Bitcoin stuff

- by brinobimo

- 5 posts

-

This episode covers the first 3 days of Blockchain week.

Joe Lubin from Ethereum

Travis Kling tells us why the market is Flying!

Tushar Jain - is he bullish on Ethereum-

By

Admin

Admin - 0 comments

- 3 likes

- Like

- Share

-

By

-

Cryptocurrency is maturing. While it’s impossible to make any lofty predictions or guarantees about the fluctuations of the market, there are plenty of signs that we’ve entered a new age of investing.

Cryptocurrency is maturing. While it’s impossible to make any lofty predictions or guarantees about the fluctuations of the market, there are plenty of signs that we’ve entered a new age of investing. The top crypto exchange handles a volume of nearly $50 billion. Your next-door neighbor might have a little bit of bitcoin.

A growing number of major banks, hedge funds and even family offices are turning to digital assets to complement their traditional investment portfolios.In what is likely a first for university endowments, the Harvard Management Company (the largest academic endowment in the world) recently invested some $5 to $10 million into cryptocurrency.

This past February, JPMorgan Chase launched JPM Coin, making it the first US bank to create a digital coin representing a fiat currency. Their token is in a prototype phase and is being tested solely with JPMorgan institutional investment clients.

But cryptocurrencies aren’t physical goods that can be locked up in a safe or transported in a Brink’s truck. Digital assets like Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP) exist on the blockchain and are maintained in a decentralized environment.

To establish “ownership” of cryptocurrencies, the transaction activity is tracked on a public ledger - the much-heralded blockchain itself - by public and private keys. Public keys are the address used to send and receive crypto. It’s necessary that everyone knows this address.

Private keys must be kept secret because they are used to authorize the transmission of cryptocurrency held. Keys are stored in what’s typically called a wallet. There are various forms of digital wallets, which I will get into shortly.

While cryptocurrency investment is on the rise, in order for this digitally-based currency to prosper the right infrastructure must be in place.Let’s be honest: cryptocurrency is a ripe target for theft. According to a report by Ledger, nearly $1 billion was stolen in 2018.

The threat landscape faced by cryptocurrency investors is similar to that facing security professionals in all tech spaces. Traditional cyberattack methods like site clones, phishing and SMS hacks coupled with hardware tampering and social engineering are still problems in this new frontier.Hackers have absconded with millions of dollars by hijacking cell phone accounts.

Entire crypto exchanges - handling upwards of hundreds of millions - have been forced to shut down as a result of cyberattacks. And it’s not just hackers to worry about. The nature of crypto storage can lead to the loss of funds as well. Take the recent QuadrigaCX debacle for instance.

At its peak, the Canadian cryptocurrency exchange handled nearly $200 million in assets. Its lone operator, Gerald Cotton, personally held all his clients’ security keys.

Last year, on December 9th, Cotton died after being hospitalized due to complications from Crohn’s disease. Because he was the only one with access to those private keys proving crypto ownership, all the assets under Quadriga’s management followed Cotton to his grave.

Though highly anomalous, the Quadriga event has served as a final wakeup call to both institutional investors and their customers as to how important it is to securely safeguard your digital assets with a trusted platform.

In the cryptocurrency world, there are several ways to store your holdings but they all generally involve some form of wallet. Basically, a “crypto wallet” is a device on which your private keys are stored. Your private keys are a critical piece of information used to authorize spending and selling crypto on the blockchain.

The wallets in which you hold them can be physical devices, software- or solution- based or simply the online exchange from which you’ve purchased your currency.Of those wallets there are two types: hot and cold. Hot wallets are connected to the internet, while cold wallets are not. Cold wallets are considered much more secure than hot wallets.

Hot Wallets

There are two main types of hot wallets:Web/Online/Exchange: Leaving your crypto on an exchange is an example of hot wallet storage. Any type of storage that is online is considered “hot.” These types of online wallets are the most unsecure and susceptible to being hacked, having your email and login info being stolen, or to a counterparty risk.

Software Wallets: A software wallet is an application that you download to your computer or phone. It is considered safer than a web/exchange wallet because you, rather than a third party, have control of your private keys. However, since your computer and phone are vulnerable to hacks, software wallets still aren’t the best option.

Cold WalletsThere are two main types of cold wallets:

Hardware Wallets: Hardware wallets are widely considered the safest option for storing your crypto. Typically, in USB format, a hardware wallet can be connected to the internet to transfer an exchange for trading, but it can be disconnected, with your crypto stored totally offline and inaccessible to hackers. The main principle behind hardware wallets is to provide full isolation between the private keys and your easily-hacked computer or smartphone.

Paper Wallets: A paper wallet is an offline mechanism for storing. You literally print out your public and private keys on paper and keep them somewhere safe. This is extremely safe - and cheap - but obviously not the best method. If you lose the paper, you completely lose your private keys.So clearly you can’t be running crypto on a bunch of jump drives. Even the most novice crypto holder needs a wallet that has both a secure element and custom OS without compromising security and convenience. While blockchain aims at revolutionizing financial systems, many investors are still decades in the past when it comes to the way they are safekeeping their digital assets.

Hardware wallets have become the de facto best practice amongst individuals serious about their investments but think about enterprises handling millions of dollars’ worth of crypto. In the early stages of institutional investing, asset managers would find themselves securing massive amounts of wealth on hardware wallets with no convenient and efficient way to implement a meaningful segregation of duty.

Finding a Holistic Security Solution

This may have created new jobs for bodyguards and generated revenue for security equipment companies, but it hindered the growth of the segment by exposing crypto funds to an operational risk far above the appetite of the average investor. Institutional investors can’t simply rely on standard wallets, however secure they may be.

The financial industry needs custody solutions that are more holistic in their approach, combining both hot and cold approaches, and encompassing both hardware and software technology solutions.The absolute most secure way to manage crypto assets is through a multi-authorization governance infrastructure.

Secure storage of large digital asset funds is complex, and exchanges and institutions need safe, comprehensive and integrated solutions. This approach employs a multi-authorization self-custody system of management and gives financial institutions security, control and speed of execution along with a reliable governance framework.

Proper security is crucial to the diligent management of crypto assets, whether you’re just a hobby holder or an institutional investor overseeing millions. Mainstream adoption of crypto is gaining momentum and as more come on board, there will be more targets for cyberattacks.

Echoing a common refrain in the tech world: It’s crucial for everyone involved to be aware of the risks and how to mitigate them.

About the Author:

Demetrios Skalkotos leads global business unit operations for Ledger Vault, a multi-authorization cryptocurrency self-custody management solution built to secure large amounts of various digital assets. Skalkotos has decades of experience running global software and infrastructure businesses for the U.S. exchanges Nasdaq and ICE. -

KEY POINTS

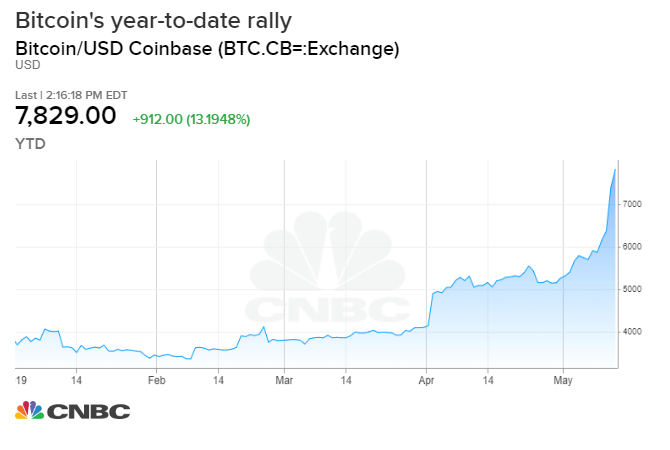

- Bitcoin was up as much as 15% Monday as major global markets reacted negatively to an ongoing trade war.

- A rally in the world’s first and largest cryptocurrency this month has coincided with a tick down in the Chinese Yuan.

- “If you were in China and you wanted to diversify, it would seem logical that bitcoin would be a short term alternative,” says Andy Brenner at National Alliance.

Trader says bitcoin bounce won’t hold

Bitcoin is making its case an uncorrelated, safe-haven asset while mainstream markets tumble.The world’s largest cryptpcurrency was up as much as 15 percent on Monday, hitting a high of $7,946.01, according to data from industry site CoinDesk.

Meanwhile, U.S. equity markets were headed in the other direction. The Dow Jones Industrial Average fell as much as 696 points Monday and was on track for its biggest one-day loss since January.

The sharp decline for stocks came after news that China would raise tariffs on roughly $60 billion of U.S. goods in an ongoing trade war between the world’s largest economies. Stocks in mainland China also dragged lower Monday while the Chinese yuan reached a four-month low this week.

Head of International Fixed Income at National Alliance Securities Andy Brenner, pointed out bitcoin’s recent and sharp divergence from Chinese currency prices.

“If you were in China and you wanted to diversify, it would seem logical that Bitcoin would be a short term alternative,” Brenner said in a note to clients Monday. “While we do not see the direct flows of who is buying bitcoin, we can see that the bid for bitcoin in this latest run has coincided with a big down tick in the value of the Chinese Yuan versus the dollar.”

The cryptocurrency’s volatility has largely barred it from becoming a useful payment method. Instead, bitcoin has been billed as a store of value, or “digital gold.” That safe-haven use-case seemed unlikely in 2018 after it ended the year down more than 73 percent.

Bitcoin prices have yet to rebound anywhere near an all-time high near $20,000, which was driven by a stampede of retail investors. But this year, the cryptocurrency has more than doubled after starting the year around $3,700.

The S&P 500 is up about 12 percent in the same time period.“Bitcoin has low correlation with markets,” Tom Lee, managing partner and head of research at Fundstrat Global Advisors told CNBC in an email. Lee, J.P. Morgan’s former chief equity strategist, said the cryptocurrency’s technical levels are “looking much better” since moving above the 200-day average.

Michael Moro, CEO of Genesis Global Trading, also said bitcoin’s rally was thanks to key technical resistance levels being broken. It climbed above a key $6,000 level last week for the first time since November.

Investors had expected “much more resistance on the way up” to $6,200, Moro said. The next key level to watch is $10,000, he said.Bitcoin may also emerge alternative asset in today’s low interest rate environment, Moro said. Similar to the appeal of high-growth technology stocks, investors may look to bitcoin as a riskier, but faster-growing bet as cash continues to earn next to nothing.

“If you look back at 2018 when the Fed was raising interest rates, bitcoin was not performing well,” Moro said. “I think that’s what we’ve seen with bitcoin the last two months -- the Fed signaling we’re cutting rates.

”Gold, a more established safe-haven trade, rose as global markets sold off this week. But its rally was less exuberant than bitcoin’s.

The precious metal was up 1 percent on Monday.Still, the decade-old bitcoin market is facing plenty of critics and headwinds as it matures. Hackers stole 7,000 bitcoin —worth more than $40 million — last week from Binance, one of the world’s largest cryptocurrency exchanges.

A study published by Bitwise in March showed that 95 percent of bitcoin spot trading is faked by unregulated exchanges — echoing concerns by regulators that nascent markets are ripe for manipulation.

Last week, Bloomberg reported that Fidelity Investments plans to allow customers to buy and sell cryptocurrencies. Jeremy Allaire, Circle co-founder and CEO, said bitcoin’s recent rally was more likely a result of recent positive news in the space and less of a “risk off” trade.

“Crypto fundamentals have been strong and building since early this year, when it was clear that we were oversold, and the continued parade of positive news and new retail and institutional offerings launching are firmly behind this bull market move,” Allaire said.-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

Recommended: Here are 5 theories for the Bitcoin price spike | Markets Insider (markets.businessinsider.com)

- Bitcoin spiked to more than $7,500 on Sunday, more than double its price in mid-December.

- Cryptocurrency enthusiasts on Reddit proposed several theories for the sudden rally.

- They highlighted the US-China trade war, institutional interest, exodus from alt coins, the Bitfinex scandal, and the Binance hack as possible reasons.

- Watch Bitcoin trade live.

Bitcoin spiked to more than $7,500 on Sunday — a sharp rise from its $5,000 level at the start of May, and more than double its price in mid-December. Analysts have struggled to identify one single catalyst.

"With no major news factors behind the aggressive appreciation, the sharp $1000 jump over the weekend remains a mystery to investors," wrote Lukman Otunuga, Research Analyst at FXTM, in a research note.However, crypto-fans have weighed in with competing theories on its sudden rise, which run the gamut from compelling to wildly far-fetched.

Here are five reasons for the rise, according to Reddit users:1. Safe haven

"It's possible that a great number of rich people know that the traditional markets are effed eight ways to Tuesday," wrote diydude2 on the r/bitcoin thread's daily discussion.

President Trump has sparked a global market sell-off after accusing China of walking back agreed provisions in a draft trade deal, hiking tariffs on $200 billion of Chinese goods, and preparing to expand tariffs to effectively all Chinese products in the next month if a trade agreement isn't struck. Investors may have bought up Bitcoin to hedge their exposure to conventional assets.2. Mainstream appeal

"Institutions are scrambling to get in ahead of the traditional brokerages' launch (Fidelity, Ameritrade, Etrade) so they can dump on the next wave of retail investors to enter the space," wrote Savage_X in the same discussion.

Fidelity, one of the world's largest asset managers, will begin buying and selling bitcoin for its institutional customers in the next few weeks, according to Bloomberg.

Online broker TD Ameritrade introduced trading of bitcoin futures in December, while securities brokerage E*Trade is preparing to enable cryptocurrency trading on its platform, Bloomberg wrote.

Rival institutions could be buying up bitcoin with the expectation that the entry of major players into the market could bolster the cryptocurrency's credibility and drive mainstream purchases, pushing up its price.3. Exodus from alt coins

"The ICO experiment is over," wrote gonzales82 in a thread about the Bitcoin spike, referring to the recent boom in cryptocurrency launches known as initial coin offerings.

"People are waking up to the realization that bitcoin is a much larger idea than any of the blockchain phantasmagorias people have been trying to push for the last couple of years.

"There's evidence to support the idea that investors are shifting funds from other cryptocurrencies to Bitcoin."From purely looking at the data — one factor that could be behind at least the BTC rally is the conversion of 'alt' coins into bitcoin," Sid Shekhar, co-founder of Token Analyst, said in an interview with Business Insider. "For example, we have consistently been seeing a lot more BTC being transferred out of exchanges than going in."4. The Bitfinex scandal drove Bitcoin purchases

The Bitcoin rally could also be a product of the Bitfinex scandal. New York Attorney General Letitia James recently filed a lawsuit accusing the owner of the Bitfinex exchange of "ongoing fraud" and draining at least $700 million from the reserves backing its digital coin, Tether, to cover up $850 million in missing funds.

'I think Bitcoin is going up because [of] the whole Bitfinex thing going on...I think they are having a lot of issues [fulfilling] withdrawal requests," wrote sanderson22.

"I think a lot of people are buying Bitcoin [and] getting out of Tether, I think a crash will come if Bitfinex's house of cards collapse[s] and they wound up losing a lot of people's money."Other commenters voiced similar views."It seems to me as soon as the Tether/Bitfinex scandal started to come out the price went straight up," wrote Swt23.

"Could this not be from people that had a lot of the money stored in Tether [deciding] it might be safer to move out of Tether into Bitcoin."A wild theory suggests Bitfinex's owners are driving up the price of Bitcoin to replenish the exchange's cash reserves.

"Bitfinex is throwing everything they have at generating a new pump to attract whatever $USD influx they can get from FOMO'ing butters because they are otherwise completely cash insolvent," wrote Poop_Shame.5. The Binance hack proved Bitcoin's integrity

After hackers stole $40 million of Bitcoin from Binance last week, the cryptocurrency exchange's CEO, Changpeng Zhao, proposed a rollback of the blockchain to reverse the illicit transactions and recover the funds. The fierce backlash to his suggestion may have bolstered Bitcoin's image as a legitimate currency and fueled demand for it.

"I think [Binance] might have helped Bitcoin a lot with their suggestion to rollback the chain," wrote 2btc20000pizzas. "That notion was swiftly shut down by the community (users, devs, and miners) almost within a single day.

"Bitcoin advocates' claims that the cryptocurrency is "censorship-resistant" and "scarce" became "more tangible when the very notion of tampering with the blockchain was shut down within hours," the commenter added.

"I really think for a lot of people, [this] might have just [shone] a light on why Bitcoin more than any other altcoin has value, and isn't just stupid Internet money."Bitcoin was up 5% at $7,048 at the time of writing.

Markets Insider

-

Francisco Gimeno - BC Analyst Theories. Everytime there is a strange crypto movement, all kind of theories come out. Maybe they are all right maybe not. What we know is that due to volatility everything and anything can affect the market. Read the article and make your own mind. Soon we will be listening to pundits foresee BTC at this or that price in 2020.

-

Peter Brandt says Bitcoin is going parabolic again!

Binance Hacked -7000!

Fidelity is launching Crypto!

Bitfinex wont raise $1bn!

Tether holders may lose $600m

Techstars launches a Blockchain Accelerator-

Francisco Gimeno - BC Analyst Oh well! Here we are on the crypto's price rollercoaster, and FOMO issues. Lots of great information here. Listen to the discourse on Parabolic move for BTC as an unprecedented and historic one. Time will say if this is right or not, be careful when you invest, do your homework and don't invest what you can't loose.

-