Bitcoin News

- by Kamil

- 7 posts

-

- Goldman Sachs is dropping its plan to open a trading desk for cryptocurrencies, Business Insider says, citing people familiar with the matter.

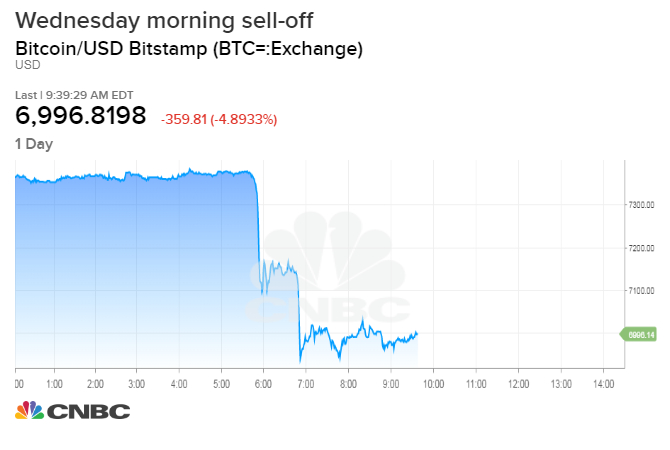

- Bitcoin fell roughly 5 percent to below $7,000 following the report, and the rest of the top five cryptocurrencies by market cap were all down by more than 12 percent.

- "To the extent that they represent the institutional herd, this is a negative," Brian Kelly of BKCM says.

Goldman Sachs reportedly ditches plans to trade cryptocurrencies 14 Hours Ago | 00:35

Goldman Sachs reportedly ditches plans to trade cryptocurrencies 14 Hours Ago | 00:35

Bitcoin slipped below $7,000 Wednesday after a report that Goldman Sachs is abandoning plans to open a trading desk for cryptocurrencies.The world's largest digital currency fell roughly 6 percent to a low of $6,866.06, according to data from CoinDesk.

Goldman still sees the regulatory environment as ambiguous, according to Business Insider, which cited people familiar with the matter.

The Wall Street giant has been considering the launch of a new trading operation focused on bitcoin and other digital currencies for the past year. The bank's CEO Lloyd Blankfein tweeted in October that Goldman was "still thinking about bitcoin."

"No conclusion - not endorsing/rejecting. Know that folks also were skeptical when paper money displaced gold," Blankfein said at the time.Executives now say more steps need to be taken, most of them outside the bank's control, before a regulated institution would be allowed to trade cryptocurrencies, according to Business Insider.

Goldman would not confirm the report to CNBC, and repeated its only public comment on the matter.

"In response to client interest in various digital products, we are exploring how best to serve them in the space. At this point, we have not reached a conclusion on the scope of our digital asset offering," Goldman Sachs said in a statement.

Brian Kelly, founder and CEO of crypto hedge fund BKCM, said while this doesn't have an impact on actual bitcoin trading volume short-term, the report pours cold water on long-term sentiment."They were not a part of the ecosystem yet, but to the extent that they represent the institutional herd, this is a negative," Kelly said.

“You do not want to give Jeff Bezos a seven-year head start.”Hear what else Buffett has to say

Bitcoin has been selling in a narrow corridor around $7,000 for the past month. Late Tuesday night, it drove up to $7,400, its highest point since the first week of August, according to data from CoinDesk.Joe DiPasquale, CEO of cryptocurrency fund of hedge funds BitBull Capital, said that price level represented a selling trigger for some investors who had been waiting for prices to recover.

"Until there's additional institutional investor interest to drive demand in pricing, many active managers in the space are going to continue to buy low and sell high," DiPasquale said.Institutional interest has been a barometer for prices, especially this summer.

Rumors of the first-ever bitcoin ETF being approved drove prices over $8,000 in July. Prices later slipped back below $7,000 after the Securities and Exchange Commission rejected the bitcoin exchange-traded funds from ProShares and other crypto ETF plans by GraniteShares, Direxion and the Winklevoss brothers.

Bitcoin prices have struggled to recover to their high near $20,000 hit in December. The entire market capitalization for all cryptocurrencies is down roughly 63 percent this year, according to data from CoinMarketCap.com.

Cryptocurrencies other than bitcoin known as "alt coins" fared even worse on Wednesday. Ethereum, the second largest cryptocurrency was down 13 percent, XRP fell 11 percent, while bitcoin cash and EOS were down 13 and 16 percent respectively. Jordan Belfort: The SEC won't get involved in Bitcoin 2:26 PM ET Mon, 27 Aug 2018 | 04:59

Jordan Belfort: The SEC won't get involved in Bitcoin 2:26 PM ET Mon, 27 Aug 2018 | 04:59

Reuters contributed to this report.

Michael Sheetz

Markets and Space Reporter Kate Rooney

Kate Rooney

Markets Reporter

-

- 1

Francisco Gimeno - BC Analyst Some days ago we were reading that crypto prices were stabilising. This drop, coming from nowhere, shows us how volatile the crypto market is yet. The institutional investors in a new market always give equivocal signs, one sep ahead, two behind, and in a more established market what Goldman is doing shouldn't make the whole market react like this. Well, folks, lets continue reading the signs, HODL if you can, do your homework and be careful, as always.- 10 1 vote

- Reply

-

Bitcoin Magazine’s Week in Review: More Than an Academic View of Progress | Bitc... (bitcoinmagazine.com)Crypto is making its entrance into the world’s academic scene, and students are lining up to learn.

A recent Coinbase study reveals that University students want to learn more about cryptocurrency and blockchain technology. Commissioned by Coinbase in partnership with Qriously, the survey sampled 675 U.S. students, and it found that students across all majors have an interest in blockchain technology.

Some have literal vested interest in the cryptocurrency market itself, while others are looking to leverage blockchain courses to break into the space’s developing job market. Of those surveyed, 18 percent reported holding some value in cryptocurrency.

Another 26 percent indicated that they’re interested in taking a blockchain-related course in the future, with the most immediate interest coming from social science (47 percent) and computer science (34 percent) majors.

Benedikt Bunz, a doctoral student at Stanford, said the "tremendous excitement" around the blockchain and cryptocurrency courses is due to the ease of getting a job after graduation due to the high demand for blockchain experts.

“If you’re an expert in cryptocurrencies and cryptography you’ll have a difficult time not finding a job,” he noted.The survey also studied the top 50 universities in the world as ranked by the U.S. News and World Report, and it found that 42 percent offer at least one class on relating to the blockchain industry.

Geographically, the study indicates that cryptocurrency courses are more popular in the U.S., with Stanford and Cornell University topping the charts for most individual offerings. Outside of the U.S., only "five of the 18 international universities" surveyed offer at least one class on blockchain technology or cryptocurrencies in general.

One of its more salient findings, the survey highlights the high demand for crypto and blockchain courses across a wide spectrum of departments.

Unsurprisingly, most of this demand stems from the finance and computer science disciplines . “Coinbase’s analysis found that, of the 172 classes listed by the top 50 universities, 15 percent were offered by business, economics, finance and law departments, and [4] percent were in social science departments such as anthropology, history, and political science,” the report notes.

Dawn Song, a computer science professor at University of California, Berkeley, said the rise in the interest in blockchain courses is due to the potential impact the technology can have on society.

“Blockchain combines theory and practice and can lead to fundamental breakthroughs in many research areas. It can have really profound and broad-scale impacts on society in many different industries.

”Song, who co-taught the “Blockchain, Cryptoeconomics, and the Future of Technology, Business, and Law” in the spring semester of 2018 said the course was so popular that they had to turn students away because the auditorium was filled up.

Elsewhere, David Yermack from the New York University Stern Business School plans to offer his blockchain course in both semesters this academic year as opposed to just one semester like last year.

Yermack launched his course on blockchain and financial services in 2014, and with an original enrollment of 35 students, it featured a smaller class size than the school's typical elective at the time.

By spring 2018, however, the number of enrolled students had increased to 230, a tangible reflection of the growing interest and enthusiasm students are exhibiting toward the field.-

Francisco Gimeno - BC Analyst International and local educators starting from Secondary schools should always consider that in an era of high speed tech changes students need a thorough generalist formation so they can specialise later easier on what is coming. I witnessed in September 2017 a prestigious teacher at a Business school saying he didn't know what blockchain was and he was not even interested. Our youngsters know what is coming, and are asking to be prepared. Let's not disappoint them.

-

-

A break of the tight trading range could see bitcoin fall to $3,000, says analys... (marketwatch.com)Bitcoin hovered just above $7,000 Friday, on track to record its third consecutive winning week.

At 5 p.m. Eastern, one bitcoin BTCUSD, -0.30% fetched $7,043.36, up 1.8% since Thursday at 5 p.m. on the Kraken crypto exchange.

Despite volatility, the No. 1 digital currency has not broken out of the $5,500 to $8,500 range in more than three months, a tendency that one asset management firm pins on the dominance of short-term traders.

“Within our own team, we tend to believe the market is in an ultra reflexive state currently. It moves within a range in response to seemingly every bit of news,” wrote Thejas Nalval, portfolio director, and Kevin Lu, director of quantitative research at Element Digital Asset Management.

“This is likely the result of trading having been dominated by short-term players that are using structured derivative vehicles with leverage to express intraday speculation,” Nalval said.Technical formation could send bitcoin to $3,000

It’s this tight trading range that has one analyst thinking the market is on the brink of a triangle breakout, one that will not please owners of digital currencies.

“The inability of bitcoin to grow above $7,000 seems to be a serious caution,” wrote Alexander Kuptsikevich, analyst at FX Pro, adding that the support near $6,000 is creating a potential bearish technical signal.

“The technical analysis teaches us that the movement within such a triangle often ends up with a breakdown of support and a sharp impulse to decline,” he said. “In this case, bitcoin has a serious chance to reach the level of $3,000” to complete the triangle.

Read: Opinion: If you want financial secrecy, bitcoin and other cryptocurrencies can’t deliver it

Bitcoin futures were outperforming spot markets Friday. The Cboe Global Markets Inc.’s September contract XBTU8, +2.94% ended 2.5% higher at $7,047.50, while the CME Group Inc.

August contract BTCQ8, +1.61% gained 1.6% to end at $6,925.56

CryptoWatch: Check bitcoin and other cryptocurrency prices, performance and market capitalization—all on one

Providing critical information for the U.S. trading day. Subscribe to MarketWatch's free Need to Know newsletter. Sign up here.-

Francisco Gimeno - BC Analyst The problem is that TA doesn't work very well with BTC or any other crypto. Up, down, HODL, buy, sell, is the same for analysts that have to justify their salaries writing articles like these. What will happen, it will happen. We can't know more while BTC is so volatile yet.

-

-

Opinions expressed by Entrepreneur contributors are their own.

In order for the world economy to continue to grow, we need to develop digital infrastructure to sustain the speed and volume in which we share information. Data infrastructure needs to be scalable and deployable as the needs of our digital era continue to evolve.

Even though blockchain is somewhat the “new kid on the block,” it has excited the world of business. According to a survey carried out by Gartner, 66 percent of the respondents said they believed that blockchain is a business disruption and 5 percent were willing to spend over $10 million on the technology.

Blockchain has many uses and implications; however, the first mainstream application we've seen is through cryptocurrency. But the initial design of cryptocurrencies was not built for widespread use and adoption.

Related: 15 Crazy and Surprising Ways People Are Using Blockchain

For Bitcoin and Ethereum to compete with mainstream systems such as Visa and PayPal, they need to step up their game with their transaction times.

As explained by crypto trading company Coindesk, "While PayPal manages 193 transactions per second and Visa manages 1,667 transactions per second, Ethereum does only 20 transactions per second while Bitcoin manages a whopping seven transactions per second. The only way that these numbers can be improved is if they work on their scalability."Scalability obstacles created by mining

When dealing with Bitcoin and Ethereum, a transaction is granted only when a miner (the person whose computer processed the code behind the currency) puts the transaction data in the blocks they've mined.

Let's say Stephen wants to send Andrew 10 BTC (bitcoin). He will send the transaction data to the miners, the miner will then put it in their block and then the transaction will be completed.

However, as Bitcoin rises in popularity, this process becomes more time-consuming. Plus, there is the issue of transactions fees. When miners mine a block, they become gatekeepers of that block. In order for transactions to go through, users will have to pay a toll to that gatekeeper.

This “toll” is referred to as a transaction fee. This fee creates issues when scaling because it creates an additional barrier. What about Ethereum? In theory, Ethereum is supposed to process 1,000 transactions per second.

However, in practice, Ethereum is limited by a cap of 6.7 million gas -- the amount of computational effort required on the receiver's side of the transaction -- on each block.

Here's how to understand what “gas” means. Stephen has issued a smart contract for Andrew. Andrew sees that the elements in the contract will cost X amount of gas. Accordingly, he will charge Stephen for the amount of gas that's used up. It's like letting your friend borrow your car and making them pay back the amount of gas that was used when they drove.

Related: 3 Industries Blockchain Entrepreneurs Will Change for the Better

These issues haven't surfaced much yet, because there hasn't been widespread adoption of cryptocurrencies until recently. Ethereum exploded in popularity around December 2017 through a game called CryptoKitties (where users buy digital cats and raise them). The popularity of the game brought to fore the issue of scalability, as documented in this Mashable article.

Here are some terms you should know regarding the scaling of blockchain.Sharding

Sharding is the splitting of the block verification process and running of parallel subcommittees to collate the completed data. Zilliqa is a platform that utilizes sharding. It has been proven to handle 2,400 transactions per second with a goal to match Visa’s average of 8,000 transactions per second, according to The-Blockchain.

Perhaps most importantly, Zilliqa reacts efficiently to scaling needs as its throughput increases with its network size, as opposed to Bitcoin becoming clogged with transactions. With a node size equivalent to Ethereum, Zilliqa predicts it could handle twice the transactions of Visa per second.Hard fork

When a platform drastically branches away from its initial platform direction, it is referred to as a "hard fork." Preceding the hacking of the decentralized autonomous organization on the Ethereum network (where $53 million of crowdfunded cryptocurrency was “stolen,” as reported by Bitcoin.com).

Ethereum took a hard fork in order to reclaim the money and continued as Ethereum Classic, while the existing course maintained the original blockchain as Ethereum. Bitcoin recently adopted a hard fork in its capped block size, which means that old and new software are incompatible with each other and renders the old outputs invalid.

Bitcoin has already forked previously, such as with Bitcoin Cash, and there are more planned for this year.

Related: Blockchain Is How We Can Protect Our Privacy in a World of Ubiquitous SurveillanceSegregated witness

The proposed Bitcoin hard forks will all incorporate SegWit (the Segregated Witness soft fork), which is software designed to solve transaction malleability but also improve the capped block size issue. Each block has a capped size that creates a finite amount of transactions to occur on each block.

SegWit increases the block size limit to 4MB, meaning a single block can hold the records of more than 8,000 transactions. However, although the block increase provides short-term respite in scalability issues, it will still eventually present the same restrictions once transactions have exceeded the limit.-

By

Admin

Admin - 0 comments

- 2 likes

- Like

- Share

-

By

-

Data is indicating that decentralized applications – dApps, for short – hemorrhage users soon after interest peaks, with most users leaving not long after launch.

The latest issue of the Diar report shows that the largest seven dApp platforms by ICO funding, capital raised, have lost 74 percent of their active users, on average, from their all time highs.

The top dApps, ranked by peak user count, included the popular Cryptokitties, which has seen a 96 percent drop in user numbers since its all time high of 14,194. Bancor has seen a 74 percent drop, Kyber Network saw a 61 percent drop, and Numerai, a 97 percent drop.

Augur has also been highlighted for its swift peak of interest, yet alarming rate at which users have steadily vacated the platform.

It would appear that beyond any initial interest in a dApp, they struggle to maintain any form of meaningful user base, once all the excitement has died down.The co-founder of the controversial betting dApp, Joey Krug, has highlighted the challenges that currently face dApps, and cites the complex fee structure as one of the main reasons behind Augur’s drop in active users.

“Right now, if you want to use Augur you have a few fees[…] Add them up you get 11 [percent], making the pay-out ratio on Augur be 89 percent or worse if you account for spreads.” Krug told the Diar report. “Fixing costs, fees is in my opinion the difference between a fun toy and something that’s actually useful.

”The issue though, is that these complex payment strucutures are not unique to Augur, but universal to the entire dApp marketplace. Generally speaking, they are not an alluring proposition for users beyond simple novelty value.

The Augur co-founder continued, “I always used to say that when Augur launched it’d be expensive, slow, and difficult to use but hopefully it works at a core level. It does work at a fundamental level now.

”When dApps It is understandable that users may become quickly disillusioned with using dApps, due to such complex, “multi-step user experiences,” high fees, and low rates of adoption.

Figures for 2018 further show an overall decrease of 38 percent of dApp users, so this downward trend isn’t exclusive to the top end of the market, but rather is a market-wide phenomenon.

When platforms like Coinbase claim to have been signing up 50,000 users a day, interest in cryptocurrency might not be waning, but by contrast, dApps certainly appear to be a flash in the pan.

For most, it appears that dApps are a challenging concept to understand in comparison to popular, easy-to-use web-based apps like Facebook, Instagram and Twitter, which are all free to use too – if you set aside the rampant harvesting of personal data and the exploitation of users, that is.

Despite vast investment in dApp projects, and blockchain startups, platforms will ultimately falter without a growing userbase. Even though they operate very differently to conventional apps, they are still at the mercy of users when it comes to their success.

If dApps can’t find a way to succeed, they may end up becoming a failed use case for blockchain tech.-

Francisco Gimeno - BC Analyst Dapps should be easy to handle and compelling. In a world where time is of the essence and bombarded by easy solutions to every thing, is normal to read that Dapps which are not very friendly user fail to get a solid customer base. This have to change and change soon.

-

-

UK cryptocurrency investment products and research firm CoinShares’ has called for Bitcoin to get a “new narrative” to drive consumer interest and lift prices to new highs.

BITCOIN TO PULL AN AMAZON?

In a series of tweets and a Medium post August 17, CEO Ryan Radloff explained how Bitcoin could follow in the footsteps of companies such as Amazon and Microsoft, whose shares deflated in the year 2000 then exploded to new heights over a long period. “So why did companies that are so clearly viable in hindsight, take so long to reclaim their high valuations from Y2K?” he asked.…Because they needed a new narrative… When you come down from great heights, the ‘growth story’ is harder to see… and most people then (and now) are investing in the (future) growth story.

Radloff referenced CoinShares’ CSO Meltem Demirors, who last week had used the Amazon-Microsoft analogy when defending Bitcoin’s prospects to mainstream media. “Price is an imperfect metric,” she had told CNBC.

Twitter Ads info and privacyHALF OF THE REMAINING NON-MINTED BITCOIN SUPPLY IS ‘SPOKEN FOR…’

…Times, they are a-changin’…medium.comDEMAND WILL BEAT SUPPLY

Both in the media and beyond, the topic of Bitcoin price $6379.82 -0.52% has appeared to reach an impasse in August. The concept that institutional investors will eventually lift Bitcoin out of its trough has met with increasing skepticism, with some sources arguing events such as a regulated Bitcoin ETF would, in fact, be detrimental to the ecosystem.

Discussing the concept, Radloff said the institutional “narrative” in fact “misses the point.”“Institutions will drive new layers of access; and bring a bit more liquidity, no doubt… but the reason they’ll help drive the next bull run is consistent with every growth cycle that came before,” he argued.New attraction, from new masses, will drive new demand; and this increasing demand will be filled through access points created on the back of the last cycle. The more people who want to play in the sandbox, the bigger the sandbox (and more sand) you need.

Based on those sandbox members constituting 99 million consumers seeking exposure to cryptocurrency, if each put the equivalent of £100 into Bitcoin, they would suck up over half the remaining unmined supply – or 1.9 million BTC.

What do you think about Ryan Radloff’s perspective on Bitcoin’s future? Let us know in the comments below!-

Francisco Gimeno - BC Analyst I mostly agree with Radloff. "Narrative" notwithstanding, Bitcoin (and all crypto market) will come out from this bubble into a new cycle where the institutions will be more active and important and more people will be driven to participate. I sent know about his statement about demand beating supply however as I am not knowledgeable enough. What do you think?

-

-

On 14th August, Steve Sosnick, the Chief Options Strategist of Interactive Brokers, gave a few predictions to the masses regarding the future of Bitcoin and the fluctuations in the cryptocurrency industry in this unpredictable market.

Steve stated that the market has been quite volatile for Bitcoin with the cryptocurrency breaking the $8000 barrier and then falling to the fringes of $6000. The reports show that the reasons for this drastic selling can be attributed to technical selling and the rejection by the United States Security and Exchange Commission [SEC] to implement the proposed Bitcoin backed Exchange Traded Funds [ETF].

Technical selling, according to reports, is the process of conducting market transactions based on users using real-world data from the cryptocurrency market. It tries to plot points on the metaphorical cryptocurrency charts to predict price changes.

Recent market researches show that technical selling is a growing trend in the industry right now, with the SEC’s decisions seeming to have no marked change in destabilizing the trend.The SEC has postponed the final decision-making process regarding Bitcoin ETF’s till the middle of September, a month that will see multiple deadlines for the ETF’s and its fate for the future."

Sosnick went on to comment that bullish users should hope that Bitcoin’s current reign close to $6000 holds, lest it falls even further. The report shown by him also pointed out the similarities between the Nasdaq dot-com bubble crash as well as the ongoing Bitcoin price fluctuations. The charts showed that both these events had three parts:- A steady hike over a distributed time period that allowed users to assess the growth of the industry and then proceed to invest.

- An intermediate stage where users jumped on the event’s bandwagon causing the prices/ shares to shoot up and thereby establishing a searing trendsetter.

- A downturn post the significant rise that made holders wary, resulting in a sporadic but obvious fall in prices.

According to him, the descending triangle towards the end of the Bitcoin price chart is a sign that the price slide is very apparent right now.The Chief Operations Strategist of Interactive Brokers also stated that there may be another positive price bounce for Bitcoin, giving users some hope in this bearish market.

He stated that $6900 might be the next threshold during the bounce after which holders should be wary during the decline.At the time of writing, Bitcoin is trading at $6066.48 with a 24-hour market volume of $5.242 billion. The cryptocurrency is suffering a loss of 6.04% and was holding a market cap of $104.288 billion.-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share