Blockchain technology

- by Leoris

- 6 posts

-

The technology underpinning blockchain is a powerful decentralizing network architecture that could revolutionize many industries. Now, some artists are leveraging blockchain to help guarantee the authenticity of their work -- and ensure that they get paid. Miles O’Brien reports on how digital documentation is putting power back into artists' hands, even when no tangible object exists.

This report features artists Nanu Berks, RFX1, Orvz1, Beatriz Ramos, Boris Toledo, Massel Quispe, Susana Riveros, Raul Avila, Javier Errecarte, Lorena Pinasco, Boris Simunich, Isa Kost, Vanesa Stati, Marko Zubak and their work.

Stream your PBS favorites with the PBS app: https://to.pbs.org/2Jb8twG

Find more from PBS NewsHour at https://www.pbs.org/newshour

Subscribe to our YouTube channel: https://bit.ly/2HfsCD6-

By

Admin

Admin - 2 comments

- 5 likes

- Like

- Share

-

- 1

Francisco Gimeno - BC Analyst Exciting insight on how the blockchain disrupt the "business as usual"mentality, empowering artists and tokenising everything. This is going to happen everywhere among all artists, from painters to actors, sport and e-sport players, cinema and anything you can think about.- 10 1 vote

- Reply

-

- 1

Jakobo Gimeno As an artist, the biggest problem is art theft and not getting paid for work that I have done. Blockchain being used to benefit artists was something I never predicted to happen. This is a good example of how the technology can be utilized in many ways.- 10 1 vote

- Reply

-

By

-

Report: Gartner sees blockchain as ‘transformational’ across industries – in 5 t... (computerworld.com)

CIOs have to continue to educate execs and senior leaders about blockchain opportunities and challenges and continue to develop proofs of concept to test its business worthiness, the research firm says.

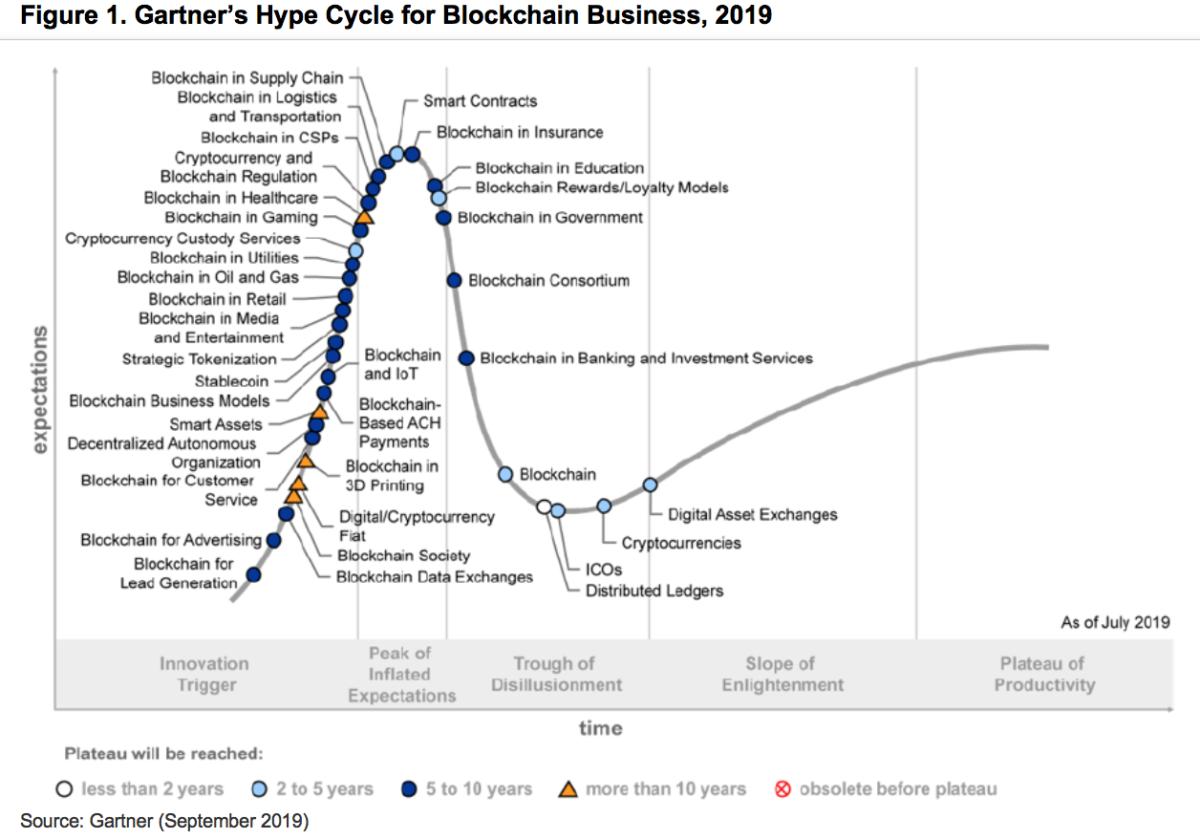

Research firm Gartner, whose past evaluations of blockchain have been conservative to say the least, expects the distributed ledger technology to transform the ways businesses operate in most industries within five to 10 years.

Right now, however, blockchain for most industries remains mired between inflated industry expectations and general disillusionment with regard to how it can improve business processes, according Gartner's latest "Hype Cycle" report.The report includes a survey of CIOs on how they perceive blockchain technology.

[ Further reading: Blockchain: The complete guide ]"Even though they are still uncertain of the impact blockchain will have on their businesses, 60% of CIOs in the Gartner 2019 CIO Agenda Survey said that they expected some level of adoption of blockchain technologies in the next three years," David Furlonger, a Gartner distinguished research vice president, said in a statement.

"However, the existing digital infrastructure of organizations and the lack of clear blockchain governance are limiting CIOs from getting full value with blockchain."Gartner's annual survey of CIOs was conducted from April through June and had 3,102 respondents from 89 countries and across major industries, including manufacturing, government, professional services, banking, energy/utilities, education, insurance, retail, healthcare, transportation, communications and media.

Last year, a Gartner CIO survey revealed on average that only 3.3% of companies worldwide had actually deployed blockchain in a production environment.In a blog post at that time, Gartner distinguished research vice president Avivah Litan listed eight hurdles needed for the technology to meet the goals stated by tech providers hawking it as a cure-all for virtually any international, transactional network need – from fee-less, cross-border payments to supply chain tracking.

Those hurdles included technically scalable blockchains, advances in smart contract technology, transaction risk assurance, data confidentiality, and an efficient consensus algorithm.

Blockchains require a consensus among users before new data can be saved to the immutable ledger; most often, at least 51% of computer nodes validating ledger entries must agree before new blocks can be added.In the latest Gartner research data, banking and investment services industries continued to see high levels of interest from innovators looking to improve decades-old operations and processes.

But only 7.6% of respondents to the CIO Survey suggested that blockchain is a game-changing technology. That said, nearly 18% of banking and investment services CIOs said they have adopted or will adopt some form of blockchain technology within the next 12 months, and nearly another 15% plan to do so within two years.

Blockchain proofs of concept or pilots are showing up in several key areas in banking and investments services, "primarily focused on permissioned ledgers," Furlonger said. That refers to centrally-controlled blockchain networks whose participants are previously vetted before being allowed to participate.

"We also expect continued developments in the creation and acceptance of digital tokens," Furlonger continued. "However, considerable work needs to be completed in non-technology-related activities such as standards, regulatory frameworks and organization structures for blockchain capabilities to reach the Plateau of Productivity – the point at which mainstream adoption takes off, in this industry.

"Gartner gauges the maturation of new technology through its "Hype Cycle," a graphic-based life-cycle that follows five phases: from the Technology Trigger, when proof-of-concept stories and media interest emerges, to the Plateau of Productivity, when mainstream adoption occurs - if the technology is more than niche.

Among those five Hype Cycles is the "Peak of Inflated Expectations" followed by the "Trough of Disillusionment," when interest wanes as pilots and fail to deliver and tech providers either work out the kinks and improve the technology, or ultimately fall short and die out.

Gartner

In retail, blockchain is being considered for "track and trace" services, counterfeit prevention, inventory management and auditing – any of which could be used to improve product quality or food safety.

For example, Walmart has adopted blockchain to track produce from farm to shelf.While supply chains have value, the real impact of blockchain for retail will depend on supporting new ideas — such as using it to transform or augment loyalty programs, according to Gartner. For example, through loyalty cards, retail businesses can offer customers digital currency such as bitcoin that can be exchanged for various other currencies, goods or services.

"Once it has been combined with the Internet of Things (IoT) and artificial intelligence (AI), blockchain has the potential to change retail business models forever, impacting both data and monetary flows and avoiding centralization of market power," Gartner said.

As a result, Gartner believes that blockchain has the potential to transform business models across all industries — but the opportunities demand that enterprises adopt complete blockchain ecosystems. Without tokenization and decentralization, most industries will not see real business value.

The journey to create a multi-company blockchain consortium is inherently awkward, Garter said.

"Making wholesale changes to decades-old enterprise methodologies is hard to achieve in any situation.

However, the transformative nature of blockchain works across multiple levels simultaneously (process, operating model, business strategy and industry structure), and depends on coordinated action across multiple companies."In particular, Gartner recommends that CIOs:

■ Continue to educate executives and senior leaders about the blockchain opportunities and challenges most critical for business.

■ Build thought leadership within IT and fight unwarranted vendor hype.

■ Expect different industry domains (upstream, midstream, downstream and marketing) and functional areas (such as commodity trading, international cash management, field supply chains and data integrity) to adopt blockchain on different timelines.

■ Continue to develop proofs of concept internally as well as part of market consortiums.

■ Expect complicated challenges as early solutions will likely be a mix of significant

process redesign, agile solution development, multiple cloud integrations and a large number of integration points with legacy systems.-

Francisco Gimeno - BC Analyst This Hype cycle scheme for the blockchain has been around for a couple of years already. Now we are in the stage of "Trough of disillusionment", where there is some fatigue and some expectations have not been realised yet. This is a stage, anyway, and we all expect to see soon a new cycle. The blockchain need to work on governance and on practical uses cases which, at now, are few and separated from each other, albeit are good examples of what we believe the 4th IR will bring with the blockchain and other new techs.

-

-

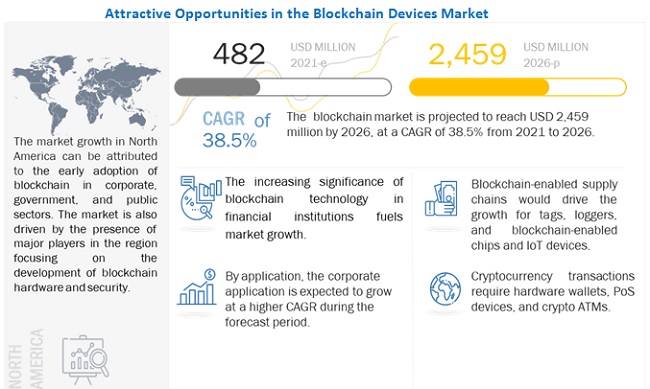

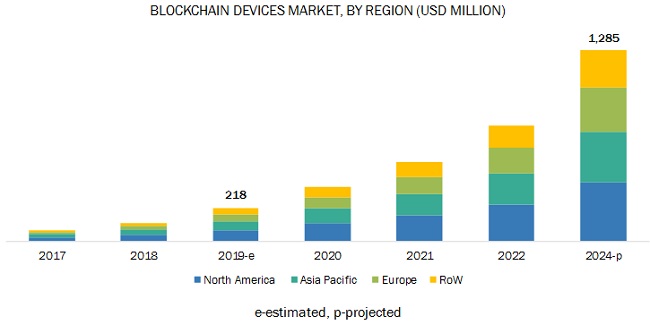

Download Research: Blockchain Devices Market Size, Share, and Industry Analysis ... (marketsandmarkets.com)The blockchain devices market is projected to grow from USD 218 million in 2019 to USD 1,285 million by 2024, at a CAGR of 42.5% from 2019 to 2024.

Some of the major growth drivers for this market include increasing adoption of blockchain technology in retail & supply chain management, rising venture capital funding, and growing market cap for cryptocurrency and Initial Coin Offering (ICO).

One of the key opportunities for the market is the increasing acceptance of cryptocurrency across various industries and regions. Whereas, major factors restraining the market growth include uncertain regulations & compliances and lack of awareness.

Wireless connectivity for blockchain devices to grow at higher CAGR during the forecast period

Blockchain smartphones, PoS devices, etc. use wireless connectivity for data transfer. They use Wi-Fi, Bluetooth, and near-field communication (NFC) technologies.

Based on type, the wireless connectivity segment of the blockchain devices market has been segmented into blockchain smartphones, crypto hardware wallets, and PoS devices. Major companies such as Ledger (France), and Pundi X (Singapore) are majorly focusing on blockchain devices that are implemented with wireless connectivity.Other devices for Blockchain devices to grow at higher CAGR during the forecast period

Of all the types of devices, other devices such as blockchain gateways & pre-configured devices expected to grow at the highest CAGR during the forecast period. Blockchain is a universal purpose digital identity gateway, which enables corporations, governments, and institutions to bridge their legacy systems with the decentralized blockchain networks.

The pre-configured devices equipped with an operating system allow access to the blockchain network from a normal network. They are used to provide Web3 access and personal home servers to blockchain networks. This device majorly adopted in industries such as banking, financial service, and insurance (BFSI), government, retail & e-commerce, travel & hospitality, automotive, transportation & logistics, IT & telecommunication, etc.

North America to account for the largest market size during the forecast period

North America is among the major contributors to the blockchain devices market, and the US accounted for the largest share of the market in North America in 2018. North America dominates the global market as the region is an early adopter of blockchain devices.

North America is an early adopter of innovative technologies as banks, government agencies, and financial institutes in this region face ever-increasing challenges related to security & transparency of the data and the transactions.

Therefore, advanced technologies are implemented to manage this information via blockchain devices. Moreover, several blockchain devices vendors are based in this region, thereby contributing to the growth of the blockchain devices market in North America.Key Market Players

Ledger SAS (France), HTC Corporation (Taiwan), Pundi X Labs Private Limited (Singapore), Filament (US), GENERAL BYTES R.O. (Czech Republic), RIDDLE&CODE (Austria), AVADO (Switzerland), Sikur (US), SIRIN LABS (Switzerland), Blockchain Luxembourg S.A. (UK), SatoshiLabs (Czech Republic), Genesis Coin Inc. (US), and Lamassu Industries AG (Switzerland) are some of the major players in the blockchain devices market.Report Scope

Report MetricDetailsMarket size available for years2019-2024Base year considered2018Forecast period2019–2024Forecast unitsValue, USD thousand/millionSegments coveredBy type, connectivity type, application, and regionRegions coveredNorth America, Europe, APAC, and RoWCompanies coveredLedger SAS (France), HTC Corporation (Taiwan), Pundi X Labs Private Limited (Singapore), Filament (US), GENERAL BYTES R.O. (Czech Republic), RIDDLE&CODE (Austria)Blockchain devices market segmentation:

In this report, the blockchain devices market is segmented into the following categories:Blockchain devices market, by Type:

- Blockchain smartphones

- Crypto hardware wallets

- Crypto ATMs

- POS devices

- Others (blockchain gateways and pre-configured devices)

Blockchain devices market, by Connectivity:

- Wired

- Wireless

Blockchain devices market, by Application:

- Personal

- Corporate

Blockchain devices market, by Region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments

- Ledger launched a new product, Ledger Nano X in May 2019. This new product is similar to Nano S, but Bluetooth connectivity is the added feature in it. Users will be able to connect with their computers wirelessly, and Ledger’s Live Mobile app will be able to send and receive cryptocurrencies via phones.

- HTC launched its first blockchain phone, EXODUS 1 in October 2018. This phone provides the premium performance and quality of design expected from HTC’s flagship device lineup. It combines with blockchain technology and software necessary to create a smartphone experience fit for a modern user and the new internet age.

- Pundi X launched a new blockchain smartphone, Function X in June 2019. This new smartphone is based on Android OS 9.0, making it compatible with Android apps. Function X is a total decentralized solution and not just a public chain. It consists of five essential components—Function X OS, Function X Blockchain, Function X IPFS, FXTP Protocol, and the Function X Docker. The main aim of these features is to decentralize all apps, websites, communications, and data.

- Filament announced the launch of Blocklet for trusted vehicle applications (TVA) in November 2018. It is the industry’s first end-to-end automotive blockchain platform that allows vehicles to participate directly in blockchain and distributed ledger technologies (DLTS). The Blocklet hardware for trusted vehicle applications includes filament’s Blocklet technology as well as cellular connectivity, and environmental sensing and access to vehicle diagnostics. Blocklet TVA is a secure and flexible platform that enables a wide range of new products, services, and business models to be created at the intersection of vehicles and blockchains

- RIDDLE&CODE launched hardware-based blockchain car wallets to enable future mobility solutions. With the help of this device, Cars will automatically settle value and exchange data with charging solutions, smart city systems, or parking zones without human interaction.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- Which are the upcoming industries that expected to adopt Blockchain devices?

- How is Blockchain devices influencing the automotive market?

- How are the companies addressing the challenge of hardware and software integration for Blockchain devices market?

- How are companies tackling the increasing number of connected devices that result in increasing issue of security?

Download the Report Here:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=177053178-

Francisco Gimeno - BC Analyst Very few years ago we couldn't even imagine a smart phone, or a VR device. Nobody would put any hope on the Cloud. however, we all feel unable to live in a world without these devices or technologies. The blockchain devices which are coming are also going to transform our lives in very few years, some we can imagine now (see the list in the article) and some which no doubt will appear from ideas which now seem science fiction. We live in interesting, disrupting and exciting times, indeed.

-

If you are one of the 2.4 billion active Facebook users, the probability that your data has been leaked is around 17%, given the recent news of 419 million accounts being exposed.

This means that, unless something changes, every sixth active user could lose control over their personal data. Again and again, no matter the government or the company managing personal data or how secure their systems are, personal data leaks happen all the time.

But what are the fundamental problems of centralization and how can we rescue our data from criminals, greedy marketers and corrupt governments?Leaks are inevitable

The last two weeks have brought us tremendous news about leaks. The most recent concerning the aforementioned database of 419 million Facebook accounts was found available to download on the internet and complete with details such as names, phone numbers, gender and country of residence.

A while ago, Mastercard officially reported about 90,000 exposed accounts to European Union authorities.

Once, when I was living in Ukraine, I went to a bank to apply for a credit card. I asked the clerk why she had not requested any proof of income to grant me a credit limit.

She replied that they had already checked the database of the pension fund. Any salary is taxed at a certain amount by the state pension fund, so by seeing my paid taxes, they could calculate my income.

"Oh, my God,” I thought. “They aren’t even trying to hide the fact that they are using a stolen database with the personal data of everyone in the country.”Hopefully, there is no need to prove that the security of personal data cannot be promised by anybody.

In some cases, the right to personal privacy will be ignored, while in other cases, users may never know about the violations (thanks for the tip, Edward Snowden).

For some people, these violations of privacy threaten well-being and freedom, such as the Chinese government hacking the iPhone’s infrastructure to capture Uyghurs living in China.

And the reason for that is centralization. Large clusters of personal datasets are concentrated on the servers of service providers, which makes this data vulnerable.Can the blockchain help?

The answer is not obvious — but yes, it can help. We need to change everything fundamentally in terms of how we manage personal data. And it can be only done with the help of blockchain and government cooperation.

During the last few years, initial coin offering (ICO)-driven attempts were made to “disrupt” the digital ID industry. I don’t want to mention any of these projects. Maybe some of them had sincere intentions, but they appeared to be premature in solving issues at global and national levels.

Related: Online ID Control: Blockchain Platforms vs. Governments and Facebook

Two new terms pertaining to the changes in personal data management are DID, which stands for “decentralized digital identifiers,” and Verifiable Credentials (which is one step away from becoming a standard). New standards for sovereign digital identity are being devised by the Digital Identity Foundation (DIF) and the World Wide Web Consortium (W3C).

The W3C Community outlined a set of general concepts, standards and methods aimed to write a new page in information and communications technology.

DID-compliant methods that have been recently developed as a prototype may be unknown even to some DID enthusiasts.

The concept is as follows: Users store personal data locally on their devices, thereby contradicting the current paradigm of state-managed cloud-based registries with partially restricted access. Users never need to disclose all their data, but only partially and only when it is justified.

Authentication is performed using a Merkle tree and digitally signed roots, which are stored on the blockchain. Service providers (web-services, governments, etc.) do not store personal data but can verify your digital identity at any moment when interacting with you.

The concept authored by Mykhailo Tiutin from Vareger works as follows. First, the data can and must be stored on the user’s device instead of on a third-party server. In many cases, the data should not even leave the user’s device or be disclosed — but when disclosed, the agent receives only a fraction of the personal data required for the interaction in question.

For example, you walk into a liquor store. Both you and the cashier have mobile devices with a preinstalled identity verification service. United States law prohibits the sale of alcohol to persons under the age of 21.

Technically, the cashier does not need to know your name, your social security number or even your birthday — only whether you are over the age of 21, as per the law.

For an engineer who designs this system, the question, “Are you over 21 years old?” is just a Boolean variable of 0 = No, 1 = Yes. To design this system, one needs a few things: a Merkle tree, where the leaves are hashes of personal data (name, birthday, address, photo, etc.) and the root, which is a cryptographic string signed by a trust service provider (TSP).

The trust provider can be the government (for example, the Ministry of Internal Affairs), a bank or a friend — i.e., someone whom the parties mutually trust. The root and the signature, as well as the digital ID of the TSP, are stored on the blockchain.

The scene at the store goes as follows: You take out your smartphone, open your identity verification app, and select which data you would like to disclose to the cashier's device. In this case: the root, the provider’s digital signature, your picture and the “Over 21” Boolean. No names, no addresses, no SSNs.

The cashier will see the verification result on her device. The device will show the photograph sent from the customer's device and will check if the picture is verified by a TSP.

But because you could have taken someone else's smartphone, the cashier checks if the picture on the screen matches the buyer's face.

No data except the root and the signature is stored on the blockchain — everything stays on your smartphone. Of course, the seller may try to save your picture on their device, but we will discuss that later.The advantage of this scheme is that there can be multiple roots with separate TSPs.

For example, you can have a root for proof of education, for which your educational institution will be the provider certifying your credits and graduation. There can also be multiple trust providers for the same data.

For instance, as a person, you can have one identity verified in three different countries, but managing multiple digital IDs has become a nightmare — you need to remember dozens of passwords and methods of authorization — but with DID, you can have one universal ID.

You can also create a pseudonym on social media, forums and online stores. There, you can be a “kitty” or just a nameless ID, if you wish. Pseudonyms can be linked via zero-knowledge protocols to a TSP’s signature, which means there is a digital proof that your identity is verified, but it is hidden from the web service.

There are many ways and schemes on how to protect identity, but the core idea is that all data should be under your control — in most cases, you shouldn’t have to disclose your data at all (by zero-knowledge proof protocols) and in some cases, you only need to partially disclose.Will they store your data?

W3C and different enthusiasts have been working on DIDs and Verifiable Credentials concepts for a few years now, but unfortunately, we have not seen any mass adoption yet and the major snag is governments.

There are two main things that need to happen for this to materialize:1. Governments themselves cease centralizing personal data.

As mentioned above, nobody — including the government — will guarantee the security of your data. One day, it will be exposed, and you should count yourself lucky if that leak does not lose your money or threaten your life. Therefore, first of all, governments must cease storing personal data.

This flip in practice is the only way to ensure secure personal data. This statement may be mind-blowing for “pro-state” thinkers, but DID and Verifiable Credentials methods ensure Know Your Customer, or KYC, without exposing personal data.

There is no need for a government to collect personal data unless it has sinister intentions.

A digital ID is necessary for certain activities on a federal level: registering a company, declaring taxes, voting, etc. At these moments, the ID must be verified with an acceptable level of certainty, which will be provided by blockchain and the infrastructure of trust service providers.2. New privacy regulations impose such high standards for personal data storage and third-party fines that storage will become economically unfeasible.

“PDPR” must become the second step after General Data Protection Regulation (GDPR), where “P” stands for “personal.” While the U.S. and other countries are trying to recover from GDPR, the concept of “Personal Data Protection Regulation” is already being discussed in the EU.

A major factor in this is that politicians must have the courage to adopt the strictest rules and impose the highest fines that can be applied.

And there is only one purpose for this: Whenever any company, bank or public servant wonders if it is a good idea to store someone’s personal data, they need to think very carefully about whether their reasons suffice, because we know that whenever personal data is centralized, it will inevitably be exposed someday.

Instead, data stored on the user’s device will create more barriers. It is easier to steal 500 million accounts from one device than from 500 million independent devices.

Every person should have the right to control the public availability of their personal data and to decide for themselves what they would like to share.

Therefore, new regulations and technology need to be angled toward stopping the practice of centrally storing personal data. If not, then relax and get used to losing your own — one “I Agree” button at a time.

Related: GDPR and Blockchain: Is the New EU Data Protection Regulation a Threat or an Incentive?

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.

Oleksii Konashevych is a Ph.D. fellow in an international program funded by the EU government, Erasmus Mundus Joint International Doctoral Fellow in Law, Science and Technology. Currently, Oleksii is visiting RMIT and collaborates with the Blockchain Innovation Hub, doing his research in the field of the use of blockchain technologies for e-governance and e-democracy.-

Francisco Gimeno - BC Analyst Data leakages will always happen. Scammers and fraudsters will always go a step ahead of anyone else. The human factor is there. The blockchain will minimise this a lot, but the way data is used will depend on how governments or international bodies regulate data handling. Our aim is a tokenised society where my data is only mine and only I can give my data to others in a safe and secure way through blockchain protocols. But the governments and economic institutions' commitment is necessary too.

-

-

Cryptokitties creator Dapper Labs raises $11 million and unveils Flow blockchain... (venturebeat.com)Dapper Labs, the company behind CryptoKitties and upcoming projects such as NBA Top Shot, has raised $11 million in funding. It also unveiled the development of Flow, a new blockchain built to enable decentralized applications at scale.

The largest investor in the round was Andreessen Horowitz’s crypto fund, with participation from new investors Accomplice, AppWorks, Autonomous Partners, Fenbushi Digital, and Warner Music Group.

Existing investors that also participated in the funding included Union Square Ventures, Venrock, Digital Currency Group, Animoca Brands, SV Angel, Version One, and CoinFund, among others. Angel investors who participated in this round included William Mougayar, James and Glenn Hutchins, Don Mattrick, and Nanon de Gaspe Beaubien-Mattrick.

“After almost two years of research, we’re excited to share Flow with the world,” said Roham Gharegozlou, CEO of Dapper Labs, in a statement. “Flow is a blockchain built from the ground up to support high-performance ecosystems of apps and games without compromising decentralization.

Bitcoin and Ethereum show how crypto can make the world of finance more open and transparent; Flow will do the same for consumers of entertainment and culture.

”Some of the types of experiences Flow will support include: artists or bands using crypto tokens to give music lovers new ways to show their fandom; games that reward players for adding value and enable interoperability with assets and identities that users can take across environments; or platforms for sports fans around the world to trade verified, authentic, limited-edition digital memorabilia in real-time.

“Warner Music is always searching for new opportunities for our artists and has dedicated itself to exploring emerging technologies to enable these,” said Jeff Bronikowski, senior vice president at Warner Music Group, in a statement.

“When we met with Dapper Labs, they immediately understood our vision so we sought to solidify the partnership through this strategic investment.”In addition to the new investment, Dapper Labs is announcing partnerships with leading entertainment publishers to ensure Flow is ready for enterprise-scale use-cases.

Ubisoft, well known for developing games like Far Cry, Just Dance, and Assassin’s Creed, is advising on Flow, providing valuable industry feedback.

“When it comes to new technologies and innovation, Ubisoft has always favored a collaborative approach,” said Nicolas Pouard, blockchain initiative director at Ubisoft’s Strategic Innovation Lab, in a statement.

“We are eager to learn more from Dapper Labs, some of the most talented pioneers in the field of blockchain-gaming while bringing our own experience of the gaming industry and triple-A development. As a player-centric technology, we believe blockchain can help make players true stakeholders and we can’t wait to see what we will achieve with this partnership.

”Animoca Brands, a renowned game developer and publisher that is currently developing a number of crypto games including F1 Delta Time and The Sandbox, will be one of the first game companies to build on Flow. These companies will contribute to making Flow a strong platform for consumer entertainment.

“We believe that crypto is the future of the gaming industry,” said Yat Siu, chairman of Animoca Brands, in a statement.

“In order to support the scale expected from games that reach and are adopted by mainstream consumers, we need a strong platform that takes into account the needs of developers and the superpowers of decentralized entertainment, which is why we will work with Dapper Labs to build fun, accessible experiences on Flow.

”Flow will launch in 2020, in time to support many of the company’s large-scale, consumer-facing entertainment, music, and gaming projects in the works. Dapper Labs has raised $40 million to date.-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

When most people hear the word “blockchain,” they automatically associate it with cryptocurrencies such as Bitcoin. This often has negative connotations given high price volatilities, shady use cases, and negative environmental impacts.

However, cryptocurrency production and trading is a small aspect of blockchain technology, which has numerous use cases. In fact, blockchain technology is already proving to be a critical tool for social innovation.

Affiliates of the Stanford Graduate School of Business recently released a report on the use of blockchain technology for social impact. Spearheaded by Douglas Galen, a lecturer at the Stanford GSB and co-founder and CEO of Rippleworks, the project brought together students from across the university to research and interview a diverse set of organizations who are using blockchain technology as an integral part of their strategy.

The majority of organizations surveyed said that their use of blockchain technology was motivated by providing a broader social good.The case studies that constitute the report are illuminating.

How organizations use blockchain for social impact varies considerably by sector. For example, in the climate and environment space, most of the interviewed companies used blockchain for the creation of marketplaces.

These companies process millions of transactions trading and distributing energy for the purpose of using natural resources more efficiently and mitigating environmental degradation. On the other hand, fintech companies focused on serving the unbanked population are more likely to use blockchain to facilitate and process payments and transactions.

This use of blockchain has the potential to disrupt and reform the financial sector, which has not traditionally served the poor effectively. Finally, in the healthcare space, blockchain technology facilitates secure and accurate storage and retrieval of electronic medical records.

Blockchain is very useful for maintaining patient privacy (thereby adhering to HIPAA standards) while at the same time ensuring the consistency of de-identified records and preventing mistreatment.

Given the potential of blockchain to solve such challenges, are there any downsides to adopting blockchain technology in service of impact?

In terms of challenges facing the use of blockchain technology for social good, companies across many sectors had a similar response: (lack of) regulation. It is risky and costly to implement blockchain infrastructure in a nascent and undeveloped regulatory environment.

Hopefully, the report will allow companies to collaborate in working with policymakers and regulators.

If you are interested in using blockchain technology in your own organization, or simply want to learn more about the space, I highly recommend reading the report.

Getty royalty free GETTY

Follow me on Twitter.

Neil MalhotraI am the Edith M. Cornell Professor of Political Economy at the Stanford Graduate School of Business where I direct the Center for Social Innovation (CSI). CSI’s mission... Read More-

By

Admin

Admin - 0 comments

- 2 likes

- Like

- Share

-

By