Blockchain Apps

- by Francisco Gimeno - BC Analyst

- 16 posts

-

Everyone is blabbing about the metaverse. But what does this future digital world look like? WSJ’s Joanna Stern checked into a hotel and strapped on a virtual-reality headset for the day. She went to work meetings, hung out with new avatar friends and attended virtual shows. Photo illustration: Tammy Lian / The Wall Street Journal

More from the Wall Street Journal:Visit WSJ.com: http://www.wsj.comVisit the WSJ Video Center: https://wsj.com/videoOn Facebook: https://www.facebook.com/pg/wsj/video... Twitter: https://twitter.com/WSJOn Snapchat: https://on.wsj.com/2ratjSM

#Metaverse #JoannaStern #WSJ #JoannaStern-

- 1

Francisco Gimeno - BC Analyst The Metaverse itself is a future technology. Gamers, engineers and others are already using VR to design, play, live and many other things; this can make us feel how the metaverse will one day work, if possible. Many things need to be developed before we can really see a metaverse platform like the ones at science fiction books. It is a interesting podcast.- 10 1 vote

- Reply

-

-

Welcome to The Daily Forkast, November 17th, 2021, presented by Angie Lau. For the latest in blockchain & crypto news. On today's show:

00:00 Coming Up

00:39 Chinese crypto mining hardware manufacturer Canaan reports Q3 earnings.

02:27 South Korea emerges as metaverse hub.

04:28 NFTs start bridging the digital and physical worlds.

---

Chinese Bitcoin mining hardware manufacturer Canaan's Q3 earnings show no sign of any setback from China's clampdown on the mining sector. The company reported a net income of just over 467 million Renminbi, or US$72.5 million compared to a net loss of US$13.5 million in the same quarter last year. Now, going forward, CEO Nangeng Zhang said the latest policy moves in Kazakhstan will promote sustainable development of the cryptocurrency mining industry in the country, and that should be beneficial for Canaan's business development there. However, dark clouds could be on the horizon for the many crypto miners who have chosen Texas as a base, with local media saying questions have been raised as to whether the state's ERCOT power grid manager can handle the growing load or keeping a close watch on that development.

Meanwhile, Chinese interest in the Metaverse continues, with gaming giant NetEase the latest to get in on the act. In its Q3 earnings call, the company said it is technologically ready and claimed it will be one of the fastest runners in the metaverse space. Netease saw a year-on-year increase in net revenue of 18.9% with games responsible for over 70% or almost US$2.5 billion worth of those earnings.

South Korea's TV home shopping businesses are going all in on the metaverse as well. GS Shop has broadcast Korea's first ever Metaverse home shopping experience. Meanwhile, several other networks are training meta human beings for the next level of TV home shopping. South Korea's capital city, Seoul, and another major city, Gwangju, have announced their full support for the metaverse industry. Televised home shopping once dominated South Korea, however, it has faced strong competition more recently. GS Shops home shopping segment for a selection of gourmet nuts gave viewers a grand tour of Old Trees Factory via the metaverse. To create the experience GS shop, visited the real factory and digitized every machine and piece of equipment so customers could view the production process closer up than if they'd actually visited. Meanwhile, Lotte Home Shopping is preparing to debut a virtual show hosted by Lucy, a 29 years old model slash design researcher metahuman. Lotte says that with Lucy, they are speeding up their metaverse business. And CJ OnStyle has collaborated with the virtual influencer named Roy to introduce a new line of fashion. City governments are also getting in on the game, with Korea's capital city, Seoul and Gwangju metropolitan city both pledging to support the metaverse industry. Earlier this month, Seoul announced a five year plan to set up an ecosystem for the industry, while Gwangju City will blend metaverse technology into its five representative industries, including producing eco-friendly automobiles in hydrogen energy.

And now let's get you the latest on NFTs and how it's defining decentralized pop culture. It's what Duc Luu, executive chairman of Sports Network, a cross-chain DeFi powered NFT marketplace, knows all about.

Angie: First question, one of the hottest artists in the NFT universe, Beeple sold his most recent project, Human One, for nearly US$29 million. The sale included both an NFT and a sculpture. And so we're asking, is this going to be what people expect from NFTs from now on? What's going on here?

Duc: Yeah, I mean, I think if you think about NFTs a year, year and a half ago, you were thinking about memes and GIFs, and you're just saying, what's so special about it? Why does it? Is it a collectible? Isn't it completely fungible versus a nonfungible token?

Duc: And so where you have Beeple, one of the stars of the scene, he's really thinking about bridging the physical and the digital, more and more. We already have instances where you can take your NFT and then bring it to a smart screen.

Angie: And that brings me to this question is this what we are going to see at one of the biggest international art fairs, Art Basel Miami? It's just around the corner. What's on your radar? Do you think NFTs are going to take over there?

Duc: Yeah, so the art market obviously is incredibly huge and integral to NFTs. We saw Art Basel one of the bigger, bigger shows in the world. You know, Art Basel Hong Kong drives the most revenue, but really, Art Basel Miami is where the cool stands. So we're going to see a lot of activity by NFT groups and NFT artists during that that weekend. And I'm looking at NFT Basel BZL as as an event to watch during that week.

---

#Crypto #Blockchain #BlockchainTechnology #DigitalAssets #Cryptocurrency #DeFi #Metaverse #BitcoinMining #Canaan #NFT #Lotte #Decentralization #Beeple #ArtBasel #Finance-

Francisco Gimeno - BC Analyst Once more Forkast giving us the latest on Asia and 4th IR. The Metaverse narrative is strong there specially in China and South Korea where they already have experience with VRand are preparing the AR experience. from there to the real Metaverse, Korea can be a metaverse hub in the near future, when adding technology, innovation, users and ll the digital services we can get into it, like NFTs, fashion, whatever is in our mind.

-

-

Audius, a music streaming platform based on the Ethereum and Solana blockchains, is partnering with TikTok on the video-sharing app’s new “Sounds” library. "The Hash" squad discusses how the partnership, the first of its kind for TikTok, could help artists on Audius increase their exposure to users and discover crypto more broadly. Will the worlds of decentralized services and Big Tech continue to collide?

-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Ex-Google TechLead exposes Ethereum and it's scalability problem. Here's Vitalik Buterin's blog post "Limits to Blockchain Scalability" https://vitalik.ca/general/2021/05/23...

Join ex-Google/ex-Facebook engineers for my coding interview training: https://techinterviewpro.com/

💻 100+ Videos of programming interview problems explained: https://coderpro.com/

💻 Sign up for my FREE daily coding interview practice: http://dailyinterviewpro.com/

📷 Learn how I built a $1,000,000+ business on YouTube: http://youtubebackstage.com/

💵 Get 2 FREE Stocks on WeBull valued up to $1850 (when you deposit $100): https://act.webull.com/k/S4oOH2yGOtHk...

🛒 All my computer/camera gear: https://www.amazon.com/shop/techlead

🎁 Get the TechLead wallet (ultra thin) on Amazon: https://amzn.to/3eGPWbB

⌨️ My favorite mechanical keyboard (80 series): http://iqunix.store/techlead

🎉 Party up:

https://instagram.com/techleadhd/

https://twitter.com/techleadhd/

https://www.linkedin.com/in/techleadhd/

Disclosure: Some links are affiliate links to products. I may receive a small commission for purchases made through these links.-

Francisco Gimeno - BC Analyst Techno Lead makes fun of serious things. And that is good when we talk about complicated things like scalability of Ethereum. There is a big problem there as many projects and products are in the Ethereum blockchain or its clones. It's PoS the solution? How it's energy consumption based? And if not what are we going to do?

-

-

Get my full interview w/ Johann: http://patreon.com/mattdavella

🙊 Here are the goods I mention in this video:

(Some are affiliate links. All are my genuine recommendations):

Get Johann's book: https://amzn.to/2UT6Ewe

💯 You can also follow me here:

Newsletter: http://mattdavella.com

IG: http://instagram.com/mattdavella

Twitter: http://twitter.com/mattdavella

Podcast: http://groundupshow.com

❤️ Get more videos & support my work:

http://patreon.com/mattdavella

Thanks for watching!-

Francisco Gimeno - BC Analyst A loneliness epidemic is being portrayed as happening in an overcorrected society which lacks profound connections, in family, friends and social groups. Anxiety is on the rise. This is global, but mostly on Western and some Asian societies. We can't disconnect from tech, but we should find a way to really deeply connect in it too. Otherwise depression and anxiety will be the norm.

-

-

In brief

- Reddit is trialing crypto-based community points for a popular Fortnite subreddit.

- You can convert those points for cash.

- The road is long and hard.

Regulars of the 1-million-strong Fortnite subreddit can trade their crypto-based community points—earned from contributions such as memes, high-quality comments, and fan-made art—for cash.

Reddit has trialed cryptocurrency rewards on the community-run subreddit for Fortnite, r/FortNiteBR, as well as on r/CryptoCurrency, since May.

The subreddit’s cryptocurrency, “Bricks”, runs on a test version of Ethereum known as “Rinkeby.” Testnet coins aren’t supposed to have value; indeed, you can request the Rinkeby version of Ethereum tokens for free.

Still, it’s possible to sell the Bricks on a new decentralized exchange, Honeyswap. There, the coins have real value. Granted, not much: a single brick is worth $0.03, and a single transaction costs $8.89.

The thing is, it’s really complicated to sell these coins and those transaction fees may not make it worth your while. It’s also slightly easier, though still very complicated, to sell the MOON cryptocurrency earned on r/CryptoCurrency because people have written software that makes the whole thing less of a minefield.Here’s How to Sell Reddit’s Crypto Tokens For Cash

Reddit’s crypto community has worked out a way to sell its $MOON currency for cash. Moons—launched in May—are ERC-20 tokens awarded to those who contribute to the cryptocurrency section of t...NewsBusinessMathew Di SalvoSep 28, 20203 min read

The Fortnite experiment is more popular. According to DappRadar, 36,770 Brick holders have made 65,291 transfers. On r/CryptoCurrency, there are 7,973 holders of MOONs and 16.748 transfers.How to sell your BRICKs

Selling Bricks is far from simple, but here’s the nuts and bolts of it, per a guide on the r/CryptoCurrency subreddit: First, send Bricks to your MetaMask wallet. MetaMask is a popular browser-based crypto wallet.

You’ll have to add BRICK as a custom token in your wallet, using the following address: “0xe0d8d7b8273de14e628d2f2a4a10f719f898450a”.

Second, you’ll need to get some cryptocurrency to pay the gas fees. You pay gas fees to the network to process your transaction. For this, you’ll need some Rinkeby ETH—remember, you can get that for free—and some xDAI. xDAI is a version of DAI, a US dollar-pegged stablecoin.

This is a cryptocurrency whose value is equal, more or less, to the US dollar. You can swap DAI for xDAI. xDAI is the same as DAI, only it’s based on an Ethereum sidechain.

Third, you’ll have to convert your Bricks to tokens supported by the xDAI sidechain.

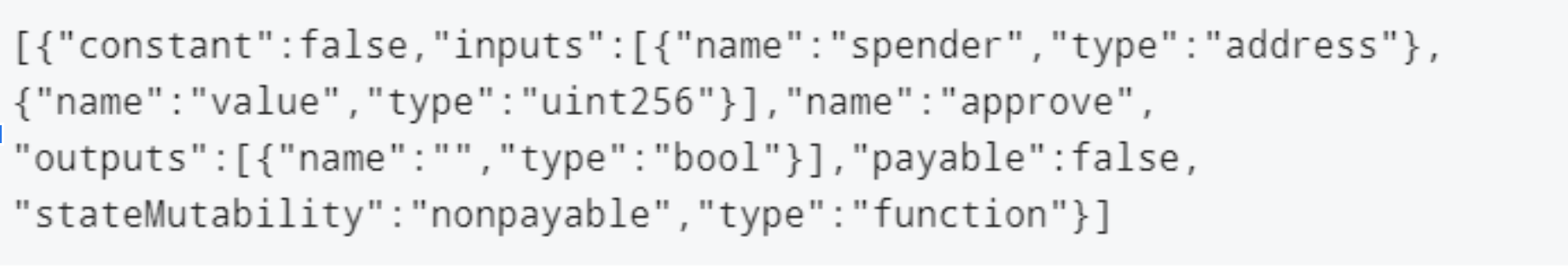

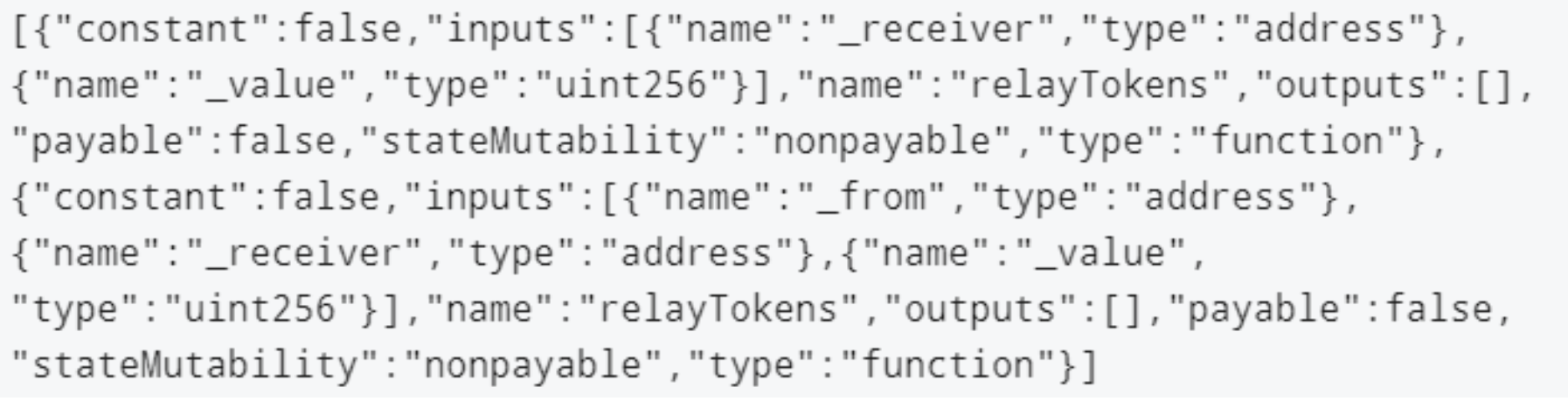

That means you’ll have to convert them to xBricks. To do this, enter the Rinkeby address for Bricks (above) in MyEtherWallet, and paste this in the ABI/JSON interface:

Instead of “spender”, put this:

“0xD925002f88279776dEB4907bA7F8dC173e2EA7a7”. Instead of “value”, enter the number of BRICK tokens you want to convert in wei. Wei is a unit of Ethereum gas. One BRICK = 1000000000000000000 wei. Then click write and confirm the transaction on MetaMask.

Then put the above contract address in address and then paste the following in the ABI/JSON Interface:

Continue, select an item, pick relayTokens, put your address in "receiver", in "_value" enter the "a7" address mentioned above, then write and convert on MetaMask.

Then switch to xDai and add xBRICK using x2f9ceBf5De3bc25E0643D0E66134E5bf5c48e191 as the contract address.

Then, you can sell it on Honeyswap, and then from there cash out.

To cash out, convert these tokens back into regular tokens (xDAI to DAI), and from there sent to an exchange and withdraw to fiat.

Who said Reddit was a waste of time?-

Francisco Gimeno - BC Analyst Gamers understand easily tokenisation, rewards and trade. We see this complicated, cumbersome even. But is there and with time it will be an easy transaction process. It is the same with the rest of crypto and tokens. Masses won't use them unless the user interface is as simple as the one of Google or a Bank platform.

-

In order to achieve blockchain mass adoption, three fundamental problems should be solved. Let’s dive into the third one: governance.

This is Part 3 of a three-part series in which Andrew Levine outlines the issues facing legacy blockchains and posits solutions to these problems.

Read Part 1 on the upgradeability crisis here and Part 2 on the vertical scaling crisis here.

Upgradeability, vertical scaling and governance: What all three of these issues have in common is that people are attempting to iterate on top of a flawed architecture. Bitcoin and Ethereum were so transformative that they have totally framed the way we look at these issues.

We need to remember that these were developed at a specific moment in time, and that time is now in the somewhat-distant past when blockchain technology was still in its infancy.

One of the areas in which this age is showing is in governance. Bitcoin launched with proof-of-work to establish Byzantine fault tolerance and deliver the decentralization necessary to create a trustless ledger that can be used to host digital money.

With Ethereum, Vitalik Buterin was seeking to generalize the underlying technology so that it could be used not just to host digital money but also to enable developers to program that money.

With that goal in mind, it made perfect sense to adopt the consensus algorithm behind the most trusted blockchain: proof-of-work.

Proof-of-work is a mechanism for minimizing Byzantine fault intolerance — proving BFT is not as easy as people like to pretend. It is not a governance system.

Bitcoin doesn’t need a governance system because it is not a general-purpose computer.

The reason general-purpose computers need a governance system is that computers need to be upgraded.

One needs no clearer proof than the magnitude of changes planned for Ethereum 2.0 and the aggressive advocacy for the adoption of the necessary hard forks.

We are not the first to point out this problem. The founders of Tezos accurately forecast this problem, but they ultimately failed to deliver a protocol that meets the needs of most developers for the following reasons:- The blockchain is written in a different language than the smart contracts.

- They introduced a political process where decision-making occurs off-chain.

- They failed to deliver on an on-chain explicit upgrade path.

- They failed to establish distinct classes that can act as checks and balances.

The smartness of smart contracts

Developers must be able to code up the behaviors they would like to see in the blockchain as smart contracts, and there must be an on-chain process for adding this behavior to the system through an explicit upgrade path.

In short, we should be able to see the history of an upgrade just as we can see the history of a given token.

The appropriate place for governance is in determining which smart contracts are made into “system” contracts based on whether they will increase the value of the protocol.

The challenge is, of course, coming to a consensus on that value.The most controversial point I will make is the critical need for algorithmically distinct classes that act as checks and balances on one another.

While intuition might suggest that more classes make consensus more difficult, this is not the case.

First, if the upgrade candidates are already running as smart contracts on the mainnet, objective metrics can be used to determine whether the ecosystem would benefit from turning the “user” contract into a “system” contract.

Second, if we were not trying to bundle upgrades into hard forks, they could be piecemeal and targeted.

We would simply be trying to assess, in a decentralized manner, whether the system would be improved by a single change.Checks and balances

It is commonly understood that in any economy, there are essentially three factors of production: land (infrastructure), labor and capital. Every major blockchain only recognizes one class: capital.

In PoW chains, those who have the most capital buy the most ASICs and determine which upgrades can go through. In proof-of-stake and delegated proof-of-stake chains, control by capital is more direct.

In addition to being problematic on its face, the absence of any other classes to act as a check on capital has a paradoxical effect that leads to political paralysis.

No group is homogenous. Classes, properly measured, create efficiency — not inefficiency — by forcing the members of a class to come to a consensus around their common interest.

Without such pressure, subclasses (groups within a class) will fight among one another, leading to gridlock. Properly designed classes motivate their members to come to an internal consensus so that they can maximize their influence on the system relative to the other classes.

If we can codify individual classes representing infrastructure, development and capital, then upgrades that receive approval from all three classes must, by definition, add value to the protocol, as these three classes encompass the totality of stakeholders within any economy.

Such a governance system, when combined with a highly upgradeable platform, would be able to rapidly adapt to the needs of developers and end-users, and evolve into a platform that can meet the needs of everyone.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Andrew Levine is the CEO of OpenOrchard, where he and the former development team behind the Steem blockchain build blockchain-based solutions that empower people to take ownership and control over their digital selves.

Their foundational product is Koinos, a high-performance blockchain built on an entirely new framework architected to give developers the features they need in order to deliver the user experiences necessary to spread blockchain adoption to the masses.-

Francisco Gimeno - BC Analyst Upgradeability, vertical scaling and governance are the big issues for blockchain developers. Governance is a big debate now as it's at the core of the other two issues. It helps to maintain check and balances on the blockchain products and services and make easier to develop global blockchain based solutions. Ethereum 2.0 is the best example of trying to solve this.

-

What Would You Choose? To find out, click here: https://lnkd.in/eGXCe7s . If you like what we are doing, kindly share this post.

#token #tokenisation ...-

Francisco Gimeno - BC Analyst In the age of disruption, who is able to opt out from FAANGs? Well, examples are clear in history of Davids against Goliath. With tokenisation and a digital economy we will witness new companies and products proudly tuning the tables, returning the power and data ownership to the users themselves, while rewarding them in a tokenised environment. Blockabase® strives to do that from now on. Become a member and part of new tokenised era.

-

-

One of the major points of contention when entering the cryptocurrency industry either as a trader or a HODLer is the security of digital assets. Many investors are on the fence when it comes to participating in this budding industry just because of the infamous incidents of hacks and cyber-attacks on crypto exchange platforms that have swindled investors to the tune of millions of dollars. As a measure to safeguard their investments, seasoned investors store their digital assets only on the most trusted and reputable crypto wallets.In this article, we look at four of the most trustworthy and secure crypto wallets in the market today – CryptX, Ledger, Bitamp, and Electrum.

Differentiation Between Hot Wallets and Cold Wallets

Before we delve deeper into the aforementioned cryptocurrency wallets, it’s important to know about the different kinds of cryptocurrency wallets.Primarily, cryptocurrency wallets can be divided between hot wallets and cold wallets.What Are Hot Wallets?

Hot wallets, as the name suggests, are digital wallets that are connected to the Internet. Due to their online nature, hot wallets enable rapid access to digital assets. There is no dearth of secure hot wallets in the industry, with some of the most popular of them being MyCelium, Bread, Edge, Bitamp, and Electrum, among others.

Hot Wallets are optimal for those who require ‘on-the-go’ access to their digital assets for quick trades.

As the price movement in the cryptocurrency industry is notoriously volatile, having or not having quick access to crypto investments can make or break the game for investors. Therefore, if you’re a trader or even just want to HODL cryptocurrencies for the long-term, you can bet your money on hot wallets. Investors can add an extra layer of security to their wallets by enabling PIN password and two-factor authorization.What Are Cold Wallets?

As the name might suggest, cold wallets are ‘cold’ in the sense that they’re disconnected from the Internet. Cold wallets from companies such as Ledger and Trezor are becoming increasingly popular among novice and veteran investors alike courtesy of their unparalleled security.

However, due to their offline nature, they might not be the ideal choice for investors who are actively trading cryptocurrencies to make profits. Despite that, the stellar security provided by cold wallets makes them an ideal choice for those who want to store large amounts of crypto assets for the long-term.Some of the Top Cryptocurrency Wallets

CryptX

Dubbed the “Swiss Bank for Digital Coins,” CryptX is a leading cryptocurrency wallet that offers its users enterprise custodial services with institutional-grade security. It is fast and easy to onboard.

(Source: CryptX)With an intuitive and sleek user-interface, CryptX provides the simplest and most convenient way of sending, receiving, and managing crypto assets at minimal fees.

The wallet secures users’ private keys in the impenetrable Swiss bank-grade Hardware Security Modules (HSM) that are developed, manufactured, and programmed in Switzerland. This, in essence, means that CryptX users can rest assured that no one is gaining unauthorized access to their private keys.

CryptX cryptocurrency wallet supports a wide array of digital assets and regularly introduces support for new ones, thereby eliminating the need for individuals to maintain multiple crypto wallets.

At present, CryptX can be used to manage more than 100 cryptocurrencies including top digital assets such as Bitcoin (BTC), Ether (ETH), Litecoin (LTC), Tether (USDT), and Chainlink (LINK), among several others.

CryptX also supports other crypto-specific events such as forks, and token airdrops so that users do not have to shuffle and move their digital assets to other wallets.

All secure information related to accessing the cryptocurrencies supported by CryptX are stored in Swiss HSM devices which can be managed through the wallet’s secure APIs via Two-Factor Authentication.

In addition, CryptX also leverages several other robust security mechanisms such as wallet freezing, and address whitelisting.CryptX provides its users with cutting-edge trading features.

For instance, consider the CryptX Auto Swap functionality that automatically swaps BTC, ETH, BCH, LTC, and USDT within the user’s wallet to eliminate exchange rate risk involved in cryptocurrency operations. In simpler terms, the Auto Swap feature ensures that users do not lose their investments on volatility.

Users can tap this feature to safeguard their digital assets from undesirable price swings.Last but not the least, CryptX is cognizant of how big a pain enormous transaction fees can be for users. In that regard, CryptX offers SegWit, transaction batching, and other fee management tools to ensure its users have minimal exposure to unnecessary expenses.

Interested individuals can book a CryptX wallet Demo on their official website here.Ledger

Ledger is a leading hardware or cold wallet firm based out of France. Ledger’s two flagship products – Ledger Nano S and Ledger Nano X, are often considered the industry-benchmark for hardware wallets because of their robust and cutting-edge security mechanism.

Ledger Nano S supports a swathe of cryptocurrencies, including some of the most popular digital assets, such as Bitcoin (BTC), Ether (ETH), XRP, Litecoin (LTC), and Bitcoin Cash (BCH), among others.

(Source: Amazon)Further, despite being a hardware wallet, it’s not necessary for users to keep their Ledger online if they want to receive any cryptocurrency.

The user can simply share their relevant wallet address and check later if the Ledger Live app whether they’ve received their assets.Bitamp

A leading Bitcoin (BTC) wallet, Bitamp is a trusted name in the cryptocurrency wallet space. Bitamp is an open-source, client-side, Bitcoin wallet that enables users to seamlessly send and receive the premier cryptocurrency from anywhere in the world.The wallet keeps user privacy at its core and requires no user information at all.

Users are not required to share their email addresses or any other personal information to enjoy the benefits of this free Bitcoin wallet. Bitmain strives to preserve user’s anonymity and, in that regard, never stores the seed phrase, private key, IP address, or user browser details.What’s more, Bitamp can also be accessed through a VPN or TOR browser.

(Source: Bitamp)Bitamp enables users to make lightning-fast Bitcoin transactions. Bitamp believes in providing users the liberty to make transactions from anywhere in the world at the fastest speeds. Staying true to the ethos of Bitcoin, making transactions through Bitamp wallet takes minimal time compared to transactions made through traditional banks.

In addition,Bitamp works without any borders in that it users to send Bitcoin to any recipient in the world without any restrictions at costs that are not even a fraction of the fees charged by banks.

Finally, Bitamp believes in the notion of giving complete control of financial assets to their owners.

With Bitamp, users can rest assured about the security of their Bitcoin holdings as they get complete control over their assets. This way, they need not worry about exchange hacks and cyberattacks pulled by criminals aimed toward stealing crypto assets.

With Bitamp, users need not worry about losing their data to third parties who have time and again failed to live up to expectations. Bitamp helps users self-custody their Bitcoin in a secure manner.

As an icing on the cake, Bitamp also allows its users to integrate famous hardware wallets such as Ledger, and Trezor.Electrum

One of the oldest digital wallets in the industry, Electrum has successfully maintained its reputation throughout the years.Electrum is a desktop Bitcoin wallet compatible with various operating platforms such as Windows, Mac, and Linux. Because it’s an open-source wallet, Electrum has continually undergone important additions from the best programmers and security enthusiasts in the crypto space.

The continual refinement has cemented Electrum as one of the most respected Bitcoin wallets in existence today. Just like Bitamp, Electrum can also be integrated with several leading hardware wallets including Ledger, Trezor, and others.

(Source: Bitcoinelectrum)However, unlike Ledger, Electrum is a Bitcoin-only wallet. On a plus side, however, Electrum offers the possibility of creating multi-sig wallets.Final Remarks

Choosing the right kind of cryptocurrency wallet largely depends on the use. If you’re an active trader and want to capitalize on the price movements of cryptocurrencies to make small and healthy profits without compromising on the security of your assets, hot wallets such as Bitamp could be the way to go.

Similarly, long-term HODLers typically tend to stick to hardware wallets such as Ledger due to their offline nature.

People who have been in the cryptocurrency space since its initial days would prefer Electrum due to its rich and long history in the industry.All in all, it goes without saying that every crypto investor must have at least one secure digital wallet. Always remember, not your keys, not your Bitcoin.-

Francisco Gimeno - BC Analyst Coming to the crypto world can be very confusing at the beginning. Want to buy and hold crypto? Better you learn first the terms, in order to understand and be successful. Read to his to do that. Or maybe you have some input for us. Get involved.

-

-

Analysing the development of blockchain in the insurance sector | Insurance Busi... (insurancebusinessmag.com)When blockchain technology was first created by a small group of individuals, many banking systems stated they would never use it. That was partly due to the reputation the technology had of being used by anarchists looking to avoid using banking systems, according to head of delivery for ConsenSys, Julien Vincent (pictured), when he spoke recently with Insurance Business.

Since then, it has progressed to the point that the banking sector has realised that it makes sense to invest and utilise blockchain, he said, and in 2019 the financial sector as a whole started to invest heavily in these solutions.

Read more: Aon’s latest report examines the "true potential" of blockchain for insurers

Vincent, who manages the delivery of ConsenSys projects worldwide, as well as the implementation of major blockchain programs for ConsenSys’s global customers, has led digital transformation projects for several international consulting firms and outlined that technological revolutions will always occur – it is only a matter of whether businesses are ahead or behind the curve.

It is difficult to say whether or not the insurance sector is late to the table when it comes to blockchain, he said.

Though the sector is lingering behind other financial services who already have substantially sized projects in production, he said, in many ways, the solution has not been fully ready for the insurance industry until now.

Up until recently, ConsenSys was carrying out proof of concepts within the insurance sector to show that the use case was working, but these projects were not going into production, Vincent said. In 2020, the value of projects began to rise from being under €500,000 to being valued between €500,000 and €2 million.

“The insurance sector is investing more in blockchain, especially this year and next year, and I think this is the right time for that investment,” he said. “It’s becoming much more important in terms of investment and most of these projects are centred around bringing efficiency to the actual use case.

”Blockchain has several significant benefits to carriers, Vincent noted, among them the capacity to save them time, cut costs, improve transparency, assist them in complying with regulations, and helping them to build better products and markets.

From his own work with insurers, he has noted that the key benefit offered by blockchain that insurance companies are interested in is its capacity to bring efficiency and reduce the cost of processes.

“Most large corporations are ready to invest one euro if they can save one euro in return,” he said, but he highlighted that for some organisations blockchain has become something of a buzzword without any real understanding of exactly what this means for the business.

“Sometimes clients come in and want to utilise blockchain, but at the end of the audit, they don’t need this, they just need to modernise their IT systems and there is no point in implementing blockchain unnecessarily.

”Blockchain has the capacity to maximise operational efficiencies for brokers, Vincent said, particularly when it comes to the opportunities afforded by this for simplifying communication between brokers and insurers.

Taking a KYC (know your customer) check for example, he said - if the KYC of one broker is validated, then, when another insurer is reached out to, this must be redone.

As seen in other areas of financial services already once the KYC is validated it can be published into the blockchain with the trust of the company validating this check.

Then, when a new client comes along, the KYC has already been validated by one or several companies and can be trusted, thus preventing the need for brokers to redo the entire process.

There is a lot of discussion about insurers and brokers adapting to new technologies and the problem of legacy systems preventing transformation, but Vincent noted how quickly transformation can take root within the employees of an organisation, and prompt significant changes in the way that businesses carry out their processes.

Looking to the coronavirus (COVID-19) outbreak and how it is forcing people to understand how to work remotely is one example of this, he said. He highlighted how a strike in France precipitated the use of public transport and how, when the strike was over, people continued cycling to work.“I think that COVID-19 will do exactly the same,” he said.

“You can see that most are now working remotely, and with Zoom, and lots of people will start saying ‘why do you have this information on paper, why is it not in a database?’.

They will ask why they cannot access information immediately and why they have to wait. And this will push companies to innovate and allow employees to access information right now, wherever they are.”Related stories:

SHARE-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

NOvid 2020: American Scientist Pushes for Blockchain to Secure Mobile Citizen Da... (the-blockchain.com)NOvid 2020: American Scientist Pushes for Blockchain to Secure Mobile Citizen Data and Build Payment Platform For Addressing Pandemic And Economic CrisisBy John Clippinger

-March 27, 2020

By John Henry Clippinger,

It takes a blunt existential crisis to redress systemic societal and economic failings. We are at such a moment with the epic storm of global health and economic crisis compounded by inept and regressive leadership. These failures will not be redressed by traditional means.

These challenges also present a singular opportunity to catalyze a new ecological, social and economic contract for the 21st century.

As data are the new currency of the digital realm, there is the real prospect of resetting foundational rights and institutions through an empowering and secure data infrastructure that protects privacy, ensures verifiability and enables authentic, resilient and equitable interactions.

Through such an infrastructure the fusion of the physical and the virtual can provide rapid and robust responses to the health, ecological and economic threats before us. And it does not require either a pubic or private Surveillance State!

Economy and Health

The Nobel Laureate economist, Paul Romer, and the physician, Alan Garber, in their NYT, 3/23,20 Opinion piece – How to Prevent a Coronovirus Depression, starkly state the problem:“To protect our way of life, we need to shift within a couple of months to a targeted approach that limits the spread of the virus but still lets most people go back to work and resume their daily activities.

This approach uses two complementary strategies. The first relies on tests to target social distancing more precisely. The second relies on protective equipment that prevents the transmission of the virus.

Adopting these strategies will require a massive increase in our capacity for coronavirus testing and a surge in the production of personal protective equipment.”It Takes a Virus To Defeat a Virus These challenges cannot be surmounted using current social media and surveying platforms. Nor can they be scaled through traditional top-down institutional governmental means.

In military parlance, it takes a network to defeat a network, and in this case, it takes a digital virus to defeat a biological virus. The challenge is not just one of speed, but veracity. Being able to capture and verify and share the right kind of data at the right time and place and with the right parties, in real-time. And being able to limit and facilitate access based upon testing and to deploy and allocate resources based upon verified data.

Empower EveryoneJust as everyone can potentially be both a carrier and a fatality so can everyone be a data collector and immunized contributor/worker. Nearly everyone has a mobile phone that can collect and verify critical medical, location, contact, movement, social distancing, and testing data and share such data in a trusted manner.

The technology is here, it works. Singapore is going in this direction – they recently announced the release of the source code for a Bluetooth-App called ‘Trace Together’ which already works like this. Based on the code, developers can independently build even better versions. Moreover, Germany’s leading public health researchers at the Robert-Koch-Institute too, are about to launch a similar mobile application.

And online hackathons are pushing the public to build software as well. It is also open and could be free and could be supported by the Linux Foundation and the WC3.

How It Works: NOVID 2020Everyone would fill out a questionnaire on their mobile phone or their PC, using a special kind of questionnaire that conforms to a form called HL7 Fast Healthcare Interoperability Resources that meets requisite privacy and health care interoperability and compliance requirements.

The design of the questions would have to be done by expert epidemiologist – computational social scientist and other stakeholders. What is special about this kind of questionnaire is that it would be implemented on a decentralized blockchain infrastructure (Ares, Indy/HyperLedger) that gives the individual a biometrically authenticated identity credential that protects the real identity and data of the individual.

Special cryptographic techniques are used called Zero-Knowledge-Proofs make it possible to prove something about the data without actually sharing the data. Hence, the data is verified, user-controlled, and encrypted. It is not under the control of Facebook, Google, Microsoft, Amazon, or any government.

The data collected on phones can be highly detailed and extremely valuable for epidemiological monitoring – such as geo-location, interactions, clicks, photos, gestures, purchases, and movements.

These can be analyzed to compute social distance metrics, contact histories, movements into infected areas and predict contact with potentially infected people.

Decentralized Testing, Verification And Access Control

The NOvid platform can also be used to verify the results of serological tests for immunity to determine whether someone has developed COVID 19 immunity.

As such tests can be self-administrated and verified through telemedical consultation. Authorized biomarkers and behavioral signatures can be generated off the phone to give the immune individual a credential that they can use to gain access to public resources and work. Ideally, there would be an incentive program for people to be tested.

For low-risk groups, there could even be work and financial incentives to develop a verified immunity through controlled exposure and treatment. The enrollment process also automatically sets up and installs a wallet for a payment account.

EVERYONE could be compensated for their participation and compliance, and companies and collaborators could use the wallet and the payment system to pay workers and partners.

The goal is to take the friction out of the entire tracking and sourcing process and to allow multiple independent parties to set up new credentials and metrics to adapt to the changing circumstances of not only the virus but underlying economic and supply chain challenges.

Digital Twins, Gaming And Community Engagement As societies start to appreciate the efficacy and ecological necessity of virtualized work and interactions, new forms of commerce, civic and cultural engagement will become virtualized and gaming platforms such as Unity and video conferencing platforms such as Zoom will provide high-resolution digital twins of work environments, communities, cities in which ‘simulations’ will substitute for ‘real-life’.

The ability to go from a digital twin of a building, vehicle, product, service or even a community to a physical instantiation is being facilitated through generative design and 3D printing technologies developed by Autodesk and others.

The proposed NOvid platform can provide a trusted entry point into those worlds where flesh and blood individuals can participate and generate sustainable value within their communities on their terms.

Editor’s Note: Dr John Clippinger is currently working with a group at MIT and open source developers to build NOvid. If you are interested contact him by email.

About John Clippinger

Dr John Henry Clippinger is a co-founder of The Token Commons

Foundation, and Executive Director of ID3 (Institute for Innovation

& Data Driven Design), formed to develop and test legal and

software trust frameworks for identity, personal data, data-driven

services, infrastructures, and organizations.

He is also Research

Scientist at the MIT Media Lab.He is also an Advisor to Bancor, Evident, Decentralized Pictures,

Cashaa, and partner in CryptoAsset Design Group. Previously, he was

founder and Co-Director of The Law Lab (www.lawlab.org) at the Berkman

Klein Center at Harvard Law School.Dr. Clippinger is a contributor and co-editor From Bitcoin to Burning

Man and Beyond; The Quest for Identity and Autonomy in Digital Society,

(2014), the author of A Crowd of One: The Future of Individual Identity

(Perseus, Public Affairs, 2007, and The Biology of Business, Natural

Laws of Enterprise Josey Bass, 1998). Previously, he was Director of

Intellectual Capital, Coopers & Lybrand, advisor to DOD CCRP

(Command and Control Research Program (CCRP), DARPA, and the founder of

four artificial intelligence software companies.He has been a member of the World Economic Forum Global Advisory

Council, Santa Fe Institute, Aspen Institute, Highlands Forum, Yale CEO

Summit, Dubai Futures Forum, Aspen Italia, TII/Vanguard, and others.

Dr. Clippinger is a graduate of Yale University and holds a Ph.D. from

the University of Pennsylvania.Visit Website-

By

Admin

Admin - 0 comments

- 2 likes

- Like

- Share

-

By

-

Blockchain startups building the infrastructure for Africa’s development - Disru... (disrupt-africa.com)Though blockchain technology has usually been thought of has simply providing the rails for bitcoin and other cryptocurrencies, a host of startups are using it in more subtle, but extremely powerful, ways.From Kenya’s BitPesa, now AZA, to Ghana’s Bit Sika, the initial wave of blockchain startups in Africa built solutions on the premise that it was the remittances space where blockchain and crypto could best be applied.

That is not necessarily wrong, and many such companies continue to launch, grow and raise funding, and bitcoin exchanges are springing up across the continent, but the application of blockchain in Africa is slowly maturing. Various startups are using it as a means of promoting transparency and increasing trust in various spaces.

The potential power of blockchain in AfricaSo far, we’ve seen African blockchain solutions used within elections, to make trade finance transactions, and to track the origins of cobalt. Startups across the continent are developing even more innovative and important use cases, and blockchain’s impact in various spaces could yet be immense.

George Maina is co-founder of Kenyan agri-tech startup Shamba Records, which has built a blockchain-based platform that uses artificial intelligence (AI) and big data to collect farmers’ harvest records, process payments and issue credit. He says blockchain is so important in Africa because the continent is still trying to emerge from the colonial era as a more independent and developed continent.

“This means we’re still playing catch up to the west and the east. When we embrace blockchain, it can leapfrog us ahead, since we shall have created strong systems that ensure the set policies are adhered to,” Maina said. “It will help us fight corruption by ensuring transparency and traceability of national resources.

In addition, blockchain will assist in solving the challenges of counterfeit or substandard goods that affect our health, production capacity and in the long run our economies.

For me blockchain is an enabler to a better Africa.”Yele Bademosi, co-founder of early-stage VC firm Microtraction and a director at the blockchain-focused Binance Labs, agrees with this, saying blockchain has the potential to drive transformative change on the continent, especially in financial services and capital markets.

“Digitisation without decentralisation, in the wrong hands, can lead to an imbalance and abuse of power, especially within nation states where there’s a lack of good governance and institutions are weak,” he said. “Blockchain creates the right type of counterbalance and empowers individuals to take control of their economic activities without the need of a middle man or centralised authority.

”The solutionsSo what solutions are being developed? There are a host of them across the continent. In Kenya, there is Shamba Records, as well as RideSafe, which is using smart contracts to ensure quality service and high insurance penetration in the moto-taxi industry.

Another Nairobi-based company, the recently-funded UTU Technologies, is building a trust infrastructure for the digital economy on the blockchain.In Nigeria, HouseAfrica has developed Africa’s first blockchain-based land and property registry, reducing the time it takes banks, lawyers and other stakeholders to query and register land titles.

Agri-tech startup Hello Tractor, which arranges leasing of farming equipment, uses the technology to reduce transaction costs between tractor owners and farmers. Hello Tractor’s founder Jehiel Oliver says there is an extremely wide scope for application of blockchain, which he says is bringing about a “revolution”.

“From finance to fashion and even to agriculture, the innovation has proven to be versatile, bringing enhanced performance to these industries through increased transparency, efficiency, security and easier traceability,” he said.

“Blockchain really is the next wave of the technology revolution, holding the potential to solve some major real-world problems and spur the growth of new businesses and business models.

”It could, in fact, be as transformational as the arrival of the internet itself.“Just like the internet came and shaped the world, so also would blockchain technology significantly change the world and the way people carry out business in the future,” said Oliver.

Governments and startups support ecosystemsWhere is the help, then, for the startups and entrepreneurs building these transformational solutions on the blockchain. Assistance from policymakers has been limited thus far, with Kenya’s blockchain taskforce probably the most enlightened and tangible development thus far.

RideSafe founder Asiimwe Benson Mugisha says most African governments have not yet fully understood the potential that blockchain has. “Many still see it as a threat due to its ability to move money without government control,” he said.

Jason Eisen, chief executive officer (CEO) of UTU, said there had been movements in the right direction from some governments.

“Governments are looking at key touch points between citizens and the government from IDs, land titling, and elections, to service delivery, securities issuances, quality standards enforcement, and IP protection as areas to harness the radical transparency, smart contracting, and data management capabilities of distributed ledger technologies,” he said.

There are international models for African governments to follow here. China is creating new legislation to deal with blockchain and how it enables new businesses, and has rolled out a Central Bank Digital Currency.

Singapore is following a similar approach. While policymakers delay, the private sector is stepping in to assist entrepreneurs, with the launch of blockchain-focused incubators like Kenya’s BitHub and South Africa’s Blockstarters.Kreaan Singh, the co-founder of Blockstarters, says in spite of blockchain’s huge potential power, hubs like his were necessary as building and implementing solutions using the tech can be a challenge.

“We have to realise that implementation will be extremely difficult, as those in power will fight tooth and nail to prevent the introduction of transparency in a system from which they personally benefit,” he said.

“Money is arguably the only proven use case of blockchains so far. We know for sure that blockchains are capable of timestamping events or provenance of digital assets, so we are likely to see them being used for applications in law and digital identity.

This will, however, rely on a user experience that is seamless for the average person. We may also start to see African businesses becoming much more prominent in the global economy, given the accessibility and transparent nature of smart contract applications.”And what of investors, who have blown and cold at the space so far?

Llew Claasen, co-founder of VC firm Newtown Partners, which has invested in a number of blockchain and crypto startups, says in many cases the technology is still relatively immature and difficult to deploy at scale.

Yet it is getting better quickly. “I think that the age of decentralised blockchain-based co-operatives as the evolution of two-sided marketplace business models are more than 10 years away, but there are strong incentives to invest early because these crypto-economic networks will tend to create strong network effects and have strong first-mover advantages that will be difficult to overcome once they achieve scale,” he said.

When and how they achieve scale is the big question for now, but what is not in doubt is the huge potential for blockchain in Africa and the serious amounts of innovation we are seeing from companies in the sector.-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Blockchain Company is closer to its beta launch of Blockabase! One of several apps for our Token Economy Ecosystem. Go see Blockabase.com , start adding urls as a very early adopter of almost anything you love or care about and get BASE! Our token for free, each time you submit urls.

Our Search Engine platform token is called BASE and is credited to your Blockabase account by proxy. You are rewarded BASE on every url you add and you are also rewarded BASE when people click, comment or vote on quality urls you have added.

You can import your bookmarks too! Adding urls to Blockabase is a bit like mining Bitcoin! But without all the complexity, anyone can submit urls to help power up Blocakbase.

Blockabase assigns synthetic ownership of the urls you have added for web discovery through our search engine for life! This means you could be making a passive income forever. Every url is unique and added on a first come basis. You can also add as many sub urls of a site you like or care about. Every bit of millions of information, on the entire web is associated with a url and thousands of new websites and platforms are being launched every day all over the world.

So What is Blockabase?

Blockabase ( a colloquial new term we coined for database) is a tokenized, incentivized, interactive and user generated search engine powered by humans + AI.

Google which is still the greatest and most powerful search engine, makes an annual revenue of over $100 billion a year, harnesses all your data for its benefit and users except for publishers, get nothing! At the same time, AI is rapidly eliminating humans from the process of work and our ability to make a decent living. Plus, data surveillance of all your personal data is the new oil.

Blockabase will help you harness your data, so only you can decide whether you wish to monetize it! We believe the future of data should be under your full control of how you wish to share it, keep it, or monetize it. Whenever we utilize your data to show ads over our network, you will see the revenue share in your Blockabase, it's that simple! We have no interest whatsoever in selling your data, unless you expressly opt-in to monetize it over our platform when we enable such features.

As the world inevitably changes, we believe, it is not Universal Basic Income that will provide an income, as white and blue collar professionals lose their jobs significantly, up to 46% by only 2025 according to Oxford University research. Instead, we take the view, it will be the new Token Economy that provides an increasing source of wealth and meaningful income for humans going forward.

We believe Silicon Valley platforms will start to tokenize and reward users for powering up their utilities, leading to an entirely new global economy and user inclusivity dynamics towards 2030.

Our BASE search engine utility token, will seek listings on several crypto exchanges, as we evolve through 2020 and any token rewards in your account will be distributed to wallets respectively at the end of 12 months or sooner.

What you currently experience on Blockabase, is just the very first embryonic MVP ( medium viable product) phase of our development.

Blockabase will aim to morph into a digital economy fit for purpose, where BASE the token, can be p2p exchanged for thousands of products and services discovered in Blockabase search engine and accepted my merchants all over the world using Blockabase for site discovery in competition with the likes of Google, Yahoo and Bing, whom we admire by the way. The only difference is, a new token economy is emerging and we aim to be a significant part of it, with you included.

Blockabase also rewards users for Ads they view over our search engine and wider network. Blockamail, Blockaads, Blockashop and soon Blockapay, are all interoperable applications part of Blockabase network. While Bitcoin unfortunately struggles with a utility use case, Blockabase search engine is the utility use case, powered up from ground zero by you!

At this very early stage, there are still bugs and lots of things for our team to fix going forward. However, it works reasonably now as a medium viable product fit for your purpose to utilize.

There are millions of urls that can be added to Blockabase and and we've made it more engaging and gamified fun to interact with. There are lots and lots of new features coming to Blockabase soon, to give our users a robust experience, as we aim to capture a reasonable part of that $100 billion a year Google makes. We believe the value of our efforts, combined with your user collaboration, should naturally be reflected in the BASE token as we scale.

You can be a passive stakeholder too!

Its free to join and start earning rewards for submitting quality urls, and earning rewards when users comment, like and vote to rank urls you added. The current free user URL Add reward, is 10 BASE per url added. This value and other rewards will decrease or increase, as our governance determines its network growth and stimulant effect.

You can think of Blockabase like an economy where interest rates are determined, subject to growth, supply, or inflation. However when you upgrade and pay a modest annual fee of $50.00, you will be entitled to up to 5x all activity rewards over the platform.

Our Ads utility rewards you separately in your Blockabase account too when Blockaads utility kicks in anytime very soon.

So that’s the skinny for now!

Go tell your friends, mates and family, get on board early to get BASE! Don’t miss out again like most of us did on Bitcoin. Start mining URLs, by simply submitting sites, news, social media and any content with a url to Blockabase.com today... Get involved!

Note* Like most reputable platforms, Blockabase fully reserves the right to remove any content it believes is not acceptable for its search engine.-

Francisco Gimeno - BC Analyst A tokenized, incentivized, interactive and user generated search engine powered by humans + AI! An ambitious proposal. We believe in empowering the individuals and groups through the blockchain and other 4th IR techs. Rewarding the members and users is part of the changes we are going to see soon in the new digital economy. FAANGs, beware, change is coming.

-

-

Imagine an application that doesn’t run on one server but harnesses the excess power of thousands of computers globally and that can be controlled by business automation software that ensures if a specific parameter is met, only then can a function be carried out.

That’s a distributed application – or dApp, as it's sometimes abbreviated – and there are thousands available for download.

[ Read the Download: Beginner's guide to blockchain special report ]

Running atop a blockchain, peer-to-peer (P2P) network that acts as a kind of operating system, dApps create an innovative open-source software ecosystem that is both secure and resilient. And it allows developers to create new online tools, many of which have piqued the interest of global business markets.

[ Take this mobile device management course from PluralSight and learn how to secure devices in your company without degrading the user experience. ]

"DApps will pool resources across numerous machines globally," said Juniper senior analyst Lauren Foye. "The results are applications which do not belong to a sole entity, [but] rather are community-driven."Bitcoin was arguably the first dApp, enabling anyone in the world to download a bit of open-source code to join a blockchain network and verify transactions using a “mining” algorithm, thereby generating digital currency (cryptocurrency) as a reward.

Like a RAIDed storage array, if one of the computers (or nodes) running the dApp software goes down, another node instantaneously resumes the task.

Because smart contracts, or self-executing business automation software, can interact with dApps, they're able to remove administrative overhead, making them one of most attractive features associated with blockchain.

While blockchain acts as an immutable electronic ledger, confirming that transactions have taken place, smart contracts execute predetermined conditions; think about a smart contract as a computer executing on "if/then," or conditional, programming.

“DApps interact with smart contracts that are on the blockchain. So dApps support the user interface into the back-end smart contract that writes data to the blockchain,” said Avivah Litan, a vice president of research at Gartner.

DApps run the gamut, from digital asset exchanges like LBank to online gambling like PokerKing and games like Cryptokitties. (LBank holds the equivalent of more than $1.4 billion in cryptocurrency.)

Depending on the blockchain platform (there are more than a dozen and vastly more modifications of those), dApps are also used by small and large businesses to track and trace goods as they move around the globe and enable cross-border financial transactions without the need of a middleman such as a central bank or clearing house.

The following is a list of 10 game-changing dApps – both business and consumer – in no particular order, according to industry experts such as Litan, and the Linux Foundation’s Hyperledger organization. Some were chosen because of popularity, others because they’re innovative and feature-rich.Chainlink

This secure middleware is promoting an open standard for a secure, decentralized data input or “oracle” system that validates information from external feeds. In short, Chainlink offers any smart contract secure access to data feeds, APIs and payments.It’s so promising that Google is testing it as the intermediary for its BigQuery platform-as-a-service data warehouse.In blockchain, an oracle can be a database or other data source that feeds traditional business information to a smart contract running on a blockchain ledger. Chainlink basically secures the data feed to and from the smart contracts and makes it that much harder to compromise, since it relies on the same types of consensus mechanisms blockchains use to come to agreement on the validity of a transaction.

A smart contract requires multiple inputs to prove contractual performance and Chainlink, which can connect to any API, can be used to validate money transfers from a bank or any number of other industry financial players, such as Visa or PayPal. Oraces are needed because smart contracts don’t interface with external systems or information directly; the oracle allows a smart contract to interact with any external system outside the blockchain (or DLT) they run on, according to Gartner.“This function is critical, especially in permissioned blockchain use cases, so that smart contracts can automatically and reliably respond to changing external circumstances, events and information. Some common examples in financial services include being notified of changing interest rates or asset prices,” Gartner said.Brave

A web browser with almost 9 million active users, Brave is attempting to turn the online advertising model upside down by putting consumers in the driver's seat. The app creates a new measure of value in the advertising world where “consumer attention” is used to set value more than unverifiable views or clicks on a webpage, Gartner said in its Cool Vendors in Blockchain Applications report. Co-founded by Brendan Eich, inventor of JavaScript and a founder of Mozilla and Firefox, Brave seeks to create a blockchain-based digital advertising and services platform that gives both information control and privacy back to users – an increasingly hot topic after the rollout of GDPR.

The dApp enables key participants in the ad ecosystem (namely advertisers, publishers and browser users) to participate in a new business model that cuts out excess intermediation between publishers and advertisers by rewarding users with “Basic Attention Tokens (BATs) or Brave Rewards that can be traded like bitcoin.“If successful, it will greatly reduce the power and influence of the powerful Internet gatekeepers, e.g. Google and Facebook,” Litan wrote via email.EOS Dynasty

In this mix, we had to include at least one game. EOS Dynasty, which has nearly 12,000 unique daily users, claims to be the first role-playing, player-versus-player (PvP) game based on blockchain. Players create up to three “heroes” or warriors who can fight battles to gain experience and grow in power and capabilities by collecting materials, forging equipment and riding mounts (horses, tigers, tortoises, etc.).

The player can also be awarded Three Kingdoms Tokens (TKTs), a limited cryptocurrency (ahem, limited to 1 billion), that enables users to earn material or profit dividends in two marketplaces based on a smart contract.Tokens are collected through a variety of accomplishments, including trading, battlefield conflicts, tasks and PvP fights. Dividends from the game are only awarded after players reach specific military ranks, enabling them to stake TKT cryptocurrency coins and then earn from them.MakerDAO

A decentralized credit service that runs on the Ethereum blockchain platform, MakerDAO supports Dai, a stablecoin whose value is pegged to the U.S. dollar.Anyone can use MakerDAO to open a Collateralized Debt Position (CDP), lock in ETH (Ethereum cryptocurrency) as collateral, and generate Dai as debt against that collateral, according to Marta Piekarska-Geater, director of Ecosystem at Hyperledger.Users can borrow Dai up to 66% of their collateral’s value (150% collateralization ratio).“CDPs that fall below that rate are subject to a 13% penalty and liquidation (by anyone) to bring the CDP out of default. Liquidated collateral is sold on an open market at a 3% discount,” Piekarska-Geater said via email.Chainyard

This dApp and consultancy is striving to solve problems with Supplier Information Management systems, which today are slow, inefficient and unable to adapt to new requirements quickly. Chainyard, a permissioned blockchain-based network, is designed to improve supplier validation, onboarding and life cycle information management.In many cases, supplier information management systems still leverage dated technology and processes; email, spreadsheets and word documents are still used to verify identities and track documents like ISO certifications, bank account info, tax certifications, and certificates of insurance throughout the lifecycle of a supplier.In partnership with IBM, Chainyard launched Trust Your Supplier, a blockchain-based service giving buyers access to their supplier’s verified background information for the purpose of onboarding them onto a supply chain. The ultimate goal: frictionless connectivity across supply chains.TRACEDonate

When it comes to charitabe giving, the “donation sector suffers from lack of transparency and traceability,” Piekarska-Geater said. That's where TRACEDonate comes in: its identity management platform is designed to allow for transparent and traceable cross-border remittances and giving.The dApp created by AID:Tech connects charitable organizations and donors to beneficiaries. It hopes to give donors peace of mind that their funds will be used for the intended purposes by those in need, whether it’s for buying groceries or utilities, rather than alcohol, etc., according to Piekarska-Geater.“It is nearly impossible for regular donors to gain transparency around the distribution of charity and what effect it is having on improving lives,” Piekarska-Geater said.

“Unfortunately, this lack of trust affects end-beneficiaries the most, who are also most in need of support.”Blockchain is used to prove the identity of the charitable organization and/or the individual to which a donation is made. It then allows the donor to track how the money is spent, because the funds are kept in a digital online wallet. Donors can also specify how they want the money used, whether for medical aid, food or other emergency supplies.Circulor

Like similar dApps that emerged before it, Circulor is a dApp offering supply chain traceability – in this case for the electric vehicle and electronics industries. It provides traceability to demonstrate the ethical and sustainable sourcing of raw materials used in the production of the latter.The track-and-trace platform enables users to secure deliveries, manage payments and check provenance of raw materials, and provides a host of other features, making Circulor designed for real-world complexity.Cipher

Created by Avanza Innovations, Cipher is middleware that supports a portfolio of four blockchain dApps for government agencies and regulators in different regions; it includes a reconciliation and settlement network, tokenization of loyalty points, a procurement payment network and a document-exchange, verification and compliance network for banks and their customers.The focus areas for Cipher's blockchain-based solutions are Digital Government Transformation and Financial Regulation & Supervision.

The company works with entities in Dubai, including Smart Dubai Government, the Department of Finance, the Dubai Electric & Water Authority, the Knowledge & Human Development Authority, Emirates NBD Bank and Network International.

“The dApp reduced 40 days of manual reconciliation to instant reconciliation, thereby cutting huge wastage in Dubai’s government functions,” Piekarska-Geater said.KYC-Chain

This app is used by businesses to verify customer identities and streamline the on-boarding process in a way that meets know-your-customer (KYC) regulations. It can verify individuals as well as corporate and institutional business clients for criminal or prohibited activities in real-time through a partner sanctions and watchlists database that spans more than 240 countries.

Together with a self-sovereign identity dApp from partner company SelfKey, KYC-Chain lets users store their own certified identity details on-chain and control public access to their credentials by offering up public keys when access is needed. The dApp allows users to pay individually for 10 services, such as accredited investor checks, crypto funds screening, ID verification and document authentication. The service also lets users check client crypto wallet spending to check against known-risk indicators and comply with anti-money laundering rules.DLT.sg

Built on the Hyperledger Fabric business platform, DLT.sg (Distributed ledger Technologies, Singapore) includes a series of enterprise-grade blockchain dApp modules focused on supply chain and counterfeit recognition technologies; DLT.sg is built for collaborative ecommerce in large supply-chain organizations. It enables trade finance, tracks end-to-end product flow and delivers a model for unlocking inventory and freeing up cash.

For example, SKR,sg’s SmartCode for Pharma is focused on resolving Pharma counterfeits by tracing their provenance throughout the production process. Another module, SmartFIN, is a dApp to help fund trade between multinational corporations, commodity traders and banks; it creates a permissioned online ledger through which corporations can securely interact with their financial institutions in the negotiation of trade finance, bonding & guarantees and risk mitigation.

DLT.sg’s dApps can also integrate with SAP and Microsoft software via APIs, if needed, in order to connect to legacy data sources.

Senior Reporter Lucas Mearian covers financial services IT (including blockchain), healthcare IT and enterprise mobile issues (including mobility management, security, hardware and apps).

-

Francisco Gimeno - BC Analyst When reading about the blockchain we tend to forget that is a tool to make protocols. The Dapps are a result of blockchain's use. Positive: that there are already powerful Apps like these in the article. The matter now would be to create Dapps which are massively used as we use now Google, FB or other applications of different protocols. A Dapp globally used, with blockchain protocols which can enmesh other 4th IR tech will be a winner.

-

-

China’s recent blockchain development bonanza shows no sign of abatement. Business leaders and investors seized on President Xi Jinping’s first-ever endorsement of blockchain as an underpinning technology, and new initiatives sprung up almost overnight.

But Chinese firms, investors and universities have been working quietly on blockchain projects since 2014. From pledging loyalty to the Communist Party and identifying smart city citizens to verifying pigs and tracking liquor shipments, here’s how China’s gone all-in on blockchain.1. An identification system for cities

China’s wasting no time with this one. Since Sunday, city authorities across China have been eligible to apply for a city identification code to link them into a blockchain network developed by three institutes in Shijiazhuang city. The network aims to enable data sharing and interconnectivity between provinces. But Chinese smart city goals don’t end there. China’s aim is to have 100 operational smart cities by 2020, including its future capital Xiongan, and blockchain will feature prominently.2. An authentication method for everything from liquor to pig meat

Prized by international dignitaries (one bottle is a staggering $450,) Moutai liquor is blended from up to 200 spirits and is manufactured by only one company, Kweichow Moutai Co., a partially state-owned Chinese enterprise. The company has been working with Ant Financial (an affiliate of China's internet behemoth Alibaba) since March 2018, to develop a blockchain-based anti-counterfeiting system for its premium hooch.

The country that’s famous for its copies of everything from Louis Vuitton bags to WAL-MART (China’s version is WU-MART), has embraced blockchain’s authentication talents like no other. It’s using them for everything from verifying pigs to “information asymmetry" in trade finance.3. A national digital currency

Many of China’s applications are a far cry from the vision of the technology’s creator Satoshi Nakamoto. One example is China’s plan for a national digital currency. It won’t be decentralized—one of the main factors ensuring that a blockchain is tamper-proof. That’s why some are calling the technology’s renaissance in China, “blockchain with Chinese characteristics.”Decentralized or not, China’s national digital currency is still likely to get off the starting blocks before Facebook’s Libra—the project that’s rumored to have precipitated its speedy rollout.4. A highway to innovation for Big Tech and banks

China’s Big Tech players, such as Jack Ma’s Ant Financial, have long been experimenting with blockchain for financial applications, such as cross-border micro-transaction payments, as well as medical reimbursement and leasing contracts. Things are going well. The People’s Bank of China, Shenzhen branch, reported, in October, that its blockchain-based trade finance platform has processed $10.7 billion in transactions in the past year.5. A hallowed technology worthy of government investment

Local government officials have begun to provide funding for "outstanding blockchain projects.”—a step up from more stealthy governmental funding of the technology through its “key pillar” projects, such tech giant, Tencent. The city of Guangzhou, a blockchain innovation hub since at least 2017, last week introduced a $150 million initiative to support two public or private-based blockchain projects per year.

There’s no reason to think that other regions won’t follow suit. And standardized regulations for the industry are also in the works.For good measure—irony of ironies, considering its prohibitive stance on cryptocurrencies—China has begun cracking down on any articles daring to tarnish blockchain.6. A breeding ground for tech unicorns

The prospect of billions of dollars in cheap government financing and subsidies, has led to Chinese investors snapping up shares in blockchain-related businesses. More than 85 stocks surged by 10 percent—the daily limit on trading in Shanghai and Shenzhen— the Financial Times reported last week.

But China is also home to three of the world’s top Bitcoin mining companies. Last week Chinese Bitcoin miner Bitmain bested all other crypto startups on this year’s “Global Unicorn List,” published by the Shanghai-based Hurun Report. And, on Wednesday, China finally put an end to speculation that bitcoin mining would be phased out, ensuring a more certain future for Canaan and Ebang, and Bitmain too, if it can sort its civil war.7. A tool for party loyalty

The study of blockchain has become a national movement in China—from civil servants, to stay-at-home moms, the public has been encouraged to study Introduction to Blockchain, on “Xuexi Qiangguo,” an app designed to teach President Xi’s thoughts. A national “Blockchain Day” is even under consideration.

And to provide indisputable evidence of loyalty to the Communist Party, a news publication operated by the People’s Daily newspaper has asked Party members to stamp their declarations of fealty directly onto a blockchain.-

Francisco Gimeno - BC Analyst Interesting analysis on how China approaches the blockchain tech and industry. It should be a very good approach, with the exception that, as with almost everything in the country, is enmeshed with the particular politics and social control systems they have there. Everyone in the industry should be very aware of what is going there, as China (or Chinese Whales) dominate a lot of the crypto market, and also the State's support for the development and use of the technology will make its spread easier in that part of the world.

-

-

Opinions expressed by Entrepreneur contributors are their own.

A little over two years ago, I was at my company’s holiday dinner, and the only topic of conversation was the stratospheric rise of cryptocurrencies like Bitcoin, Ethereum and those others that were lesser known but certainly more amusingly named (like Putincoin).

Related: Should You Still Invest in Bitcoin in 2018?

With Bitcoin at that time topping $20,000 and Crypto Kitties also hitting the world by storm, something momentous was afoot; and we all wanted in. Yet, my company’s CTO called a halt to our excitement, cautioning that a deep decline was coming.