Internet

- by azer2012

- 7 posts

-

When news broke of the Cambridge Analytica data scandal in 2018, where personal data of millions of people's Facebook profiles had been harvested without their consent, there was fear and outrage, but most importantly, shock.

Since Facebook, as well as other major interest companies, started taking off on the back of important and valuable data, people have been mostly oblivious as to the reach these companies have when it comes to collecting personal information.

However, what is even more concerning is that many people who do enter into these social contracts with internet companies, where their data is stored and collected, are far too trusting. The expectation is that a company on the scale of Facebook, Google, or other similarly large corporations will have an arsenal of data protection fallbacks.

However, more and more data hacks and scandals are hitting the news, and it is often the internet giants that are implicated, spilling millions of people’s information across the web.

Thus, it is understandable that people are starting to wise up and look for alternative ways to protect their data in an internet age that prizes it so heavily.

The fact that data has always been so freely taken without much consent is what irks people, and that is why they are starting to look elsewhere.Secure identity systems are one use of blockchain technology that has made quite a bit of headway in the recent past.

Civic was probably one of the first blockchain companies that looked at handing power back to the individual when it came to controlling their data, but now, with this added demand for data security other companies are popping up, and even overtaking the likes of Civic.

The fact remains though that there is now an even more significant demand for data security. And because of what the blockchain can offer people, and what they are looking for in this internet age, where data give and take is necessary, means that many more people are exploring this option.

Data at risk

Cambridge Analytica was the very highly publicised tip of the iceberg in regards to data hacks and breaches. The first half of 2018 saw 2,308 publicly disclosed data breaches that resulted in the exposure of approximately 2.6 billion user records, a report from cyber threat intelligence company Risk Based Security showed.

A lot of these breaches would have occurred through poorly protected websites and data collecting portals which were easily compromised. Protecting one's data from these types of sites is more common sense than anything.

However, it is the tech giants that made news in their data breaches that seemingly caused a change in mindset. Social media devours data and information, but for the most part, people have been happy to part with it knowing that it will be secure. That is not the case.

“Every week we are seeing news of breaches from major corporations,” explains Ryan Faber, cofounder of Bloom, a company creating cryptographically secure identity, powered by the blockchain.

"The public is starting to learn about the murky world of data collection. Many are shocked to learn that every moment, servers are logging, cataloguing, and selling your personal, private information.

”The importance, and value, of data, has grown in magnitude over the past decade or so. For the individuals who are producing it, there has been no form of compensation, and certainly not enough security. Because of this, people have started to place more importance on their data and are thus looking for a secure global identity system.

Blockchain securityA basic look over the function of a blockchain immediately lends itself to data protection. It is immutable and un-hackable, eliminating breeches from unwanted actors, but it is can also be transactional, meaning that people can choose what level of data they want to reveal, and said data is reachable on the distributed ledger.

Civic was one of the first companies that looked at putting identities on the blockchain, but as demand has increased for control and security of data, so have other alternative started gaining traction.

“The demand for secure identity and better data management practices has been huge,” adds Faber. “More than ever, people want to take back control of their data. We’ve seen this reflected in our rapid user growth for example, with more than 120,000 BloomIDs created last year alone.

”The power of blockchain identity systems is not only that the data is on the blockchain and thus un-hackable, but it is also that the user becomes in charge of what data can and cannot be accessed.It differs significantly than the current way things are done.

Data is syphoned from individuals for little to no compensation, and this data is then sold off for vast sums of money leaving individuals pillaged, often without even knowing it.

Faber goes on to explain just how different blockchain data security is from traditional methods.

“The access to your data is stored locally on your device, meaning you have ultimate and complete control over your data. The data doesn’t touch a traditional central server, reducing the risk of a data breach. For instance, we use public-key cryptography to securely store and share your data with parties of your choice.

”More than individual demand

There is no denying the fact that data is becoming a form of currency in the modern digital world, and because of this heading, there will no doubt be more of a focus on the protection of data going forward.

Individuals are starting waking up to the value of their data and the desire to keep it secure and safe, and so, corporations are also beginning to see the value of companies offering these blockchain solutions.

Bloom, for example, has collaborated with American Express Middle East to help drive fintech innovation as part of the company’s ACCELERATE ME program. Furthermore, they were also one of six startups selected for the Financial Services Collaboration Lab.

Civic has also started utilising its secure identity system in a real-world use case, integrating their app with Johnson Controls Smart Buildings.Still searching for the killer app.

Blockchain technology continues to be pointed and stretched across a multitude of different sectors in the search for its ‘killer app’. There is real evidence that the technology can serve in the protection and control of individual data, and as demand continues to surge, this facet of blockchain technology will continue to expand.

The days of data being freely and openly pillaged from individuals and sold off to fuel major internet corporation are quickly coming to an end. Users demand more security than can be offered by these giants, and they are also claiming back their right to have control over their data.

Be among the first to get important crypto and blockchain news and information with Forbes Crypto Confidential. Sign up for free now.

Darryn Pollock

Contributor

I am an award-winning journalist that has covered a variety of topics from finance to economics, technology, and even sport. With the emergence of Blockchain technology and the rise in popularity of cryptocurrencies I have focused my efforts towards this fascinating and imp... Read More-

- 1

Francisco Gimeno - BC Analyst We don't believe the masses are yet in the step of asking for blockchain secure data and ID, but it is true that those in the know realise that data handling and use is already the most delicate issue in the Web, and as to now only blockchain can guarantee that security. Data is currency and as such, everyone should be able to control its private data from storage to use. Think about the consequences of this.- 10 1 vote

- Reply

-

-

In 2017, Cognizant proposed 21 jobs that will emerge in the next 10 years and be central to the future of work. In October 2018, we presented 21 more. Both reports espouse our argument that even as work is changing with the emergence of AI, humans have never been more integral to the future of work. Once again, we invite you to ponder 21 jobs that are both plausible and futuristic – and above all represent important work that humans will continue to need to do.

Download the Free 64 page pdf report here:

https://www.cognizant.com/whitepapers/21-more-jobs-of-the-future-a-guide-to-getting-and-staying-empl...-

By

Admin

Admin - 0 comments

- 6 likes

- Like

- Share

-

By

-

Half of richer, online South Africans want to buy cryptocurrencies here is what ... (businessinsider.co.za)

Half of richer, online South Africans want to buy cryptocurrencies – here’s what’s holding them back

A study into cryptocurrency adoption in SA found roughly three in four people who are online, and on the richer end of spectrum, are familiar with digital currencies.Bitcoin remains the best known and most popular, with the likes of ripple lagging behind. Half of respondents want to buy digital currencies but are held back by trust and security concerns.

A study into opinions and awareness of cryptocurrencies in South Africa and nine other countries by Kantar TNS on behalf of Luno has found considerable local interest in digital money – in a very specific group.

The survey found that 69% of the respondents, or roughly three in four people, are familiar with cryptocurrencies, especially bitcoin, and about half want to buy some form of digital money.But the study participants were not exactly average South Africans; 85% of the 1,000 locals polled were above the middle class line.

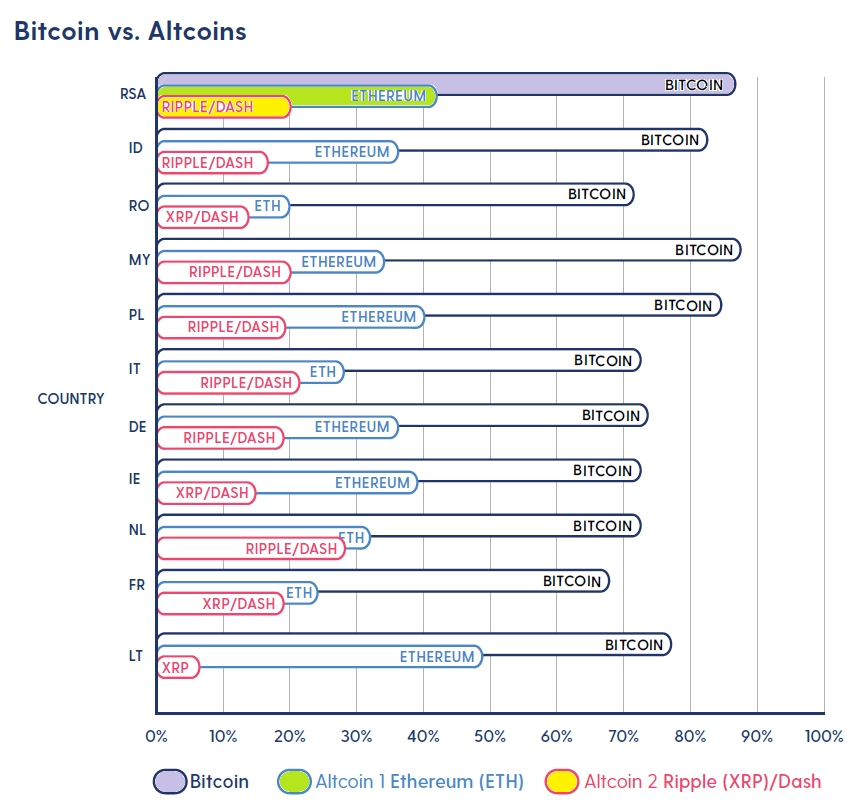

The popularity of Bitcoin across different countries including South Africa. (Graph: Luno)

What is Bitcoin? Everything you need to know about the cryptocurrencyA motion graphics explainer of what the payment system Bitcoin is, and how it can be used.

The high number of South Africans who at least claim to know about digital currencies puts SA on par with other emerging markets like Indonesia and Malaysia.

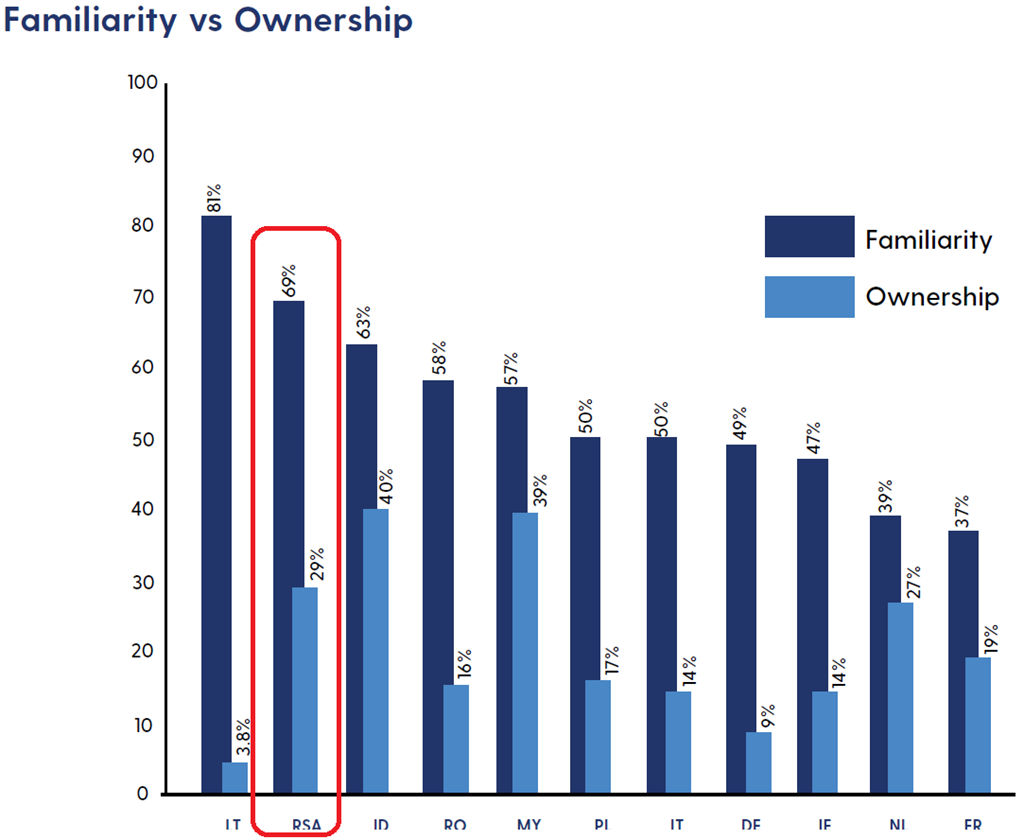

Familiarity vs Ownership (Left to Right: Lithuania, SA, Indonesia, Romania, Malaysia, Poland, Italy, Germany, Ireland, Netherlands & France). (Graph: Luno)290 out of the 1,000 surveyed South Africans said they already own cryptocurrency – a level considerably above ownership levels below 20% found in countries like Lithuania, Germany, Ireland, Italy, Poland, France, and Romania.

Out of the remaining 710 local respondents who said they don't own any digital currency, 530 showed interest in one day buying it, with only 18% not keen on ever owning any.

Luno's country manager for SA, Marius Reitz, tells Business Insider South Africa there were three elements holding people back from buying bitcoin or its peers:

Trust and security, with price volatility and reports of online scams keeping people wary.Their social circle's opinion, with friends and family warning against crypto cash.Consumer education, as many people say they lack the knowledge that would make them comfortable with digital cash usage.-

Francisco Gimeno - BC Analyst This study can be translated globally and really appeals to common sense. Crypto is new and exciting for many to invest, but it continues to be too volatile, unregulated and unfriendly for many users. Crypto development will bring normalcy and hopefully mass use in the future.

-

-

Cryptocurrencies like bitcoin have endured a crushing blow in recent months, but that doesn't mean investors should blow off the underlying blockchain technology that underwrites them.

"Cryptocurrency is one application of blockchain technology, but there's a whole range of other ways to use this technology that may be able to abstract pieces of cryptocurrency or maybe not using cryptocurrency at all," Case Kuhlman, CEO of blockchain and contract software company Monax told TheStreet.

He cited the use cases for banks, supply chain companies, and even legal companies adopting the underlying technology to streamline the services they provide.

Most famously, Walmart (WMT - Get Report) which has employed blockchain for its leafy green tracking and reduced the discovery time of contaminants in its romaine lettuce supply from about one week to merely two and a half seconds seconds.

"Lots of companies are starting to look at this potential [in blockchain] and it has nothing to do with cryptocurrencies," Kevin Werbach, professor of business ethics and legal studies at the University of Pennsylvania's Wharton School of Business told Real Money in a December interview.

"They're solving a real business problem."

The space has only attracted more attention as new broke that Facebook (FB - Get Report) is building its own blockchain dedicated division to apply to its own business problems.

"It's another data point for the uses of the technology by large companies," Kuhlman commented.

So, with some of the largest companies in America like Facebook and Walmart dipping into blockchain for their various needs, how big can blockchain be? Is it the next cloud?

Possibly, according to Kuhlman.

"What cloud platforms like Salesforce (CRM - Get Report) and others have traditionally done is separate the installation of software on a particular computer with the ability to interact with that piece of software.

That was a real fundamental change for device mobility and a whole range of other things," he explained. "What blockchains do, is they sit behind an application and they enable us to divorce a single operator of a dataset or a system with that dataset or system.

So in other words, now a group of companies, or an ecosystem can all collaboratively manage a system."

With such a tangible use case and lofty comparison, Kuhlman suggested that a "cambrian explosion" is ahead for the space in 2019.

To find out more on what to expect from the "explosion" of use cases, check out the interview above.-

Francisco Gimeno - BC Analyst After the crypto craziness is yet surprising to see people dismissing blockchain "because crypto is a mess". Blockchain continues its journey evolving and coming into new projects and different sectors. We will easily see a lot of developments in the acceptance of this technology this year, with few but amazing projects coming into reality.

-

-

Blockchain has the ability to transform the supply chain discipline and the businesses that rely on it for the better. It has many other applications beyond Bitcoin. File Photo: IOL

JOHANNESBURG – One technology with enormous promise is blockchain. Surprised? Don’t be – there’s much more to blockchain than the world of cryptocurrency and finance.

Blockchain has the ability to transform the supply chain discipline and the businesses that rely on it for the better. It has many other applications beyond Bitcoin.

Imagine a simple head of lettuce on a supermarket shelf. What farm was it grown on? What methods were used in the growing? How far did it travel to the store? When a business deploys blockchain, consumers can track the lettuce from the time it was sown to when it reaches the store shelves.

Whether it’s a head of lettuce grown on a farm or a server farm itself, everyone wants to know where their purchases came from. Blockchain will add visibility and trust to the supply chain – benefits that will help everyone.

If business is about creating customer value, then the supply chain is about delivering that value to the customer in the most efficient and effective manner.

Blockchain technology strengthens the supply chain by hardcoding that trust with security, bringing reliability with better asset management, and optimising manual work – by saving hours of laboUr spent on reconciling accounts and settling disputes.

Blockchain’s security blanket

People want to know where their servers were built, understand what components are in those servers and how those components were manufactured.

What blockchain does though is to wrap the information in a security blanket so that no one can hack, alter or destroy it. If a customer wants to check it after 20 years, the integrity of the information will be sound.

Optimising manual laboUr and efficiencyHow much does the manual laboUr that goes into all the paperwork in supply chain operations cost a company? If you are talking multiple large deals, the paperwork will cost you hundreds of thousands of rands a year.

Millions of rands can be saved by eliminating unnecessary paperwork by using blockchain.

There is also the perennial problem of reconciling accounts receivables and payables. The amount of time, human intelligence and intervention that goes into resolving disputes is considerable. With blockchain, you minimise the work and time that’s wasted on these today.

These improvements that blockchain technology will bring to business operations will result in huge cost savings and positively impact the customer experience.

Jim Holland, Country Manager at Lenovo Data Center Group Southern Africa.

The views expressed here do not necessarily represent those of Independent Media.

-

Francisco Gimeno - BC Analyst We have been saying this along for a time now: blockchain is a beautiful tool with which companies will save money and time, in business operations. Use cases are necessary and a trial/success/failures period is needed but blockchain will be used in few years in the business sector directly or indirectly

-

-

Bitcoin was recently called a combination of a bubble, a Ponzi scheme and an environmental disaster by one of the world's leading authorities on finance and economics.

But underneath that sensational description, cryptocurrencies are saddled with underlying technological flaws that will likely prevent them from living up to the hype or merely becoming a more commonly used currency.

Hyun Song Shin, head of research at the Bank for International Settlements in Switzerland, discusses the topic with Bloomberg News economics editor Scott Lanman.

Listen here... https://www.bloomberg.com/news/articles/2018-08-09/bitcoin-s-big-problems-

By

Admin

Admin - 2 comments

- 7 likes

- Like

- Share

-

Francisco Gimeno - BC Analyst Bitcoin has been dismissed so many times since its inception that is already becoming tiring when listening to podcasts like this. Bitcoin itself has no flaws. It has been built to endure. We can discuss on its ultimate use and importance in the crypto digital economy (maximalists will defend BTC as the only crypto worthy of its name, f.i.) and evolution of the system will surely see new Alt coins which are not the mostly speculative and weak ones offered up to now, but real useful digital currency which will be able to be used as a common currency. I foresee yet anyway a long life for BTC. What do you think?

-

Jakobo Gimeno I loved this post because the guy does point out very valid reasons to why Bitcoin as a currency has flaws. I believe that as great as Bitcoin is it still has room for improvements till it can be used casually by people. This is the nature of every technological creation it has to be perfected and with Blockchain we might get that Crypto currency in the future. Maybe I am wrong, time will tell.

-

By

-

By Frederick Munawa. Discovered by Player FM and our community — copyright is owned by the publisher, not Player FM, and audio streamed directly from their servers.

Lisa Cheng is the Founder and Head of Research & Development for the Vanbex Group. Vanbex is a full stack professional services and development company specializing in Blockchain and Cryptocurrency.

Lisa is also an advisor for emerging tech startups and has expertise in business development and product strategy. Her background includes Fortune 500 companies, enterprise sales, big data, and SaaS.In this episode, we discuss:- How Lisa got let go from several jobs and was on unemployment before working for organizations like the Ethereum Foundation and Mastercoin (now known as Omni)

- How she became the Founder of the Vanbex Group

- And how Vanbex’s Etherparty project raised $30 million in its ICO pre-sale

Click here to listen now: https://player.fm/series/blockchain-innovation-interviewing-the-brightest-minds-in-blockchain/019-th...

-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share