Proba

- by Ivo Morcic

- 10 posts

-

Why should you create a user account on Blockchain Company (BC) today?For one, you will qualify to receive 500 free BC Tokens as long as… continue reading on our Medium page here: https://medium.com/blockchain-company/create-a-free-consumer-or-business-account-and-get-free-bc-tok...

-

By

Admin

Admin - 0 comments

- 6 likes

- Like

- Share

-

By

-

Recommended Learning: 8 Important Words You Should Know About Cryptocurrencies (interestingengineering.com)Cryptocurrency remains one of the hottest topics in recent years. The combination of technological innovations, software prowess, and business acumen attract a wide variety of people.

However, it's so easy to get swept up in the minutia of cryptocurrency jargon. Right now, that jargon is what's keeping the general public from understanding how it works. If the average investor struggles to understand the language behind an idea, then why do cryptocurrency fanboys swear that everyone will support it within the next decade?

In the words of United States Senator Thomas Carper, "Virtual currencies, perhaps most notably Bitcoin, have captured the imagination of some, struck fear among others, and confused the heck out of the rest of us." This list of terms starts at the very basics of the industry to explain key phrases and words you'll probably hear a lot as digital currencies get more popular.

Cryptocurrency

Let's start with understanding the key concept -- cryptocurrency. In short, cryptocurrency is a medium of exchange that uses cryptography to transfer funds. It was designed to be anonymous and (surprisingly) secure. It's completely decentralized and thus relies on a massive public ledger (called a blockchain) in order to validate transfers and maintain the ledger.

There are no fees and no extensive regulations which pique the interests of those exhausted by financial squabbles within their own countries. Cryptocurrencies might be brilliant for those willing to take a risk on investing, but major banks have stayed relatively clear of them. Cryptocurrencies make it hard for central banks to influence the price of credit in an economy.

They take away a regulatory body's ability to gather data about economic activity. Many banking executives expect cryptocurrencies will also hinder a central banking agency's ability to control exchange rate and other major functions of monetary policy.

Cryptocurrencies -- especially bitcoin -- have garnered a reputation in pop culture as being the go-to transaction for illicit activities like drug deals. (And, due to the extensive anonymity offered by the very nature of cryptocurrencies, we can neither confirm nor deny the validity of that association...)

Still don't get it? SciShow did a brilliant explanation of Bitcoin (but Cryptocurrencies as a whole) which you can watch below.

Bitcoin

In 2008, Satoshi Nakamoto created the world's first (and arguably most important) cryptocurrency. He never intended to invent an entirely new currency system; he just wanted to make a "peer-to-peer electronic cash system" unconnected to anything else.

The most important contribution of Bitcoin's initial founding was that it developed a decentralized digital cash system after decades of failed attempts.

Innovation

The Most Popular Digital Currencies You Should Know About

Bitcoin remains the most popular and most frequently traded cryptocurrency to date. In March 2017, the value of Bitcoin outweighed the value of an ounce of gold, $1,268 compared to gold's $1,233. The value peaked at nearly $5,000 earlier last month.

Altcoins

These are basically any cryptocurrency that isn't Bitcoin. It's a blend of "alternative" and "bitcoin." All altcoins also use decentralized control and a similar blockchain transaction setup. Popular altcoins include any initial coin offering (ICO) group. Ripple, Litecoin, and Ethereum are big names amongst altcoins.

Fork

Forks are what happens when two bitcoin roads diverge in an internet woods, to borrow a Robert Frost poem. It's when developers don't agree on how to improve the program, and thus the codebases split. The blockchain can handle this split but, since the realm of cryptocurrency isn't regulated, the developers sort out values on their own.

The most famous fork was in August 2017 when bitcoin split to form another cryptocurrency -- Bitcoin Cash. As with operations in any new bank, resulting companies take time to draw in users. Two new forks could be on their way before 2018. The proposed Bitcoin Gold claims to have a new algorithm and a truly decentralized market. The other fork would be Segwit2X and looks to boost the capability of bitcoin. Ethereum is also planning on its first fork within the next year.

Address

An address is a name by which you send and receive bitcoin. It's like an email address as users send bitcoins to a person by sending it to one of their addresses. However, unlike email, people have many different Bitcoin addresses and different addresses are used for each new transaction.

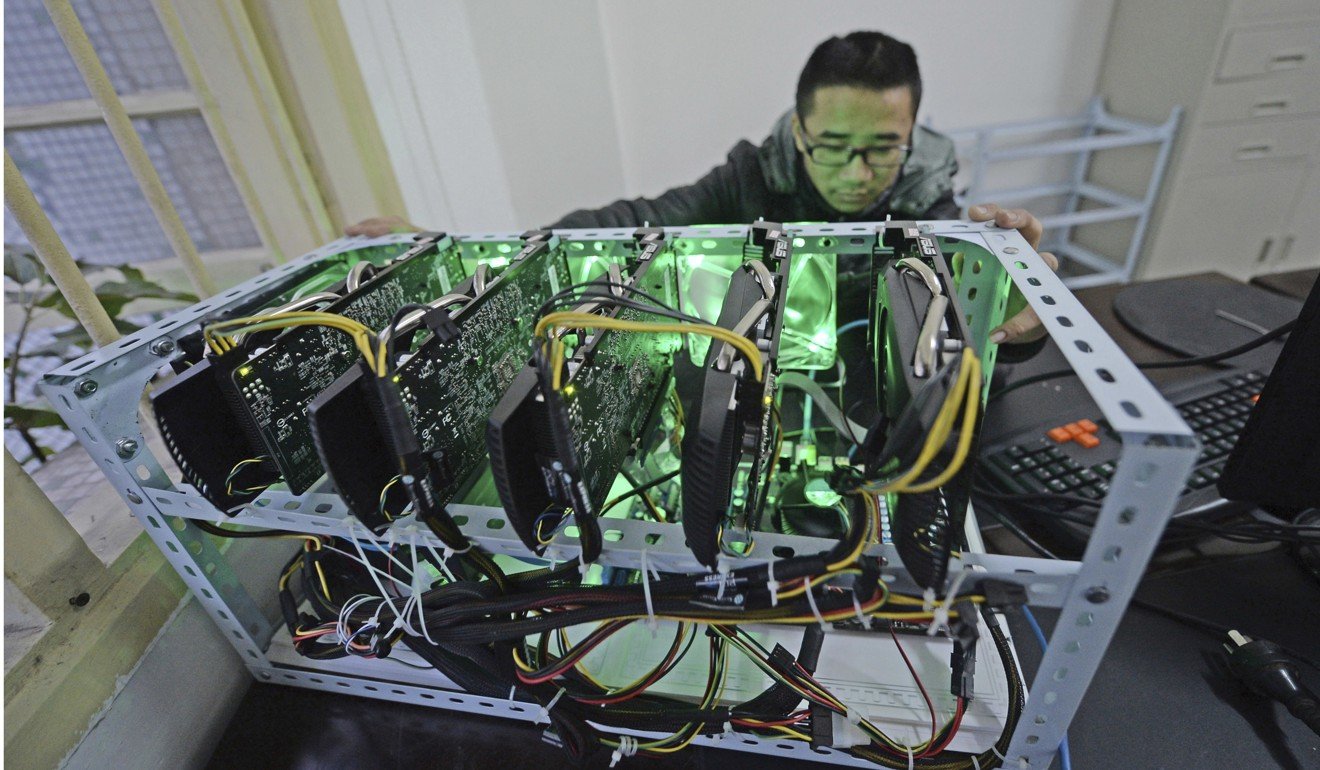

Mining

It's one of the most popular words associated with bitcoin and other cryptocurrencies. Bitcoin mining is how new money is added to the public ledger (see 'blockchain' further down). However, mining for gold in real life might be easier than mining for cryptocurrencies given the increasingly difficult puzzles.

Anyone who has access to the Internet and decent hardware can mine. In an oversimplified explanation, participants have to solve an incredibly difficult puzzle. The first person to solve gets to put a new block on the blockchain and win the rewards. Essentially, miners invest time, money, and technological effort into hopefully 'striking it rich' on solving one of the hash algorithms and adding to the blockchain.

Signature

The bitcoin signature is one of the most important safety nets in cryptocurrency. In transactions, there are two types of keys -- a private key and a public key. Those keys are specifically linked to one user, and the private key is only known by that user. To send a transaction, the private key 'stamps' the transaction which creates the public key.

That public key creates the address by which the transaction is sent. The sender signs the message with the signature and the key to the peer-to-peer public network for validation. The signature is mathematically unique and varies just as your own signature has slight differences each time you sign for a purchase at a store.

"In a physical signature, you'll typically affix, let's say, a sequence of characters representing your name or identity to a document," said Khan Academy's Zulfikar Ramzan. "This process effectively binds your identity to that document and more so by formulating the characters in your name, and maybe some particular to a unique or peculiar way that's unique to you.

The hope is that nobody will be able to forge your name on that document. Now in a digital signature scheme, it turns out you can achieve these kinds of properties mathematically."

Blockchain

It's the public ledger for all bitcoin transactions. It lets information get distributed for the sake of accountability but not copied. Fans of bitcoin call it the "backbone of a new type of internet.

" Think of it like a spreadsheet that anyone can get a copy of across a network of computers. This spreadsheet will update with recent transactions for everyone to see. That's a blockchain in a nutshell.

For many, blockchain technology is the most effective and useful thing to come out of cryptocurrencies. The database isn't stored in one centralized location, meaning there's no incentive for hackers as everyone has this information and can verify it.

The data is literally accessible to anyone with internet. Writers Don and Alex Tapscott said, "The blockchain is an incorruptible digital ledger of economic transactions that can be programmed to record not just financial transactions but virtually everything of value.

" Still want to know more about bitcoin and other cryptocurrencies? Check out Khan Academy's course on bitcoin. It's an excellent and free cryptocurrency primer.

Discover more articles on Interesting Engineering: https://interestingengineering.com/8-important-words-you-should-know-about-cryptocurrencies

-

By

Admin

Admin - 0 comments

- 5 likes

- Like

- Share

-

By

-

This month, Morgan Stanley issued a report in which it performed an analysis of the cryptocurrency ecosystem. Researchers at the Morgan Stanley Decrypted!

A Crypto/Blockchain Teach-in sought answers to gain a better understanding of the underlying features of various iterations of blockchaintechnology, as well as the cryptocurrencies that inhabit those ecosystems.

The researchers identified four big takeaways from the teach-in: the pace of development in the cryptospace is "mind boggling," seasoned players are ready to face challenges and are "self-aware of opportunities," platforms still must undergo a great deal of development before going mainstream, and incumbent investors will seek to "retain their moat.

"An analysis of Bitcoin versus Ethereum blockchains pointed out the pliability of executable distributed code contracts as well as the Ethereum blockchain's ability to create a means of broad-spectrum consensus, whereas Bitcoin is only a balance of accounts. Research was also performed on Ripple and its remittance solutions suite....continue reading on Ethnews: https://www.ethnews.com/morgan-stanley-report-analyzes-blockchain-based-currencies-and-industry

-

By

Admin

Admin - 0 comments

- 9 likes

- Like

- Share

-

By

-

However, not all people share the same view about the disastrous consequences of the latest hurricanes and climate change in general. Sir Richard Branson, the English business magnate, investor and philanthropist, shared his thoughts on Facebook:

“When I opened the door after Hurricane Irma, I looked out over Necker Island, saw the horrendous devastation and felt enormously sad and worried for the whole BVI. But I also felt extremely angry at climate change deniers and more motivated than ever to help unite the world behind climate action.”

Energy - a huge source of CO2

Unfortunately, the biggest polluters are people. 7.5 billion People live in today’s world, and they produceCO2 in various ways, sometimes without even realizing it. Do you pollute when reading this article? Yes. You see, this article is read on an electronic device that needs electricity and nowadays the world is running on dirty energy. Moreover, the demand for electricity continues to grow every day.

To be exact, 78.4% of the total energy consumption is produced by polluting the environment and increasing climate change[1]. Due to a drop in the investment level this year, it became difficult to reach the 100% renewable energy target[2].

Without higher investment into renewable energy, the fight against climate change will not be successful. 2008, when prices in the global oil market have reached record levels, developed countries have started to increase their use of alternative energy sources and develop renewable energy programs.

With new technologies and decreasing prices for renewable energy production, the shift from dirty to clean energy became foreseeable. But the most important thing is that it will not require decades to see the change.Empowering the sharing of economic principles in the energy sector.

One of the ways used to increase renewable energy production and its use in the world is to create the necessary clean energy supply according to the market price, but to reach this, somebody has to finance the renewable energy production.

Access to the missing capital can be created by empowering every person to become part of the change. Sharing economic principles in the energy market could solve the problems faced by the producers of renewable energy projects and generate good returns for everyone.

With the help of blockchain and smart contracts, it is now finally possible to create global and transparent networks for the distribution of green energy, where each one of us can become green energy producers, buyers or investors in green energy.

PEXELS.COMWindmills on Shore

Investing in Green Power has become easier and easier for everyoneWith the aim of fighting back against global warming, entrepreneurs have started creating platforms that are tokenizing energy and enabling the transparent global financing and trading of green energy. Technology ensures full transparency – everyone can know where and what energy they’ve bought and when it was produced as well as consumed.

This makes the buying of future energy production safe, profitable and liquid. From the perspective of a renewable energy producer, this allows the sale of tokenized energy to cover the construction costs of renewable energy plants.With such a business model based on novel technology, everyone can buy energy tokens globally, regardless of the place a person lives.

As an example, such platforms would enable Koreansto buy the clean energy in Spain, where the energy is produced according to the market price, and make profits from the difference between the price paid for the energy upfront and the price of the energy at the moment of its production.

With such monetary benefits, who would not want to invest in green energy and save the planet? The first platform offering such a solution is We Power, whose model increases a renewable energy producer’s return on equity ratio by 25% and offers energy buyers a return of 17-20%.

How does it work?

Blockchain platforms connected to the energy infrastructure can connect energy tokens with the data about the energy that will be produced at a certain point in time. The energy tokens represent the ownership right of a specific amount of energy to be produced in the future. The ease of buying and selling tokens allows the global trading of tokenized energy on a blockchain.

The trades are done through the conclusion of smart contracts, which represent power purchase agreements and indicate when the energy will be produced, what price was paid for it, and calculate the difference between the price paid and the market price.

The smart contracts ensure liquidity and standard purchase rules for everyone. Investors can easily transfer them and exit from their investments made in renewable energy. Once the energy is produced, it can be either used by the token owner or sold to the energy market at the current market price.

Starting with renewable energy project financing, such platforms could become the next generation of utility companies based on the core principles of decarbonisation, democratization and decentralization. Eventually, every one of us will join together in the movement to stop the pollution of our planet by investing in and using green energy.

Discover even more blockchain reports like this on HuffPost here: http://www.huffingtonpost.com/entry/revealed-the-real-secret-of-green-power-powered-by_us_59ce1d3ae4...

-

By

Admin

Admin - 0 comments

- 5 likes

- Like

- Share

-

By

-

The U.S. Department of Homeland Security (DHS) has awarded a grant of nearly $1 million dollars to a blockchain startup.Virginia-based DigitalBazaar, according to a September 25 release from the DHS, received the $749,241 in funding through the Small Business Innovation Program (SBIR).

The grant, the department said, is intended to fuel the development of "fit-for-purpose blockchains" for a number of use cases.Specifically, the government said, the firm will work on a "flexible software ecosystem" to include "digital credentials and digital wallets to address a wide variety of identity management and online access use cases.

"The software is being developed for the department's Homeland Security Enterprise initiative.The news marks the third time DigitalBazaar has received funding through the SBIR. The startup was one of several recipients of funding in...continue reading: https://www.coindesk.com/us-government-awards-750k-new-blockchain-startup-grant/-

By

Admin

Admin - 0 comments

- 6 likes

- Like

- Share

-

By

-

Sirin Labs today announced it’s developing a smartphone and PC designed to function on the blockchain.

The devices will ship with built-in resource-sharing capabilities and run on their own cryptocurrency token.The Finney smartphone and PC are being billed as niche` products, and with a price tag of $999 for the phone and $799 for the PC. After all, not everyone needs a secure e-wallet device that allows them to spend tokens on shared resources — but it would be really cool if we all had one.

Moshe Hogeg, CEO and Founder of Sirin Labs, is a big-picture kind of person. The companies last device, the Solarin, was a $16,000 smartphone billed as the world’s most secure cell phone. It seems like the idea was to provide a solution for celebrities and secret agents who are willing to spend anything to keep their data safe.This time he’s building for the cryptocurrency market and, like many other startup CEOs, he’s betting on the blockchain.Hogeg told TNW:It will integrate a highly secure wallet for cryptocurrency cold-storage, to ensure security, and it also has a lot of blockchain technology. For example you can use the devices as a shared resource center. If you and I were travelling and I needed to charge my phone you could share your battery power with me in exchange for tokens. I could share my data plan with someone in exchange for tokens or become a hot-spot.

While there’s no word yet on some specifics such as release date, Sirin Lab’s website does list the following technical specs for the Finney phone:

- 5.2-inch QHD Display

- 256GB of internal memory storage

- 8GB RAM

- Wi-Fi 802.11ac

- BT 5.0

- 16MP Main camera

- 12MP Wide-Angle selfie camera

And for the Finney PC:

- 24-inch (diagonal) 2K Display

- Biometric security sensors

- 8GB Memory

- 256GB storage

- Wi-Fi 802.11ac

Sirin Lab’s own SRN.Sirin Labs will be launching its SRN token sale sometime in October, with early adopter bonuses and bounties. They’ll be accepting fiat money and popular cryptocurrency like Bitcoin and ETH. For the most part, this looks like your standard ICO launch. The distinction here is that token holders are the only people who will be given access to purchase the devices.

It’s hard to picture a device geared toward the cryptocurrency crowd reaching the kinds of sales figures necessary to keep a $999 phone afloat, but how amazing would it be if we all started sharing our device’s resources?I look forward to living in a world where CPU power never goes to waste, data-plans are shared securely, and you don’t need an advanced...continue reading: https://thenextweb.com/finance/2017/09/26/this-blockchain-powered-phone-and-pc-could-be-out-next-yea...

-

Jakobo Gimeno people are really trying to make as much money as they can from blockchain its good to see its getting alot of attention lately.

-

As dozens of bitcoin exchanges in China were told to shut down and at least one industry conference was forced to flee Beijing for Hong Kong, the Ministry of Industry and Information Technology last week launched a “trusted blockchain alliance” to speed up study of the digital ledger.

Financial News, the mouthpiece of the People’s Bank of China, published an opinion piece on last Tuesday saying Beijing should “accelerate the process of launching a sovereign digital currency after it curbed risks of encryptocurrencies”.

While the article was authored by Huang Zhen, a professor at the Central University of Finance and Economics in Beijing, its publication in an official newspaper reflects the central bank’s endorsement of the view.

China’s bitcoin miners in limbo after Beijing shuts down exchangesChina’s ambition to lead the world in blockchain technology and sovereign digital currency is not new.

The IT ministry in October published an 82-page white paper announcing its desire to be at the forefront globally in blockchain technology and encouraging Chinese businesses to become involved in setting global technical standards.

The central bank, meanwhile, has set up a special institute to study digital currency, and Zhou Xiaochuan, its governor, told a press conference in March that the central bank encouraged the development of technologies such as digital currency and blockchain.

The bitcoin boom and the quick spread of initial coin offerings, however, alerted the Chinese government that cryptocurrencies were becoming tools of speculation and even crime.It banned ICOs earlier this month, defining them as illegal fundraising, and told exchanges of bitcoin and other digital currencies to shut down trading.

Why has China declared war on bitcoin and digital currencies?“It’s disappointing to see that the speculative nature of trading activity has hijacked the reasonable demand for bitcoin, ICOs and other digital coins,” said Ben Shenglin, dean of the Academy of Internet Finance at Zhejiang University in eastern China.

The government, which is making financial risk prevention a priority, “has no choice but to shut exchanges down”, he said.While the PBOC is leading government agencies in a crackdown on ICOs and bitcoin exchanges, the central bank is trying to separate ICOs from blockchain technology, even though many coin offerings are designed to fund blockchain-based projects.

After Beijing’s crackdown, Sun Guofeng, who heads the financial research institute at the central bank, told Financial News last week that “blockchain remains a good technology ... and there should be a distinction between blockchain technologies and ICOs”.Can China’s central bank mint an answer to bitcoin?

China’s fintech firms were still encouraged to study blockchain even though ICOs were banned, he said.

The IT ministry has approved nine products that meet trusted blockchain standards, including Tencent Blockchain developed by the tech giant’s online payment system Tenpay, and a platform from Chinese telecom conglomerate ZTE.

However, the jury is still out on whether China can embrace blockchain by banning bitcoin and ethereum, the most popular digital currencies.

China’s WeChat crackdown drives bitcoin enthusiasts to Telegram

Han Feng, who teaches blockchain at Tsinghua University, said it was understandable that the PBOC was trying to issue a digital currency so it could better control transaction data, but that it still faced technological challenges.

In a September 17 report, the Bank of International Settlement said central banks must consider whether to issue their own digital currencies, but reminded them of the risks involved....continue reading: http://www.scmp.com/news/china/economy/article/2112578/china-still-keen-develop-sovereign-digital-cu...-

By

Admin

Admin - 0 comments

- 3 likes

- Like

- Share

-

By

-

By John Bonar :

Russian interest in cryptocurrencies is blossoming with the endorsement of the country’s president Vladimir Putin. While some within the country’s financial sector, including Bank of Russia chairwoman, Elvira Nabiullina, remain cautious, others are embracing the crypto currency phenomena enthusiastically.

Vitalik Buterin, the Russian-Canadian founder of Ethereum the second largest blockchain platform after Bitcoin, hosted the “Ethereum Russia 2016” conference in Skolkovo, and later announced the formation of Ethereum Russia in partnership with Vladislav Martynov, CEO of Yota Devices, a mobile communications and connectivity devices company based in Russia and financed by Russia’s state-owned Bank for Development and Foreign Economic Affairs, (VEB).

Ethereum Russia was created to enhance the country’s ability to implement blockchain technology which underpins the cryptocurrencies.

Martynov explained that Ethereum Russia will provide education, events and architecture review for VEB, and guide the development of a new centre for blockchain research in the National University of Science and Technology (MISIS). It is funded by VEB. The centre in Russia’s Silcon Valley emulator will aim to introduce blockchain technology to the financial, banking and state sectors, as well as the industry of commodity exchange. Another function of the centre will be the support IT projects and startups working with blockchain technology.

Vice President of Skolkovo, Igor Bogachev, has said, “The Skolkovo Foundation, in co-operation with Ethereum, will organize the selection and acceleration of promising projects and teams, and provide support to blockchain startups in the form of tax benefits and grants.

The development centre will not only be able to satisfy the current demands of the state and business, but also the future ones: Internet of Things micropayments, complex smart contracts execution, creation of hybrid platforms and state registers of any kind.”

In early June this year The 23-year old Russian-born Buterin attended the St. Petersburg International Economic Forum and met with Mr. Putin. During the Forum the Russian President declared,” The digital economy isn’t a separate industry, it’s essentially the foundation for creating brand-new business models.”

The Moscow government plans to regulate cryptocurrencies like securities rather than outlawing them, Finance Minister Anton Siluanov told reporters in September.

“The state certainly understands that cryptocurrencies are a reality, there is no point in prohibiting them,” Siluanov told reporters in Moscow. “It is possible to regulate them, so the Finance Ministry will draw up a bill by the end of the year.

”Alexander Dunaev, COO at emerging markets fintech company ID Finance, told Forbes magazine that the Russian government is recognizing the change in financial services caused by technological disruption. ‘The last time the world saw such an unprecedented change was in the second half of the 20th century with the adoption of personal computers - which Russia missed due to geopolitical isolation. There is a lot of will to avoid this pitfall in the future.’

Thanks to the original cryptocurrency Bitcoin’s widespread use for cross border anonymous transfers, many Russians consider bitcoins and other cryptocurrencies as money surrogates which have previously been linked with fraudulent pyramid schemes.

According to Bloomberg, Putin was attracted to Ethereum as a ‘potential tool to help Russia diversify its economy beyond oil and gas’.

‘Blockchain may have the same effect on businesses that the emergence on the internet once had - it would change business models, and eliminate intermediaries such as escrow agents and clerks. If Russia implements it first, it will gain similar advantages to those the Western countries did at the start of the internet age,’ Martynov has said.

The concern about cryptocurrency pyramid schemes has crystalized around Initial Coin Offerings (ICO’s) which have been used to raise millions virtually overnight and created millionaires out of the founders of a flood of new cryptocurrencies.

These concerns prompted China’s draconian clamp down on ICO’s and cryptocurrency trading earlier in September which reverberated through the blockchain market....continue reading:

http://www.marketoracle.co.uk/Article60281.html-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Start-ups are opting for private investment rounds and are shying away from the public scrutiny of the global capital markets, but one fund manager says he knows the solution.

"Quite frankly, there is no profit to be made for the banks for having companies go public under a three- or four-billion dollar valuation," said Jeff Stewart, co-founder of the Global Public Offering Fund and the former CEO of Singapore-based Lenddo, a credit score firm.

Stewart said public offerings by small growth companies once opened a door for further growth, but now that path to list in the United States is nearly impossible."At the end of the day, companies in the $100 million to $200 million market cap range can't go public.

Oracle, Cisco and Intel would be deemed too small to go public today if they decided to list," he told CNBC's "The Rundown."Last year, only 18 American companies completed IPOs that raised less than $50 million as compared with 557 companies in 1996, according to the fund.

Stewart and Key Compton, who founded several North America-based technology companies, are setting up a fund to invest in U.S. firms and take them public on Asia-Pacific exchanges.And it's not taking the traditional financing route.The ICO approach

Designed to capitalize on what the pair describe as the coming decentralization of capital markets, the Global Public Offering Fund plans to use an initial coin offering (ICO) to raise capital to invest.

"Long term, ICOs are the future of the capital markets," he told CNBC, pointing to that increasingly popular process in which start-ups bring in millions of dollars by issuing blockchain-supported virtual tokens to investors in exchange for money.

"The tokenization of capital is really the future. It's going to provide new levels of liquidity and new levels of transparency. You already have most of the major exchanges with major blockchain initiatives," said Stewart.In fact, he said, blockchain-based tech will "evolve the global capital markets and create new paths for capital raising, liquidity and governance.

"ICOs are essentially a form of crowdfunding, allowing a larger and wider pool of investors to buy into a company or technological idea, but it's not without controversy.

The ICO market is largely unregulated, but it continues to attract mainstream investor attention. There is still a lack of consistency in the methodology of pricing a token, and the limited due diligence required to initiate a sale presents both risk for participants.

"Conducting our own ICO will provide valuable learnings and allow our portfolio companies to have a front row seat in defining what constitutes a global public offering," said Compton.

"There are obvious advantages to blockchain-based technologies, distributed ledgers and smart contracts and they will help to evolve financial systems everywhere. Our hope is to advance the current state of the art and utilize the GPO Fund to make long-term and constructive contributions to the global capital markets."The new fund

The GPO Fund will be focusing on founder-lead technology companies that can grow aggressively in the Asia-Pacific region. It's seeking companies with private valuations in the $100 to $200 million range, with the goal of listing on a major Asia-Pacific exchange within 12 months of investment.

"Our strategy is to invest in companies, well-run companies that we think can be worth substantially more in the U.S., and then bring them public globally," Stewart said.The fund is looking at exchanges in Asia, including Singapore, Hong Kong and Australia, depending on the company.

Discover even more stories like this on CNBC here:

https://www.cnbc.com/2017/09/20/the-us-ipo-market-is-dead-but-icos-are-the-future-says-entrepreneur....-

Jose Ojeda Portillo Adviser at Blockchain Company / Water Health Environment / Biosphere University << The tokenization of capital is really the future. It's going to provide new levels of liquidity and new levels of transparency. You already have most of the major exchanges with major blockchain initiatives. Blockchain-based tech will evolve the global capital markets and create new paths for capital raising, liquidity and governance. >>

-

-

The Blockchain conference is taking place in Auckland New Zeland in May 2017

The Blockchain and Smart Contracts are set to transform the world. This event is about helping people to understand how the blockchain and smart contracts are going to change & disrupt every business sector from agriculture to finance.

The event is aimed at anybody who wants to know what all the fuss is about including CEO's, Directors, Entrepreneurs, Project Managers, Programers in every business domain . We will take you on a journey from teaching you the basics through to exploring some of the real life ways that blockchain technology is being used to disrupt business models and transform our society.

We will challenge you. We will inspire you. You will get to meet many of the world's thought leaders in this space.

Learn more...http://www.theblockchain.nz/

-

By

Admin

Admin - 0 comments

- 0 likes

- Like

- Share

-

By