two punch of China and Dimon, falling 39 percent from its peak of $4,919 on September 1. Last Thursday it lost more than $611 a unit, one of its worst days ever, but on Friday the cryptocurrency rallied strongly again.

However, at time of publication the cryptocurrency had slipped below the $4,000 mark.With its ability to validate all transactions in an immutable electronic ledger, the blockchain has the potential to be as disruptive as Amazon (NASDAQ: AMZN) was in the late 1990s.

When the company went public in 1997, there were serious doubts whether people would willingly give up their credit card information just to buy a book. Since then, Amazon stock is up 8,000 percent, and founder Jeff Bezos briefly overtook Bill Gates in July to become the world’s wealthiest person.If you’re curious to learn more about how blockchains work, I recommend that you watch this two-minute video.Gold Price Correlated to Money Supply Growth

In some ways, cryptocurrency more closely resembles gold. Just as there’s only so much gold that can be mined in the world, the number of Bitcoins that can ever be mined is set at 21 billion. But the exact amount is irrelevant. It could have been set at 21 trillion—the point is that supply is limited and finite.

The same cannot be said of the U.S. dollar, or any fiat currency, which today is printed “out of thin air” with abandon. This has led to hyperinflation in some instances and destroyed the value of several countries’ currency, including the Zimbabwean dollar and, more recently, the Venezuelan bolivar.

I’m not suggesting we’ll see the same thing happen here in the U.S. Nevertheless, rampant money-printing has certainly contributed to many people’s dwindling trust in traditional monetary systems.

A 2016 Gallup poll found that Americans’ confidence in banks is stuck below 30 percent, where it’s been since the beginning of the financial crisis nearly 10 years ago.

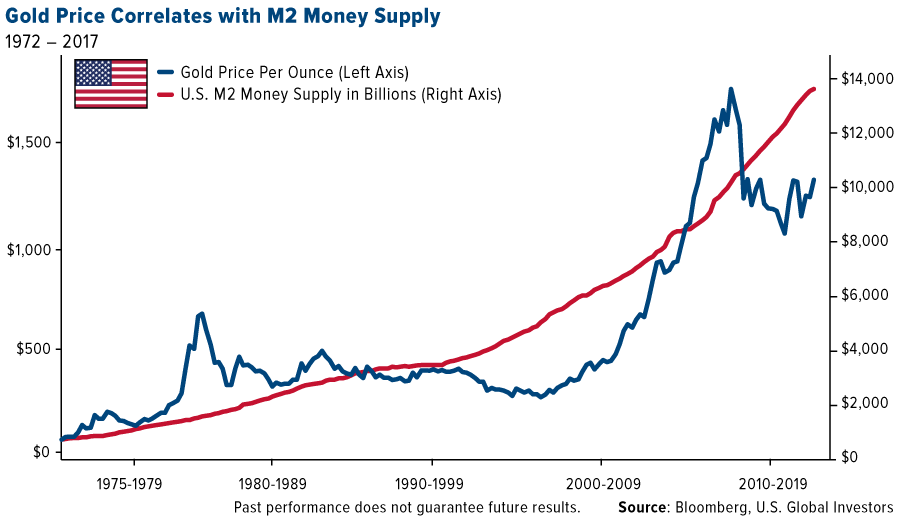

When more money is printed, gold has traditionally been a beneficiary, for two key reasons:

1) If the money-printing is accompanied by economic growth, greater access to capital might boost demand for luxury items, including gold (the Love Trade); and

2) If the money-printing isn’t accompanied by economic growth, inflationary pressures might prompt investors to increase their exposure to real assets, such as gold (the Fear Trade).

These were among the findings in a 2010 World Gold Council (WGC) study. Even after seven years, the findings still apply. As you can see below, the price of gold expanded over the years as more and more money was printed.

Gold price correlates with M2 money supplyIf we want to get really technical, the WGC estimates that for every 1 percent increase in U.S. money supply, the price of gold tends to rise 0.9 percent—nearly as much—within six months.

According to the most recent Federal Reserve report (September 7), more than $13.67 trillion in M2, or broad money, are now in circulation. That’s up about 1 percent since the end of June, when M2 stood at $13.54 trillion.So will the gold price climb 1 percent in response? That would amount to only $13 an ounce, but remember, there are other factors driving gold, including negative real interest rates and geopolitical uncertainty.

One final note: A former UBS metals trader was arrested and charged last week with fraud and conspiracy over his alleged role in placing “spoof” orders for precious metals futures contracts. Andre Flotron, a Swiss citizen, was arrested while visiting his girlfriend in New Jersey. Flotron began working for UBS in 1999 but was put on leave in 2014.

See Zero Hedge for more on conspiracies and convictions in court over price manipulation of precious metals. Many cryptocurrency advocates allege this is why Jamie Dimon is so aggressive in knocking down Bitcoin. The enthusiasm for Bitcoin has accelerated this year with South Korean and Japanese banks accepting them as a form of money.

Disclosure: All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.-

By

Admin

Admin - 0 comments

- 2 likes

- Like

- Share

-

By