-

Big Tech is pouring billions into AI chips and the infrastructure needed to monetize artificial intelligence. Apple is opening its AI models to outside developers, Google just unveiled an AI-powered Search mode, and Nvidia’s data-center revenue is soaring. In this episode of This Week on Wall Street, Matt Weinschenk and tech investor Josh Baylin break down:

- Apple’s high-stakes pivot – why letting third-party developers build iPhone AI apps is critical as OpenAI and Johnny Ive team up on a rival device.

- Google’s counterattack – new video-generation tools (Veo, Flow), AR glasses 2.0, and a search overhaul designed to keep ad dollars flowing.

- Nvidia’s “inference boom” – 73% data-center growth shows companies are shifting from training models to deploying them in real-world products.

- Cloudflare’s quiet edge – its fast-growing developer ecosystem could make it an under-the-radar winner as AI workloads move to the network edge.

- Chatbots vs. embedded AI – why the next profits will come from seamless tools woven into everyday tasks, not just standalone prompts.

Get free stock market research at https://stansberrydigest.com/, and hit Like & Subscribe for weekly market insights on the AI arms race.-

By

Admin

Admin - 0 comments

- 0 likes

- Like

- Share

- Apple’s high-stakes pivot – why letting third-party developers build iPhone AI apps is critical as OpenAI and Johnny Ive team up on a rival device.

-

CNBC's Steve Kovach joins 'The Exchange' to report on OpenAI releasing its video generation tool.

-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Muscat, Oman, sometimes described as the anti-Dubai, is trying to modernize as it looks toward an economic future without oil. But can it create a new model of a Middle Eastern city or will it succumb to the glitzier approach of its neighbors like the Line in Saudi Arabia or Egypt’s new capital?

WSJ explores the new project aimed at modernizing Muscat and explains why it’s important to the country.

Chapters:

0:00 Muscat

0:51 The project and why it’s important

2:30 Dysfunctional housing policy

4:21 Tourism and international investment

6:40 What’s next?

Breaking Ground

Breaking Ground digs into megaprojects around the world, uncovering what these developments might mean for the surrounding region and the ultimate costs.

#Oman #Megaprojects #WSJ-

By

Admin

Admin - 0 comments

- 2 likes

- Like

- Share

-

By

-

#Miami #Florida #yahoofinance

This segment originally aired on November 2, 2022.

FREEHOLD Hospitality Co-Founder & CEO Brice Jones joins Yahoo Finance Live anchors Jared Blikre and Brooke DiPalma to discuss the tourism industry in Brooklyn and Miami, inflation, and staffing locations.

Don't Miss: Valley of Hype: The Culture That Built Elizabeth Holmes

WATCH HERE:

• Elizabeth Holmes:...

• Elizabeth Holmes:...

Subscribe to Yahoo Finance: https://yhoo.it/2fGu5Bb

About Yahoo Finance:

At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates that help you manage your financial life.

Yahoo Finance Plus: With a subscription to Yahoo Finance Plus get the tools you need to invest with confidence. Discover new opportunities with expert research and investment ideas backed by technical and fundamental analysis. Optimize your trades with advanced portfolio insights, fundamental analysis, enhanced charting, and more.

To learn more about Yahoo Finance Plus please visit: https://yhoo.it/33jXYBp

Connect with Yahoo Finance:

Get the latest news: https://yhoo.it/2fGu5Bb

Find Yahoo Finance on Facebook: http://bit.ly/2A9u5Zq

Follow Yahoo Finance on Twitter: http://bit.ly/2LMgloP

Follow Yahoo Finance on Instagram: http://bit.ly/2LOpNYz

Follow Yahoo Finance Premium on Twitter: https://bit.ly/3hhcnmV-

By

Admin

Admin - 0 comments

- 0 likes

- Like

- Share

-

By

-

It started with CryptoKitties. In December 2017, the dopey-looking cartoon cats, created by Canadian company Dapper Labs, debuted as tradable collectibles, like Pokémon cards for the bitcoin era.

Each image was associated with a unique string of digits – a cryptocurrency “non-fungible token” or NFT – that could be traded on the Ethereum blockchain platform as a title deed granting the holder ownership of a particular kitty.

The trading game quickly caught on among the crypto-initiated, so much so that CryptoKitties-related transactions clogged and slowed down Ethereum.

That was eventually solved – and that was, for most people, the last they heard of CryptoKitties.

But the process the goggle-eyed cats set off did not end there. Its end point is an auction starting tomorrow, in which a token associated with a digital collage of 5,000 images by graphic designer Beeple will go under the hammer at auction house Christie’s. Cryptocurrency payments are of course accepted.

NFTs are selling like hotcakes, and this time the Ethereum network, which has been upgraded since 2017, is better equipped to deal with the endless sloshing.

One recent report by NonFungible.com, a company releasing market insights on NFTs, says that, in 2020, NFT trading was worth over $250m, an increase by almost 300 per cent from the previous year.

On online platforms such as Rarible, OpenSea, and Nifty Gateway (backed by twins Tyler and Cameron Winklevoss) people are shelling out big sums of cryptocurrency and legal tender to buy tokens representing ownership of digital objects, which are then often re-auctioned at higher prices.

Some of these NFTs are stand-ins for collectibles in the tradition of CryptoKitties – like Non-Fungible Pepes, a postmodern bid to reclaim the meme frog from the alt-right; others are objects intended to be used in video games; but more and more they are linked to pieces of digital art designed by honest-to-god creators such as Beeple – who, two months ago, sold a token for $777,777 on Nifty Gateway.

If all of this sounds bizarre, that’s because it is. The idea of paying for the symbolic ownership of a digital image that lives somewhere on the web and can be captured on a screenshot or right-click-download within seconds, is so alien it seems either idiotic or ironic.

Yet NFT proponents purport to be solving exactly that problem: the near-impossibility of monetising digital artworks.

“As a mechanism, NFTs make it possible to assign value to digital art, which opens the door to a sea of possibility for a medium that is unbridled by physical limitations,” says Noah Davis, a specialist in post-war and contemporary art at Christie’s.- By GIAN VOLPICELLI

Currency and cryptocurrency units are also, usually, fractionable into smaller units – dollars can be broken down to cents, bitcoins to particles called satoshis – which can be spent separately. On the contrary, NFTs – cryptocurrency assets developed according to special Ethereum standards ERC-721 and ERC-1155 – are unique and indivisible.

Where a bitcoin is comparable to a dollar bill, an NFT can be likened to a cat, a sculpture, or a painting: you can’t sell part of it without spoiling the whole, and its value is rather subjective.

Those characteristics render NFTs a good metaphor for art. Now, the crypterati and a waxing portion of the art world are asking us to take a leap of faith and believe that by buying an NFT we should feel like the owners of whatever artwork an artist has decided to link with it.

Christie's/Beeple

This cannot credibly apply to physical artworks: if you are after a Jeff Koons balloon dog sculpture, you will likely not be happy with a cryptocurrency token. But when it comes to intangible digital art, NFTs might just do the trick. Sure, everyone can download Beeple’s images from his Instagram feed, but that is missing the point, says Vincent Harrison, a New York gallerist who counts the Winklevosses among his clients and is helping Nifty Gateway attract more established artists onto the platform.

“Anyone can see pictures on the internet of the most expensive artworks; posters are sold in museums,” he says. “But it's the ownership that creates value. So with [NFTs], not only do you have ownership, you have ownership on the blockchain, you have ownership that is transparent for everyone to see.

”NFT technology, Harrison says, provides a way to attach a price tag to digital art, tapping into that primal high-quality hoarding instinct – the quest for status-affording Veblen goods, coveted only insofar as they are pricey – that is behind many collectors’ urge.

Mix that with a frothy community eager to trade and meme any new shiny blockchain-adjacent construct to considerable prices and the trick is done.“In this digital world, we have accelerators: suddenly you could get three or four times what you paid for something – tomorrow there is someone ready to buy it,” Harrison says.

Even better, blockchains are also able to keep track in a secure, immutable way, of how a token originated and changed hands over time. “Provenance is obviously an important part of the value of art,” Harrison says.

READ NEXT

This is how the bitcoin bubble will burst

This is how the bitcoin bubble will burst

By GIAN VOLPICELLI

The crowd buying NFT-linked art is varied. Some of its members are cryptocurrency magnates looking for the newest thing to plunge their savings into.

“People who were early in crypto and have a bunch of ether [Ethereum’s cryptocurrency], they're looking for ways to use it,” says James Beck, director of communications and content at ConsenSys, a blockchain company that has built an app to store and manage NFTs.

They want to show, Beck says, that they are “patron[s] of the art on the internet’.

”It helps that some NFT marketplaces allow people to showcase their purchases like in an online gallery or museum. Jamie Burke, founder and CEO of blockchain investment firm Outlier Ventures, and an NFT enthusiast, is one of those keen about their newfound role as digital arts supporters.

Burke says that he was initially turned off by the early, “self-referential” cryptocurrency-focused artworks – strewn with Bitcoin signs and pixelated memes. But when he got more interested in the space, in summer 2020, he was “blown away” by the new artists.

“This was art in and of its own right that I would buy, and I liked the idea that I could have a unique digital edition of it,” he says. “I just started collecting, personally, and trying to get new artists and professionals who are coming into the space. I'm building a bit of a collection.

” That does not mean he turns down a good deal when it presents itself: on February 13, he sold an NFT he had paid $500 for, for $20,000 in ether.

Announcing the sale in a tweet, Burke said he would use the return to buy more art.

Harrison says that while the market right now is crawling with speculators who would buy and flip any blockchain-based asset in the hope that it increases in value, bona fide collectors are increasingly getting involved.

“It's a combination of people that are just speculative and of people that want to collect and have something cool,” he says.

“My role is to balance an element of speculation with enough people that want to buy something because they like it, and they want a hot collection habit. If everyone is buying to speculate, it doesn't work, then it just becomes another tradable token.

”Some digital artists are welcoming of the trend. Most platforms are simple to use, allowing them to upload their works, automatically “mint” NFTs and wait for the offers to rain in – and these are often higher than the sums they would receive if they tried to sell their digital artworks online or as prints.

Brendan Dawes, a UK graphic designer and artist who creates digital imagery using machine learning and algorithms, says that a print of one of his pieces would typically sell for $2,000, while his latest NFT sold for $37,000.

READ NEXTCrypto tokens will bridge the gap between AR and reality

Crypto tokens will bridge the gap between AR and realityBy JOHN EGAN

The profits don’t stop there. NFTs can be designed to pay their creators a cryptocurrency fee every time they change hands: if a buyer of one of Dawes’s pieces resells it, Dawes automatically receives ten per cent of the price paid. “That's again, one of the differences when compared to the traditional world: you get this ongoing, ongoing royalty.

”Andrea Bonaceto, a venture capitalist and artist who is also creating NFT-backed artwork, thinks that the method might spur new forms of digital art blending digital imagery, music and technology.

“You can create hybrids of art and music, or of art and literature and link both of them to a token. You can use smart contracts [self-executing routines that can be programmed onto a blockchain], so that the artwork changes over time,” he says. “This totally opens up an artist’s creativity.”

Christie's/Beeple

Crypto being crypto, NFTs are bound to produce excesses. Some of the prices paid can be beyond comprehension, the epitome being the purchase of a virtual racing car for $100,000; and the fact that some websites are offering cryptocurrency loans in exchange for NFT collaterals has all the signs of a mini-crash waiting to happen.

At a more basic level, William O'Rorke, a partner at Paris-based law firm ORWL Avocats, says that while the structure of NFTs – modelled after artwork rather than currencies or shares – means they are not subjected to the kind of financial regulation other kinds of cryptoassets have to abide by, they still risk falling foul of intellectual property law (for instance, if selling someone else’s artwork as one’s own) and consumer law protection.READ NEXT

The Winklevosses have launched their bitcoin exchange in the UK

The Winklevosses have launched their bitcoin exchange in the UKBy NATASHA BERNALOnline auctions are also another quagmire, O’Rorke says, as sellers could potentially leverage fake accounts to tamper with the bidding process. “If you have ten accounts, you can artificially increase the price of NFT,” he says. “This kind of practice exists actually also on eBay, on all these kinds of services.

But when people participate in the auction with anonymous cryptocurrency, for instance, it's much much more complicated to find out.

” Luckily, he says, there are techniques and methods to detect coordination that could stave off the worst.In general, O’Rorke sees NFT art as a “spectacular” trend, but at the end of the day, smaller than other sectors in which NFTs are likely to take hold – from gaming, to football trading cards – as more and more brands, including toy manufacturer Superplastic and Nike get acquainted with the technology.

The big question is, then whether this is just another cryptocurrency fad, or whether NFT art is here for good. Harrison has no doubt that what has been happening is just the beginning of a long-awaited transition, partly triggered by the pandemic-induced closures of museums and galleries.

“There's something real here: this is just an acceleration of a cultural shift,” he says.

Federica Beretta, gallery director at London-based Opera Gallery, says that while the pandemic, and a push for sustainability, made turning to digital artwork and digital auctions a “no brainer”, physical art will probably keep an edge in the long run.

“The digital world offers extraordinary opportunities to artists, collectors, museums and galleries and it could also be seen as a fantastic complement to traditional art,” she says. “I do not believe art will become only digital in the future.

”Gian Volpicelli is a senior editor at WIRED. He tweets from-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

Decentralized Finance or ‘DeFi’ as it is commonly called, refers to financial services that utilize technologies such as blockchain. The recent boom behind DeFi is largely based on the same promises being made by blockchain for years now – transparency, open source, borderless, permissionless.

Some of the implementations of technology currently capturing the attention of the market include,- Lending Platforms

- Prediction Platforms

- Decentralized Exchanges

The following are only a few of the various examples in recent months where this has occurred.Hacks

Origin Protocol

This young company is actively building its suite of services which allow for the creation of decentralized e-commerce stores, underpinned through its stablecoin OUSD.Origin Protocol has just announced on November 17th, that it has become the latest DeFi project to be the victim of a hack – which has resulted in the loss of at least $7 million USD.“OUSD has been hacked, and there has been a loss of user funds. We are actively investigating the issue.

We are committed to making things right.”Akropolis

Lending/borrowing, savings accounts, and customizable decentralized autonomous organizations (DAO) – each of these are financial services offered by a company known as Akropolis.On November 12th, Akropolis suffered a theft amounting to roughly $2 million USD.

“At ~14:36 GMT we noticed a discrepancy in the APYs of our stablecoin pools and identified that ~2.0mn DAI had been drained out of the yCurve and sUSD pools…These pools had been audited by two independent firms, however, the attack vectors used in the exploit were not identified in either audit.

The essence of the exploit in question is a combination of a re-entrancy attack with dYdX flash loan origination.”Value Protocol

While its services are various, Value Protocol is most known for its ‘Value Vaults’, which act as a yield-farming aggregator.On Nov. 14th, Value Protocol was the victim of yet another attack, resulting in the loss of user funds.

“On Nov 14th 2020 at 03:36:30 PM UTC, a hacker performed a flash-loan exploit on the MultiStables vault of ValueDeFi protocol, which resulted in a net loss of roughly 6mil$.”Method of Attack

Interestingly, in each of the cases above, a similar method of attack was used. Known as a ‘flash-loan’, hackers would take out significant loans in a particular asset, large enough to swing its market price. The attacker would then use the funds from the loan to re-purchase the asset at devalued prices. Upon doing so, the attacker will pay back the original loan, netting a significant profit.Mixed Reception

Due to the issues surrounding DeFi, figure heads within the industry appear split on whether the potential of DeFi is real, and/or enough to overcome the potential bubble which has formed.Binance CEO, Changpeng Zhao, maintains a positive attitude, stating,“I think some of the pro-innovations will remain.

The liquidity providers, “profitable farming,” now provide a high annual percentage of income. It may not last very long…Companies create new tokens, issue them as a reward. This is not a long-running story. But I think DeFi is here to stay.

Even now, with Bitcoin’s popularity rising again, DeFi is still popular. We think there is a lot of growth potential in DeFi.”Economist, Nouriel Roubini, who is notoriously ‘anti-blockchain’, has taken a differing stance, likening DeFi to vapourware.“DeFi was vaporware from its onset. Now totally faltering as blockchain was always the most over-hyped technology in human history.”A Dangerous Place to Be

If the message from the aforementioned examples isn’t clear yet, it is this – DeFi is a dangerous place to be right now. The amount of hype surrounding what often amounts to simply a ‘buzzword’, has resulted in a growing amount of hacks.

Combined with the rapid growth of DeFi and these hacks, the sector is unsettlingly reminiscent of the 2017 ICO boom, in which markets were flooded with similar issues.

While DeFi may hold limitless potential for the way we view finance, be careful when jumping into the fray.If the money lost through hacks isn’t scary enough, maybe the growing number of scams will be to ward of uneducated investors.

For a more detailed look at what DeFi is, and what it has to offer, make sure to peruse our ‘DeFi 101’ article HERE.-

Francisco Gimeno - BC Analyst Hype, promises, emotions, money, risks, DeFi is repeating what 2017-18 supposed for ICOs and blockchain projects. DeFi is real and has a lot of way ahead, but by now is a dangerous landscape where money can be both earned and lost very easily, filled both by ill thought products and smart scammers which darken the real opportunities.

-

In brief

- Reddit is trialing crypto-based community points for a popular Fortnite subreddit.

- You can convert those points for cash.

- The road is long and hard.

Regulars of the 1-million-strong Fortnite subreddit can trade their crypto-based community points—earned from contributions such as memes, high-quality comments, and fan-made art—for cash.

Reddit has trialed cryptocurrency rewards on the community-run subreddit for Fortnite, r/FortNiteBR, as well as on r/CryptoCurrency, since May.

The subreddit’s cryptocurrency, “Bricks”, runs on a test version of Ethereum known as “Rinkeby.” Testnet coins aren’t supposed to have value; indeed, you can request the Rinkeby version of Ethereum tokens for free.

Still, it’s possible to sell the Bricks on a new decentralized exchange, Honeyswap. There, the coins have real value. Granted, not much: a single brick is worth $0.03, and a single transaction costs $8.89.

The thing is, it’s really complicated to sell these coins and those transaction fees may not make it worth your while. It’s also slightly easier, though still very complicated, to sell the MOON cryptocurrency earned on r/CryptoCurrency because people have written software that makes the whole thing less of a minefield.Here’s How to Sell Reddit’s Crypto Tokens For Cash

Reddit’s crypto community has worked out a way to sell its $MOON currency for cash. Moons—launched in May—are ERC-20 tokens awarded to those who contribute to the cryptocurrency section of t...NewsBusinessMathew Di SalvoSep 28, 20203 min read

The Fortnite experiment is more popular. According to DappRadar, 36,770 Brick holders have made 65,291 transfers. On r/CryptoCurrency, there are 7,973 holders of MOONs and 16.748 transfers.How to sell your BRICKs

Selling Bricks is far from simple, but here’s the nuts and bolts of it, per a guide on the r/CryptoCurrency subreddit: First, send Bricks to your MetaMask wallet. MetaMask is a popular browser-based crypto wallet.

You’ll have to add BRICK as a custom token in your wallet, using the following address: “0xe0d8d7b8273de14e628d2f2a4a10f719f898450a”.

Second, you’ll need to get some cryptocurrency to pay the gas fees. You pay gas fees to the network to process your transaction. For this, you’ll need some Rinkeby ETH—remember, you can get that for free—and some xDAI. xDAI is a version of DAI, a US dollar-pegged stablecoin.

This is a cryptocurrency whose value is equal, more or less, to the US dollar. You can swap DAI for xDAI. xDAI is the same as DAI, only it’s based on an Ethereum sidechain.

Third, you’ll have to convert your Bricks to tokens supported by the xDAI sidechain.

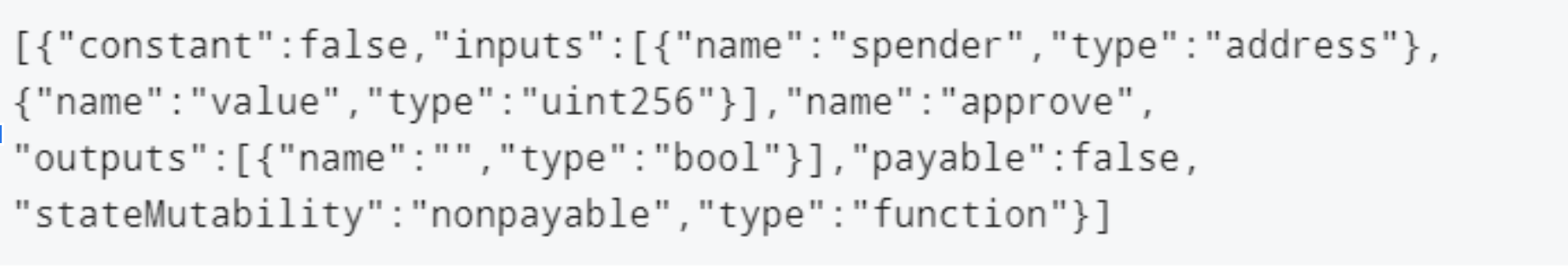

That means you’ll have to convert them to xBricks. To do this, enter the Rinkeby address for Bricks (above) in MyEtherWallet, and paste this in the ABI/JSON interface:

Instead of “spender”, put this:

“0xD925002f88279776dEB4907bA7F8dC173e2EA7a7”. Instead of “value”, enter the number of BRICK tokens you want to convert in wei. Wei is a unit of Ethereum gas. One BRICK = 1000000000000000000 wei. Then click write and confirm the transaction on MetaMask.

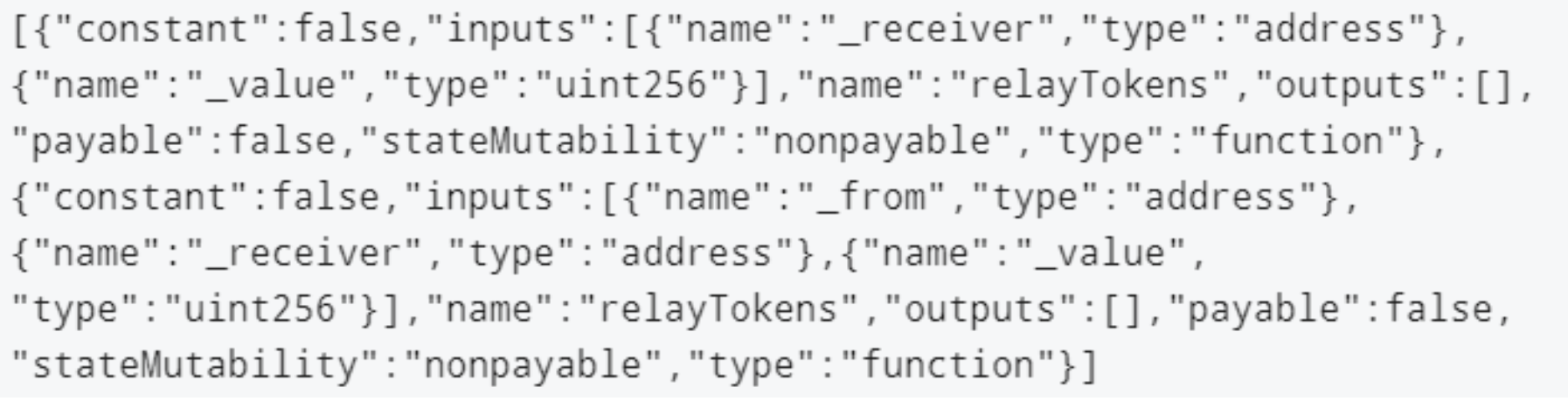

Then put the above contract address in address and then paste the following in the ABI/JSON Interface:

Continue, select an item, pick relayTokens, put your address in "receiver", in "_value" enter the "a7" address mentioned above, then write and convert on MetaMask.

Then switch to xDai and add xBRICK using x2f9ceBf5De3bc25E0643D0E66134E5bf5c48e191 as the contract address.

Then, you can sell it on Honeyswap, and then from there cash out.

To cash out, convert these tokens back into regular tokens (xDAI to DAI), and from there sent to an exchange and withdraw to fiat.

Who said Reddit was a waste of time?-

Francisco Gimeno - BC Analyst Gamers understand easily tokenisation, rewards and trade. We see this complicated, cumbersome even. But is there and with time it will be an easy transaction process. It is the same with the rest of crypto and tokens. Masses won't use them unless the user interface is as simple as the one of Google or a Bank platform.

-

The idea of an average investor being able to afford a luxury car, fine art or even a Class A real estate property has previously been thought to be unattainable.

However, tokenization is revolutionizing the investment process by offering fractional ownership of assets via security token offerings, and creating more opportunities for small investors to get involved.

Tokenization would not be possible without the adaptation of blockchain technology, which offers new layers of transparency, security and liquidity to investors.

Tokens are a newer way to invest in many types of assets, and many believe that security tokens will ultimately replace traditional stock ownership in the future, while also offering a way to invest in asset classes that were previously unavailable to all but the largest investors. Examples of the latter include the tokenization of high-end vintage cars, which have generated an average 330% ROI to UHNW investors in the past decade, according to Knight Frank, a global Real Estate consulting firm that created a luxury investment index for a variety of assets.

Two companies, CurioInvest and MERJ, recently partnered with plans to offer 500 vintage cars, worth over $200 million, through a security token offering. Although token holders will not be able to use the vintage cars, the expected ROI on their investment would theoretically provide sufficient incentive to invest.

Tokenization has also created the opportunity to offer fractionalized real estate property ownership via security tokens, rather than through a traditional REIT offering. In 2018, 19% of the St. Regis Aspen Resort was sold for $18 million via a security token sale. Investors participated at $1 per token with a minimum required investment of 10,000 tokens or $10,000.

The property manager received necessary capital for the ongoing development and operations, and investors received the ability to invest in a very unique property with anticipated long-term appreciation.Ultimately, tokenizing real estate presents the opportunity for investors to invest in high end properties via a unique investment mechanism.

Houston-based digital investment bank Entoro Capital is currently collaborating with Red Swan CRE Marketplace, a business-to-business CRE tokenization system, with plans to offer a $2.2 billion portfolio of Class A commercial properties in Houston, Brooklyn, Austin, Oakland and San Jose.

Tokenization of these high-end properties will enable investors to participate in ownership of Class A real estate property via security token offerings. According to the firm’s website, this will provide investors “a substantially easier and more efficient process for acquiring commercial real estate investments (and enable) global investors to grow their portfolio of high-quality assets in a decentralized manner.

”As more people invest in token offerings around previously unattainable assets such as Class A real estate, fine cars, and more, the potential exists for smaller investors, previously shut out from these types of investment instruments, to realize ROIs previously only available to the UHNW and institutional investors.Patrick Doyle is an intern at Entoro Capital.-

Francisco Gimeno - BC Analyst Tokenisation is coming as the 4th IR digital economy arrives. However, is not as easy as it seems here in the article. There are many obstacles yet, first of all of understanding of the tech behind, enough successful use cases, even psychological obstacles, as this is a revolutionary economic concept after centuries of normal capitalism. However, the signs are there. Be aware, get involved.

-

-

Coinbase CEO Brian Armstrong says he’s taking a ‘Google or Amazon’ approach to distinguish solid projects and tokens from those with low value that could tarnish the entire industry.In an ask-me-anything session for Coinbase Pro on YouTube, Armstrong responds to a question about why he decided to open up the leading US cryptocurrency exchange to more than just Bitcoin, and how he intends to spot low-quality coins and keep them out of the mix.

Armstrong, who first explored Bitcoin in December of 2010 when he read the white paper, founded Coinbase in June of 2012.“Coinbase started and we were just Bitcoin, and there was really part of me that was hoping – from a simplicity of the product point of view – I was like, ‘I really just hope everything is going to be Bitcoin’, because then we don’t have to give people this idea of choosing different ones or switching between them.”

But after input from customers, the Bitcoin-only model changed.“We’d always go talk to our customers, and we see what they want. And it became clear at a certain point that more and more of them wanted to use Ethereum.We kind of resisted for a while, but then we were like, alright, let’s put the second one in there. And then there was a third, then there was a fourth.

And now it’s getting into this place where – I don’t know how many – if we fast forward five years, I’m not sure how many protocols there are going to be globally used. That might end up being like fiat currencies, where there are five or six majors and a whole bunch of minor ones.

But I do think there will be millions of tokens.There could be a token for every company or side project or GitHub repo or nonprofit. So I think that ship has sailed at this point. We’re going to be in a world with many, many tokens… How do we add the ones that don’t tarnish the brand or the whole industry?

Because there are a lot of projects out there that are just probably outright scams. That’s not good for anybody. So here’s the way I think about this now. I think about it a lot like Google or Amazon.”Armstrong says the general idea is to list everything that’s not a scam or harmful to people, while also giving traders and investors the tools to evaluate different tokens and coins.“A good example is Amazon.

There might be a product on there that has two out of five stars, and you can choose whether or not to buy it. But if it’s not like a fraudulent product or something, they’re not actually going to remove it, right?Similarly, Google – they’re going to index the whole web. If they didn’t index the whole web and show results for the whole web, it would be an incomplete search engine.

But if there is some site that has malware or the HTTPS certificate has expired or whatever, they might show you a warning, and they’re not going to let you do something that actually hurts you.

But they’re not going to try to tell you what you should or should not look at or use on the internet, unless they think it’s really dangerous.

They just think it’s low-quality. They might rank it lower or give it a lower rating. So that’s, I think, the world we’re moving to with Coinbase, and hopefully that is the best of both worlds.”-

By

Admin

Admin - 0 comments

- 2 likes

- Like

- Share

-

By

-

Facebook is reportedly planning to launch its own cryptocurrency within Whatsapp, which would allow users to frictionlessly transact with one another through the service without incurring fees.

According to Bloomberg, the new cryptocurrency will initially focus on the remittance market in India, where there are hundreds of millions of Whatsapp users and most financial transfers today are made via mobile payments. It's worth noting however that this coin won't be a typical cryptocurrency, it will be a 'stablecoin'.

Some kind of move into payments for the social media giant has been predicted ever since it appointed former PayPal president David Marcus to run its Messenger app in 2014. In May 2018, Marcus was then appointed to head up Facebook's blockchain initiatives.

He also sat on the board of crypto exchange Coinbase up until August 2018.

Another report from the New York Times suggests that this coin launch is expected to take place in the first half of 2019. Reportedly, the company has also spoken to exchanges about supporting the launch of the coin.

But Facebook is not alone in this space. Telegram, the secure messaging service favoured by crypto enthusiasts, Isis, and drug dealers alike, is also planning the launch of a within-app cryptocurrency soon, and so is its rival Signal.Why?

Initially focusing in India makes perfect sense for Whatsapp because there are less established payment structures in place than markets such as the US or the UK. In fact, although cash is still king in India, uptake of mobile technologies is spreading rapidly meaning that Whatsapp-enabled payments could enjoy fast and extensive market penetration.

At of last year, the country boasted a $400bn (£290bn) mobile wallet market, dominated by Paytm, India's biggest mobile payment company (part owned by Alibaba and Japan's Softbank) which has over 300 million registered users.

By launching in India first, Facebook is following in the footsteps of Google, who launched Tez (now named Google Pay), the company's first mobile payment service in India in 2017 before expanding into other countries.

Right now, there are reportedly 40 million monthly active users of Google Pay in India. What does Facebook's move signal? That the company aims to start competing with mobile payment services in India? Is this simply a trial ahead of a global launch?

It's hard to say exactly what Facebook is planning, but this fits neatly into the company's aim to infiltrate every aspect of our daily lives and become increasingly indispensable.What is a stablecoin?

Stablecoins are crypto coins with values pegged to that of an already existing currency or security. As the name would suggest, this ensures that the values of these coins are not subject to the wild fluctuations that affect currencies like bitcoin and ether.

Instead, the value of these coins only fluctuates at the same rate as the currency they are tied to, which is in most cases the US dollar. However, according to the New York Times, the Whatsapp coin would be pegged to a range of different foreign currencies.

Due to these features, stablecoins have proved popular recently, with a large number of new coins being launched in the past year. However, there have also been some high-profile flops, such as Tether and Basis, and the most used coins continue to be the older, more traditional forms of cryptocurrencies.

However, the financial clout and impressive technological know-how of Facebook may signal a new lease of life for the stablecoin market. The impact that this coin were to have if successful could be vast, given Facebook's huge potential reach into a receptive market of 2.4 billion monthly users.

But would these coins, linked to vast conglomerates such as Facebook, be truly decentralised as other cryptocurrencies are? It's likely that these coins would incorporate the best bits of crypto but probably be set up in a way as to be less decentralised than other coins.

This could involve privileging the Facebook management teams in decisions about the coin. Therefore, this would represent a departure from a truly decentralised world of cryptocurrency.

It's also unlikely these coins would be based on the same intensive 'proof-of-work' model that Bitcoin mining is based on, and instead may be closer to the premissioned blockchain networks popular in the enterprise.Will Facebook make money from this?

This to some extent depends how they orchestrate the model of the currency and its infrastructure. For coins that have been launched before, ICOs have been held where interested investors or people who would like to transact buy into a set amount of coins in exchange for whatever the value of the coin was at that time (something which has typically been set by demand).

The stable coin approach means that demand is less of a decisive factor, because value should remain steady regardless. However, if Facebook is creating a currency out of nowhere, then offering it to people in exchange for fiat currencies, the company will undoubtedly be making profit from the initial stages of the endeavour at least.-

Francisco Gimeno - BC Analyst This is going to be a very interesting experiment on stable coins and remittance use cases. We are eager to see how other more established platforms like Google Pay and in Africa Mpesa et alia react to this. However, this is just a speck of what will happen when the 4th IR disrupt traditional banking. Governments and Central Banks are just realising this.

-

-

Interview: Tokenization on the Blockchain with Former MD at Morgan Stanley - Coi... (coinnewslive.com)In an interview with CoinNewsLive, Patrick Springer, Former MD at Morgan Stanley discussed the future of asset tokenization on the blockchain and how will it change the financial markets.

Late last month we spoke to Patrick L. Springer, Advisor, Polybird Global Exchange on the future of cryptocurrencies and adoption of blockchain technology by big enterprises. In a follow-up conversation with CoinNewsLive, Springer discusses asset tokenization which has been identified as one of the next steps for large scale blockchain adoption.

CoinNewsLive (CNL): Asset tokenization: What is it and how will it change the financial markets – will it expand and open up the capital markets?

Springer: Asset tokenization is the process by which a financial asset is digitized and made available for exchange through blockchain technology.

The key words in the last sentence are digitized and Blockchain,and these two terms are enabling a trend that will be paradigm-shifting. Prior to the blockchain, there has been a finite way in which to exchange assets.

At the top end, an asset owner could list an instrument on a physical exchange, this would be limited mostly to equity and some types of debt securities; an elaborate trading and settlement system, and a somewhat costly one, has been created for this purpose.

Or it could be exchanged via a bank, who could form a loan or project financing syndicate with a party of entities the banks know. Finally, one could sell it to someone who is an acquaintance or through a lawyer, which is how most people buy or sell their #1 financial asset, their homes.

In each of these cases, a financial intermediary is needed to secure the transaction – the exchange, the bank, or the lawyer, respectively. Each of these methods has toll costs that need to be paid, and friction that may or may not lead to getting the best market-clearing price, for both the buyer and seller.

Digitizing an asset and securing it cryptographically via a blockchain can open new ways for assets to be exchanged and for investors to more specifically target their investments. With digitization, investments can be fractionalized into smaller denominations, making an investment available to larger numbers of investors, thereby making it potentially more liquid.

An example of this is a real estate project – from a large multi-billion-dollar mixed-use project to a new fifteen-unit condo project being constructed – it becomes possible via tokenization for more types of investors to participate in more types of real estate transactions.

Asset tokenization enables better micro-targeting of investments – for example, equity ownership vs. a coupon of cash flows, ability to buy an investment unit in Brooklyn and/or a unit in Miami, or a retail mall project in Arizona vs. a single-family unit in Colorado).

Asset tokenization has significant economies of scale that also reduce costs. Smart contracts on the blockchain will take on many of the legal and administrative functions of a transaction and will automate processes that until now require many steps, many hands, and a lot more time.

Automated rules via smart contracts will ensure that only appropriate investors – investors who meet regulatory requirements and financial suitability requirements – participate in an offering. All of this can reduce the toll costs I referenced above, and it reduces frictions.

For financial markets, historically this cost reduction has caused massive growth in financial markets driven by increased participation and higher turnover.

To be clear, however, asset tokenization is just getting started, and it will move and proceed in a stair-step pattern. Right now, the technology is being built to tokenize assets. But asset owners need help getting through the tokenization process, and there needs to be a marketplace where investors, especially institutional investors, can see, compare, and value different types of tokens.

In other words, a parallel system of digital capital markets advisors and a digital marketplace or marketplaces needs to be formed.

I am an advisor for Polybird Exchange, and this is where our business model resides. Remember that blockchain by design is decentralized by its nature, so the eco-system that will be created for digital assets may look quite different than the one we know for current asset markets today.

Patrick L Springer

CNL: Why Is it worth tokenizing company/rare assets?

Springer: In a world that is very concerned about inequality and asymmetrical access to financial opportunities, continued financial innovation is extremely important. There is no doubt that access to the global financial markets through stocks, bonds, ETFs, investment funds, and 401-Ks has made achieving risk and inflation-adjusted investment returns more possible for more people than ever before.

And for all those that think innovation has not gone far enough to democratize financial markets and improve investment access, then they should be very interested in tokenization and blockchain. Today’s institutional investors continuing to gravitate towards the markets for private securities, such as private equity and private credit, because they are having continued trouble making money in public markets dominated by ETFs and computer-based trading.

The markets for private securities are opaque, hard to access, and have limited price transparency and liquidity. Over time, more of these private securities will be digitized and made available on the Blockchain. More types of investors will be able to access these investments over time. This is very democratizing.

CNL: Why put stocks and bonds on the Blockchain?

Springer: There are two ways to look at this. One is that the current equity and debt markets are very efficient and will not need to change. It is infinitely easier for you to buy and sell a share of Apple than it is to buy or sell a car, a home, or a family antique. The needs case for digitizing the largest, currently traded equity securities is not here.

But there are many small companies that go public in off-exchange offerings, and there are many companies that avoid the costs of being a public company. These may find asset tokenization a financial opportunity. Separately, there are many parts of the publicly traded bond market where price transparency and liquidity are controlled by a very small number of dealers.

Have you ever tried to buy a municipal bond? Investors can only buy them in denominations of $5,000. Given the public finances of so many of our states, I can see the case that those securities should be fractionalized!

CNL: What else can be tokenized?

What are the benefits for these entities to do so? (i.e. movie financing, football teams, artwork?)

Springer: There are a lot of use cases for different types of assets, and there are use cases that have not even been thought of yet.Take the case of the biotech company, Agenus. This is a NASDAQ-listed biotech company with a market cap of about $450 million. Recall what I said about the efficiency of the capital markets for currently listed equities.

Well in January 2019, Agenus raised capital via a security token offering that offers investors a way to invest in a specific biotechnology product of theirs in return for a portion of potential future US sales of that product.

This has been offered to qualified investors via Atomic Capital, and so my understanding is that this has been done in conjunction with current US securities laws.

Want to get the latest crypto updates, analysis and breaking news? Follow us on Twitter (@CoinnewsLive).-

Francisco Gimeno - BC Analyst Very interesting. Who would tell us three or four years ago that we would be talking about asset Tokens, Security Token Offerings, crypto economy and market, as not only a game field but the potential future of financial and economic world in very few years time? Read this interview.

-

-

Token: Rewards App Powered by Blockchain Technology to be Introduced in Ithaca |... (cornellsun.com)Rewardzzz, a rewards app that identifies itself as the “first universal points exchange” and is known for its reliance on blockchain technology and the crytocurrency Stellar, will be introduced in Ithaca this fall.

Hunter Friedland ’19, CEO and founder of the tech startup, elaborated on how blockchain technology and cryptocurrencies function to explain how the app is meant to work.“Blockchain is the technology that powers all cryptocurrencies.

Bitcoin, Ethereum, Ripple, et cetera. Each cryptocurrency is its own blockchain. That’s one misconception a lot of people don’t understand,” he said.Friedland, who is a student in the School of Hotel Administration, explained further that cryptocurrencies are virtual assets that use blockchain technology as a distributive ledger.

Rewardzzz is built to be fairly straightforward to use — keeping the user away from the backend involvement with the blockchain, according to Friedland.Once users have the app, they can start getting rewards by going to any linked business. The user can get rewards at one business and use them at another — locally as well as internationally.

In Ithaca, Collegetown Bagels, Ithaca Bakery and Agava have already agreed to be a part of the Rewardzzz platform, with more businesses expected to join in the following weeks and months.

“How it works is when you go to a business, you have your linked cards. You swipe one of those card. The point of sale knows that card and automatically sends you the points,” Friedland said.According to Friedland, using blockchain for the app increases efficiency and reduces costs drastically.

“It cheaper for us to use the blockchain as opposed to, say, Amazon web service to power this,” he said.The transparency associated with blockchain also makes it a better prospect for the businesses which Rewardzzz is working with.

We are working with a bunch of independent businesses that don’t want to share their data and want to remain anonymous with each other; using a blockchain allows us to do that,” Friedland explained.

Over the summer and into the fall semester, Friedland is expecting the app to grow and to bring on more businesses as the app gathers attention, with the goal of having 20-25 businesses on the platform by the end of the summer.

http://cornellsun.com/2018/06/18/rewards-app-powered-by-blockchain-technology-to-debut-in-ithaca-are...

-

Francisco Gimeno - BC Analyst One new Dapp blockchain based to reward use of services in Ithaca, USA, with less costs than normal apps. These particular uses of Dapps are increasing and building the big picture of the Blockchain and tokenisation system, step by step. Tokenisation, transparency, democratisation is the key.

-

-

Security Token Academy was at the NYC Crypto Mondays Meetup hosted by Lou Kerner and James Haft of CryptoOracle.

The evening featured discussions on the rise of Security Tokens and the driving force behind the endurance of Blockchain.

Hear from:

James Galitsis, Investor

Sunil Mirpuri, Founder & CFO, Dispozables

Ricardo Irizarry, Founder, Binary AEON

Learn more about Security Token Academy at https://www.securitytokenacademy.com

-

Francisco Gimeno - BC Analyst Security Tokens, utility tokens... New Yorkers bet for security tokens as more tangible and useful in this stage of Blockchain development, and this is seen as a good thing in the middle term, to protect investors and allow the ecosystem to thrive. Well watch this and let us know what is your opinion. Join us.

-

-

-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Building a token sale is at once quite simple — you build a token and sell it — and quite complex. A number of issues crop up immediately, including, but not limited to, the need for an expensive team of lawyers, marketers, social media experts and, until now, an expensive crew to build your smart contract.

CoinLaunch, a project by repeat entrepreneur Reuven Cohen, aims to reduce the complexity of at least one part of the process. His service, CoinCreator, allows non-programmers to build simple smart contracts in a few minutes.

“Early this year we began looking for an end-to-end platform that facilitated everything we needed to build, deploy and monetize compliant Initial Coin Offerings in one place,” said Cohen. “As we searched we quickly realized that nothing like this exists.”

“Today if you want to create an ICO the only real option is to hire a team of blockchain developers, lawyers and accountants, and marketing gurus or build all the smart contract components yourself.

This process is time-consuming, complicated and expensive and also assumes you can even find the right people to help you, which is in itself difficult.

”The creator asks for a few basic bits if data, including the name of your coin and the total issued. Then you create a simple contract that controls the flow and usage of these tokens.

Cohen claims the product is compliant with current regulations as long as you connect the token to some sort of utility and avoid selling equity.

The project is self-funded and Cohen and his partner Randy Clemens are planning their own token sale in 2018.“CoinLaunch provides a free and easy to use Coin Creator that enables anyone with little to no experience in cryptocurrencies the ability to create their own Ethereum-based ICO (ERC20 tokens),” said Cohen.

“Combined with an ICO campaign creator that allows users to create an entire ICO campaign as well as accept Ethereum-based funding from backers.”

“The platform includes an integrated compliance system that allows for any vetted ICOs to comply with various local regulations, including KYC and AML.

We are also working on integrating SEC-based crowdfunding compliance, specifically Job Act Title III and Regulation A.”Ultimately tools that reduce the complexity of token sales will take over from the jerry-built systems currently in place.

Token-sales-in-a-box services exist, but they are aimed at raising massive consulting fees and basic, programmatic and regulated services just don’t exist yet. This is an interesting first step, and, according to Cohen, it’s quite popular.

The project launched yesterday and so far users have generated the equivalent of about $1 billion using the service.

Read more like this on Techcrunch here: https://techcrunch.com/2017/10/13/build-your-own-token-sale-with-coinlaunchs-coincreator/

-

Francisco Gimeno - BC Analyst New opportunities, new services, are born to deal with the challenges of the new blockchain and cryptocurrency economy.

-

-

Why should you create a user account on Blockchain Company (BC) today?For one, you will qualify to receive 500 free BC Tokens as long as… continue reading on our Medium page here: https://medium.com/blockchain-company/create-a-free-consumer-or-business-account-and-get-free-bc-tok...

-

By

Admin

Admin - 0 comments

- 6 likes

- Like

- Share

-

By

-

In the current era of Blockchain evolution a new concept has emerged: tokenization. Tokenization is an intrinsic part of the Blockchain technology that serves the purpose of platform identification and accessibility.

The power of tokens

Every Blockchain platform is powered by tokens, sometimes also referred to as “coins.” Bitcoin is a token, as is Litecoin, Dash, and other currencies that function over a Blockchain. While tokens can represent money, as in the case of the above, they can also represent other things.

The demand for a particular Blockchain product is usually the main determinant of the value and eventual market price of its token. This is why there is a variation in the prices of different altcoins in the Blockchain environment.

For example, Bitcoin is more readily accepted by merchants than Litecoin, and is consequently more valuable.The force behind Ethereum

Ethereum, despite coming after many older altcoins, remains the third most valuable cryptocurrency in existence behind only Bitcoin and the its recent fork, Bitcoin Cash.Ethereum’s value is largely determined by the demand for its platform by distributed application (dApp) developers.

Many of these developers issue tokens to grant access to their services, essentially building their own Blockchains atop Ethereum’s platform. In many cases, developers pre-sale their tokens as part of an initial coin offering (ICO), and they usually accept Ethereum’s token “ether” as payment.

In essence, the organic value of a given token or cryptocurrency is determined not just by the functionality, but the demand for its Blockchain product.Blockchains and their tokens

There are numerous Blockchain products in existence claiming to offer different solutions to various problems. Many more are still in the development. Below are some examples of Blockchain products and what they do:Steemit

Steemit is a social network that rewards users who participate in various ways. The Steemit token is called STEEM. It is used to reward content creators and curators of the best content on the site.Dash

Dash, which stands for “Digital Cash,” is a fork of Bitcoin that is fine-tuned for more privacy and instant transactions. The platform’s token is called DASH. Dash is also self-funded through its own Blockchain (a portion of mining rewards fund the currency’s development) and features a working governance model.ZCash

The token for Zcash is called ZEC. ZCash is a cryptocurrency that grew out of the Zerocoin project which aims to improve anonymity for Bitcoin users.

Zcash payments are published on a public Blockchain, but users are able to use an optional privacy features to conceal the sender, recipient, and amount being transacted....continue reading: https://cointelegraph.com/news/tokenization-the-force-behind-blockchain-technology-

By

Admin

Admin - 0 comments

- 13 likes

- Like

- Share

-

By

-

Blockchain healthcare company Patientory has been busy since Bitcoin Magazine first covered the organization in May.

The company, which is putting electronic medical records (EMRs) on an Ethereum-based blockchain for better security, has obtained funding and partnerships to help promote its concept.

By the time it launches its enterprise solution, the company wants to give medical practitioners healthcare at their fingertips - and easy account settlement for patients and healthcare payers alike.

Patientory released its payment token, "PTOY," on May 31. The three-day token sale raised $7.2 million from over 1,700 purchasers. The company is using the funding to launch its smart contract-based platform for EMR storage and patient payment processing.

"The healthcare system is fragmented," explained Chrissa McFarlane, CEO of Patientory. As McFarlane pointed out, Patientory "really brings together the industry as a collective toward reducing costs and improving not only the U.S. healthcare infrastructure but the global healthcare ecosystem.

"Since its crowdsale, the company has focused on integrating with other networks to help build a decentralized ecosystem for healthcare participants. One of the most significant developments for Patientory came in late August when it announced its partnership with the Linux Foundation's Hyperledger initiative.

Hyperledger follows the Linux Foundation's model of building reference platforms for commonly-used technologies. What it did for Linux, it hopes to do for the blockchain. Just as there are multiple Linux distributions, the project will spawn a family of blockchain frameworks using code from a single reference platform, making it easier for the frameworks to interoperate with each other.

A key part of a smart contract-based platform is an oracle, an agent that derives information from a third-party information source; which Patientory will build to communicate with Hyperledger's code.But Hyperledger won't be the group's only such partnership.

"The future of the blockchain is that there will be multiple chains out there," explained McFarlane. She expects to build oracles for those, too.One of Patientory's key goals is to integrate disparate processes in the healthcare system to produce end-to-end visibility.

"If we're going to use the blockchain to really be the foundational layer for that interoperability, then the chains have to interact with each other and provide the same functionality," McFarlane said.The company is paying similar attention to payments integration.

Blockchain-based digital cash network Dash has partnered with blockchain web services company BlockCypher to offer a grant program for organizations integrating their services. Patientory announced its participation in that program in August.

"Dash is purely digital cash, so we're able to spearhead and accelerate the usage of digital currency for transactions in the health industry," said McFarlane.

With this integration initiative, Patientory is focusing on healthcare payers. They can use the network for claims processing, finding patients securely and processing their claims transactions. Patients will also be able to use the system for settling payments.

Using the blockchain for payments between providers will drive efficiencies into a traditionally complex and bureaucratic system.Patientory "decreases their transaction fees and overhead from an administrative level," said McFarlane.

Patientory has been busy building relationships in other ways, too. McFarlane now chairs a blockchain working group; and July saw the company win an "innovation mention" in the #Patient2Consumer challenge organized by start-up network 1776 and the MedStar Institute for Innovation.

Patientory is also active on the conference circuit and is involved in the Distributed: Health conference currently taking place in Nashville.On the technical side, Patientory established its genesis block in July and launched its Alpha testnet.

Perhaps the biggest task facing the company now, though, is educating the market: It hopes to do so through the Patientory Foundation, the organization that orchestrated the crowdsale.

"A part of that at the Foundation level is to host events," McFarlane said. "We promote the concept and providing an avenue for people to ask questions and learn about the process and how everything works in this space.

"The company is hoping to launch its enterprise solution and beta the 1.0 version of it by the end of this year. Its focus now is on proving its concept, scaling the platform and fostering adoption. The first half of 2017 may have been busy, but for Patientory, much is still to come.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more stories like this on NASDAQ here: http://www.nasdaq.com/article/patientorys-journey-to-change-healthcare-cm850627-

By

Admin

Admin - 0 comments

- 0 likes

- Like

- Share

-

By

-

Token

- Everything (17537)

- Blockchain News (2016)

- Blockchain Apps (34)

- Crypto Currencies (262)

- White Papers (26)

- ICO (124)

- Use Cases (416)

- Conference and Seminars (15)

- Courses (19)

- Jobs and Talent (85)

- Events (35)

- Training and Lectures (120)

- Developers (16)

- Token (20)

- Research and Reports (614)

- Regulation (33)

- Service Providers (36)

- Wallets (28)

- Video (11825)

- Investors (27)

- Listen (64)

- Press Release (31)

- Tasks (18)

- 4IR Company (34)

- Defi (20)

- NFT (1)

- DAONFT

- Search BC

- About BC