Cryptocurrencies are becoming a common alternative to trading and a great money management tool.

Are you interested in dipping your toes in crypto waters but want to check out how it works first? Or maybe it is your friend who is willing to try something better than a bank, Sofi or Paypal without taking financial risks? Try crypto simulators to safely trade multiple cryptocurrencies without investing real money.

First off, let us come down to the essentials and provide insight into how it works. A cryptocurrency simulator is a universal tool that was developed for learning how to trade on a cryptocurrency exchange.

It works in real-time, receiving the necessary information about current rates, orders and transactions for all cryptocurrencies that are available on the specific crypto exchange.

A crypto simulator makes it possible to use funds on a virtual account and will be useful for both beginners and experienced traders in working out trading strategies without the risk of losing a deposit.

Each transaction in the simulator is recorded in the diary, which allows you to analyze your trading history. Access to the diary can be open to all users or limited so that only you and your friends see it.

Game-design elements and smooth UX make many crypto sims a perfect way to learn to trade from your phone or laptop. We have searched high and low for the best software developed by the leading crypto exchanges and ranked them according to users’ preferences.

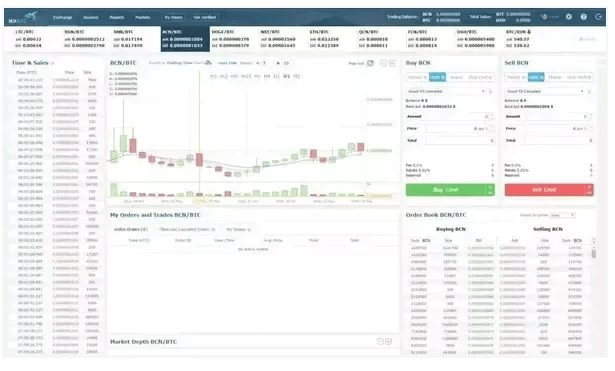

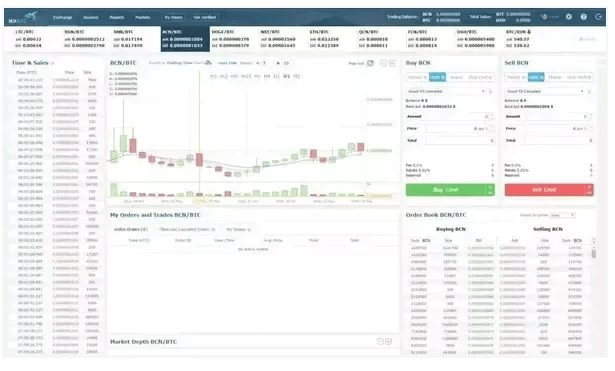

HitBTC is a global trading platform supporting digital assets, fiat currencies, tokens and ICOs since 2013. Here you can practice trading Bitcoin and Litecoin and you don’t even need to register to use the demo. Like many competitors, HitBTC offers a demo account.

However, HitBTC’s demo account stands out. What is good about this educational and training platform? It enables users to trade manually or via the API.

Relying on HitBTC’s blog, “the test mode is as fast and responsive as the regular exchange platform.” Besides the 0.1% fees, 800+ pairs, over 500 spot instruments supported and powerful APIs, HiBTC has a standout element that is not always the case with competitors.

You don’t need to provide other personal information than email and password before using the demo account, which helps potential clients protect their privacy.

Some users dislike high withdrawal fees for several tokens. You should keep in mind that HitBTC has flat fees that don’t change no matter how many coins a user wants to withdraw.

Over the years there were cases of unexpected delisting which caused problems with traders. Since then HitBTC has warned about its reactions to market changes in social media. Users can check the status of each coin at the System Monitor page.

Multi-factor authentication might seem a problem but it actually grants security. “I like that the company is striving to protect user’s funds to keep their account disabled until they enable 2fa protection. It saved me when some hacker tried to steal my funds but he couldn’t since the team took care of it” - a CryptoCompare user says.

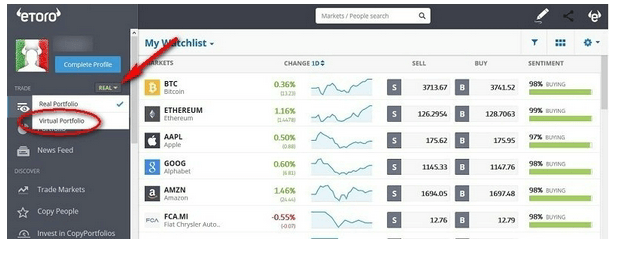

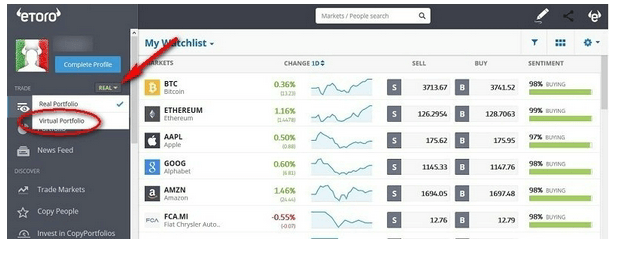

eToro is an interesting notion in global Fintech. Starting as a small brokerage company, it grew into a social trading network with crypto coins, currencies, stocks and commodities among its instruments.

The strong point of the exchange is that it allows traders to learn from each other. Its products OpenBook and WebTraders enable users to watch trading strategies of others and copy them.

Also, you can get a demo account with 100.000 virtual USD to check out trends and understand how the system works. Besides the demo eToro offers a marketplace where you can commute with other traders. The downsides are that you have to enter private data like your email address and telephone number.

Alternatively you can login with Facebook or Google+, which doesn’t sound secure as well. Copy-trading that was marked as a good feature also is quite controversial as it can’t guarantee newbies either gains or losses.

If you consider using this demo for trading on eToro in the future, mind the pitfalls of the exchange. The fees are higher than average.

The majority of retail investors dealing with CFDs are put off from this provider because of the 75% money loss cases. What also disappoints is the lack of a standalone version and connecting technology for third-party software. Also, eToro is said to be “designed for people that never leave their country.” So be mindful of this quirk if you are planning to trade from different IPs.

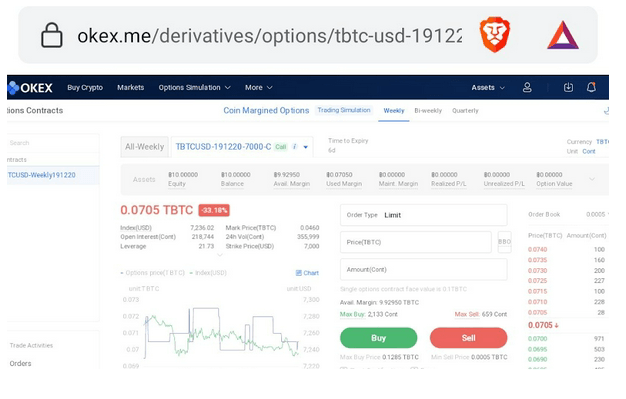

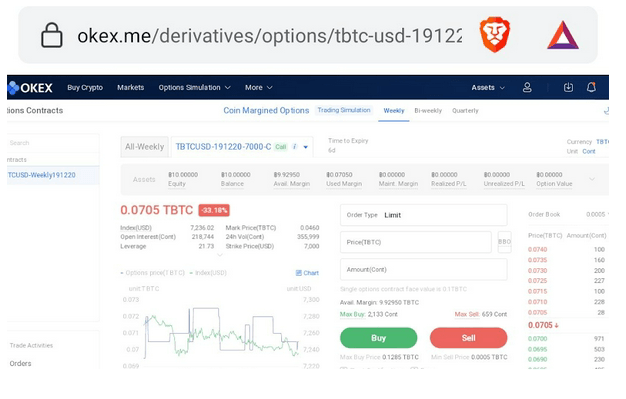

This Malta-based cryptocurrency exchange boasts a $1 billion trading volume per day. OKEx has 400+ trading pairs and one of the most impressive lists of supported cryptocurrencies.

The platform is often regarded as one of the largest ones, however, it only launched its options trading demo in December 2019. After registering, users are free to join OKEx options trading simulation contest. Each participant gets a simulation fund of 10 BTC and can win up to $150,000. Sounds fun if you like options.

But what is there to watch out for?UX is a questionable matter with the trading simulator. Some mechanisms like site navigation, transferring funds and settings menu differ from the industry standard, which weights OKEx demo down.

As a potential user, you should know this old broker hasn’t established itself as the most reliable and trusted one. In 2018, $400 million was liquidated when OKEX froze the trader’s account. Looks like trading volume, the crown jewel of this exchange, is fake. This crypto enthusiast’s analysis of publicly available data about OKEx proves “up to 93% of its volume being nonexistent.”

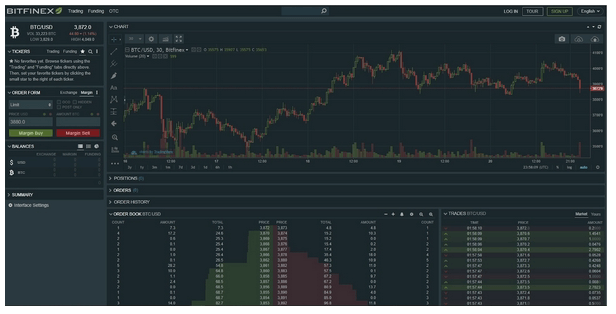

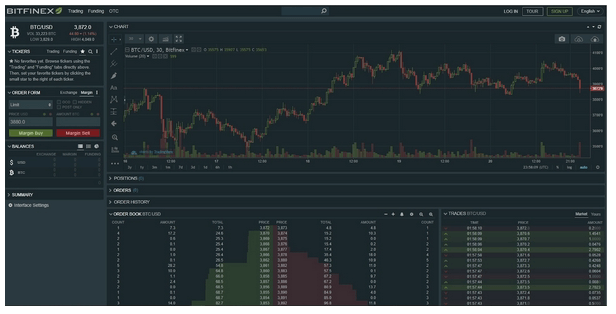

Bitfinex is as famous as its neighbours on the list. Before 2016, Bitfinex was called the “world’s largest Bitcoin exchange”. Now it is mostly popular with experienced seasoned traders.

The exchange is well suited for margin trading and lending. It supports crypto-to-crypto and crypto-to-fiat (only USD). It has a demo mode which can show users around the website without making them pass the login procedure.

With its help, you will be able to learn the main functions and the buttons. However, full demo functionality requires signing-up. Besides, as Bitfinex support section says, the website “doesn’t currently offer a demo account allowing for site-wide navigation or the placing of paper trade orders.

”Is Bittfinex a reputable exchange? In 2016, it lost trading volume after $70 million worth of coins were stolen from many accounts. Except for the hacker attack, Bitfinex experienced another throw down in 2017.

Like other brokers trading on margin, it was forced to stop serving verified users from the US. As a result, Bitfinex has lost the trust and the market cap it used to enjoy. A fun fact: googling Bitfinex reviews you only find advice on how to recover lost funds.

Last but not least, Binance is the fastest high-frequency trading system. This Chinese giant offers users both a centralized and a decentralized exchange. Binance is famous for 500+ crypto pairs and increasing scope for deposits and fiat withdrawals.

The testnet sections are convenient and user-friendly. Binance provides users with a thorough guide on funding a testnet DEX account, creating and unlocking a DEX wallet. One of the key factors here is that you need to make a number of steps which might be confusing for a new trader.

Also, you only can obtain Binance Chain testnet funds if you have a Binance account with a minimum of 1 Binance Coin (BNB) in it. Only then you will be prompted to open a testnet wallet.

This anti-spam measure might not frighten the customers. What’s scarier is the wake-up call from May 2019 when hackers siphoned off more than 7,000 BTC from Binance. On Trustpilot, only 26% of users rated Binance as excellent, while 38% think it is bad and call it a “shady company.”

These guys fall out of the top list and here is why. IQ Option started out as a binary options broker, but now it allows customers to trade cryptos, FX, Contracts for Difference (CFDs) on stocks, Exchange Traded Funds (ETFs) and other digital options.

This company attracts the audience with jaw-dropping leverage ratios of 1:300 (which might as well cause x300 money losses). The demo is user-friendly and smooth. It offers $10,000 in virtual funds. The money can be replenished and the time of using the account is unlimited so that you could keep practicing.

IQoption has good video tutorials which are also a big win in the plus column.Here come the minuses.

A major part of the crypto sphere doesn’t have IQ Option down as a legitimate broker considering binary options a scam. Some of those who were lucky to earn money couldn’t withdraw their winnings. So disappointingly even though the demo itself is quite convenient users don’t recommend it.

When it comes down to crypto exchanges, the choice is never easy. And of course, it is safer to play around with a cryptocurrency trading simulator before actually starting to trade. Some Monday morning quarterbacks from the world of crypto are skeptical about simulators. On the web, you can find a ton of negative reviews, for instance:

Opinions may differ. But novice traders shouldn't take internet criticism for a qualified opinion. It is safe to assume that strategy and experience are more efficient than the "just click up and down" approach.

That is why it is so important to choose a reliable crypto trading simulator with a realistic environment. Always remember to do your own research. And practice as much as you can to raise your trading game till you risk to spill some cash on a real deal.

TradeSanta is not a registered broker-dealer or an investment advisor. You must trade and take sole responsibility to evaluate all information provided by this website and use it at your own risk.

Are you interested in dipping your toes in crypto waters but want to check out how it works first? Or maybe it is your friend who is willing to try something better than a bank, Sofi or Paypal without taking financial risks? Try crypto simulators to safely trade multiple cryptocurrencies without investing real money.

First off, let us come down to the essentials and provide insight into how it works. A cryptocurrency simulator is a universal tool that was developed for learning how to trade on a cryptocurrency exchange.

It works in real-time, receiving the necessary information about current rates, orders and transactions for all cryptocurrencies that are available on the specific crypto exchange.

A crypto simulator makes it possible to use funds on a virtual account and will be useful for both beginners and experienced traders in working out trading strategies without the risk of losing a deposit.

Each transaction in the simulator is recorded in the diary, which allows you to analyze your trading history. Access to the diary can be open to all users or limited so that only you and your friends see it.

Game-design elements and smooth UX make many crypto sims a perfect way to learn to trade from your phone or laptop. We have searched high and low for the best software developed by the leading crypto exchanges and ranked them according to users’ preferences.

HitBTC

HitBTC is a global trading platform supporting digital assets, fiat currencies, tokens and ICOs since 2013. Here you can practice trading Bitcoin and Litecoin and you don’t even need to register to use the demo. Like many competitors, HitBTC offers a demo account.

However, HitBTC’s demo account stands out. What is good about this educational and training platform? It enables users to trade manually or via the API.

Relying on HitBTC’s blog, “the test mode is as fast and responsive as the regular exchange platform.” Besides the 0.1% fees, 800+ pairs, over 500 spot instruments supported and powerful APIs, HiBTC has a standout element that is not always the case with competitors.

You don’t need to provide other personal information than email and password before using the demo account, which helps potential clients protect their privacy.

Some users dislike high withdrawal fees for several tokens. You should keep in mind that HitBTC has flat fees that don’t change no matter how many coins a user wants to withdraw.

Over the years there were cases of unexpected delisting which caused problems with traders. Since then HitBTC has warned about its reactions to market changes in social media. Users can check the status of each coin at the System Monitor page.

Multi-factor authentication might seem a problem but it actually grants security. “I like that the company is striving to protect user’s funds to keep their account disabled until they enable 2fa protection. It saved me when some hacker tried to steal my funds but he couldn’t since the team took care of it” - a CryptoCompare user says.

eToro

eToro is an interesting notion in global Fintech. Starting as a small brokerage company, it grew into a social trading network with crypto coins, currencies, stocks and commodities among its instruments.

The strong point of the exchange is that it allows traders to learn from each other. Its products OpenBook and WebTraders enable users to watch trading strategies of others and copy them.

Also, you can get a demo account with 100.000 virtual USD to check out trends and understand how the system works. Besides the demo eToro offers a marketplace where you can commute with other traders. The downsides are that you have to enter private data like your email address and telephone number.

Alternatively you can login with Facebook or Google+, which doesn’t sound secure as well. Copy-trading that was marked as a good feature also is quite controversial as it can’t guarantee newbies either gains or losses.

If you consider using this demo for trading on eToro in the future, mind the pitfalls of the exchange. The fees are higher than average.

The majority of retail investors dealing with CFDs are put off from this provider because of the 75% money loss cases. What also disappoints is the lack of a standalone version and connecting technology for third-party software. Also, eToro is said to be “designed for people that never leave their country.” So be mindful of this quirk if you are planning to trade from different IPs.

OKEx

This Malta-based cryptocurrency exchange boasts a $1 billion trading volume per day. OKEx has 400+ trading pairs and one of the most impressive lists of supported cryptocurrencies.

The platform is often regarded as one of the largest ones, however, it only launched its options trading demo in December 2019. After registering, users are free to join OKEx options trading simulation contest. Each participant gets a simulation fund of 10 BTC and can win up to $150,000. Sounds fun if you like options.

But what is there to watch out for?UX is a questionable matter with the trading simulator. Some mechanisms like site navigation, transferring funds and settings menu differ from the industry standard, which weights OKEx demo down.

As a potential user, you should know this old broker hasn’t established itself as the most reliable and trusted one. In 2018, $400 million was liquidated when OKEX froze the trader’s account. Looks like trading volume, the crown jewel of this exchange, is fake. This crypto enthusiast’s analysis of publicly available data about OKEx proves “up to 93% of its volume being nonexistent.”

Bitfinex

Bitfinex is as famous as its neighbours on the list. Before 2016, Bitfinex was called the “world’s largest Bitcoin exchange”. Now it is mostly popular with experienced seasoned traders.

The exchange is well suited for margin trading and lending. It supports crypto-to-crypto and crypto-to-fiat (only USD). It has a demo mode which can show users around the website without making them pass the login procedure.

With its help, you will be able to learn the main functions and the buttons. However, full demo functionality requires signing-up. Besides, as Bitfinex support section says, the website “doesn’t currently offer a demo account allowing for site-wide navigation or the placing of paper trade orders.

”Is Bittfinex a reputable exchange? In 2016, it lost trading volume after $70 million worth of coins were stolen from many accounts. Except for the hacker attack, Bitfinex experienced another throw down in 2017.

Like other brokers trading on margin, it was forced to stop serving verified users from the US. As a result, Bitfinex has lost the trust and the market cap it used to enjoy. A fun fact: googling Bitfinex reviews you only find advice on how to recover lost funds.

Binance

Last but not least, Binance is the fastest high-frequency trading system. This Chinese giant offers users both a centralized and a decentralized exchange. Binance is famous for 500+ crypto pairs and increasing scope for deposits and fiat withdrawals.

The testnet sections are convenient and user-friendly. Binance provides users with a thorough guide on funding a testnet DEX account, creating and unlocking a DEX wallet. One of the key factors here is that you need to make a number of steps which might be confusing for a new trader.

Also, you only can obtain Binance Chain testnet funds if you have a Binance account with a minimum of 1 Binance Coin (BNB) in it. Only then you will be prompted to open a testnet wallet.

This anti-spam measure might not frighten the customers. What’s scarier is the wake-up call from May 2019 when hackers siphoned off more than 7,000 BTC from Binance. On Trustpilot, only 26% of users rated Binance as excellent, while 38% think it is bad and call it a “shady company.”

IQ Option

These guys fall out of the top list and here is why. IQ Option started out as a binary options broker, but now it allows customers to trade cryptos, FX, Contracts for Difference (CFDs) on stocks, Exchange Traded Funds (ETFs) and other digital options.

This company attracts the audience with jaw-dropping leverage ratios of 1:300 (which might as well cause x300 money losses). The demo is user-friendly and smooth. It offers $10,000 in virtual funds. The money can be replenished and the time of using the account is unlimited so that you could keep practicing.

IQoption has good video tutorials which are also a big win in the plus column.Here come the minuses.

A major part of the crypto sphere doesn’t have IQ Option down as a legitimate broker considering binary options a scam. Some of those who were lucky to earn money couldn’t withdraw their winnings. So disappointingly even though the demo itself is quite convenient users don’t recommend it.

Takeaway

When it comes down to crypto exchanges, the choice is never easy. And of course, it is safer to play around with a cryptocurrency trading simulator before actually starting to trade. Some Monday morning quarterbacks from the world of crypto are skeptical about simulators. On the web, you can find a ton of negative reviews, for instance:

- There is no precise technique to trade on crypto and all you need is luck.

- There is no point in wasting your time on practice while you can directly play on your own risk.

- Start small if you want to learn. Using real money is much better than practicing using fake money.

Opinions may differ. But novice traders shouldn't take internet criticism for a qualified opinion. It is safe to assume that strategy and experience are more efficient than the "just click up and down" approach.

That is why it is so important to choose a reliable crypto trading simulator with a realistic environment. Always remember to do your own research. And practice as much as you can to raise your trading game till you risk to spill some cash on a real deal.

TradeSanta is not a registered broker-dealer or an investment advisor. You must trade and take sole responsibility to evaluate all information provided by this website and use it at your own risk.