saad

- by Saad Hacini

- 6 posts

-

According to PwC, issuing credentials on blockchain could significantly reduce employers’ screening costs

“Like many others, I take pride in the certificate hanging on my wall but cannot take it down and share it when I need to, or keep a digital record of my ongoing professional development," said Steve Davies, global blockchain leader at PwC.

PwC has announced the launch of its Smart Credential platform which harnesses blockchain technology to issue staff with digital versions of their certifications, which are then kept in virtual wallets.

The new platform is being trialled by PwC staff who have qualified with the Institute of Chartered Accountants of Scotland (ICAS) in the last two years.

According to PwC, Smart Credential is a secure and tamper-proof digital ledger that allows users to store, share and verify professional qualifications in real time.PwC is hopeful that it could significantly reduce employers’ screening costs and help them to move away from paper credentials.

“Blockchain is traditionally associated with financial uses given its link to cryptocurrencies, but there are a wealth of potential use cases for this emerging technology and one of them is in overcoming the challenges of digital identity,” said Steve Davies, global blockchain leader at PwC.

Predictions for 2019: Blockchain, AI and AR technology, Transitioning from unfamiliar entities into targeted solutions

Predictions for Blockchain, AR and VR technology: High in the sky aims have given way to clear, targeted goals and expectations

“We’re seeing high demand for verified, trusted and irrefutable identities from many different types of organisations, but a common challenge for employers is ensuring that an applicant holds the credentials listed on their CV,” said Steve Davies, global blockchain leader at PwC.

“Like many others, I take pride in the certificate hanging on my wall but cannot take it down and share it when I need to, or keep a digital record of my ongoing professional development.

”He added: “Blockchain was designed to allow participants to share data without needing intermediaries. No one party has central ownership, so individuals get more control over their personal data. In this first project with ICAS, the data is a Chartered Accountant certificate, but you can also see the potential in any case where credentials are earned and continually updated – such as medical professionals, pilots or safety engineers.”

High hopes for blockchain as enterprises lean into experimentation mode

Great expectations for blockchain as enterprises lean into experimentation mode, says KPMG

Dismiss the future of Blockchain at your own peril

There are two reasons to consider investing in blockchain says Dr. Demetrios Zamboglou as he ponders the future of blockchain-

- 1

Francisco Gimeno - BC Analyst Imagine going to a job interview without original papers, photocopies, certificates, pics, recommendations, copies of your CV... imagine being a HR Manager and not be drowning in papers and documentation... that is what blockchain helps to happen in the next future, starting now. The trend is that in very few years all our career and papers will be in our blockchain, duly certified and authenticated.- 10 1 vote

- Reply

-

-

Report: What the hell is a blockchain phone—and do I need one? - MIT Technology ... (technologyreview.com)

The first wave of crypto-focused smartphones from big players like Samsung is a small step toward a decentralized web.

- by Mike Orcutt

All of a sudden, several crypto-focused handsets are hitting the market, or will soon. The biggest player in the new game is Samsung, which confirmed this month that the Galaxy S10 will include a secure storage system for cryptocurrency private keys.

It joins HTC, which for months has been touting the Exodus 1; Sirin Labs, which used proceeds from a huge ICO to build the Finney; and Electroneum, which this week began selling an $80 Android phone that can mine cryptocurrency.

So what is the point? In the wildest dreams of enthusiasts, these devices will be a gateway to something called the decentralized web, or “Web 3.0.” In this future version of the internet, blockchains and similar technologies would support decentralized applications—“dapps”—that look and feel like the mobile apps we use today but run on public, peer-to-peer networks instead of the private servers of big tech companies.

It’s widely thought that a major impediment to mainstream adoption of cryptocurrency and dapps is that these technologies are too difficult to use for people who are not especially tech savvy. Better user experiences, starting with cryptographic key management, could change that. But getting there is not straightforward, given that key security is paramount: you lose your keys, you lose your assets.

This also explains why Ethereum creator Vitalik Buterin seems so excited about one particular feature of HTC’s Exodus 1, called social key recovery. Essentially, users can choose a small group of contacts and give them parts of their keys. If they lose their keys, they can recover them piece by piece from their contacts.

Buterin, as usual, is looking far down the road, in this case to a future where people use blockchains to maintain more control over their digital identities and personal data than is generally possible today.

Social key recovery is “arguably an early step toward formalized non-state-backed identity,” he tweeted.First things first, though. To be compelling to users outside the bubble of enthusiasts and speculators, these phones will probably need to do more than just keep your keys safe. This week, Samsung and HTC touted a few things they hope will do the trick.

Samsung seemed to reveal partnerships with several blockchain projects, including beauty services dapp Cosmee and Enjin, a blockchain-based gaming platform. HTC announced that it has partnered with browser maker Opera to make it easier for people to use crypto, whether for making micropayments on websites or for using dapps.

“We are at the dawn of a new generation of the web, one where new decentralized services will challenge the status quo,” Charles Hamel, Opera’s head of crypto, said in a statement about the company’s tie-up with HTC.

For now, the $699 Exodus 1 can only be bought online, but HTC’s “decentralized chief officer” Phil Chen tells CoinDesk that the company is working on getting it into carriers’ stores. Samsung’s Galaxy S10 will reach a much bigger market earlier, but it is more expensive, starting at $900.

Sirin Labs is selling the Finney for $999. And Electroneum is taking a different approach, targeting emerging markets with a cheap handset. Should you buy one?

If you are curious about crypto and can afford one, it might be a nice way to test the waters. If you are already into crypto, you probably already have a wallet you trust, and this first generation of phones may not offer you much extra.

A Wired review of the Exodus 1 called it a “smartphone with a cryptocurrency side gig.” That’s about as much of a “blockchain phone” as can be expected at this point.Indeed, even if these phones take off, the decentralized web will still be mostly a dream. Construction of its foundational infrastructure is in the beginning stages.

Perhaps an influx of new users would spawn compelling new applications, which might in turn inspire the development of new infrastructure. But the best the first round of blockchain phones can do is give us a glimpse at a potential future that’s still a long way off.

Keep up with the latest in blockchain at Business of Blockchain 2019.

Share

Ethereum, blockchain, cryptocurrency, smart contracts

Mike Orcutt Associate EditorI’m an associate editor at MIT Technology Review, focusing on the world of cryptocurrencies and blockchains. My reporting, which includes a twice-weekly, blockchain-focused email newsletter, Chain Letter… More-

Francisco Gimeno - BC Analyst We think that a blockchain phone by now is at a very early stage, but a step on what the future can bring once all things crypto and the 5G are there in a decentralised web. It is yet difficult to grasp what this device (there are becoming a extension of our senses and body somehow in the digital era) will offer when the blockchain era becomes mainstream.

-

Cryptocurrency non-profit, the Fusion Foundation, and the Automotive eXchange Platform (AXP) are joining forces to bring the U.S. second-hand car market and its insurance and financing to a blockchain.

The first step in the partnership, according to a Monday announcement, is to integrate Fusion’s blockchain platform and digitize AXP’s current database of 10.5 million automobiles, so they can be properly tracked and audited.

The auto industry has long struggled with a lack of transparency and widespread information inaccuracies from titles all the way through financing, said Max Kane CEO and co-founder of AXP, adding,“There’s a million vehicles on the road that have ‘washed’ titles, which means there is fraud there. The insurance industry is hit with billions in fraud because of missing information, drivers providing the wrong information and inaccurate reporting.”

The AXP network encompasses some 25,000 independent car dealers across the U.S. and this extends to relationships with counterparties in finance and loan origination, Kane said.

John Liu, chief product officer at the Singapore-based Fusion Foundation, said the pilot, which is now underway, could be extended to state-based government agencies and the Department of Motor Vehicles (DMV).

The system, which will go live by the first half of this year is expected to handle $60m–$100m of car financing loans, he said.Fusion is known for having raised over $40 million in an oversubscribed token sale a year ago (many investors were turned away and the sale had to be stopped after 24 hours).

The firm has ambitious goals when it comes to tokenizing assets, having previously partnered with firms involved in asset management and car financing – opening up a potential $12.3 billion in assets, Reuters reported.

Fusion’s founder, DJ Qian, said the blockchain his company has built was inspired by ethereum and will have both public and permissioned components.

“We didn’t want to reinvent the wheel,” he said. Lui added that “spinning up a node will be as easy as in something like bitcoin or ethereum,” but said only a select group of validators will be running such nodes to begin with.He continued:“We don’t need the government or dealers to worry about running a node yet. We want them to use an application that they are familiar with. The number of nodes will be as much as we need to support a secure blockchain.”

Used cars

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.-

By

Admin

Admin - 0 comments

- 4 likes

- Like

- Share

-

By

-

Interview: Tokenization on the Blockchain with Former MD at Morgan Stanley - Coi... (coinnewslive.com)In an interview with CoinNewsLive, Patrick Springer, Former MD at Morgan Stanley discussed the future of asset tokenization on the blockchain and how will it change the financial markets.

Late last month we spoke to Patrick L. Springer, Advisor, Polybird Global Exchange on the future of cryptocurrencies and adoption of blockchain technology by big enterprises. In a follow-up conversation with CoinNewsLive, Springer discusses asset tokenization which has been identified as one of the next steps for large scale blockchain adoption.

CoinNewsLive (CNL): Asset tokenization: What is it and how will it change the financial markets – will it expand and open up the capital markets?

Springer: Asset tokenization is the process by which a financial asset is digitized and made available for exchange through blockchain technology.

The key words in the last sentence are digitized and Blockchain,and these two terms are enabling a trend that will be paradigm-shifting. Prior to the blockchain, there has been a finite way in which to exchange assets.

At the top end, an asset owner could list an instrument on a physical exchange, this would be limited mostly to equity and some types of debt securities; an elaborate trading and settlement system, and a somewhat costly one, has been created for this purpose.

Or it could be exchanged via a bank, who could form a loan or project financing syndicate with a party of entities the banks know. Finally, one could sell it to someone who is an acquaintance or through a lawyer, which is how most people buy or sell their #1 financial asset, their homes.

In each of these cases, a financial intermediary is needed to secure the transaction – the exchange, the bank, or the lawyer, respectively. Each of these methods has toll costs that need to be paid, and friction that may or may not lead to getting the best market-clearing price, for both the buyer and seller.

Digitizing an asset and securing it cryptographically via a blockchain can open new ways for assets to be exchanged and for investors to more specifically target their investments. With digitization, investments can be fractionalized into smaller denominations, making an investment available to larger numbers of investors, thereby making it potentially more liquid.

An example of this is a real estate project – from a large multi-billion-dollar mixed-use project to a new fifteen-unit condo project being constructed – it becomes possible via tokenization for more types of investors to participate in more types of real estate transactions.

Asset tokenization enables better micro-targeting of investments – for example, equity ownership vs. a coupon of cash flows, ability to buy an investment unit in Brooklyn and/or a unit in Miami, or a retail mall project in Arizona vs. a single-family unit in Colorado).

Asset tokenization has significant economies of scale that also reduce costs. Smart contracts on the blockchain will take on many of the legal and administrative functions of a transaction and will automate processes that until now require many steps, many hands, and a lot more time.

Automated rules via smart contracts will ensure that only appropriate investors – investors who meet regulatory requirements and financial suitability requirements – participate in an offering. All of this can reduce the toll costs I referenced above, and it reduces frictions.

For financial markets, historically this cost reduction has caused massive growth in financial markets driven by increased participation and higher turnover.

To be clear, however, asset tokenization is just getting started, and it will move and proceed in a stair-step pattern. Right now, the technology is being built to tokenize assets. But asset owners need help getting through the tokenization process, and there needs to be a marketplace where investors, especially institutional investors, can see, compare, and value different types of tokens.

In other words, a parallel system of digital capital markets advisors and a digital marketplace or marketplaces needs to be formed.

I am an advisor for Polybird Exchange, and this is where our business model resides. Remember that blockchain by design is decentralized by its nature, so the eco-system that will be created for digital assets may look quite different than the one we know for current asset markets today.

Patrick L Springer

CNL: Why Is it worth tokenizing company/rare assets?

Springer: In a world that is very concerned about inequality and asymmetrical access to financial opportunities, continued financial innovation is extremely important. There is no doubt that access to the global financial markets through stocks, bonds, ETFs, investment funds, and 401-Ks has made achieving risk and inflation-adjusted investment returns more possible for more people than ever before.

And for all those that think innovation has not gone far enough to democratize financial markets and improve investment access, then they should be very interested in tokenization and blockchain. Today’s institutional investors continuing to gravitate towards the markets for private securities, such as private equity and private credit, because they are having continued trouble making money in public markets dominated by ETFs and computer-based trading.

The markets for private securities are opaque, hard to access, and have limited price transparency and liquidity. Over time, more of these private securities will be digitized and made available on the Blockchain. More types of investors will be able to access these investments over time. This is very democratizing.

CNL: Why put stocks and bonds on the Blockchain?

Springer: There are two ways to look at this. One is that the current equity and debt markets are very efficient and will not need to change. It is infinitely easier for you to buy and sell a share of Apple than it is to buy or sell a car, a home, or a family antique. The needs case for digitizing the largest, currently traded equity securities is not here.

But there are many small companies that go public in off-exchange offerings, and there are many companies that avoid the costs of being a public company. These may find asset tokenization a financial opportunity. Separately, there are many parts of the publicly traded bond market where price transparency and liquidity are controlled by a very small number of dealers.

Have you ever tried to buy a municipal bond? Investors can only buy them in denominations of $5,000. Given the public finances of so many of our states, I can see the case that those securities should be fractionalized!

CNL: What else can be tokenized?

What are the benefits for these entities to do so? (i.e. movie financing, football teams, artwork?)

Springer: There are a lot of use cases for different types of assets, and there are use cases that have not even been thought of yet.Take the case of the biotech company, Agenus. This is a NASDAQ-listed biotech company with a market cap of about $450 million. Recall what I said about the efficiency of the capital markets for currently listed equities.

Well in January 2019, Agenus raised capital via a security token offering that offers investors a way to invest in a specific biotechnology product of theirs in return for a portion of potential future US sales of that product.

This has been offered to qualified investors via Atomic Capital, and so my understanding is that this has been done in conjunction with current US securities laws.

Want to get the latest crypto updates, analysis and breaking news? Follow us on Twitter (@CoinnewsLive).-

Francisco Gimeno - BC Analyst Very interesting. Who would tell us three or four years ago that we would be talking about asset Tokens, Security Token Offerings, crypto economy and market, as not only a game field but the potential future of financial and economic world in very few years time? Read this interview.

-

-

Use Case: The Coffee Farmers Betting On Blockchain To Boost Business - Forbes Af... (forbesafrica.com)On a bustling street near the shiny new international airport in Ethiopia’s capital is a small coffee roastery with big dreams. Nearly 40 Ethiopians – a third of them women – sift, roast and package prized Arabica beans for export to Europe under the Moyee brand, founded by a Dutch social entrepreneur.

The roastery, together with the innovative use of blockchain technology to ensure the supply chain is transparent, represents an attempt to keep as much of the profits as possible in Ethiopia, one of the world’s poorest countries.“It’s the world’s favorite drink.

We drink over 2 billion cups a day,” said Killian Stokes, who set up the Irish branch of Moyee. “The industry’s worth $100 billion and yet 90 percent of coffee farmers in Ethiopia live on less than $2 a day.

”That is partly because most exporters process the beans elsewhere, but also down to price fluctuations and other factors that make coffee growing a precarious business.

READ MORE | Ugandan Firm Uses Blockchain To Trace Coffee From Farms To Stores

To make things fairer, Moyee has created unique digital identities for the 350 farmers it currently works with – meaning buyers can see exactly how much each individual grower is paid, with prices set at 20 percent above the market rate.

Now the brand, whose slogan is “radically good coffee”, wants to use blockchain to take that to the next level – allowing buyers to tip farmers, or fund projects such as a new planting program, through a mobile app.

The U.N. Food and Agriculture Organization (FAO) said in a recent report that blockchain had huge potential to address challenges smallholder farmers faced by “reducing uncertainty and enabling trust among market players”.

The technology, used to underpin cyber-currencies like Bitcoin, allows shared access to data that is maintained by a network of computers and can quickly trace the hundreds of parties involved in the production and distribution of food.Once entered, any information cannot be altered or tampered with.‘BIGGER THAN THE INTERNET’

Siobhan Kelly, an advisor to the Food Systems Programme at the FAO, said blockchain would ultimately be “much bigger than the internet”. “Within 10 years – it’ll take probably 10 years – it’s going to be a major revolution, for everything,” said Kelly.

Fruit farmers in Caribbean nations are also looking at using blockchain to attract better-paying customers, bring traceability and build a credit trail. “It’s an innovation that is poised to empower local farmers in the Caribbean region,” said Pamela Thomas, executive director of the Agriculture Alliance of the Caribbean (AACARI), a regional network of nearly 100,000 farmers.

AACARI’s project has two components: auditing by accredited professionals to ensure farmers adhere to the Global GAP (good agricultural practices) standards, and a digital marketplace where buyers can find detailed information about the produce. Global GAP is a voluntary standard required by many European and U.S. supermarket chains.

Vijay Kandy, whose company is building the blockchain platform, said the auditing process would allow farmers to deal directly with buyers – bypassing the middlemen that many currently rely on – and make access to credit easier.

“One reason why buyers from faraway places or different countries go through middlemen is because they rely on them to make sure farmers are following these good practices,” he said.

One such buyer is London-based Union Hand-Roasted Coffee. The company sources its coffee directly from growers’ cooperatives to ensure higher quality, pays farmers more than minimum price set by the global Fairtrade organization, and works with more than 40 producer groups in 14 countries.

“We currently undertake direct interviews to verify farmers have been paid, but it’s very time- and labor-intensive to do that and to record all that data,” said Steven Macatonia, who co-founded Union in 2001.

“So to have a much more simple system where we can get a confirmation that payment has been received and how much that is, that could be hugely beneficial,” he said. Price fluctuations and the impact of climate change make coffee a particularly challenging crop to grow.

“Large companies’ profits usually increase when prices are low, but the profit for farmers does not, and in some cases it may cost them money to produce coffee,” said Aaron Davis, head of coffee research at Britain’s Royal Botanic Gardens at Kew.

Davis’s latest research shows climate change and deforestation are putting more than half of the world’s wild coffee species at risk of extinction.Ethiopia – the birthplace of Arabica, the world’s most popular coffee – is of particular concern. Up to 60 percent of the land used to grow coffee could become unsuitable by the end of the century, Davis found.“The more a farmer is paid, the more resources he will be able to devote to climate resilience,” he said.

Both Davis and the FAO’s Kelly however cautioned that blockchain technology was not going to be a “quick fix”, with farmers around the world facing multiple challenges.

“Farmers need access to affordable seeds, to affordable finance and credit when they need it … and these things are not going to be given by blockchain,” said Kelly. -Reuters-Thin Lei Win @thinink-

Francisco Gimeno - BC Analyst Coffee business (all agricultural products in fact) are the perfect use case for application of blockchain's tech and platforms which will not just make sure we enjoy a morning cup of this desired infusion and also helping to diminish the danger we already foresee of losing coffee's world production to climate change in the next future. Blockchain is our tool, let's use it properly.

-

-

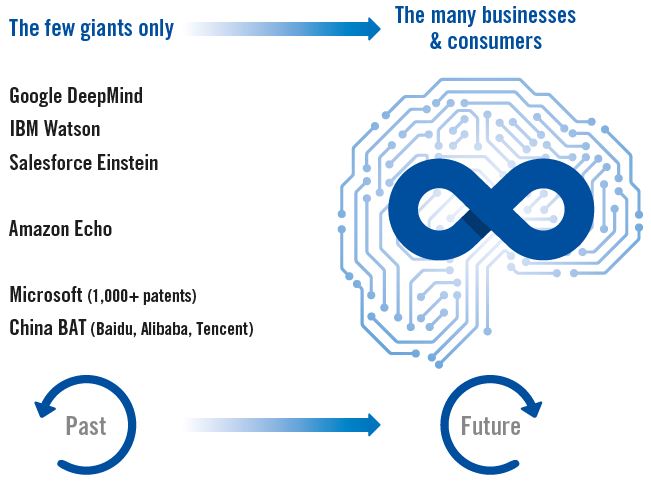

Artificial intelligence (AI) and machine learning are gaining a strong foothold across numerous applications, lowering the barriers to the use and availability of data (figure 1).

From now on, AI will not only be relevant to just a few large corporations but will form an integral part of most business strategies and is likely to influence our daily lives in more ways than we may recognise (figure 2).

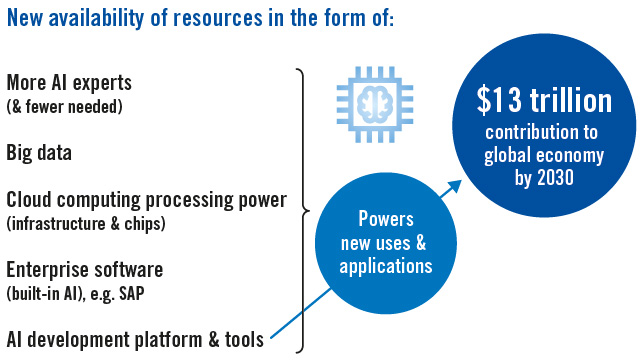

New cloud-based and AI-enhanced enterprise-as-a-service software requires less expertise and lower upfront investment. Companies no longer need to develop their own applications and end users do not need to gain extra knowledge or learn a new interface as AI runs in the background (figure 3).

As an emerging technology, AI is taking hold as virtual assistants, chatbots, deep learning (see below) autonomous systems (e.g. self-driving cars), and natural language processing. AI innovation and sophistication is on an exponential growth curve. AI promises a new cognitive partnership between man and machine.“AI innovation and sophistication is on an exponential growth curve. AI promises a new cognitive partnership between man and machine.”

From assisted intelligence, the future holds new forms of augmented intelligence and autonomous intelligence. Automation based on robotics and machine learning facilitates functional (and sophisticated) jobs today. Tomorrow, the opportunities will arise from artificial augmentation and the Internet-of-Things powered by 5G connectivity.

This is not about single technologies but the convergence of many cognitive enterprise systems all inter-connecting with AI and exponential data at the centre.Difference to Machine Learning

One definition of AI is intelligence demonstrated by machines as opposed to natural intelligence by humans. Thus, AI is the science of engineering intelligent machines. AI research identifies three types of systems:

Analytical (with cognitive learning and decision making)Human-inspired (as above plus emotions)Humanised artificial intelligence (as above plus self-consciousness and self-awareness)

AI and machine learning are often used interchangeably. Yet, machine learning can be defined as systems learning and improving (as in ‘Analytical’ above).

Thus, machine learning is a specific subset of AI that excludes emotions, self-consciousness and self-awareness – and also human (DNA hardwired) dimensions such as ethics and morals.

AI is not confined to biologically observable approaches only. Whilst the world has been able to construct machine learning systems, it still has fallen short of ‘broader’ AI with human aspects as mentioned above. Figure 2: The future for AI industry is for the many businesses, not just the few giants. Source: CFI.co

Figure 2: The future for AI industry is for the many businesses, not just the few giants. Source: CFI.coDeep Neural Networks

AI and machine learning comprise deep-learning neural networks. Here, ‘deep’ simply means more sophisticated neural networks that have multiple layers which interconnect. Neural networks include new performance offerings with current relevance such as:- Computer vision (e.g. face recognition and visuals for cars)

- Natural language processing

- Big data predictions and analytics

The new neural networks can be based on neuromorphic chips that mimic the brain’s neurons with a lot more power than current chips.

Figure 3: New availability of resources powers AI growth. Source: CFI.coAI Confluence in 4IR

The dream of AI has gripped the imagination of philosophers throughout the ages. Machine learning has evolved since the 1950s with the advent of computing power. First came the counting computer (spreadsheets) and after that the programmable era.

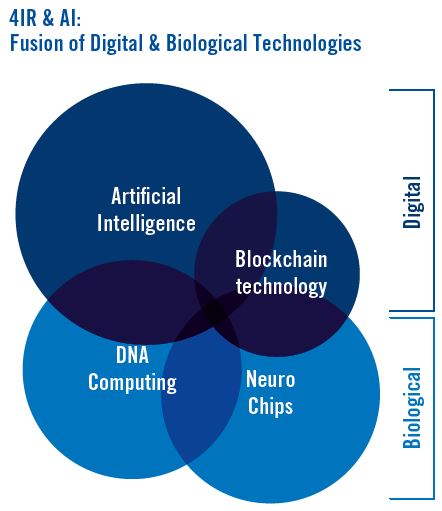

We are now at the tail end of the third industrial revolution in the cognitive era where new available resources and technology (figure 3) allow the embedding of AI and machine learning into new products that, in turn, streamline decision-making processes.AI in the fourth industrial revolution (4IR) is a continuum promising a convergence of new technologies such as, for example, quantum computing.

The fusion of digital and biological technologies empowers the internet-of-things and internet-of-everything (figure 4).As Ian Fletcher from IBM explains in the CFI.co summer 2018 issue, the 4IR and augmentation come together to capitalise, cultivate, and orchestrate data assets in order to improve performance.

They also increase the capacity for continuous change whilst building a cognitive platform, encompassing self-learning systems, natural language processing, robotic process automation, enhanced data intelligence, augmented reality, and predictive patterns – all accessible through an open API (application program interface).

These elements should be supported by a cognitive journey map, cognitive enabled workflows, business process automation – empowering businesses to make faster and more informed decisions. In short, AI and 4IR technology confluence must be culturally imbedded in the corporate DNA. Figure 4:

Figure 4:

Technology Convergence in the 4th Industrial Revolution Source: CFI.coMoore’s Law and Metcalfe’s Law

This meteoric change is made possible in the fourth industrial revolution because of two key observational concepts: Moore’s law and Metcalfe’s law.

Moore’s law is the observation that the number of transistors in a dense integrated circuit doubles about every two years, whilst Metcalfe’s law states the effect of a telecommunications network is proportional to the square of the number of connected users of the system (n2).

The less costly devices made possible by Moore’s law, increase the number of nodes boosting the network’s value in Metcalfe’s law. One key outcome is more powerful chips designed to mimic human behaviour.

New fourth industrial revolution neuromorphic chips have biological inspired neuro transmitters growing and learning – providing an exponential level of extra intelligence.

Other ground-breaking and powerful technologies are starting to emerge – such as DNA computing, which permits the storage of hundreds of trillions of terabytes of data on 1 gram of human DNA, fusing our digital and biological worlds.

AI’s relevance is forming part of – and being at the heart of – the confluence of this brave new world of 4IR technologies, which must be well understood in order to harness its full potential.Will AI develop consciousness – and if so, what are the moral and ethical implications?About the Author

Tor Svensson is the Chairman of Capital Finance International.

Read the article from the Winter 2018-2019 print issue, or from the CFI.co app (download from iTunes or Google Play).-

Francisco Gimeno - BC Analyst AI is working its way in 2019. Surely we won't see spectacular changes in the way we live or work this year or in five years, as a self conscious AI is far on the line yet, but there is already incremental changes in AI entering and linking with work processes and other new techs like blockchain and robotics, which are preparing the new social and work landscape. How are you preparing for this?