best

- by belkacem

- 5 posts

-

Report: Kazakhstan’s Blockchain and Cryptocurrency Association Seeks State Regis... (cryptovest.com)Kazakhstan intends to step up blockchain promotion and adoption. The newly formed Blockchain and Cryptocurrency Association recently filed to be officially registered as a legal entity. With this move, the group aims to support blockchain and help develop a legislative framework for the technology.

As reported by Kapital.kz, the association currently has six members but 15 organizations have already applied to join. Last week, the alliance held its first meeting.

The people behind it come from various backgrounds, with some having worked for regulatory bodies and technology companies.Yesset Butin, co-founder and council chairperson of the association, has held positions at subsidiaries of Kazakhstan’s National Bank, while Arman Dzhakambayev has worked in the field of banking supervision.

The association’s executive director, Dastan Kozhabekov, was head of the Parasat national scientific and technological center and the Kazakh Institute of Oil and Gas.Butin said:“Our main goal is to prescribe the rules of the game in the blockchain market and cryptocurrency in Kazakhstan together with the regulator [the National Bank]. There are no companies operating in the blockchain market in Kazakhstan, but there are more companies that see the promise of technology for themselves.”

He went on to add:“First, we must follow world trends. The Russian Association of Blockchain and Cryptocurrency has already been created and literally within a month they managed to achieve certain results. Belarus announced the imminent emergence of such an association.

Butin said it was not possible to estimate the value of Kazakhstan’s blockchain market given its infancy. He stressed that it was essential to build the infrastructure and legal framework to make things work.

We believe the time has come to create such an association here to unite organizations and companies that work in the blockchain market or plan to work in the cryptocurrency markets.”

Additionally, the Blockchain and Cryptocurrency Association plans to collaborate with universities to launch educational courses focused on blockchain.According to Butin, a “cryptotenge” issued by the National Bank would support the creation of a legal platform for buying cryptocurrency in tenge as the cryptotenge would be easily convertible to other popular cryptocoins.“People are looking for an alternative and find it in the form of cryptocurrency,” he added.

Earlier, the National Bank chief Daniyar Akishev said he was concerned about the risks of cryptocurrencies, warning that they are not sound investment options.

However, he also admitted to lack of sufficient knowledge in the area of cryptocurrencies.

On the other hand, Kazakhstan President Nursultan Nazarbayev is very positive about digital money and has even called for a global cryptocurrency.

Discover more blockchain perspectives and insights from Cryptovest here:

https://cryptovest.com/news/kazakhstans-blockchain-and-cryptocurrency-association-seeks-state-regist...

-

By

Admin

Admin - 0 comments

- 0 likes

- Like

- Share

-

By

-

With Ethereum wallets under constant attack, Jibrel Network decided to build the... (techcrunch.com)Since blockchain technologies appeared people have been trying to figure out how to put traditional assets like currencies, bonds and other financial instruments onto it in a way which has regulatory compliance and is secure.

If you could do that you could sell securities in a legitimate way, thus disrupting large swathes of the asset management industry. In case you didn’t happen to know, the asset management industry is worth around $69 trillion or more, globally.

But you have to hold these assets in wallets. And it’s not easy getting it right.There are already a number of players in this space. Tether is a cryptocurrency issued on the Bitcoin blockchain via the Omni Layer Protocol. This allows users to trade and use digital tokens backed by the US Dollar.

Each of their ‘USDT’ cryptocurrency tokens is allegedly backed by this real currency held in Tether’s reserves and can be redeemed through the Tether Platform.

LAToken is a blockchain protocol and platform for creating and trading listed equity asset tokens. And Blackmoon Crypto is designed to enable traditional asset managers create and manage tokenized funds in a legally compliant manner (i.e. not go to jail!).But this world is not easy and is fraught with problems.

Tether recently claimed it was robbed of $31 million in tokens after a malicious attack.And just recently the leading Ethereum developer, Parity, accidentally permanently froze over $160 million worth of user funds because of a fault in its wallet.

Oops!Now a new company claims it will be able to fix some of these problems, especially as it concerns wallets.Jibrel Network, a company registered in the so-called “crypto-valley” of the Swiss canton of Zug, specializes in blockchain implementations for banks and so-called ‘Non-Bank Financial Institutions’.

It recently raised $3 million from crypto investors including TaaS Fund, Tech Squared, Aurora Partners, Arabian Chain, among others.With few robust Ethereum wallets available, and hacks continuing, the team decided to build its own.

It’s now launched the jWallet, a product aimed at consumers which, the company says, can store financial assets such as currencies, commodities, bonds and equities, on the Ethereum blockchain.

The Alpha version of the wallet, which provides a simple way to store, transfer and convert ERC20 tokens, comes out today. jWallet holds no user data and all keys are stored locally.

Most wallets have to make the decision to either sacrifice security or usability. But the jWallet can be run locally, is open source and a mobile version is also available.

“There is a growing need for reliable, enterprise-grade wallet solutions, that deliver the highest levels of user-friendliness, without sacrificing security,” says Victor Mezrin, CTO.

Unlike Tether, which provides only USD in the form of ERC-20 tokens, Jibrel has created tokens for six fiat currencies (USD, GBP, EUR, RUB, AED, CNY).Yazanz’s Barghuthi (project lead at Jibrel Networks) criticised Tether’s approach:

“As it stands, Tether requires centralization with reliance on traditional banking… Simply put, in tether, users purchased USDT directly from an exchange, whereas in Jibrel, one purchases JNT and then uses that to purchase asset-backed tokens from the Jibrel DAO.

”Fighting talk.Jibrel’s advisory board includes Don Tapscott (of Thinkers50 and author of ‘Blockchain Revolution’) and Eddy Zuaiter (former COO Soros Fund).

Techcrunh publish great reports like this you can discover here: https://techcrunch.com/2017/11/22/with-ethereum-wallets-under-constant-attack-jibrel-network-decided...

-

By

Admin

Admin - 0 comments

- 0 likes

- Like

- Share

-

By

-

You’re sitting down to a nice meal and your aunt, always one step ahead, mentions she wants to start investing in Bitcoin. You freeze, a drip of gravy plopping off the ladle. It’s your time to shine.You got this.

First, you know that the state of crypto is very, very good. This has been a banner year for cryptocurrencies. Bitcoin rose from $738 a year ago to $8220 as of this year.

If you invested $7000 in Bitcoin in November 2016 you’d be rounding into six figures by now.

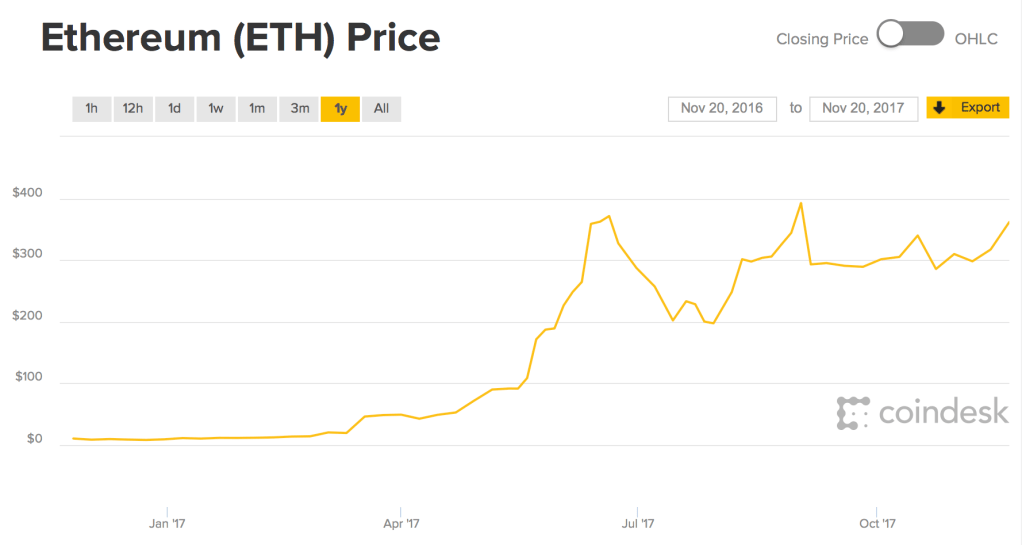

The same can be said about Ethereum with a bump from $9 in 2016 to $350 in 2017. Check out these graphs:

It’s enough to make your aunt want to sell her summer home and dump it all into the blockchain! But should she?Probably not.Interestingly, as the price has risen and the fluctuations have become more manageable, talk of crypto investing has died down.

There are many reasons, but the primary one is that the crypto world loves to keep quiet and take profits on the sly. This means if you’re planning on getting in you’d best act decisively. You can dabble, sure, but if you want to see real returns I do not expect things to fall back down to $3,000 or even $5,000.

We’re almost at a set-point for the next few months and, barring flash crashes, don’t expect much to change barring some wild SEC regulation.We’ve entered a strange era in cryptocurrencies.

The technology is mature enough that anyone can implement a blockchain solution — from small fintechs to MasterCard — but not yet trusted enough to become a true store of general value.

However the recent Segwit2x failure essentially showed the world that the “rulers” of the blockchain, namely the whales who have millions in crypto and the miners, want BTC to avoid becoming a utility and act more as a commodity.

They don’t want to turn the blockchain into a credit card transaction service but instead want a way to store and transfer massive hordes of cash electronically.

Ethereum, on the other hand, will be the utility. The price should rise until after January but will probably fall drastically once the first of the poorly-orchestrated ICOs fail. It will rise again once the the first true ICOs — the true token sales that approach this with an eye on monetary management vs. get rich quick schemes— begin rolling out. This will happen in the first and second quarters. How do you pick a good token sale? Right now you can’t. Your best bet is to buy Ether on a dip and avoid the weirder token solutions that come over the pike. Tokens are, in my my opinion, the future. Just not in their current form.Ultimately, the Ethereum network will grow to handle more transactions and Bitcoin will remain the same, a safeguard and bulwark for those who don’t want to keep their gold doubloons in a safe under the floor.

Twitter Ads info and privacy

Jameson Lopp ✔@loppWelcome to Bitcoin, newcomers! Here's your FAQ:

Q: Who should I trust?

A: Nobody.

Q: When should I sell?

A: Never.

Q: Is Bitcoin dying because ____?

A: No.

Q: What have I gotten myself into?

A: Nobody knows.

Q: How do I learn more?

A: https://lopp.net/bitcoin.html 8:52 PM - Nov 19, 2017

Is your aunt still hounding you for advice? If she owns she should hold. If she doesn’t own, she might as well give it a try. Make a her a Coinbase account and buy a few hundred dollars worth of BTC and Ether. Let her watch it move and begin to acclimate herself to the news cycle and, more importantly, the hype cycle.

Remember: results may vary and this does not constitute investment advice any more than me saying “Hey, you should try learning to use Linux. You might make a really nice salary when it gets popular” back in 1992.

Cryptocurrencies are entering the mainstream.

There are a few problems with its current popularity, the primary one being that people are entering the market without understanding it.

This is fine – this has been practiced for decades on the NASDAQ with untrained traders making gut-based guesses on complex companies – but in crypto the technology is wedded to the price and misunderstanding the news coming out of services like CoinDesk can get you into a lot of trouble.

To a degree the crypto loyalists love the fact that their world is inscrutable. To another degree this makes for some nail-biting times....continue reading on Techcrunch here: https://techcrunch.com/2017/11/20/how-to-talk-about-cryptocurrency-at-the-holiday-dinner-table/

-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

J.P. Morgan CEO Jamie Dimon thinks bitcoin is a “fraud.” Investor Mark Cuban called it “a bubble.” Goldman Sachs CEO Lloyd Blankfein is still undecided.

But whether or not executives believe in the potential of bitcoin, ethereum or blockchain technology, they and their companies can’t avoid talking about cryptocurrencies.

Mentions of “cryptocurrency” (digital currencies not tied to any country’s legal tender) and related terms including “bitcoin” and “ethereum” (the two most popular cryptocurrencies), “blockchain” (the technology underlying these currencies), and “initial coin offering” (or ICO, which lets companies raise capital through the creation of a new cryptocurrency) have skyrocketed over the last seven years, according to data from Sentieo, a financial research firm.

In total, 1,200 publicly traded companies have generated over 12,000 mentions of digital currency during the past 14 years.With another month left to go in 2017, references to cryptocurrency in corporate communications are already double what they were in all of 2016, according to a Fortune analysis of the Sentieo data.

And they’re up more than 7,000% since 2010, when admittedly only a handful of companies had talked about “digital currency” during earnings calls or presentations.It began with ‘digital currency’ … and getting bitcoin’s name wrong

From 2009 through 2012, most of the mentions only referenced “digital currency,” which includes cryptocurrencies, along with other money recorded electronically or stored in another device.

Players in the digital currency space, like PayPal and Square, had to address cryptocurrencies earlier than most.In a March 2014 statement to eBay shareholders about PayPal’s IPO, Carl Icahn calls bitcoin “the digital currency Mr. [Marc] Andreessen cheerleads for.

”Amusingly enough, bitcoin was actually misidentified in its first actual mention by name during Discover’s 2013 annual meeting.

“One of the questions I’ve put down, the subject is bio coin,” a shareholder began to say.Discover CEO David Nelms course-corrected. “You mean bitcoins?”“Yes, bitcoins. You’re a good listener,” the shareholder said. “You picked it up. ”Fortune analyzed Sentieo data from earnings call transcripts, press releases, presentations, and SEC filings — 8Ks and 10Ks.

Cryptocurrency and related terms pop up in press releases most often, followed by SEC filings and presentations. And that’s to be expected. Most companies publish press releases a lot more frequently than they submit SEC filings or hold earnings calls.A lot of financial institutions mention it only to say it’s irrelevant, or deny its ability to disrupt their industry

Less than 20% of the S&P 500 appear among the 1,200 companies talking about cryptocurrencies, and only 65 hail from the 2017 Fortune 500 list. Information technology and finance companies, unsurprisingly, have discussed the topic more fervently than other industries.

Many times, large financial institutions have brought up cryptocurrency because they’re denying its importance or expressing disinterest in bitcoin. But some companies in the consumer-facing fintech subset have been talking about it because they’re planning to adopt parts of the new technology....continue reading on Fortune here: http://fortune.com/2017/11/20/ceos-bitcoin-ethereum-blockchain-cryptocurrency/

-

By

Admin

Admin - 0 comments

- 2 likes

- Like

- Share

-

By

-

This video is also showing now on BCtv here, for larger screen viewing on your desktop, laptop and connected smart tv.

Capital Ideas Media publisher Mark Bunting talks to the CEO of freshly

public eXeBlock Technology (XBLK-CSE), which is developing decentralized

apps (dapps), and has a historic, unlikely and cool spot for its

headquarters.

As a bonus, watch out tomorrow for an exclusive interview

with contributor Fabrice Taylor, who owns eXeBlock shares, and

believes the company may be the best of the blockchain bunch.

We speak to the CEO of Leonovus, which is developing blockchain storage

security for RBC and has surged since our first interview.

We talk to the CEO of GMP Capital, who is so convinced of blockchain's

future that he set up a dedicated team of analysts and bankers to

explore, finance and guide blockchain companies.

Plus, contributor Genevieve Roch-Decter sits down with Blockchain

Revolution co-author, Alex Tapscott, to talk about blockchain's impact

and future.

-

By

Admin

Admin - 0 comments

- 2 likes

- Like

- Share

-

By