daniel's page

- by Daniel Mihail

- 8 posts

-

French President Emmanuel Macron has called for increased use of data technologies such as blockchain in the EU to boost the agriculture industry and address concerns over food traceability.

Inaugurating the 56th International Agricultural Fair in Paris at the weekend, Agridigitale.net reports, Macron spoke of the need to authenticate and track agricultural products amid growing consumer concerns over issues such such as the recent Polish beef scandal, saying:“Let’s do this in Europe, [be at the] the vanguard of agricultural data by developing tools that will track every product from raw material production to packaging and processing.”

He continued to say “the innovation is there and it must be used in the agricultural world,” as doing so would both bring “shared excellence” and offer benefits to consumers.The call for innovation came as part of a multi-part strategy that the president outlined in his speech.

Europe’s agricultural policy going forward, he said, would be based on the protection of farmers and consumers against climate change and market risks, farming more ecologically, and using technology and innovation to help to solve industry challenges.

If there is support from the EU member nations, Macron also said he would propose the establishment of a European task force to ensure the standards of agricultural products and fight food fraud.Editor’s note: Some statements have been translated from French.

Emmanuel Macron image via Shutterstock

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.-

- 1

Francisco Gimeno - BC Analyst France continues to strongly bet for blockchain and innovation, after its last year announcement of a new revolution based on new tech like this one. They are working at their own path to develop the European foundation of this revolution.- 10 1 vote

- Reply

-

-

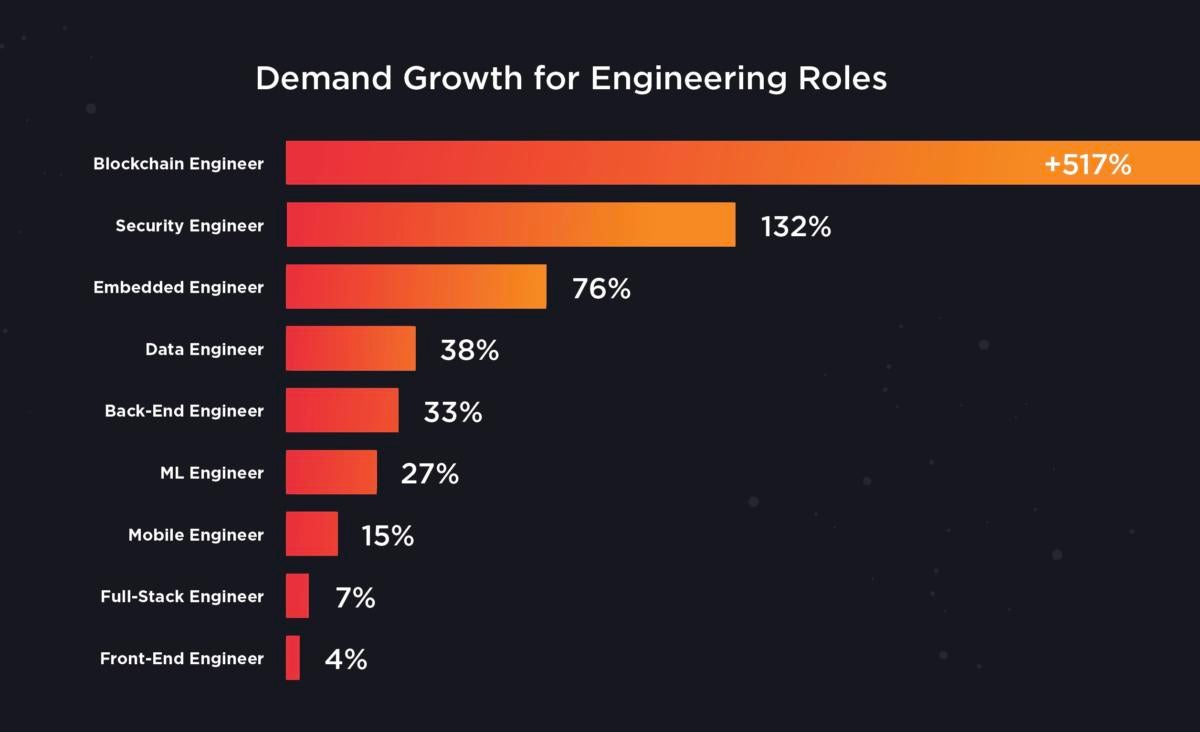

There's been a 517% increase in demand for software engineers with blockchain development skills in the past year, according to a new report from job search site Hired.

In its first-ever analysis of only software engineering jobs, Hired found blockchain development skills ranked in the top three job openings in almost every global region. Blockchain engineers were followed by security engineers and embedded engineers, which saw 132% and 76% year-over-year growth, respectively.

Hired

Mehul Patel, CEO of Hired, said the growth in demand for blockchain skills has gone "through the roof" and tops anything he's ever seen.

[ Further reading: Blockchain: The complete guide ]"It's staggering growth," Patel said.

San Francisco-based Hired culled its data from the resumes of more than 100,000 job seekers and job postings from more than 10,000 companies that use the website.Salaries for software developers with blockchain skills are as high as $157,000 in the U.S., according to the report. Outside the U.S., salaries drop significantly, but that is to be expected, as pay for software engineers in general is lower in other regions, Patel said.

Hired

In London, for example, software engineers with blockchain development skills earn as much as $90,000; in Toronto they earn up to $75,000; and in Paris, $67,000, according to Hired's report.[ Looking to upgrade your career in tech? This comprehensive online course teaches you how. ]Hired's data is not far off that of other recent job reports.

For example, job market research firm Burning Glass Technologies in December reported that blockchain developer job openings had grown 316% in the past year – creating 12,006 job openings in the U.S. alone.The median advertised salary for software developers requiring blockchain skills in the U.S. was $125,000, according to Burning Glass Technologies.

Hired

"As demand increases, so do salaries," according to the Hired report.Also, in December, LinkedIn revealed its top five emerging careers and found blockchain developer was number one.

Job listings for those who can create blockchain ledgers had grown 33-fold in a year, according to LinkedIn's 2018 U.S. Emerging Jobs Report. In distant second place were machine learning engineers, positions that saw a 12-fold increase during the same period.

While blockchain engineering is the most in-demand skill on the Hired marketplace, only 12% of survey respondents identified blockchain as the top technology they want to learn. Fifty-one percent of survey respondents named Python as one of their most-liked languages, while 49% cited Javascript. PHP was ranked the least favorite at 19%.

Another problem affecting the mismatch between the need for blockchain developers and a lack of available workers is the difficulty in finding places that offer training, Patel said. In general, one in five software engineers is self-taught, according to Hired's data."I think generally we are seeing less than half of engineers we looked at had a B.S. degree and one fifth of them had gone through a year and a half of school.

So one-third of our engineering base are self-taught or taught through non-traditional means," Patel said. Almost two-thirds of the software engineering roles on Hired's platform didn't have blockchain in the title, but did list it as a skill.

"So, I think the title itself is not out there yet, but folks are definitely looking for the skills," Patel said.While still relatively rare, blockchain training programs have begun to pop up and are now being offered by some of the nation's leading universities, including Princeton, Stanford, UC Berkeley, and MIT.

Currently, the easiest and fastest way to become proficient is to learn on your own or attend programs organized by blockchain vendors and industry groups, such as Consensys, Blockapps, the Ethereum Foundation and Hyperledger.

While blockchain may be a relatively new technology in terms of enterprise deployments, Patel said he's confident demand will continue to be strong for years to come as businesses begin implementing "their countless use cases" Those uses involve everything from digital identity and smart contracts to workforce management and distributed data storage.

"I think there's a deep feeling here that blockchain is the next wave of technology innovation that will underpin almost every industry one way or another – sort of like the first wave of the internet in the 1990s," Patel said. "So no, I don't think this is a temporary thing."-

By

Admin

Admin - 3 comments

- 3 likes

- Like

- Share

-

Daniel Mihail piramida at s.c piramida s.r.l. I think what go up must come down like in Euler diagram, the need for software engineers is on the wave but what if in the near future Artificial Intelligence will be able to write block code,

-

Francisco Gimeno - BC Analyst If you are a software engineer with blockchain development skills, congratulations! You are at the crest of the blockchain wave and will get jobs offers from all around for your picking. If you are not, prepare as for the next decade all jobs blockchain related in the industry will be (…more)

-

By

-

Report: What the hell is a blockchain phone—and do I need one? - MIT Technology ... (technologyreview.com)

The first wave of crypto-focused smartphones from big players like Samsung is a small step toward a decentralized web.

- by Mike Orcutt

All of a sudden, several crypto-focused handsets are hitting the market, or will soon. The biggest player in the new game is Samsung, which confirmed this month that the Galaxy S10 will include a secure storage system for cryptocurrency private keys.

It joins HTC, which for months has been touting the Exodus 1; Sirin Labs, which used proceeds from a huge ICO to build the Finney; and Electroneum, which this week began selling an $80 Android phone that can mine cryptocurrency.

So what is the point? In the wildest dreams of enthusiasts, these devices will be a gateway to something called the decentralized web, or “Web 3.0.” In this future version of the internet, blockchains and similar technologies would support decentralized applications—“dapps”—that look and feel like the mobile apps we use today but run on public, peer-to-peer networks instead of the private servers of big tech companies.

It’s widely thought that a major impediment to mainstream adoption of cryptocurrency and dapps is that these technologies are too difficult to use for people who are not especially tech savvy. Better user experiences, starting with cryptographic key management, could change that. But getting there is not straightforward, given that key security is paramount: you lose your keys, you lose your assets.

This also explains why Ethereum creator Vitalik Buterin seems so excited about one particular feature of HTC’s Exodus 1, called social key recovery. Essentially, users can choose a small group of contacts and give them parts of their keys. If they lose their keys, they can recover them piece by piece from their contacts.

Buterin, as usual, is looking far down the road, in this case to a future where people use blockchains to maintain more control over their digital identities and personal data than is generally possible today.

Social key recovery is “arguably an early step toward formalized non-state-backed identity,” he tweeted.First things first, though. To be compelling to users outside the bubble of enthusiasts and speculators, these phones will probably need to do more than just keep your keys safe. This week, Samsung and HTC touted a few things they hope will do the trick.

Samsung seemed to reveal partnerships with several blockchain projects, including beauty services dapp Cosmee and Enjin, a blockchain-based gaming platform. HTC announced that it has partnered with browser maker Opera to make it easier for people to use crypto, whether for making micropayments on websites or for using dapps.

“We are at the dawn of a new generation of the web, one where new decentralized services will challenge the status quo,” Charles Hamel, Opera’s head of crypto, said in a statement about the company’s tie-up with HTC.

For now, the $699 Exodus 1 can only be bought online, but HTC’s “decentralized chief officer” Phil Chen tells CoinDesk that the company is working on getting it into carriers’ stores. Samsung’s Galaxy S10 will reach a much bigger market earlier, but it is more expensive, starting at $900.

Sirin Labs is selling the Finney for $999. And Electroneum is taking a different approach, targeting emerging markets with a cheap handset. Should you buy one?

If you are curious about crypto and can afford one, it might be a nice way to test the waters. If you are already into crypto, you probably already have a wallet you trust, and this first generation of phones may not offer you much extra.

A Wired review of the Exodus 1 called it a “smartphone with a cryptocurrency side gig.” That’s about as much of a “blockchain phone” as can be expected at this point.Indeed, even if these phones take off, the decentralized web will still be mostly a dream. Construction of its foundational infrastructure is in the beginning stages.

Perhaps an influx of new users would spawn compelling new applications, which might in turn inspire the development of new infrastructure. But the best the first round of blockchain phones can do is give us a glimpse at a potential future that’s still a long way off.

Keep up with the latest in blockchain at Business of Blockchain 2019.

Share

Ethereum, blockchain, cryptocurrency, smart contracts

Mike Orcutt Associate EditorI’m an associate editor at MIT Technology Review, focusing on the world of cryptocurrencies and blockchains. My reporting, which includes a twice-weekly, blockchain-focused email newsletter, Chain Letter… More-

Francisco Gimeno - BC Analyst We think that a blockchain phone by now is at a very early stage, but a step on what the future can bring once all things crypto and the 5G are there in a decentralised web. It is yet difficult to grasp what this device (there are becoming a extension of our senses and body somehow in the digital era) will offer when the blockchain era becomes mainstream.

-

If 3D printing technology wants to get ahead of its inherent security issues, the best way would be to adopt blockchain.

Speaking at the 2019 Pacific Design & Manufacturing Show, Jack Heslin, President of 3D Tech Talks, a 3D printing consultancy, said as 3D printing becomes cheaper, easier, faster, and more ubiquitous, the very nature of the technology is going to demand the security afforded by blockchain.

It's all about what Heslin called the Digital Thread of Additive Manufacturing (DTAM), “the single, seamless strand of data that stretches from the initial design to the finished, 3D-printed part.”

Sponsored Content Brought to you by Design News

Cutting Costs With 3D Printing From Prototyping to Validation

Engineers and designers across industries are leveraging in-house 3D printing to shorten design cycles and cut costs. In this webinar, learn how Cutsforth, a manufacturer in the power industry for 25 years, uses 3D printing to quickly validate designs and streamline manufacturing.

If you've never heard of such a thing for 3D printing that's okay, because Heslin said such a thing really doesn't exist. “The [3D printing] process is linear, but it's not single or seamless,” he said.

3D-printing moves through several stages: from concept, to CAD file, to generative design (when available), to the actual 3D print. Then comes the post print process, and finally support if and when it is needed. All these steps each represent a point of vulnerability in which a 3D print can be corrupted or even stolen, putting company's intellectual property at risk.

“The digital thread of manufacturing has vulnerabilities. Design files can be stolen,” Heslin said. The one that scares me the most is that design files can be hacked to deliberately put in a flaw...I'm not saying it's happening right now, or it's easy to do, but it is a concern.

”Research has already shown 3D printing has a growing need for cybersecurity. Researchers from New York University's Tandon School of Engineering for example have found that there are serious security issues around 3D printing that could present significant safety hazards due to counterfeit parts and products, or products being deliberately printed with hidden flaws and built-in failures.

The Liberator (shown) is a single-shot gun that can be 3D-printed using unsecured files available on the Internet. (Image source: NotLessOrEqual [CC0]) In 2016 researchers from the University of California, Irvine demonstrated a novel approach to 3D printer hacking when they revealed that the source code to produce 3D-printed parts can be stolen by recording the sounds the printer makes.

All of this leads to implications for a number of issues Heslin pointed out. Aside from printers being taken offline by malicious entities and concerns of stolen IP there are also larger issues, particularly around gun safety.

For several years now a debate has raged about 3D-printed guns. Recently, a would-be domestic terrorist in Texas was arrested and sentenced after he was found in possession of an illegal AR-15 assault rifle that he was able to assemble with the help of 3D printed parts created using files freely available on the Internet.

One step beyond this, Heslin noted, would be the illegal and unauthorized printing of military machine parts and weapons or hacking 3D printer files to do deliberate damage to sensitive equipment or machines.

In a 2016 paper, “dr0wned – Cyber-Physical Attack with Additive Manufacturing” a team of researchers were able to hack a PC connected to a 3D printer and from there make secret alterations to the 3D printing files for a $1000 drone that caused its propellor to fail mid-flight.

So how does blockchain address all of this? Blockchain works by creating a distributed, encrypted ledger across any number of parties that can be used to verify not only identities but also the status of any particular job. That means every entity involved in any stage of a 3D print is aware of what all the others are doing at any time in a safe and secure manner.

Since a blockchain is decentralized, meaning no single entity owns it, stealing or altering a 3D printed file from a blockchain is not about tricking a single computer or printer – you'd have to hack every entity that was a part of that particular chain, which is exponentially more difficult, if not sometimes impossible.

RELATED ARTICLES:- How Blockchain is the Key to a Secure IoT

- Blockchain Needs to Answer Four Major Questions

- Is the Blockchain Prepared for Enterprise?

“When you have multiple stakeholders in the process you have to ask is consensus required across stakeholders,” Heslin said. In that regard blockchain can provide authority to print and authority to send files to be printed.He also pointed to the audit trail benefits offered.

“We all know about Six Sigma and ISO – a lot of it is about audit trails,” Heslin said. “Blockchain, by nature, is an audit trail. It shows every edit and iteration in the process. ” Furthermore, because the audit trail is decentralized it becomes immutable and cannot be erased.Even as early the conceptual level there are benefits.

“If you're a design engineer and you send parts to a service bureau to be 3D printed, you don't know if anyone else printed that part,” Heslin said. “Look at a site like Thingiverse. You can see how many times a file has been downloaded, but you have no idea how many times something has been printed...or if its being sold without your permission.

”There are already companies working on this. In 2017 GE filed a patent for an additive manufacturing (AM) system that is “an AM device configured to implement a distributed ledger system...wherein the the distributed ledger is a blockchain ledger.

” The basic premise of the system is to use blockchain to identify and verify builds, and the authors of those builds, in an AM system.Wipro, an India-based IT consultancy, is developing a blockchain system for AM specifically targeted at fighting IP theft. As the company's website states:“3D printing empowers small manufacturers to create new products anywhere. The creators can share the files to a secluded printing facility. Blockchain can help set up such small independent value chain to make the production processes nimbler. The smart contracting application can ease out the transactions to assure integrity of product history, production process details, ownership and much more. It will also help to locate the most feasible printing facility and reduce the negotiation time regarding price, date of availability etc. At last the blockchain would capture the digital trail of the product, with details such as the type of raw material used, the source of raw material, production parameters, technical specifications, where it was manufactured, how it was stored and maintained etc.”

Where blockchain is typically looked at more on the software end, as with Bitcoin and other cryptocurrencies that have made it so popular, Heslin said 3D printing holds an “interesting extra layer in that this deals with physical products.

”And while cyberattacks against 3D printers have been confined mostly to research labs, 3D printers will only become a more enticing target for hackers as more and more printers are connected via the IoT and more and more companies trust 3D printers with sensitive files and information.

There's a shift happening in which what's most valuable won't be the end product, but rather the information that enables that end product, Heslin said.

“You can't say with certainty that we can do this. But this issue is serious enough you have to address this.”Chris Wiltz is a Senior Editor at Design News covering emerging technologies including AI, VR/AR, blockchain, and robotics.-

Francisco Gimeno - BC Analyst The 4th IR needs 3D printing as one of its important disruptive techs. But 3D Printing's spread has been very slow up to now due to security concerns. Blockchain will help in making the 3d printing process safe and secure, by making it more difficult to be hacked. Imagine a world where 3D Printing (aided by His) is ubiquitous, safe and secure, protected by blockchain layers.

-

When J.P. Morgan announced it had created its own cryptocurrency last week, the bank left the industry speculating about what the move might mean for the blockchain-based payments and for the broader future of banking.

JPM Coin, as it’s called, isn’t a traditional cryptocurrency—instead of being something to invest in—it’s more of a tool for settling transactions between financial institutions and across countries with a digital coin pegged to the U.S. dollar.

The bank said it’s already successfully tested JPM Coin, making it the first bank to make its own digital coin. However, unlike many ad-tech companies, which rely on a vast ecosystem of partners and customers, JP Morgan is able to test internally without the buy-in of anyone else.

Regardless of what J.P. Morgan does with JPM Coin, brands and other blockchain companies will likely be watching closely over the coming weeks and months.

They’ll also be watching to see how other banks working on their own blockchain technology respond—or how blockchain companies like Ripple, whose cryptocurrency, XRP, has gained traction to solve a similar issue around intra-bank transactions—now that a competitor is now in its backyard.

Anne Ward, CEO of Veritoken, a blockchain startup focused on identity management, said it might be good for Ripple to have competition because it further proves the need for the company’s technology. She said XRP has already been “battle tested.

”According to Ward, 2019 will be a “year of firsts” for cryptocurrency,” which could lead to more validation in the space—and more encouragement for testing now that the biggest brands are getting on board.“If this spawns a bunch of silos, I don’t think that’s great,” she said. “But if we figure out how this can go into a wallet and consumers can use it, that would be amazing.

It tells you they’re looking for other ways to move money around.”J.P. Morgan is not the only big bank already making bets on blockchain this year. The day before it announced JPM Coin, the Spanish bank Banco Santander announced a $700 million deal with IBM to speed up its own digital transformation.

The five-year plan isn’t solely focused on blockchain—other areas will include improved uses of artificial intelligence and security systems—and could provide further assistance to the “digital investment team” that Santander started last year. Smaller banks are also testing.

As Coindesk pointed out last week, California-based Signature Bank is already moving money with a similar system called Signet, with “more than 100 clients” using it to send “millions of dollars each day.”Jesse Lund, head of blockchain solutions for financial services at IBM, said JPM Coin’s uses overlap with what HSBC began testing last year.

However, while they’re not exactly the same, he said there are other opportunities, too. For example, it could allow JP Morgan to extend its lending model outside of the bank.

Lund said that could make JPM Coin an “equalizer’” if smaller banks can transmit directly to the bank.“It allows the small guys to sort of play on the field only the big guys could play before,” he said. “It’s a paradigm shift. It really is.

”That’s not necessarily good news for Ripple, which has been courting larger banks and even central banks for tests. Lund said Ripple’s implementation that forces banks to only use XRP ended up being “problematic.” That inspired IBM to allow choices for its own World Wire program, which gives clients the chance to use XRP and other tokens.

He said JPM Coin’s pivot to the dollar might be more attractive than the more speculative value of XRP.“It kind of torpedoes their model compared to everyone else, but also plays into model we were hopping for,” he said. Ripple, which now has more than 200 banks using its payment system, declined to comment.

However, Ripple CEO Brad Garlinghouse told Bloomberg that JPM Coin’s debut on a closed network “is like launching AOL after Netscape’s IPO.”Rajesh Kandaswamy, Gartner’s chief of research for blockchain, doesn’t necessarily see JPM Coin as direct competition to XRP, describing it as “expected.”

However, if JPM Coin takes off, the creation of the coin could increase the likelihood of banks developing blockchain tech directly rather than relying on outside vendors. However, he stressed that JPM Coin is very much still a prototype.

“What I anticipate is after this is we’re not going to see some news for some time,” he said. “And while it will spur some activity, it’ll be wait and watch more for some time.

”Less than 10 percent of the top 100 largest banks will have core systems for blockchain in place by 2021, according to recent research by Gartner. And yet, the research firm sees financial services as one of the sectors most likely to benefit from the technology, both in terms of improving processes and finding new markets.

So does JPM Coin count as an inflection point? No, Kandaswamy said. However, it is a next step.“Everyone talks about banking as a key place for blockchain,” he said. “In our view, banking is one of the first entrants, but it doesn’t necessarily mean they’re one of the earliest beneficiaries.

”Branding JPM Coin as a cryptocurrency is also curious, considering how the bank’s CEO, Jamie Dimon, has vocally criticized the likes of Bitcoin for more than a year. And while he has praised the promises of blockchain technology for other uses, it’s left some wondering why J.P. Morgan didn’t simply describe it as a tool rather than a token.

“I don’t think what they’re offering is anymore of a cryptocurrency than Monero in Fortnite,” said Kyle Asman, partner at the blockchain investment advisory firm BX3 Capital, referencing the fake money used in the popular video game.

Frank Chaparro, a journalist who covers cryptocurrencies for the blockchain-focused media company The Block, expressed a similar sentiment. He said it might be to help the bank capture the “awe and sexiness” of fin tech—much like it did by creating its own investment app to compete with the likes of free stock-trading platforms like Robinhood.

“Why did they go about marketing it as a cryptocurrency?” he said. “Do they want to embrace the ecosystem? Was it a play for coverage and marketing pickup? That’s an interesting angle too.”

Marty Swant

@martyswantMarty Swant is a technology staff writer for Adweek, where he specializes in digital marketing trends, social platforms, ad tech and emerging tech such as virtual reality and artificial intelligence.-

Francisco Gimeno - BC Analyst JPMCoin is just showing how banks have realised the strength of being at the crypto sphere, and, as usual, trying to dominate and control it. We don't consider this so called coin a strong competitor of real cryptocurrency, like BTC, or useful like ETH or EOS. But is an important sign on how the banks are going to go in the next future.

-

-

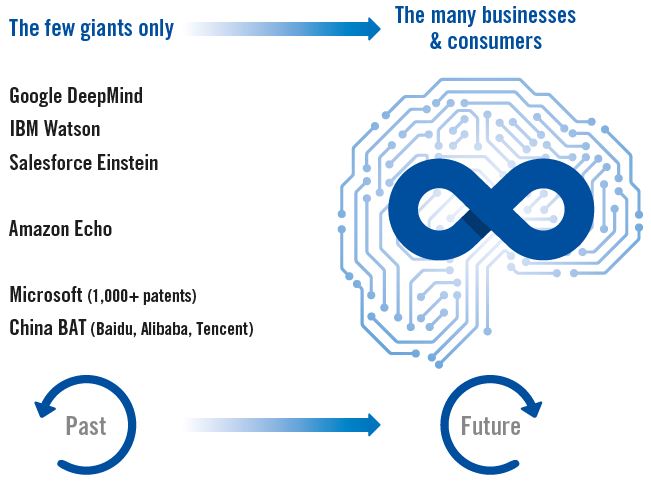

Artificial intelligence (AI) and machine learning are gaining a strong foothold across numerous applications, lowering the barriers to the use and availability of data (figure 1).

From now on, AI will not only be relevant to just a few large corporations but will form an integral part of most business strategies and is likely to influence our daily lives in more ways than we may recognise (figure 2).

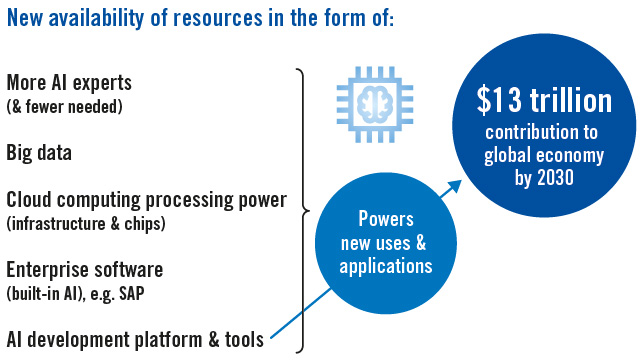

New cloud-based and AI-enhanced enterprise-as-a-service software requires less expertise and lower upfront investment. Companies no longer need to develop their own applications and end users do not need to gain extra knowledge or learn a new interface as AI runs in the background (figure 3).

As an emerging technology, AI is taking hold as virtual assistants, chatbots, deep learning (see below) autonomous systems (e.g. self-driving cars), and natural language processing. AI innovation and sophistication is on an exponential growth curve. AI promises a new cognitive partnership between man and machine.“AI innovation and sophistication is on an exponential growth curve. AI promises a new cognitive partnership between man and machine.”

From assisted intelligence, the future holds new forms of augmented intelligence and autonomous intelligence. Automation based on robotics and machine learning facilitates functional (and sophisticated) jobs today. Tomorrow, the opportunities will arise from artificial augmentation and the Internet-of-Things powered by 5G connectivity.

This is not about single technologies but the convergence of many cognitive enterprise systems all inter-connecting with AI and exponential data at the centre.Difference to Machine Learning

One definition of AI is intelligence demonstrated by machines as opposed to natural intelligence by humans. Thus, AI is the science of engineering intelligent machines. AI research identifies three types of systems:

Analytical (with cognitive learning and decision making)Human-inspired (as above plus emotions)Humanised artificial intelligence (as above plus self-consciousness and self-awareness)

AI and machine learning are often used interchangeably. Yet, machine learning can be defined as systems learning and improving (as in ‘Analytical’ above).

Thus, machine learning is a specific subset of AI that excludes emotions, self-consciousness and self-awareness – and also human (DNA hardwired) dimensions such as ethics and morals.

AI is not confined to biologically observable approaches only. Whilst the world has been able to construct machine learning systems, it still has fallen short of ‘broader’ AI with human aspects as mentioned above. Figure 2: The future for AI industry is for the many businesses, not just the few giants. Source: CFI.co

Figure 2: The future for AI industry is for the many businesses, not just the few giants. Source: CFI.coDeep Neural Networks

AI and machine learning comprise deep-learning neural networks. Here, ‘deep’ simply means more sophisticated neural networks that have multiple layers which interconnect. Neural networks include new performance offerings with current relevance such as:- Computer vision (e.g. face recognition and visuals for cars)

- Natural language processing

- Big data predictions and analytics

The new neural networks can be based on neuromorphic chips that mimic the brain’s neurons with a lot more power than current chips.

Figure 3: New availability of resources powers AI growth. Source: CFI.coAI Confluence in 4IR

The dream of AI has gripped the imagination of philosophers throughout the ages. Machine learning has evolved since the 1950s with the advent of computing power. First came the counting computer (spreadsheets) and after that the programmable era.

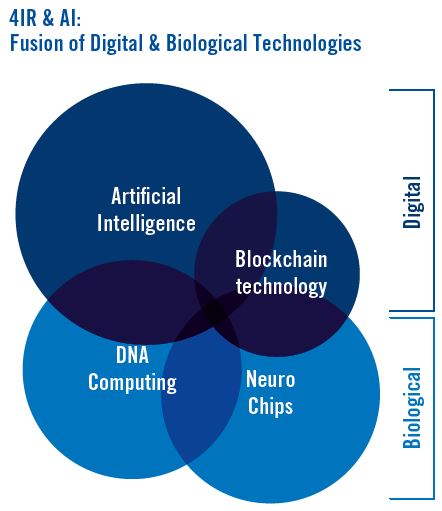

We are now at the tail end of the third industrial revolution in the cognitive era where new available resources and technology (figure 3) allow the embedding of AI and machine learning into new products that, in turn, streamline decision-making processes.AI in the fourth industrial revolution (4IR) is a continuum promising a convergence of new technologies such as, for example, quantum computing.

The fusion of digital and biological technologies empowers the internet-of-things and internet-of-everything (figure 4).As Ian Fletcher from IBM explains in the CFI.co summer 2018 issue, the 4IR and augmentation come together to capitalise, cultivate, and orchestrate data assets in order to improve performance.

They also increase the capacity for continuous change whilst building a cognitive platform, encompassing self-learning systems, natural language processing, robotic process automation, enhanced data intelligence, augmented reality, and predictive patterns – all accessible through an open API (application program interface).

These elements should be supported by a cognitive journey map, cognitive enabled workflows, business process automation – empowering businesses to make faster and more informed decisions. In short, AI and 4IR technology confluence must be culturally imbedded in the corporate DNA. Figure 4:

Figure 4:

Technology Convergence in the 4th Industrial Revolution Source: CFI.coMoore’s Law and Metcalfe’s Law

This meteoric change is made possible in the fourth industrial revolution because of two key observational concepts: Moore’s law and Metcalfe’s law.

Moore’s law is the observation that the number of transistors in a dense integrated circuit doubles about every two years, whilst Metcalfe’s law states the effect of a telecommunications network is proportional to the square of the number of connected users of the system (n2).

The less costly devices made possible by Moore’s law, increase the number of nodes boosting the network’s value in Metcalfe’s law. One key outcome is more powerful chips designed to mimic human behaviour.

New fourth industrial revolution neuromorphic chips have biological inspired neuro transmitters growing and learning – providing an exponential level of extra intelligence.

Other ground-breaking and powerful technologies are starting to emerge – such as DNA computing, which permits the storage of hundreds of trillions of terabytes of data on 1 gram of human DNA, fusing our digital and biological worlds.

AI’s relevance is forming part of – and being at the heart of – the confluence of this brave new world of 4IR technologies, which must be well understood in order to harness its full potential.Will AI develop consciousness – and if so, what are the moral and ethical implications?About the Author

Tor Svensson is the Chairman of Capital Finance International.

Read the article from the Winter 2018-2019 print issue, or from the CFI.co app (download from iTunes or Google Play).-

Francisco Gimeno - BC Analyst AI is working its way in 2019. Surely we won't see spectacular changes in the way we live or work this year or in five years, as a self conscious AI is far on the line yet, but there is already incremental changes in AI entering and linking with work processes and other new techs like blockchain and robotics, which are preparing the new social and work landscape. How are you preparing for this?

-

We thoroughly recommend checking out Earth 2050! https://bit.ly/2lGi2qQ

Find our predictions for the future here: http://bit.ly/AlltimeConspiracies

Thanks to Kaspersky Earth 2050, Robin was inspired to look into our future and predict what will happen.

Don't forget to Subscribe for more Conspiracies! - http://bit.ly/1dmVsvF-

Francisco Gimeno - BC Analyst Predictions are always a part of humanity. We wish for a better future, or we try and plan for whatever is coming. But what we wish is not always what it will be. The future is already here with a whole tech and jobs' disruption, social changes, climate change threat, whatever you can imagine. We believe what is important is not to be afraid, but to help the change to be for better.

-

-

Can blockchain deliver richer and more accurate real-time data for businesses and their customers? Our David Treat and Peter Hiom, the Deputy CEO of the Australia Securities Exchange, discuss.

-

Francisco Gimeno - BC Analyst Blockchain being more and more involved into real financial world. Saving time, saving money and doing everything more efficient, including crypto.

-