Strong Use Case: For real estate, blockchain could unshackle investment | Computerworld

(computerworld.com)

A blockchain industry alliance has released a guide and list of use cases for deploying the technology to enable, among other things, the purchase of fractions of real estate property as digital securities on an open marketplace.

The Enterprise Ethereum Alliance (EEA) used its 30-page Real Estate Use Case document to promote blockchain as a more open, transparent and traceable method of transacting in the multi-trillion dollar realty industry.

The document was created by the EEA's Real Estate Special Interest Group(SIG), which was created a year ago and has already garnered more than 50 member companies.

[ Further reading: Blockchain: The complete guide ]Among the member companies are blockchain software developers such as Applicature, Blockapps and ConsenSys, as well as Deloitte LLC, John Hancock Life Insurance, Ott Capital Ventures, and online blockchain-powered real estate platforms Propy and Blockimmo.

Bastiaan Don, chair of the EEA's Real Estate SIG, began developing his Swiss-based Blockimmo marketplace a little over a year ago. Like a stock market with corporations, Blockimmo users can purchase, sell or trade portions of real estate properties that have been turned into digital tokens on a global marketplace that runs 24/7.

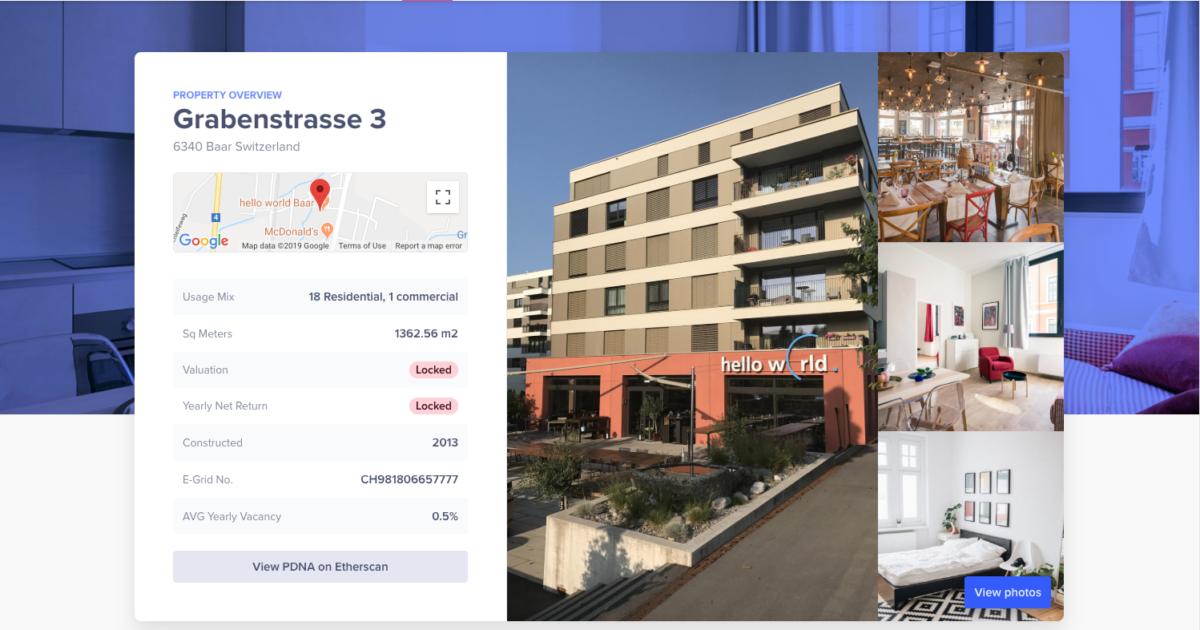

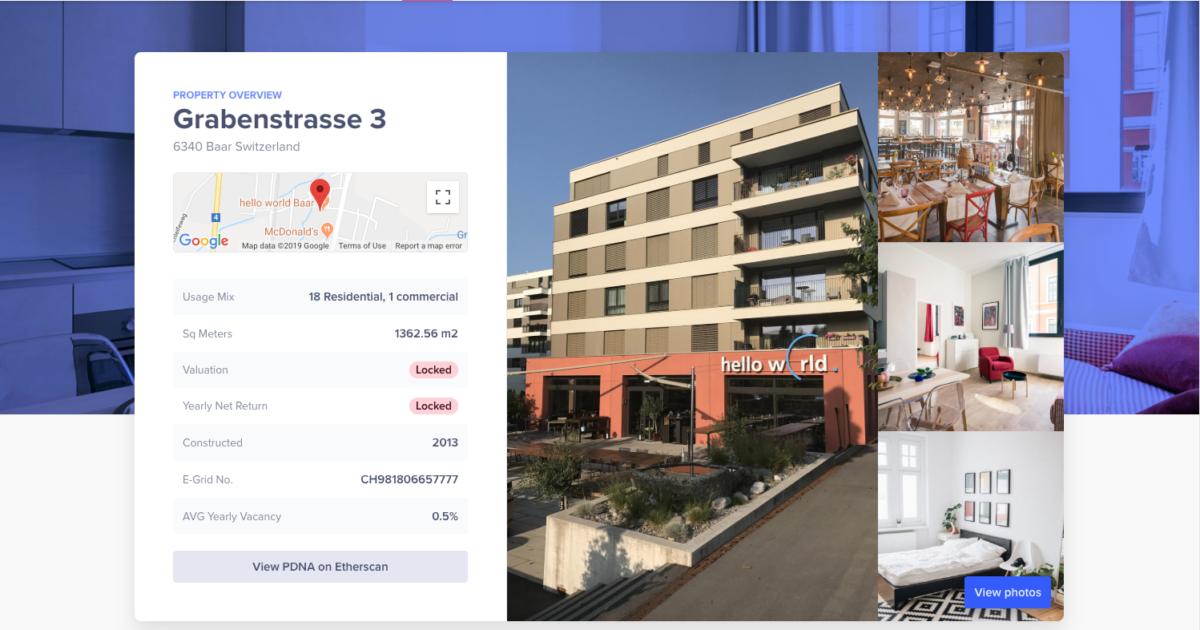

On March 1, Blockimmo listed its first tokenized property – an apartment building with a restaurant – with a value of 15 million Swiss francs ($14.8 million). Twenty percent of the property's value was converted to "Swiss Crypto Tokens," with transactions enabled through the use of the "CryptoFranc," a stablecoin linked directly to the Swiss franc. The tokens sold to four investors.

BlockimmoProperty data hashed on the an Ethereum blockchain using an Interplanetary File System (IFPS)Stablecoins are cryptocurrencies that, unlike bitcoin, are linked to fiat currency, such as the U.S. dollar or Swiss franc.

They're expected to become increasingly popular as a vehicle to tokenize (digitize) assets, such as property that can then be bought or traded on blockchain exchanges. For example, J.P. Morgan recently created a stablecoin to transfer funds over a blockchain network internally and internationally between institutional clients.

The EEA's Real Estate playbook lists eight different uses for blockchain, including property identification (including listings and data); token-enabled marketplaces; token securitization; public registries detailing ownership of properties; and sales process optimization.

Along with creating a real estate exchange, blockchain has been used as a platform for conventional real estate sales. For example, New York-based ShelterZoom plans to go live this year with a platform that enables sellers and buyers to make offers over an Ethereum blockchain.

SponsoredPost Sponsored by Deloitte

SponsoredPost Sponsored by Deloitte

This Is What Genuine Blockchain Progress Looks LikeBarriers to blockchain adoption are falling, helping to resolve key issues and bring the technology into the mainstream.

Another start-up, Jointer.io is focused exclusively on real estate tokenization. Unlike other services, it doesn't offer one property as shares that can be purchased. It offers a number of buildings in an index, and participants can buy tokens from that index. The result is less risk and more profit, according to Jude Regev, founder and CEO of Jointer.

The real estate market is highly liquid, meaning property can be bought or sold relatively quickly with little to no loss in value. But the ability to play in that marketplace has mostly been reserved for a small number of wealthy investors, Don argued. And, it's a complex system because of the need for a middleman (a bank) and others to enable transaction clearance and settlement.

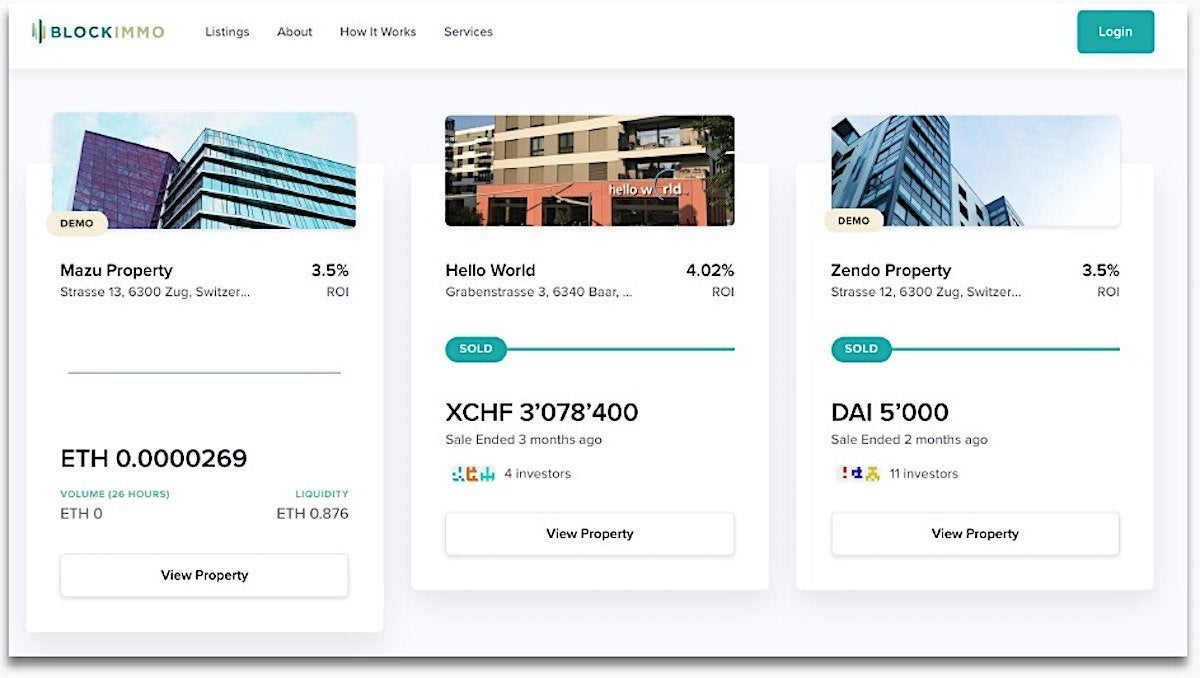

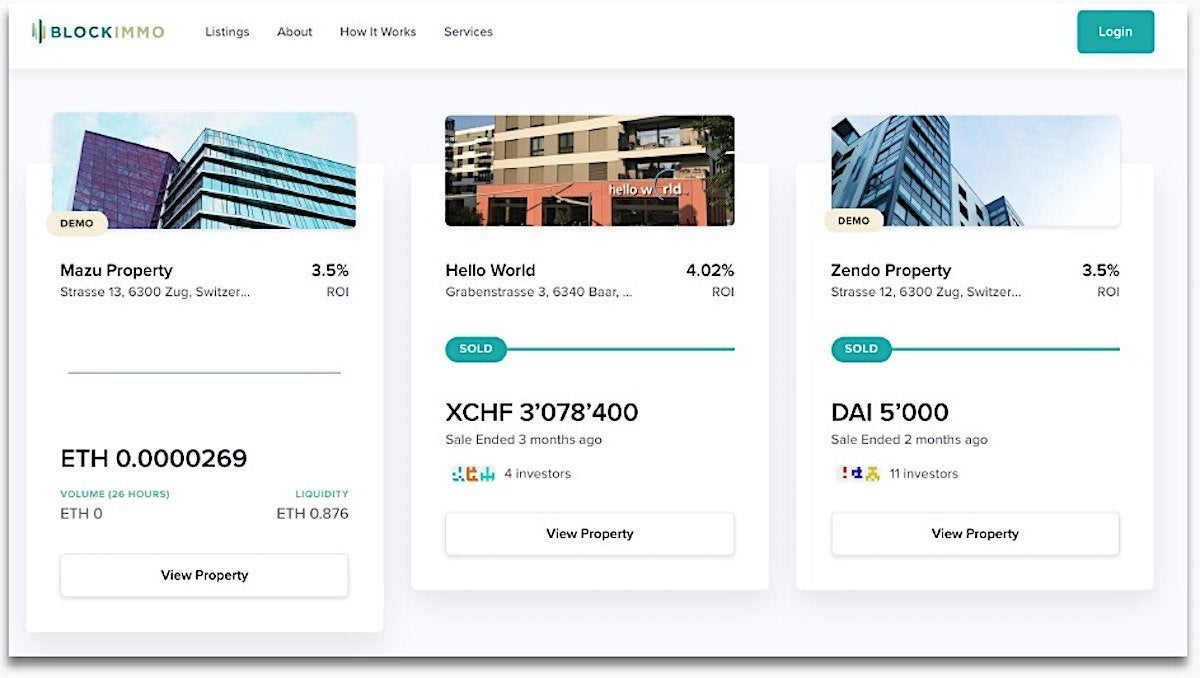

BlockimmoTokenized properties for sale on Blockimmo's real estate marketplace.

"It's almost impossible for a semi-professional investor to get access to it. So on one hand, by applying blockchain technology, you can enable anyone to invest because the costs to do it are so much lower, and it enables fractionalized ownership," Don said, referring to the absence of banking fees.

"That's exactly what tokenization does; it allows someone to indirectly acquire a piece of real estate.""Democratization," a term that has frequently been applied to blockchain's ability to enable an open and transparent marketplace, is also being used by the EEA's Real Estate SIG to describe the benefits of real estate tokenization.

The new Mazda3 has given people a lot to talk about, but what are they saying?

"It enables anyone to own and acquire a piece of real estate. You can do that today through an investment company, but blockchain allows anyone to sell anytime. You can sell your share on a secondary market," Don said. "And, in our case, it's not just marketing talk. We've already launched a decentralized exchange for real estate tokens."The ability to purchase a fraction of a piece of property is not new.

A Real Estate Investment Trust (REIT) is a fund or security that allows investors to purchase shares of income-generating real estate properties. REITs are owned and operated by shareholders who invest in commercial properties such as office and apartment buildings, shopping centers and hotels.

"Our solutions let the investors decide which property at which exact location they want to invest their money," Don said. "Each property will have its own smart-contract and thus own token.

They can choose to invest in a specific property at a specific address in New York, Amsterdam and Zurich and build up their own customized, flexible and diversified real estate portfolio of which they are in control."

While Don describes his company's Ethereum-based marketplace as a public or open blockchain, in reality it fits the definition of a private blockchain in that it's governed or administered by a central authority of users who whitelist those who can participate by first authenticating their identities.

Once cleared, their personally identifiable information is encrypted and stored in a cryptowallet, a piece of software that keeps track of the secret keys used to digitally sign blockchain transactions.

During the blockchain onboarding process, potential users are automatically asked questions and required to submit proof of identity (such as a copy of a passport) through a business automation application known as a "smart contract" that is intended to satisfy know-your-customer and anti-money laundering regulations, Don said.

Those who complete the onboarding process have their cryptowallets whitelisted for blockchain transactions.

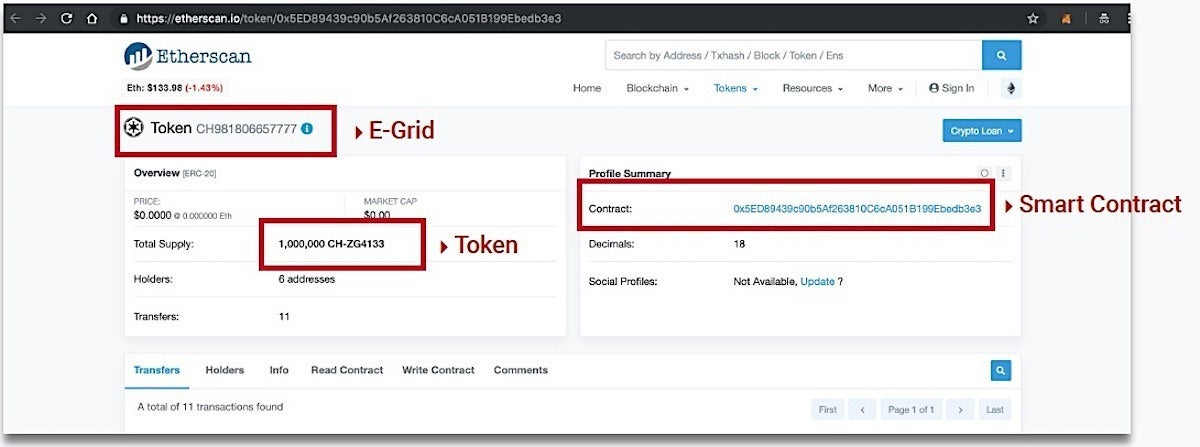

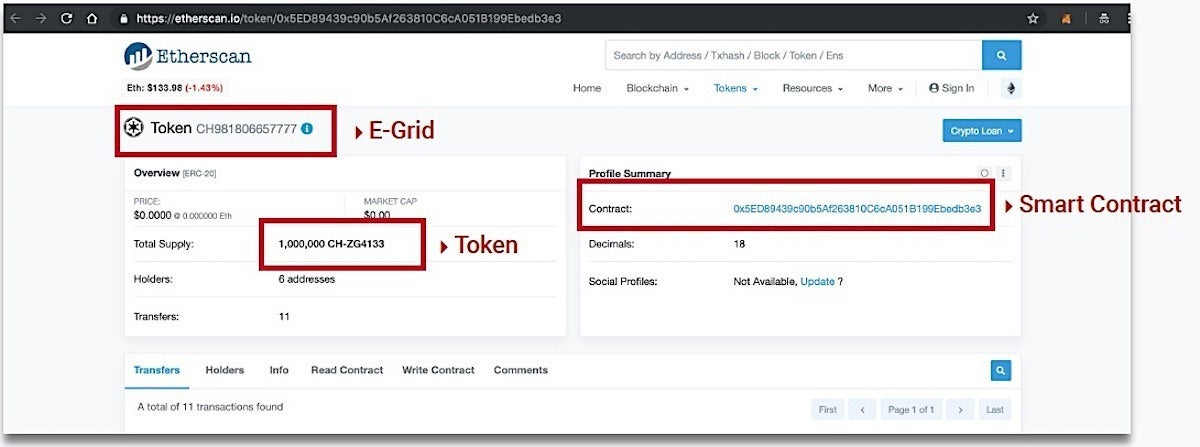

BlockimmoA tokenized property showing where it exists on a blockchain, its token identifier and the smart contract controlling its distribution."If I'm whitelisted, I'm able to participate in crowdfunding opportunities – for instance an interesting real estate building being offered on the blockchain platform.

But more importantly, I'm also allowed to trade these tokens on a secondary market," Don said. "The technology has to adapt to the infrastructure and regulations of the markets. And Ethereum is perfectly able to do that today. You can program smart contracts so you stick to these laws and regulations.

"A real estate property can be divided into individual investment units each identified and embodied via a security token (via the ERC 20 or ERC 721 specifications or another variant).

The tokens, which include the property's lot number, will identify ownership, provide a mechanism for transactional processing, and serve as the property identifier to allow for trading on regulated secondary markets.

"We only offer tokenization of properties as a service, but the asset owner is in control of the tokens," Don said.

"If our company goes bankrupt, and we've tokenized 100,000 buildings, nothing happens to those buildings.""It's early days," Don continued, "but it's heading in the right direction. Larger institutional investors are seeing the potential of using public blockchains like Ethereum.

At least in Switzerland, even financial regulators see that it's possible to use a public blockchain and be able to stick to laws and regulations."Related: Senior Reporter Lucas Mearian covers financial services IT (including blockchain), healthcare IT and enterprise mobile issues (including mobility management, security, hardware and apps).

The Enterprise Ethereum Alliance (EEA) used its 30-page Real Estate Use Case document to promote blockchain as a more open, transparent and traceable method of transacting in the multi-trillion dollar realty industry.

The document was created by the EEA's Real Estate Special Interest Group(SIG), which was created a year ago and has already garnered more than 50 member companies.

[ Further reading: Blockchain: The complete guide ]Among the member companies are blockchain software developers such as Applicature, Blockapps and ConsenSys, as well as Deloitte LLC, John Hancock Life Insurance, Ott Capital Ventures, and online blockchain-powered real estate platforms Propy and Blockimmo.

Bastiaan Don, chair of the EEA's Real Estate SIG, began developing his Swiss-based Blockimmo marketplace a little over a year ago. Like a stock market with corporations, Blockimmo users can purchase, sell or trade portions of real estate properties that have been turned into digital tokens on a global marketplace that runs 24/7.

On March 1, Blockimmo listed its first tokenized property – an apartment building with a restaurant – with a value of 15 million Swiss francs ($14.8 million). Twenty percent of the property's value was converted to "Swiss Crypto Tokens," with transactions enabled through the use of the "CryptoFranc," a stablecoin linked directly to the Swiss franc. The tokens sold to four investors.

BlockimmoProperty data hashed on the an Ethereum blockchain using an Interplanetary File System (IFPS)Stablecoins are cryptocurrencies that, unlike bitcoin, are linked to fiat currency, such as the U.S. dollar or Swiss franc.

They're expected to become increasingly popular as a vehicle to tokenize (digitize) assets, such as property that can then be bought or traded on blockchain exchanges. For example, J.P. Morgan recently created a stablecoin to transfer funds over a blockchain network internally and internationally between institutional clients.

The EEA's Real Estate playbook lists eight different uses for blockchain, including property identification (including listings and data); token-enabled marketplaces; token securitization; public registries detailing ownership of properties; and sales process optimization.

Along with creating a real estate exchange, blockchain has been used as a platform for conventional real estate sales. For example, New York-based ShelterZoom plans to go live this year with a platform that enables sellers and buyers to make offers over an Ethereum blockchain.

SponsoredPost Sponsored by Deloitte

SponsoredPost Sponsored by DeloitteThis Is What Genuine Blockchain Progress Looks LikeBarriers to blockchain adoption are falling, helping to resolve key issues and bring the technology into the mainstream.

Another start-up, Jointer.io is focused exclusively on real estate tokenization. Unlike other services, it doesn't offer one property as shares that can be purchased. It offers a number of buildings in an index, and participants can buy tokens from that index. The result is less risk and more profit, according to Jude Regev, founder and CEO of Jointer.

The real estate market is highly liquid, meaning property can be bought or sold relatively quickly with little to no loss in value. But the ability to play in that marketplace has mostly been reserved for a small number of wealthy investors, Don argued. And, it's a complex system because of the need for a middleman (a bank) and others to enable transaction clearance and settlement.

BlockimmoTokenized properties for sale on Blockimmo's real estate marketplace.

"It's almost impossible for a semi-professional investor to get access to it. So on one hand, by applying blockchain technology, you can enable anyone to invest because the costs to do it are so much lower, and it enables fractionalized ownership," Don said, referring to the absence of banking fees.

"That's exactly what tokenization does; it allows someone to indirectly acquire a piece of real estate.""Democratization," a term that has frequently been applied to blockchain's ability to enable an open and transparent marketplace, is also being used by the EEA's Real Estate SIG to describe the benefits of real estate tokenization.

The new Mazda3 has given people a lot to talk about, but what are they saying?

"It enables anyone to own and acquire a piece of real estate. You can do that today through an investment company, but blockchain allows anyone to sell anytime. You can sell your share on a secondary market," Don said. "And, in our case, it's not just marketing talk. We've already launched a decentralized exchange for real estate tokens."The ability to purchase a fraction of a piece of property is not new.

A Real Estate Investment Trust (REIT) is a fund or security that allows investors to purchase shares of income-generating real estate properties. REITs are owned and operated by shareholders who invest in commercial properties such as office and apartment buildings, shopping centers and hotels.

"Our solutions let the investors decide which property at which exact location they want to invest their money," Don said. "Each property will have its own smart-contract and thus own token.

They can choose to invest in a specific property at a specific address in New York, Amsterdam and Zurich and build up their own customized, flexible and diversified real estate portfolio of which they are in control."

How it works

While Don describes his company's Ethereum-based marketplace as a public or open blockchain, in reality it fits the definition of a private blockchain in that it's governed or administered by a central authority of users who whitelist those who can participate by first authenticating their identities.

Once cleared, their personally identifiable information is encrypted and stored in a cryptowallet, a piece of software that keeps track of the secret keys used to digitally sign blockchain transactions.

During the blockchain onboarding process, potential users are automatically asked questions and required to submit proof of identity (such as a copy of a passport) through a business automation application known as a "smart contract" that is intended to satisfy know-your-customer and anti-money laundering regulations, Don said.

Those who complete the onboarding process have their cryptowallets whitelisted for blockchain transactions.

BlockimmoA tokenized property showing where it exists on a blockchain, its token identifier and the smart contract controlling its distribution."If I'm whitelisted, I'm able to participate in crowdfunding opportunities – for instance an interesting real estate building being offered on the blockchain platform.

But more importantly, I'm also allowed to trade these tokens on a secondary market," Don said. "The technology has to adapt to the infrastructure and regulations of the markets. And Ethereum is perfectly able to do that today. You can program smart contracts so you stick to these laws and regulations.

"A real estate property can be divided into individual investment units each identified and embodied via a security token (via the ERC 20 or ERC 721 specifications or another variant).

The tokens, which include the property's lot number, will identify ownership, provide a mechanism for transactional processing, and serve as the property identifier to allow for trading on regulated secondary markets.

"We only offer tokenization of properties as a service, but the asset owner is in control of the tokens," Don said.

"If our company goes bankrupt, and we've tokenized 100,000 buildings, nothing happens to those buildings.""It's early days," Don continued, "but it's heading in the right direction. Larger institutional investors are seeing the potential of using public blockchains like Ethereum.

At least in Switzerland, even financial regulators see that it's possible to use a public blockchain and be able to stick to laws and regulations."Related: Senior Reporter Lucas Mearian covers financial services IT (including blockchain), healthcare IT and enterprise mobile issues (including mobility management, security, hardware and apps).

-

- 1

Francisco Gimeno - BC Analyst Real Estate has already tried crowdfunding sales and even promotions. The next step is logically the tokenisation of real estate in he blockchain, which can disrupt totally the sector, from the ways promotors and investors work to the way buyers purchase and own. This is good news.