Bitcoin

Bitcoin

Bitcoin is a cryptocurrency and worldwide payment system. It is the first decentralized digital currency, as the system works without a central bank or single administrator. The network is peer-to-peer.

- Birthday August 18th, 2008

- Country United States

-

Profession - Describe your professional skills or service here

Learn about Bitcoin

Buy Bitcoin

Trade in Bitcoin

Invest in Bitcon

Use Bitcoin to make payments

Send Bitcoin to friends and people you love or care about.

Discover the ecosystem of Blockchain

Follow us after you've created a free account here on BC. Bitcoin will follow you back!

Share Bitcoin content with friends and what you discover to your BC blockchain page, just like this one. Thanks for helping others around the world discover and learn about Bitcoin!

- 14 followers

- 543 following

- 21 posts

- 11 likes received

- 1 comment received

- 35 points

- About Bitcoin 2 items

- Blockchain Use Cases 1 items

- FAQ 1 items

- Introduction To Bitcoin 5 items

- Participate 2 items

- Stories We Like 19 items

-

About bitcoin.org

Bitcoin.org is dedicated to help Bitcoin to develop in a sustainable way.Who owns bitcoin.org?

Bitcoin.org was originally registered and owned by Bitcoin's first two developers, Satoshi Nakamoto and Martti Malmi.

When Nakamoto left the project, he gave ownership of the domain to

additional people, separate from the Bitcoin developers, to spread

responsibility and prevent any one person or group from easily gaining

control over the Bitcoin project.

From 2011 to 2013, the site was primarily used for releasing new

versions of the software now called Bitcoin Core. In 2013, the site was

redesigned into its current form, adding numerous pages, listing

additional Bitcoin software, and creating the translation system.

Developer documentation was added in 2014.

Today the site is an independent open source project with

contributors from around the world. Final publication authority is held

by the co-owners, but all regular activity is organized through the

public pull request process and managed by the site co-maintainers.

Bitcoin.org is not Bitcoin's official website. Just like nobody

owns the email technology, nobody owns the Bitcoin network. As such,

nobody can speak with authority in the name of Bitcoin.Then... who controls Bitcoin?

Bitcoin is controlled by all Bitcoin users around the world.

Developers are improving the software but they can't force a change in

the rules of the Bitcoin protocol because all users are free to choose

what software they use. In order to stay compatible with each other, all

users need to use software complying with the same rules.

Bitcoin can

only work decently with a complete consensus between all users.

Therefore, all users and developers have strong incentives to adopt and

protect this consensus.Mission

- Inform users to protect them from common mistakes.

- Give an accurate description of Bitcoin properties, potential uses and limitations.

- Display transparent alerts and events regarding the Bitcoin network.

- Invite talented humans to help with Bitcoin development at many levels.

- Provide visibility to the large scale Bitcoin ecosystem.

- Improve Bitcoin worldwide accessibility with internationalization.

- Remain a neutral informative resource about Bitcoin.

Help us

You can report any problem or help to improve bitcoin.org on GitHub

by opening an issue or a pull request in English. When submitting a

pull request, please take required time to discuss your changes and

adapt your work. You can help with translations by joining a team on Transifex.

Please don't ask for promotion for your personal business or website,

except for special cases like conferences. Many thanks to all

contributors who are spending time improving bitcoin.org!

- Admin and

- Ahmet Jamal

-

- 1

Bitcoin Bitcoin Bitcoin is hot in the news and has risen dramatically lately. You can learn more about Bitcoin right here on BC! As always, invest wisely, sensibly and invest only what you can afford.- 10 1 vote

- Reply

-

This video is also showing now on BCtv here, for larger screen viewing on your desktop, laptop and connected smart tv.

Subscribe to our Free Financial Newsletter:

http://crushthestreet.com

For more information on how to profit from this massive world-changing trend, visit CrushTheStreet.com/bitcoin.

- Paula Nita and

- Bitcoin

-

Bitcoin Bitcoin Share Blockchain videos like this one with friends. Blockchain is the protocol that enables Bitcoin an over 1000 Cryptocurrencies today. The blockchain is disrupting every industry one way or the other and skills in this area are highly sought after. Learn more to keep ahead

-

Over the past year, the price of a Bitcoin has skyrocketed from less than $800 to nearly $20,000 — a meteoric rise that financial insiders say is no different than the escalating cost of a tulip in seventeenth-century Amsterdam.

Is it a bubble? Who cares!This video is also showing now on BCtv here, for larger screen viewing on your desktop, laptop and connected smart tv.

As VICE News' Jay Kang told us, “It’s impossible right now to not get rich if you own any Bitcoin.”

Kang first got the Bitcoin bug in July, initially investing $4000, upping it to $9000, then fearing a crash, betting his entire crypto-cache on a random soccer game (which he lost).

A former aspiring professional poker player, Kang bounced back undeterred, and with the surging price of the currency, Bitcoin mania has taken over his life. He claims 10 percent of his net worth is now invested in cryptocurrency.

Subscribe to VICE News here: http://bit.ly/Subscribe-to-VICE-News

-

CNBC's Bob Pisani discusses what factors play into varying bitcoin prices.

» Subscribe to CNBC: http://cnb.cx/SubscribeCNBCThis video is also showing now on BCtv here, for larger screen viewing on your desktop, laptop and connected smart tv.

-

By

Bitcoin

Bitcoin - 0 comments

- 0 likes

- Like

- Share

-

By

-

Oliver Bussmann is founder and managing partner at Bussmann Advisory, the president of not-for-profit Crypto Valley Association and former group CIO and managing director at UBS.

The following article is an exclusive contribution to CoinDesk's 2017 in Review.

2017 was a year of tremendous growth for blockchain, though not in the expected ways.At the beginning of this year, I and others predicted that 2017 would be the year that blockchain moved from proof-of-concepts into production.

We did see some notable successes in this regard.Ripple became a fully operational platform with over 100 members and payment volumes in the billions, and industries began to form blockchain business networks, for example, the Digital Trade Chain consortium (DTC) in trade finance.

But overall, I expected to see more "go lives" than we did. On the other hand, I don't think anyone expected the unprecedented growth in the market capitalization of cryptocurrencies or the related ICO boom.So, what will the new year bring? Despite the obvious perils in making predictions, I feel confident that, among other things, we will see the following:- Blockchain solutions will continue to come into production as the "low-hanging fruit" are addressed.

- Cryptocurrencies will continue to grow, fueled by traditional asset management players and techniques.

- Companies will focus on changing business models as blockchain begins to transform market structures.

- New ecosystems with smart contract technology will arise as integration platforms between existing industries.

- The ICO will become "professionalized" and morph into IPO 2.0.

- Scalability and performance of blockchains will become a critical issue, and there will be interesting new approaches

- People will increasingly recognize that local blockchain ecosystems are a critical success factor.

Low-hanging fruit

Although it was quieter than expected this year, I believe we will continue to see blockchain solutions come into production as enterprises address the "low-hanging fruit" by digitizing businesses and use cases where blockchain can make the most impact.In fintech, the two most promising use cases remain payments (where there are $50–60 billion of potential savings to be had) and trade finance (which stands to save some $15 billion).

As we saw payments do in 2017, I expect we will see trade finance begin to go live on blockchain in 2018. In payments, momentum will pick up and volumes will increase as larger banks, including correspondent banks, get into the act. These players will be tempted by the advantages blockchain brings in terms of real-time processing, lower risk profiles, lower costs and transparency.

Blockchain can serve as a stick as well as a carrot, simply by proving that there are better alternatives to the status quo in many industries. We can imagine, as an example, that blockchain has had a hand to play in the European Banking Authority's EU-wide transparency exercises.

We were all somewhat surprised – if pleasantly so – by how well cryptocurrencies did in 2017 as a speculative asset. Indeed, growth was spectacular, with the asset class rising from $14 billion in December 2016 to over $450 billion in December 2017 in terms of market capitalization.

I think this growth will continue to be fueled by traditional asset management approaches, including bitcoin futures, crypto hedge funds and the like, all of which will increase the demand for cryptocurrencies and tokens.New business models

As blockchain continues to change market structures, companies will increasingly focus on changing business models.In a world where middlemen are becoming obsolete, companies will have to learn to stop thinking in silos and be more open to becoming partners in ecosystems or on broader platforms.

That, in turn, means deciding what kinds of business models they want – whether it's platform plays, product plays, omni-channel strategies, and so on.

These discussions will become multi-dimensional, encompassing both existing services and, increasingly, the new kinds of services that blockchain enables – particularly as blockchain combines with IoT and AI to create new kinds of marketplaces where industry silos come down in favor of broad, horizontal structures.

One of the most satisfying parts of 2017 for me was being able to see this start to happen close-hand among some of the companies I have the privilege to work with. (See disclosures below.)Deon Digital has partnered with Mercedes Benz to develop a new operating system that will help break down silos in the mobility space.

Skycell is a good example of IoT and blockchain opening up the pharmaceutical supply chain to embrace payments, invoicing and insurance. TEND is rethinking investment management by creating a Sharing Economy 2.0 for high-value assets.

One space I think we should keep a particular eye on in 2018 is the fund industry, where firms like Melonport are using blockchain to rethink asset management. I think we will see more of this, and that the fund industry will start to be significantly disrupted next year.

This will start with the management of crypto assets, but over time we will see traditional assets increasingly being tokenized, migrated onto blockchains and managed on-chain.The morphing of ICOs

With startups raising over $3.5 billion in ICOs, 2017 was clearly the year of the token launch.To me, though, the ICO boom is significant, not necessarily because of the amounts raised, but because we are seeing the beginnings of the democratization of venture capital.

And though the concept had a great 2017, change will come to the world of ICOs in 2018 as more traditional players get involved.

Over the next 12-18 months, I expect people with experience and expertise in the IPO world will embrace tokenization as a technical platform, and the whole business will be professionalized, with book building, pricing, startup evaluation and so on happening more along traditional lines.

As we've already begun to see, it will be harder to get funding simply on the back of a white paper. Investors will demand sound business plans and high levels of transparency, with all that entails.Scalability and ecosystems

One of the key challenges of existing blockchain technology is scale and performance. I predict that next year we will see alternatives to current blockchain technologies that will be more scalable, faster and minimize energy consumption.

IOTA, which has gained a lot of traction lately, is, I think, a project to watch in this regard.

I also believe people will increasingly find that local blockchain ecosystems, where critical services are co-located in one geographical area, are critical success factors for blockchain projects. This is certainly what we see in the "Crypto Valley" in Switzerland.

As the President of the Crypto Valley Association, I hope readers will forgive me for predicting – or at the least, pitching for – the continued success of Switzerland as a blockchain ecosystem.

Crypto Valley has a high concentration of all the services blockchain projects will need to raise money and set up shop, including legal, advisory, tax, accounting, smart contract platforms, KYC/AML utilities and marketing expertise.

This coupled with Switzerland’s other advantages, from its state-of-the-art infrastructure to its highly skilled workforce, will, in my opinion, mean it should remain a great draw for blockchain companies – in the new year and hopefully for many years to come.

Disclosure: Oliver Bussman is a strategic advisor to IOTA, Deon Digital and Tend, mentioned in this article.

Disagree? CoinDesk's 2017 in Review is ongoing – and open for submissions. Email [email protected] to pitch your article ideas.

-

By

Bitcoin

Bitcoin - 2 comments

- 1 like

- Like

- Share

-

Bitcoin Bitcoin Share Blockchain stories like this one with friends. Blockchain is the protocol that enables Bitcoin an over 1000 Cryptocurrencies today. The blockchain is disrupting every industry one way or the other and skills in this area are highly sought after. Learn more to keep ahead

-

Just 1,000 bitcoin holders own 40 per cent of the market, according to a new report. These major investors, known as “whales”, could cause the value of the cryptocurrency to plummet at any point, it has been claimed.

Bitcoin hit a new record high on 8 December, soaring above the $17,600 mark. At the start of the year, it was worth $970. However, the cryptocurrency is notoriously volatile. Its value fell to below $14,000 on 10 December, before rising to more than $16,000 on 11 December. What's more, financial experts have suggested that bitcoin could be even more unstable than people thought.

1,000 holders own about 40 per cent of bitcoin, a new Bloomberg report claims, adding that the future of the cryptocurrency lies largely in these so-called bitcoin whales’ hands.

At current prices, each of them may be considering selling around half of their holdings, Aaron Brown, the former managing director and head of financial markets research at AQR Capital Management, told Bloomberg.

The report adds that many of the whales have know each other for several years, and can coordinate their moves by sharing information – which isn't illegal in the case of bitcoin.

According to a recent report, 16,381,204 bitcoin were in circulation as of mid-2017, and almost four million have been lost and may never be recovered.

This article originally used the word “people” about the biggest holders of bitcoin. Some of those owners are in fact groups and organisations, and the article has been edited to reflect that.

Reference:

According to a recent report, 16,381,204 bitcoin were in circulation as of mid-2017, and almost four million have been lost and may never be recovered.

-

By

Bitcoin

Bitcoin - 0 comments

- 0 likes

- Like

- Share

-

By

-

When your cab driver starts talking about Bitcoin, it’s time to sell | Financial... (business.financialpost.com)Whether it’s the shoeshine boy of decades past, or the taxi driver

of more recent times, an old investing adage suggests that when somebody

you wouldn’t expect is talking stocks or giving you portfolio advice,

it’s time to sell.

And these days, it’s hard to find someone who isn’t talking about Bitcoin.

From

high school students discussing how to purchase fractions of the

digital currency over lunch at McDonald’s to YouTube celebrities giving

advice on how to make a quick buck, or thousand, the mania around the

cryptocurrency has been mounting for weeks

On Sunday night, it grew even stronger, as Cboe Global Markets Inc. launched the trading

of Bitcoin futures contracts, leading to another price surge and the

imposition of trading halts to quell the frenzied activity.

On

Monday, the rise continued, as prices for the contract expiring on Jan.

17 — the vast majority of CBOE Bitcoin futures traded so far have been

of the one-month variety — leapt more than US$3,100 to US$18,600 by late

afternoon.The

price of Bitcoin itself, as report by Coindesk.com, also surged Monday,

climbing nearly 13 cent to surpass US$17,000 for the first time.

“We’re

obviously dealing with a global phenomenon that everyone can

potentially partake in — both the creation of Bitcoin, but also

investing in it,” said Douglas Porter, chief economist at BMO Capital

Markets. “There is a place for it, and certainly the blockchain

technology does have a very important future. Having said that, every

great mania or bubble starts off with a very compelling story.

”The

most popular of many unregulated digital currencies with blockchain as

the underpinning technology, Bitcoin began 2017 just below US$1,000, and

is up more than 275 per cent in the past three months alone.“It

has — to some extent — gotten a stamp of legitimacy from the fact that

the CBOE has welcomed it, and the fact that so many central bank

officials globally are now looking at it,” Porter said, noting

speculation that the U.S.

Federal Reserve may eventually issue its own

cryptocurrency, and ensure Americans use it.“We’re definitely

hearing modern-day versions of the shoeshine boy story, which is usually

a pretty good signal that we’re getting close to the top.

Although,

history has show that manias can go on a lot longer than many people

believe is possible,” he added....continue reading: http://business.financialpost.com/technology/blockchain/when-your-cab-driver-starts-talking-about-bi...

-

Bitcoin traders and watchers have been busy heralding the entrance of

cryptocurrencies futures. What they should really be focused on is the

exit.

The first 24 hours of the Cboe Global Markets Inc.'s bitcoin

futures contract went pretty well.

By Monday evening, 3,969 of the

Cboe's main January contracts had been bought and sold -- not big by

established futures market standards, but more than many people

expected. With some brokers barring shorting, there was some concerns

that buyers wouldn't be able to find sellers.

That didn't happen. There

also wasn't a huge flood of people waiting to bet against bitcoin and

driving the price of the contract down. Instead, it ended up $3,545 on

the day at $18,545. Bitcoin rose, too. As much as bitcoin bulls

might want to use the smooth start of trading to contend that the

cryptocurrency and its price are more solid than critics contend, the

real test won't come until Jan. 17.

That's when the Cboe's first main

contract expires. And as any futures trader knows, getting out can be

trickier than getting in.

Less Buzz

There

already are some troublesome signs. On Tuesday, the price of the

January contract was down $815, and volume was much lower in the second

day of trading.

But the biggest problem could be the persistent, and

unusually large, gap between the price of bitcoins and the futures

contract. That spread was more than $1,000, or 6 percent, as of Tuesday

morning, though it had been double that a day earlier....continue reading on Bloomberg: https://www.bloomberg.com/gadfly/articles/2017-12-12/bitcoin-bulls-should-focus-on-futures-exit-not-...

-

By

Bitcoin

Bitcoin - 0 comments

- 0 likes

- Like

- Share

-

By

-

Hi it’s Invest Diva’s Kiana with News BTC and here is your

crypotocurrency update. After a big day for Bitcoin in the futures

market, Ethereum, the second largest cryptocurrency by market cap, still

struggles to break above the key resistance level of $484 versus the

USD.

Ethereum has been considered Bitcoin’s direct competitor by many

investors, but its price is nowhere as volatile as Bitcoin price.

Therefore, Ethereum is less likely to be driving up in a bubble, and

carries less crash risk as of today. On the corporate side, some of the

largest banks in the world have revealed a pilot designed to simplify

compliance using Ethereum. The project was born out of UBS' London-based

fintech laboratory.

Now they have help from Barclays, Credit Suisse,

KBC, SIX and Thomson Reuters. Also known as the Massive Autonomous

Distributed Reconciliation (Madrec) platform, this project was designed

to make it easier for banks to reconcile a large amount of data about

their counterparties. But it’s not all sunshine and rainbows for the

Ethereum market players.

According to Mashable, A fake version of

popular wallet for Ethereum, called MyEtherWallet, is currently being

sold in Apple's App Store. The app is created by a developer called Nam

Le, with no ties to the makers of the original MyEtherWallet, which

currently exists only as a browser app.

So if you’re into Ethereum

investing, keep your coins safe and do your research before moving your

assets from one wallet to another. Thanks for watching, invest

responsibly, and I’ll see you with more updates tomorrow.

-

By

Bitcoin

Bitcoin - 0 comments

- 0 likes

- Like

- Share

-

By

-

With the launch of bitcoin futures on the Cboe, BitGO CEO Mike Belshe discusses the cryptocurrency ecosystem.

» Subscribe to CNBC:

http://cnb.cx/SubscribeCNBC

About CNBC:This video is also showing now on BCtv here, for larger screen viewing on your desktop, laptop and connected smart tv.

From 'Wall Street' to 'Main Street' to award winning

original documentaries and Reality TV series, CNBC has you covered.

Experience special sneak peeks of your favorite shows, exclusive video

and more.

-

Tyler Winklevoss and Cameron Winklevoss, co-founders at Gemini, discuss

the positives of bitcoin, the cryptocurrency's potential to disrupt

gold, and the potential for a further twentyfold increase in the price

of bitcoin. They speak on "Bloomberg Daybreak: Americas."This video is also showing now on BCtv here, for larger screen viewing on your desktop, laptop and connected smart tv.

-

By Rob Wile

10:40 AM EST

Earlier this year, Nobel-winning Yale economist Robert Shiller called Bitcoin “the best example” of a speculative bubble there is right now.That was when the price of a single Bitcoin was still below $5,000.

As of Tuesday morning, the price is at nearly $17,000.In an email to MONEY on Monday, Shiller, who famously spotted a possible housing bubble before it actually blew up, said that it was “not easy to see” where Bitcoin is going.

He is also the author of the best-selling book, Irrational Exuberance.Its prices, he said, aren’t really reflective of anything other than people’s interest, though, he noted, interest levels are spreading “like a contagion,” meaning it has “aspects of a bubble.”

“The Bitcoin price is like a thermometer measuring the intensity of the epidemic,” he said.One reason for the intensity has something to do with how people think about Bitcoin: For many, cryptocurrencies have always been, and continue to be, an ideology.

“Bitcoin…is also a political movement, appealing to people who wish to see themselves freed from government regulation,” he said.Shiller also called for increased regulation, if only because things remain so uncertain.“Bitcoin is one of hundreds of cryptocurrencies.

Beyond the currencies themselves, there are exchanges and securities and futures markets. It is a big phenomenon. It is not easy to see where it is going.”Bitcoin futures started trading for the first time yesterday, revealing how volatile things remain in the cryptocurrency world.

Futures on the world’s most popular cryptocurrency surged as much as 26% in their debut session on the exchange, triggering two temporary trading halts designed to calm the market, Bloomberg reported.

“It is rare that you see something more volatile than Bitcoin, but we found it: Bitcoin futures,” Zennon Kapron, managing director of Shanghai-based consulting firm Kapronasia, told the news service.One analyst for Bitcoin news and research group Coindesk said Tuesday’s price movements indicate Bitcoin could hit $20,000 shortly.

“The ascending 10-day [moving average] favors further upside in prices, and suggests that any pullbacks are likely to be short-lived,” Coindesk’s Omkar Godbole said.

-

By

Bitcoin

Bitcoin - 0 comments

- 0 likes

- Like

- Share

-

By

-

General

What is Bitcoin?

Bitcoin is a consensus network that enables a new payment system and a

completely digital money. It is the first decentralized peer-to-peer

payment network that is powered by its users with no central authority

or middlemen. From a user perspective, Bitcoin is pretty much like cash

for the Internet. Bitcoin can also be seen as the most prominent triple entry bookkeeping system in existence.

Who created Bitcoin?

Bitcoin is the first implementation of a concept called

"cryptocurrency", which was first described in 1998 by Wei Dai on the

cypherpunks mailing list, suggesting the idea of a new form of money

that uses cryptography to control its creation and transactions, rather

than a central authority. The first Bitcoin specification and proof of

concept was published in 2009 in a cryptography mailing list by Satoshi

Nakamoto. Satoshi left the project in late 2010 without revealing much

about himself. The community has since grown exponentially with many developers working on Bitcoin.

Satoshi's anonymity often raised unjustified concerns, many of which

are linked to misunderstanding of the open-source nature of Bitcoin. The

Bitcoin protocol and software are published openly and any developer

around the world can review the code or make their own modified version

of the Bitcoin software. Just like current developers, Satoshi's

influence was limited to the changes he made being adopted by others and

therefore he did not control Bitcoin. As such, the identity of

Bitcoin's inventor is probably as relevant today as the identity of the

person who invented paper.

Who controls the Bitcoin network?

Nobody owns the Bitcoin network much like no one owns the technology

behind email. Bitcoin is controlled by all Bitcoin users around the

world. While developers are improving the software, they can't force a

change in the Bitcoin protocol because all users are free to choose what

software and version they use. In order to stay compatible with each

other, all users need to use software complying with the same rules.

Bitcoin can only work correctly with a complete consensus among all

users. Therefore, all users and developers have a strong incentive to

protect this consensus.

How does Bitcoin work?

From a user perspective, Bitcoin is nothing more than a mobile app or

computer program that provides a personal Bitcoin wallet and allows a

user to send and receive bitcoins with them. This is how Bitcoin works

for most users.

Behind the scenes, the Bitcoin network is sharing a public ledger

called the "block chain". This ledger contains every transaction ever

processed, allowing a user's computer to verify the validity of each

transaction. The authenticity of each transaction is protected by

digital signatures corresponding to the sending addresses, allowing all

users to have full control over sending bitcoins from their own Bitcoin

addresses. In addition, anyone can process transactions using the

computing power of specialized hardware and earn a reward in bitcoins

for this service. This is often called "mining". To learn more about

Bitcoin, you can consult the dedicated page and the original paper.

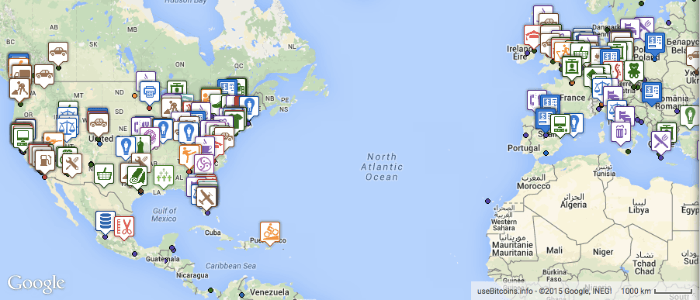

Is Bitcoin really used by people?

Yes. There are a growing number of businesses

and individuals using Bitcoin. This includes brick-and-mortar

businesses like restaurants, apartments, and law firms, as well as

popular online services such as Namecheap, Overstock.com, and Reddit.

While Bitcoin remains a relatively new phenomenon, it is growing fast.

At the end of April 2017, the total value of all existing bitcoins exceeded 20 billion US dollars, with millions of dollars worth of bitcoins exchanged daily.

How does one acquire bitcoins?

- As payment for goods or services.

- Purchase bitcoins at a Bitcoin exchange.

- Exchange bitcoins with someone near you.

- Earn bitcoins through competitive mining.

While it may be possible to find individuals who wish to sell

bitcoins in exchange for a credit card or PayPal payment, most exchanges

do not allow funding via these payment methods. This is due to cases

where someone buys bitcoins with PayPal, and then reverses their half of

the transaction. This is commonly referred to as a chargeback.

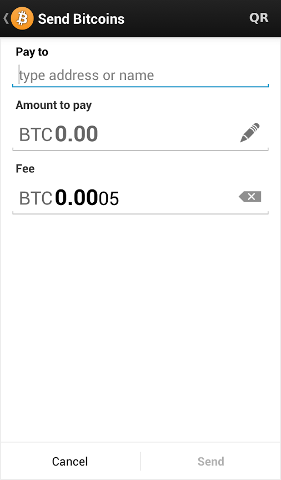

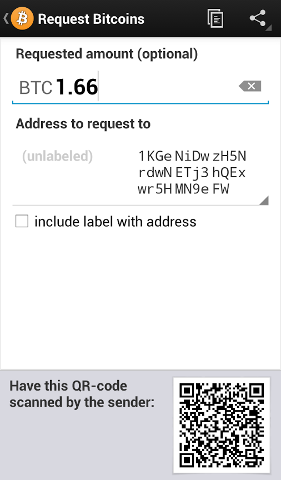

How difficult is it to make a Bitcoin payment?

Bitcoin payments are easier to make than debit or credit card

purchases, and can be received without a merchant account. Payments are

made from a wallet application, either on your computer or smartphone,

by entering the recipient's address, the payment amount, and pressing

send. To make it easier to enter a recipient's address, many wallets can

obtain the address by scanning a QR code or touching two phones

together with NFC technology.

What are the advantages of Bitcoin?

- Payment freedom - It is possible to send and

receive bitcoins anywhere in the world at any time. No bank holidays. No

borders. No bureaucracy. Bitcoin allows its users to be in full control

of their money.

- Choose your own fees - There is no fee to receive

bitcoins, and many wallets let you control how large a fee to pay when

spending. Higher fees can encourage faster confirmation

of your transactions. Fees are unrelated to the amount transferred, so

it's possible to send 100,000 bitcoins for the same fee it costs to send

1 bitcoin. Additionally, merchant processors exist to assist merchants

in processing transactions, converting bitcoins to fiat currency and

depositing funds directly into merchants' bank accounts daily. As these

services are based on Bitcoin, they can be offered for much lower fees

than with PayPal or credit card networks.

- Fewer risks for merchants - Bitcoin transactions

are secure, irreversible, and do not contain customers’ sensitive or

personal information. This protects merchants from losses caused by

fraud or fraudulent chargebacks, and there is no need for PCI

compliance. Merchants can easily expand to new markets where either

credit cards are not available or fraud rates are unacceptably high. The

net results are lower fees, larger markets, and fewer administrative

costs. - Security and control - Bitcoin users are in full

control of their transactions; it is impossible for merchants to force

unwanted or unnoticed charges as can happen with other payment methods.

Bitcoin payments can be made without personal information tied to the

transaction. This offers strong protection against identity theft.

Bitcoin users can also protect their money with backup and encryption. - Transparent and neutral - All information

concerning the Bitcoin money supply itself is readily available on the

block chain for anybody to verify and use in real-time. No individual or

organization can control or manipulate the Bitcoin protocol because it

is cryptographically secure. This allows the core of Bitcoin to be

trusted for being completely neutral, transparent and predictable.

What are the disadvantages of Bitcoin?

- Degree of acceptance - Many people are still

unaware of Bitcoin. Every day, more businesses accept bitcoins because

they want the advantages of doing so, but the list remains small and

still needs to grow in order to benefit from network effects. - Volatility - The total value

of bitcoins in circulation and the number of businesses using Bitcoin

are still very small compared to what they could be. Therefore,

relatively small events, trades, or business activities can

significantly affect the price. In theory, this volatility will decrease

as Bitcoin markets and the technology matures. Never before has the

world seen a start-up currency, so it is truly difficult (and exciting)

to imagine how it will play out. - Ongoing development - Bitcoin software is still in

beta with many incomplete features in active development. New tools,

features, and services are being developed to make Bitcoin more secure

and accessible to the masses. Some of these are still not ready for

everyone. Most Bitcoin businesses are new and still offer no insurance.

In general, Bitcoin is still in the process of maturing.

Why do people trust Bitcoin?

Much of the trust in Bitcoin comes from the fact that it requires no

trust at all. Bitcoin is fully open-source and decentralized. This means

that anyone has access to the entire source code at any time. Any

developer in the world can therefore verify exactly how Bitcoin works.

All transactions and bitcoins issued into existence can be transparently

consulted in real-time by anyone. All payments can be made without

reliance on a third party and the whole system is protected by heavily

peer-reviewed cryptographic algorithms like those used for online

banking. No organization or individual can control Bitcoin, and the

network remains secure even if not all of its users can be trusted.

Can I make money with Bitcoin?

You should never expect to get rich with Bitcoin or any emerging

technology. It is always important to be wary of anything that sounds

too good to be true or disobeys basic economic rules.

Bitcoin is a growing space of innovation and there are business

opportunities that also include risks. There is no guarantee that

Bitcoin will continue to grow even though it has developed at a very

fast rate so far. Investing time and resources on anything related to

Bitcoin requires entrepreneurship. There are various ways to make money

with Bitcoin such as mining, speculation or running new businesses. All

of these methods are competitive and there is no guarantee of profit. It

is up to each individual to make a proper evaluation of the costs and

the risks involved in any such project.

Is Bitcoin fully virtual and immaterial?

Bitcoin is as virtual as the credit cards and online banking networks

people use everyday. Bitcoin can be used to pay online and in physical

stores just like any other form of money. Bitcoins can also be exchanged

in physical form such as the Denarium coins,

but paying with a mobile phone usually remains more convenient. Bitcoin

balances are stored in a large distributed network, and they cannot be

fraudulently altered by anybody. In other words, Bitcoin users have

exclusive control over their funds and bitcoins cannot vanish just

because they are virtual.

Is Bitcoin anonymous?

Bitcoin is designed to allow its users to send and receive payments

with an acceptable level of privacy as well as any other form of money.

However, Bitcoin is not anonymous and cannot offer the same level of

privacy as cash. The use of Bitcoin leaves extensive public records. Various mechanisms

exist to protect users' privacy, and more are in development. However,

there is still work to be done before these features are used correctly

by most Bitcoin users.

Some concerns have been raised that private transactions could be

used for illegal purposes with Bitcoin. However, it is worth noting that

Bitcoin will undoubtedly be subjected to similar regulations that are

already in place inside existing financial systems. Bitcoin cannot be

more anonymous than cash and it is not likely to prevent criminal

investigations from being conducted. Additionally, Bitcoin is also

designed to prevent a large range of financial crimes.

What happens when bitcoins are lost?

When a user loses his wallet, it has the effect of removing money out

of circulation. Lost bitcoins still remain in the block chain just like

any other bitcoins. However, lost bitcoins remain dormant forever

because there is no way for anybody to find the private key(s) that

would allow them to be spent again. Because of the law of supply and

demand, when fewer bitcoins are available, the ones that are left will

be in higher demand and increase in value to compensate.

Can Bitcoin scale to become a major payment network?

The Bitcoin network can already process a much higher number of

transactions per second than it does today. It is, however, not entirely

ready to scale to the level of major credit card networks. Work is

underway to lift current limitations, and future requirements are well

known. Since inception, every aspect of the Bitcoin network has been in a

continuous process of maturation, optimization, and specialization, and

it should be expected to remain that way for some years to come. As

traffic grows, more Bitcoin users may use lightweight clients, and full

network nodes may become a more specialized service. For more details,

see the Scalability page on the Wiki.

Legal

Is Bitcoin legal?

To the best of our knowledge, Bitcoin has not been made illegal

by legislation in most jurisdictions. However, some jurisdictions (such

as Argentina and Russia) severely restrict or ban foreign currencies.

Other jurisdictions (such as Thailand) may limit the licensing of

certain entities such as Bitcoin exchanges.

Regulators from various jurisdictions are taking steps to provide

individuals and businesses with rules on how to integrate this new

technology with the formal, regulated financial system. For example, the

Financial Crimes Enforcement Network (FinCEN), a bureau in the United

States Treasury Department, issued non-binding guidance on how it

characterizes certain activities involving virtual currencies.

Is Bitcoin useful for illegal activities?

Bitcoin is money, and money has always been used both for legal and

illegal purposes. Cash, credit cards and current banking systems widely

surpass Bitcoin in terms of their use to finance crime. Bitcoin can

bring significant innovation in payment systems and the benefits of such

innovation are often considered to be far beyond their potential

drawbacks.

Bitcoin is designed to be a huge step forward in making money more

secure and could also act as a significant protection against many forms

of financial crime. For instance, bitcoins are completely impossible to

counterfeit. Users are in full control of their payments and cannot

receive unapproved charges such as with credit card fraud. Bitcoin

transactions are irreversible and immune to fraudulent chargebacks.

Bitcoin allows money to be secured against theft and loss using very

strong and useful mechanisms such as backups, encryption, and multiple

signatures.

Some concerns have been raised that Bitcoin could be more attractive

to criminals because it can be used to make private and irreversible

payments. However, these features already exist with cash and wire

transfer, which are widely used and well-established. The use of Bitcoin

will undoubtedly be subjected to similar regulations that are already

in place inside existing financial systems, and Bitcoin is not likely to

prevent criminal investigations from being conducted. In general, it is

common for important breakthroughs to be perceived as being

controversial before their benefits are well understood. The Internet is

a good example among many others to illustrate this.

Can Bitcoin be regulated?

The Bitcoin protocol itself cannot be modified without the

cooperation of nearly all its users, who choose what software they use.

Attempting to assign special rights to a local authority in the rules of

the global Bitcoin network is not a practical possibility. Any rich

organization could choose to invest in mining hardware to control half

of the computing power of the network and become able to block or

reverse recent transactions. However, there is no guarantee that they

could retain this power since this requires to invest as much than all

other miners in the world.

It is however possible to regulate the use of Bitcoin in a similar

way to any other instrument. Just like the dollar, Bitcoin can be used

for a wide variety of purposes, some of which can be considered

legitimate or not as per each jurisdiction's laws. In this regard,

Bitcoin is no different than any other tool or resource and can be

subjected to different regulations in each country. Bitcoin use could

also be made difficult by restrictive regulations, in which case it is

hard to determine what percentage of users would keep using the

technology. A government that chooses to ban Bitcoin would prevent

domestic businesses and markets from developing, shifting innovation to

other countries. The challenge for regulators, as always, is to develop

efficient solutions while not impairing the growth of new emerging

markets and businesses.

What about Bitcoin and taxes?

Bitcoin is not a fiat currency with legal tender status in any

jurisdiction, but often tax liability accrues regardless of the medium

used. There is a wide variety of legislation in many different

jurisdictions which could cause income, sales, payroll, capital gains,

or some other form of tax liability to arise with Bitcoin.

What about Bitcoin and consumer protection?

Bitcoin is freeing people to transact on their own terms. Each user

can send and receive payments in a similar way to cash but they can also

take part in more complex contracts. Multiple signatures allow a

transaction to be accepted by the network only if a certain number of a

defined group of persons agree to sign the transaction. This allows

innovative dispute mediation services to be developed in the future.

Such services could allow a third party to approve or reject a

transaction in case of disagreement between the other parties without

having control on their money. As opposed to cash and other payment

methods, Bitcoin always leaves a public proof that a transaction did

take place, which can potentially be used in a recourse against

businesses with fraudulent practices.

It is also worth noting that while merchants usually depend on their

public reputation to remain in business and pay their employees, they

don't have access to the same level of information when dealing with new

consumers. The way Bitcoin works allows both individuals and businesses

to be protected against fraudulent chargebacks while giving the choice

to the consumer to ask for more protection when they are not willing to

trust a particular merchant.

Economy

How are bitcoins created?

New bitcoins are generated by a competitive and decentralized process

called "mining". This process involves that individuals are rewarded by

the network for their services. Bitcoin miners are processing

transactions and securing the network using specialized hardware and are

collecting new bitcoins in exchange.

The Bitcoin protocol is designed in such a way that new bitcoins are

created at a fixed rate. This makes Bitcoin mining a very competitive

business. When more miners join the network, it becomes increasingly

difficult to make a profit and miners must seek efficiency to cut their

operating costs. No central authority or developer has any power to

control or manipulate the system to increase their profits. Every

Bitcoin node in the world will reject anything that does not comply with

the rules it expects the system to follow.

Bitcoins are created at a decreasing and predictable rate. The number

of new bitcoins created each year is automatically halved over time

until bitcoin issuance halts completely with a total of 21 million

bitcoins in existence. At this point, Bitcoin miners will probably be

supported exclusively by numerous small transaction fees.

Why do bitcoins have value?

Bitcoins have value because they are useful as a form of money.

Bitcoin has the characteristics of money (durability, portability,

fungibility, scarcity, divisibility, and recognizability) based on the

properties of mathematics rather than relying on physical properties

(like gold and silver) or trust in central authorities (like fiat

currencies). In short, Bitcoin is backed by mathematics. With these

attributes, all that is required for a form of money to hold value is

trust and adoption. In the case of Bitcoin, this can be measured by its

growing base of users, merchants, and startups. As with all currency,

bitcoin's value comes only and directly from people willing to accept

them as payment.

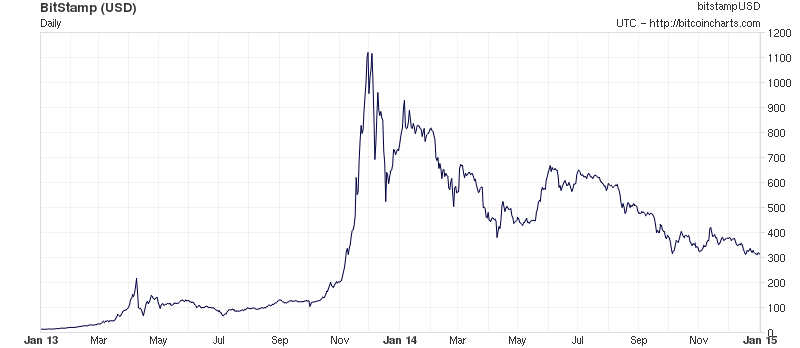

What determines bitcoin’s price?

The price of a bitcoin is determined by supply and demand. When

demand for bitcoins increases, the price increases, and when demand

falls, the price falls. There is only a limited number of bitcoins in

circulation and new bitcoins are created at a predictable and decreasing

rate, which means that demand must follow this level of inflation to

keep the price stable. Because Bitcoin is still a relatively small

market compared to what it could be, it doesn't take significant amounts

of money to move the market price up or down, and thus the price of a

bitcoin is still very volatile.

Bitcoin price over time:

Can bitcoins become worthless?

Yes. History is littered with currencies that failed and are no longer used, such as the German Mark during the Weimar Republic and, more recently, the Zimbabwean dollar.

Although previous currency failures were typically due to

hyperinflation of a kind that Bitcoin makes impossible, there is always

potential for technical failures, competing currencies, political issues

and so on. As a basic rule of thumb, no currency should be considered

absolutely safe from failures or hard times. Bitcoin has proven reliable

for years since its inception and there is a lot of potential for

Bitcoin to continue to grow. However, no one is in a position to predict

what the future will be for Bitcoin.

Is Bitcoin a bubble?

A fast rise in price does not constitute a bubble. An artificial

over-valuation that will lead to a sudden downward correction

constitutes a bubble. Choices based on individual human action by

hundreds of thousands of market participants is the cause for bitcoin's

price to fluctuate as the market seeks price discovery. Reasons for

changes in sentiment may include a loss of confidence in Bitcoin, a

large difference between value and price not based on the fundamentals

of the Bitcoin economy, increased press coverage stimulating speculative

demand, fear of uncertainty, and old-fashioned irrational exuberance

and greed.

Is Bitcoin a Ponzi scheme?

A Ponzi scheme is a fraudulent investment operation that pays returns

to its investors from their own money, or the money paid by subsequent

investors, instead of from profit earned by the individuals running the

business. Ponzi schemes are designed to collapse at the expense of the

last investors when there is not enough new participants.

Bitcoin is a free software project with no central authority.

Consequently, no one is in a position to make fraudulent representations

about investment returns. Like other major currencies such as gold,

United States dollar, euro, yen, etc. there is no guaranteed purchasing

power and the exchange rate floats freely. This leads to volatility

where owners of bitcoins can unpredictably make or lose money. Beyond

speculation, Bitcoin is also a payment system with useful and

competitive attributes that are being used by thousands of users and

businesses.

Doesn't Bitcoin unfairly benefit early adopters?

Some early adopters have large numbers of bitcoins because they took

risks and invested time and resources in an unproven technology that was

hardly used by anyone and that was much harder to secure properly. Many

early adopters spent large numbers of bitcoins quite a few times before

they became valuable or bought only small amounts and didn't make huge

gains. There is no guarantee that the price of a bitcoin will increase

or drop. This is very similar to investing in an early startup that can

either gain value through its usefulness and popularity, or just never

break through. Bitcoin is still in its infancy, and it has been designed

with a very long-term view; it is hard to imagine how it could be less

biased towards early adopters, and today's users may or may not be the

early adopters of tomorrow.

Won't the finite amount of bitcoins be a limitation?

Bitcoin is unique in that only 21 million bitcoins will ever be

created. However, this will never be a limitation because transactions

can be denominated in smaller sub-units of a bitcoin, such as bits -

there are 1,000,000 bits in 1 bitcoin. Bitcoins can be divided up to 8

decimal places (0.000 000 01) and potentially even smaller units if that

is ever required in the future as the average transaction size

decreases.

Won't Bitcoin fall in a deflationary spiral?

The deflationary spiral theory says that if prices are expected to

fall, people will move purchases into the future in order to benefit

from the lower prices. That fall in demand will in turn cause merchants

to lower their prices to try and stimulate demand, making the problem

worse and leading to an economic depression.

Although this theory is a popular way to justify inflation amongst

central bankers, it does not appear to always hold true and is

considered controversial amongst economists. Consumer electronics is one

example of a market where prices constantly fall but which is not in

depression. Similarly, the value of bitcoins has risen over time and yet

the size of the Bitcoin economy has also grown dramatically along with

it. Because both the value of the currency and the size of its economy

started at zero in 2009, Bitcoin is a counterexample to the theory

showing that it must sometimes be wrong.

Notwithstanding this, Bitcoin is not designed to be a deflationary

currency. It is more accurate to say Bitcoin is intended to inflate in

its early years, and become stable in its later years. The only time the

quantity of bitcoins in circulation will drop is if people carelessly

lose their wallets by failing to make backups. With a stable monetary

base and a stable economy, the value of the currency should remain the

same.

Isn't speculation and volatility a problem for Bitcoin?

This is a chicken and egg situation. For bitcoin's price to

stabilize, a large scale economy needs to develop with more businesses

and users. For a large scale economy to develop, businesses and users

will seek for price stability.

Fortunately, volatility does not affect the main benefits of Bitcoin

as a payment system to transfer money from point A to point B. It is

possible for businesses to convert bitcoin payments to their local

currency instantly, allowing them to profit from the advantages of

Bitcoin without being subjected to price fluctuations. Since Bitcoin

offers many useful and unique features and properties, many users choose

to use Bitcoin. With such solutions and incentives, it is possible that

Bitcoin will mature and develop to a degree where price volatility will

become limited.

What if someone bought up all the existing bitcoins?

Only a fraction of bitcoins issued to date are found on the exchange

markets for sale. Bitcoin markets are competitive, meaning the price of a

bitcoin will rise or fall depending on supply and demand. Additionally,

new bitcoins will continue to be issued for decades to come. Therefore

even the most determined buyer could not buy all the bitcoins in

existence. This situation isn't to suggest, however, that the markets

aren't vulnerable to price manipulation; it still doesn't take

significant amounts of money to move the market price up or down, and

thus Bitcoin remains a volatile asset thus far.

What if someone creates a better digital currency?

That can happen. For now, Bitcoin remains by far the most popular

decentralized virtual currency, but there can be no guarantee that it

will retain that position. There is already a set of alternative

currencies inspired by Bitcoin. It is however probably correct to assume

that significant improvements would be required for a new currency to

overtake Bitcoin in terms of established market, even though this

remains unpredictable. Bitcoin could also conceivably adopt improvements

of a competing currency so long as it doesn't change fundamental parts

of the protocol.

Transactions

Why do I have to wait for confirmation?

Receiving notification of a payment is almost instant with Bitcoin.

However, there is a delay before the network begins to confirm your

transaction by including it in a block. A confirmation means that there

is a consensus on the network that the bitcoins you received haven't

been sent to anyone else and are considered your property. Once your

transaction has been included in one block, it will continue to be

buried under every block after it, which will exponentially consolidate

this consensus and decrease the risk of a reversed transaction. Each

confirmation takes between a few seconds and 90 minutes, with 10 minutes

being the average. If the transaction pays too low a fee or is

otherwise atypical, getting the first confirmation can take much longer.

Every user is free to determine at what point they consider a

transaction sufficiently confirmed, but 6 confirmations is often considered to be as safe as waiting 6 months on a credit card transaction.

How much will the transaction fee be?

Transactions can be processed without fees, but trying to send free

transactions can require waiting days or weeks. Although fees may

increase over time, normal fees currently only cost a tiny amount. By

default, all Bitcoin wallets

listed on Bitcoin.org add what they think is an appropriate fee to your

transactions; most of those wallets will also give you chance to review

the fee before sending the transaction.

Transaction fees are used as a protection against users sending

transactions to overload the network and as a way to pay miners for

their work helping to secure the network. The precise manner in which

fees work is still being developed and will change over time. Because

the fee is not related to the amount of bitcoins being sent, it may seem

extremely low or unfairly high. Instead, the fee is relative to the

number of bytes in the transaction, so using multisig or spending

multiple previously-received amounts may cost more than simpler

transactions. If your activity follows the pattern of conventional

transactions, you won't have to pay unusually high fees.

What if I receive a bitcoin when my computer is powered off?

This works fine. The bitcoins will appear next time you start your

wallet application. Bitcoins are not actually received by the software

on your computer, they are appended to a public ledger that is shared

between all the devices on the network. If you are sent bitcoins when

your wallet client program is not running and you later launch it, it

will download blocks and catch up with any transactions it did not

already know about, and the bitcoins will eventually appear as if they

were just received in real time. Your wallet is only needed when you

wish to spend bitcoins.

What does "synchronizing" mean and why does it take so long?

Long synchronization time is only required with full node clients

like Bitcoin Core. Technically speaking, synchronizing is the process of

downloading and verifying all previous Bitcoin transactions on the

network. For some Bitcoin clients to calculate the spendable balance of

your Bitcoin wallet and make new transactions, it needs to be aware of

all previous transactions. This step can be resource intensive and

requires sufficient bandwidth and storage to accommodate the full size

of the block chain. For Bitcoin to remain secure, enough people should

keep using full node clients because they perform the task of validating

and relaying transactions.

Mining

What is Bitcoin mining?

Mining is the process of spending computing power to process

transactions, secure the network, and keep everyone in the system

synchronized together. It can be perceived like the Bitcoin data center

except that it has been designed to be fully decentralized with miners

operating in all countries and no individual having control over the

network. This process is referred to as "mining" as an analogy to gold

mining because it is also a temporary mechanism used to issue new

bitcoins. Unlike gold mining, however, Bitcoin mining provides a reward

in exchange for useful services required to operate a secure payment

network. Mining will still be required after the last bitcoin is issued.

How does Bitcoin mining work?

Anybody can become a Bitcoin miner by running software with

specialized hardware. Mining software listens for transactions broadcast

through the peer-to-peer network and performs appropriate tasks to

process and confirm these transactions. Bitcoin miners perform this work

because they can earn transaction fees paid by users for faster

transaction processing, and newly created bitcoins issued into existence

according to a fixed formula.

For new transactions to be confirmed, they need to be included in a

block along with a mathematical proof of work. Such proofs are very hard

to generate because there is no way to create them other than by trying

billions of calculations per second. This requires miners to perform

these calculations before their blocks are accepted by the network and

before they are rewarded. As more people start to mine, the difficulty

of finding valid blocks is automatically increased by the network to

ensure that the average time to find a block remains equal to 10

minutes. As a result, mining is a very competitive business where no

individual miner can control what is included in the block chain.

The proof of work is also designed to depend on the previous block to

force a chronological order in the block chain. This makes it

exponentially difficult to reverse previous transactions because this

requires the recalculation of the proofs of work of all the subsequent

blocks. When two blocks are found at the same time, miners work on the

first block they receive and switch to the longest chain of blocks as

soon as the next block is found. This allows mining to secure and

maintain a global consensus based on processing power.

Bitcoin miners are neither able to cheat by increasing their own

reward nor process fraudulent transactions that could corrupt the

Bitcoin network because all Bitcoin nodes would reject any block that

contains invalid data as per the rules of the Bitcoin protocol.

Consequently, the network remains secure even if not all Bitcoin miners

can be trusted.

Isn't Bitcoin mining a waste of energy?

Spending energy to secure and operate a payment system is hardly a

waste. Like any other payment service, the use of Bitcoin entails

processing costs. Services necessary for the operation of currently

widespread monetary systems, such as banks, credit cards, and armored

vehicles, also use a lot of energy. Although unlike Bitcoin, their total

energy consumption is not transparent and cannot be as easily measured.

Bitcoin mining has been designed to become more optimized over time

with specialized hardware consuming less energy, and the operating costs

of mining should continue to be proportional to demand. When Bitcoin

mining becomes too competitive and less profitable, some miners choose

to stop their activities. Furthermore, all energy expended mining is

eventually transformed into heat, and the most profitable miners will be

those who have put this heat to good use. An optimally efficient mining

network is one that isn't actually consuming any extra energy. While

this is an ideal, the economics of mining are such that miners

individually strive toward it.

How does mining help secure Bitcoin?

Mining creates the equivalent of a competitive lottery that makes it

very difficult for anyone to consecutively add new blocks of

transactions into the block chain. This protects the neutrality of the

network by preventing any individual from gaining the power to block

certain transactions. This also prevents any individual from replacing

parts of the block chain to roll back their own spends, which could be

used to defraud other users. Mining makes it exponentially more

difficult to reverse a past transaction by requiring the rewriting of

all blocks following this transaction.

What do I need to start mining?

In the early days of Bitcoin, anyone could find a new block using

their computer's CPU. As more and more people started mining, the

difficulty of finding new blocks increased greatly to the point where

the only cost-effective method of mining today is using specialized

hardware. You can visit BitcoinMining.com for more information.

Security

Is Bitcoin secure?

The Bitcoin technology - the protocol and the cryptography - has a

strong security track record, and the Bitcoin network is probably the

biggest distributed computing project in the world. Bitcoin's most

common vulnerability is in user error. Bitcoin wallet files that store

the necessary private keys can be accidentally deleted, lost or stolen.

This is pretty similar to physical cash stored in a digital form.

Fortunately, users can employ sound security practices to protect their money or use service providers that offer good levels of security and insurance against theft or loss.

Hasn't Bitcoin been hacked in the past?

The rules of the protocol and the cryptography used for Bitcoin are

still working years after its inception, which is a good indication that

the concept is well designed. However, security flaws

have been found and fixed over time in various software

implementations. Like any other form of software, the security of

Bitcoin software depends on the speed with which problems are found and

fixed. The more such issues are discovered, the more Bitcoin is gaining

maturity.

There are often misconceptions about thefts and security breaches

that happened on diverse exchanges and businesses. Although these events

are unfortunate, none of them involve Bitcoin itself being hacked, nor

imply inherent flaws in Bitcoin; just like a bank robbery doesn't mean

that the dollar is compromised. However, it is accurate to say that a

complete set of good practices and intuitive security solutions is

needed to give users better protection of their money, and to reduce the

general risk of theft and loss. Over the course of the last few years,

such security features have quickly developed, such as wallet

encryption, offline wallets, hardware wallets, and multi-signature

transactions.

Could users collude against Bitcoin?

It is not possible to change the Bitcoin protocol that easily. Any

Bitcoin client that doesn't comply with the same rules cannot enforce

their own rules on other users. As per the current specification, double

spending is not possible on the same block chain, and neither is

spending bitcoins without a valid signature. Therefore, It is not

possible to generate uncontrolled amounts of bitcoins out of thin air,

spend other users' funds, corrupt the network, or anything similar.

However, powerful miners could arbitrarily choose to block or reverse

recent transactions. A majority of users can also put pressure for some

changes to be adopted. Because Bitcoin only works correctly with a

complete consensus between all users, changing the protocol can be very

difficult and requires an overwhelming majority of users to adopt the

changes in such a way that remaining users have nearly no choice but to

follow. As a general rule, it is hard to imagine why any Bitcoin user

would choose to adopt any change that could compromise their own money.

Is Bitcoin vulnerable to quantum computing?

Yes, most systems relying on cryptography in general are, including

traditional banking systems. However, quantum computers don't yet exist

and probably won't for a while. In the event that quantum computing

could be an imminent threat to Bitcoin, the protocol could be upgraded

to use post-quantum algorithms. Given the importance that this update

would have, it can be safely expected that it would be highly reviewed

by developers and adopted by all Bitcoin users.

Help

I'd like to learn more. Where can I get help?

You can find more information and help on the resources and community pages or on the Wiki FAQ.

-

By

Bitcoin

Bitcoin - 2 comments

- 0 likes

- Like

- Share

-

How to buy Bitcoin

There are several ways you can buy Bitcoin.

Use a Bitcoin Exchange

Our Bitcoin Exchange page, lists many different businesses that can help you buy Bitcoin using your bank account.

Discover people selling Bitcoin in your community

Local Bitcoins lets you

search and browse through various sellers of Bitcoin in your area.

Sellers have reviews and feedback scores to help you choose.

Use a Bitcoin ATM

Bitcoin ATMs work like a regular ATM, except they allow you to

deposit and withdrawal money so that you can buy and sell Bitcoin. Coin ATM Radar has an interactive map to help you find the closest Bitcoin ATM near you.

-

By

Bitcoin

Bitcoin - 2 comments

- 0 likes

- Like

- Share

-

By

-

Support Bitcoin

Bitcoin is a protocol that was born from a small

community and has grown fast since. There are a lot of things you can do

to help Bitcoin to spread and improve over time.

Using Bitcoin

Using Bitcoin is

the first thing you can do to support Bitcoin. There are probably many

cases where it can make your life easier. You can accept payments and

make purchases with Bitcoin.

Be the network

If you have a good Internet connection, you can strengthen the Bitcoin network by keeping full node software running on your computer or server with port 8333 open. Full nodes are securing and relaying all transactions.

Mining

You can start mining bitcoins

to help processing transactions. In order to protect the network, you

should join smaller mining pools and prefer decentralized pools like P2Pool or pools with getblocktemplate (GBT) support.

Translate

You can help to increase Bitcoin availability by translating or

improving translations inside important parts of the Bitcoin ecosystem.

Just pick a project you would like to help.

Bitcoin Core - Bitcoin.org - Bitcoin Wiki - Bitcoin Wallet (Android) - Electrum

Development

Bitcoin is free software. So if you are a developer, you can use your super-powers to do good and improve Bitcoin. Or you can build amazing new services or software that can use Bitcoin.

Donation

The easiest way to help is to donate

a few bitcoins to BitGive. Or you can help directly fund any project

related to Bitcoin that you believe will be helpful in the future.

Organizations

Many non-profit organizations

are dedicated to protecting and promoting Bitcoin. You can help these

groups by joining them and taking part in their projects, discussions

and events.

Spread

Speak about Bitcoin to interested people. Write about it on your

blog. Tell your favorite shops you would like to pay with Bitcoin. Help

to keep merchant directories up to date. Or be creative and make yourself a nice Bitcoin T-shirt.

Documentation

Bitcoin.org and the Bitcoin wiki

provide useful documentation and we are constantly improving the

information they contain. You can help to improve these resources and

keep them up to date.

Meet the communities

You can join Bitcoin communities

and talk with other Bitcoin enthusiasts. You can learn more about

Bitcoin every day, give help to new users and get involved in

interesting projects.

-

By

Bitcoin

Bitcoin - 2 comments

- 0 likes

- Like

- Share

-

By

-

Some things you need to know

If you are about to explore Bitcoin, there are a

few things you should know. Bitcoin lets you exchange money in a

different way than with usual banks. As such, you should take time to

inform yourself before using Bitcoin for any serious transaction.

Bitcoin should be treated with the same care as your regular wallet, or

even more in some cases!

Securing your wallet

Like in real life, your wallet must be secured. Bitcoin makes it

possible to transfer value anywhere in a very easy way and it allows you

to be in control of your money. Such great features also come with

great security concerns. At the same time, Bitcoin can provide very high

levels of security if used correctly. Always remember that it is your

responsibility to adopt good practices in order to protect your money. Read more about securing your wallet.

Bitcoin price is volatile

The price of a bitcoin can unpredictably increase or decrease over a

short period of time due to its young economy, novel nature, and

sometimes illiquid markets. Consequently, keeping your savings with

Bitcoin is not recommended at this point. Bitcoin should be seen like a

high risk asset, and you should never store money that you cannot afford

to lose with Bitcoin. If you receive payments with Bitcoin, many

service providers can convert them to your local currency.

Bitcoin payments are irreversible

Any transaction issued with Bitcoin cannot be reversed, they can only

be refunded by the person receiving the funds. That means you should

take care to do business with people and organizations you know and

trust, or who have an established reputation. For their part, businesses

need to keep control of the payment requests they are displaying to

their customers. Bitcoin can detect typos and usually won't let you send

money to an invalid address by mistake. Additional services might exist

in the future to provide more choice and protection for the consumer.

Bitcoin is not anonymous

Some effort is required to protect your privacy with Bitcoin. All

Bitcoin transactions are stored publicly and permanently on the network,

which means anyone can see the balance and transactions of any Bitcoin

address. However, the identity of the user behind an address remains

unknown until information is revealed during a purchase or in other

circumstances. This is one reason why Bitcoin addresses should only be

used once. Always remember that it is your responsibility to adopt good

practices in order to protect your privacy. Read more about protecting your privacy.

Unconfirmed transactions aren't secure

Transactions don't start out as irreversible. Instead, they get a confirmation

score that indicates how hard it is to reverse them (see table). Each

confirmation takes between a few seconds and 90 minutes, with 10 minutes

being the average. If the transaction pays too low a fee or is

otherwise atypical, getting the first confirmation can take much longer.

Confirmations

Lightweight wallets

Bitcoin Core

0

Only safe if you trust the person paying you

1

Somewhat reliable

Mostly reliable

3

Mostly reliable

Highly reliable

6

Minimum recommendation for high-value bitcoin transfers

30

Recommendation during emergencies to allow human intervention

Bitcoin is still experimental

Bitcoin is an experimental new currency that is in active

development. Each improvement makes Bitcoin more appealing but also

reveals new challenges as Bitcoin adoption grows. During these growing

pains you might encounter increased fees, slower confirmations, or even

more severe issues. Be prepared for problems and consult a technical

expert before making any major investments, but keep in mind that nobody

can predict Bitcoin's future.

Government taxes and regulations

Bitcoin is not an official currency. That said, most jurisdictions

still require you to pay income, sales, payroll, and capital gains taxes

on anything that has value, including bitcoins. It is your

responsibility to ensure that you adhere to tax and other legal or regulatory mandates issued by your government and/or local municipalities.

-

By

Bitcoin

Bitcoin - 2 comments

- 2 likes

- Like

- Share

-

By

-

How does Bitcoin work?

This is a question that often causes confusion. Here's a quick explanation!

The basics for a new user

As a new user, you can get started

with Bitcoin without understanding the technical details. Once you have

installed a Bitcoin wallet on your computer or mobile phone, it will

generate your first Bitcoin address and you can create more whenever you

need one. You can disclose your addresses to your friends so that they

can pay you or vice versa. In fact, this is pretty similar to how email

works, except that Bitcoin addresses should only be used once.

Balances - block chain

The block chain is a shared public ledger on which the entire

Bitcoin network relies. All confirmed transactions are included in the

block chain. This way, Bitcoin wallets can calculate their spendable

balance and new transactions can be verified to be spending bitcoins

that are actually owned by the spender. The integrity and the

chronological order of the block chain are enforced with cryptography.

Transactions - private keys

A transaction is a transfer of value between Bitcoin wallets that gets included in the block chain. Bitcoin wallets keep a secret piece of data called a private key

or seed, which is used to sign transactions, providing a mathematical

proof that they have come from the owner of the wallet. The signature

also prevents the transaction from being altered by anybody once it has

been issued. All transactions are broadcast between users and usually