LIMON'S FAVOURITE

- by Rhys

- 5 posts

-

Strong Use Case: For real estate, blockchain could unshackle investment | Comput... (computerworld.com)A blockchain industry alliance has released a guide and list of use cases for deploying the technology to enable, among other things, the purchase of fractions of real estate property as digital securities on an open marketplace.

The Enterprise Ethereum Alliance (EEA) used its 30-page Real Estate Use Case document to promote blockchain as a more open, transparent and traceable method of transacting in the multi-trillion dollar realty industry.

The document was created by the EEA's Real Estate Special Interest Group(SIG), which was created a year ago and has already garnered more than 50 member companies.

[ Further reading: Blockchain: The complete guide ]Among the member companies are blockchain software developers such as Applicature, Blockapps and ConsenSys, as well as Deloitte LLC, John Hancock Life Insurance, Ott Capital Ventures, and online blockchain-powered real estate platforms Propy and Blockimmo.

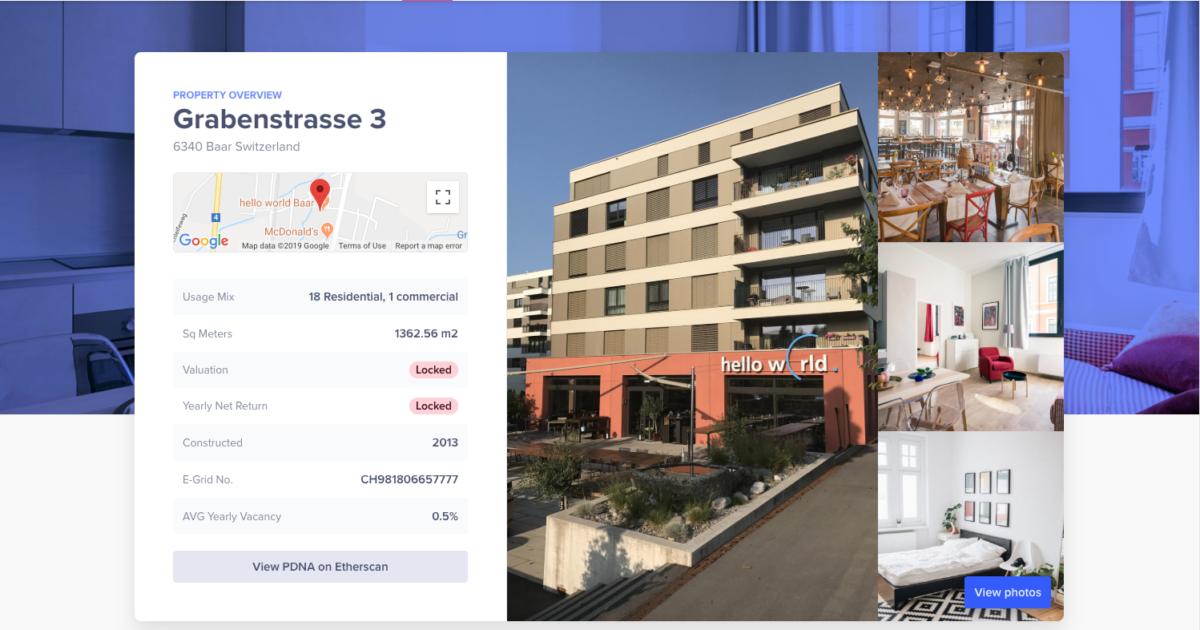

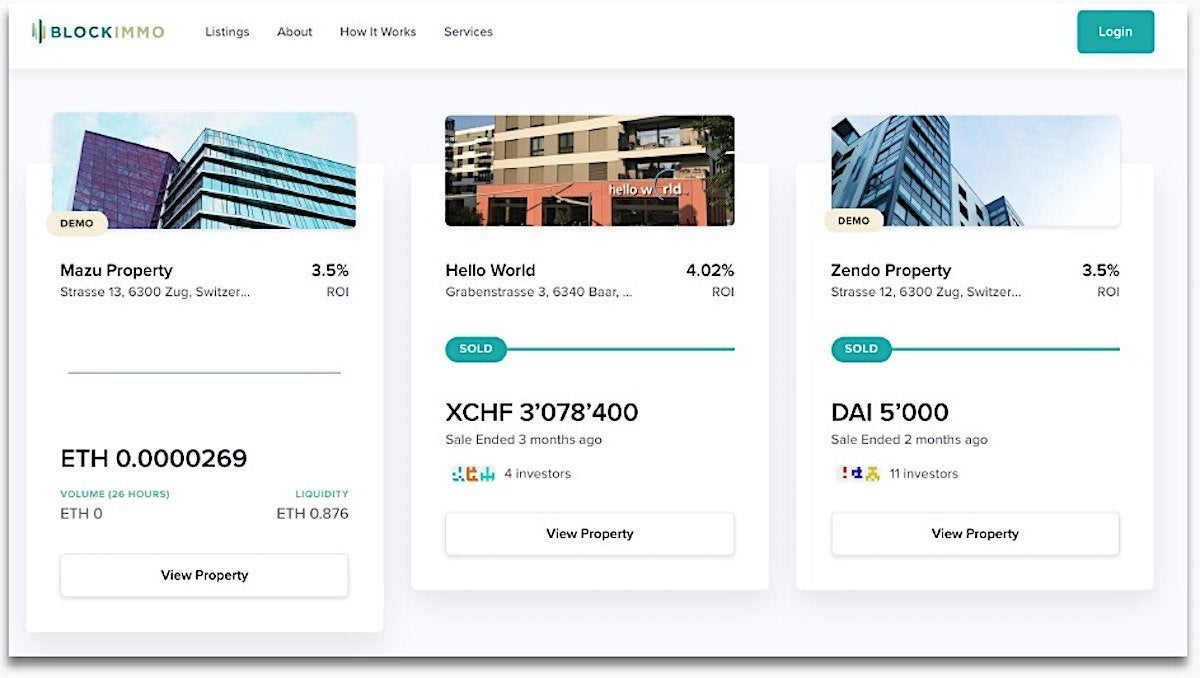

Bastiaan Don, chair of the EEA's Real Estate SIG, began developing his Swiss-based Blockimmo marketplace a little over a year ago. Like a stock market with corporations, Blockimmo users can purchase, sell or trade portions of real estate properties that have been turned into digital tokens on a global marketplace that runs 24/7.

On March 1, Blockimmo listed its first tokenized property – an apartment building with a restaurant – with a value of 15 million Swiss francs ($14.8 million). Twenty percent of the property's value was converted to "Swiss Crypto Tokens," with transactions enabled through the use of the "CryptoFranc," a stablecoin linked directly to the Swiss franc. The tokens sold to four investors.

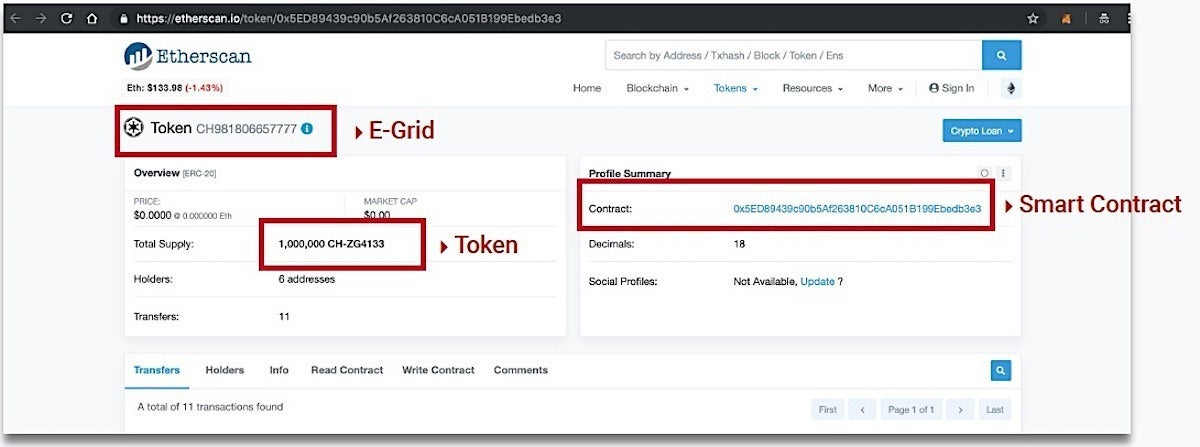

BlockimmoProperty data hashed on the an Ethereum blockchain using an Interplanetary File System (IFPS)Stablecoins are cryptocurrencies that, unlike bitcoin, are linked to fiat currency, such as the U.S. dollar or Swiss franc.

They're expected to become increasingly popular as a vehicle to tokenize (digitize) assets, such as property that can then be bought or traded on blockchain exchanges. For example, J.P. Morgan recently created a stablecoin to transfer funds over a blockchain network internally and internationally between institutional clients.

The EEA's Real Estate playbook lists eight different uses for blockchain, including property identification (including listings and data); token-enabled marketplaces; token securitization; public registries detailing ownership of properties; and sales process optimization.

Along with creating a real estate exchange, blockchain has been used as a platform for conventional real estate sales. For example, New York-based ShelterZoom plans to go live this year with a platform that enables sellers and buyers to make offers over an Ethereum blockchain. SponsoredPost Sponsored by Deloitte

SponsoredPost Sponsored by Deloitte

This Is What Genuine Blockchain Progress Looks LikeBarriers to blockchain adoption are falling, helping to resolve key issues and bring the technology into the mainstream.

Another start-up, Jointer.io is focused exclusively on real estate tokenization. Unlike other services, it doesn't offer one property as shares that can be purchased. It offers a number of buildings in an index, and participants can buy tokens from that index. The result is less risk and more profit, according to Jude Regev, founder and CEO of Jointer.

The real estate market is highly liquid, meaning property can be bought or sold relatively quickly with little to no loss in value. But the ability to play in that marketplace has mostly been reserved for a small number of wealthy investors, Don argued. And, it's a complex system because of the need for a middleman (a bank) and others to enable transaction clearance and settlement.

BlockimmoTokenized properties for sale on Blockimmo's real estate marketplace.

"It's almost impossible for a semi-professional investor to get access to it. So on one hand, by applying blockchain technology, you can enable anyone to invest because the costs to do it are so much lower, and it enables fractionalized ownership," Don said, referring to the absence of banking fees.

"That's exactly what tokenization does; it allows someone to indirectly acquire a piece of real estate.""Democratization," a term that has frequently been applied to blockchain's ability to enable an open and transparent marketplace, is also being used by the EEA's Real Estate SIG to describe the benefits of real estate tokenization.

The new Mazda3 has given people a lot to talk about, but what are they saying?

"It enables anyone to own and acquire a piece of real estate. You can do that today through an investment company, but blockchain allows anyone to sell anytime. You can sell your share on a secondary market," Don said. "And, in our case, it's not just marketing talk. We've already launched a decentralized exchange for real estate tokens."The ability to purchase a fraction of a piece of property is not new.

A Real Estate Investment Trust (REIT) is a fund or security that allows investors to purchase shares of income-generating real estate properties. REITs are owned and operated by shareholders who invest in commercial properties such as office and apartment buildings, shopping centers and hotels.

"Our solutions let the investors decide which property at which exact location they want to invest their money," Don said. "Each property will have its own smart-contract and thus own token.

They can choose to invest in a specific property at a specific address in New York, Amsterdam and Zurich and build up their own customized, flexible and diversified real estate portfolio of which they are in control."How it works

While Don describes his company's Ethereum-based marketplace as a public or open blockchain, in reality it fits the definition of a private blockchain in that it's governed or administered by a central authority of users who whitelist those who can participate by first authenticating their identities.

Once cleared, their personally identifiable information is encrypted and stored in a cryptowallet, a piece of software that keeps track of the secret keys used to digitally sign blockchain transactions.

During the blockchain onboarding process, potential users are automatically asked questions and required to submit proof of identity (such as a copy of a passport) through a business automation application known as a "smart contract" that is intended to satisfy know-your-customer and anti-money laundering regulations, Don said.

Those who complete the onboarding process have their cryptowallets whitelisted for blockchain transactions.

BlockimmoA tokenized property showing where it exists on a blockchain, its token identifier and the smart contract controlling its distribution."If I'm whitelisted, I'm able to participate in crowdfunding opportunities – for instance an interesting real estate building being offered on the blockchain platform.

But more importantly, I'm also allowed to trade these tokens on a secondary market," Don said. "The technology has to adapt to the infrastructure and regulations of the markets. And Ethereum is perfectly able to do that today. You can program smart contracts so you stick to these laws and regulations.

"A real estate property can be divided into individual investment units each identified and embodied via a security token (via the ERC 20 or ERC 721 specifications or another variant).

The tokens, which include the property's lot number, will identify ownership, provide a mechanism for transactional processing, and serve as the property identifier to allow for trading on regulated secondary markets.

"We only offer tokenization of properties as a service, but the asset owner is in control of the tokens," Don said.

"If our company goes bankrupt, and we've tokenized 100,000 buildings, nothing happens to those buildings.""It's early days," Don continued, "but it's heading in the right direction. Larger institutional investors are seeing the potential of using public blockchains like Ethereum.

At least in Switzerland, even financial regulators see that it's possible to use a public blockchain and be able to stick to laws and regulations."Related: Senior Reporter Lucas Mearian covers financial services IT (including blockchain), healthcare IT and enterprise mobile issues (including mobility management, security, hardware and apps).-

- 1

Francisco Gimeno - BC Analyst Real Estate has already tried crowdfunding sales and even promotions. The next step is logically the tokenisation of real estate in he blockchain, which can disrupt totally the sector, from the ways promotors and investors work to the way buyers purchase and own. This is good news.- 10 1 vote

- Reply

-

-

Facebook in Talks With Coinbase, Winklevoss Gemini to Launch Its Globalcoin: FT ... (cointelegraph.com)Social media giant Facebook has reportedly held talks with major United States-based crypto exchanges about the issuance of its own crypto, the Financial Times (FT) reports on May 24.

Citing two people familiar with Facebook’s “Globalcoin” project, the FT wrote that Facebook has discussed the initiative with major crypto exchange and wallet Coinbase.

The article also notes that Facebook reportedly spoke with the Gemini exchange, which was founded by the Winklevoss twins, the well-known rivals of Facebook CEO Mark Zuckerberg.

According to the anonymous sources, Facebook has been conducting negotiations with major crypto-related firms in order to ensure that its long-rumored stablecoin is pegged to the value of the United States dollar and is liquid, tradeable and secure.

Other firms reportedly included Chicago’s leading high-frequency trading firms Jump and DRW, the report says.

All the parties mentioned above have declined to comment on the matter to the FT, with the report adding that the social media giant has required them to sign non-disclosure agreements.

While the BBC has recently reported that Facebook’s upcoming cryptocurrency will be focused on payments, the sources reportedly revealed that Globalcoin will be “bigger and more open” than just a payment method for purchases on Facebook.

As previously reported, Facebook allegedly plans to integrate its three fully-owned applications — WhatsApp, Messenger and Instagram — to deliver its massively exposed cryptocurrency project.

According to the FT, industry experts claim that regulation will be Facebook’s biggest obstacle in delivering its own cryptocurrency. On May 2, Facebook registered a new financial tech firm, Libra Networks LLC, in Geneva, which notably plans to offer services in finance and emerging technologies including payments, financing, identity management, data analysis, big data, blockchain and others.

Earlier in April, Cameron and Tyler Winklevoss came to an agreement with bitcoin (BTC) entrepreneur Charlie Shrem to end a lawsuit the twins filed against Shrem last year. The brothers had previously accused Shrem of stealing 5,000 bitcoin (worth about $40 million at press time). -

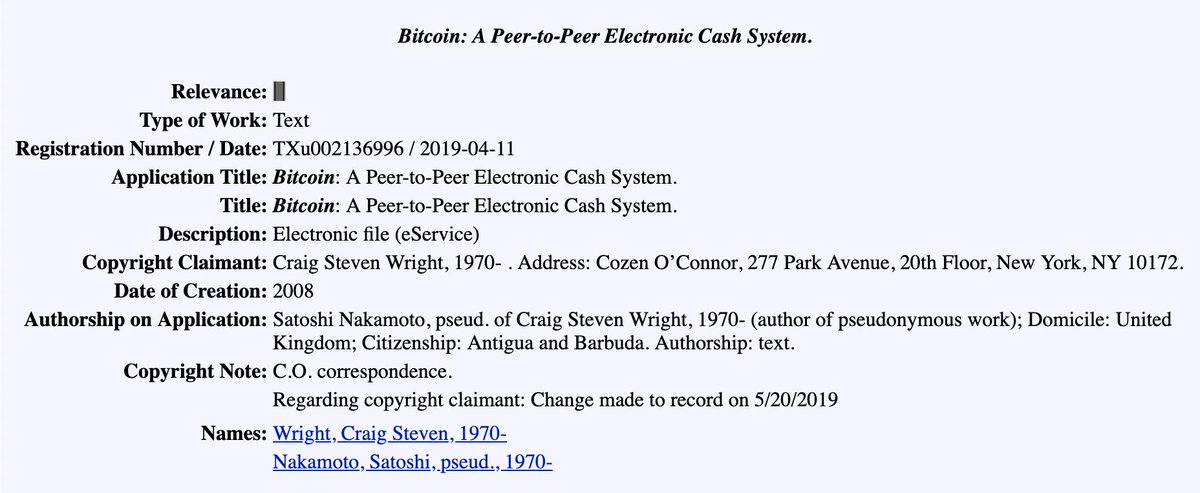

Craig Wright, the self-proclaimed creator of bitcoin, has filed registrations with the U.S. Copyright Office supporting his claims of authorship over the original bitcoin code and the Satoshi white paper.

The registrations, which are visible here and here, pertain specifically to “Bitcoin: A Peer-to-Peer Electronic Cash System” and “Bitcoin,” meaning the original 2009 code.A press release sent to CoinDesk states:“In the future, Wright intends to assign the copyright registrations to Bitcoin Association to hold for the benefit of the Bitcoin ecosystem. Bitcoin Association is a global industry organization for Bitcoin businesses. It supports BSV and owns the Bitcoin SV client software.”

Founding President Jimmy Nguyen commented in the release:“We are thrilled to see Craig Wright recognized as author of the landmark Bitcoin white paper and early code. Better than anyone else, Craig understands that Bitcoin was created be a massively scaled blockchain to power the world’s electronic cash for billions of people to use, and be the global data ledger for the biggest enterprise applications. We look forward to working with Craig and others to ensure his original vision is recognized as Bitcoin and is realized through BSV.”

To be clear, registration does not imply ownership nor is this an official patent. The copyright process allows anyone to register anything in an effort to prepare, say, for lawsuits associated to ownership.

Computer code and white papers can be copyrighted insofar as they are considered literary works and, as the copyright office writes: “In general, registration is voluntary. Copyright exists from the moment the work is created.

You will have to register, however, if you wish to bring a lawsuit for infringement of a U.S. work.”In other words you, the reader, could register this post and I would have to fight you in court to contest it.Jerry Brito, executive director at advocacy group Coin Center, tweeted:

294 people are talking about this

Jerry Brito@jerrybrito

Registering a copyright is just filing a form. The Copyright Office does not investigate the validity of the claim; they just register it. Unfortunately there is no official way to challenge a registration. If there are competing claims, the Office will just register all of them.

Neeraj K. Agrawal@NeerajKACraig Wright filed a copyright registration for the Bitcoin whitepaper https://cocatalog.loc.gov/cgi-bin/Pwebrecon.cgi?v1=15&ti=1,15&Search_Arg=bitcoin&Search_Code=FT%2A&CNT=25&PID=nzoD_881lnuCunVeTvIfD742gwJ8&SEQ=20190521081301&SID=1 …

5345:27 AM - May 21, 2019Twitter Ads info and privacy

“People register things for a reason. They want to exploit it and they want the credit for it,” said David H. Faux, Esq., an intellectual property attorney in New York City. “Someone dishonest would register the Bitcoin white paper to put it on his website and get speaking engagements.

But at some point it would catch up with him.”“The market takes care of itself,” said Faux.When asked for comment noted Wright critic Jameson Lopp said “LOL.”CoinDesk has contacted Wright’s representatives and the Copyright Office for further comment.UPDATE – Wright wrote:“BTC is not bitcoin. Bitcoin is set in stone and does not change. Where there is a protocol change, there is developer control which is the exact opposite of what bitcoin is about. BTC is passing off as Bitcoin. It is an air drop copy that has been designed to slowly alter the protocol allowing the system to be anonymized to such an extent that criminal activity can happen. The goal is to create a system that allows people to commit crimes, extort money, have automated ransomware and worse. This is not the goal of Bitcoin.”

Craig Wright image via CoinDesk archives

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.-

Francisco Gimeno - BC Analyst Craig's lawyers need a copyright validated to proceed with any case dealing with Craig's claim to be Nakamoto. Everything is about control and money, whatever Craig says. The issue is already weird, and getting weirder. Can we dismiss it with a LOL, like Mr.Lopp? What do you think?

-

-

Buckle up! This bull run will make the last one look like play school.

Here is all you need to know for the next run.-

By

Admin

Admin - 0 comments

- 2 likes

- Like

- Share

-

By

-

Bitcoin is dropping fast as speculators cash out after its recent spike (BTC) | ... (markets.businessinsider.com)

- Bitcoin slumped more than 8% on Friday as speculators cashed out.

- The decline probably reflected profit-taking and algorithmic trading, according to one expert.

- Bitcoin had surged from $5,000 to more than $8,000 this month, but still trades well below its peak of $19,000 in December 2017.

- Watch bitcoin trade live.

Bitcoin slumped more than 8% to below $7,200 on Friday as investors cashed out following the cryptocurrency's breathless rise this year. The prices of other cryptocurrencies such as ethereum and litecoin slid by a similar amount, while bitcoin cash and ripple dropped around 12%.

The cryptocurrency's latest tumble probably reflected profit-taking and algorithmic trading exacerbating the decline, said Jehan Chu, co-founder of Kenetic Capital, in an interview with CNBC.

The total market capitalization for the cryptocurrency industry has shrunk by about 9% to around $225 billion in the past day, according to data from CoinMarketCap.

The price of bitcoin had surged to nearly $8,200 earlier this week, more than doubling its value since the start of the year. There are several theories about what caused the spike, including the US-China trade war, growing institutional interest, an exodus from risky "alt-coins," a lawsuit against the owners of the Bitfinex exchange, and the hacking of the Binance exchange.

Given bitcoin's sharp rise, "it is no surprise we have seen a small adjustment," Marcus Swanepoel, CEO of Luno, a cryptocurrency company, said in a note.

"Data will almost certainly show that a number of people who bought on the last major price rise will now be exiting at a price which covers their initial investment.

"Bitcoin still trades more than 40% above its $5,000 level at the start of May. However, it remains well short of the $19,000 peak it reached in December 2017.-

Francisco Gimeno - BC Analyst There is a problem with BTC yet. So many people believe the price of BTC determines its value. It is not. BTC is more than that. However, a this stage, and with a small market where few people called "whales" can change the price by dumping their BTCs for hard cash, this is just a small tumble. If you are an investor, maybe you should look for the long term market. What do you think?