results for ""

-

CNBC's "Power Lunch" team discusses the rise of cryptocurrencies and ransomware attacks with Lee Reiners, executive director of the Global Financial Markets Center at Duke Law School.

-

- 1

Francisco Gimeno - BC Analyst Sometimes we despair of the general critical thinking of our fellow humans. Should we ban USD as it's being used by despots, drug lords and human traffickers? Should we ban knives are they are use also for crimes? Etc. Cryptology experts would probably laugh at this. However, ransomware is a very serious crime growing steadily, and who says state actors are not among them (North Korea, anyone?). We need new solutions which don't mean to kill all the sheep because in this way the wolf will die of hunger.- 10 1 vote

- Reply

-

-

-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

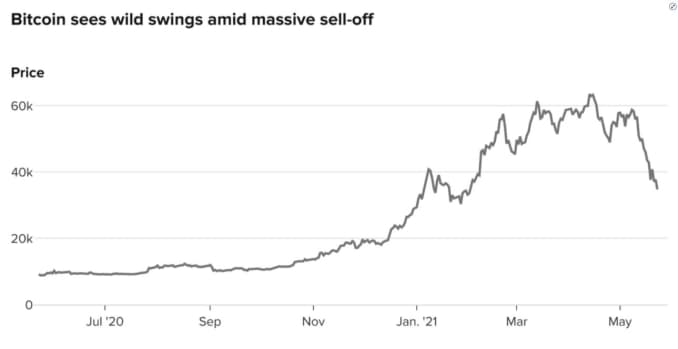

As Bitcoin takes a major hit following Elon Musk's tweets and China's crypto crackdown, Vince Lanci breaks down the news with Daniela Cambone— and advises long-term investors to ignore the volatility.

#bitcoin #china #digitalcurrency

What to do after the latest crypto sell-off: https://stansberryinvestor.com/media-...

More on China's crackdown on crypto: https://stansberryinvestor.com/media-...

Find the best crypto opportunities: https://stansberryinvestor.com/resear...

______________________________

Follow us on Facebook: https://www.facebook.com/StansberryRe...-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Brett Heath, CEO of Metalla Royalty & Streaming, said that cryptocurrencies will be the cause of the next financial crisis.

Citing previous crises in recent financial history, like the Dot Com Bubble, Heath told David Lin, anchor for Kitco News, that new technologies usually lead financial downturns.

__________________________________________________________________

Kitco News is the world’s #1 source of metals market information. Our videos feature interviews with prominent industry figures to bring you market-affecting insights, with the goal of helping people make informed investment decisions.

Subscribe to our channel to stay up to date on the latest insights moving the metals markets.

For more breaking news, visit http://www.kitco.com/

Follow us on social media:

Facebook - https://www.facebook.com/KitcoNews/?r...

Twitter - https://twitter.com/kitconewsnow

StockTwits - https://stocktwits.com/kitconews-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Register here for Consensus: https://www.coindesk.com/events/conse... .

Join us at the largest event in the emerging world of digital finance. Speakers include Ray Dalio, Caitling Long, Jamson Lopp, and more. May 24th -27th.

Data is an integral part of assessing and understanding ESG investments, but it's not always easy to use the available data correctly. Cristina Dolan, founder and CEO of InsideChains, and Marc Johnson of the Rocky Mountain Institute join "Money Reimagined" to discuss the intersection of data and ESG investing.-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Here are the 5 reasons you should NOT buy cryptocurrency, UNLESS you're prepared to follow a few strategies that give you the best chance at NOT losing money - Enjoy! Add me on Instagram: GPStephan

GET YOUR FREE STOCK WORTH UP TO $50 ON PUBLIC & SEE MY STOCK TRADES: http://www.public.com/graham-

Francisco Gimeno - BC Analyst Fun, but real. Small retailers, many being Millenials, are losing a lot, even in bullish market. Why? Because they don't have a plan, or don't understand the market. The focus is on rationality and common sense. That should be the foundation for any investment. There is a lot of speculation around.

-

-

Join us at the largest event in the emerging world of digital finance. Speakers include Ray Dalio, Caitling Long, Jamson Lopp, and more. May 24th -27th.

Bram Cohen joins "The Hash" and explains why Chia, a new cryptocurrency that is "farmed" based on proof of space and time, has a significant influence on the goal toward "green mining." Plus, his future plans for taking Chia public after its latest funding round with big-name backers.-

Francisco Gimeno - BC Analyst Chia has a very interesting community around. We have to see if really they are so energy efficient and "green" as they state. Not everybody agrees with them. Their concept of proof of space and time? We don't really know about it. There is already a strong debate in the Net on issues about PoW and PoS. As usual with any project, take your time to research, listen to other opinions and use your common sense.

-

-

Register here for Consensus: https://pixelfy.me/Consensus2021 .

Join us at the largest event in the emerging world of digital finance. Speakers include Ray Dalio, Caitling Long, Jamson Lopp, and more. May 24th -27th.

TechCrunch founder Michael Arrington is selling his apartment in Kyiv, Ukraine, as an NFT. "The Hash" panel discusses what tokenized deeds mean for the future of the NFT market.-

Francisco Gimeno - BC Analyst NFT's landscape is just starting. This use case, Real Estate NFTs, is very interesting. It's much more than a smart contract, as we can experiment for instance how this works, specifically how the transfer of property title is done. This is part of a global DeFi environment. More use cases with NFTs will be coming to the front soon.

-

-

The regulator has suggested that a dedicated market regulator would offer some protection against fraud and manipulation.

DeFi and crypto lending may pose issues for investors, SEC Chair Gary Gensler said.Decentralized finance (DeFi) could pose fresh challenges for U.S. investors, Securities and Exchange Commission (SEC) Chair Gary Gensler said Wednesday.

The cryptocurrency sector poses various risks to investors in the markets and challenges to the securities regulator, Gensler said in prepared testimony before the House Appropriations Committee. He pointed to volatility in the market and novel products as some examples of these issues.

“Crypto lending platforms and so-called decentralized finance (‘DeFi’) platforms raise a number of challenges for investors and the SEC staff trying to protect them,” Gensler said.

SEC Chairman Gensler: SEC Should Be ‘Ready to Bring Cases’ Involving Crypto

U.S. Securities and Exchange Commission (SEC) chief Gary Gensler said Thursday federal financial regulators should “be ready to bring cases” against bad actors in crypto and other emerging technologies. “The Hash” team weighs in.

The crypto market had an overall market capitalization of $1.6 trillion on Monday after losing over one-third of its value in under two weeks, he said. While bitcoin (BTC, +1.51%) grabs most headlines, he noted that more than 80 tokens have a $1 billion market cap, while more than 1,500 had a market cap of over $1 million.

Gensler previously told the House Financial Services Committee that stronger regulation around crypto exchanges could help protect investors. In particular, he suggested a dedicated market regulator for the crypto markets would provide some protection around fraud and manipulation, two concerns the SEC has often cited in rejecting bitcoin exchange-traded fund (ETF) applications.The regulator repeated the concern on Wednesday.

“Tokens currently on the market that are securities may be offered, sold, and traded in non-compliance with the federal securities laws. Furthermore, none of the exchanges trading crypto tokens has registered yet as an exchange with the SEC.

Altogether, this has led to substantially less investor protection than in our traditional securities markets, and to correspondingly greater opportunities for fraud and manipulation,” he said.

Read more: BlockFi Botches Promo With Outsized Bitcoin Reward Payments

Even the crypto market’s current volatility is suspect, Gensler seemed to say.“In recent weeks, the reported trading volume has ranged from $130 billion to $330 billion per day.

These figures, however, are not audited or reported to regulatory authorities, as the tokens are traded on unregistered crypto exchanges. That is just one of many regulatory gaps in these crypto asset markets,” Gensler said.

He also indicated that the SEC would be willing to bring enforcement actions against parties that don’t comply with federal securities laws.

The regulatory agency has already brought 75 such actions, and “has been consistent” in how it describes its approach, he said. He said the SEC “should be ready” to bring further actions in a speech to the Financial Industry Regulatory Authority last week.-

Francisco Gimeno - BC Analyst These SEC comments are not a negative opinion on the digital economy, but a reminder that anything which offers lending but with high risks is always delicate for regulators everywhere, and customers or users should fully understand this before investing or working with DeFi or crypto lending. Too much speculation and volatility around yet.

-

-

Under the waters of Lake Baikal in 1982, 7 Russian divers are exploring the world deepest freshwater lake on a research mission, but 50 metres underwater, strange humanoid creatures appear and in an attempt to capture one of them, all the divers are pushed up to the top by an unknown force. Who were these creatures and what can we learn from this encounter?

Catch full episodes of UFOs The Lost Evidence here:

https://bit.ly/3mNvYPR

Subscribe to Quest TV for more great clips:

http://www.youtube.com/subscription_c...-

Francisco Gimeno - BC Analyst There is a renewed interest in UAVs (old UFOs), but as event which can't be explained and which potentially could be a threat, both in air and under water, and even Obama affirming it. Why is this happening now? Maybe the era of secrets is gone, or there is a deeper meaning to this. Videos like this one (which can't be proved, btw) are fun but, what is happening out there?

-

-

- Traders taking excessive risk in the bitcoin market being forced to sell when the price goes down were the bigger culprits for last week’s 30% drop in bitcoin prices, according to analysts.

- Bitcoin traders liquidated roughly $12 billion in levered positions last week as the price of the cryptocurrency spiraled, according to bybt.com, a cryptocurrency futures trading platform.

- “Selling begets more selling until you come to an equilibrium on leverage in the system,” says JMP’s Devin Ryan.

Slow Ventures’ Jill Carlson on fears surrounding bitcoin mining councilBitcoin’s aggressive moves are being driven by much more than the next China crackdown or Elon Musk headline.

Traders taking excessive risk in the unregulated cryptocurrency market being forced to sell when prices go down were in large part responsible for last week’s 30% drop in prices and outages for major exchanges, according to analysts.

A burgeoning bitcoin lending market is also adding to the volatility.The price of cryptocurrencies tanked last week, with bitcoin losing roughly a third of its value in a matter of hours. Bitcoin popped to nearly $40,000 on Monday but is still down about 33% from its high.

When traders use margin, they essentially borrow from their brokerage firm to take a bigger position in bitcoin. If prices go down, they have to pay the brokerage firm back in what’s known as a “margin call.

” As part of that, there’s often a set price that triggers selling in order to make sure traders can pay the exchange back.Brian Kelly, CEO of BKCM, pointed to firms in Asia such as BitMEX allowing 100-to-1 leverage for cryptocurrency trades.

Robinhood does not allow traders to use margin for cryptocurrency, and Coinbase only allows it for professional traders.

Bitcoin bull says the volatility could lead to a big breakout

“You get this crowd factor — everybody’s liquidation price tends to be somewhat near everyone else’s-- when you hit that, all of these automatic sell orders come in, and the price just cascades down,” Kelly, told CNBC.Bitcoin traders liquidated roughly $12 billion in levered positions last week as the price of the cryptocurrency spiraled, according to bybt.com. This mass exodus wiped out about 800,000 crypto accounts.

“Selling begets more selling until you come to an equilibrium on leverage in the system,” said JMP analyst Devin Ryan. That selling begins to “compound” as leveraged positions are liquidated, because they can’t meet those margin requirements, he said.

“Leverage in the crypto markets — particularly on the retail side — has been a big theme that accentuates the volatility,” Ryan added.As the crypto market expands, Ryan said he expects leverage to become less of an influence, especially as more institutional capital comes in.Investors, both retail and institutional, have poured into bitcoin and other digital assets in 2021.

The world’s largest cryptocurrency exchange — Coinbase — said trading volume in the first quarter of the year was $335 billion, of which approximately $120 billion was retail and $215 billion was institutional.

Trading volumes totaled about $30 billion in the first quarter of 2020.Mark Cuban weighed in on the leverage aspect for ether, the world’s second largest cryptocurrency, on

Twitter last week.

“De-Levered Markets get crushed. Doesn’t matter what the asset is. Stocks. Crypto. Debt. Houses. They bring forced liquidations and lower prices. But crypto has the same problem that [high-frequency traders] bring to stocks, front-running is legal, as gas fees introduce latency that can be gamed,” Cuban said in a tweet last week.Lending

The other behind-the-scenes cause for selling may have come from the growing bitcoin lending market.Crypto companies such as BlockFi and Celsius allow bitcoin holders to store their crypto with the firm, in exchange for an interest rate of between 6% and 8%. On the back end, those firms lend bitcoin out to hedge funds and other professional traders.

They also allow people to use their bitcoin holdings as collateral for loans.For example, if someone took out a $1 million loan backed by bitcoin and the price drops by 30%, they may owe 30% more to the lender.

″As you hit a certain collateral level, firms will automatically sell your bitcoin and send the collateral to the lender,” BKCM’s Brian Kelly said. “This adds to the massive cascade effect -- there was so much volume that most of the exchanges broke.”Regulation

The fact that bitcoin is not regulated by a central bank is part of what makes it so valuable to its investors.But that lack of a central authority, and increased adoption has put a target on its back from some in Washington. The Treasury Department announced Thursday it will require any transfer worth $10,000 or more in crypto to be reported to the Internal Revenue Service.

“The market does not have the same backstops that other more traditional markets do,” said Ryan. “In some ways the crypto markets are cleaner and they’re not being influenced by a buyer of last resort.

”Still, Ryan said regulation can be viewed as validation of the crypto market, and could be a positive for the digital asset.

“The crypto markets are still in their early days relative to other asset classes and so they’re going through a maturation phase where they are scaling and adoption in increasing, its still relatively nascent,” he said. “Volatility is a feature here just as the market develops,” Ryan said.-

Francisco Gimeno - BC Analyst Many are trying to find causes for the selling and price dip of BTC, to try and foresee what is going to happen. Very reasonable points here, volatility fuelled by words from authorities, from high risk trading and from loans fuelled in DeFi platforms. We believe there are many others which together have resulted in this big mess.

-

The most brutal crash in crypto in the last 7 years has left even the experts asking themselves whether we are entering a MULTI-YEAR BRUTAL BEAR MARKET! Taking into account our new set of data and the opinions of experts, we have concluded with strong evidence a case that answers this question.

BEAR MARKET? HOW LONG WILL IT LAST?

We discuss BOTH scenarios, and use an unemotional approach to look at FACTS AND DATA. The evidence is overwhelming and best you come to this show prepared for all outcomes!

Guests Channels:

The Technical Traders: https://www.thetechnicaltraders.com/

Lisa Edwards (Twitter): https://twitter.com/LisaNEdwards

-----------------------------------------------------------------

SHOW PARTNER: Coin Panel

Referral Link: https://coinpanel.com/cryptobanter

Exchanges force you to choose between limiting your losses with a stop loss order and securing profits with a take profit order. You must be able to do both to trade safely and profitably.

On CoinPanel, you can use Stop-Limit/Stop-Market, Take-Profit-Limit/Take-Profit-Market orders to easily create stop loss and target orders. We watch the markets 24/7 for you, so you can relax, knowing your strategy is locked in.

What Do You Get?

1) Crypto Banter subscribers to Coin Panel get exclusive access for 30 days at no charge (From launch date)

2) Platform is not yet released to the public - so only Crypto Banter subscribers have access to it

--------------------------------------------------

Banter Twitter Channels:

Crypto Banter (Twitter): @crypto_banter

Ran NeuNer (Twitter): @Cryptomanran

Sheldon (Twitter): @Sheldon_sniper

Fred (Twitter): @Freds_Head

Rudo (Twitter): @TheChartArtist

Li (Twitter): @Fibonaccli

---------------------------------------------------

Crypto Banter is a live streaming channel that brings you the hottest crypto news, market updates and fundamentals of the world of digital assets – “straight out of the bull’s mouth”!! Join the fastest growing crypto community to get notified on the most profitable trades and latest market news!

LATEST AND EXCLUSIVE Crypto Banter Project Reports Download Link:

https://mailchi.mp/cryptobanter/h0cwt...

🚀 Join our community on https://t.me/cryptobantergroup for daily updates!! 🚀

🚀 Announcement Channel - https://t.me/cryptobanterannouncement 🚀

🚀 Banter Discord Channel - https://discord.gg/fhpKtEygeP 🚀

🚀 Instagram Page - https://www.instagram.com/crypto_banter/ 🚀

-----------------------------------------------------

**BEWARE OF SCAMMERS IN OUR COMMENTS AND COMMUNITY CHANNELS**

00:00 Introduction

11:00 The first thing I did this weekend

12:30 Has anything changed in my thesis of crypto?

16:50 The next thing I did this weekend

17:50 What caused this correction?

21:30 The structure of a property market

23:00 Structure of crypto market

29:15 My signal to start buying

31:00 BTC chart

34:10 Stock market cycle compared to BTC

39:30 An imminent stock market correction ahead?

46:00 Matic chart

51:00 Shopping list

52:00 A perfect portfolio

54:00 Total market cap chart

55:00 BTC chart-

Francisco Gimeno - BC Analyst Ran Neuer continues his almost daily banter and he is becoming one of the people to listen in this volatile landscape. Better, he provides loads of information and connects with all kind of experts which may help us to make better decisions. This specific video is tremendously interesting for those yet confused by the latest turn of crypto.

-

-

Abhijit Chawda is a Theoretical Physicist, Technologist, History & Geopolitics researcher, and writer. This is part 2 of our mind-bending podcast. Part 1 was an introduction to what goes around our universe. A deeper and more mind-blown knowledge, packed into this episode.

From Aliens to time travel to multi & parallel universe, Abhijit Chawda has answered all these questions and shared more unknown secrets of our universe and our solar system that you never knew.

For every space nerd and science geek, don’t miss out on this one as we unravel some of the most interesting topics in the simplest way possible.

#alien #timetravel

0:00- Introduction

1:06- Ranveer on the movie, Arrival

3:16- Abhijit on Aliens

6:33- Are Aliens a part of the unexplored solar system?

8:32- Ranveer on mind-stimulating video games

12:03- Mind-bending science fiction movies

13:40- Abhijit on time travel, multi-dimension & more

18:57- What if humans pass through a black hole?

22:01- Abhijit’s knowledge portal

23:40- Twitter-verse

23:48- Sound of the cosmos

25:53- What does space smell like?

26:25- Will time travel create multiple timelines?

29:45- Do our thoughts create multiple universes?

30:53- Positivity attracts positivity

34:40- Picking up people’s energies

37:10- Ranveer on great intuition vs weak intuition

38:23- Abhijit on pattern recognition

39:58- Other versions of humans in parallel universes

46:57- Theories on why a black hole doesn’t exist

50:11- Did ancient Indian space-time made any sense?

54:39- Parting off note for viewers

YouTube: https://www.youtube.com/channel/UC2bB...

Instagram: https://www.instagram.com/abhijit.cha...

Facebook: http://facebook.com/AbhijitLChavda

Twitter: https://twitter.com/AbhijitChavda

Website: https://abhijitchavda.com/

🎧 Listen To #TheRanveerShow On Spotify:

https://open.spotify.com/show/6ZcvVBP...

-

Francisco Gimeno - BC Analyst We live in weird times. What was considered foolery not so long ago it's now on the main news. What before was science fiction is now science, or at least not fiction anymore. Quantum, the multiuniverse theory, and the possibility of alien life. Mix it with everything we are learning about the theory of consciousness and we are in a new knowledge paradigm.

-

-

Wolfe Research is recommending a liquidation of Lordstown Motors shares, saying it competes in the EV space; investors argue Ether could become a real commodity before Bitcoin; and Microsoft is pulling the plug on Internet Explorer after 25 years. Subscribe to CNBC PRO for access to investor and analyst insights on crypto and more: https://cnb.cx/2BT2E7y

» Subscribe to CNBC TV: https://cnb.cx/SubscribeCNBCtelevision

» Subscribe to CNBC: https://cnb.cx/SubscribeCNBC

» Subscribe to CNBC Classic: https://cnb.cx/SubscribeCNBCclassic

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

The News with Shepard Smith is CNBC’s daily news podcast providing deep, non-partisan coverage and perspective on the day’s most important stories. Available to listen by 8:30pm ET / 5:30pm PT daily beginning September 30: https://www.cnbc.com/2020/09/29/the-n...

Connect with CNBC News Online

Get the latest news: http://www.cnbc.com/-

Francisco Gimeno - BC Analyst Time of changes. BTC is not ETH and we can't compare them as they have different ecosystems and issues. If we are moving to a new crypto landscape, a Crypto2.0, new crypto coins will appear which offer solutions to real use cases. Otherwise we will continue with the same volatile and speculative system.

-

-

Bobby Lee, Ballet founder and CEO and "The Promise of Bitcoin" author, joins "Squawk on the Street" to discuss the swings in the price of bitcoin. Subscribe to CNBC PRO for access to investor and analyst insights on crypto and more: https://cnb.cx/2BT2E7y

» Subscribe to CNBC TV: https://cnb.cx/SubscribeCNBCtelevision

» Subscribe to CNBC: https://cnb.cx/SubscribeCNBC

» Subscribe to CNBC Classic: https://cnb.cx/SubscribeCNBCclassic

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

The News with Shepard Smith is CNBC’s daily news podcast providing deep, non-partisan coverage and perspective on the day’s most important stories. Available to listen by 8:30pm ET / 5:30pm PT daily beginning September 30: https://www.cnbc.com/2020/09/29/the-n...

Connect with CNBC News Online

Get the latest news: http://www.cnbc.com/-

Francisco Gimeno - BC Analyst Strange title for an interview. BTC can't change from what it's now. The crypto market is like a casino now, but this is because of the high volatility of the speculation happening there. The whole concept of crypto should return to its origin, a tool for the digital economy of the 4th IR.

-

-

CNBC's Kelly Evans discusses the volatility in the crypto market with Meltem Demirors, chief strategy officer of CoinShares. Subscribe to CNBC PRO for access to investor and analyst insights on crypto and more: https://cnb.cx/2BT2E7y

» Subscribe to CNBC TV: https://cnb.cx/SubscribeCNBCtelevision

» Subscribe to CNBC: https://cnb.cx/SubscribeCNBC

» Subscribe to CNBC Classic: https://cnb.cx/SubscribeCNBCclassic

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

The News with Shepard Smith is CNBC’s daily news podcast providing deep, non-partisan coverage and perspective on the day’s most important stories. Available to listen by 8:30pm ET / 5:30pm PT daily beginning September 30: https://www.cnbc.com/2020/09/29/the-n...

Connect with CNBC News Online

Get the latest news: http://www.cnbc.com/-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Patrick Bet-David has a virtual sit-down with theoretical physicist and futurist Michio Kaku. In this interview they talk about the universe, God and more. Check out his newest book "The God Equation: The Quest for a Theory of Everything: " https://amzn.to/3vMU5BD

Michio Kaku's official website: https://bit.ly/3b3EMwD

Recommended video - Classified Alien Encounters Revealed By Traumatologist:https://youtu.be/CiKT2z5HiDU-

By

Admin

Admin - 0 comments

- 2 likes

- Like

- Share

-

By

-

Given the remarkable advances in precision cosmology over the past few decades, can we forecast what we might discover in 10 or 20 years or even 30 years at mid-century? What are the categories of human destruction and what are the odds of each? What is the far far future of life and sentience in the cosmos? Martin Rees answers these questions and more in this Closer To Truth Live event.

Register for free at closertotruth.com for subscriber-only exclusives: http://bit.ly/2GXmFsP

Closer to Truth presents the world’s greatest thinkers exploring humanity’s deepest questions. Discover fundamental issues of existence. Engage new and diverse ways of thinking. Appreciate intense debates. Share your own opinions. Seek your own answers.-

Francisco Gimeno - BC Analyst In an age of changes, we try to understand the big picture, as humans, as a civilisation, our role in the Universe, what is there ahead of us, what about life, conscience and sentience? Just 100 years ago the paradigm was we were living in a Galaxy. Now we know much more, starting with this: we are just starting to glimpse what is everything about.

-

-

The International Monetary Fund has mixed views about cryptocurrencies. Tommaso Mancini-Griffoli of IMF says the organization sees them as investment assets rather than an alternative to fiat money due to volatility. Mancini-Griffoli joins "First Mover" to discuss the financial reasons why the IMF thinks people are drawn to crypto and shares his thoughts on how China's CBDC project will impact the global financial system.

-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Join us at the largest event in the emerging world of digital finance. Speakers include Ray Dalio, Caitling Long, Jamson Lopp, and more. May 24th -27th.

BTCKing, LLC CEO Dee Duncan discusses how crypto can abolish colonial systems of control in Africa and transform the future of economic development in the continent.-

Francisco Gimeno - BC Analyst If there is somewhere crypto is a tool of change beyond speculation and rife volatility is the Africa continent, particularly the Sub-Saharan countries. The economy and financial power house of Africa is slowly waking up, with multitude of projects and developments which can build the 4th IR for the African Renaissance.

-

-

Shark Tank star and entrepreneur Kevin O'Leary joins this special ESG edition of "Money Reimagined" to explain how the crypto industry can become more sustainable and why he believes "clean" bitcoin will become more popular with investors.

-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Gov. Gordon joins "First Mover" to discuss the nascent crypto industry blooming in Wyoming and what it will take to get more "pioneers" to go west to Wyoming. Plus, the Governor shares whether he holds any crypto or not.

-

Francisco Gimeno - BC Analyst Wyoming doesn't only welcomes Bitcoin. They welcome the innovation of new techs around the blockchain and other 4th IR techs. Crypto being one of the tools to make sure this happens. Entrepreneurs, investors and users find the environment is conducive to create this. Yes, it's not Silicon Valley, nor Miami. But, somehow, it's becoming the haven for all things 4th IR in the USA.

-

-

The current Bitcoin price cycle is coming to an end, and before the price continues its upward trajectory, it must first correct downwards, said Clem Chambers of InvestorsHub.

Chambers told David Lin, anchor for Kitco News, that the price will likely correct to $20,000 before a “crypto winter”, a period of price stagnation, takes place. After that, a rally to new all-time highs, potential $120,000, is possible.

__________________________________________________________________

Kitco News is the world’s #1 source of metals market information. Our videos feature interviews with prominent industry figures to bring you market-affecting insights, with the goal of helping people make informed investment decisions.

Subscribe to our channel to stay up to date on the latest insights moving the metals markets.

For more breaking news, visit http://www.kitco.com/

Follow us on social media:

Facebook - https://www.facebook.com/KitcoNews/?r...

Twitter - https://twitter.com/kitconewsnow

StockTwits - https://stocktwits.com/kitconews

Live gold price and charts: http://www.kitco.com/gold-price-today...

Live silver price and charts:-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Beijing's warning to miners is being blamed for bitcoin's tumble back down to $32K. The Asian crypto markets are spooked. The crypto exchange and mining operation Huobi says it will suspend new accounts in China and scale back its mining operations. Angie Lau of Forkast News joins "First Mover" to update the state of crypto in Asia.

-

By

Admin

Admin - 0 comments

- 1 like

- Like

- Share

-

By

-

Jan Van Eck, CEO of VanEck Associates, joins Worldwide Exchange to discuss the recent moves in cryptocurrencies. Subscribe to CNBC PRO for access to investor and analyst insights on crypto and more: https://cnb.cx/2BT2E7y

» Subscribe to CNBC TV: https://cnb.cx/SubscribeCNBCtelevision

» Subscribe to CNBC: https://cnb.cx/SubscribeCNBC

» Subscribe to CNBC Classic: https://cnb.cx/SubscribeCNBCclassic

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

The News with Shepard Smith is CNBC’s daily news podcast providing deep, non-partisan coverage and perspective on the day’s most important stories. Available to listen by 8:30pm ET / 5:30pm PT daily beginning September 30: https://www.cnbc.com/2020/09/29/the-n...

Connect with CNBC News Online

Get the latest news: http://www.cnbc.com/-

Francisco Gimeno - BC Analyst More explanations on the crypto massacre of the last week. Volatility is rife yet. Crypto is becoming a casino, as anything can happen. We believe, we will say again and again, this is not what crypto should be in a digital economy fuelling the 4th IR. Things should change.

-