Stories We Like

We think these stories and videos rock! If you think so too, share them with friends, so they can also learn and discover blockchain and cryptocurrencies

- by Bitcoin

- 19 posts

-

This video is also showing now on BCtv here, for larger screen viewing on your desktop, laptop and connected smart tv.

Subscribe to our Free Financial Newsletter:

http://crushthestreet.com

For more information on how to profit from this massive world-changing trend, visit CrushTheStreet.com/bitcoin.

- Paula Nita and

- Bitcoin

-

- 1

Bitcoin Bitcoin Share Blockchain videos like this one with friends. Blockchain is the protocol that enables Bitcoin an over 1000 Cryptocurrencies today. The blockchain is disrupting every industry one way or the other and skills in this area are highly sought after. Learn more to keep ahead- 10 1 vote

- Reply

-

Over the past year, the price of a Bitcoin has skyrocketed from less than $800 to nearly $20,000 — a meteoric rise that financial insiders say is no different than the escalating cost of a tulip in seventeenth-century Amsterdam.

Is it a bubble? Who cares!This video is also showing now on BCtv here, for larger screen viewing on your desktop, laptop and connected smart tv.

As VICE News' Jay Kang told us, “It’s impossible right now to not get rich if you own any Bitcoin.”

Kang first got the Bitcoin bug in July, initially investing $4000, upping it to $9000, then fearing a crash, betting his entire crypto-cache on a random soccer game (which he lost).

A former aspiring professional poker player, Kang bounced back undeterred, and with the surging price of the currency, Bitcoin mania has taken over his life. He claims 10 percent of his net worth is now invested in cryptocurrency.

Subscribe to VICE News here: http://bit.ly/Subscribe-to-VICE-News

-

Tim Draper, Draper Oakwood senior adviser and DFJ founder, discusses the volatility in bitcoin and the future of cryptocurrencies with Bloomberg's Emma Chandra on "Bloomberg Technology."

This video is also showing now on BCtv here, for larger screen viewing on your desktop, laptop and connected smart tv.

-

By

Admin

Admin - 0 comments

- 4 likes

- Like

- Share

-

By

-

Just as blockchain technology is being aligned with the Internet of Things (IoT), it is also increasingly being mentioned by those involved in advancing artificial intelligence (AI).

Indeed, some - including legacy institutions like IBM and SAP - see a future involving the convergence of all of these technologies.A (Relatively) Established TechnologyUnlike blockchain technology and IoT, AI - which, in one sense, is about creating computer applications that act as smart as humans - is not a new concept.

Research began in academia in the 1950s, and the subject was popularized in the 1968 science fiction movie "2001: A Space Odyssey," featuring the humanlike HAL 9000 computer. Usable computing systems running AI programs emerged in the 1980s, in the form of expert systems that were able to apply pre-programmed knowledge and make rules-based business decisions. In 1997, an IBM AI system called "Deep Blue" beat reigning world champion Gary Kasparov at chess.

Today, AI - and a related focus on machine learning (allowing computers to learn based on supplied data) - is rapidly evolving due to the development of high-performance microprocessors that are able to work quickly with very large amounts of in-memory data.Data is a key ingredient of approaches to developing AI and machine learning, which are now being applied to a wide variety of uses, from stock trading to chatbots to self-driving cars. There is barely a business or human activity that is not considered as a target for AI in future years and decades.

This is where blockchain technology comes in, which has its own role to play in the world of data. While work on aligning blockchain and AI technology is still emerging, a few development threads now exist and 2018 looks to be a year when progress toward convergence will accelerate.Enter Blockchains

Blockchain technology's ability to guarantee the accuracy of data makes it useful for a number of AI applications, both for feeding data into AI systems and for recording results from them.

For example, CognitiveScale, an AI startup that's backed by IBM, Intel, Microsoft and USAA, among others, is leveraging blockchain technology to securely store the results of an AI application that it built for regulatory compliance in the financial markets world .

That's an industry with a lot of regulatory scrutiny, so being able to store AI-derived decisions securely helps market participants stay on top of onerous reporting requirements.IBM is marrying both its blockchain offering (based on the open-source Hyperledger Fabric codebase) and its Watson AI platform for a range of industries.

One early project involves Everledger, which is applying blockchain technology to track the provenance of luxury items, including diamonds.

Leveraging Everledger's data store of individual diamond characteristics (more than a million of them, secured by IBM's blockchain), Watson is applying knowledge of thousands of regulations to ensure that diamonds comply with United Nations edicts preventing the sale of conflict minerals.

Some see certain implementations of blockchain technology as benefiting the development of AI applications, which improve as more data is made available to them for training the machine-learning models upon which they are built.

The Importance of Data

In a lengthy blog post , Trent McConaghy, founder and CTO of BigchainDB, set out his reasoning for why blockchain-enabled, decentralized networks encourage the creation of available data - essentially because individual data silos are replaced by a shared and accurate ledger - which can be leveraged to train better AI models.

For example, a consortium of banks sharing credit card usage data via a shared ledger might be expected to lead to improved, faster and more accurate fraud detection.

BigchainDB is currently rolling out a database that combines the capacity and performance of NoSQL database technology with the immutability and consensus of blockchain approaches. Already, the company is working on enterprise implementations in partnership with the likes of Capgemini, Daimler, Porsche and Toyota.

Moreover, the company is also deploying its technology to underpin the Interplanetary Database(IPDB), a publicly owned and governed database network that it sees as becoming the database for a "decentralized world computer," much like the platform the Ethereum community is creating.

Most recently, BigchainDB began to evangelize the open Ocean Protocol , designed to facilitate data exchange as an enabler for AI applications. Core software that supports the protocol leverages the IPDB. A test network for the protocol should be launched by the middle of 2018.

Other recent initiatives to develop transactional interoperability between blockchains should also feed into the availability of shared data to drive better AI applications.

Last month, the Blockchain Interoperability Alliance announced its formation with a mission to connect blockchain networks being created by Aion, ICON and Wanchain.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

See more on blockchain and cryptocurrencies from NASDAQ here: http://www.nasdaq.com/article/analysis-what-blockchain-technology-means-for-artificial-intelligence-...

-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

For the greater good: how blockchain technology will be the new way of accelerat... (thenextweb.com)Blockchain technology is now used in many industries for data verification and storage but the next wave of working with data will almost certainly center on the combination of blockchain technology and Big Data, combined with better methods of data interpretation.

This will allow us to bring Big Data tools in line with contextual understanding and to help individuals and companies make decisions which will drive the new paradigm in development.Digital Services for Personal Development are Prevailing over Traditional Ones

Traditional consultants such as life coaches who help people to make right decisions are expensive and no-one can make sure whether the method a particular consultant practices is valid or not. Unlike consultants, applications generated and deployed on the blockchain will be continuously checked on the decentralized network.

Consumers of these services will be able to use the application in any place and consultants will be able to develop projects, digitize them, and get access to a larger audience on the basis of ecosystem.The Problems of Modern-Day Development Apps

Today, there are a lot of apps centered around analyzing one’s personal data according to several methods (personal data interpretation tests). For example, an app like Remente asks you to fill in a questionnaire to assess personal development. Upon completion, the system analyzes the data and provides users with recommendations on strengths and weaknesses found by the algorithm.

The first problem with these apps is that they are nonsystematic and each of them gives different answers to particular questions. The second problem is that it’s difficult to improve methods on the basis of how differing apps interpret dat, because data collected is not stored in one place.

Much could be improved by harnessing the collective power of these apps and synergizing data inputs and outputs.Personal data interpretation methods help to understand personal traits; what motivates people, their likes and dislikes, and more. In the mass market, methods such as IQ tests, Myers-Briggs, and Astrology tests are commonly used.

At the same time, there have been huge advances in knowledge, resulting from studies about the brain. What’s interesting about that is that they can offer us much deeper personal analysis when applied to our pre-existing knowledge on personal characteristics and brain chemistry.The World is Lacking the Combination of Blockchain and Big Data

In spite of the fact that blockchain was created as a system for serving the financial sector, its scope oversteps these bounds. There are even apps using a technology blockchain in a healthcare and science setting.Their creators believe that opportunities of a blockchain data storage will improve people’s life.

Experts agree that combining Blockchain Technology and Big Data is a global challenge for the world, and will need innovative decisions to be implemented effectively. In the future, the scenario of personal problems and limitations on development will be prevented with the use of technology.

Needless to say, this doesn’t mean it will be possible to fully predict the way human brain works, but Big Data tools and Blockchain based on the methods of personal analysis will be a breakthrough in our attempt to remedy this.

Due to decentralization, it will be possible to collect large scores of data regarding human behavior, and keep methods potentially forever using the Blockchain. With the help of these tools it will soon be possible to provide people with smart digital consultancy based on complex methods and verify these absolutely.Creating Scientific Opportunities through the Blockchain

Creating blockchain networks focused on interpreting such data methods and storing the collected data in a decentralized way is a major issue, of course. The storage of personal data should be approached in a way that’s both impersonal and accessible so as to be useful to the scientific community.

One such company aiming to solve these issues is the Human Discovery Platform, a blockchain startup based in Moscow who wish to create a network that encompasses all of the above. The idea is that scientists who work through the service will be able to work within the same ecosystem, adding their research blocks as one.By incorporating knowledge in an open and accessible style the same way that Wikipedia and other Open-Source projects do, the platform will attract more users. The more people that get involved in the production of data and services – the faster the economy of the project will accelerate.” says CEO of Human Discovery Platform Timur Karimbaev.

It is clear that the introduction of Blockchain Technologies and the realization of the power of Big Data will do much to improve the impact of personal improvement.

Where will this new age of ergonomic excellence take us? Only time will tell. This post is part of our contributor series.

The views expressed are the author's own and not necessarily shared by TNW.

Discover more from TNW here: https://thenextweb.com/contributors/2017/11/24/greater-good-blockchain-technology-will-new-way-accel...

-

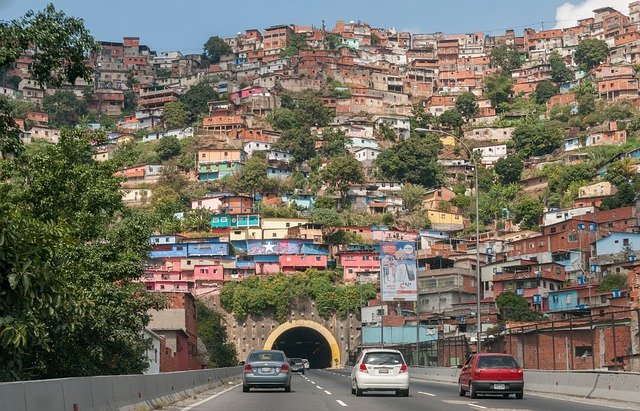

Recommended: Wealthy Families in Latin America Snapping Up Bitcoin - Blockchain ... (insidebitcoins.com)The average citizen in many Latin American countries has turned to Bitcoin in order to survive, and now many wealthy families are becoming a believer in the cryptocurrency and are buying as much as they can.

The economic situation in many Latin American countries is extremely dire. Hyperinflation has hit Peru, Bolivia, Argentina, Venezuela, and Brazil, with some countries in worse shape than others (Venezuela). Many normal residents began to turn to Bitcoin when the economic situation began to hit rock bottom.

Now it seems that the upper echelons of Latin American society have taken note as many wealthy families are now diving enthusiastically into Bitcoin.

A LAND OF UPHEAVAL

Venezuela has served as ground zero for the economic crisis in Latin America. The situation is so desperate that many turned to crypto mining in order to buy the basic necessities, such as food and medicine. A shocking stat is that a full 3/4th of the country lost weight last year due to food shortages.

Despite government crackdowns, the local population continues to actively trade in cryptocurrency, with Localbitcoins serving as the main hub.The elites of Latin America have not proven immune to the economic situation. Wealthy families are now buying big into Bitcoin as a means to protect their assets from currency controls and rising consumer prices.

Several cryptocurrency funds have opened up in 2017 to provide service to this elite clientele.One of these funds is Solidus Capital, founded by Carlos Mosquera Benatuil, who fled to Rome from Venezuela to open the business. He says that family offices make up most of the funds, who are looking to turn around their fortunes. He says:Latin America is very volatile. Cryptos are turning into a new haven for these families.

BITCOIN OFFERS HOPE

Whether rich or poor, the skyrocketing inflation has eaten into everybody’s savings and spending power. Compounding the issue is strict government controls, especially the Venezuelan government cutting off access to US dollars.

Bitcoin offers a refuge from these problems.To show how much Bitcoin and other digital currencies have exploded in Latin America due to the ongoing economic crisis, the number of cryptocurrency transactions in Venezuela alone have tripled since the start of 2017. Demand in Argentina spiked in June when former President Cristina Fernández de Kirchner, whose policies put the country into a recession, announced that she was running again for political office.Interesting post on /r/Bitcoin from a Redditor who compares the different options for storing value in Venezuela.“I know a lot of people who sold everything they could to leave the country and took their money to bitcoins through @LocalBitcoins.”

People in Latin America are turning to Bitcoin as it offers immediate payment without the need for a bank. Even professionals are now demanding to be paid in digital currencies. For family members who live abroad, Bitcoin is a lifesaver as they can send money in an instant back home without the onerous fees charged by groups like Western Union.

https://t.co/dvmxu4ozhV pic.twitter.com/R3egCdmoLa— Kyle Torpey (@kyletorpey) December 1, 2017

The fact that anybody with a smart phone can now begin trading Bitcoin has led the way. The chief executive of the Panama-based Cryptobuyer digital currency exchange, Jorge Farias, says:There are countries today without potable water where everyone has a cellphone. Anyone who has a smartphone can have a bitcoin account, which is something that couldn’t happen before. So its niche really is the whole world.

While many governments in Latin America continue to hamstring their economies, their citizens are increasingly turning to Bitcoin in order to survive or protect what they have left. It’s amazing that the situation is so bad that even the rich are now turning to the cryptocurrency to stave off the current economic effects.

More from Inside Bitcoin here: http://insidebitcoins.com/news/wealthy-families-in-latin-america-snapping-up-bitcoin/89797

-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

America's college students may not be sold on bitcoin. Here's what they think of the cryptocurrency.

» Subscribe to CNBC:This video is also showing now on BCtv here, for larger screen viewing on your desktop, laptop and connected smart tv

http://cnb.cx/SubscribeCNBC

About CNBC: From 'Wall Street' to 'Main Street' to award winning original documentaries and Reality TV series, CNBC has you covered. Experience special sneak peeks of your favorite shows, exclusive video and more.

Connect with CNBC News Online

Get the latest news: http://www.cnbc.com/

Find CNBC News on Facebook: http://cnb.cx/LikeCNBC

Follow CNBC News on Twitter: http://cnb.cx/FollowCNBC

Follow CNBC News on Google+: http://cnb.cx/PlusCNBC

Follow CNBC News on Instagram: http://cnb.cx/InstagramCNBC-

By

Admin

Admin - 0 comments

- 0 likes

- Like

- Share

-

By

-

Coinbase CEO Brian Armstrong discusses the rise in cryptocurrencies, bitcoin futures, customer service glitches and working with the IRS on tax issues. He speaks on "Bloomberg Technology."

This video is also showing now on BCtv here, for larger screen viewing on your desktop, laptop and connected smart tv.

-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Jobs & Talent: Blockchain developer salaries in Switzerland raised by ICO bo... (businessinsider.com)

- Switzerland has become a hotspot for companies doing ICOs.

- Most are working with blockchain technology.

- Competition for talent has pushed average salaries to around $180,000, CEO of Eidoo says.

LONDON — Blockchain developers are at a premium in Switzerland, commanding salaries up to $180,000, as the country establishes itself as a centre for companies carrying out initial coin offerings (ICOs).

Thomas Bertani, the CEO of Switzerland-based Eidoo, told Business Insider that developers with expertise in blockchain technology, which underpins ICOs, can command salaries of around $10,000 to $15,000 a month in Switzerland, equivalent to $120,000 to $180,000 a year.

"The reasons are: 1) highly skilled blockchain-experienced devs are very hard to find; and 2) Switzerland is well known to be one of the most expensive countries on earth," Bertani said.

Oliver Bussmann, the president of the Crypto Valley Association in Zug, Switzerland, told Business Insider over email that the salary estimates sounded about right.

Switzerland has seen a surge in blockchain companies setting up shop there thanks to the permissive approach of its regulator to initial coin offerings (ICOs).

ICOs are where startups issue digital tokens in exchange for real money to help fund their business. The tokens can be redeemed for a good or service linked to the startup at a future date and can be freely traded, offering greater liquidity to investors in private, early-stage businesses.

Companies can self-issue these tokens and most use the blockchain underpinning digital currency ethereum to register who has bought tokens.

Over $3 billion has poured into this new form of fundraising, which is inspired by bitcoin.

But regulators around the world are concerned that it is unproven, unregulated, and high-risk.China has banned ICOs and watchdogs in both the US and UK have warned investors to be wary of investing.

Switzerland, meanwhile, has sought to become a hub for this new type of investment, which some see as the future of fundraising.

"You can show the regulator your white paper and they either approve it or not," Bertani said, referring to the documents usually used to outline ICO plans to potential investors.As a result, many companies pursuing ICOs have chosen to set up some or all of their operations in Switzerland.

The Crypto Valley Association lists over 100 members, including both organisations and individuals.Most companies who have pursued ICOs this year tend to be linked to either cryptocurrency or the blockchain technology that underpins it and this has pushed up the salary of developers in the country.

As a result, Bertani said it has become "almost impossible" to find good blockchain developers there as companies flush with ICO cash pay higher and higher salaries to attract talent.Eidoo raised $27.8 million through an ICO in October.

The startup has built a mobile cryptocurrency wallet but is also developing tools to let investors back ICOs through its app and other features such as a decentralized cryptocurrency exchange.

Business Insider cover lots of stories on blockchain and cryptocurrencies. Discover more from Business Insider here: http://www.businessinsider.com/blockchain-developer-salaries-in-switzerland-raised-by-ico-boom-2017-...

-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

Luzi-Ann Javier

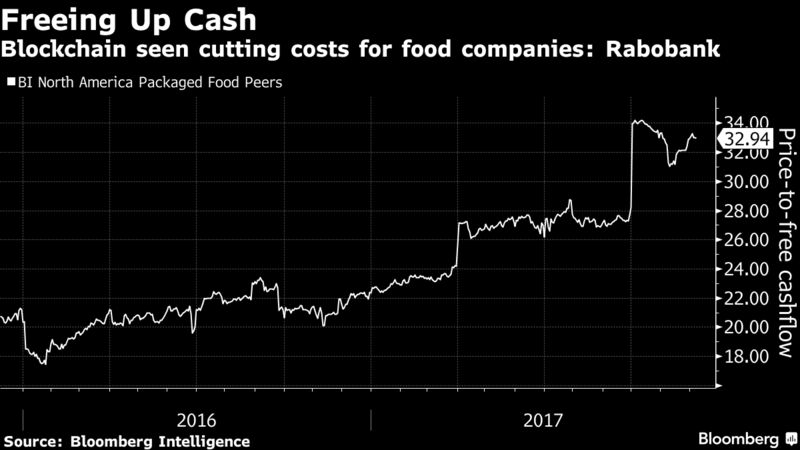

December 7, 2017, 4:40 PM GMT- Technology set to improve efficiency, Rabobank analyst says

- Food-fraud costs industry $40 billion a year, university says

The technology that tracks bitcoin transactions is set to revolutionize the food chain.Blockchain, the distributed ledger technology, will lower transaction costs for food companies, improve efficiency and create new business opportunities, said Harry Smit, a senior analyst at Rabobank International.

Firms should explore options to adapt to the new technology or risk losing their competitive edge as innovation takes hold, he said in a report released Thursday.

Wal-Mart Stores Inc. and International Business Machines Corp. have already jumped on the bandwagon and more are joining in, including Nestle SA and Dole Food Co. Companies are seeking to improve transparency in industry targeted by food-fraudthat’s been estimated by Michigan State University to cost as much as $40 billion a year.

“In order for goods to be traceable from farm to fork, all parties that handle the goods should be linked to the blockchain,” Smit said.

“Once the hurdle of broad participation is taken and the benefits of a more transparent supply chain manifest themselves, laggards will be forced to join fast, or otherwise remain at a competitive disadvantage.

”— With assistance by Megan Durisin

Bloomberg publish regular content covering blockchain and cryptocurrencies. You can discover more from Bloomberg here: https://www.bloomberg.com/news/articles/2017-12-07/blockchain-seen-revolutionizing-food-chain-cuttin...

-

By

Admin

Admin - 0 comments

- 2 likes

- Like

- Share

-

The biggest tech buzzword of 2017 was undeniably “the blockchain,” with startups moving to distributed tamper-proof ledgers, even if they didn’t actually need to. Facebook for cats? Put it on the blockchain. The Uber of ICOs? Blockchainify it (it’s a word, trust me. Or, at least, it will be. Probably).

But it’s not all nonsense. TMT Investments, an AIM-listed venture capital firm with money parked in the likes of Taxify and BackBlaze, just launched the TMT Crypto Fund. This $60 million fund aims to tap the immense amount of wealth and interest in the crypto space, and apply it to rapidly growing blockchain-based startups.TNW spoke to Igor Shofiot, co-founder of the TNT Crypto Fund. Here’s how he explained it.“We are taking the traditional VC model and adding the ability for qualified investors (based on the laws of their country) to invest from all over the world, as well as established Limited Partners, in either fiat currency or cryptocurrency. In return they receive tokens both in the fund itself and the fund’s investments.”

You could be forgiven for scratching your head. The VC model is one that’s tried-and-tested, and has been successfully replicated the world over. Why fiddle with something that (by-and-large) works, and has been the rocket fuel behind virtually every Silicon Valley success story?

“This [Crypto Fund] offers a great deal of benefits beyond the classical model, such as more immediate liquidity (usually you have to wait for an exit or IPO for an investment to pay you) and transparency for all parties,” explained Shofiot.

The biggest difference is something that’s often missing from the established VC model: openness.“Decentralization brings numerous opportunities for disruption, cost-savings, better security, and so on,” Shofiot told us.“Crypto funds let investors in the fund exchange their tokens for those of portfolio startups, benefit from transparency, trade freely and have a much better cash flow than is offered in a traditional VC model.”

TMT Investments is no sketchy, fly-by-night ICO. It’s based in London and San Francisco. The founding partners have built and scaled several major companies. One partner, German Kaplun, built RBC, which is currently one of Russia’s biggest media houses.

The VC firm itself has been around for a while, and has backed some startups you’ve probably already heard of.Taxify is probably the biggest; the Uber-rival has enjoyed growth in several African cities, and now has its eyes set on London and Paris.

Other big names include Le Tote, DepositPhotos, and Amazon S3-rival BackBlaze.With the TMT Crypto Fund, the company aims to target high-growth startups involved in the nascent blockchain space.“We will invest in companies that demonstrate a true ability to scale,” Shofiot explained.“Real companies, focused in the blockchain space, which of course means far more than simply crypto-currency focused companies. We also look forward to seeing companies that can take the blockchain and apply its abilities to other core areas of our expertise: technology and media, in spaces like cyber security, SaaS, cloud storage, enterprise platforms, financial services, and social media.”

Despite issuing tokens, TMT aims to behave much like a VC when it comes to who it lets invest in the fund. “Only qualified US investors in the US, and only people who qualify to invest under the laws of their respective countries can invest in the fund,” explained Shiofot.

So, what makes an investor ‘qualified’? Money. While an ICO isn’t all that discerning on who can invest, to throw some cash into this fund in the US, you have to have a net worth of either $1 million, or have earned at least $200,000 in each of the past two years.

“We want to make sure that the offering is done in a strict compliance to the US and international law, and since one of the partners, Julian, who is a highly reputable attorney that has structured many blockchain transactions, we will make sure that everything is done strictly by law,” said ShofiotTMT Investments are smart to focus on the blockchain space.

There’s a lot of crap, certainly, but it has the capacity to transform banking, finance, insurance, and other key sectors that require transparency and the immutability of records. It’ll be interesting to see how other VCs follow suit.

TNW is a leader in technology publishing. You can discover even more blockchain pertinent publications on TNW here: https://thenextweb.com/hardfork/2017/12/07/oh-god-even-vcs-are-on-the-blockchain-now/

-

By

Admin

Admin - 0 comments

- 2 likes

- Like

- Share

-

By

-

Cyrptocurrency is the new black, in the sense that all your favorite DJs wanna cover themselves in it. RAC released his latest album using Etherium blockchain. Gramatik recently made himself the first tokenized musician by creating his own cryptocurrency GRMTK.

Now, Gareth Emery wants to disrupt the entire music industry with a new publishing and distribution platform he calls Choon.The English trance DJ is no train jumper. He's been a long-game player in the cryptocurrency market since he first discovered Bitcoin in late 2013.“I’d bought a house in Los Angeles, and everything was so incredibly long0winded and difficult that I clearly remember thinking that there must be a better way,” he says in an email interview.

“A month or two later, Bitcoin came into my life, and it seemed to have the ideas that could eventually solve many problems with our broken financial system.

”Read more: Gramatik Celebrates Successful Cryptocurrency Launch, Becomes First Tokenized Artist

At the time, he was procrastinating on his album Drive, doing anything but knocking out the fine-print finishing touches. Soon, he was pouring five to six hours a day into the emerging economy, buying and trading the digital currency, creating offline paper wallets for safe storage and other activities.

Drive eventually saw the light of day, and as the years passed without much progress in cryptocurrency security and use, his interest in Bitcoin waned.His interest returned earlier this year when he heard about Etherium, with its advanced security measures and emerging leadership. It was enough to get him back online and in the trader's seat.

“Many of my college friends went to work at investment banks, and I figured, if my ambition was to sit behind a load of screens and make trades, I might as well have joined Goldman when I left college,” he says. “I realized my passion was building new things, and changing people’s lives for the better, either through music, or in this case, a company.

So I got out of the trading game and started to think about where I could make a positive impact instead.”Six months later, Choon is set for launch in early 2018. He teamed up with his friends and blockchain technologists John Watkinson and Matt Hall to create a platform that gives artists complete control over their product as well as a platform upon which to share that product direct to consumers for proper compensation.

“There’s this common misconception that there’s no money in music, and that the only way you can make a living is touring, but that’s not really correct,” Emery says.” It’s a $16 billion industry. What I realized though, was that the money is going to all the wrong people: intermediaries and middlemen who don’t really need to be there.

Choon is our attempt to fix these problems, cut out these people, and provide a much better deal for artists.

”Read more: Dance DJ Gareth Emery on the Strength of the City of Manchester After Tragedy

The biggest hurdles so far have been the regulatory and legal aspects involved with selling cryptocurrency tokens, though it's a jungle through which Emery is happy to navigate with patience."It’s still very much the wild west of finance,” he says, “but it’s getting better, and we’ve chosen to take the legitimate route: fully complying with all the relevant anti-money-laundering regulations, getting everything checked by lawyers, and that slows you down.

But I want to protect us, and everyone who’s going to be involved in this project long-term, so building on a stable foundation is important.

”Fans will be able to purchase music using NOTES, Choon's unique cryptocurrency. NOTES value will fluid and ultimately determined by supply and demand, but at launch, users will be able to buy NOTES for five cents each.

Listeners will also have the ability to earn NOTES by creating popular playlists, listening to promoted songs, and by providing useful comments and community feedback.The music discovery process should run as it does for Soundcloud, Spotify or any other major streaming platform. Just don't expect to find the classics.

“We’re not interested in trying to stream The Beatles, or indeed any music that’s signed into the old legacy system of major labels and publishers,” he says. “These companies are just too difficult to deal with, and would likely force us into deals that would make it hard for us to pay smaller artists fairly. So almost every artist on Choon will be on the newer side, or just happen to own the rights to their old music.

”Read more: Gareth Emery Takes on Bullying With 'Saving Light' Charity Release on Monstercat

Similarly, artists may not upload songs that sample major-label artists, though they will be able to sample each other easily using Smart Sample Contracts that make Choon music available to other Choon artists at the price of 50 percent remix profits. It simplifies the ownership process while opening the door to creativity.

It will take time to build the community upon which the Choon ecosystem and economy will run, but that's a feat Emery faces with a sunny disposition.“I’m not going to claim we’ll have everything perfect on day one, because we won’t,” he says. “A lot of the more advanced functions of the Choon ecosystem will likely take a few years to develop, but they will be worth it when we roll them out.”Interested in learning more about Choon?

Visit the company online and watch the informational breakdown video below. It may just be the future of music, but either way, the era of blockchain technology is here.

See more from Billboard here: https://www.billboard.com/biz/articles/8061802/gareth-emery-wants-to-disrupt-music-labels-with-block...

-

By

Admin

Admin - 0 comments

- 2 likes

- Like

- Share

-

By

-

We discovered this video and thought Sophia was fun and interesting to share with you on Blockchain Company (BC) . It includes footage of an interview with Sophia Robot by CNBC. Sophia is now the first robot citizen of Saudi Arabia. Enjoy watching!

This video is also showing now on BCtv here, for larger screen viewing on your desktop, laptop and connected smart tv

Meet our new virtual one world ruler......or perhaps, instead, mans' most helpful creation yet.....or is it? You decide.

Blockchain Company ( BC ) has plans to work on an AIblockchain.org, a solution to help control nefarious AI. Stay tuned.

See latest AI development from Google as of 5, Dec 2017 :

http://www.independent.co.uk/life-style/gadgets-and-tech/news/google-child-ai-bot-nasnet-automl-mach...

-

Almost 40% of Puerto Rico has still not been reconnected to the power grid. 30% of the cell towers are still down. People are still in shelters because their homes have not been rebuilt, and many other challenges remain.Sounds like a problem for blockchain and cryptocurrency?

"We’re leapfrogging the developed world," Enrique Martinez, CEO of WebCapitalists, said today at TechBeach Retreat in Jamaica. "We're bringing solar panels to Puerto Rico ... and can now create a market for electricity using cryptocurrencies and blockchain.

"Martinez was born in Puerto Rico and returned recently to see how the island is recovering from the devasting Hurricane Maria. Now he's working with local people to create a community of houses that are connected to a hospital. Each house -- and the hospital -- has solar panels.

Any house that has extra electricity can sell it to the hospital ... or to neighboring houses.The physical infrastructure is important, but just as important is the digital infrastructure. Blockchain enables simple and transparent insight into where power is being produced and by who.

Cryptocurrency, or tokens, provide the ability to reward those who are producing more, and enable those who are consuming more to access it....continue reading page 2 of this article on Forbes here: https://www.forbes.com/sites/johnkoetsier/2017/12/01/local-entrepreneurs-are-using-blockchain-and-cr...

-

Filmed at DFJ Summit 11/16/17: Brian Armstrong, Coinbase & Tim Draper, DFJ on the state of cryptocurrency's maturing market: ICOs as new funding vehicle, disruption of VC, the end of fiat, rise of open source, & the continued dominance & resiliency of bitcoin

Timestamps

This video is also showing now on BCtv here, for larger screen viewing on your desktop, laptop and connected smart tv

0:01 Thank you to Walker Corporate Law & Wordpress for supporting TWiST, visit them at http://walkercorporatelaw.com & http://wordpress.com/twist

0:30 Introduction to fireside chat at DFJ Summit November 16, 2017. Guests: Brian Armstrong, Coinbase & Tim Draper, DFJ. Moderated by Jason Calacanis.

1:55 Brian talks about his first project, getting people to watch videos and paying them in Bitcoin.

3:12 Will the next Facebook be cryptocurrency-based? Brian explains exciting trend that could happen with incentivising user-generated content by cryptocurrency.

3:58 Jason talks about Tim Draper’s “superpower” as an investor. Tim explains his process behind investing, importance of transformative opportunities, & betting on the upside.

9:07 Should you be investing in ICOs by founders with zero track record? Are they scams? Brian explains the bubble, need for regulation, and potential of ICOs.

12:57 Thank you Walker Corporate Law for supporting TWiST. Visit them at http://walkercorporatelaw.com

14:07 Jason asks Tim if he is concerned about the current state of ICOs and raising large amounts of money on only a white paper. Tim explains why too much money is detrimental to a company.

16:24 Tim describes the benefits that ICOs have for investors, and how government regulations have made it difficult for companies to go public.

19:23 Jason voices his disagreement on accredited v. nonaccredited investor qualifications, and proposes an idea. Tim likes it.

21:45 Jason ask Brian if it is safer to store digital currency in a server, or in cold storage. Brian compares the two, and shares what he does personally.

23:45 Do you know who your buyers are? Brian explains the regulation behind Coinbase.

25:03 Thank you to Wordpress for supporting TWiST. Go to http://wordpress.com/twist to save 15% on a website.

27:27 Will Bitcoin move from being a store of value to something else? Tim explains why he won’t sell his Bitcoin. And the inefficiencies of government-issued currency.

29:23 What are the chances of the U.S. launching its own cryptocurrency? Tim explains why country-based cryptocurrency is a bad idea. Brian believes digital currency will soon be as stable as fiat currencies.

30:41 Is Bitcoin in a vulnerable position, due to miners in China having majority compute power? Brian thinks most digital currencies will move away from mining. Tim explains the resilience of Bitcoin thus far.

33:25 How manipulated is Bitcoin? Brian explains that market cap for bitcoin is too large to be manipulated by a small number of people.

35:38 Jason presses Brian: Bitcoin or Ethereum, which do you prefer? Brian shares the story of his first love, Bitcoin … and why he’s now more interested in Ethereum trajectory.

38:29 Jason and Tim talk about the structural change about to occur in Venture Capital. And the rise of lawsuits against ICOs.

42:52 Should all startups use ICO rather than raise VC money & dilute ownership? Brian explains what he would do. “Right now today, I would go with traditional investors.” Tim explains entrepreneurs should figure out use/purpose of a coin before an ICO.

46:45 Brian & Tim talk about how people working on protocols/foundational pieces of technology can participate in the upside through coins. It’s a fundamental shift -- developers are leaving big tech co’s to work on open source projects.

50:18 Jason asks his final question: What will the price of Bitcoin be in 10 years?-

By

Admin

Admin - 0 comments

- 3 likes

- Like

- Share

-

By

-

Ari Paul, CIO of cryptocurrency hedge fund BlockTower Capital, talks with Business Insider executive editor Sara Silverstein about the value in cryptocurrency and where he thinks the market is headed in the next two years.

-

By

Admin

Admin - 0 comments

- 2 likes

- Like

- Share

-

By

-

James Altucher, Formula Capital managing director, and Spencer Bogart, Blockchain Capital managing director, break down what drives the bitcoin demand, its use and projected earnings.

»

Subscribe to CNBC: http://cnb.cx/SubscribeCNBC

About CNBC: From 'Wall Street' to 'Main Street' to award winning original documentaries and Reality TV series, CNBC has you covered. Experience special sneak peeks of your favorite shows, exclusive video and more.-

By

Admin

Admin - 0 comments

- 3 likes

- Like

- Share

-

By

-

Bitcoin on a unstoppable bull run! Are you a believer yet?

-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Host Ran Neu-Ner takes his weekly plunge into the world of Crypto Currency trading where he chats to traders, ICOs and gives you, the audience tips and tricks on trading in Crypto currency.

-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By