Japan Sees its First Crypto Seizure As Binance Helps Take Down Money Laundering Group - CityAM : CityAM

(cityam.com)

This week the price of Bitcoin (BTC) moved sharply up and surpassed the $12,000 mark to hit a high shortly above it. The price has since declined to a weekly low at $11,500, before recovering to $11,750, according to data from CrpytoCompare.

Ether (ETH), the second-largest cryptocurrency by market capitalization, started the week at $425 but quickly moved up to $440, accompanying BTC’s move up. ETH then entered a steady downtrend to $380, a point from which it bounced back to $405 at press time.

This week cryptocurrency headlines were dominated by security-related advancements, as the Tokyo District Court ordered the first cryptocurrency seizure in the country, seizing cryptoassets associated with the 2018 Coincheck hack.

Coincheck is a Japanese cryptocurrency exchange that suffered the biggest hack in the history of the space two years ago, seeing hackers steal around $530 million worth of NEM (NEM) from its wallets in the breach.

While the funds were quickly moved and spread across the blockchain, the Tokyo District Court ordered the seizure of 48 million yen (about $45,000) in BTC and XEM associated with the hack.

The funds were seized from a 30-year old doctor who had been arrested in March together with an accomplice for allegedly buying cryptocurrency linked to the hack, violating laws against participating in organized crime in the process.

After the hack, Coincheck struggled but was soon after acquired by online brokerage group Monex for “several billion yen.” It has since made several improvements to its system and was approved for an operating license.

It suffered a data breach earlier this year.Another cryptocurrency exchange was in the news this week as leading trading platform Binance unveiled, through a joint press release with the Cyber Police of Ukraine, that it had helped take down a large-scale money laundering network on the darknet using cryptocurrencies.

The press release details the cybercriminal group distributed ransomware and washed hacker funds to the tune of $42 million over two years. Authorities seized $200,000 in computer equipment, weapons, ammunition, cash and “digital evidence” linking three arrested suspects to the operation.

While these were advances when it comes to the cryptocurrency space’s security Thomas Silkjær, founder of a “community-driven” XRP data aggregator, found that scammers on the Google-owned video-sharing platform YouTube have stolen over 940,000 XRP tokens from users of crypto exchange Coinbase alone.

Silkjær released the figures on social media and added the scammers also received funds from exchanges like Crypto.com, Kraken, and Uphold. Xrplorer called on Coinbase to start proactively blocking addresses from these scams.

YouTube has been sued by Ripple, its co-founder Brad Garlinghouse, and by Apple co-founder Steve Wozniak over its failure to stop scammers from impersonating celebrities to promote fake giveaways.

YouTube itself denies liability for these cryptocurrency scams, on the grounds of Section 230 of the Communications Decency Act, which serves to protect platform publishers from being liable for third parties. It argues the scammers and impersonators are third parties creating content.

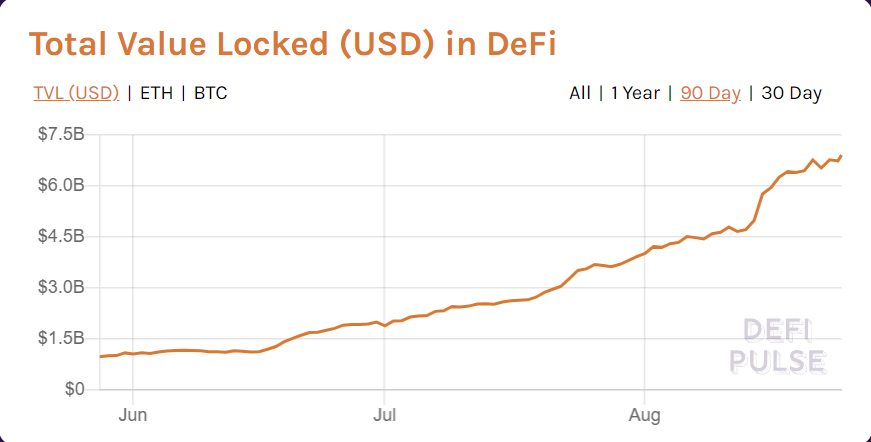

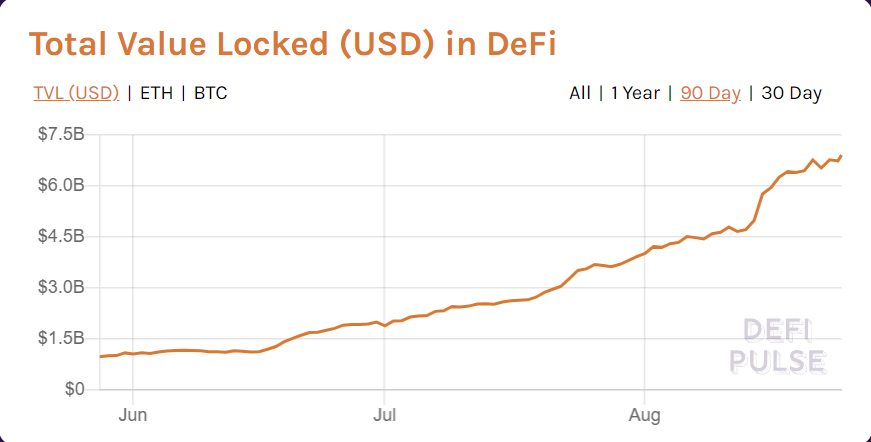

Meanwhile, the decentralized finance (DeFi) space has continued to grow, as more and more users take advantage of lending and borrowing protocols to both earn interest on their cryptocurrency holdings, and to be rewarded in platforms’ native governance tokens.

At press time, DeFiPulse shows there are $6.87 billion locked in DeFi protocols, with three projects having over $1 billion locked in them: Maker, Aave, and Curve Finance.

Maker is the project behind a cryptocurrency-backed stablecoin named DAI, while Aave is a lending and borrowing protocol. Curve Finance is a decentralized exchange.

In other news, the first cryptocurrency-backed loan issued in Russia has been issued, using the Waves (WAVES) token as collateral. Local reports detailed the loan was issued by commercial bank Expobank to local entrepreneur Mikhail Uspensky, who is committed to holding onto the WAVES tokens.

While some legal experts revealed they were not too confident in the cryptocurrency-backed loan being legal under Russian loan, others argued in favour of it, saying there are “no restrictions on the circulation of non-payment tokens in our country.

Crypto AM: Market View in association with Ziglu

Ether (ETH), the second-largest cryptocurrency by market capitalization, started the week at $425 but quickly moved up to $440, accompanying BTC’s move up. ETH then entered a steady downtrend to $380, a point from which it bounced back to $405 at press time.

This week cryptocurrency headlines were dominated by security-related advancements, as the Tokyo District Court ordered the first cryptocurrency seizure in the country, seizing cryptoassets associated with the 2018 Coincheck hack.

Coincheck is a Japanese cryptocurrency exchange that suffered the biggest hack in the history of the space two years ago, seeing hackers steal around $530 million worth of NEM (NEM) from its wallets in the breach.

While the funds were quickly moved and spread across the blockchain, the Tokyo District Court ordered the seizure of 48 million yen (about $45,000) in BTC and XEM associated with the hack.

The funds were seized from a 30-year old doctor who had been arrested in March together with an accomplice for allegedly buying cryptocurrency linked to the hack, violating laws against participating in organized crime in the process.

After the hack, Coincheck struggled but was soon after acquired by online brokerage group Monex for “several billion yen.” It has since made several improvements to its system and was approved for an operating license.

It suffered a data breach earlier this year.Another cryptocurrency exchange was in the news this week as leading trading platform Binance unveiled, through a joint press release with the Cyber Police of Ukraine, that it had helped take down a large-scale money laundering network on the darknet using cryptocurrencies.

The press release details the cybercriminal group distributed ransomware and washed hacker funds to the tune of $42 million over two years. Authorities seized $200,000 in computer equipment, weapons, ammunition, cash and “digital evidence” linking three arrested suspects to the operation.

While these were advances when it comes to the cryptocurrency space’s security Thomas Silkjær, founder of a “community-driven” XRP data aggregator, found that scammers on the Google-owned video-sharing platform YouTube have stolen over 940,000 XRP tokens from users of crypto exchange Coinbase alone.

Silkjær released the figures on social media and added the scammers also received funds from exchanges like Crypto.com, Kraken, and Uphold. Xrplorer called on Coinbase to start proactively blocking addresses from these scams.

YouTube has been sued by Ripple, its co-founder Brad Garlinghouse, and by Apple co-founder Steve Wozniak over its failure to stop scammers from impersonating celebrities to promote fake giveaways.

YouTube itself denies liability for these cryptocurrency scams, on the grounds of Section 230 of the Communications Decency Act, which serves to protect platform publishers from being liable for third parties. It argues the scammers and impersonators are third parties creating content.

Decentralized Finance Near $7 Billion in Value Locked

Meanwhile, the decentralized finance (DeFi) space has continued to grow, as more and more users take advantage of lending and borrowing protocols to both earn interest on their cryptocurrency holdings, and to be rewarded in platforms’ native governance tokens.

At press time, DeFiPulse shows there are $6.87 billion locked in DeFi protocols, with three projects having over $1 billion locked in them: Maker, Aave, and Curve Finance.

Maker is the project behind a cryptocurrency-backed stablecoin named DAI, while Aave is a lending and borrowing protocol. Curve Finance is a decentralized exchange.

In other news, the first cryptocurrency-backed loan issued in Russia has been issued, using the Waves (WAVES) token as collateral. Local reports detailed the loan was issued by commercial bank Expobank to local entrepreneur Mikhail Uspensky, who is committed to holding onto the WAVES tokens.

While some legal experts revealed they were not too confident in the cryptocurrency-backed loan being legal under Russian loan, others argued in favour of it, saying there are “no restrictions on the circulation of non-payment tokens in our country.

Crypto AM: Market View in association with Ziglu

-

- 1

Francisco Gimeno - BC Analyst "Wild West" times for crypto are over. Now, regulations, compliance are the new mantra. Unfortunately even if complying, hackers and scammers will take all advantage possible. That is why there are always negative news like in here. Be aware, be involved.